|

시장보고서

상품코드

1906298

광전 센서 시장 : 감지 방식별, 구조별, 구현별, 광원별 - 예측(-2032년)Photoelectric Sensor Market by Sensing Mode (Through-beam, Retroreflective, Diffuse Reflective), Structural (Interrupter, Fiber-optic, Multi-beam), Mounting (Cylindrical, Rectangular, Threaded Barrel, Fork), Source (Laser, LED) - Global Forecast to 2032 |

||||||

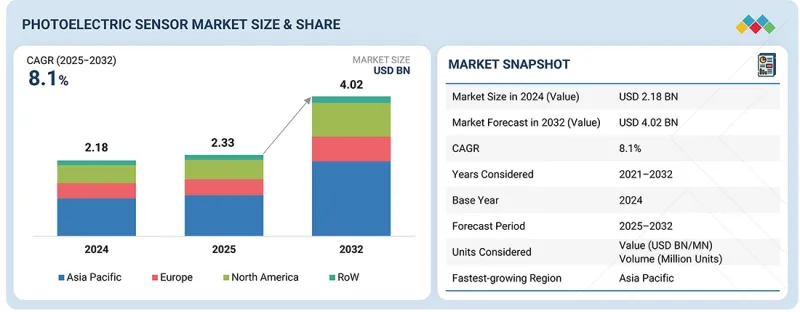

세계의 광전 센서 시장 규모는 2025년 23억 3,000만 달러에서 2032년까지 40억 2,000만 달러에 이를 것으로 예측되며, CAGR 8.1%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 10억 달러 |

| 부문 | 감지 방식, 구조, 구현, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

산업 환경에서의 품질 관리, 작업 안전, 에너지 효율에 대한 관심이 높아지면서 시장이 주도하고 있습니다. 자동 검사 시스템, 자재관리 장비, 물류 자동화의 확산으로 정밀 물체 감지 솔루션에 대한 수요가 증가하고 있습니다. 또한, 마모 및 유지보수 비용 절감을 위한 비접촉식 감지 기술로의 전환은 다양한 최종 사용 산업에서 채택을 가속화하고 있습니다.

"원통형 부문이 2025년 광전 센서 시장에서 두드러진 점유율을 차지할 것으로 예측됩니다. "

원통형 부문은 다재다능한 디자인, 설치 용이성, 산업 장비와의 폭넓은 호환성으로 인해 2025년의 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이 센서는 표준 크기(M12, M18, M30 등)로 제공되며, 다양한 자동화 시스템에 통합하기에 적합합니다. 견고한 구조와 높은 감지 정확도로 자동차, 포장, 자재관리 등 열악한 산업 환경에서도 신뢰할 수 있는 성능을 발휘합니다. 또한, 컴팩트하고 교체가 용이한 센서 솔루션에 대한 수요가 증가함에 따라 원통형 광전 센서 세계 시장에서의 우위가 더욱 강화되고 있습니다.

"LED 부문이 예측 기간 동안 큰 폭의 성장률을 나타낼 것으로 예상했습니다. "

비용 효율성, 긴 수명, 에너지 효율성에 힘입어 LED 부문은 예측 기간 동안 광전 센서 시장에서 눈에 띄게 성장할 것으로 예측됩니다. LED 기반 센서는 안정적인 발광, 빠른 응답 시간, 단거리 및 중거리에서 신뢰할 수 있는 감지를 실현하여 포장, 자재관리, 조립 라인 응용 분야에 적합합니다. 낮은 발열과 최소한의 유지보수 요구사항은 연속적인 작업에서 더욱 매력적입니다. 또한, 고휘도/다파장 LED 기술의 발전으로 감지 정확도가 향상되어 그 유용성이 다양한 산업 환경으로 확대되고 있습니다.

"아시아태평양은 2025-2032년 사이 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다. "

아시아태평양은 예측 기간 동안 광전 센서 시장에서 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다. 이는 급속한 산업화, 도시화, 그리고 제조 부문 전반에 걸친 자동화 기술의 확산에 기인합니다. 중국, 일본, 한국, 인도에서는 스마트팩토리, 로봇, 산업용 IoT에 대한 투자가 활발해지면서 첨단 센싱 솔루션에 대한 수요가 증가하고 있습니다. 자동차, 전자, 포장, 반도체 산업에서 광전 센서는 정밀한 감지 및 품질 관리를 위해 널리 활용되고 있습니다. 또한, 디지털 전환과 스마트 제조를 추진하려는 정부의 이니셔티브는 센서의 채택을 가속화하고 있습니다. KEYENCE CORPORATION(일본), OMRON Corporation(일본), Panasonic Corporation(일본)과 같은 주요 기업들은 강력한 유통망을 보유하고 있으며, 이는 시장의 꾸준한 성장을 더욱 뒷받침하고 있습니다.

세계의 광전 센서 시장에 대해 조사 분석했으며, 주요 촉진요인 및 저해요인, 제품 개발 및 혁신, 경쟁 구도 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 지견

- 광전 센서 시장의 매력적인 기회

- 광전 센서 시장 : 감지 방식별

- 광전 센서 시장 : 최종사용자별

- 북미 광전 센서 시장 : 최종사용자별, 국가별

- 광전 센서 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 광전 센서 시장 미충족 요구

- 화이트 스페이스 기회

- 연결된 시장과 부문간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 전략적 파괴, 특허, 디지털, AI 채택

- 주요 신기술

- CMOS 기술

- 듀라빔 기술

- 멀티 픽셀 기술(MPT)

- 보완 기술

- 산업용 IoT(IIoT) 및 엣지 접속성

- 머신 비전 및 AI 기반 비전 시스템

- 기술/제품 로드맵

- 특허 분석

- 광전 센서 시장에 대한 AI/생성형 AI의 영향

- 사례 연구 : 광전 센서 시장 AI 도입

- 상호 접속된 인접 에코시스템과 영향

- 광전 센서 시장의 생성형 AI 채택을 향한 클라이언트 준비 상황

제6장 규제 상황

- 규제기관, 정부기관 및 기타 조직

- 규제 : 지역별

- 북미

- 유럽

- 아시아태평양

- 중동

- 규격과 인증

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종사용자로부터 미충족 요구

제8장 기술과 혁신 동향

제9장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 지표

- GDP 동향과 예측

- 세계의 자동차 제조 산업 동향

- 포장 및 인쇄/E-Commerce 물류 산업 동향

- 밸류체인 분석

- 생태계 분석

- 가격 결정 분석

- 광전 감지 방식 평균 판매 가격 : 주요 기업별

- 평균 판매 가격 : 지역별

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 고객 고객에게 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

제10장 광전 센서 시장 : 감지 방식별

- THROUGH BEAM

- 회귀 반사

- 확산 반사

제11장 광전 센서 시장 : 구조 유형별

- 슬롯/포크/인터럽터 센서

- 광섬유 광전 센서

- 멀티 빔/어레이 센서

제12장 광전 센서 시장 : 감지 범위별

- 단거리(100mm 미만)

- 중거리(100mm-1m)

- 장거리(1m-30m)

- 초장거리(30m 이상)

제13장 광전 센서 시장 : 구현 유형별

- 원통형

- 장방형

- 슬롯/포크 모듈

제14장 광전 센서 시장 : 빔 광원별

- LED

- 레이저

제15장 광전 센서 시장 : 최종사용자별

- 자동차 제조

- 포장 및 인쇄/E-Commerce/물류

- 식품 및 음료

- 제약 및 의료

- 반도체 및 전자

- 소비재

- 에너지 및 유틸리티

- 기타

제16장 광전 센서 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 남미

- 중동

- 아프리카

제17장 경쟁 구도

- 주요 시장 진출기업의 전략/강점(2021년-2025년)

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제18장 기업 개요

- 주요 기업

- OMRON CORPORATION

- SCHNEIDER ELECTRIC

- KEYENCE CORPORATION

- ROCKWELL AUTOMATION

- SICK AG

- PANASONIC CORPORATION

- IFM ELECTRONIC GMBH

- PEPPERL+FUCHS

- BALLUFF AUTOMATION INDIA PVT. LTD.

- EATON

- 기타 기업

- SENSOPART INDUSTRIESENSORIK GMBH

- HTMSENSORS

- FARGO CONTROLS INC.

- LEUZE ELECTRONIC, INC

- WENGLOR SENSORIC GMBH

- AUTONICS CORPORATION

- SINGOO

- HANS TURCK GMBH & CO. KG

- CARLO GAVAZZI HOLDING AG

- BAUMER

- CONTRINEX INC.

- OPTEX FA CO., LTD.

- TMSS FRANCE

- PILZ GMBH & CO. KG

- BANNER ENGINEERING CORP.

제19장 조사 방법

제20장 부록

LSH 26.01.22At a CAGR of 8.1%, the global photoelectric sensor market is anticipated to grow from USD 2.33 billion in 2025 to USD 4.02 billion by 2032.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Sensing Mode, Structural, Mounting and Region |

| Regions covered | North America, Europe, APAC, RoW |

The market is driven by the increasing emphasis on quality control, operational safety, and energy efficiency in industrial environments. The expanding use of automated inspection systems, material handling equipment, and logistics automation fuels the demand for precise object detection solutions. Moreover, the shift toward contactless sensing technologies to reduce wear and maintenance costs accelerates the adoption across diverse end-use industries.

"Cylindrical segment is expected to capture a prominent share of photoelectric sensor market in 2025"

The cylindrical segment is expected to hold the largest market share in 2025 during the forecast period, owing to its versatile design, ease of installation, and wide compatibility with industrial equipment. These sensors are available in standard sizes (such as M12, M18, and M30), making them suitable for integration across various automation systems. Their rugged construction and high sensing accuracy enable reliable performance in harsh industrial environments like automotive, packaging, and material handling. Additionally, the growing demand for compact and easily replaceable sensor solutions further strengthens the dominance of cylindrical photoelectric sensors in the global market.

"LED segment is projected to record a significant growth rate during the forecast period"

The LED segment is projected to grow commendably in the photoelectric sensor market during the forecast period, driven by its cost-effectiveness, long operational life, and energy efficiency. LED-based sensors offer stable light emission, quick response times, and reliable detection over short to medium ranges, making them ideal for packaging, material handling, and assembly line applications. Their low heat generation and minimal maintenance requirements further enhance their appeal for continuous industrial operations. Moreover, advances in high-intensity and multi-wavelength LED technology improve detection accuracy and expand their usability across diverse industrial environments.

"Asia Pacific is anticipated to be the fastest-growing market from 2025 to 2032"

Asia Pacific is projected to be the fastest-growing market for photoelectric sensors during the forecast period, driven by rapid industrialization, urbanization, and increasing adoption of automation technologies across manufacturing sectors. China, Japan, South Korea, and India are heavily investing in smart factories, robotics, and industrial IoT, fueling the demand for advanced sensing solutions. The expanding automotive, electronics, packaging, and semiconductor industries rely extensively on photoelectric sensors for precision detection and quality control. Additionally, government initiatives promoting digital transformation and smart manufacturing are accelerating sensor adoption. The presence of key players, including KEYENCE CORPORATION (Japan), OMRON Corporation (Japan), and Panasonic Corporation (Japan), with strong distribution networks further supports the robust market growth.

Breakdown of Primaries

Various executives from key organizations operating in the photoelectric sensor market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: Directors - 25%, C-level Executives - 35%, and Others - 40%

- By Region: North America - 25%, Europe - 42%, Asia Pacific - 21%, and RoW - 12%

Note: Three tiers of companies have been defined based on their total revenue as of 2024: Tier 1: >USD 500 million, Tier 2: USD 100 million-USD 500 million, and Tier 3: <USD 100 million. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in the photoelectric sensor market report are Schneider Electric (France), OMRON Corporation (Japan), SICK AG (Germany), KEYENCE CORPORATION (Japan), Rockwell Automation (US), ifm electronic gmbh (Germany), Pepperl+Fuchs SE (Germany), Balluff GmbH (Germany), Panasonic Corporation (Japan), SensoPart Industriesensorik GmbH (Germany), HTMSensors (US), Fargo Controls Inc. (US), Eaton (Ireland), Leuze electronic GmbH + Co. KG (Germany), wenglor sensoric GmbH (Germany), Autonics Corporation (South Korea), BERNSTEIN AG (Germany), CNTD Electric Technology Co., Ltd. (China), Hans Turck GmbH & Co. KG (Germany), Carlo Gavazzi (Switzerland), Molex (US), Baumer (Switzerland), Contrinex S.A. (Switzerland), OPTEX FA CO., LTD. (Japan), TMSS France (France), and Pilz GmbH & Co. KG (Germany). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key market players, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the photoelectric sensor market based on sensing mode, structural type, sensing range, mounting type, beam source, end user, and region. The sensing mode segment includes through-beam, retro-reflective, and diffuse-reflective. The structural type segment includes slot/fork/interrupter sensors, fiber-optic photoelectric sensors, and multi-beam/array sensors. The sensing range segment includes short range (<100 MM), mid range (100 MM-1 M), long range (1 M-30 M), ultra long range (>30 M). The mounting type segment includes cylindrical, rectangular, and slot/fork modules. The beam source segment comprises LED and laser. The end user segment includes automotive manufacturing, packaging printing & e-commerce logistics, food & beverages, pharmaceutical & medical, semiconductor & electronics, consumer goods, energy & utilities, and others. The market has been segmented into four regions: North America, Asia Pacific, Europe, and RoW.

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the photoelectric sensor market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Extensive use of photoelectric sensors in different industries, Increased adoption of retroreflective photoelectric sensors in various applications, Surging adoption of industrial robots across several regions), restraints (US-China trade war, Easy availability of competent alternative sensors), opportunities (Increasing demand for photoelectric sensors for packaging applications from food & beverages industry, Ongoing digitization and emerging connected industries, Prevailing trend of miniaturized sensors), and challenges (Unavailability of raw materials, High maintenance costs of photoelectric sensors) influencing the growth of the photoelectric sensor market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the photoelectric sensor market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the photoelectric sensor market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the photoelectric sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including OMRON Corporation (Japan), Schneider Electric (France), KEYENCE CORPORATION (Japan), Rockwell Automation (US), and SICK AG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING PHOTOELECTRIC SENSOR MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 GLOBAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHOTOELECTRIC SENSOR MARKET

- 3.2 PHOTOELECTRIC SENSOR MARKET, BY SENSING MODE

- 3.3 PHOTOELECTRIC SENSOR MARKET, BY END USER

- 3.4 NORTH AMERICA: PHOTOELECTRIC SENSOR MARKET, BY END USER AND COUNTRY

- 3.5 PHOTOELECTRIC SENSOR MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Widespread adoption of photoelectric sensors across multiple industries

- 4.2.1.2 Expanded application of retro-reflective photoelectric sensors in various industries

- 4.2.1.3 Rapid adoption of industrial robots across multiple regions

- 4.2.2 RESTRAINTS

- 4.2.2.1 Rising trade tensions between US and China

- 4.2.2.2 Easy availability of competent alternative sensors

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising use of photoelectric sensors in food & beverage packaging applications

- 4.2.3.2 Advanced digital transformation and expansion of connected industrial ecosystems

- 4.2.3.3 Growing use of compact, miniaturized sensor solutions

- 4.2.4 CHALLENGES

- 4.2.4.1 High maintenance costs

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 UNMET NEEDS IN PHOTOELECTRIC SENSOR MARKET

- 4.5 WHITE SPACE OPPORTUNITIES

- 4.6 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.7 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 STRATEGIC DISRUPTION, PATENT, DIGITAL, AND AI ADOPTION

- 5.1 KEY EMERGING TECHNOLOGIES

- 5.1.1 CMOS TECHNOLOGY

- 5.1.2 DURABEAM TECHNOLOGY

- 5.1.3 MULTI-PIXEL TECHNOLOGY (MPT)

- 5.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.1 INDUSTRIAL IOT (IIOT) & EDGE CONNECTIVITY

- 5.2.2 MACHINE VISION & AI-BASED VISION SYSTEMS

- 5.3 TECHNOLOGY/PRODUCT ROADMAP

- 5.4 PATENT ANALYSIS

- 5.5 IMPACT OF AI/GEN AI ON PHOTOELECTRIC SENSOR MARKET

- 5.5.1 CASE STUDY: IMPLEMENTATION OF AI IN PHOTOELECTRIC SENSOR MARKET

- 5.5.2 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT

- 5.5.3 CLIENT READINESS TO ADOPT GEN AI IN PHOTOELECTRIC SENSOR MARKET

6 REGULATORY LANDSCAPE

- 6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2 REGULATIONS, BY REGION

- 6.2.1 NORTH AMERICA

- 6.2.1.1 ANSI B11 - Machine Safety

- 6.2.2 EUROPE

- 6.2.2.1 Machinery Directive (2006/42/EC)

- 6.2.3 ASIA PACIFIC

- 6.2.3.1 RoHS and REACH Regulations

- 6.2.4 MIDDLE EAST

- 6.2.4.1 UAE National Strategy for Artificial Intelligence

- 6.2.1 NORTH AMERICA

- 6.3 STANDARDS & CERTIFICATIONS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS END USERS

8 TECHNOLOGY AND INNOVATION TRENDS

- 8.1 INTRODUCTION

- 8.2 SHIFT TO HYBRID CONNECTORS

- 8.3 INTEGRATION WITH AI AND EDGE COMPUTING HARDWARE

- 8.4 DEVELOPMENT OF EMI-SHIELDED AND HIGH-SPEED CONNECTOR SOLUTIONS

- 8.5 MINIATURIZATION AND DEMAND FOR FINE-PITCH CONNECTORS

- 8.6 ADVANCEMENTS IN AUTOMATED TESTING AND INSPECTION DURING MANUFACTURING

9 INDUSTRY TRENDS

- 9.1 PORTER'S FIVE FORCES ANALYSIS

- 9.1.1 THREAT FROM NEW ENTRANTS

- 9.1.2 THREAT FROM SUBSTITUTES

- 9.1.3 BARGAINING POWER OF SUPPLIERS

- 9.1.4 BARGAINING POWER OF BUYERS

- 9.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 9.2 MACROECONOMIC INDICATORS

- 9.2.1 INTRODUCTION

- 9.2.2 GDP TRENDS AND FORECAST

- 9.2.3 TRENDS IN GLOBAL AUTOMOTIVE MANUFACTURING INDUSTRY

- 9.2.4 TRENDS IN PACKAGING AND PRINTING & E-COMMERCE LOGISTICS INDUSTRY

- 9.3 VALUE CHAIN ANALYSIS

- 9.4 ECOSYSTEM ANALYSIS

- 9.5 PRICING ANALYSIS

- 9.5.1 AVERAGE SELLING PRICE OF PHOTOELECTRIC SENSING MODES, BY KEY PLAYER

- 9.5.2 AVERAGE SELLING PRICE, BY REGION

- 9.6 TRADE ANALYSIS

- 9.6.1 IMPORT SCENARIO

- 9.6.2 EXPORT SCENARIO

- 9.7 KEY CONFERENCES & EVENTS, 2025-2026

- 9.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMER

- 9.9 INVESTMENT & FUNDING SCENARIO

- 9.10 CASE STUDY ANALYSIS

- 9.10.1 INTEGRATION OF SICK AG'S PHOTOELECTRIC SENSORS WITH HEYE INTERNATIONAL GMBH'S MACHINERY FOR ACCURATE GLASS BOTTLE COUNTING

- 9.10.2 AUDIO HUNGARIA MOTOR DEPLOYED OG DIFFUSE REFLECTION TYPE PHOTOELECTRIC SENSORS FROM IFM ELECTRONIC GMBH

- 9.10.3 ENHANCING MANUFACTURING EFFICIENCY AND QUALITY THROUGH ADVANCED PHOTOELECTRIC SENSOR DEPLOYMENT AT KEYENCE

- 9.11 IMPACT OF 2025 US TARIFFS

- 9.11.1 INTRODUCTION

- 9.11.2 KEY TARIFF RATES

- 9.11.3 PRICE IMPACT ANALYSIS

- 9.11.4 IMPACT ON COUNTRY/REGION

- 9.11.4.1 US

- 9.11.4.2 Europe

- 9.11.4.3 Asia Pacific

- 9.11.5 IMPACT ON END-USE INDUSTRIES

10 PHOTOELECTRIC SENSOR MARKET, BY SENSING MODE

- 10.1 INTRODUCTION

- 10.2 THROUGH BEAM

- 10.2.1 THROUGH-BEAM PHOTOELECTRIC SENSORS PROVIDE LONG-DISTANCE DETECTION

- 10.3 RETRO REFLECTIVE

- 10.3.1 RISING NEED FOR RETRO REFLECTIVE PHOTOELECTRIC SENSORS FOR TRANSPARENT PRODUCTS

- 10.4 DIFFUSE REFLECTIVE

- 10.4.1 NEED FOR COST-EFFICIENT SENSORS TO DRIVE DEMAND

11 PHOTOELECTRIC SENSOR MARKET, BY STRUCTURAL TYPE

- 11.1 INTRODUCTION

- 11.2 SLOT/FORK/INTERRUPTER SENSORS

- 11.2.1 NEED FOR SENSORS FOR HIGH-SPEED PRECISION TASKS TO DRIVE MARKET

- 11.3 FIBER-OPTIC PHOTOELECTRIC SENSORS

- 11.3.1 INCREASE USE OF SENSORS IN EXTREME AND CONFINED ENVIRONMENTS TO DRIVE DEMAND

- 11.4 MULTI-BEAM/ARRAY SENSORS

- 11.4.1 FOCUS ON WIDE-AREA PROFILING AND DIMENSIONING SOLUTIONS TO BOOST GROWTH

12 PHOTOELECTRIC SENSOR MARKET, BY SENSING RANGE

- 12.1 INTRODUCTION

- 12.2 SHORT RANGE (< 100 MM)

- 12.2.1 NEED FOR SENSORS WITH HIGH RESOLUTION AND QUICK RESPONSE TIMES TO DRIVE MARKET

- 12.3 MID RANGE (100 MM-1 M)

- 12.3.1 DEMAND FOR SENSORS THAT BALANCE COST, RELIABILITY, AND PERFORMANCE TO DRIVE MARKET

- 12.4 LONG RANGE (1 M-30 M)

- 12.4.1 GROWING DEMAND FOR LONG-RANGE SENSORS IN INTRALOGISTICS AND AGVS TO DRIVE MARKET

- 12.5 ULTRA LONG RANGE (> 30 M)

- 12.5.1 ULTRA-LONG-RANGE SENSORS ARE CRITICAL FOR OUTDOOR AND LARGE-SCALE AUTOMATION

13 PHOTOELECTRIC SENSOR MARKET, BY MOUNTING TYPE

- 13.1 INTRODUCTION

- 13.2 CYLINDRICAL

- 13.2.1 NEED FOR SENSORS WITH STANDARDIZED THREAD SIZE AND QUICK-CHANGE CAPABILITY TO DRIVE MARKET

- 13.2.2 M5

- 13.2.3 M8

- 13.2.4 M12

- 13.2.5 M18

- 13.2.6 M30

- 13.3 RECTANGULAR

- 13.3.1 DEMAND FOR SPACE-EFFICIENT SENSORS WITH FEATURE-RICH DESIGN TO DRIVE MARKET

- 13.4 SLOT/FORK MODULES

- 13.4.1 NEED FOR HIGH PRECISION AND IMMUNITY IN DEDICATED APPLICATIONS TO DRIVE GROWTH

14 PHOTOELECTRIC SENSOR MARKET, BY BEAM SOURCE

- 14.1 INTRODUCTION

- 14.2 LED

- 14.2.1 NEED FOR SENSORS OFFERING EXCELLENT PRICE-PERFORMANCE RATIO TO DRIVE MARKET

- 14.3 LASER

- 14.3.1 FOCUS ON RELIABLE DETECTION OF STRUCTURED SURFACES TO DRIVE MARKET FOR LASER-BASED SENSORS

15 PHOTOELECTRIC SENSOR MARKET, BY END USER

- 15.1 INTRODUCTION

- 15.2 AUTOMOTIVE MANUFACTURING

- 15.2.1 RAPID INTEGRATION OF PHOTOELECTRIC SENSORS ACROSS ROBOTIC ASSEMBLY AND QUALITY INSPECTION LINES TO DRIVE MARKET

- 15.3 PACKAGING AND PRINTING & E-COMMERCE LOGISTICS

- 15.3.1 ACCELERATED ADOPTION OF PHOTOELECTRIC SENSORS IN SORTATION AND PARCEL TRACKING SYSTEMS TO DRIVE MARKET

- 15.4 FOOD & BEVERAGE

- 15.4.1 RISING NEED FOR HYGIENIC PROCESSING AND PACKAGING INSPECTION TO DRIVE MARKET

- 15.5 PHARMACEUTICAL & MEDICAL

- 15.5.1 PRECISION DRUG PACKAGING, DEVICE ASSEMBLY, AND CLEANROOM AUTOMATION TO DRIVE GROWTH

- 15.6 SEMICONDUCTOR & ELECTRONICS

- 15.6.1 STRONG DEMAND FOR ULTRA-PRECISE PHOTOELECTRIC SENSORS IN CHIP ASSEMBLY AND PCB INSPECTION TO BOOST GROWTH

- 15.7 CONSUMER GOODS

- 15.7.1 FOCUS ON HIGH-VOLUME ASSEMBLY AND QUALITY ASSURANCE OPERATIONS TO FUEL ADOPTION OF PHOTOELECTRIC SENSORS

- 15.8 ENERGY & UTILITIES

- 15.8.1 INCREASING APPLICATION OF PHOTOELECTRIC SENSORS IN POWER PLANTS AND RENEWABLE ENERGY SYSTEMS TO BOOST GROWTH

- 15.9 OTHERS

16 PHOTOELECTRIC SENSOR MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Ongoing industrial automation to drive market

- 16.2.2 CANADA

- 16.2.2.1 Rising investments in advanced technologies to drive growth

- 16.2.3 MEXICO

- 16.2.3.1 Rising manufacturing investments under FTAs to fuel market growth

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 GERMANY

- 16.3.1.1 Expanding automotive industry to drive demand for photoelectric sensors

- 16.3.2 UK

- 16.3.2.1 Expanding construction sector to drive demand for photoelectric sensors

- 16.3.3 FRANCE

- 16.3.3.1 Rising deployment of robotics and automated machinery to boost market growth

- 16.3.4 ITALY

- 16.3.4.1 Adoption of photoelectric sensors among small and medium-sized enterprises to boost market

- 16.3.5 SPAIN

- 16.3.5.1 Rapid industrial automation across manufacturing, logistics, and food & beverage sectors to drive market

- 16.3.6 NORDICS

- 16.3.6.1 Expanding warehouse automation and e-commerce logistics to contribute to growth

- 16.3.7 REST OF EUROPE

- 16.3.1 GERMANY

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Rapid industrial automation across manufacturing sector to boost market

- 16.4.2 JAPAN

- 16.4.2.1 Need for robust industrial automation and smart manufacturing to drive market

- 16.4.3 SOUTH KOREA

- 16.4.3.1 Rising demand for photoelectric sensors in industrial robotic applications to drive market

- 16.4.4 INDIA

- 16.4.4.1 Rapid expansion of manufacturing sector to boost demand

- 16.4.5 AUSTRALIA

- 16.4.5.1 Presence of advanced manufacturing and mining sectors to drive market

- 16.4.6 INDONESIA

- 16.4.6.1 Push toward industrialization and growth of manufacturing sector to drive market

- 16.4.7 MALAYSIA

- 16.4.7.1 Presence of robust electronics and semiconductor industries to drive growth

- 16.4.8 THAILAND

- 16.4.8.1 Rapid growth of automotive and food processing industries to drive market

- 16.4.9 VIETNAM

- 16.4.9.1 Evolving safety standards in pharmaceutical and consumer goods sectors to boost market

- 16.4.10 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 ROW

- 16.5.1 SOUTH AMERICA

- 16.5.1.1 Focus on industrial modernization and mining automation to drive market

- 16.5.2 MIDDLE EAST

- 16.5.2.1 Saudi Arabia

- 16.5.2.1.1 'Vision 2030' to fuel adoption of photoelectric sensors

- 16.5.2.2 UAE

- 16.5.2.2.1 Industry 4.0 and smart cities to drive demand for photoelectric sensors

- 16.5.2.3 Oman

- 16.5.2.3.1 Emerging industrial zones to ignite adoption of photoelectric sensors

- 16.5.2.4 Qatar

- 16.5.2.4.1 LNG expansion and petrochemical diversification to drive market growth

- 16.5.2.5 Kuwait

- 16.5.2.5.1 Need for modernization of refineries and safety of petrochemicals to boost demand

- 16.5.2.6 Bahrain

- 16.5.2.6.1 Growth of logistics industry to spur demand for photoelectric sensors

- 16.5.2.7 Rest of Middle East

- 16.5.2.1 Saudi Arabia

- 16.5.3 AFRICA

- 16.5.3.1 South Africa

- 16.5.3.1.1 Focus on automation of mining and manufacturing revival to drive growth

- 16.5.3.2 Other African countries

- 16.5.3.1 South Africa

- 16.5.1 SOUTH AMERICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY VALUATION AND FINANCIAL METRICS

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Sensing mode footprint

- 17.7.5.4 Beam source footprint

- 17.7.5.5 End user footprint

- 17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.8.5.1 Detailed list of key startups/SMEs

- 17.8.5.2 Competitive benchmarking of key startups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 17.9.2 DEALS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 OMRON CORPORATION

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 MnM view

- 18.1.1.3.1 Key strengths

- 18.1.1.3.2 Strategic choices

- 18.1.1.3.3 Weaknesses and competitive threats

- 18.1.2 SCHNEIDER ELECTRIC

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches/enhancements

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 KEYENCE CORPORATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches/enhancements

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 ROCKWELL AUTOMATION

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches/enhancements

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 SICK AG

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches/enhancements

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 PANASONIC CORPORATION

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.7 IFM ELECTRONIC GMBH

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Deals

- 18.1.8 PEPPERL+FUCHS

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches/enhancements

- 18.1.9 BALLUFF AUTOMATION INDIA PVT. LTD.

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.10 EATON

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.1 OMRON CORPORATION

- 18.2 OTHER PLAYERS

- 18.2.1 SENSOPART INDUSTRIESENSORIK GMBH

- 18.2.2 HTMSENSORS

- 18.2.3 FARGO CONTROLS INC.

- 18.2.4 LEUZE ELECTRONIC, INC

- 18.2.5 WENGLOR SENSORIC GMBH

- 18.2.6 AUTONICS CORPORATION

- 18.2.7 SINGOO

- 18.2.8 HANS TURCK GMBH & CO. KG

- 18.2.9 CARLO GAVAZZI HOLDING AG

- 18.2.10 BAUMER

- 18.2.11 CONTRINEX INC.

- 18.2.12 OPTEX FA CO., LTD.

- 18.2.13 TMSS FRANCE

- 18.2.14 PILZ GMBH & CO. KG

- 18.2.15 BANNER ENGINEERING CORP.

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of key secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 List of primary interview participants

- 19.1.3.2 Major primary interviewees

- 19.1.3.3 Key data from primary sources

- 19.1.3.4 Key industry insights

- 19.1.3.5 Breakdown of primaries

- 19.2 MARKET SIZE ESTIMATION METHODOLOGY

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Market size estimation using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Market size estimation using top-down analysis (supply side)

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS

- 19.6 RISK ASSESSMENT

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS