|

시장보고서

상품코드

1906300

고무 가공유 시장(-2030년) : 유형(나프텐계, 파라핀계, TDAE, DAE, MES, RAE, TRAE), 용도(타이어, 산업용 고무 제품, 유전폴리머, 열가소성 엘라스토머), 점도, 지역별Rubber Process Oil Market by Type (Naphthenic, Paraffinic, TDAE, DAE, MES, RAE, and TRAE), Application (Tires, Industrial Rubber Products, Oil-extended Polymers, and Thermoplastic Elastomers), Viscosity, and Region - Global Forecast to 2030 |

||||||

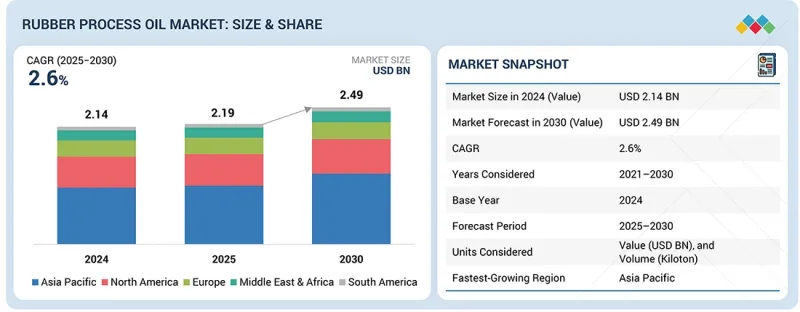

세계의 고무 가공유 시장 규모는 예측 기간 중에 CAGR 2.6%로 성장하여 2025년 21억 9,000만 달러에서 2030년에는 24억 9,000만 달러에 이를 전망입니다.

고무 가공유는 천연 고무 및 합성 고무 화합물의 가공 특성과 성능 특성을 향상시키는 데 중요한 역할을 합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러), 킬로톤 |

| 부문 | 유형, 점도, 용도 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

이 오일은 필러의 분산성을 높이고 점도를 낮추며 보다 원활한 혼합 작업을 가능하게 함으로써 타이어, 산업용 고무 제품, 열가소성 엘라스토머, 오일 확장 폴리머의 일관된 생산을 지원합니다. 시장은 점점 더 변화하는 배합 요건에 따라 형성되고 있으며, 제조업체들은 진화하는 규제 기준과 성능 기대치를 충족시키기 위해 더 깨끗하고 PAH가 적으며 용도에 특화된 오일에 초점을 맞추었습니다. 고무 배합이 더욱 전문화되고 생산 라인의 효율성이 요구되는 가운데, 점도 범위와 추출 유형을 넘나드는 맞춤형 RPO 등급의 중요성은 꾸준히 증가하고 있습니다.

"유형별로는 가공된 증류 방향족 추출물(TDAE) 부문이 예측 기간 동안 금액 기준으로 두 번째 점유율을 차지할 것으로 예측됩니다."

TDAE는 성능, 안전성, 비용의 균형이 우수하여 다양한 고무 응용 분야에서 선호되는 선택이 되고 있습니다. 규제 기준에 따라 고다환방향족탄화수소(PAH) 함유 방향족 오일의 사용이 단계적으로 감소하는 가운데, 많은 타이어 및 산업용 고무 제조업체들은 기존 배합에 필요한 가공 용이성, 탄성 향상 및 적합성을 유지하면서 보다 안전하고 규제에 부합하는 대안으로 TDAE를 채택하고 있습니다. 컴파운드의 유연성 유지, 분산성 향상, 우수한 구름 저항 및 내열성 특성으로 인해 표준 타이어와 중성능 타이어 카테고리 모두에서 신뢰할 수 있는 선택이 될 수 있습니다. 동시에, 그 가용성과 저렴한 가격으로 인해 대량 생산 제조업체도 쉽게 사용할 수 있는 제품입니다. TDAE는 규제 적합성, 성능 신뢰성, 비용 적합성을 겸비한 TDAE는 RPO 시장에서 2위를 차지하고 있으며, 타이어 및 비타이어 고무 제품 모두에서 안정적인 수요를 유지하고 있습니다.

"용도별로는 산업용 고무 부문이 예측 기간 동안 두 번째로 큰 시장 점유율을 차지할 것으로 예측됩니다."

산업용 고무 부문은 벨트, 호스, 개스킷, 씰, 성형 부품 등 다양한 제품에 사용되어 예측 기간 동안 두 번째 주요 응용 분야가 될 것으로 예측됩니다. 고무 가공유는 유연성을 높이고, 필러의 분산을 개선하고, 안정적인 가공 성능을 보장하기 때문에 산업용 고무 제조에 필수적입니다. 이 분야는 산업화, 인프라 개발, 여러 분야에서 내구성과 고성능을 갖춘 고무 부품에 대한 수요에 힘입어 안정적인 수요가 예상됩니다. 또한, 제조업체들은 환경 기준 및 규제 기준을 준수하면서도 제품 성능을 유지하기 위해 고품질의 저 PAH(다환방향족 탄화수소) 오일을 채택하는 경향이 증가하고 있습니다. 타이어 제조는 여전히 총량 기준으로 가장 큰 응용 분야이지만, 산업용 고무 분야는 지속적인 사용, 광범위한 적용성, 성능 최적화 및 규제 준수 오일에 대한 수요 증가로 인해 견고한 입지를 유지하고 있습니다.

"예측 기간 동안 북미가 두 번째 시장 점유율을 차지할 것으로 예측됩니다."

북미는 자동차 제조에서의 강력한 존재감, 대규모 교체용 타이어 시장, 확립된 산업용 고무 부문으로 인해 고무 가공유 시장에서 두 번째 규모를 유지할 것으로 예측됩니다. 이 지역은 타이어, 벨트, 호스, 개스킷, 성형 고무 부품 등 일관된 고품질 고무 가공유에 크게 의존하는 제품의 성숙한 생산 능력을 보유하고 있습니다. 고성능 및 특수 고무 소재의 첨단 제품 개발도 TDAE, 저 PAH 배합 등 보다 깨끗하고 정제도가 높은 RPO 등급의 안정적 수요를 견인하고 있습니다. 또한, 이 지역의 엄격한 규제 환경은 보다 안전하고 환경 친화적인 오일의 사용을 촉진하고 고부가가치 RPO 유형으로의 전환을 촉진하고 있습니다. 안정적인 정제 기반, 고품질 소재에 대한 고객의 높은 선호도, 그리고 고무 가공 기술의 지속적인 향상으로 북미는 지속적인 산업 활동과 강력한 자동차 산업 생태계를 바탕으로 지역별 시장 규모에서 2위를 차지하고 있습니다.

세계의 고무 가공용 오일(Rubber Processing Oil) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 프리미엄 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 관련 시장, 타업종과의 분야 횡단적 기회

- Tier1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 세계의 거시경제 전망

- 공급망 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 고객 사업에 영향을 미치는 동향/파괴적 변화

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 트럼프 관세가 고무 가공유 시장에 미치는 영향

제6장 기술 진보, AI에 의한 영향, 특허, 혁신, 향후 응용

- 주요 신기술

- 바이오 고무 가공유

- 보완적 기술

- 고무 가공유 성능 향상을 위한 첨단 첨가제

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- 생성형 AI가 고무 가공유 시장에 미치는 영향

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 지속가능성 이니셔티브

- 지속가능성에 대한 영향과 규제 정책 대처

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 기준

- 채택 장벽과 내부 과제

- 다양한 용도 미충족 요구

- 시장 수익성

제9장 고무 가공유 시장 : 점도별

- 저점도

- 중점도

- 고점도

제10장 고무 가공유 시장 : 용도별

- 타이어

- 유전폴리머

- 산업용 고무 제품

- 열가소성 엘라스토머(TPE)

- 기타

제11장 고무 가공유 시장 : 유형별

- 처리된 증류 방향족 추출물(TDAE)

- 증류 방향 엑기스(DAE)

- 마일드 추출 용매화물(MES)

- 잔류 방향 추출물(RAE) 및 처리된 잔류 방향족 추출물(TRAE)

- 파라핀

- 나프텐

제12장 고무 가공유 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 인도네시아

- 태국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 러시아

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타

- 중동 및 아프리카

- GCC 국가

- 이란

- 기타

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타

제13장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

- 기업 평가와 재무 지표

제14장 기업 개요

- 주요 기업

- SINOPEC

- PETROCHINA COMPANY LIMITED

- CHEVRON CORPORATION

- EXXON MOBIL CORPORATION

- SHELL PLC

- APAR INDUSTRIES LTD.

- PANAMA PETROCHEM LTD.

- BEHRAN OIL CO.

- ENILIVE S.P.A.

- GANDHAR OIL REFINERY(INDIA) LIMITED

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- INDIAN OIL CORPORATION LTD

- ORLEN UNIPETROL GROUP

- IDEMITSU KOSAN CO., LTD.

- REPSOL

- ORGKHIM BIOCHEMICAL HOLDING

- GPPL

- IRANOL(LLP)

- PETRO GULF INTERNATIONAL FZE

- CALUMET, INC.

- H&R GROUP

- NYNAS AB

- IRPC PUBLIC COMPANY LIMITED

- PT. ENERCO RPO INTERNASIONAL

- WITMANS INDUSTRIES PVT. LTD.

- THAIOIL GROUP

- SHANGDONG TIANYUAN CHEMICAL CO., LTD

- P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED

- 기타 기업

- PETRO NAFT

- PANOL INDUSTRIES RMC FZE

- EAGLE PETROCHEM

- LODHA PETRO

- RLS PETROCHEM LUBRICANTS LLC

- GAZPROMNEFT-LUBRICANTS LTD.

제15장 조사 방법

제16장 부록

LSH 26.01.22The global rubber process oil market is projected to grow from USD 2.19 billion in 2025 to USD 2.49 billion by 2030, at a CAGR of 2.6% during the forecast period. Rubber process oils play a critical role in improving the processing behavior and performance characteristics of both natural and synthetic rubber compounds.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), and Volume (Kiloton) |

| Segments | Type, Viscosity, and Application |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

By enhancing filler dispersion, reducing viscosity, and enabling smoother mixing operations, these oils support consistent production of tires, industrial rubber goods, thermoplastic elastomers, and oil-extended polymers. The market is increasingly shaped by shifting formulation requirements, where manufacturers are focusing on cleaner, low-PAH, and more application-specific oils to meet evolving regulatory norms and performance expectations. As rubber formulations become more specialized and production lines demand higher efficiency, the relevance of tailored RPO grades-across viscosity ranges and extract types-continues to grow steadily.

"By type, treated distillate aromatic extract (TDAE) segment to account for second-largest share during forecast period in terms of value"

The treated distillate aromatic extract (TDAE) segment is estimated to account for the second-largest share of the rubber process oil market. TDAE strikes a strong balance between performance, safety, and cost, making it a preferred choice for a wide range of rubber applications. As regulatory norms continue to phase down high-PAH aromatic oils, many tire and industrial rubber manufacturers are adopting TDAE as a safer and more compliant alternative, yet one that still offers the processing ease, elasticity improvement, and compatibility required in traditional formulations. Its ability to maintain compound softness, enhance dispersion, and support better rolling and heat-resistance characteristics has made it a dependable option for both standard and mid-performance tire categories. At the same time, its availability and affordability keep it accessible for large-volume producers. This combination of regulatory alignment, performance reliability, and cost suitability has positioned TDAE as the second-largest segment in the RPO market, with steady demand across both tire and non-tire rubber products.

"By application, industrial rubber segment to account for second-largest market share during forecast period"

The industrial rubber segment is projected to be the second-largest application of rubber process oil during the forecast period due to its wide use in products such as belts, hoses, gaskets, seals, and molded components. Rubber process oils enhance flexibility, improve filler dispersion, and ensure consistent processing performance, making them essential for industrial rubber manufacturing. The segment benefits from steady demand driven by industrialization, infrastructure development, and the need for durable and high-performance rubber components across multiple sectors. Additionally, manufacturers increasingly adopt high-quality and low-PAH oils to comply with environmental and regulatory standards while maintaining product performance. Although tire manufacturing remains the largest application segment due to higher overall volume, industrial rubber maintains a strong position because of recurring usage, broad applicability, and rising demand for performance-optimized, regulation-compliant oils.

"North America to account for second-largest market share during forecast period"

North America is projected to be the second-largest market for rubber process oil due to its strong presence in automotive manufacturing, a large replacement tire market, and a well-established industrial rubber sector. The region benefits from mature production capabilities for tires, belts, hoses, gaskets, and molded rubber components, all of which rely heavily on consistent and high-quality rubber process oils. Advanced product development in high-performance and specialty rubber materials also drives steady demand for cleaner and more refined RPO grades, including TDAE and low-PAH formulations. In addition, the region's robust regulatory environment encourages the use of safer, environmentally aligned oils, reinforcing the shift toward higher-value RPO types. A stable refining base, strong customer preference for premium-quality materials, and continuous upgrades in rubber processing technologies collectively position North America as the second-largest regional market, supported by sustained industrial activity and a strong automotive ecosystem.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors - 25%, Managers - 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) are some of the major players operating in the rubber process oil market.

Research Coverage:

The report segments the rubber process oil market based on type, viscosity, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles rubber process oil manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the rubber process oil market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical Drivers (Rising global vehicle production-including passenger cars, MHCVs, and off-highway vehicles-along with increasing aftermarket tire replacements, is boosting tire output and driving demand for rubber process oils; Growth in synthetic rubber production; Rising demand for low-PAH, low-viscosity, and specialty oils), Restraints (Stringent global regulations on aromatic RPO (EU, US, China), Substitution by bio-based/sustainable plasticizers, Declining availability of suitable Group I/II base oils), Opportunities (Rising demand for green/biodegradable rubber oils; New tire plant investments across Asia, MEA, and Eastern Europe; Rising demand for luxury vehicles and electric cars boosting need for high-performance tires), and Challenges (Fluctuating prices of key RPO feedstocks such as crude-derived distillates and aromatic extracts)

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the rubber process oil market

- Market Development: Comprehensive information about lucrative markets - the report analyses the rubber process oil market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) in the rubber process oil market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RUBBER PROCESS OIL MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RUBBER PROCESS OIL MARKET

- 3.2 RUBBER PROCESS OIL MARKET, BY REGION

- 3.3 RUBBER PROCESS OIL MARKET, BY TYPE

- 3.4 RUBBER PROCESS OIL MARKET, BY KEY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising global vehicle production, along with increasing aftermarket tire replacements, boosting tire output

- 4.2.1.2 Growth in synthetic rubber production

- 4.2.1.3 Rising demand for low-PAH, low-viscosity, and specialty oils

- 4.2.2 RESTRAINTS

- 4.2.2.1 Stringent global regulations on aromatic RPO (EU, US, China)

- 4.2.2.2 Substitution by bio-based/sustainable plasticizers

- 4.2.2.3 Declining availability of suitable Group I/II base oils

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for green/biodegradable rubber oils

- 4.2.3.2 New tire plant investments across Asia, MEA, and Eastern Europe

- 4.2.3.3 Rising demand for luxury vehicles and electric cars boosting need for high-performance tires

- 4.2.4 CHALLENGES

- 4.2.4.1 Fluctuating prices of key RPO feedstocks, such as crude-derived distillates and aromatic extracts, create cost pressures

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN RUBBER PROCESS OIL MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 GLOBAL MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL RUBBER PROCESS OIL INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLY

- 5.3.2 RUBBER PROCESS OIL PRODUCTION

- 5.3.3 RUBBER PROCESS OIL TYPES

- 5.3.4 DISTRIBUTORS

- 5.3.5 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL, BY REGION, 2022-2025

- 5.5.2 AVERAGE SELLING PRICE OF RUBBER PROCESS OIL TYPE, BY KEY PLAYER, 2025

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 2709)

- 5.6.2 EXPORT SCENARIO (HS CODE 2709)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 RRII (RUBBER RESEARCH INSTITUTE) - INDIAN OIL COLLABORATION ON ADVANCED RUBBER PROCESS OIL APPLICATIONS

- 5.10.2 REPSOL'S BIOEXTENSOIL - A CIRCULAR AND HIGH-PERFORMANCE ALTERNATIVE TO MINERAL RUBBER PROCESS OILS

- 5.10.3 SHELL FLAVEX 595 - ENABLING COMPLIANCE AND HIGH-PERFORMANCE TIRE MANUFACTURING

- 5.11 TRUMP TARIFF IMPACT ON RUBBER PROCESS OIL MARKET

- 5.11.1 KEY TARIFF RATES IMPACTING MARKET

- 5.11.2 PRICE IMPACT ANALYSIS

- 5.11.3 KEY IMPACT ON VARIOUS REGIONS

- 5.11.3.1 US

- 5.11.3.2 Europe

- 5.11.3.3 Asia Pacific

- 5.11.4 IMPACT ON END-USE INDUSTRIES OF RUBBER PROCESS OIL MARKET

- 5.11.4.1 Tires

- 5.11.4.2 Oil-extended polymers

- 5.11.4.3 Industrial rubber products

- 5.11.4.4 Thermoplastic elastomers (TPEs)

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 BIO-BASED RUBBER PROCESS OILS

- 6.1.1.1 Introduction: A shift toward sustainable processing oils

- 6.1.1.2 Renewable feedstocks driving material transformation

- 6.1.1.3 Regulatory alignment and industry-wide adoption momentum

- 6.1.1.4 Market impact and long-term strategic relevance

- 6.1.1 BIO-BASED RUBBER PROCESS OILS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED ADDITIVES FOR ENHANCED PERFORMANCE IN RUBBER PROCESS OILS

- 6.2.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.2.2.1 Short-term (2025-2027) | process efficiency & low-PCA compliance

- 6.2.2.2 Mid-term (2027-2030) | sustainability transition & value-added formulations

- 6.2.2.3 Long-term (2030-2035+) | circularity, high-performance synthesis & next-gen RPO

- 6.3 PATENT ANALYSIS

- 6.3.1 METHODOLOGY

- 6.4 FUTURE APPLICATIONS

- 6.4.1 TIRES: ENHANCED FLEXIBILITY AND PROCESSING EFFICIENCY

- 6.4.2 OIL-EXTENDED POLYMERS: IMPROVED POLYMER FLOW AND REDUCED VISCOSITY

- 6.4.3 INDUSTRIAL RUBBER PRODUCTS: SUPPORTED ELASTICITY AND UNIFORM COMPOUNDING

- 6.4.4 THERMOPLASTIC ELASTOMERS (TPE): FACILITATED SOFTENING AND MELT-FLOW BEHAVIOR

- 6.5 IMPACT OF GENERATIVE AI ON RUBBER PROCESS OIL MARKET

- 6.5.1 INTRODUCTION

- 6.5.2 AI-DRIVEN FORMULATION INNOVATION

- 6.5.3 SMART MANUFACTURING AND PROCESS OPTIMIZATION

- 6.5.4 MARKET INSIGHT AND PRODUCT POSITIONING

- 6.5.5 CUSTOMER COLLABORATION AND VALUE-ADDED SERVICES

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF RUBBER PROCESS OIL

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF RUBBER PROCESS OIL

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 RUBBER PROCESS OIL MARKET, BY VISCOSITY

- 9.1 INTRODUCTION

- 9.2 LOW VISCOSITY

- 9.2.1 GROWING FOCUS ON EFFICIENT, EASY-PROCESSING RUBBER FORMULATIONS

- 9.3 MEDIUM VISCOSITY

- 9.3.1 BROAD ADAPTABILITY AND CONSISTENT PERFORMANCE

- 9.4 HIGH VISCOSITY

- 9.4.1 RISE IN DEMAND FOR DURABLE, HIGH-PERFORMANCE RUBBER PRODUCTS

10 RUBBER PROCESS OIL MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 TIRES

- 10.2.1 RISING DEMAND FOR HIGH-PERFORMANCE, DURABLE, AND ENVIRONMENTALLY COMPLIANT TIRES

- 10.3 OIL-EXTENDED POLYMERS

- 10.3.1 GROWING USE OF OIL-EXTENDED POLYMERS IN HIGH-PERFORMANCE RUBBER PRODUCTS

- 10.4 INDUSTRIAL RUBBER PRODUCTS

- 10.4.1 INCREASING NEED FOR DURABLE, HIGH-PERFORMANCE, AND COMPLIANT INDUSTRIAL RUBBER PRODUCTS

- 10.5 THERMOPLASTIC ELASTOMERS (TPE)

- 10.5.1 RISING ADOPTION OF THERMOPLASTIC ELASTOMERS IN VERSATILE AND HIGH-PERFORMANCE APPLICATIONS

- 10.6 OTHER APPLICATIONS

11 RUBBER PROCESS OIL MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 TREATED DISTILLATE AROMATIC EXTRACT (TDAE)

- 11.2.1 RISING PREFERENCE FOR CLEANER, REGULATION-COMPLIANT, AND HIGH-PERFORMANCE RUBBER PROCESS OILS

- 11.3 DISTILLATE AROMATIC EXTRACT (DAE)

- 11.3.1 CONTINUED USE OF COST-EFFECTIVE, HIGH-SOLVENCY AROMATIC OILS LIKE DAE IN KEY RUBBER PROCESSING APPLICATIONS

- 11.4 MILD EXTRACTED SOLVATE (MES)

- 11.4.1 INCREASING INDUSTRY SHIFT TOWARD LOW-PAH, ENVIRONMENTALLY COMPLIANT, AND PERFORMANCE-STABLE RUBBER PROCESS OILS

- 11.5 RESIDUAL AROMATIC EXTRACT (RAE) AND TREATED RESIDUAL AROMATIC EXTRACT (TRAE)

- 11.5.1 STEADY USE OF RAE AND GROWING ADOPTION OF CLEANER TRAE GRADES

- 11.6 PARAFFINIC

- 11.6.1 RISING NEED FOR CLEAN, THERMALLY STABLE, AND HIGH-PERFORMANCE RUBBER FORMULATIONS

- 11.7 NAPHTHENIC

- 11.7.1 NEED FOR EFFICIENT, FLEXIBLE, AND WIDE-COMPATIBILITY PROCESSING OILS

12 RUBBER PROCESS OIL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Increasing vehicle and tire production in China boosting rubber compounding activity

- 12.2.2 JAPAN

- 12.2.2.1 Advanced tire manufacturing and precision-focused industrial rubber production

- 12.2.3 INDIA

- 12.2.3.1 Strong replacement-driven tire growth and expanding industrial rubber production

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Growing vehicle production and strong industrial rubber manufacturing base

- 12.2.5 INDONESIA

- 12.2.5.1 Expansion of industrial rubber manufacturing base and rise in domestic tire demand

- 12.2.6 THAILAND

- 12.2.6.1 Abundant natural rubber resources and growing domestic tire and industrial rubber production

- 12.2.7 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Shift toward electric mobility strengthening demand dynamics for rubber process oils

- 12.3.2 CANADA

- 12.3.2.1 Growth in industrial production base and increasing need for durable, climate-resilient rubber components

- 12.3.3 MEXICO

- 12.3.3.1 Expansion of automotive manufacturing base and rising demand for cost-efficient, high-performance rubber goods

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 RUSSIA

- 12.4.1.1 Growing tire replacement needs and expanding industrial rubber production

- 12.4.2 GERMANY

- 12.4.2.1 Shift toward electric mobility and strong manufacturing demand for rubber-intensive components

- 12.4.3 UK

- 12.4.3.1 Expanding demand for high-quality rubber components and growing EV-related material production

- 12.4.4 FRANCE

- 12.4.4.1 Rising vehicle registrations and strong demand for tire and industrial rubber components

- 12.4.5 SPAIN

- 12.4.5.1 Rising tire demand and expanding industrial rubber manufacturing

- 12.4.6 ITALY

- 12.4.6.1 Strong tire manufacturing activity and rising demand for industrial rubber components

- 12.4.7 REST OF EUROPE

- 12.4.1 RUSSIA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Rising vehicle registrations and industrial expansion under Vision 2030

- 12.5.1.2 UAE

- 12.5.1.2.1 Growing vehicle usage, strong replacement demand, and rising industrial rubber consumption

- 12.5.1.3 Rest of GCC Countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 IRAN

- 12.5.2.1 Expanding domestic tire production, increasing self-sufficiency, and rising output across multiple vehicle segments

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expanding automotive activity, strong tire demand, and broad-based industrial rubber production

- 12.6.2 ARGENTINA

- 12.6.2.1 Sustained tire demand and expanding use of industrial rubber products

- 12.6.3 COLOMBIA

- 12.6.3.1 High demand for tires, mining-related rubber goods, and general industrial rubber components

- 12.6.4 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.3.1 TOP 5 PLAYERS' REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 MARKET SHARE OF KEY PLAYERS

- 13.4.1.1 Sinopec (China)

- 13.4.1.2 PetroChina Company Limited (China)

- 13.4.1.3 Chevron Corporation (US)

- 13.4.1.4 Exxon Mobil Corporation (US)

- 13.4.1.5 Shell plc (UK)

- 13.4.1 MARKET SHARE OF KEY PLAYERS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.5.1 POWEROIL FLEXOIL N

- 13.5.2 PANOL C 160-P

- 13.5.3 ENI CELTIS

- 13.5.4 DIVYOL PARAFFINIC OIL

- 13.5.5 CALSOL

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Viscosity footprint

- 13.6.5.4 Type footprint

- 13.6.5.5 Application footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- 13.8.2 DEALS

- 13.9 COMPANY VALUATION AND FINANCIAL METRICS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SINOPEC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 PETROCHINA COMPANY LIMITED

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 CHEVRON CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 EXXON MOBIL CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 SHELL PLC

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 APAR INDUSTRIES LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 PANAMA PETROCHEM LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BEHRAN OIL CO.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 ENILIVE S.P.A.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 GANDHAR OIL REFINERY (INDIA) LIMITED

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 INDIAN OIL CORPORATION LTD

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 ORLEN UNIPETROL GROUP

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 IDEMITSU KOSAN CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.15 REPSOL

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.16 ORGKHIM BIOCHEMICAL HOLDING

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.17 GPPL

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.18 IRANOL (LLP)

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.19 PETRO GULF INTERNATIONAL FZE

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.20 CALUMET, INC.

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.21 H&R GROUP

- 14.1.21.1 Business overview

- 14.1.21.2 Products/Solutions/Services offered

- 14.1.22 NYNAS AB

- 14.1.22.1 Business overview

- 14.1.22.2 Products/Solutions/Services offered

- 14.1.22.3 Recent developments

- 14.1.22.3.1 Product launches

- 14.1.23 IRPC PUBLIC COMPANY LIMITED

- 14.1.23.1 Business overview

- 14.1.23.2 Products/Solutions/Services offered

- 14.1.24 PT. ENERCO RPO INTERNASIONAL

- 14.1.24.1 Business overview

- 14.1.24.2 Products/Solutions/Services offered

- 14.1.24.3 Recent developments

- 14.1.24.3.1 Deals

- 14.1.25 WITMANS INDUSTRIES PVT. LTD.

- 14.1.25.1 Business overview

- 14.1.25.2 Products/Solutions/Services offered

- 14.1.26 THAIOIL GROUP

- 14.1.26.1 Business overview

- 14.1.26.2 Products/Solutions/Services offered

- 14.1.27 SHANGDONG TIANYUAN CHEMICAL CO., LTD

- 14.1.27.1 Business overview

- 14.1.27.2 Products/Solutions/Services offered

- 14.1.28 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED

- 14.1.28.1 Business overview

- 14.1.28.2 Products/Solutions/Services offered

- 14.1.1 SINOPEC

- 14.2 OTHER PLAYERS

- 14.2.1 PETRO NAFT

- 14.2.2 PANOL INDUSTRIES RMC FZE

- 14.2.3 EAGLE PETROCHEM

- 14.2.4 LODHA PETRO

- 14.2.5 RLS PETROCHEM LUBRICANTS LLC

- 14.2.6 GAZPROMNEFT - LUBRICANTS LTD.

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 List of primary interview participants (demand and supply sides)

- 15.1.2.3 Key industry insights

- 15.1.2.4 Breakdown of interviews with experts

- 15.1.1 SECONDARY DATA

- 15.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 15.3 MARKET SIZE ESTIMATION

- 15.3.1 BOTTOM-UP APPROACH

- 15.3.2 TOP-DOWN APPROACH

- 15.3.2.1 Calculations for supply-side analysis

- 15.4 GROWTH FORECAST

- 15.5 DATA TRIANGULATION

- 15.6 RESEARCH ASSUMPTIONS

- 15.7 RESEARCH LIMITATIONS

- 15.8 RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS