|

시장보고서

상품코드

1915209

광업용 AI 시장 : 제공별, 전개 방식별, 기술별, 용도별, 채광 기술별, 채광 유형별, 지역별 - 세계 예측(-2032년)AI in Mining Market by Offering (Software, Services), Mining Type (Surface, Underground), Deployment Mode (On-Premises, Cloud, Hybrid), Technology (Generative AI, Machine Learning, NLP), Application, Vertical, and Region - Global Forecast to 2032 |

||||||

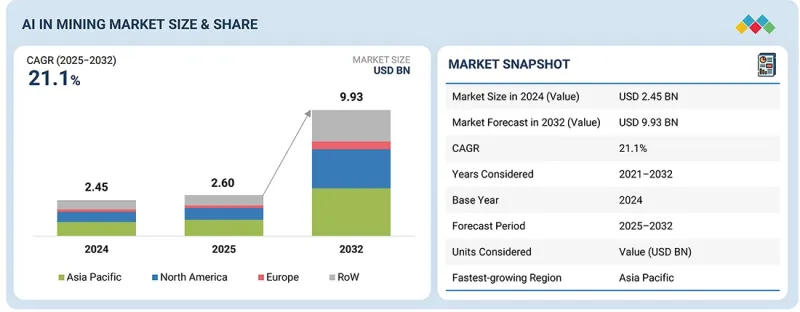

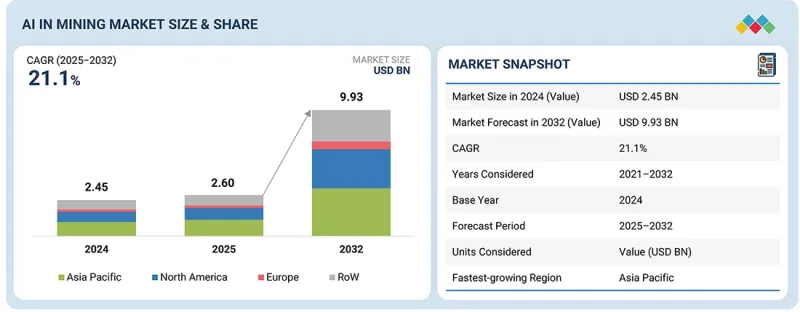

광업용 AI 시장 규모는 2025년 26억 달러에서 2032년까지 99억 3,000만 달러로 성장하여 2025년부터 2032년까지 CAGR은 21.1%로 예측됩니다. 이 성장은 급속한 디지털 전환과 광산 현장에서의 IoT, 클라우드 컴퓨팅, 5G 연결의 보급 확대에 의해 주도되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공별, 전개 방식별, 기술별, 용도별, 채광 기술별, 채광 유형별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

자율 운반 시스템, 스마트 시추, 차량 관리 플랫폼의 채택 확대는 특히 복잡하고 접근하기 어려운 광산 현장에서 자동화를 가속화하고 원격 조작을 가능하게 하고 있습니다.

생성형 AI 기술 부문은 전체 채굴 프로세스에서 업무 효율성, 의사결정 및 예측 능력 향상에 기여하는 특성으로 인해 2030년 채굴용 AI 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다. 생성형 AI는 방대한 지질 데이터, 운영 데이터, 센서 데이터를 분석하여 실용적인 인사이트, 시뮬레이션, 예측 모델을 생성함으로써 광산 기업이 탐사, 시추, 채굴 전략을 최적화할 수 있도록 돕습니다. 광체의 정확한 3D 모델 생성, 설비 고장 예측, 채굴 시나리오 시뮬레이션을 통해 생성형 AI는 운영 리스크, 다운타임, 비용을 절감합니다. 또한, 설계 및 계획 워크플로우를 가속화하여 엔지니어가 구현 전에 여러 접근 방식을 가상으로 테스트할 수 있도록 지원합니다. 이 기술은 위험 상황 및 광미 관리에 대한 예측 경보를 생성하여 환경 컴플라이언스 및 안전 관리도 지원합니다. 컴퓨터 비전 및 IoT 분석과 같은 다른 AI 도구와의 통합을 통해 엔드 투 엔드 광산 운영 전반에 걸쳐 가치를 더욱 확대할 수 있습니다. 고급 분석, 자동화, 스마트한 자원 활용에 대한 수요가 증가함에 따라, 생성형 AI는 운영 및 전략적 과제를 모두 해결할 수 있는 확장 가능하고 지능적인 솔루션을 제공함으로써 광업용 AI 시장의 주요 기술 분야로 자리매김하고 있습니다.

예측 기간 동안 서비스 분야는 광업용 AI 시장에서 가장 높은 CAGR로 성장할 것으로 예상됩니다. 이는 광산업 기업들이 고급 AI 솔루션을 성공적으로 도입하고 확장하기 위해 컨설팅, 시스템 통합, 교육, 매니지드 서비스에 대한 의존도가 높아졌기 때문입니다. 광산 운영이 더욱 복잡해지고 디지털 연결성이 높아짐에 따라 기업은 AI 플랫폼을 기존 장비, IoT 장치, 기업 시스템, 원격 운영 센터와 통합하기 위한 전문 지식이 필요합니다. 예측 유지보수, 차량 최적화, 지질 모델링, 안전 모니터링과 같은 AI 사용 사례를 현장의 고유한 과제와 규제 요건에 맞게 맞춤화하는 데 있어 서비스는 매우 중요합니다. 또한, 채굴 분야의 숙련된 AI 및 데이터 과학 전문가 부족으로 인해, 사업자들은 지속적인 지원, 실시간 성능 모니터링 및 모델 개선에 있어 타사 서비스 제공업체에 대한 의존도가 높아지고 있습니다. 매니지드 서비스 및 구독형 도입 모델은 초기 투자 비용을 절감하고 성과 기반 성과 계약을 통해 장기적인 투자수익률(ROI)을 보장함으로써 수요를 더욱 촉진할 수 있습니다. AI가 파일럿 프로젝트에서 본격적인 도입 단계에 접어들면서 서비스 제공업체는 필수적인 파트너가 되어 이 부문의 성장을 주도하고 있습니다.

아시아태평양은 대규모 광산 인프라 확장, 산업 생산량 증가, 에너지 생산 및 제조업에 필요한 금속, 광물, 석탄에 대한 수요 증가로 인해 2030년 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 중국, 호주, 인도, 인도네시아는 철광석, 구리, 금, 리튬, 석탄 등 주요 원자재 생산국으로서 광업 현대화에 많은 투자를 하고 있습니다. 운영 효율성 향상, 비용 최적화, 생산성 향상에 대한 요구가 높아지면서 예측 분석, 자율 운반 시스템, AI를 활용한 시추 최적화, 실시간 장비 모니터링 등 첨단 AI 기술 도입이 가속화되고 있습니다. 정부의 디지털 전환과 인더스트리 4.0 통합을 지원하는 정부의 노력과 자동화를 위한 대규모 공공 및 민간 자금 지원은 AI 도입을 더욱 촉진하고 있습니다. 또한, 숙련된 엔지니어 인력의 풍부한 공급과 5G 연결 및 클라우드 컴퓨팅 플랫폼과 같은 빠르게 진화하는 디지털 인프라를 통해 원격 광산 사이트 전체에 AI 솔루션을 원활하게 통합할 수 있습니다. 이 지역에서는 전자기기, 전기자동차 배터리, 재생에너지 산업을 뒷받침하기 위해 광물 채굴의 규모가 계속 확대되고 있으며, 2030년까지 광업용 AI 시장을 선도할 수 있는 위치에 있습니다.

2차 조사를 통해 광업용 AI 시장의 주요 부문 및 하위 부문의 시장 규모를 수집한 후, 이를 확정하고 검증하기 위해 업계 주요 전문가를 대상으로 광범위한 1차 인터뷰를 실시했습니다. 본 보고서의 1차 조사 대상자 내역은 다음과 같습니다:

본 보고서에서는 광업용 AI 시장의 주요 진입업체를 시장 순위 분석과 함께 프로파일링하고 있습니다. 본 보고서에서 다루고 있는 주요 진출기업은 다음과 같습니다. Caterpillar(미국), Komatsu Ltd.(일본), Sandvik AB(스웨덴), Epiroc AB(스웨덴), Hitachi Construction Machinery(일본), Hexagon AB(스웨덴), Rockwell Automation(미국), Siemens(독일), Trimble Inc.(미국), ABB(스위스), Microsoft(미국), SAP SE(독일) 등이 있습니다.

이 외에도 IBM(미국), RPMGLOBAL HOLDINGS LIMITED(호주), Liebheer(스위스), GroundHog(미국), Haultrax(호주), Micromine(호주), SYMX. Tomorrow Companies Inc.(미국), VRIFY(미국), IntelliSense.io(영국), Orica Limited(호주), MineSense Technologies Ltd.(캐나다), Exyn Technologies(미국) 등이 광업용 AI 시장에 진출한 몇 안 되는 기업들입니다.

조사 범위:

본 조사 보고서에서는 광업용 AI 시장을 제공 내용, 채굴 유형, 도입 형태, 기술, 용도, 업종, 지역별로 분류하여 조사했습니다. 광업용 AI 시장과 관련된 주요 시장 촉진요인, 제약요인, 도전과제, 기회를 설명하고 2032년까지 시장 예측을 제시합니다. 이 외에도 광업용 AI 시장 생태계에 포함된 모든 기업의 리더십 매핑 및 분석도 포함되어 있습니다.

본 보고서 구매의 주요 이점

이 보고서는 광업용 AI 시장 전체 및 하위 부문에 대한 대략적인 수치에 대한 정보를 제공하여 시장 리더와 신규 진입자에게 도움을 줄 수 있습니다. 이해관계자들이 경쟁 상황을 이해하고, 사업 포지셔닝을 최적화하고 적절한 시장 진입 전략을 수립하는 데 도움이 되는 인사이트를 얻을 수 있도록 지원합니다. 또한, 시장 동향을 파악하고 주요 시장 촉진요인, 제약요인, 과제, 기회요인에 대한 정보를 제공합니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 주요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 상호 접속된 시장과 분야 횡단적인 기회

- 티어1/2/3 진출 기업의 전략적 활동

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 2026년의 주요 회의와 이벤트

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 광업용 AI 시장

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신

- 주요 기술

- 보완적 기술

- 특허 분석

제7장 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 표준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 기준

- 채용 장벽과 내부 과제

- 다양한 광업 유형 미충족 수요

제9장 광업용 AI 시장(제공별)

- 소프트웨어

- 서비스

제10장 광업용 AI 시장(전개 방식별)

- 온프레미스

- 클라우드 기반

- 하이브리드

제11장 광업용 AI 시장(기술별)

- 생성형 AI

- 머신러닝

- 자연어 처리

- 컴퓨터 비전

제12장 광업용 AI 시장(용도별)

- 예측 보수와 자산 관리

- 오퍼레이션과 프로세스 최적화

- 탐사와 지구 과학

- 안전, 보안, 환경

제13장 광업용 AI 시장(채광 기술별)

- 노천 채굴

- 지하 채굴

제14장 광업용 AI 시장(채광 유형별)

- 광물 채굴

- 금속 채굴

- 석탄 채굴

제15장 광업용 AI 시장(지역별)

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 러시아

- 독일

- 프랑스

- 카자흐스탄

- 기타

- 아시아태평양

- 중국

- 인도

- 호주

- 인도네시아

- 기타

- 기타 지역

- 중동 및 아프리카

- 남미

제16장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점, 2021-2025년

- 시장 점유율 분석, 2024년

- 매출 분석, 2020-2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제17장 기업 개요

- 주요 진출 기업

- CATERPILLAR

- KOMATSU LTD.

- SANDVIK AB

- HITACHI CONSTRUCTION MACHINERY CO., LTD.

- HEXAGON AB

- EPIROC AB

- ROCKWELL AUTOMATION

- SIEMENS

- TRIMBLE INC.

- ABB

- MICROSOFT

- SAP SE

- 기타 기업

- IBM

- RPMGLOBAL HOLDINGS LIMITED

- LIEBHEER

- GROUNDHOG

- HAULTRAX

- MICROMINE PTY LTD.

- SYMX.AI

- THE TOMORROW COMPANIES INC.

- VRIFY

- INTELLISENSE.IO

- ORICA LIMITED

- MINESENSE TECHNOLOGIES LTD.

- EXYN TECHNOLOGIES

제18장 조사 방법

제19장 부록

KSM 26.02.05The AI in mining market is anticipated to grow from USD 2.60 billion in 2025 to USD 9.93 billion by 2032, at a CAGR of 21.1% between 2025 and 2032. The AI in mining market is driven by rapid digital transformation and the increasing deployment of IoT, cloud computing, and 5G connectivity across mining sites.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment, Technology, Application, Minig Type, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific , Latin America, Middle East & Africa |

The expanding adoption of autonomous haulage systems, smart drilling, and fleet management platforms accelerates automation and enables remote operations, particularly in complex and inaccessible mining locations.

"Generative AI technology segment is estimated to hold the largest market share in 2030."

The generative AI technology segment is expected to account for the largest share of the AI in mining market in 2030 due to its ability to enhance operational efficiency, decision-making, and predictive capabilities across mining processes. Generative AI can analyze massive volumes of geological, operational, and sensor data to generate actionable insights, simulations, and predictive models, enabling mining companies to optimize exploration, drilling, and extraction strategies. By producing accurate 3D models of ore bodies, predicting equipment failures, and simulating mining scenarios, generative AI reduces operational risks, downtime, and costs. Additionally, it accelerates design and planning workflows, allowing engineers to test multiple approaches virtually before implementation. The technology also supports environmental compliance and safety management by generating predictive alerts for hazardous conditions and tailings management. Its integration with other AI tools, such as computer vision and IoT analytics, further amplifies value across end-to-end mining operations. Given the growing demand for advanced analytics, automation, and smarter resource utilization, generative AI provides a scalable and intelligent solution that addresses both operational and strategic challenges, securing its position as the leading technology segment in the AI in mining market.

"Services segment is estimated to record the highest CAGR during the forecast period."

The services segment is expected to grow at the highest CAGR in the AI in mining market during the forecast period due to the increasing reliance of mining companies on consulting, system integration, training, and managed services to successfully deploy and scale advanced AI solutions. As mining operations become more complex and digitally connected, companies require specialized expertise to integrate AI platforms with existing equipment, IoT devices, enterprise systems, and remote operational centers. Services are crucial in customizing AI use cases, such as predictive maintenance, fleet optimization, geological modeling, and safety monitoring, to meet site-specific challenges and regulatory requirements. Additionally, the shortage of skilled AI and data science professionals within the mining sector pushes operators to depend heavily on third-party service providers for ongoing support, real-time performance monitoring, and continuous model improvements. Managed services and subscription-based deployment models further drive the demand by reducing upfront investment costs and ensuring long-term ROI through outcome-based performance contracts. As AI transitions from pilot projects to full-scale implementation, service providers become essential partners, fueling the segmental growth.

"Asia Pacific is projected to hold the largest share of the AI in mining market in 2030."

Asia Pacific is estimated to hold the largest market share in 2030 due to the massive mining infrastructure expansion, the growing industrial output, and the rising demand for metals, minerals, and coal required for energy production and manufacturing. China, Australia, India, and Indonesia are among the world's largest producers of essential raw materials, including iron ore, copper, gold, lithium, and coal, leading to substantial investment in mining modernization. The increasing need for operational efficiency, cost optimization, and high productivity has accelerated the adoption of advanced AI technologies, such as predictive analytics, autonomous haulage systems, AI-powered drilling optimization, and real-time equipment monitoring. Government initiatives supporting digital transformation and Industry 4.0 integration in mining, along with large-scale public and private funding for automation, further strengthen AI deployment. Additionally, the high availability of skilled engineering talent and rapidly evolving digital infrastructure-5G connectivity and cloud computing platforms-enable seamless integration of AI solutions across remote mining sites. As the region continues to scale mineral extraction to support electronics, EV batteries, and renewable energy industries, it is positioned to lead the AI in mining market by 2030.

Extensive primary interviews were conducted with key industry experts in the AI in mining to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is provided below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation: C-level Executives-45%, Directors-40%, and Others-15%

- By Region: North America-30%, Europe-20%, Asia Pacific-35%, and RoW-15%

The report profiles key players in the AI in mining market with their respective market ranking analysis. Prominent players profiled in this report are Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Hexagon AB (Sweden), Rockwell Automation (US), Siemens (Germany), Trimble Inc. (US), ABB (Switzerland), Microsoft (US), and SAP SE (Germany), among others.

Apart from this, IBM (US), RPMGLOBAL HOLDINGS LIMITED (Australia), Liebheer (Switzerland), GroundHog (US), Haultrax (Australia), Micromine (Australia), SYMX.AI (Canada), The Tomorrow Companies Inc. (US), VRIFY (US), IntelliSense.io (UK), Orica Limited. (Australia), MineSense Technologies Ltd. (Canada), Exyn Technologies (US), among others, are among the few other companies in the AI in mining market.

Research Coverage:

This research report categorizes the AI in mining market based on offering, mining type, deployment mode, technology, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the AI in mining market and forecasts the same till 2032. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the AI in mining market ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the numbers for the overall AI in mining market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (strong focus on AI-enabled safety, efficiency, and productivity improvements), restraints (high deployment costs and complex integration with legacy systems), opportunities (inclination of mine operators toward digital technologies), and challenges (interoperability issues between AI platforms, sensors, and mining equipment) of the AI in mining market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in mining market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the AI in mining market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI in mining market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Hexagon AB (Sweden) in the AI in mining market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING AI IN MINING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI IN MINING MARKET

- 3.2 AI IN MINING MARKET, BY OFFERING

- 3.3 AI IN MINING MARKET, BY DEPLOYMENT MODE

- 3.4 AI IN MINING MARKET, BY TECHNOLOGY

- 3.5 AI IN MINING MARKET, BY MINING TECHNIQUE

- 3.6 AI IN MINING MARKET, BY MINING TYPE

- 3.7 AI IN MINING MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

- 3.8 AI IN MINING MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing focus on AI-driven safety, efficiency, and productivity

- 4.2.1.2 Rising adoption of predictive maintenance and real-time monitoring solutions

- 4.2.1.3 High emphasis on data-driven sustainable mining operations

- 4.2.2 RESTRAINTS

- 4.2.2.1 High deployment costs and integration complexities

- 4.2.2.2 Poor data quality and limited digital infrastructure in remote mine sites

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Inclination toward digital technologies to optimize mining operations

- 4.2.3.2 Rising adoption of smart, connected mining practices

- 4.2.3.3 Reliance on AI for advanced geological modeling and exploration

- 4.2.4 CHALLENGES

- 4.2.4.1 Interoperability issues between AI platforms, sensors, and mining equipment

- 4.2.4.2 Rising sustainability concerns hindering tech-led mining

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL MINING INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AI INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY OFFERING, 2024

- 5.5.2 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY KEY PLAYER, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8429)

- 5.6.2 EXPORT SCENARIO (HS CODE 8429)

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ROCKWELL AUTOMATION OFFERS CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS TO MINIMIZE DOWNTIME AND OPERATIONAL COST IN MINING PLANT

- 5.10.2 KOMATSU PROVIDES AUTONOMOUS HAULAGE SYSTEM TO ENHANCE PRODUCTIVITY AND SAFETY IN AITIK COPPER MINE

- 5.10.3 ROCKWELL AUTOMATION DEPLOYS FACTORYTALK SUITE AT AMRUN BAUXITE MINE TO IMPROVE OPERATIONAL VISIBILITY

- 5.10.4 HEXAGON OFFERS OPERATIONS MANAGEMENT SOLUTIONS TO STREAMLINE OPERATIONS AT VALTERRA PLATINUM LIMITED'S MINING SITES

- 5.11 IMPACT OF 2025 US TARIFF - AI IN MINING MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON MINING TYPES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 MACHINE LEARNING AND PREDICTIVE ANALYTICS

- 6.1.2 COMPUTER VISION AND AUTONOMOUS SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 IOT AND EDGE COMPUTING

- 6.2.2 HIGH-PRECISION MAPPING AND GEOSPATIAL ANALYTICS

- 6.3 PATENT ANALYSIS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.3.1 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS MINING TYPES

9 AI IN MINING MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 SOFTWARE

- 9.2.1 HIGH EMPHASIS ON DIGITAL TRANSFORMATION, DATA-DRIVEN DECISION-MAKING, AND OPERATIONAL EFFICIENCY TO SPUR DEMAND

- 9.3 SERVICES

- 9.3.1 INCREASING USE OF ADVANCED ANALYTICS, MACHINE LEARNING, AND COMPUTER VISION IN MINING OPERATIONS TO DRIVE MARKET

10 AI IN MINING MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- 10.2 ON-PREMISES

- 10.2.1 RELIABILITY, OPERATIONAL INDEPENDENCE, AND SUITABILITY FOR MISSION-CRITICAL MINING ACTIVITIES TO BOOST SEGMENTAL GROWTH

- 10.3 CLOUD-BASED

- 10.3.1 ABILITY TO PROVIDE SCALABLE COMPUTING AND CENTRALIZED DATA ACCESSIBILITY TO AUGMENT SEGMENTAL GROWTH

- 10.4 HYBRID

- 10.4.1 SUPPORT FOR REAL-TIME EDGE-BASED DECISION-MAKING TO CONTRIBUTE TO SEGMENTAL GROWTH

11 AI IN MINING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 GENERATIVE AI

- 11.2.1 MOUNTING ADOPTION IN EXPLORATION, MINE PLANNING, AND OPERATIONAL SIMULATION TO FOSTER SEGMENTAL GROWTH

- 11.2.2 RULE-BASED MODELS

- 11.2.3 STATISTICAL MODELS

- 11.2.4 DEEP LEARNING

- 11.2.5 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 11.2.6 AUTOENCODERS

- 11.2.7 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 11.2.8 TRANSFORMER MODELS

- 11.3 MACHINE LEARNING

- 11.3.1 RISING NEED FOR PREDICTIVE AND PRESCRIPTIVE ANALYTICS TO ACCELERATE SEGMENTAL GROWTH

- 11.4 NATURAL LANGUAGE PROCESSING

- 11.4.1 STRONG FOCUS ON ANALYZING UNSTRUCTURED DATA TO DERIVE REAL-TIME ACTIONABLE INTELLIGENCE TO BOLSTER SEGMENTAL GROWTH

- 11.5 COMPUTER VISION

- 11.5.1 HIGH SUPPORT FOR REAL-TIME IMAGE AND VIDEO ANALYTICS TO EXPEDITE SEGMENTAL GROWTH

12 AI IN MINING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT

- 12.2.1 RISING EQUIPMENT MAINTENANCE COSTS AND ASSET COMPLEXITY TO AUGMENT SEGMENTAL GROWTH

- 12.3 OPERATIONS & PROCESS OPTIMIZATION

- 12.3.1 STRONG FOCUS ON MAXIMIZING RECOVERY RATES AND OPTIMIZING OPERATING MARGINS TO FUEL SEGMENTAL GROWTH

- 12.4 EXPLORATION & GEOSCIENCES

- 12.4.1 URGENT NEED TO SECURE CRITICAL MINERALS FOR RENEWABLE ENERGY AND ELECTRIC VEHICLE SUPPLY CHAINS TO DRIVE MARKET

- 12.5 SAFETY, SECURITY & ENVIRONMENT

- 12.5.1 TIGHTENING ENVIRONMENTAL AND WORKER-SAFETY REGULATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

13 AI IN MINING MARKET, BY MINING TECHNIQUE

- 13.1 INTRODUCTION

- 13.2 SURFACE MINING

- 13.2.1 LOW OPERATIONAL COMPLEXITY, REDUCED SAFETY HAZARDS, AND COST ADVANTAGES TO BOOST SEGMENTAL GROWTH

- 13.3 UNDERGROUND MINING

- 13.3.1 STRONG FOCUS ON WORKER SAFETY, SUSTAINABILITY, AND PRODUCTIVITY TO FACILITATE SEGMENTAL GROWTH

14 AI IN MINING MARKET, BY MINING TYPE

- 14.1 INTRODUCTION

- 14.2 MINERAL MINING

- 14.2.1 EMPHASIS ON RESOURCE OPTIMIZATION AND COST-EFFICIENT PRODUCTION TO ACCELERATE SEGMENTAL GROWTH

- 14.3 METAL MINING

- 14.3.1 RISING DEMAND FOR CRITICAL MINERALS FOR ELECTRIC VEHICLES AND NEXT-GENERATION MANUFACTURING TO DRIVE MARKET

- 14.4 COAL MINING

- 14.4.1 FOCUS ON SAFETY, COST OPTIMIZATION, AND AUTOMATION TO BOOST SEGMENTAL GROWTH

15 AI IN MINING MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Rapid digitalization of surface and underground mining operations to bolster market growth

- 15.2.2 CANADA

- 15.2.2.1 Strong presence of mineral and metal reserves to fuel market growth

- 15.2.3 MEXICO

- 15.2.3.1 High emphasis on predictive maintenance and advanced geological modeling to augment market growth

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 RUSSIA

- 15.3.1.1 Rapid innovation in AI-powered survey and exploration tools to bolster market growth

- 15.3.2 GERMANY

- 15.3.2.1 Industrial modernization and energy transition to contribute to market growth

- 15.3.3 FRANCE

- 15.3.3.1 Emphasis on enhancing operational efficiency, safety, and sustainability to accelerate market growth

- 15.3.4 KAZAKHSTAN

- 15.3.4.1 Digital transformation and Industry 4.0 adoption to foster market growth

- 15.3.5 REST OF EUROPE

- 15.3.1 RUSSIA

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Energy security priorities and massive coal production scale to expedite market growth

- 15.4.2 INDIA

- 15.4.2.1 Need to enhance mineral discovery, improve operational efficiency, and strengthen regulatory compliance to drive market

- 15.4.3 AUSTRALIA

- 15.4.3.1 Vast mineral reserves and technology-driven mining ecosystem to facilitate market growth

- 15.4.4 INDONESIA

- 15.4.4.1 Mounting production of minerals for EV batteries and clean energy technologies to contribute to market growth

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 ROW

- 15.5.1 MIDDLE EAST & AFRICA

- 15.5.1.1 Abundant mineral and energy resources to boost market growth

- 15.5.1.2 GCC countries

- 15.5.1.3 Africa & Rest of Middle East

- 15.5.2 SOUTH AMERICA

- 15.5.2.1 Global energy transition and thriving electric vehicle industry to expedite market growth

- 15.5.1 MIDDLE EAST & AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Offering footprint

- 16.7.5.4 Mining technique footprint

- 16.7.5.5 Application footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CATERPILLAR

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 KOMATSU LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 SANDVIK AB

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 HEXAGON AB

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 EPIROC AB

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.7 ROCKWELL AUTOMATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.8 SIEMENS

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Deals

- 17.1.9 TRIMBLE INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.10 ABB

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.11 MICROSOFT

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Deals

- 17.1.12 SAP SE

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Deals

- 17.1.1 CATERPILLAR

- 17.2 OTHER PLAYERS

- 17.2.1 IBM

- 17.2.2 RPMGLOBAL HOLDINGS LIMITED

- 17.2.3 LIEBHEER

- 17.2.4 GROUNDHOG

- 17.2.5 HAULTRAX

- 17.2.6 MICROMINE PTY LTD.

- 17.2.7 SYMX.AI

- 17.2.8 THE TOMORROW COMPANIES INC.

- 17.2.9 VRIFY

- 17.2.10 INTELLISENSE.IO

- 17.2.11 ORICA LIMITED

- 17.2.12 MINESENSE TECHNOLOGIES LTD.

- 17.2.13 EXYN TECHNOLOGIES

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.2 SECONDARY AND PRIMARY RESEARCH

- 18.2.1 SECONDARY DATA

- 18.2.1.1 Key data from secondary sources

- 18.2.1.2 List of key secondary sources

- 18.2.2 PRIMARY DATA

- 18.2.2.1 Key data from primary sources

- 18.2.2.2 List of primary interview participants

- 18.2.2.3 Breakdown of primaries

- 18.2.2.4 Key industry insights

- 18.2.1 SECONDARY DATA

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 BOTTOM-UP APPROACH

- 18.3.2 TOP-DOWN APPROACH

- 18.3.3 MARKET SIZE CALCULATION FOR BASE YEAR

- 18.4 MARKET FORECAST APPROACH

- 18.4.1 SUPPLY SIDE

- 18.4.2 DEMAND SIDE

- 18.5 DATA TRIANGULATION

- 18.6 FACTOR ANALYSIS

- 18.7 RESEARCH ASSUMPTIONS

- 18.8 RESEARCH LIMITATIONS

- 18.9 RISK ANALYSIS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS