|

시장보고서

상품코드

1914125

알루미늄박 포장 시장 예측(-2030년) : 제품 유형별, 포장 유형별, 유형별, 용도별, 지역별Aluminum Foil Packaging Market by Product Type (Bags & Pouches, Wraps & Rolls, Blisters), Packaging Type (Semi-rigid, Flexible, Others), Type (Backed Foil, Rolled Foil), Application (Food, Beverages, Pharmaceuticals), & Region - Global Forecast to 2030 |

||||||

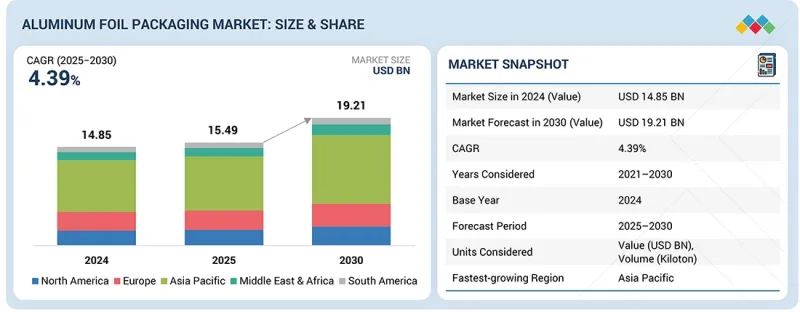

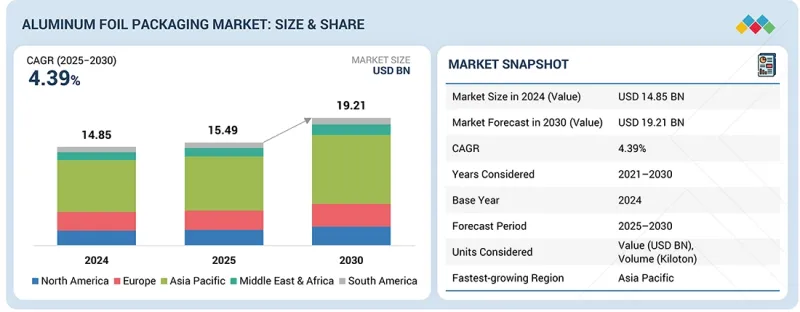

세계의 알루미늄박 포장 시장 규모는 2025년 154억 9,000만 달러에서 2030년까지 192억 1,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 4.39%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/킬로톤 |

| 부문 | 제품 유형, 유형, 포장 유형, 용도, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

알루미늄 포일 포장 시장은 주로 E-Commerce 매출 증가, 식품, 음료, 의약품 등 다양한 최종사용자 수요 증가, 지속가능하고 친환경적인 포장 솔루션의 채택, 식품에 대한 장기 보존성 이점으로 인해 빠르게 성장할 것으로 예측됩니다.

"블리스터 포장은 예측 기간 중 가장 빠르게 성장하는 분야가 될 것으로 예측됩니다. "

알루미늄 포일 포장 시장에서 블리스터 포장이 가장 빠르게 성장하는 분야가 될 것으로 예측됩니다. 이러한 성장은 전 세계 다양한 산업과 소비자 수요 증가에 의해 촉진되고 있습니다. 이러한 추세의 배경에는 제약 산업이 중요한 요인으로 작용하고 있습니다. 블리스터 알루미늄 포일은 습기, 빛, 산소, 오염물질에 대한 차단성이 뛰어나 정제, 캡슐, 1회용 제품 등 의약품의 안정성, 유효성, 안전성을 유지하는데 특히 효과적입니다. 이러한 제품 수요 증가는 고령화, 만성질환 증가, 전 세계적인 의료 접근성 확대 등에 의해 촉진되고 있습니다.

블리스터 포장은 변조 방지 및 어린이 저항 기능과 같은 고성능 기능을 갖추고있어 엄격한 규제 요구 사항을 충족하는 동시에 환자의 안전을 향상시킵니다. 이러한 장점으로 인해 제약회사들은 다른 유형의 용기보다 블리스터 호일을 선호하고 있습니다.

"롤 포일 부문은 예측 기간 중 두 번째로 높은 성장률을 보일 것으로 예측됩니다. "

알루미늄 포일 포장 시장에서 롤 포일 포장 부문이 두 번째로 높은 성장률을 보일 것으로 예측됩니다. 이러한 성장은 경제적인 알루미늄 포일 포장 솔루션으로서의 다용도성으로 인해 가정 및 푸드서비스 분야 모두에서 수요가 지속되고 있기 때문입니다. 롤 포일은 습기, 빛, 산소, 냄새에 대한 우수한 차단 특성으로 인해 주로 조리, 베이킹, 그릴, 식품 보존에 사용됩니다. 이러한 특성은 식품의 신선도 유지와 오염 방지에 기여합니다. 소매용 알루미늄 포일 롤 수요는 신흥 경제권을 중심으로 한 도시 지역의 가구 수 증가, 가처분 소득 증가, 그리고 편의성을 중시하는 요리법 동향 증가에 의해 촉진되고 있습니다. 또한 퀵서비스 레스토랑, 케이터링 서비스, 클라우드 키친의 확대로 인해 식품 조리 및 배송 중 포장, 분량 조절, 보온을 목적으로 한 롤 알루미늄 포일의 대량 사용이 급증하고 있습니다.

"음료 부문은 예측 기간 중 두 번째로 높은 성장률을 보일 것으로 예측됩니다. "

음료는 알루미늄 포일 포장 시장에서 두 번째로 높은 성장률을 보이는 분야로, 다양한 음료 형태에서 제품 보호, 유통기한 연장, 브랜드 이미지 향상에 중요한 역할을 하는 것이 주요 원인입니다. 알루미늄 포일은 음료 상자 및 뚜껑에 널리 사용되며, 특히 주스, 유음료, 기능성 음료, RTD 차 및 커피의 무균 포장에 활용되고 있습니다. 이러한 응용 분야에서 알루미늄 포일은 산소, 빛, 습기, 미생물 오염에 대한 우수한 장벽 기능을 발휘하며, 이는 냉장 보관 없이 맛, 영양가, 제품 안전성을 유지하는 데 필수적입니다. 호일 포장에 대한 높은 수요는 도시화, 바쁜 라이프스타일, 신흥 시장에서의 콜드체인 물류 확대에 힘입어 장기 보관이 가능한 포장 음료에 대한 전 세계적인 수요 증가에 의해 촉진되고 있습니다.

"금액 기준으로는 유럽이 알루미늄 포일 포장 시장에서 2위 시장 점유율을 차지할 것으로 예측됩니다. "

유럽은 알루미늄 포일 포장 분야에서 두 번째로 큰 시장이며, 그 주요 원인으로는 첨단화된 식품 및 음료 산업, 규제 당국의 포장 안전에 대한 강조, 지속가능성에 대한 노력 등을 들 수 있습니다. 이 지역 인구의 대부분은 식품, 의약품, 음료 포장에 의존하고 있으며, 알루미늄 포일이 제공하는 우수한 차단성, 위생성, 제품 보호의 이점을 누릴 수 있습니다. 식품 접촉 재료에 대한 엄격한 EU 규정, 의약품 포장의 무결성, 보존 기간 유지 등의 요구 사항은 다른 재료에 비해 알루미늄 포일의 우위를 더욱 강화하여 안정적인 수요를 지원하고 있습니다. 또한 유럽은 지속가능성과 순환 경제에 대한 노력에서 세계를 선도하고 있으며, 고도로 발달된 알루미늄 재활용 시스템과 다른 지역보다 높은 재활용률을 가지고 있습니다.

세계의 알루미늄박 포장 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- 알루미늄박 포장 시장에서의 매력적인 기회

- 알루미늄박 포장 시장 : 제품 유형별

- 알루미늄박 포장 시장 : 유형별

- 알루미늄박 포장 시장 : 포장 유형별

- 알루미늄박 포장 시장 : 용도별

- 아시아태평양의 알루미늄박 포장 시장 : 포장 유형별, 국가별(2024년)

- 알루미늄박 포장 시장 : 국가별

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 박박·다층 라미네이트 스트림용 신뢰성과 확장성이 뛰어난 재활용

- 심플한 재활용을 가능하게 하는 모노 매트리얼 포일 솔루션

- 지속가능한 폐기 경로를 가진 고급 외관

- 신선도 표시와 디지털 관여에 이용하는 스마트 포일 리드

- 상호접속된 시장과 부문 횡단적인 기회

- 상호접속된 시장

- 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

- Tier 1 기업 : 통합과 혁신을 추진하는 세계 리더

- Tier 2 기업 : 지역의 이노베이터와 니치 리더

- Tier 3 기업 : 폐기물 제로 마일스톤으로 환경 효율을 강화

제5장 업계 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격결정 분석

- 가격결정 분석 : 주요 기업별

- 가격결정 분석 : 지역별

- 밸류체인 분석

- 에코시스템 분석

- 무역 분석

- 수입 데이터(HS 코드 7607)

- 수출 데이터(HS 코드 7607)

- 주요 컨퍼런스와 이벤트(2025년)

- Porter's Five Forces 분석

- 사례 연구 분석

- 거시경제 분석

- GDP의 동향과 예측

- 인구증가와 도시화

- 세계의 식품 및 음료 업계의 동향

- 세계의 퍼스널케어·화장품 업계의 동향

- 투자와 자금조달 시나리오

- 알루미늄박 포장 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 다양한 국가/지역에 대한 중요한 영향

- 최종 용도 부문에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 주요 신기술

- 항균박

- 인쇄 방법

- 보완 기술

- 나노테크놀러지

- 냉간 성형 알루미늄박

- 인접 기술

- 고강도 합금박에 의한 경량화

- 첨단 재활용 밸류체인과 순환형 경제 시스템

- 기술/제품 로드맵

- 단기|전환·디지털 채택 단계(2025-2027년)

- 중기|순환형 스케일링·재료 재설계·첨단 자동화 단계(2027-2030년)

- 장기|완전 스마트 순환형 박 에코시스템, 차세대 코팅, 넷 제로 생산 단계(2030-2035년 이후)

- 특허 분석

- 어프로치

- 문서의 유형

- 관할 분석

- 주요 출원자

- 향후 용도

- 스마트 센서-통합 박포장(IoT/상태 감시)

- 의약품 마이크로-도징·스마트 디스펜싱 포일 블리스터 시스템

- 형상 변형·적응형 알루미늄박 포장(프로그래머블 포장)

- 고배리어성 재활용 가능한 박 기반 모노 매트리얼 구조

- 알루미늄박 포장 시장에 대한 AI/생성형 AI의 영향

- 주요 사용 사례와 시장의 장래성

- E-Commerce 패키지 베스트 프랙티스

- 알루미늄박 포장 시장에서 AI 도입 사례 연구

- 상호접속된 에코시스템과 시장 기업에 대한 영향

- 알루미늄박 포장 시장에서 생성형 AI의 채택에 대한 고객 준비 상황

제7장 규제 상황과 지속가능성에 관한 구상

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 구상

- 순환형 경제와 재활용 구상

- 순환형 정책 의무부여

- 기업의 혁신과 순환형 솔루션

- 재활용 퍼포먼스 얼라이언스

- 순환형 디자인

- 디지털 이력추적과 순환형 시장 메커니즘

- 지속가능성 구상에 대한 규제 정책의 영향

- 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 용도로부터의 미충족 요구

- 시장의 수익성

- 잠재적 매출

- 비용 역학

- 마진 기회 : 최종 용도별

제8장 알루미늄박 포장 시장 : 제품 유형별

- 백·파우치

- 랩·롤

- 블리스터

- 컨테이너

- 기타 제품 유형

제9장 알루미늄박 포장 시장 : 용도별

- 식품

- 음료

- 의약품

- 퍼스널케어·화장품

- 기타 용도

제10장 알루미늄박 포장 시장 : 포장 유형별

- 반경질 포장

- 연포장

- 기타 포장 유형

제11장 알루미늄박 포장 시장 : 유형별

- 롤 포일

- 백 포일

- 기타 유형

제12장 알루미늄박 포장 시장 : 두께별

- 7-50미크론

- 51-100미크론

- 기타

제13장 알루미늄박 포장 시장 : 기술별

- 콜드 폼 포일

- 핫 실 포일

제14장 알루미늄박 포장 시장 : 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 기타 아시아태평양

- 유럽

- 독일

- 이탈리아

- 영국

- 프랑스

- 스페인

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제15장 경쟁 구도

- 개요

- 주요 참여 기업의 전략

- 시장 점유율 분석

- 주요 기업의 매출 분석

- 기업의 평가와 재무 지표

- 브랜드의 비교

- RUSAL(알루미늄박 제품)

- HULAMIN(포장용 박 솔루션)

- HINDALCO INDUSTRIES LTD.(알루미늄박·컨버터 제품)

- CHINA HONGQIAO GROUP LIMITED(알루미늄 포장 재고)

- AMCOR PLC(알루미늄 연포장)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- RUSAL

- HULAMIN

- HINDALCO INDUSTRIES LTD.

- CHINA HONGQIAO GROUP LIMITED

- AMCOR PLC

- KIBAR HOLDING

- CONSTANTIA FLEXIBLES

- REYNOLDS CONSUMER PRODUCTS

- GARMCO

- NOVOLEX

- RAVIRAJ FOILS LIMITED

- 기타 기업

- PENNY PLATE, LLC

- JINDAL(INDIA) LIMITED

- PG FOILS LTD.

- EUROFOIL LUXEMBOURG SA

- ALUFOIL PRODUCTS CO.

- FLEXIFOIL PACKAGING PVT LTD

- ALIBERICO

- CARCANO ANTONIO S.P.A.

- D&W FINE PACK

- HANDI-FOIL CORPORATION

- COPPICE

- SYMETAL

- WYDA SOUTH AFRICA

- AMPCO

- LSKB ALUMINIUM FOILS PVT. LTD.

- TAKAMUL INDUSTRIES

제17장 조사 방법

제18장 부록

KSA 26.01.29The aluminum foil packaging market is projected to grow from USD 15.49 billion in 2025 to USD 19.21 billion by 2030, at a CAGR of 4.39% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Kiloton) |

| Segments | Product Type, Type, Packaging Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The aluminum foil packaging market is poised for rapid growth, primarily driven by an increase in e-commerce sales, rising demand from various end users like food, beverages, and pharmaceuticals, the adoption of sustainable and eco-friendly packaging solutions, and the advantage of long shelf life offered to food products.

"Blisters are projected to be the fastest-growing segment during the forecast period."

Blister packaging is anticipated to be the fastest-growing segment in the aluminum foil packaging market. This growth is driven by the increasing demands of various sectors and consumers worldwide. A significant factor behind this trend is the pharmaceutical industry, which benefits from blister aluminum foil's superior barriers against moisture, light, oxygen, and contaminants. This packaging is particularly effective in preserving the stability, efficacy, and safety of medications, such as tablets, capsules, and unit-dose products. The rising demand for these products is driven by aging populations, the growing prevalence of chronic diseases, and increased global access to healthcare.

Blister packaging offers high-performance features, including tamper-evidence and child-resistance, which meet strict regulatory requirements and enhance patient safety. These advantages explain why pharmaceutical manufacturers prefer blister foil over other types of containers.

"The rolled foil segment is projected to be the second-fastest-growing segment during the forecast period."

The rolled foil packaging segment is expected to experience the second-fastest growth in the aluminum foil packaging market. This growth can be attributed to its versatility as an economical aluminum foil wrapping solution, which remains relevant for both household and foodservice applications. Rolled foil is primarily used for cooking, baking, grilling, and food storage due to its excellent barrier properties against moisture, light, oxygen, and odors. These properties help preserve food freshness and prevent contamination. The demand for retail aluminum foil rolls is being driven by the increasing number of urban families, rising disposable incomes, and a growing trend towards convenience-oriented cooking, particularly in emerging economies. Additionally, the expansion of quick-service restaurants, catering services, and cloud kitchens has led to a surge in the bulk usage of rolled foil for wrapping, portioning, and retaining heat during food preparation and delivery.

"The beverages segment is expected to register the second-fastest growth during the forecast period."

Beverages account for the second-fastest-growing segment in the aluminum foil packaging market, primarily due to the crucial role these packages play in protecting products, extending shelf life, and enhancing brand image across various beverage formats. Aluminum foil is widely used in drink cartons, lids, and lidding, especially in the aseptic packaging of juices, dairy-based drinks, functional beverages, and ready-to-drink teas and coffees. In these applications, aluminum foil serves as a superior barrier against oxygen, light, moisture, and microbial contamination, which is essential for preserving flavor, nutritional value, and product safety without the need for refrigeration. The increasing demand for foil-based packaging is driven by the growing global appetite for packaged and long shelf-life beverages, fueled by urbanization, busy lifestyles, and the expansion of cold-chain logistics in emerging markets.

"In terms of value, Europe is expected to account for the second-largest market share in the aluminum foil packaging market."

Europe is the second-largest market for aluminum foil packaging, primarily due to its advanced food and beverage sector, a strong emphasis on packaging safety by regulatory authorities, and well-established sustainability practices. A significant portion of the region's population relies on packaged and processed foods, pharmaceuticals, and beverages, all of which benefit from the superior barrier properties, hygiene, and product protection provided by aluminum foil. Strict EU regulations regarding food contact materials, the integrity of pharmaceutical packaging, and shelf-life preservation further enhance the advantages of aluminum foil over other materials, contributing to steady demand. Additionally, Europe is a global leader in sustainability and circular economy initiatives, with a highly developed aluminum recycling system and recycling rates that surpass those of most other regions.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million

Companies Covered

RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the aluminum foil packaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the aluminum foil packaging market based on product type (bags & pouches, wraps & rolls, blisters, containers, and other product types), packaging type (semi-rigid, flexible, and other packaging types), type (backed foil, rolled foil, and other types), application (food, beverages, pharmaceuticals, personal care & cosmetics, and other applications), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope encompasses detailed information regarding the drivers, restraints, challenges, and opportunities that influence the growth of the aluminum foil packaging market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, products offered, and key strategies, including partnerships, collaborations, product launches, expansions, and acquisitions, associated with the aluminum foil packaging market. This report covers a competitive analysis of upcoming startups in the aluminum foil packaging market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aluminum foil packaging market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (long shelf life of food products, high demand for aluminum foils from end-use industries, growth of e-commerce sector, and increasing sustainability concerns), restraints (volatile prices of raw materials and easy availability of substitutes), opportunities (upcoming regulations and government initiatives and demand from food-delivery and retail-ready meals), and challenges (recyclability of multi-layer aluminum foils and economic imbalance of trade).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the aluminum foil packaging market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the aluminum foil packaging market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aluminum foil packaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM FOIL PACKAGING MARKET

- 3.2 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE

- 3.3 ALUMINUM FOIL PACKAGING MARKET, BY TYPE

- 3.4 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE

- 3.5 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION

- 3.6 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE AND COUNTRY, 2024

- 3.7 ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Long shelf life of food products

- 4.2.1.2 High demand for aluminum foil from end-use industries

- 4.2.1.3 Growth of e-commerce sector

- 4.2.1.4 Increasing concerns about sustainability

- 4.2.2 RESTRAINTS

- 4.2.2.1 Volatile raw material prices

- 4.2.2.2 Easy availability of substitutes

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Upcoming regulations and government initiatives

- 4.2.3.2 Demand from food delivery and retail-ready meals

- 4.2.4 CHALLENGES

- 4.2.4.1 Recyclability of multi-layer aluminum foils

- 4.2.4.2 Economic imbalance of trade

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 RELIABLE, SCALABLE RECYCLING FOR THIN FOIL & MULTILAYER LAMINATE STREAMS

- 4.3.2 MONO-MATERIAL FOIL SOLUTIONS THAT ENABLE SIMPLE RECYCLING

- 4.3.3 PREMIUM AESTHETICS WITH SUSTAINABLE DISPOSAL PATHWAYS

- 4.3.4 SMART FOIL LIDS FOR FRESHNESS INDICATORS AND DIGITAL ENGAGEMENT

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.4.2.1 Food Beverages

- 4.4.2.2 Food Pharma

- 4.4.2.3 Food Personal Care & Cosmetics

- 4.4.2.4 Beverage Pharma

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 4.5.1.1 Expansion of thin-gauge aluminum foil capacity by RusAL

- 4.5.1.2 Plastic-free aluminum-paper foil for sustainable wine & spirits by Amcor plc

- 4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 4.5.2.1 Constantia Flexibles' acquisition of Drukpol Flexo

- 4.5.2.2 Reynolds Consumer Products' new product launch

- 4.5.3 TIER 3 PLAYERS: STRENGTHENS ECO-EFFICIENCY WITH ZERO WASTE MILESTONE

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

5 INDUSTRY TRENDS

- 5.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.2 PRICING ANALYSIS

- 5.2.1 PRICING ANALYSIS, BY KEY PLAYER

- 5.2.2 PRICING ANALYSIS, BY REGION

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA (HS CODE 7607)

- 5.5.2 EXPORT DATA (HS CODE 7607)

- 5.6 KEY CONFERENCES AND EVENTS, 2025

- 5.7 PORTER'S FIVE FORCES' ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CONSTANTIA FLEXIBLES: REINVENTING BEVERAGE INNOVATION THROUGH RECYCLABLE ALUMINUM CAPSULES

- 5.8.2 HOLOFLEX: ADVANCED ANTI-COUNTERFEIT FOIL TECHNOLOGY THAT ELIMINATES MARKET FAKE DRUGS

- 5.8.3 AMCOR PLC: DEVELOPMENT OF PLASTIC-FREE ALUMINUM/PAPER FOIL

- 5.9 MACROECONOMIC ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 GDP TRENDS AND FORECASTS

- 5.9.3 RISING POPULATION AND URBANIZATION

- 5.9.4 TRENDS IN GLOBAL FOOD & BEVERAGE INDUSTRY

- 5.9.5 TRENDS IN GLOBAL PERSONAL CARE & COSMETIC INDUSTRY

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 IMPACT OF 2025 US TARIFF ON ALUMINUM FOIL PACKAGING MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 1.16.2. KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 KEY IMPACT ON VARIOUS COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 END-USE SECTOR IMPACT

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ANTIMICROBIAL FOILS

- 6.1.2 PRINTING METHODOLOGIES

- 6.1.2.1 Rotogravure

- 6.1.2.2 Lithography

- 6.1.2.3 Flexography

- 6.1.2.4 Digital printing

- 6.1.2.5 High barrier foil technology

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 NANOTECHNOLOGY

- 6.2.2 COLD-FORMING ALUMINUM FOIL

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 LIGHTWEIGHTING VIA HIGHER-STRENGTH ALLOY FOILS

- 6.3.2 ADVANCED RECYCLING VALUE CHAINS & CIRCULAR-ECONOMY SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027) | TRANSITION & DIGITAL ADOPTION PHASE

- 6.4.2 MID-TERM (2027-2030): CIRCULARITY SCALING, MATERIAL RE-ENGINEERING, & ADVANCED AUTOMATION PHASE

- 6.4.3 LONG-TERM (2030-2035+): FULLY SMART CIRCULAR FOIL ECOSYSTEM, NEXT-GEN COATINGS, & NET-ZERO PRODUCTION PHASE

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 APPROACH

- 6.5.3 DOCUMENT TYPE

- 6.5.4 JURISDICTION ANALYSIS

- 6.5.5 TOP APPLICANTS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 SMART SENSOR-INTEGRATED FOIL PACKAGING (IOT/CONDITION MONITORING)

- 6.6.2 PHARMACEUTICAL MICRO-DOSING & SMART-DISPENSING FOIL BLISTER SYSTEMS

- 6.6.3 SHAPE-MORPHING & ADAPTIVE ALUMINUM FOIL PACKAGING (PROGRAMMABLE PACKAGING)

- 6.6.4 HIGH-BARRIER RECYCLABLE FOIL-BASED MONO-MATERIAL STRUCTURES

- 6.7 IMPACT OF AI/GEN AI ON ALUMINUM FOIL PACKAGING MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES IN E-COMMERCE PACKAGING

- 6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM FOIL PACKAGING MARKET

- 6.7.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ALUMINUM FOIL PACKAGING MARKET

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CIRCULAR ECONOMY AND RECYCLING INITIATIVES

- 7.2.2 CIRCULAR POLICY MANDATES

- 7.2.3 CORPORATE INNOVATION AND CIRCULAR SOLUTIONS

- 7.2.4 RECYCLING PERFORMANCE ALLIANCES

- 7.2.5 DESIGN-FOR-CIRCULARITY

- 7.2.6 DIGITAL TRACEABILITY AND CIRCULAR MARKET MECHANISMS

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.5 DECISION-MAKING PROCESS

- 7.6 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.6.2 BUYING CRITERIA

- 7.7 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.8 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 7.9 MARKET PROFITABILITY

- 7.9.1 REVENUE POTENTIAL

- 7.9.2 COST DYNAMICS

- 7.9.3 MARGIN OPPORTUNITIES BY END-USE APPLICATIONS

- 7.9.3.1 Food (Medium to High Margins)

- 7.9.3.2 Beverages (Medium Margins)

- 7.9.3.3 Pharmaceuticals (High Margins)

- 7.9.3.4 Personal Care & Cosmetics (Medium to High Margins)

8 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 BAGS & POUCHES

- 8.2.1 HIGH BARRIER PROTECTION, LIGHTWEIGHT CONSTRUCTION, AND FLEXIBLE FORMABILITY TO DRIVE ADOPTION

- 8.3 WRAPS & ROLLS

- 8.3.1 THERMAL STABILITY, BARRIER PROTECTION, AND RISING HOUSEHOLD USAGE TO DRIVE DEMAND

- 8.4 BLISTERS

- 8.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY, REGULATORY FOCUS, AND UNIT-DOSE PACKAGING ADOPTION TO ACCELERATE DEMAND

- 8.5 CONTAINERS

- 8.5.1 RISING PREFERENCE FOR LIGHTWEIGHT RIGID FORMATS, ENHANCED HYGIENE STANDARDS, AND RECYCLING BENEFITS TO DRIVE ADOPTION

- 8.6 OTHER PRODUCT TYPES

9 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FOOD

- 9.2.1 RISING PACKAGED FOOD PRODUCTION TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING

- 9.3 BEVERAGES

- 9.3.1 GROWING BEVERAGE PRODUCTION AND SUSTAINABILITY FOCUS TO DRIVE DEMAND

- 9.4 PHARMACEUTICALS

- 9.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 9.5 PERSONAL CARE & COSMETICS

- 9.5.1 GROWING PERSONAL CARE & COSMETICS INDUSTRY TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING

- 9.6 OTHER APPLICATIONS

10 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE

- 10.1 INTRODUCTION

- 10.2 SEMI-RIGID PACKAGING

- 10.2.1 RISING DEMAND FOR HEAT-RESISTANT, HIGH-BARRIER, AND DURABLE SEMI-RIGID FOIL PACKAGING TO DRIVE MARKET

- 10.3 FLEXIBLE PACKAGING

- 10.3.1 RISING ADOPTION OF FLEXIBLE, HIGH-BARRIER, AND RECYCLABLE ALUMINUM FOIL SOLUTIONS TO PROPEL MARKET

- 10.4 OTHER PACKAGING TYPES

11 ALUMINUM FOIL PACKAGING MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 ROLLED FOIL

- 11.2.1 RISING DEMAND FOR LIGHTWEIGHT, HIGH-BARRIER, AND RECYCLABLE SOLUTIONS TO DRIVE GROWTH

- 11.3 BACKED FOIL

- 11.3.1 GROWING DEMAND FOR HIGH-BARRIER, DURABLE, AND CUSTOMIZABLE BACKED FOILS TO DRIVE MARKET

- 11.4 OTHER TYPES

12 ALUMINUM FOIL PACKAGING MARKET, BY THICKNESS

- 12.1 INTRODUCTION

- 12.2 7-50 MICRONS

- 12.3 51-100 MICRONS

- 12.4 OTHERS

13 ALUMINUM FOIL PACKAGING MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 COLD FORM FOIL

- 13.3 HOT SEAL FOIL

14 ALUMINUM FOIL PACKAGING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Rapid expansion of food delivery services to propel market

- 14.2.2 INDIA

- 14.2.2.1 Rapid growth in food delivery, digital commerce, and healthcare spending to drive demand

- 14.2.3 JAPAN

- 14.2.3.1 Rising packaging shipments, sustainability focus, and convenience-driven food consumption support packaging demand

- 14.2.4 AUSTRALIA

- 14.2.4.1 Government initiatives toward sustainability and convenient packaging to drive market

- 14.2.5 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Government initiatives toward circular economy to boost market

- 14.3.2 ITALY

- 14.3.2.1 Rising demand from retail, food, and healthcare industries to drive market

- 14.3.3 UK

- 14.3.3.1 Growth of healthcare industry to offer lucrative opportunities

- 14.3.4 FRANCE

- 14.3.4.1 Increase in retail sales of packaged foods to drive market

- 14.3.5 SPAIN

- 14.3.5.1 Increasing demand for aluminum foil in various end-use industries to propel market

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 NORTH AMERICA

- 14.4.1 US

- 14.4.1.1 Rising consumption of packaged food and large pharmaceutical industry to propel market

- 14.4.2 CANADA

- 14.4.2.1 Growing household expenditure on food and personal care products to accelerate demand

- 14.4.3 MEXICO

- 14.4.3.1 Rising food and personal care consumption to support market growth

- 14.4.1 US

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Increasing opportunities in end-use industries to fuel market

- 14.5.1.2 UAE

- 14.5.1.2.1 Rising food safety standards and convenience food trends to propel market

- 14.5.1.3 Rest of GCC countries

- 14.5.1.1 Saudi Arabia

- 14.5.2 SOUTH AFRICA

- 14.5.2.1 Growing local generics production, expanding F&B sector, and healthcare packaging regulation support to drive demand

- 14.5.3 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Strong demand from food, beverage, and healthcare sectors to drive demand

- 14.6.2 ARGENTINA

- 14.6.2.1 Dynamic food and personal care industries to support market growth

- 14.6.3 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES

- 15.3 MARKET SHARE ANALYSIS

- 15.4 REVENUE ANALYSIS OF KEY PLAYERS

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND COMPARISON

- 15.6.1 RUSAL (ALUMINUM FOIL PRODUCTS)

- 15.6.2 HULAMIN (PACKAGING FOIL SOLUTIONS)

- 15.6.3 HINDALCO INDUSTRIES LTD. (ALUMINIUM FOIL & CONVERTER PRODUCTS)

- 15.6.4 CHINA HONGQIAO GROUP LIMITED (ALUMINIUM PACKAGING STOCK)

- 15.6.5 AMCOR PLC (ALUMINUM-BASED FLEXIBLE PACKAGING)

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Product type footprint

- 15.7.5.5 Packaging type footprint

- 15.7.5.6 Thickness footprint

- 15.7.5.7 Technology footprint

- 15.7.5.8 Application footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIOS

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 RUSAL

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 HULAMIN

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 MnM view

- 16.1.2.3.1 Key strengths

- 16.1.2.3.2 Strategic choices

- 16.1.2.3.3 Weaknesses and competitive threats

- 16.1.3 HINDALCO INDUSTRIES LTD.

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 CHINA HONGQIAO GROUP LIMITED

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 AMCOR PLC

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 KIBAR HOLDING

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Expansions

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 CONSTANTIA FLEXIBLES

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.3.2 Expansions

- 16.1.7.4 MnM view

- 16.1.7.4.1 Key strengths

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 REYNOLDS CONSUMER PRODUCTS

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.4 MnM view

- 16.1.8.4.1 Key strengths

- 16.1.8.4.2 Strategic choices

- 16.1.8.4.3 Weaknesses and competitive threats

- 16.1.9 GARMCO

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Expansions

- 16.1.9.4 MnM view

- 16.1.9.4.1 Key strengths

- 16.1.9.4.2 Strategic choices

- 16.1.9.4.3 Weaknesses and competitive threats

- 16.1.10 NOVOLEX

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.10.4 MnM view

- 16.1.10.4.1 Key strengths

- 16.1.10.4.2 Strategic choices

- 16.1.10.4.3 Weaknesses and competitive threats

- 16.1.11 RAVIRAJ FOILS LIMITED

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 MnM view

- 16.1.11.3.1 Key strengths

- 16.1.11.3.2 Strategic choices

- 16.1.11.3.3 Weaknesses and competitive threats

- 16.1.1 RUSAL

- 16.2 OTHER PLAYERS

- 16.2.1 PENNY PLATE, LLC

- 16.2.2 JINDAL (INDIA) LIMITED

- 16.2.3 PG FOILS LTD.

- 16.2.4 EUROFOIL LUXEMBOURG SA

- 16.2.5 ALUFOIL PRODUCTS CO.

- 16.2.6 FLEXIFOIL PACKAGING PVT LTD

- 16.2.7 ALIBERICO

- 16.2.8 CARCANO ANTONIO S.P.A.

- 16.2.9 D&W FINE PACK

- 16.2.10 HANDI-FOIL CORPORATION

- 16.2.11 COPPICE

- 16.2.12 SYMETAL

- 16.2.13 WYDA SOUTH AFRICA

- 16.2.14 AMPCO

- 16.2.15 LSKB ALUMINIUM FOILS PVT. LTD.

- 16.2.16 TAKAMUL INDUSTRIES

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.1.2 List of secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key primary participants

- 17.1.2.2 Key data from primary sources

- 17.1.2.3 Breakdown of interviews with experts

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 TOP-DOWN APPROACH

- 17.2.2 BOTTOM-UP APPROACH

- 17.3 BASE NUMBER CALCULATION

- 17.3.1 SUPPLY-SIDE APPROACH

- 17.4 GROWTH FORECAST

- 17.5 DATA TRIANGULATION

- 17.6 RESEARCH ASSUMPTIONS

- 17.7 FACTOR ANALYSIS

- 17.8 RESEARCH LIMITATIONS

- 17.9 RISK ASSESSMENT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS