|

시장보고서

상품코드

1923690

RFID 시장 예측(-2034년) : 제공별, 폼팩터별, 용도별, 최종 용도별RFID Market by Offering, Form Factor, Application, End Use - Global Forecast to 2034 |

||||||

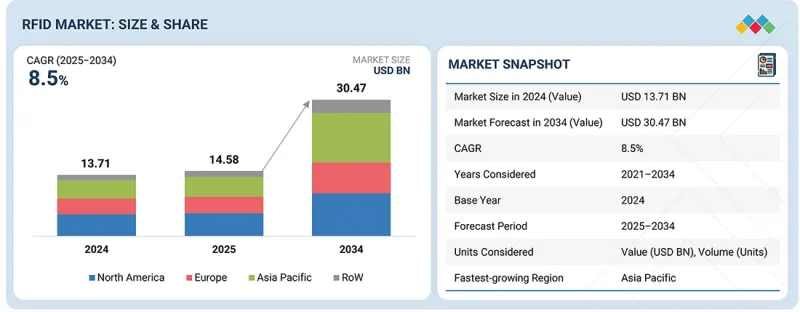

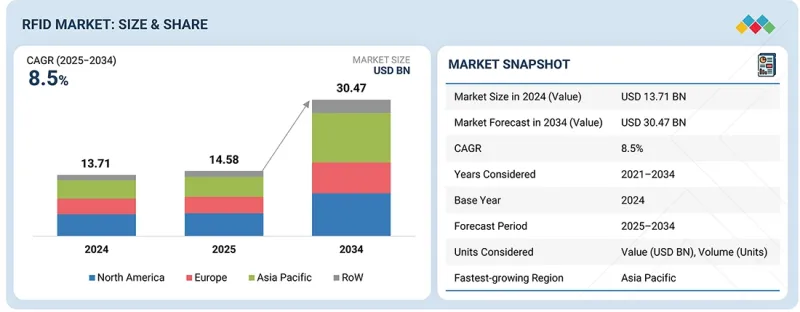

세계의 RFID 시장 규모는 2025년에 145억 8,000만 달러, 2034년까지 304억 7,000만 달러에 달할 것으로 예측되며, 2025-2034년에 CAGR로 8.5%의 성장이 전망됩니다.

여러 산업에서 실시간 추적, 업무 가시성, 데이터 정확성에 대한 수요가 증가함에 따라 시장은 예측 기간 중 안정적인 성장세를 보일 것으로 예측됩니다. 기업은 재고 정확도, 자산 활용도, 공급망 투명성 향상을 위해 RFID를 도입하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2034년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2034년 |

| 단위 | 10억 달러 |

| 부문 | 제공, 주파수 대역, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

UHF RFID 태그, 고정형/휴대용 리더기, 안테나, RFID 소프트웨어 플랫폼의 확산은 소매, 물류, 제조, 의료 환경의 자동화를 지원하고 있습니다. 상품 단위의 태깅과 창고 자동화를 통해 수작업과 사이클 타임을 단축하고 있습니다. RFID와 IoT 플랫폼, 클라우드 애널리틱스, 기업 시스템의 통합을 통해 데이터베이스 의사결정과 예측적 사고를 가능하게 합니다. 옴니채널 소매, 콜드체인 물류, 산업 자동화의 확대가 채택을 더욱 촉진하고 있습니다. 추적성, 식품 안전, 의료 규정 준수에 대한 정부의 구상도 시장 성장을 지원하고 있습니다. 그러나 초기 도입 비용, 시스템 통합의 복잡성, 데이터 관리 요건 등의 문제로 인해 비용에 민감한 환경에서는 도입이 제한적일 수 있습니다. 태그 디자인, 리더기 성능, 소프트웨어 상호운용성 및 확장 가능한 배포 모델에서 지속적인 혁신이 RFID 시장의 장기적인 성장에 중요한 역할을 할 것으로 보입니다.

"용도별로는 비접촉식 결제 부문이 2025-2034년 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

비접촉식 결제 부문은 예측 기간 중 RFID 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 빠르고, 안전하고, 편리한 결제 방식에 대한 수요 증가에 따른 것입니다. NFC/HF 기반 RFID 기술 채택이 확대되면서 소매, 대중교통, 숙박, 호텔, 은행 등 다양한 분야에서 널리 활용되고 있습니다. 소비자들은 거래 시간 단축, 위생 개선, 사용자 경험 향상을 이유로 비접촉식 결제를 선호합니다. 정부와 금융기관은 현금 없는 결제 생태계를 지속적으로 추진하고 있으며, 인프라 업그레이드와 단말기 설치에 박차를 가하고 있습니다. 도시 교통 시스템의 성장과 스마트 모빌리티 개념은 RFID 기반 요금 징수 시스템의 채택을 더욱 촉진할 것입니다. 보안 요소, 암호화, 토큰화의 발전은 거래의 안전성과 규제 준수를 강화합니다. 비접촉식 결제 시스템과 모바일 지갑, 웨어러블 기기, 스마트카드의 통합은 대응 가능한 사용처를 확대합니다. 신흥 시장에서는 디지털 결제의 보급률 향상과 함께 빠른 성장세를 보이고 있습니다. 초기 인프라 비용과 상호운용성 문제는 여전히 남아 있지만, 표준화의 진전과 기술 개선으로 비접촉식 결제는 RFID 시장에서 가장 빠르게 성장하고 있는 응용 분야입니다.

"폼팩터별로는 라벨 부문이 2034년 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. "

RFID 라벨 부문은 대량 생산 및 비용 중심의 용도에 널리 채택되고 있으며, 가장 큰 시장 점유율을 유지할 것으로 예측됩니다. RFID 라벨은 RFID 인레이와 인쇄 라벨을 결합하여 제품, 포장 및 자산을 효율적으로 식별하고 추적할 수 있습니다. 소매업은 그 첫 번째 촉진요인이며, 재고 정확도 향상, 손실 감소, 옴니채널 대응을 지원하기 위해 상품 단위의 라벨링이 대규모로 전개되고 있습니다. 물류 및 창고 업무에서 RFID 라벨은 배송 추적, 팔레트 관리, 프로세스 자동화에 활용되고 있습니다. 이 부문은 낮은 단가, 통합의 용이성, 기존 라벨링 작업 흐름과의 호환성 등의 이점을 누릴 수 있습니다. 안테나 설계, 칩 감도, 인쇄 기술의 발전으로 판독 성능과 내구성이 향상되었습니다. RFID 라벨은 의료, 제약, 식품 공급망에서도 추적성과 규제 준수를 지원하기 위해 RFID 라벨을 채택하고 있습니다. UHF 프로토콜의 표준화와 세계 조달 능력은 확장성을 지원하고 있습니다. 기업이 시범 프로젝트를 넘어 RFID 도입을 확대하는 가운데, RFID 라벨은 전체 RFID 시장에서 수량과 적용 범위에서 선두를 유지하고 있습니다.

세계의 RFID 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- RFID 시장의 기업에 매력적인 기회

- RFID 시장 : 제공별

- RFID 시장 : 폼팩터별

- RFID 시장 : 재료별

- RFID 시장 : 주파수 대역별

- RFID 시장 : 최종 용도별

- RFID 시장 : 용도별

- RFID 시장 : 지역별

- RFID 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 상호접속된 시장과 부문 횡단적인 기회

- 상호접속된 시장

- 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- GDP의 동향과 예측

- 세계의 RFID 업계의 동향

- 세계의 IoT 업계의 동향

- 밸류체인 분석

- 에코시스템 분석

- 가격결정 분석

- RFID 제품의 평균 판매 가격 동향 : 주요 기업별(2021-2024년)

- RFID 제품의 평균 판매 가격 동향 : 지역별(2021-2024년)

- 무역 분석

- 수입 시나리오(HS 코드 8523)

- 수출 시나리오(HS 코드 8523)

- 주요 컨퍼런스와 이벤트(2026-2027년)

- 고객 비즈니스에 영향을 미치는 동향/파괴적 변화

- 투자와 자금조달 시나리오(2021-2025년)

- 사례 연구 분석

- 2025년 미국 관세의 영향 - RFID 시장

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신

- 주요 신기술

- 컴퓨터 비전

- 실시간 위치추적 시스템

- RFID 대응 센서·로봇

- 보완 기술

- 클라우드 기반 RFID

- IoT용 RFID

- RFID와 블록체인의 통합

- 인접 기술

- NFC·RFID 하이브리드 솔루션

- 플렉서블 RFID 태그

- 테크놀러지 로드맵

- 단기 : 인프라의 현대화와 지능형 트래킹(2025-2027년)

- 중기 : 지능형 자동화와 에코시스템 통합(2027-2030년)

- 장기 : 자율형, 신뢰성, 데이터 드리븐 RFID 에코시스템(2030-2035년 이후)

- 특허 분석

- RFID 시장에 대한 AI의 영향

- 주요 사용 사례와 시장의 장래성

- RFID 시장에서 기업의 베스트 프랙티스

- RFID 시장에서 AI 도입에 관한 사례 연구

- 상호접속 된/인접하는 에코시스템과 시장 기업에 대한 영향

- RFID 시장에서 AI 채택에 대한 고객 준비 상황

제7장 규제 상황과 지속가능성에 관한 구상

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 구상

- 환경에 대한 영향을 경감하기 위한 RFID의 사용

- 지속가능 RFID 제품의 설계와 재료의 활용

- 에너지 효율이 높은 저소비전력 RFID 시스템의 배포

- RFID를 활용한 순환형 경제·재사용 가능 모델의 채택

- 환경과 이력추적에 관한 규제에 대응하기 위한 RFID의 도입

- 지속가능 제조와 공급망 투명성의 수용

- 포장과 문서 폐기물을 삭감하기 위한 RFID의 채택

- 지속가능성 구상에 대한 규제 정책의 영향

- RFID 제품 설계에 대한 환경 규제의 영향

- RFID 벤더와 최종사용자에 대한 폐기물 관리 정책의 영향

- 국내·국제 공급망에서 무역 규제의 영향

- 데이터 수집과 관리에 대한 ESG 개시 규제의 영향

- 지역에서 다른 규제의 영향

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 평가 기준

- 구매 프로세스에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 부문의 미충족 요구

제9장 RFID 칩 제조에 사용되는 웨이퍼 치수

- 8인치

- 12인치

- 기타

제10장 RFID 시장 : 제공별

- 태그

- 리더

- 소프트웨어·서비스

제11장 RFID 시장 : 재료별

- 플라스틱

- 유리

- 종이

- 기타 재료

제12장 RFID 시장 : 주파수 대역별

- 저

- 고

- 초고

제13장 RFID 시장 : 폼팩터별

- 카드

- 라벨

- 키 포브·토큰

- 밴드

- 종이·인레이

- 임플란트

- 센서 기반 태그

- 기타 폼팩터

제14장 RFID 시장 : 용도별

- 재고·자산관리

- 보안·액세스 제어

- 발권 업무

- 비접촉형 결제

제15장 RFID 시장 : 최종 용도별

- 자동차

- 의료·의약품

- 농업

- 소매

- 운송·물류·창고

- 동물 추적

- 항공우주·방위

- 스포츠·이벤트·인물 추적

- 데이터센터

- 산업·제조

제16장 RFID 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 폴란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주·뉴질랜드

- ASEAN

- 기타 아시아태평양

- 기타 지역

- 중동

- 아프리카

- 남미

제17장 경쟁 구도

- 개요

- 주요 기업의 경쟁 전략/강점(2021-2025년)

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업의 평가와 재무 지표(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드/제품 비교

- 경쟁 시나리오

제18장 기업 개요

- 주요 기업

- ZEBRA TECHNOLOGIES CORP.

- HONEYWELL INTERNATIONAL INC.

- AVERY DENNISON CORPORATION

- HID GLOBAL CORPORATION

- DATALOGIC S.P.A.

- IMPINJ, INC.

- ALIEN TECHNOLOGY, LLC

- CAEN RFID S.R.L.

- GAO RFID INC.

- XEMELGO, INC.

- 기타 기업

- INVENGO INFORMATION TECHNOLOGY CO., LTD.

- MOJIX

- SAG SECURITAG ASSEMBLY GROUP CO., LTD.

- LINXENS

- CHECKPOINT SYSTEMS, INC.

- IDENTIV, INC.

- NEDAP N.V.

- JADAK

- UNITECH ELECTRONICS CO., LTD.

- INFOTEK SOFTWARE & SYSTEMS(P) LTD.

- BARTRONICS INDIA LIMITED

- BARTECH DATA SYSTEMS PVT. LTD.

- GLOBERANGER

- ORBCOMM INC.

- BEONTAG

- CORERFID

- TAGMASTER NORTH AMERICA

- RFID, INC.

- OMNITAAS

- CONTROLTEK

제19장 조사 방법

제20장 부록

KSAThe RFID market is projected to reach USD 14.58 billion in 2025 and USD 30.47 billion by 2034, registering a CAGR of 8.5% between 2025 and 2034. The market is projected to witness steady growth during the forecast period, driven by increasing demand for real-time tracking, operational visibility, and data accuracy across multiple industries. Enterprises are adopting RFID to improve inventory accuracy, asset utilization, and supply chain transparency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2034 |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Frequency Range, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Growing deployment of UHF RFID tags, fixed and handheld readers, antennas, and RFID software platforms supports automation across retail, logistics, manufacturing, and healthcare environments. Item-level tagging and warehouse automation are reducing manual processes and cycle times. Integration of RFID with IoT platforms, cloud analytics, and enterprise systems enables data-driven decision-making and predictive insights. Expansion of omnichannel retail, cold-chain logistics, and industrial automation further strengthens adoption. Government initiatives related to traceability, food safety, and healthcare compliance also support market growth. However, challenges such as upfront implementation costs, system integration complexity, and data management requirements may limit adoption in cost-sensitive environments. Continued innovation in tag design, reader performance, and software interoperability, along with scalable deployment models, will be critical to sustaining long-term RFID market expansion.

"By application, the contactless payments segment is expected to register the highest CAGR between 2025 and 2034."

The contactless payments segment is projected to record the highest CAGR in the RFID market during the forecast period, driven by rising demand for fast, secure, and convenient transaction methods. Increasing adoption of NFC- and HF-based RFID technologies supports widespread deployment across retail, public transport, hospitality, and banking applications. Consumers prefer contactless payments for reduced transaction time, improved hygiene, and enhanced user experience. Governments and financial institutions continue to promote cashless payment ecosystems, accelerating infrastructure upgrades and terminal installations. Growth of urban transit systems and smart mobility initiatives further boosts adoption of RFID-enabled fare collection. Advancements in secure elements, encryption, and tokenization strengthen transaction security and regulatory compliance. Integration of contactless payment systems with mobile wallets, wearables, and smart cards expands addressable use. Emerging markets are witnessing rapid growth as digital payment penetration increases. While initial infrastructure costs and interoperability challenges remain, ongoing standardization and technology improvements position contactless payments as the fastest-growing application segment in the RFID market.

"Based on form factor, the labels segment is projected to account for the largest market share in 2034."

The RFID labels segment is projected to hold the largest market share due to widespread adoption across high-volume, cost-sensitive applications. RFID labels combine RFID inlays with printed labels, enabling efficient identification and tracking of products, packages, and assets. Retail remains the primary driver, with large-scale deployment of item-level labeling to improve inventory accuracy, reduce shrinkage, and support omnichannel fulfillment. Logistics & warehousing operations use RFID labels for shipment tracking, pallet management, and process automation. The segment benefits from low unit costs, ease of integration, and compatibility with existing labeling workflows. Advances in antenna design, chip sensitivity, and printing technologies improve read performance and durability. RFID labels are also gaining adoption in healthcare, medical & pharmaceuticals, and food supply chains to support traceability and regulatory compliance. Standardization of UHF protocols and global sourcing capabilities further support scalability. As enterprises expand RFID deployments beyond pilot projects, RFID labels continue to dominate by volume and application breadth within the overall RFID market.

"The Asia Pacific region is projected to exhibit the highest CAGR from 2025 to 2034."

Asia Pacific represents the largest RFID market due to its strong manufacturing base, large retail footprint, and expanding logistics and supply chain networks. Countries such as China, Japan, South Korea, and India are witnessing rising adoption of RFID across retail, electronics manufacturing, automotive, healthcare, and transportation sectors. High-volume production of consumer goods and electronics supports large-scale deployment of RFID tags, inlays, and readers. The region benefits from the presence of major RFID component manufacturers, tag converters, and system integrators, enabling cost-effective and scalable deployments. Retailers in the Asia Pacific increasingly adopt item-level tagging to improve inventory accuracy and support omnichannel fulfillment. Logistics providers use RFID for warehouse automation, shipment tracking, and asset visibility. Government initiatives promoting digitalization, smart manufacturing, and supply chain transparency further support adoption. Growing use of RFID in healthcare, food safety, and public transportation also contributes to market expansion. Combined with declining tag costs and improving infrastructure, these factors position Asia Pacific as the leading regional contributor to the global RFID market.

The break-up of the profile of primary participants in the RFID market-

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, Tier 3 - 40%

- By Designation: C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 25%, RoW - 15%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the RFID market with a significant global presence include Zebra Technologies Corp. (US), Honeywell International Inc. (US), Avery Dennison Corporation (US), HID Global Corporation (US), and Datalogic S.p.A. (Italy).

Research Coverage

The report segments the RFID market and forecasts its size by offering, form factor, frequency range, vertical, application, material, and region. It also comprehensively reviews the drivers, restraints, opportunities, and challenges that influence market growth. The report encompasses both qualitative and quantitative aspects of the market.

Reasons to Buy the Report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall RFID market and related segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to strengthen their market position and develop effective go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (supply chain digitalization and real-time visibility demand, automation growth in logistics and warehousing, integration of RFID with IoT and analytics platforms, demand for contactless and touchless identification solutions), restraints (high total cost of ownership for large-scale deployments, integration complexity with legacy IT and WMS/ERP systems, price sensitivity of tags in low-margin industries, infrastructure upgrade requirements at the site level), opportunities (industry 4.0 and smart manufacturing adoption, RFID-enabled traceability in healthcare and pharmaceuticals, advances in low-cost, sensor-enabled, and printable RFID tags, adoption in emerging markets with modernizing supply chains), and challenges (RF signal interference and read accuracy constraints in metal- and liquid-intensive RFID deployments, )

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and strategies such as new product launches, expansions, partnerships, and acquisitions in the RFID market

- Market Development: Comprehensive information about lucrative markets-the report analyses the RFID market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the RFID market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Zebra Technologies Corp. (US), Honeywell International Inc. (US), Avery Dennison Corporation (US), HID Global Corporation (US), Datalogic S.p.A. (Italy), Impinj, Inc. (US), Alien Technology, LLC (US), CAEN RFID S.r.l. (Italy), GAO RFID Inc. (Canada), and Xemelgo, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RFID MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RFID MARKET

- 3.2 RFID MARKET, BY OFFERING

- 3.3 RFID MARKET, BY FORM FACTOR

- 3.4 RFID MARKET, BY MATERIAL

- 3.5 RFID MARKET, BY FREQUENCY RANGE

- 3.6 RFID MARKET, BY END USE

- 3.7 RFID MARKET, BY APPLICATION

- 3.8 RFID MARKET, BY REGION

- 3.9 RFID MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Evolution of digital supply chains

- 4.2.1.2 Automation in logistics and warehousing due to rapid expansion of e-commerce sector

- 4.2.1.3 Integration of RFID into IoT, analytics, and edge computing platforms

- 4.2.1.4 Rising demand for contactless and touchless identification solutions

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of ownership for large-scale multi-site deployments

- 4.2.2.2 Complexities associated with RFID integration in legacy IT and WMS/ERP systems

- 4.2.2.3 Price sensitivity of RFID tags in low-margin industries

- 4.2.2.4 Site-level infrastructure upgrade requirements

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Elevating adoption of Industry 4.0 and smart manufacturing solutions

- 4.2.3.2 Increasing use of RFID-enabled traceability solutions in healthcare and pharmaceutical supply chains

- 4.2.3.3 Advances in low-cost, sensor-enabled, and printable RFID tags

- 4.2.3.4 Transition of emerging markets toward digital supply chains

- 4.2.4 CHALLENGES

- 4.2.4.1 RF signal interference and read accuracy constraints in metal- and liquid-intensive RFID deployments

- 4.2.4.2 Interoperability issues in heterogeneous RFID ecosystems

- 4.2.4.3 Limited RFID expertise and workforce skills among SMEs

- 4.2.4.4 Difficulty in scaling pilot projects into enterprise-wide deployments

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL RFID INDUSTRY

- 5.3.4 TRENDS IN GLOBAL IOT INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY KEY PLAYER, 2021-2024

- 5.6.1.1 Average selling price trend of RFID tags, by key player, 2021-2024

- 5.6.1.2 Average selling price trend of RFID readers, by key player, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY REGION, 2021-2024

- 5.6.2.1 Average selling price trend of RFID tags, by region, 2021-2024

- 5.6.2.2 Average selling price trend of RFID readers, by region, 2021-2024

- 5.6.1 AVERAGE SELLING PRICE TREND OF RFID OFFERINGS, BY KEY PLAYER, 2021-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8523)

- 5.7.2 EXPORT SCENARIO (HS CODE 8523)

- 5.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 WALMART IMPROVES ITEM-LEVEL INVENTORY ACCURACY USING RFID TAGS OFFERED BY AVERY DENNISON

- 5.11.2 DECATHLON ENHANCES SUPPLY CHAIN VISIBILITY BY DEPLOYING RFID SOLUTION PROVIDED BY ZEBRA TECHNOLOGIES

- 5.11.3 HID GLOBAL HELPS HOSPITAL HEALTHCARE NETWORK TO OPTIMIZE STAFF PRODUCTIVITY BY DEPLOYING RFID TAGS

- 5.12 IMPACT OF 2025 US TARIFF - RFID MARKET

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON END USES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 COMPUTER VISION

- 6.1.2 REAL-TIME LOCATION SYSTEMS

- 6.1.3 RFID-ENABLED SENSORS AND ROBOTICS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 CLOUD-BASED RFID

- 6.2.2 RFID IN IOT

- 6.2.3 INTEGRATION OF RFID WITH BLOCKCHAIN

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 NEAR-FIELD COMMUNICATION AND RFID HYBRID SOLUTIONS

- 6.3.2 FLEXIBLE RFID TAGS

- 6.4 TECHNOLOGY ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): INFRASTRUCTURE MODERNIZATION & INTELLIGENT TRACKING

- 6.4.2 MID-TERM (2027-2030): INTELLIGENT AUTOMATION & ECOSYSTEM INTEGRATION

- 6.4.3 LONG-TERM (2030-2035+): AUTONOMOUS, TRUSTED, & DATA-DRIVEN RFID ECOSYSTEMS

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON RFID MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY COMPANIES IN RFID MARKET

- 6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN RFID MARKET

- 6.6.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI IN RFID MARKET

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 INDUSTRY STANDARDS

- 7.2.2.1 ISO/IEC RFID air interface standards (ISO/IEC 18000 series)

- 7.2.2.2 EPCglobal standards (GS1 EPC framework)

- 7.2.2.3 RFID security and data protection standards (ISO/IEC 29167 series)

- 7.2.2.4 Regional spectrum and compliance standards (ETSI, FCC, and others)

- 7.2.2.5 RAIN RFID interoperability specifications

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 USE OF RFID TO REDUCE ENVIRONMENTAL IMPACT

- 7.3.1.1 Deployment of RFID technology to reduce carbon impact

- 7.3.1.2 Implementation of RFID products to promote circular economy

- 7.3.2 UTILIZATION OF SUSTAINABLE RFID PRODUCT DESIGNS AND MATERIALS

- 7.3.2.1 Material innovation and end-of-life considerations

- 7.3.3 DEPLOYMENT OF ENERGY-EFFICIENT AND LOW-POWER RFID SYSTEMS

- 7.3.3.1 Passive RFID and infrastructure-level energy optimization

- 7.3.4 ADOPTION OF RFID-ENABLED CIRCULAR ECONOMY AND REUSABLE MODELS

- 7.3.4.1 Lifecycle visibility and asset circulation

- 7.3.5 IMPLEMENTATION OF RFID TO MEET ENVIRONMENTAL AND TRACEABILITY REGULATIONS

- 7.3.5.1 Traceability of environmental and ESG regulations

- 7.3.6 ACCEPTANCE OF SUSTAINABLE MANUFACTURING AND SUPPLY CHAIN TRANSPARENCY

- 7.3.6.1 Process visibility and resource optimization

- 7.3.7 ADOPTION OF RFID TO REDUCE PACKAGING AND DOCUMENTATION WASTE

- 7.3.7.1 Digital identification and paperless operations

- 7.3.1 USE OF RFID TO REDUCE ENVIRONMENTAL IMPACT

- 7.4 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4.1 IMPACT OF ENVIRONMENTAL REGULATIONS ON RFID PRODUCT DESIGN

- 7.4.2 IMPACT OF WASTE MANAGEMENT POLICIES ON RFID VENDORS AND END USERS

- 7.4.3 IMPACT OF TRADE REGULATIONS ACROSS DOMESTIC AND CROSS-BORDER SUPPLY CHAINS

- 7.4.4 IMPACT OF ESG DISCLOSURE REGULATIONS ON DATA COLLECTION AND MANAGEMENT

- 7.4.5 IMPACT OF VARYING REGULATIONS ACROSS REGIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS END USE SEGMENTS

9 WAFER DIMENSIONS USED IN RFID CHIP MANUFACTURING

- 9.1 INTRODUCTION

- 9.2 8-INCH

- 9.3 12-INCH

- 9.4 OTHERS

10 RFID MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 TAGS

- 10.2.1 RISING DEMAND FOR REAL-TIME INVENTORY VISIBILITY AND SUPPLY CHAIN AUTOMATION TO DRIVE MARKET

- 10.2.2 PASSIVE

- 10.2.2.1 Low unit cost and suitability for high-volume tagging to accelerate demand

- 10.2.3 ACTIVE

- 10.2.3.1 Demand for long-range, real-time asset visibility to fuel segmental growth

- 10.3 READERS

- 10.3.1 GROWING FOCUS ON REAL-TIME VISIBILITY AND FASTER OPERATIONAL DECISION-MAKING TO SPUR DEMAND

- 10.3.2 FIXED

- 10.3.3 HANDHELD

- 10.3.4 WEARABLE

- 10.4 SOFTWARE & SERVICES

- 10.4.1 INCREASING COMPLEXITY OF MULTI-SITE OPERATIONS TO ESCALATE DEMAND

11 RFID MARKET, BY MATERIAL

- 11.1 INTRODUCTION

- 11.2 PLASTIC

- 11.2.1 COST EFFICIENCY, DURABILITY, AND HIGH-VOLUME DEPLOYMENTS TO FACILITATE SEGMENTAL GROWTH

- 11.3 GLASS

- 11.3.1 STABLE READ PERFORMANCE AND RESISTANCE TO HARSH CONDITIONS TO SUPPORT SEGMENTAL GROWTH

- 11.4 PAPER

- 11.4.1 INCREASING USE OF RECYCLABLE PACKAGING MATERIALS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.5 OTHER MATERIALS

12 RFID MARKET, BY FREQUENCY RANGE

- 12.1 INTRODUCTION

- 12.2 LOW

- 12.2.1 STRINGENT REGULATIONS ACROSS AGRICULTURE AND FOOD SUPPLY CHAINS TO FOSTER SEGMENTAL GROWTH

- 12.3 HIGH

- 12.3.1 RISING USE IN FINANCIAL TRANSACTIONS AND COMPLIANCE-SENSITIVE APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- 12.4 ULTRA-HIGH

- 12.4.1 LONG-RANGE READABILITY AND HIGH-SPEED MULTI-TAG IDENTIFICATION FEATURES TO BOOST DEMAND

13 RFID MARKET, BY FORM FACTOR

- 13.1 INTRODUCTION

- 13.2 CARDS

- 13.2.1 INCREASING USE IN ACCESS CONTROL AND SECURITY APPLICATIONS TO DRIVE MARKET

- 13.3 LABELS

- 13.3.1 NEED FOR REAL-TIME VISIBILITY INTO PRODUCT AVAILABILITY TO SPUR DEMAND

- 13.4 KEY FOBS & TOKENS

- 13.4.1 INCREASING USE OF CONTACTLESS ACCESS CONTROL SOLUTIONS AT OFFICES AND TRANSPORTATION HUBS TO DRIVE MARKET

- 13.5 BANDS

- 13.5.1 SURGING USE OF WEARABLE TECHNOLOGY TO CREATE GROWTH OPPORTUNITIES

- 13.6 PAPERS & INLAYS

- 13.6.1 RISING ADOPTION IN PHARMACEUTICAL PACKAGING TO ENSURE REGULATORY COMPLIANCE TO DRIVE MARKET

- 13.7 IMPLANTS

- 13.7.1 HEALTHCARE DIGITIZATION AND REGULATED IDENTIFICATION REQUIREMENTS TO BOOST DEMAND

- 13.8 SENSOR-BASED TAGS

- 13.8.1 COLD CHAIN INTEGRITY, CONDITION MONITORING, AND DATA-DRIVEN TRACEABILITY TO STIMULATE DEMAND

- 13.9 OTHER FORM FACTORS

14 RFID MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 INVENTORY & ASSET MANAGEMENT

- 14.2.1 E-COMMERCE EXPANSION, WAREHOUSE AUTOMATION, AND REAL-TIME VISIBILITY TO HIGH-VOLUME INVENTORY TO FACILITATE ADOPTION

- 14.3 SECURITY & ACCESS CONTROL

- 14.3.1 IDENTITY ASSURANCE, COMPLIANCE ENFORCEMENT, AND SMART FACILITY GOVERNANCE REQUIREMENTS TO ELEVATE ADOPTION

- 14.4 TICKETING

- 14.4.1 NEED FOR CROWD FLOW OPTIMIZATION IN HIGH-DENSITY ENVIRONMENTS TO FUEL DEMAND

- 14.5 CONTACTLESS PAYMENTS

- 14.5.1 PREFERENCE FOR FAST, RELIABLE, AND CONTACTLESS PAYMENTS TO FOSTER MARKET GROWTH

15 RFID MARKET, BY END USE

- 15.1 INTRODUCTION

- 15.2 AUTOMOTIVE

- 15.2.1 NEED FOR SUPPLY CHAIN OPTIMIZATION AND REAL-TIME INVENTORY MANAGEMENT TO DRIVE MARKET

- 15.3 MEDICAL, HEALTHCARE & PHARMACEUTICAL

- 15.3.1 DEMAND FOR REAL-TIME VISIBILITY OF PATIENTS, ASSETS, AND PHARMACEUTICALS TO DRIVE ADOPTION

- 15.4 AGRICULTURE

- 15.4.1 GROWING ADOPTION OF AUTOMATION AND TRACEABILITY IN CROP AND PRODUCE MANAGEMENT TO FUEL MARKET GROWTH

- 15.5 RETAIL

- 15.5.1 DEMAND FOR INVENTORY ACCURACY AND OMNICHANNEL FULFILLMENT TO FOSTER DEPLOYMENT

- 15.6 TRANSPORTATION, LOGISTICS & WAREHOUSING

- 15.6.1 FOCUS ON AUTOMATION, REAL-TIME VISIBILITY, AND INFRASTRUCTURE DIGITALIZATION TO SPUR DEMAND

- 15.7 ANIMAL TRACKING

- 15.7.1 REGULATORY MANDATES FOR ANIMAL IDENTIFICATION TO PROMOTE RFID ADOPTION

- 15.8 AEROSPACE & DEFENSE

- 15.8.1 EMPHASIS ON ENHANCING ASSET CONTROL AND IMPROVING MAINTENANCE EFFICIENCY TO BOOST DEMAND

- 15.9 SPORTS, EVENTS, & PEOPLE TRACKING

- 15.9.1 REQUIREMENT FOR SECURITY MEASURES FOR CROWD MANAGEMENT TO ELEVATE DEMAND

- 15.10 DATA CENTER

- 15.10.1 NEED TO MINIMIZE ASSET LOSS AND MANUAL AUDIT EFFORT TO INCREASE DEMAND

- 15.11 INDUSTRIAL & MANUFACTURING

- 15.11.1 AUTOMATION, TRACEABILITY, AND ASSET VISIBILITY REQUIREMENTS TO BOOST ADOPTION

- 15.11.2 PAPER & PULP

- 15.11.3 METAL & MINING

- 15.11.4 CEMENT

- 15.11.5 FOOD PROCESSING

- 15.11.6 OTHERS

16 RFID MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Rising focus of industry players on enhancing supply chain transparency to accelerate demand

- 16.2.2 CANADA

- 16.2.2.1 Growing adoption of RFID in logistics and transportation applications to drive market

- 16.2.3 MEXICO

- 16.2.3.1 Thriving e-commerce sector to create growth opportunities

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Booming retail and logistics sectors to propel market

- 16.3.2 GERMANY

- 16.3.2.1 Smart city initiatives to fuel market growth

- 16.3.3 FRANCE

- 16.3.3.1 Significant investment in digital transformation and smart city projects to spike demand

- 16.3.4 ITALY

- 16.3.4.1 Retail, fashion, and agriculture industries to contribute to market growth

- 16.3.5 SPAIN

- 16.3.5.1 Digital transformation of retail sector to fuel demand

- 16.3.6 RUSSIA

- 16.3.6.1 Government-backed infrastructure modernization projects to create opportunities

- 16.3.7 POLAND

- 16.3.7.1 Thriving e-commerce and logistics & warehousing sectors to propel market

- 16.3.8 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Retail, healthcare, and logistics & warehousing industries to be key contributors to market growth

- 16.4.2 JAPAN

- 16.4.2.1 Growing deployment of smart ticketing solutions in public transportation to augment market growth

- 16.4.3 SOUTH KOREA

- 16.4.3.1 Rising adoption of smart manufacturing to drive market

- 16.4.4 INDIA

- 16.4.4.1 Increasing use of automated toll collection systems to support market growth

- 16.4.5 AUSTRALIA & NEW ZEALAND

- 16.4.5.1 Elevating use of digital technology in agriculture, retail, and healthcare sectors to foster market growth

- 16.4.6 ASEAN

- 16.4.6.1 Growing adoption in logistics & warehousing, retail, animal tracking, and agriculture sectors to foster market growth

- 16.4.7 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 ROW

- 16.5.1 MIDDLE EAST

- 16.5.1.1 Bahrain

- 16.5.1.1.1 Government initiatives promoting smart infrastructure and operational transparency to drive market

- 16.5.1.2 Kuwait

- 16.5.1.2.1 Continued investments in energy infrastructure to propel market

- 16.5.1.3 Oman

- 16.5.1.3.1 Sustained capital allocation to modernize infrastructure and deploy automation to drive market

- 16.5.1.4 Qatar

- 16.5.1.4.1 Smart infrastructure development and logistics automation to boost adoption

- 16.5.1.5 Saudi Arabia

- 16.5.1.5.1 Large-scale industrial digitization to accelerate RFID adoption

- 16.5.1.6 UAE

- 16.5.1.6.1 Smart city initiatives to drive market

- 16.5.1.7 Rest of Middle East

- 16.5.1.1 Bahrain

- 16.5.2 AFRICA

- 16.5.2.1 South Africa

- 16.5.2.1.1 High demand from mining, retail, and healthcare sectors to contribute to market growth

- 16.5.2.2 Rest of Africa

- 16.5.2.1 South Africa

- 16.5.3 SOUTH AMERICA

- 16.5.3.1 Brazil

- 16.5.3.1.1 Large-scale retail operations and export-oriented agriculture to boost demand

- 16.5.3.2 Rest of South America

- 16.5.3.1 Brazil

- 16.5.1 MIDDLE EAST

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Region footprint

- 17.6.5.3 Offering footprint

- 17.6.5.4 Frequency range footprint

- 17.6.5.5 Application footprint

- 17.6.5.6 End use footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 BRAND/PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 INTRODUCTION

- 18.2 KEY PLAYERS

- 18.2.1 ZEBRA TECHNOLOGIES CORP.

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Solutions/Services offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Product launches/Enhancements

- 18.2.1.3.2 Deals

- 18.2.1.4 MnM view

- 18.2.1.4.1 Key strengths/Right to win

- 18.2.1.4.2 Strategic choices

- 18.2.1.4.3 Weaknesses/Competitive threats

- 18.2.2 HONEYWELL INTERNATIONAL INC.

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Solutions/Services offered

- 18.2.2.3 Recent developments

- 18.2.2.3.1 Product launches/Enhancements

- 18.2.2.3.2 Deals

- 18.2.2.4 MnM view

- 18.2.2.4.1 Key strengths/Right to win

- 18.2.2.4.2 Strategic choices

- 18.2.2.4.3 Weaknesses/Competitive threats

- 18.2.3 AVERY DENNISON CORPORATION

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Solutions/Services offered

- 18.2.3.3 Recent developments

- 18.2.3.3.1 Product launches/Enhancements

- 18.2.3.3.2 Deals

- 18.2.3.3.3 Expansions

- 18.2.3.4 MnM view

- 18.2.3.4.1 Key strengths/Right to win

- 18.2.3.4.2 Strategic choices

- 18.2.3.4.3 Weaknesses/Competitive threats

- 18.2.4 HID GLOBAL CORPORATION

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Solutions/Services offered

- 18.2.4.3 Recent developments

- 18.2.4.3.1 Product launches/Enhancements

- 18.2.4.3.2 Deals

- 18.2.4.4 MnM view

- 18.2.4.4.1 Key strengths/Right to win

- 18.2.4.4.2 Strategic choices

- 18.2.4.4.3 Weaknesses/Competitive threats

- 18.2.5 DATALOGIC S.P.A.

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Solutions/Services offered

- 18.2.5.3 MnM view

- 18.2.5.3.1 Key strengths/Right to win

- 18.2.5.3.2 Strategic choices

- 18.2.5.3.3 Weaknesses/Competitive threats

- 18.2.6 IMPINJ, INC.

- 18.2.6.1 Business overview

- 18.2.6.2 Products/Solutions/Services offered

- 18.2.6.3 Recent developments

- 18.2.6.3.1 Product launches/Enhancements

- 18.2.7 ALIEN TECHNOLOGY, LLC

- 18.2.7.1 Business overview

- 18.2.7.2 Products/Solutions/Services offered

- 18.2.8 CAEN RFID S.R.L.

- 18.2.8.1 Business overview

- 18.2.8.2 Products/Solutions/Services offered

- 18.2.8.3 Recent developments

- 18.2.8.3.1 Product launches/Enhancements

- 18.2.8.3.2 Deals

- 18.2.8.3.3 Expansions

- 18.2.9 GAO RFID INC.

- 18.2.9.1 Business overview

- 18.2.9.2 Products/Solutions/Services offered

- 18.2.9.3 Recent developments

- 18.2.9.3.1 Expansions

- 18.2.10 XEMELGO, INC.

- 18.2.10.1 Business overview

- 18.2.10.2 Products/solutions/services offered

- 18.2.10.3 Recent developments

- 18.2.10.3.1 Product launches/Enhancements

- 18.2.10.3.2 Deals

- 18.2.10.3.3 Other developments

- 18.2.1 ZEBRA TECHNOLOGIES CORP.

- 18.3 OTHER PLAYERS

- 18.3.1 INVENGO INFORMATION TECHNOLOGY CO., LTD.

- 18.3.2 MOJIX

- 18.3.3 SAG SECURITAG ASSEMBLY GROUP CO., LTD.

- 18.3.4 LINXENS

- 18.3.5 CHECKPOINT SYSTEMS, INC.

- 18.3.6 IDENTIV, INC.

- 18.3.7 NEDAP N.V.

- 18.3.8 JADAK

- 18.3.9 UNITECH ELECTRONICS CO., LTD.

- 18.3.10 INFOTEK SOFTWARE & SYSTEMS (P) LTD.

- 18.3.11 BARTRONICS INDIA LIMITED

- 18.3.12 BARTECH DATA SYSTEMS PVT. LTD.

- 18.3.13 GLOBERANGER

- 18.3.14 ORBCOMM INC.

- 18.3.15 BEONTAG

- 18.3.16 CORERFID

- 18.3.17 TAGMASTER NORTH AMERICA

- 18.3.18 RFID, INC.

- 18.3.19 OMNITAAS

- 18.3.20 CONTROLTEK

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of key secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 List of primary interview participants

- 19.1.3.2 Breakdown of primaries

- 19.1.3.3 Key data from primary sources

- 19.1.3.4 Key industry insights

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS

- 19.6 RISK ASSESSMENT

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS