|

시장보고서

상품코드

1914120

항공기 전기 시스템 시장 : 솔루션, 용도, 항공기 유형(민간 항공, 비즈니스 항공, 일반 항공, 군용 항공, 첨단 항공 모빌리티, 추진 기술, 판매 시점 시스템), 지역별(-2030년)Aircraft Electrical Systems Market by Solution, Application, Aircraft Type (Commercial Aviation, Business & General Aviation, Military Aviation, Advanced Air Mobility, Propulsion Technology, Point of Sale), and Region - Global Forecast to 2030 |

||||||

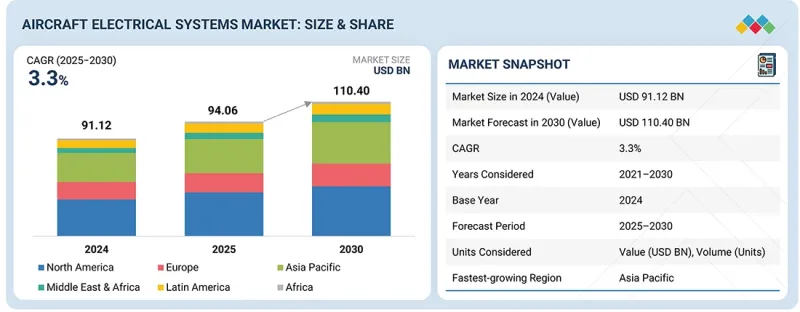

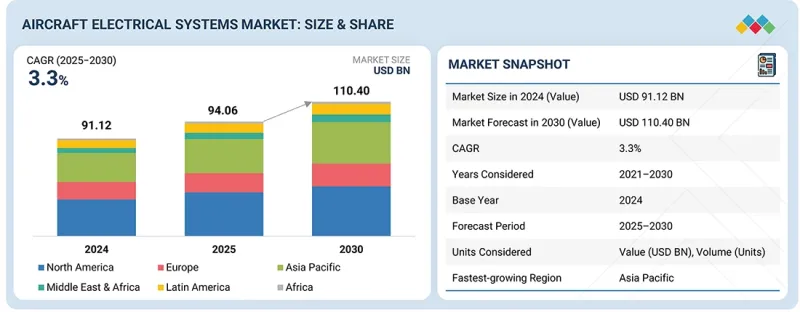

항공기 전기 시스템 시장 규모는 예측 기간 동안 CAGR 3.3%로 성장하여 2025년 940억 6,000만 달러에서 2030년까지 1,104억 달러에 이를 것으로 전망됩니다.

시장 성장의 주요 요인으로는 More-Electric Aircraft(MEA) 및 Hybrid-Electric Aircraft(HEA) 아키텍처 채택 확대, 기체 현대화 프로그램 증가, 발전기, 컨버터, 배전 유닛, 전동 액추에이션 시스템 등의 첨단 전기 부품에 대한 수요 증가가 있습니다. 항공기 플랫폼의 첨단 전기화가 진행되고 있는 가운데, 제조업체 각 사는 전력 효율의 향상, 시스템 신뢰성의 강화, 디지털 헬스 모니터링의 지원을 실현하는 인텔리전트 전기 시스템에 대한 투자를 진행하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 솔루션, 용도, 추진 기술, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

또한 고전압 아키텍처, 경량 EWIS(전기 배선 상호 연결 시스템), 전기 추진 기술의 발전으로 유지보수 및 수명 주기 비용을 절감하면서 전력 사용을 최적화할 수 있습니다. 지속가능성, 운영 안전, 에너지 효율에 대한 규제의 중요성이 높아짐에 따라 OEM 및 MRO 공급업체는 상용, 군용, 비즈니스 항공 및 신흥 AAM 플랫폼 전반에 걸쳐 보다 스마트하고 가볍고 내구성 있는 전기 시스템의 통합을 더욱 추진하고 있습니다.

"용도별로는 추진 및 파워트레인 분야가 예측 기간 동안 가장 높은 CAGR을 나타낼 전망"

추진 및 파워트레인 분야는 효율 향상과 배출량 감축을 목적으로 한 전기식 및 하이브리드 전기식 항공기의 채택 확대를 배경으로 예측 기간 중 가장 높은 CAGR로 성장할 것으로 전망됩니다. 항공사와 OEM은 성능 향상과 운영 비용 절감을 위해 첨단 전기 추진 시스템, 고전압 전력 분배 시스템, 경량 에너지 변환 기술의 통합을 가속화하고 있습니다. 또한 지속가능한 항공에 대한 규제적 관심 증가가 전기추진의 연구개발투자를 가속화하고 있습니다. 또한 차세대 항공기를 지원하는 혁신적인 파워트레인 구조에 대한 수요 증가도 부문 성장을 더욱 추진하고 있습니다.

"POS별로는 예측 기간 동안 OEM 부문이 애프터마켓 부문을 초과하는 CAGR을 나타낼 전망"

이는 Airbus, Boeing, Embraer, COMAC와 같은 주요 제조업체의 견고한 항공기 생산율과 엄청난 수주 잔액으로 이어집니다. 또한 첨단 추진 시스템과 하이브리드 전기 구성을 갖춘 차세대 항공기 플랫폼의 지속적인 개발로 더욱 컴팩트하고 가볍고 효율적인 열 관리 시스템에 대한 수요가 가속화되고 있습니다. 성장을 견인하는 또 다른 중요한 요소는 항공기 조립 공정에서 적층 제조 기술과 고성능 재료의 통합이 진행되고 있다는 것입니다. 이를 통해 열효율 향상, 시스템 중량 감소, 설계 유연성 향상이 가능합니다. 애프터마켓 교체 부품과 달리 OEM은 다년간의 생산 계약과 장기 공급 파트너십의 이점을 추구하며, 주요 공급업체는 항공기 프로그램에 통합되어 장기간의 라이프사이클을 공유합니다.

"아시아태평양이 예측 기간 동안 가장 높은 성장률을 보여줄 전망"

아시아태평양은 2030년까지 항공기 전기 시스템 시장에서 가장 높은 성장률을 나타낼 것으로 예측됩니다. 이는 급속한 기체확장, 견고한 경제 성장, 국내항공우주제조에 대한 투자 증가에 지지되고 있습니다. 중국, 인도, 일본 등의 국가들은 대규모 민간 항공기 도입과 국산 항공기 개발 프로그램을 통해 지역 성장을 이끌고 있습니다. 항공 여객 수 증가와 지역 항공사의 존재감 증가도 이 지역의 성장을 가속하고 있습니다.

본 보고서에서는 세계 항공기 전기 시스템 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분, 지역별, 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미개척 시장 및 미충족 수요 분석

- 상호 연결된 시장 및 산업 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 가격 분석

- 무역 분석

- 고객의 사업에 영향을 미치는 동향과 혼란

- 사례 연구 분석

- 2025년 미국 관세의 영향

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 신기술의 동향

- 특허 분석

- 미래의 응용

- AI/생성형 AI가 항공기 전기 시스템 시장에 미치는 영향

제6장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제7장 고객정세와 구매행동

- 의사결정 프로세스

- 이해관계자와 구매평가기준

- 채택 장벽과 내부 과제

- 다양한 최종 사용자의 미충족 요구

제8장 항공기 전기 시스템 시장 : 솔루션별

- 발전

- 스타터 제너레이터

- 보조 전원 장치

- 비상 및 백업 발전기

- 배전

- 와이어 및 케이블

- 커넥터 및 어셈블리

- 버스바

- 스위칭 및 절연 하드웨어

- 전력 변환

- 인버터

- 컨버터

- 전력 저장

- 메인 배터리와 비상 배터리

- 고전압 견인 배터리

- 피크 저감형 에너지 저장 시스템

- 전력 관리

- 발전기 및 전원 제어 장치

- 버스 및 부하 관리 유닛

- 보호 장치

- 열 관리

- 전력 구동

- 추진 드라이브

- 환경과 유틸리티 드라이브

- 액추에이터 드라이브

제9장 항공기 전기 시스템 시장, 용도별

- 추진과 파워트레인

- 비행 제어 및 작동 시스템

- 항공전자 및 임무 시스템

- 객실 및 승객 시스템

- 환경 제어 시스템

- 항공기 유틸리티 및 지원 시스템

제10장 항공기 전기 시스템 시장 : 플랫폼별

- 민간 항공기

- 협동체 항공기

- 광동체 항공기

- 지역 항공기

- 비즈니스 및 일반 항공

- 비즈니스 제트

- 소형 항공기

- 상용 / 민간 헬리콥터

- 군용기

- 전투기

- 특수 임무기

- 수송기

- 군용 헬리콥터

- 첨단항공모빌리티(AAM)

- 전기 수직 이착륙기(eVTOL)

- 하이브리드 전동기

제11장 항공기 전기 시스템 시장 : 추진 기술별

- 기존 항공기

- 하이브리드 항공기

- MEA(More Electric Aircraft)

- 전기 항공기

제12장 항공기 전기 시스템 시장 : POS별

- OEM

- 애프터마켓

제13장 항공기 전기 시스템 시장 : 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 프랑스

- 독일

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 카타르

- 라틴아메리카

- 브라질

- 멕시코

- 기타

- 아프리카

- 남아프리카

- 나이지리아

제14장 경쟁 구도

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업평가 매트릭스: 스타트업/중소기업

- 브랜드/제품 비교

- 기업평가와 재무지표

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 기업

- SAFRAN SA

- HONEYWELL INTERNATIONAL INC.

- RTX

- THALES GROUP

- GE AEROSPACE

- ASTRONICS CORPORATION

- AMPHENOL CORPORATION

- AMETEK. INC.

- TRANSDIGM GROUP

- PARKER HANNIFIN CORP

- BAE SYSTEMS

- EAGLEPICHER TECHNOLOGIES

- CRANE AEROSPACE AND ELECTRONICS

- PBS AEROSPACE

- HEICO CORPORATION

- PIONEER MAGNETICS

- 기타 기업

- H55 SA

- WRIGHT ELECTRIC CORPORATION

- ELECTRIC POWER SYSTEMS INC.

- MAGNIX

- EVOLITO LTD

- H3X TECHNOLOGIES INC.

- EMRAX DOO

- MGM COMPRO

- TRI-MAG LLC

제16장 조사 방법

제17장 부록

SHWThe aircraft electrical systems market is projected to reach USD 110.40 billion by 2030, growing from USD 94.06 billion in 2025, at a CAGR of 3.3% during the forecast period. The increasing adoption of More-Electric and Hybrid-Electric Aircraft architectures, rising fleet modernization programs, and growing demand for advanced electrical components, such as generators, converters, power distribution units, and electric actuation systems, primarily drive market growth. As aircraft platforms evolve toward higher electrification, manufacturers are investing in intelligent electrical systems that enhance power efficiency, improve system reliability, and support digital health monitoring.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, Application, Propulsion Technology and region |

| Regions covered | North America, Europe, APAC, RoW |

Moreover, advancements in high-voltage architectures, lightweight EWIS (Electrical Wiring Interconnection Systems), and electric propulsion technologies are enabling optimized power usage while reducing maintenance and lifecycle costs. Increased regulatory emphasis on sustainability, operational safety, and energy efficiency is further encouraging OEMs and MRO providers to integrate smarter, lighter, and more durable electrical systems across commercial, military, business aviation, and emerging AAM platforms.

"By application, the propulsion & powertrain segment is projected to grow at the highest CAGR during the forecast period."

The propulsion & powertrain segment is projected to grow at the highest CAGR during the forecast period, driven by the rising adoption of more electric and hybrid-electric aircraft to improve efficiency and reduce emissions. Airlines and OEMs are increasingly integrating advanced electrical propulsion systems, high-voltage power distribution, and lightweight energy conversion technologies to enhance performance and lower operating costs. Growing regulatory focus on sustainable aviation is accelerating investments in electric propulsion research and development. Additionally, the increasing demand for innovative powertrain architectures to support next-generation aircraft is further propelling segment growth.

"By point of sale, the OEM segment is projected to grow at a higher CAGR than the aftermarket segment during the forecast period."

The OEM segment is projected to record higher growth than the aftermarket segment during the forecast period, driven by strong aircraft production rates and substantial order backlogs from major manufacturers, including Airbus, Boeing, Embraer, and COMAC. Additionally, the continuous development of next-generation aircraft platforms with advanced propulsion and hybrid-electric configurations is accelerating the need for more compact, lightweight, and efficient thermal management systems. Another significant factor driving growth is the increasing integration of additive manufacturing and high-performance materials during aircraft assembly, which enables improved thermal efficiency, reduced system weight, and enhanced design flexibility. Unlike aftermarket replacements, OEMs demand benefits from multi-year production contracts and long-term supply partnerships, where key suppliers are embedded in aircraft programs for extended lifecycles.

"Asia Pacific is projected to grow at the highest rate during the forecast period."

Asia Pacific is projected to register the highest growth rate in the aircraft electrical systems market through 2030, supported by rapid fleet expansion, strong economic growth, and increasing investments in domestic aerospace manufacturing. Countries such as China, India, and Japan are leading regional growth through large-scale commercial aircraft acquisitions and indigenous aircraft development programs. Rising air passenger traffic and the growing presence of regional airlines are also fueling the growth of the region.

On the defense side, regional modernization programs in India, South Korea, and Japan are boosting procurement of advanced fighter aircraft, transport planes, and UAVs equipped with high-efficiency thermal management systems. Furthermore, emerging nations such as Indonesia, Malaysia, and the Philippines are expanding their MRO infrastructure. These factors are positioning Asia Pacific as the fastest-growing market, driven by sustained OEM output, growing defense procurement, and increased focus on fleet efficiency across commercial and military aviation sectors.

The breakdown of profiles for primary participants in the aircraft electrical systems market is provided below:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level - 35%, Director-Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10% Rest of the World (RoW) - 5%

Research Coverage:

This market study covers the aircraft electrical systems market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to Buy this Report:

The report will help the market leader/new entrants with information on the closest approximations of the revenue numbers for the overall aircraft electrical systems market. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers [Adoption of More Electric and All-Electric Aircraft (MEA and AEA) Architectures], Restraints (High development, certification, and lifecycle costs), Opportunities (Growing adoption of hybrid-electric and electric propulsion systems), Challenges (Legacy architecture integration and platform compatibility)

- Market Penetration: Comprehensive information on aircraft electrical systems offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the aircraft electrical systems market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the aircraft electrical systems market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the aircraft electrical systems market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 TRENDS AND DISRUPTIONS SHAPING MARKET

- 2.3 HIGH-GROWTH SEGMENT AND EMERGING FRONTIERS

- 2.4 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 3.2 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY SOLUTION

- 3.3 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY POINT OF SALE

- 3.4 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY APPLICATION

- 3.5 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY REGION

- 3.6 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY PROPULSION TECHNOLOGY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Adoption of more electric and all-electric aircraft architectures

- 4.2.1.2 Rising aircraft fleet expansion and modernization initiatives

- 4.2.1.3 Sustainability initiatives in aviation industry

- 4.2.1.4 Advancements in power electronics and energy distribution technologies

- 4.2.2 RESTRAINTS

- 4.2.2.1 Limited standardization across OEM platforms and electrical interfaces

- 4.2.2.2 Limited availability of skilled workforce for high-voltage aviation technologies

- 4.2.2.3 Reliability concerns in extreme environmental and operational conditions

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Growing adoption of hybrid-electric and electric propulsion systems

- 4.2.3.2 Integration of smart power management and digital monitoring systems

- 4.2.3.3 Increasing demand for lightweight materials and modular electrical architectures

- 4.2.3.4 Expansion of electrification in emerging markets and urban air mobility

- 4.2.4 CHALLENGES

- 4.2.4.1 Legacy architecture integration and platform compatibility

- 4.2.4.2 Certification complexity and extended time-to-market

- 4.2.4.3 Material and component supply challenges

- 4.2.4.4 Energy storage and thermal management issues

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 4.3.2 WHITE SPACES IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 4.4 INTER-CONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER 1, 2, AND 3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMIC OUTLOOK

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL AVIATION INDUSTRY

- 5.1.4 TRENDS IN GLOBAL AIRCRAFT ELECTRONICS INDUSTRY

- 5.2 VALUE CHAIN ANALYSIS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 MANUFACTURERS

- 5.3.2 SOLUTION AND SERVICE PROVIDERS

- 5.3.3 END USERS

- 5.4 INVESTMENT AND FUNDING SCENARIO

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS OF POWER GENERATION SYSTEMS, BY PLATFORM

- 5.5.2 INDICATIVE PRICING ANALYSIS OF POWER DISTRIBUTION SYSTEMS, BY PLATFORM

- 5.5.3 INDICATIVE PRICING ANALYSIS OF POWER CONVERSION SYSTEMS, BY PLATFORM

- 5.5.4 INDICATIVE PRICING ANALYSIS OF POWER STORAGE SYSTEMS BY PLATFORM

- 5.5.5 INDICATIVE PRICING ANALYSIS OF POWER MANAGEMENT SYSTEMS, BY PLATFORM

- 5.5.6 INDICATIVE PRICING ANALYSIS OF POWER DRIVES, BY PLATFORM

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 HONEYWELL INTERNATIONAL INC.: HIGH-VOLTAGE POWER SYSTEM FOR HYBRID ELECTRIC AIRCRAFT

- 5.8.2 SAFRAN ELECTRICAL & POWER: INTEGRATED ELECTRICAL SYSTEM FOR AIRBUS A320NEO FAMILY

- 5.8.3 COLLINS AEROSPACE: ELECTRIFICATION OF AIRCRAFT POWER ARCHITECTURE

- 5.9 IMPACT OF 2025 US TARIFFS

- 5.9.1 INTRODUCTION

- 5.9.2 KEY TARIFF RATES

- 5.9.3 PRICE IMPACT ANALYSIS

- 5.9.4 IMPACT ON COUNTRY/REGION

- 5.9.4.1 US

- 5.9.4.2 Europe

- 5.9.4.3 Asia Pacific

- 5.9.5 IMPACT ON END-USE INDUSTRIES

- 5.9.5.1 Commercial aviation

- 5.9.5.2 Government and military

- 5.10 KEY EMERGING TECHNOLOGIES

- 5.10.1 HIGH-VOLTAGE DC POWER DISTRIBUTION (540V-1000V HVDC ARCHITECTURE)

- 5.10.2 SILICON CARBIDE (SIC) AND GALLIUM NITRIDE (GAN) POWER ELECTRONICS

- 5.10.3 ADVANCED BATTERY SYSTEMS AND AIRCRAFT-GRADE BMS TECHNOLOGIES

- 5.10.4 DIGITAL POWER MANAGEMENT AND AI-DRIVEN PREDICTIVE MAINTENANCE

- 5.11 COMPLEMENTARY TECHNOLOGIES

- 5.11.1 ADVANCED THERMAL MANAGEMENT SYSTEMS FOR HIGH-POWER ELECTRONICS

- 5.11.2 SMART WIRING, FIBER-OPTIC NETWORKS, AND LIGHTWEIGHT HARNESSING

- 5.11.3 SOLID-STATE CIRCUIT PROTECTION AND RECONFIGURABLE ELECTRICAL DISTRIBUTION

- 5.11.4 INTEGRATED DIGITAL TWINS FOR ELECTRICAL SYSTEM SIMULATION AND CERTIFICATION

- 5.12 TECHNOLOGY/PRODUCT ROADMAP

- 5.13 EMERGING TECHNOLOGY TRENDS

- 5.14 PATENT ANALYSIS

- 5.15 FUTURE APPLICATIONS

- 5.16 IMPACT OF AI/ GENERATIVE AI ON AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 5.16.1 TOP USE CASES AND MARKET POTENTIAL

- 5.16.2 BEST PRACTICES IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 5.16.3 CASE STUDIES OF AI IMPLEMENTATION IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 5.16.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.16.5 CLIENTS' READINESS TO ADOPT GENAI IN AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 5.16.5.1 Airbus: GenAI-enabled Electrical Load Forecasting for MEA Programs

- 5.16.5.2 Raytheon Technologies (RTX): GenAI for Autonomous Power-Management Logic

- 5.16.5.3 Boeing: GenAI for Electrical Load Optimization & System Reliability Enhancement

6 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.1.1 North America: Regulatory bodies, government agencies, and other organizations

- 6.1.1.2 Europe: Regulatory bodies, government agencies, and other organizations

- 6.1.1.3 Asia Pacific: Regulatory bodies, government agencies, and other organizations

- 6.1.1.4 Middle East: Regulatory bodies, government agencies, and other organizations

- 6.1.1.5 Latin America: Regulatory bodies, government agencies, and other organizations

- 6.1.1.6 Africa: Regulatory bodies, government agencies, and other organizations

- 6.1.2 INDUSTRY STANDARDS

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF AIRCRAFT ELECTRICAL SYSTEMS

- 6.2.1.1 Carbon impact reduction

- 6.2.1.2 Eco-applications

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF AIRCRAFT ELECTRICAL SYSTEMS

- 6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 6.3.1 SUSTAINABILITY IMPACT ON AIRCRAFT ELECTRICAL SYSTEMS MARKET

- 6.3.2 REGULATORY POLICY INITIATIVES DRIVING AIRCRAFT ELECTRICAL SYSTEM DEPLOYMENT

- 6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

7 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING EVALUATION CRITERIA

- 7.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS END USERS

- 7.4.1 HIGH-VOLTAGE SYSTEM RELIABILITY & FAULT RESILIENCE

- 7.4.2 ADVANCED THERMAL MANAGEMENT FOR POWER-DENSE ELECTRONICS

- 7.4.3 PREDICTIVE DIAGNOSTICS AND REAL-TIME HEALTH MONITORING

8 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY SOLUTION (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 8.1 INTRODUCTION

- 8.2 POWER GENERATION

- 8.2.1 USE CASE: ADVANCED STARTER-GENERATORS AND ELECTRIC POWER GENERATION BY SAFRAN

- 8.2.2 STARTER GENERATORS

- 8.2.2.1 Increasing shift toward more electric aircraft and efficiency optimization to drive demand

- 8.2.3 AUXILIARY POWER UNITS

- 8.2.3.1 Growing demand for power autonomy, operational efficiency, and cabin electrification in next-generation aircraft to drive demand

- 8.2.4 EMERGENCY & BACKUP GENERATORS

- 8.2.4.1 Investment in high-reliability generators to drive demand

- 8.3 POWER DISTRIBUTION

- 8.3.1 USE CASE: SMART POWER DISTRIBUTION SYSTEMS BY HONEYWELL AEROSPACE

- 8.3.2 WIRES & CABLES

- 8.3.2.1 Increasing electrical load density and weight optimization demand to drive growth

- 8.3.3 CONNECTORS & ASSEMBLIES

- 8.3.3.1 Shift toward modular avionics and scalable electrical architectures to drive demand

- 8.3.4 BUSBARS

- 8.3.4.1 Increasing adoption of modular and zonal electrical architectures in more electric aircraft to drive demand

- 8.3.5 SWITCHING AND ISOLATION HARDWARE

- 8.3.5.1 Increasing electrification, safety compliance, and system fault protection to drive demand

- 8.4 POWER CONVERSION

- 8.4.1 USE CASE: INVERTERS AND CONVERTERS BY HONEYWELL AEROSPACE

- 8.4.2 INVERTERS

- 8.4.2.1 Growth of more electric and hybrid electric aircraft to drive demand

- 8.4.3 CONVERTERS

- 8.4.3.1 Growth of digitally enabled converters with intelligent power control, real-time thermal monitoring, and built-in fault isolation to drive demand

- 8.5 POWER STORAGE

- 8.5.1 USE CASE: SAFRAN AND AIRBUS COLLABORATION ON ADVANCED AIRCRAFT ENERGY STORAGE SYSTEMS

- 8.5.2 MAIN & EMERGENCY BATTERIES

- 8.5.2.1 Increasing dependence on electrical systems for avionics, flight control, safety functions, and autonomous operations to drive growth

- 8.5.3 HIGH-VOLTAGE TRACTION BATTERIES

- 8.5.3.1 Fast development of eVTOL, regional hybrid electric aircraft, and advanced air mobility to drive demand

- 8.5.4 PEAK-SHAVING STORAGE SYSTEMS

- 8.5.4.1 Shift toward high-voltage architectures and more-electric propulsion to drive demand

- 8.6 POWER MANAGEMENT

- 8.6.1 USE CASE: COLLINS AEROSPACE INTEGRATED POWER MANAGEMENT SOLUTIONS FOR MORE ELECTRIC AIRCRAFT (MEA)

- 8.6.2 GENERATOR & SOURCE CONTROL UNITS

- 8.6.2.1 Increasing demand for optimized power allocation and health monitoring in high-voltage aircraft networks to drive growth

- 8.6.3 BUS & LOAD MANAGEMENT UNITS

- 8.6.3.1 Growth in electrical load density and automated power prioritization to drive demand

- 8.6.4 PROTECTION DEVICES

- 8.6.4.1 Enhanced safety requirements and high-power electronics adoption to drive demand

- 8.6.5 THERMAL MANAGEMENT

- 8.6.5.1 Trend toward advanced cooling solutions to drive demand

- 8.7 POWER DRIVE

- 8.7.1 USE CASE: ROLLS-ROYCE INTEGRATED ELECTRIC POWER DRIVES FOR PROPULSION, FLIGHT CONTROL, AND CABIN SYSTEMS

- 8.7.2 PROPULSION DRIVE

- 8.7.2.1 Increasing demand for high-voltage drives capable of handling dynamic load conditions to drive growth

- 8.7.3 ENVIRONMENTAL & UTILITY DRIVE

- 8.7.3.1 Rising electrification of cabin, climate control, and utility systems to drive demand for advanced environmental & utility drives

- 8.7.4 ACTUATOR DRIVE

- 8.7.4.1 Increasing adoption of electromechanical actuators to drive demand

9 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 9.1 INTRODUCTION

- 9.2 PROPULSION & POWERTRAIN

- 9.2.1 USE CASE: GE AEROSPACE - ELECTRIC PROPULSION & POWERTRAIN INTEGRATION FOR HYBRID ELECTRIC AIRCRAFT

- 9.2.2 INCREASING PUSH FOR HYBRID-ELECTRIC PROPULSION AND MEA ARCHITECTURES TO DRIVE GROWTH

- 9.3 FLIGHT CONTROL & ACTUATION

- 9.3.1 USE CASE: AIRBUS - ELECTRIFIED FLIGHT CONTROL & ACTUATION SYSTEMS IN MORE ELECTRIC AIRCRAFT PLATFORMS

- 9.3.2 INCREASING DEMAND FOR INTELLIGENT FLIGHT CONTROL & ACTUATION DRIVES TO DRIVE GROWTH

- 9.4 AVIONICS & MISSION SYSTEMS

- 9.4.1 USE CASE: HONEYWELL AEROSPACE - INTEGRATED AVIONICS AND POWER-OPTIMIZED MISSION SYSTEMS FOR MORE ELECTRIC AND MILITARY AIRCRAFT

- 9.4.2 RISING DIGITALIZATION, CONNECTIVITY, AND MISSION-CENTRIC OPERATIONS TO DRIVE DEMAND

- 9.5 CABIN & PASSENGER SYSTEMS

- 9.5.1 USE CASE: PANASONIC AVIONICS - ELECTRICALLY OPTIMIZED CABIN EXPERIENCE AND SMART PASSENGER SYSTEMS

- 9.5.2 RISING DEMAND FOR PASSENGER COMFORT, DIGITAL CONNECTIVITY, AND ELECTRIFIED CABIN OPERATIONS TO DRIVE GROWTH

- 9.6 ENVIRONMENTAL CONTROL SYSTEMS

- 9.6.1 USE CASE: PANASONIC AVIONICS - ELECTRIFIED ENVIRONMENTAL CONTROL SYSTEMS FOR NEXT-GENERATION AIRCRAFT

- 9.6.2 TRANSITION FROM BLEED AIR TO ELECTRICALLY DRIVEN ENVIRONMENTAL CONTROL SYSTEMS TO DRIVE DEMAND

- 9.7 AIRCRAFT UTILITIES & SUPPORT SYSTEMS

- 9.7.1 USE CASE: SAFRAN - ELECTRIFIED UTILITY AND SUPPORT SYSTEMS FOR ENHANCED OPERATIONAL SAFETY AND EFFICIENCY

- 9.7.2 INCREASING ELECTRIFICATION OF AUXILIARY SYSTEMS TO IMPROVE EFFICIENCY, MAINTENANCE, AND GROUND OPERATIONS

10 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY PLATFORM (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL AIRCRAFT

- 10.2.1 USE CASE: BOEING - ELECTRICAL SYSTEM INTEGRATION IN COMMERCIAL AIRCRAFT PLATFORMS

- 10.2.2 NARROW-BODY AIRCRAFT

- 10.2.2.1 Increasing fleet replacement, high utilization, and operational cost optimization to drive electrical system upgrades in narrow-body aircraft

- 10.2.3 WIDE-BODY AIRCRAFT

- 10.2.3.1 Increasing long-haul electrification, passenger comfort, and power density requirements to drive electrical innovation in wide-body aircraft

- 10.2.4 REGIONAL TRANSPORT AIRCRAFT

- 10.2.4.1 Adoption of hybrid-electric technologies and scalable electrical systems to drive growth

- 10.3 BUSINESS & GENERAL AVIATION

- 10.3.1 USE CASE: GULFSTREAM - ADVANCED ELECTRICAL ARCHITECTURE INTEGRATION IN BUSINESS JETS.

- 10.3.2 BUSINESS JET

- 10.3.2.1 Premium cabin experience, advanced avionics, and fuel efficiency to drive electrification in business jets

- 10.3.3 LIGHT AIRCRAFT

- 10.3.3.1 Growing pilot training demand and cost efficiency needs to boost electrical system adoption in light aircraft

- 10.3.4 COMMERCIAL/CIVIL HELICOPTER

- 10.3.4.1 Increased safety, mission flexibility, and electrified avionics to drive demand for advanced electrical systems in helicopters

- 10.4 MILITARY AIRCRAFT

- 10.4.1 USE CASE: LOCKHEED MARTIN - INTEGRATED ELECTRICAL SYSTEMS IN ADVANCED FIGHTER AIRCRAFT (F-35 LIGHTNING II)

- 10.4.2 FIGHTER JET

- 10.4.2.1 Increasing electrical load for electronic warfare, stealth, and advanced avionics to drive high-density power systems in fighter jets

- 10.4.3 SPECIAL MISSION AIRCRAFT

- 10.4.3.1 Increasing ISR and surveillance requirements to fuel demand for electrically intensive mission systems

- 10.4.4 TRANSPORT AIRCRAFT

- 10.4.4.1 Growing demand for electrified logistics, cargo systems, and reliability in military transport aircraft to drive market

- 10.4.5 MILITARY HELICOPTER

- 10.4.5.1 High-vibration mission environments to drive demand for ruggedized electrical systems in military helicopters

- 10.5 ADVANCED AIR MOBILITY (AAM)

- 10.5.1 USE CASE: NORTHROP GRUMMAN - ELECTRIFIED POWER SYSTEMS IN MILITARY UAVS (GLOBAL HAWK PLATFORM)

- 10.5.2 ELECTRIC VERTICAL TAKE-OFF AND LANDING (EVTOL)

- 10.5.2.1 Rising adoption of fully electric propulsion and distributed systems to drive growth

- 10.5.3 HYBRID ELECTRIC

- 10.5.3.1 Increasing focus on extended range and higher payload capability to drive growth

11 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY PROPULSION TECHNOLOGY (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 11.1 INTRODUCTION

- 11.2 CONVENTIONAL AIRCRAFT

- 11.2.1 USE CASE: AIRBUS A320 - CONVENTIONAL POWER INTEGRATION WITH INCREMENTAL ELECTRICAL ENHANCEMENTS

- 11.2.2 RELIABILITY, COST CONTROL, AND RETROFIT OPPORTUNITIES SUSTAINING ELECTRICAL UPGRADES IN CONVENTIONAL AIRCRAFT

- 11.3 HYBRID AIRCRAFT

- 11.3.1 USE CASE: AIRBUS ECOPULSE - HYBRID-ELECTRIC PROPULSION DEMONSTRATOR WITH DISTRIBUTED ELECTRICAL DRIVES

- 11.3.2 OEM INVESTMENT IN HYBRID DEMONSTRATOR PROGRAMS FOR REGIONAL, BUSINESS, AND SPECIAL MISSION SEGMENTS TO DRIVE DEMAND

- 11.4 MORE ELECTRIC AIRCRAFT

- 11.4.1 USE CASE: BOEING 787 DREAMLINER - BENCHMARK FOR MORE ELECTRIC AIRCRAFT ARCHITECTURE

- 11.4.2 GROWING DIGITALIZATION TO DRIVE MARKET

- 11.5 ELECTRIC AIRCRAFT

- 11.5.1 USE CASE: ROLLS-ROYCE ACCEL - ALL-ELECTRIC AIRCRAFT DEMONSTRATOR

- 11.5.2 ZERO-EMISSION TARGETS AND URBAN AIR MOBILITY TO DRIVE GROWTH

12 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY POINT OF SALE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 12.1 INTRODUCTION

- 12.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

- 12.2.1 USE CASE: THALES AND AIRBUS - OEM ELECTRICAL SYSTEM INTEGRATION FOR ADVANCED AIRCRAFT PLATFORMS

- 12.2.2 GROWING AIRCRAFT PRODUCTION, ELECTRIFICATION, AND OEM PARTNERSHIPS TO DRIVE DEMAND FOR LINE-FIT ELECTRICAL SYSTEMS

- 12.3 AFTERMARKET

- 12.3.1 USE CASE: COLLINS AEROSPACE - ELECTRICAL SYSTEM RETROFIT AND MAINTENANCE SOLUTIONS IN AFTERMARKET AVIATION

- 12.3.2 FLEET MODERNIZATION, MRO GROWTH, AND DIGITAL RETROFITS TO DRIVE AFTERMARKET ELECTRICAL SYSTEM DEMAND

13 AIRCRAFT ELECTRICAL SYSTEMS MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Rapid development of hybrid electric and more electric aircraft programs to drive market

- 13.2.2 CANADA

- 13.2.2.1 Ongoing hybrid-electric propulsion testing and dedicated testbeds for electric and hydrogen-electric powertrains to drive market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 FRANCE

- 13.3.1.1 Strategic focus on hybrid electric and hydrogen electric aircraft platforms to drive market

- 13.3.2 GERMANY

- 13.3.2.1 Commitment to electric propulsion research to drive demand

- 13.3.3 UK

- 13.3.3.1 Aggressive decarbonization targets and electrical propulsion programs to drive market

- 13.3.4 ITALY

- 13.3.4.1 Advancing electrical modernization in commercial and defense programs to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Alignment with regional sustainability regulations and decarbonization targets to drive market

- 13.3.6 REST OF EUROPE

- 13.3.1 FRANCE

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Rising commercial aircraft production to drive market

- 13.4.2 INDIA

- 13.4.2.1 Need for modern electrical architectures, smart monitoring systems, and efficient thermal management technologies to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Focus on improvements in electrical efficiency, subsystem reliability, and digital integration to drive market

- 13.4.4 AUSTRALIA

- 13.4.4.1 Initiatives on aviation sustainability and airport modernization to drive market

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Defense modernization, indigenous aircraft development, and improved operational efficiency to drive market

- 13.4.6 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST

- 13.5.1 UAE

- 13.5.1.1 Investments in MRO modernization and AAM to drive market

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Aerospace manufacturing capacity through partnerships with international OEMs and Tier 1 suppliers to drive market

- 13.5.3 TURKEY

- 13.5.3.1 Heavy investment in locally engineered aircraft platforms to drive market

- 13.5.4 QATAR

- 13.5.4.1 Commitment to global aviation sustainability targets to drive market

- 13.5.1 UAE

- 13.6 LATIN AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Development of electrical propulsion architectures, high-voltage power distribution, and advanced energy storage integration to drive market

- 13.6.2 MEXICO

- 13.6.2.1 Emergence as manufacturing and MRO hub for aerospace industry to drive market

- 13.6.3 REST OF LATIN AMERICA

- 13.6.1 BRAZIL

- 13.7 AFRICA

- 13.7.1 SOUTH AFRICA

- 13.7.1.1 Localization of electrical subsystem manufacturing and assembly to drive market

- 13.7.2 NIGERIA

- 13.7.2.1 Government-led initiatives to upgrade airports, air navigation systems, and aviation safety infrastructure to drive demand

- 13.7.1 SOUTH AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Solution footprint

- 14.5.5.4 Application footprint

- 14.5.5.5 Platform footprint

- 14.5.5.6 Propulsion technology footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 14.6.5.1 List of startups/SMEs

- 14.6.5.2 Competitive benchmarking of startups and SMEs

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SAFRAN S.A.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 HONEYWELL INTERNATIONAL INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 RTX

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 THALES GROUP

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 GE AEROSPACE

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.3.2 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 ASTRONICS CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.7 AMPHENOL CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Other developments

- 15.1.8 AMETEK. INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.9 TRANSDIGM GROUP

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 PARKER HANNIFIN CORP

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 BAE SYSTEMS

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.3.2 Other developments

- 15.1.12 EAGLEPICHER TECHNOLOGIES

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.13 CRANE AEROSPACE AND ELECTRONICS

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.13.3.2 Other developments

- 15.1.14 PBS AEROSPACE

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.14.3.2 Deals

- 15.1.15 HEICO CORPORATION

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.16 PIONEER MAGNETICS

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.1 SAFRAN S.A.

- 15.2 OTHER PLAYERS

- 15.2.1 H55 S.A.

- 15.2.2 WRIGHT ELECTRIC CORPORATION

- 15.2.3 ELECTRIC POWER SYSTEMS INC.

- 15.2.4 MAGNIX

- 15.2.5 EVOLITO LTD

- 15.2.6 H3X TECHNOLOGIES INC.

- 15.2.7 EMRAX D.O.O.

- 15.2.8 MGM COMPRO

- 15.2.9 TRI-MAG LLC

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.2 SECONDARY DATA

- 16.2.1 KEY DATA FROM SECONDARY SOURCES

- 16.2.1.1 List of secondary sources

- 16.2.1 KEY DATA FROM SECONDARY SOURCES

- 16.3 PRIMARY DATA

- 16.3.1 KEY DATA FROM PRIMARY SOURCES

- 16.3.1.1 Primary sources

- 16.3.2 BREAKDOWN OF PRIMARY INTERVIEWS

- 16.3.2.1 Key industry insights

- 16.3.1 KEY DATA FROM PRIMARY SOURCES

- 16.4 MARKET SIZE ESTIMATION

- 16.4.1 BOTTOM-UP APPROACH

- 16.4.2 TOP-DOWN APPROACH

- 16.4.3 BASE NUMBER CALCULATION

- 16.5 MARKET FORECAST APPROACH

- 16.5.1 INTRODUCTION

- 16.5.2 SUPPLY SIDE

- 16.5.3 DEMAND SIDE

- 16.6 RESEARCH ASSUMPTIONS

- 16.7 RESEARCH LIMITATIONS

- 16.8 RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS