|

시장보고서

상품코드

1924862

배회 탄약 시장 : 유형별, 클래스별, 체공시간별, 탄두 유형별, 내비게이션 센서별, 발사 방식별, 최종사용자별, 지역별 - 예측(-2030년)Loitering Munition Market by Type, Class (Short Range, Mid Range, Long Range ), Air Time (Short Endurance, Medium Endurance, Long Endurance ), Warhead Type, Navsensor, Launch Mode, End User, and Region - Global Forecast to 2030 |

||||||

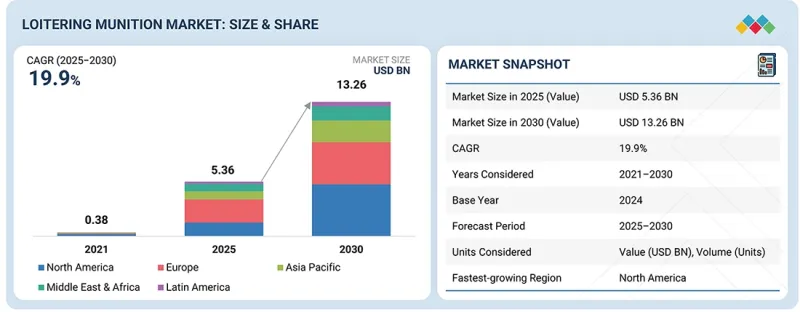

세계의 배회 탄약 시장 규모는 2025년에 53억 6,000만 달러, 2030년까지 132억 6,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR로 19.9%의 성장이 전망되고 있습니다.

이러한 성장은 정밀하고 비용 효율적인 전투 시스템에 대한 수요 증가에 의해 촉진되고 있습니다. 군는 표적의 정확도를 높이기 위해 배회 탄약의 사용을 확대하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 클래스, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

AI와 자율 표적 포착 기술을 통해 의사결정이 빨라지고, 작전의 효율성이 향상되고 있습니다. 국방 현대화 프로그램은 장거리 공대공 미사일 시스템에 대한 투자를 지원하고 있습니다. 소형화 및 모듈화 설계로 여러 플랫폼에서 운영 유연성이 향상되었습니다. 또한, 멀티 도메인 전략과 신속 전개 전략을 지원하는 시스템에 대한 수요도 증가하고 있습니다.

"항해 시간별로는 장시간 항해(120분 이상) 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다."

국방 부대가 장시간 비행이 가능한 체공 시스템을 필요로 하기 때문에 장시간 항속 시간 부문이 성장하고 있습니다. 항속시간 연장을 통해 부대는 행동에 앞서 해당 지역을 감시할 수 있습니다. 이는 목표물이 장시간 대기 후 출현하는 작전에서 효과적입니다. 부대는 광역 순찰 작전에 이러한 시스템을 선호하고 있습니다. 국경 지역의 감시 수요가 증가함에 따라 수요가 증가하고 있습니다. 긴 항속시간은 공격 작전의 타이밍 정확도 향상에도 기여합니다. 작전이 더욱 복잡해짐에 따라 이 능력은 점점 더 중요해지고 있습니다.

"내비게이션 센서별로는 관성항법시스템 부문이 30.9%의 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

방위 기관이 자율적으로 작동하는 유도 시스템을 필요로 하는 가운데, 관성 항법 부문은 계속 성장하고 있습니다. 이러한 시스템은 외부 신호가 불안정한 작전을 지원하며, 전자적 방해가 심한 분쟁 지역에서 유용합니다. 바이어들은 안정적인 비행 성능으로 인해 관성항법을 선호하고 있으며, 신호 방해가 증가하는 작전 환경에서 수요가 증가하고 있습니다.

"예측 기간 동안 북미가 가장 높은 성장률을 보일 것으로 예측됩니다. "

북미 시장은 미국과 캐나다가 방범 탄약 프로그램에 대한 집중을 강화함에 따라 빠르게 성장하고 있습니다. 이 지역의 방위 기관들은 실전 배치 및 훈련 수요에 대응하기 위해 이러한 시스템을 추가하고 있습니다. 미국은 적극적인 시범 운영과 새로운 조달 계획을 통해 수요를 촉진하고 있습니다. 캐나다도 국경 및 방어 작전을 위한 현대적 공격 수단에 대한 투자를 진행하고 있습니다. 양국의 예산 지원은 채용을 가속화하는 데 기여하고 있습니다. 군가 유연하고 신속한 공격 수단으로 전환하면서 관심이 높아지고 있습니다.

세계의 배회 탄약 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 제품 개발 및 혁신, 경쟁 구도에 대한 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 지견

- 배회 탄약 시장 기업에 있어서 매력적인 기회

- 배회 탄약 시장 : 유형별

- 배회 탄약 시장 : 탄두 별

- 배회 탄약 시장 : 최종사용자별

- 배회 탄약 시장 : 발사 방식별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 연결된 시장과 부문간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 거시경제 전망

- GDP 동향과 예측

- 세계의 방위 업계 동향

- 세계의 배회 탄약 업계 동향

- 밸류체인 분석

- 자금조달 계획이라고 재검토해( 약15%)

- 연구개발( 약20%)

- 원재료 조달과 제조( 약15%)

- 조립, 테스트, 승인( 약30%)

- 유통( 약10%)

- 애프터서비스( 약10%)

- 생태계 분석

- 제조업체

- 솔루션·서비스 제공업체

- 최종사용자

- 투자 및 자금조달 시나리오

- 가격 결정 분석

- 주요 기업이 제공하는 배회 탄약 참고 가격 분석

- 참고 가격 분석 : 지역별

- 무역 분석

- 수입 시나리오(HS코드 9306)

- 수출 시나리오(HS코드 9306)

- 사례 연구 분석

- 미국 관세(2025년)

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 용도에 대한 영향

제6장 기술 진보, AI에 의한 영향, 특허, 혁신, 향후 용도.

- 주요 기술

- AI에 의한 표적 인식과 자율 내비게이션

- 마르치드메인스워무 조정 시스템

- 강화된 추진·동력 시스템

- 시큐어 데이터 링크와 방해 전파 대책 통신 네트워크

- 보완 기술

- 멀티 스펙트럼 센서 퓨전과 소형 페이로드

- 엣지 컴퓨팅과 온보드 처리

- 적층 가공과 rapid 프로토타이핑

- 예지보전과 디지털 트윈 플랫폼

- 기술 로드맵

- 특허 분석

- 향후 용도

- AI/생성형 AI의 영향

- 주요 이용 사례와 시장 장래성

- AI도입 사례 연구

- 상호 접속된 에코시스템과 시장 기업에 대한 영향

- AI/생성형 AI 채택에 대한 클라이언트 준비 상황

- 성공 사례와 실세계에의 응용

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 이니셔티브

- 탄소 영향 삭감

- 에코 용도

- 지속가능성 영향과 규제 정책 구상

- 배회 탄약 시장에 대한 지속가능성 영향

- 배회 탄약 전개를 촉진하는 규제 정책 구상

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종사용자로부터 미충족 요구

- 긴 항속 시간과 다용도체공 능력에의 요구

- 생존성과 C-UAS 내성 향상에의 요구

- 저비용으로 확장성 있는 신속 전개 가능한 솔루션에의 요구

제9장 배회 탄약 시장

- 배회 탄약 평가(회복 가능과 일회용)

- 회복 가능

- 일회용

제10장 배회 탄약 시장 : 클래스별

- 중량에 근거한 배회 탄약 분류

- 단거리(25 km미만)

- 중거리(25-100 km)

- 장거리(100 km초)

제11장 배회 탄약 시장 : 항속 시간별

- 배회 시간에 근거한 배회 탄약 분류

- 단항속 시간(45분 미만)

- 안항속 시간(45-120분)

- 장 항속 시간(120분 이상)

제12장 배회 탄약 시장 : 탄두 유형별

- 탄두 중량에 근거한 배회 탄약 분류

- 폭약 탄두

- 파편 탄두

- 대장갑/성형작약탄두

- 대방사선 탄두

- 서모바릭크 탄두

제13장 배회 탄약 시장 : 내비게이션 센서별

- 감지 기술에 근거한 배회 탄약 분류

- EO

- GPS/GNSS

- 적외선/열

- INS

- RF 기반

제14장 배회 탄약 시장 : 발사 방식별

- 자동화 레벨에 근거한 배회 탄약 분류

- 공중 발사

- 수직 이륙

- 캐니스터 발사

- 비행기 사출기 발사

- 손던지기

제15장 배회 탄약 시장 : 최종사용자별

- 취득에 근거한 배회 탄약 조달 분류

- 육군

- 해군

- 공군

제16장 배회 탄약 시장 : 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 프랑스

- 독일

- 영국

- 이탈리아

- 기타 유럽

- 아시아태평양

- 인도

- 일본

- 호주

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 이스라엘

- 튀르키예

- 기타 지역

- 라틴아메리카

- 아프리카

제17장 경쟁 구도

- 주요 시장 진출기업의 전략/강점(2021년-2025년)

- 매출 분석(2021년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제18장 기업 개요

- 주요 기업

- AEROVIRONMENT, INC.

- ELBIT SYSTEMS LTD.

- RHEINMETALL AG

- ISRAEL AEROSPACE INDUSTRIES

- UVISION

- THALES

- NORTHROP GRUMMAN

- WB GROUP

- EDGE GROUP PJSC

- ANDURIL INDUSTRIES

- AEVEX AEROSPACE

- STM

- KNDS

- PARAMOUNT GROUP

- MBDA

- TELEDYNE FLIR LLC

- SOLAR GROUP

- 기타 기업

- ARQUIMEA

- ROKETSAN

- TATA ADVANCED SYSTEMS LIMITED

- SPEAR

- TRANSVARO ELEKTRON ALETLERI

- BAYKAR TECH

- OVERWATCH GROUP

- KADET DEFENCE SYSTEMS

- DEFENDTEX

- JOHNNETTE GROUP

제19장 조사 방법

제20장 부록

LSHThe global loitering munition market size is estimated at USD 5.36 billion in 2025 and is projected to reach USD 13.26 billion by 2030, at a CAGR of 19.9% over the same period. Growth is driven by rising demand for precision, cost-efficient combat systems. Armed forces are increasing the use of loitering munitions to improve targeting accuracy.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Class, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

Artificial Intelligence (AI) and autonomous targeting are enabling faster decision-making, which improves mission effectiveness. Defense modernization programs are supporting investments in long-range loitering missile systems. Miniaturized and modular designs are improving operational flexibility across multiple platforms. Demand is also rising for systems that support multi-domain and rapid deployment operations.

"By air time, the long endurance (>120 min) segment is projected to grow at the highest CAGR during the forecast period."

The long endurance segment is growing as defense forces need loitering systems that can stay airborne for extended periods. Longer flight time allows units to monitor areas before taking action. This helps in missions where targets appear after long wait times. Forces prefer these systems for wide zone patrol tasks. Demand is rising as surveillance needs increase in border areas. Longer endurance also supports better timing during strike missions. This capability is becoming important as operations grow more complex.

"By Navsensor, the Inertial Navigation systems segment is projected to grow at the highest CAGR of 30.9%."

The inertial navigation segment is growing as defense forces require guidance systems that operate independently. These systems support missions where external signals are unreliable. This is useful in conflict zones with high electronic interference. Buyers prefer inertial navigation for consistent flight performance. Demand is rising as operations face more signal disruption.

"North America is projected to grow at the highest rate during the forecast period."

The market in North America is growing fast as the US and Canada increase focus on loitering munition programs. Defense forces in this region are adding these systems for field use and training needs. The US is driving demand through active trials and new procurement plans. Canada is also investing in modern strike tools for border and defense roles. Budget support in both countries is helping with faster adoption. Interest is rising as forces shift toward flexible and rapid strike options.

The breakdown of profiles for primary participants in the loitering munition market is provided below:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10% Rest of the World (RoW) - 5%

Research Coverage:

This market study covers the loitering munition market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations on their products and business offerings, recent developments, and the key market strategies they have adopted.

Reasons to buy this report:

The report will help market leaders and new entrants with information on the closest approximations of revenue for the overall loitering munition market. It will also help stakeholders understand the competitive landscape and gain deeper insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers (Shift toward precision strike systems that reduce cost and risk in combat missions), Restraints (Ethical and legal concerns linked to autonomous strike decisions), Opportunities (Integration of swarm-based loitering systems for coordinated missions), Challenges (Managing autonomy while keeping human control in combat operations)

- Market Penetration: Comprehensive information on the loitering munition market offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the loitering munition market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the loitering munition market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the loitering munition market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN LOITERING MUNITION MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LOITERING MUNITION MARKET

- 3.2 LOITERING MUNITION MARKET, BY TYPE

- 3.3 LOITERING MUNITION MARKET, BY WARHEAD

- 3.4 LOITERING MUNITION MARKET, BY END USER

- 3.5 LOITERING MUNITION MARKET, BY LAUNCH MODE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Shift toward precision and cost-effective warfare

- 4.2.1.2 Integration of AI and autonomous targeting

- 4.2.1.3 Geopolitical tensions and modernization of defense forces

- 4.2.1.4 Rise of miniaturization and modularity

- 4.2.1.5 Expansion of tactical and strategic multi-domain operations

- 4.2.2 RESTRAINTS

- 4.2.2.1 Ethical and legal concerns surrounding autonomous lethality

- 4.2.2.2 Export control restrictions and technology transfer limitations

- 4.2.2.3 Limited endurance and payload constraints

- 4.2.2.4 High development and integration costs

- 4.2.2.5 Vulnerability to electronic warfare and C-UAS technologies

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of swarm and collaborative mission systems

- 4.2.3.2 Expansion across emerging defense markets

- 4.2.3.3 Advancements in AI-driven autonomy and target recognition

- 4.2.3.4 Trend of modular and multi-mission configurations

- 4.2.4 CHALLENGES

- 4.2.4.1 Balancing autonomy with human oversight in combat decision-making

- 4.2.4.2 Evolving threat landscape

- 4.2.4.3 Interoperability and integration within existing defense architectures

- 4.2.4.4 Supply chain complexity and component dependency

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL DEFENSE INDUSTRY

- 5.2.4 TRENDS IN GLOBAL LOITERING MUNITION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 PLANNING AND REVISING FUNDING (~15%)

- 5.3.2 RESEARCH AND DEVELOPMENT (~20%)

- 5.3.3 RAW MATERIAL PROCUREMENT AND MANUFACTURING (~15%)

- 5.3.4 ASSEMBLY, TESTING, AND APPROVAL (~30%)

- 5.3.5 DISTRIBUTION (~10%)

- 5.3.6 AFTER-SALES SERVICE (~10%)

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 MANUFACTURERS

- 5.4.2 SOLUTION AND SERVICE PROVIDERS

- 5.4.3 END USERS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS OF LOITERING MUNITIONS OFFERED BY KEY PLAYERS

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9306)

- 5.7.2 EXPORT SCENARIO (HS CODE 9306)

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 AEROVIRONMENT INC.'S SWITCHBLADE NEXT-GENERATION LOITERING MUNITION SYSTEM

- 5.8.2 ISRAEL AEROSPACE INDUSTRIES' HAROP LOITERING MUNITION

- 5.8.3 STM'S KARGU ROTARY-WING LOITERING MUNITION

- 5.8.4 UVISION'S HERO SERIES LOITERING MUNITION

- 5.9 2025 US TARIFF

- 5.9.1 INTRODUCTION

- 5.9.2 KEY TARIFF RATES

- 5.9.3 PRICE IMPACT ANALYSIS

- 5.9.4 IMPACT ON COUNTRY/REGION

- 5.9.4.1 US

- 5.9.4.2 Europe

- 5.9.4.3 Asia Pacific

- 5.9.5 IMPACT ON APPLICATION

- 5.9.5.1 Anti-armor strike applications

- 5.9.5.2 ISR

- 5.9.5.3 SEAD

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS.

- 6.1 KEY TECHNOLOGIES

- 6.1.1 AI-DRIVEN TARGET RECOGNITION AND AUTONOMOUS NAVIGATION

- 6.1.2 MULTI-DOMAIN SWARM COORDINATION SYSTEMS

- 6.1.3 ENHANCED PROPULSION AND POWER SYSTEMS

- 6.1.4 SECURE DATA LINKS AND ANTI-JAMMING COMMUNICATION NETWORKS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MULTI-SPECTRAL SENSOR FUSION AND MINIATURIZED PAYLOADS

- 6.2.2 EDGE COMPUTING AND ONBOARD PROCESSING

- 6.2.3 ADDITIVE MANUFACTURING AND RAPID PROTOTYPING

- 6.2.4 PREDICTIVE MAINTENANCE AND DIGITAL TWIN PLATFORMS

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.3 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.4 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6.5.1 AeroVironment: Gen AI-optimized target recognition for Switchblade systems

- 6.6.5.2 Israel Aerospace Industries: Gen AI-driven autonomous mission planning for Harop and Harpy

- 6.6.5.3 UVision: Gen AI-enhanced flight efficiency and impact precision for HERO Series

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT REDUCTION

- 7.2.2 ECO-APPLICATIONS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.3.1 SUSTAINABILITY IMPACT ON LOITERING MUNITION MARKET

- 7.3.2 REGULATORY POLICY INITIATIVES DRIVING LOITERING MUNITION DEPLOYMENT

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END USERS

- 8.4.1 NEED FOR EXTENDED-ENDURANCE AND MULTI-MISSION LOITERING CAPABILITIES

- 8.4.2 NEED FOR ENHANCED SURVIVABILITY AND C-UAS RESISTANCE

- 8.4.3 NEED FOR LOWER-COST, SCALABLE, AND RAPIDLY DEPLOYABLE SOLUTIONS

9 LOITERING MUNITION MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 9.1 INTRODUCTION

- 9.2 ASSESSMENT OF LOITERING MUNITION (RECOVERABLE VS. EXPENDABLE)

- 9.2.1 PROCUREMENT TRENDS

- 9.2.2 SUSTAINMENT/UPGRADES

- 9.3 RECOVERABLE

- 9.3.1 OPERATIONAL FLEXIBILITY AND COST EFFICIENCY TO DRIVE MARKET

- 9.3.2 USE CASE: SPIKE FIREFLY BY RAFAEL ADVANCED DEFENSE SYSTEMS

- 9.4 EXPENDABLE

- 9.4.1 HIGH-IMPACT PRECISION STRIKE AND RAPID DEPLOYMENT TO DRIVE MARKET

- 9.4.2 USE CASE: PHOENIX GHOST BY AEVEX AEROSPACE

10 LOITERING MUNITION MARKET, BY CLASS (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 10.1 INTRODUCTION

- 10.2 CLASSIFICATION OF LOITERING MUNITION BASED ON WEIGHT

- 10.2.1 SMALL LOITERING MUNITION (<25 KG): TOP THREE USE CASES

- 10.2.1.1 Use case: Switchblade 300 for infantry-level precision strike

- 10.2.1.2 Use case: HERO-30 for special operations and low-collateral damage

- 10.2.1.3 Use case: Warmate for border security and static target neutralization

- 10.2.2 TACTICAL LOITERING MUNITION (25-150 KG): TOP THREE USE CASES

- 10.2.2.1 Use case: Lancet-3 for anti-armor and air defense suppression

- 10.2.2.2 Use case: HERO-120 for anti-tank and heavy fortification strike missions

- 10.2.2.3 Use case: Warmate 2 for battlefield interdiction and delayed strike operations

- 10.2.3 STRATEGIC LOITERING MUNITION (>150 KG): TOP THREE USE CASES

- 10.2.3.1 Use case: Harop for deep-strike electronic warfare and radar neutralization

- 10.2.3.2 Use case: HERO-900 for long-endurance target persistence and time-sensitive strike decisions

- 10.2.3.3 Use case: Harpy for anti-radar suppression and air defense neutralization

- 10.2.1 SMALL LOITERING MUNITION (<25 KG): TOP THREE USE CASES

- 10.3 SHORT RANGE (<25 KM)

- 10.3.1 EXTENSIVE USE IN CLOSE COMBAT TO DRIVE MARKET

- 10.3.2 USE CASE: NAGASTRA 1R BY SOLAR GROUP

- 10.4 MEDIUM RANGE (25-100 KM)

- 10.4.1 NEED FOR ENHANCED OPERATIONAL AGILITY AND PRECISION STRIKES TO DRIVE MARKET

- 10.4.2 USE CASE: LANCET BY ZALA AERO

- 10.5 LONG RANGE (>100 KM)

- 10.5.1 INCREASED PREFERENCE FOR DEEP-STRIKE CAPABILITIES AMONG MILITARY FORCES TO DRIVE MARKET

- 10.5.2 USE CASE: HARPY BY ISRAEL AEROSPACE INDUSTRIES

11 LOITERING MUNITION MARKET, BY AIR TIME (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 11.1 INTRODUCTION

- 11.2 CLASSIFICATION OF LOITERING MUNITION BASED ON LOITER TIME

- 11.2.1 BELOW 60 MINUTES: TOP THREE USE CASES

- 11.2.1.1 Use case: Switchblade 300 for rapid infantry strike and mobile target neutralization

- 11.2.1.2 Use case: HERO-30 for special operations and urban close-quarters strike

- 11.2.1.3 Use case: Warmate for border patrol and rapid engagement missions

- 11.2.2 ABOVE 60 MINUTES: TOP THREE USE CASES

- 11.2.2.1 Use case: Harop for extended strike and electronic warfare target elimination

- 11.2.2.2 Use case: HERO-900 for time-sensitive target tracking and delayed strike operations

- 11.2.2.3 Use case: Switchblade 600 for extended anti-armor and precision strike missions

- 11.2.1 BELOW 60 MINUTES: TOP THREE USE CASES

- 11.3 SHORT ENDURANCE (<45 MINUTES)

- 11.3.1 HIGH DEMAND FOR MICRO/NANO TACTICAL EXPENDABLE LOITERERS TO DRIVE MARKET

- 11.3.2 USE CASE: BLACK HORNET-STYLE NANO EXPENDABLE LOITERER

- 11.4 MEDIUM ENDURANCE (45-120 MINUTES)

- 11.4.1 EMPHASIS ON MINI AND TACTICAL LOITERING STRIKE PLATFORMS TO DRIVE MARKET

- 11.4.2 USE CASE: WARMATE 1 BY WB GROUP

- 11.5 LONG ENDURANCE (>120 MINUTES)

- 11.5.1 SHIFT TOWARD HIGH-ENDURANCE EXPENDABLE LOITERERS TO DRIVE MARKET

- 11.5.2 USE CASE: HAROP BY ISRAEL AEROSPACE INDUSTRIES

12 LOITERING MUNITION MARKET, BY WARHEAD TYPE (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 12.1 INTRODUCTION

- 12.2 CLASSIFICATION OF LOITERING MUNITION BASED ON WARHEAD WEIGHT

- 12.2.1 BELOW 5 KG: TOP THREE USE CASES

- 12.2.1.1 Use case: Switchblade 300 for low-collateral precision strike in urban combat

- 12.2.1.2 Use case: HERO-30 for special forces covert strike operations

- 12.2.1.3 Use case: Warmate 1 Micro for border security and rapid engagement

- 12.2.2 5-10 KG: TOP THREE USE CASES

- 12.2.2.1 Use case: Switchblade 600 for anti-armor precision strike

- 12.2.2.2 Use case: HERO-70 for counter-insurgency and light vehicle neutralization

- 12.2.2.3 Use case: Warmate 2 for mobile launch and battlefield interdiction

- 12.2.3 ABOVE 10 KG: TOP THREE USE CASES

- 12.2.3.1 Use case: Harop for long-duration deep strike and target confirmation

- 12.2.3.2 Use case: HERO-1250 for strategic infrastructure and high-value target elimination

- 12.2.3.3 Use case: Harpy NG for autonomous anti-radiation strike and electronic warfare suppression

- 12.2.1 BELOW 5 KG: TOP THREE USE CASES

- 12.3 HIGH-EXPLOSIVE WARHEAD

- 12.3.1 MODERN ARMED FORCES' PUSH FOR PRECISION AND AUTONOMY IN STRIKE OPERATIONS TO DRIVE MARKET

- 12.3.2 USE CASE: SWITCHBLADE 600 BY AEROVIRONMENT

- 12.4 FRAGMENTATION WARHEAD

- 12.4.1 INCREASING REQUIREMENT FOR SWARM-ENABLED MINI LOITERERS TO DRIVE MARKET

- 12.4.2 USE CASE: HERO-120 BY UVISION

- 12.5 ANTI-ARMOR/SHAPE-CHARGED WARHEAD

- 12.5.1 RAPID ADOPTION OF AUTONOMOUS ANTI-ARMOR LOITERING STRIKE PLATFORMS TO DRIVE MARKET

- 12.5.2 USE CASE: LANCET-3 BY ZALA AERO

- 12.6 ANTI-RADIATION WARHEAD

- 12.6.1 FOCUS ON SUPPRESSING ENEMY AIR DEFENSE AND RADAR INFRASTRUCTURE TO DRIVE MARKET

- 12.6.2 USE CASE: HARPY BY ISRAEL AEROSPACE INDUSTRIES

- 12.7 THERMOBARIC WARHEAD

- 12.7.1 COMPLEX URBAN AND ASYMMETRIC COMBAT ENVIRONMENTS TO DRIVE MARKET

- 12.7.2 USE CASE: HERO-30 THERMOBARIC BY UVISION

13 LOITERING MUNITION MARKET, BY NAVSENSOR (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 13.1 INTRODUCTION

- 13.2 CLASSIFICATION OF LOITERING MUNITION BASED ON SEEKER TECHNOLOGY

- 13.2.1 EO CAMERAS: TOP THREE USE CASES

- 13.2.1.1 Use case: EO-guided micro strike via Switchblade 300 for urban precision engagement

- 13.2.1.2 Use case: EO-guided HERO-120 for area surveillance and target-directed strike

- 13.2.1.3 Use case: EO-seeker Lancet-3 for moving target neutralization and battlefield interdiction

- 13.2.2 IR/THERMAL IMAGERS: TOP THREE USE CASES

- 13.2.2.1 Use case: Phoenix Ghost for thermal-guided night strike and hidden target engagement

- 13.2.2.2 Use case: HERO-400EC for heat-signature targeting against armored and fortified assets

- 13.2.2.3 Use case: Lancet-3 for IR-guided counter-artillery and air defense target neutralization

- 13.2.3 RF SEEKERS: TOP THREE USE CASES

- 13.2.3.1 Use case: Harpy for autonomous RF-homing anti-radiation strike

- 13.2.3.2 Use case: Harpy NG multi-frequency RF-guided loitering missile for advanced electronic warfare targets

- 13.2.3.3 Use case: RF-enabled HERO-1250 for electronic warfare target attrition

- 13.2.1 EO CAMERAS: TOP THREE USE CASES

- 13.3 EO

- 13.3.1 INTEGRATION OF COMPUTER-VISION AUTONOMY IN TACTICAL LOITERERS TO DRIVE MARKET

- 13.3.2 USE CASE: EO-GUIDED ROTEM ALPHA BY ISRAEL AEROSPACE INDUSTRIES

- 13.4 GPS/GNSS

- 13.4.1 RISING DEMAND FOR LONG-RANGE EXPENDABLE LOITERERS TO DRIVE MARKET

- 13.4.2 USE CASE: GNSS-GUIDED SKYSTRIKER BY ELBIT SYSTEMS

- 13.5 IR/THERMAL

- 13.5.1 RAPID ADOPTION OF AUTONOMOUS IR-BASED MICRO/ MINI LOITERING SYSTEMS TO DRIVE MARKET

- 13.5.2 USE CASE: THERMAL-GUIDED PHOENIX GHOST BY AEVEX AEROSPACE

- 13.6 INS

- 13.6.1 DEMAND FOR NAVIGATION-RESILIENT EXPENDABLE LOITERERS TO DRIVE MARKET

- 13.6.2 USE CASE: INS-ENABLED HAROP BY ISRAEL AEROSPACE INDUSTRIES

- 13.7 RF-BASED

- 13.7.1 INCREASING COMPLEXITY OF ELECTRONIC WARFARE TO DRIVE MARKET

- 13.7.2 USE CASE: RF-HOMING HARPY NG BY ISRAEL AEROSPACE INDUSTRIES

14 LOITERING MUNITION MARKET, BY LAUNCH MODE (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 14.1 INTRODUCTION

- 14.2 CLASSIFICATION OF LOITERING MUNITION BASED ON AUTOMATION LEVEL

- 14.2.1 HUMAN-IN-THE-LOOP: TOP THREE USE CASES

- 14.2.1.1 Use case: Switchblade 300 operator-controlled precision strike for small tactical units

- 14.2.1.2 Use case: HERO-30 for human-validated anti-personnel and light-vehicle engagements

- 14.2.1.3 Use case: SkyStriker for human-supervised long-endurance precision engagements

- 14.2.2 HUMAN-ON-THE-LOOP: TOP THREE USE CASES

- 14.2.2.1 Use case: STM Kargu-2 for autonomous swarm-enabled target tracking with operator override

- 14.2.2.2 Use case: Harop for autonomous SEAD missions with human oversight

- 14.2.2.3 Use case: HERO-120 for anti-armor missions with operator intervention capability

- 14.2.3 HUMAN-OUT-OF-THE-LOOP: TOP THREE USE CASES

- 14.2.3.1 Use case: Harpy for fully autonomous anti-radiation strike against enemy air defense networks

- 14.2.3.2 Use case: STM Kargu for AI-driven target identification in communication-denied environments

- 14.2.3.3 Use case: Shahed-136 for high-density saturation strikes against strategic targets

- 14.2.1 HUMAN-IN-THE-LOOP: TOP THREE USE CASES

- 14.3 AIR-LAUNCHED

- 14.3.1 NEED FOR RAPID RESPONSE TIMES IN MILITARY OPERATIONS TO DRIVE MARKET

- 14.3.2 USE CASE: ALTIUS-700M BY ANDURIL INDUSTRIES

- 14.4 VERTICAL TAKE-OFF

- 14.4.1 MODERNIZATION OF MILITARY ARSENALS AMID EVOLVING THREATS TO DRIVE MARKET

- 14.4.2 USE CASE: ROTEM ALPHA BY ISRAEL AEROSPACE INDUSTRIES

- 14.5 CANISTER-LAUNCHED

- 14.5.1 HIGH DEMAND FOR VERSATILE DEPLOYMENT METHODS FROM MILITARY FORCES TO DRIVE MARKET

- 14.5.2 USE CASE: SKYSTRIKER BY ELBIT SYSTEMS

- 14.6 CATAPULT-LAUNCHED

- 14.6.1 SHIFT TOWARD INTEGRATED COMBAT SOLUTIONS TO DRIVE MARKET

- 14.6.2 USE CASE: WARMATE BY WB GROUP

- 14.7 HAND-LAUNCHED

- 14.7.1 FOCUS ON PRECISION STRIKES IN URBAN WARFARE TO DRIVE MARKET

- 14.7.2 USE CASE: HERO-30 BY UVISION

15 LOITERING MUNITION MARKET, BY END USER (MARKET SIZE & FORECAST TO 2030, USD MILLION)

- 15.1 INTRODUCTION

- 15.2 CLASSIFICATION OF LOITERING MUNITION PROCUREMENT BASED ON ACQUISITION

- 15.2.1 DEFENSE BUDGET ALLOCATION

- 15.2.2 NEAR-TERM PROCUREMENT ORDERS

- 15.2.3 MULTI-YEAR ACQUISITION PLANS

- 15.3 ARMY

- 15.3.1 PUSH FOR ENHANCING OPERATIONAL CAPABILITIES TO DRIVE MARKET

- 15.3.2 USE CASE: LONG-RANGE LOITERING WEAPONS FOR SATURATION STRIKES AGAINST CRITICAL INFRASTRUCTURE

- 15.4 NAVY

- 15.4.1 SHARP RISE OF ASYMMETRIC THREATS TO DRIVE MARKET

- 15.4.2 USE CASE: LOITERING MISSILES FOR COASTAL DEFENSE AND SHORELINE ATTACKS

- 15.5 AIR FORCE

- 15.5.1 SURGE IN DEFENSE BUDGETS AND MODERNIZATION EFFORTS TO DRIVE MARKET

- 15.5.2 USE CASE: GROUND-LAUNCHED LOITERING WEAPONS FOR SEAD MISSIONS

16 LOITERING MUNITION MARKET, BY REGION (USD MILLION)

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Rising operational integration and industrial expansion to drive market

- 16.2.1.2 Top three loitering munitions and specifications

- 16.2.2 CANADA

- 16.2.2.1 Domestic capability development and strategic alignment to drive market

- 16.2.2.2 Top three loitering munitions and specifications

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 FRANCE

- 16.3.1.1 Strategic autonomy and indigenous production to drive market

- 16.3.1.2 Top three loitering munitions and specifications

- 16.3.2 GERMANY

- 16.3.2.1 Defense restructuring and multinational collaboration to drive market

- 16.3.2.2 Top three loitering munitions and specifications

- 16.3.3 UK

- 16.3.3.1 Advanced autonomy programs and regulatory integration to drive market

- 16.3.3.2 Top three loitering munitions and specifications

- 16.3.4 ITALY

- 16.3.4.1 Industrial revitalization and European defense alignment to drive market

- 16.3.4.2 Top three loitering munitions and specifications

- 16.3.5 REST OF EUROPE

- 16.3.5.1 Top three loitering munitions and specifications

- 16.3.1 FRANCE

- 16.4 ASIA PACIFIC

- 16.4.1 INDIA

- 16.4.1.1 Indigenization and operational readiness to drive market

- 16.4.1.2 Top three loitering munitions and specifications

- 16.4.2 JAPAN

- 16.4.2.1 Strategic defense expansion and indigenous R&D to drive market

- 16.4.2.2 Top three loitering munitions and specifications

- 16.4.3 AUSTRALIA

- 16.4.3.1 Sovereign capability development and strategic partnerships to drive market

- 16.4.3.2 Top three loitering munitions and specifications

- 16.4.4 REST OF ASIA PACIFIC

- 16.4.1 INDIA

- 16.5 MIDDLE EAST

- 16.5.1 SAUDI ARABIA

- 16.5.1.1 Defense industrialization and capability diversification to drive market

- 16.5.1.2 Top three loitering munitions and specifications

- 16.5.2 ISRAEL

- 16.5.2.1 Robust export and innovation capabilities to drive market

- 16.5.2.2 Top three loitering munitions and specifications

- 16.5.3 TURKEY

- 16.5.3.1 Rapid industrial growth and export momentum to drive market

- 16.5.3.2 Top three loitering munitions and specifications

- 16.5.1 SAUDI ARABIA

- 16.6 REST OF THE WORLD

- 16.6.1 LATIN AMERICA

- 16.6.1.1 Growing demand for cost-efficient loitering strike and surveillance systems to drive market

- 16.6.1.2 Top three loitering munitions and specifications

- 16.6.2 AFRICA

- 16.6.2.1 Rising border security needs and cost-effective precision strike capabilities to drive market

- 16.6.2.2 Top three loitering munitions and specifications

- 16.6.1 LATIN AMERICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2021-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- 17.5.5 COMPANY FOOTPRINT

- 17.5.5.1 Company footprint

- 17.5.5.2 Type footprint

- 17.5.5.3 End user footprint

- 17.5.5.4 Launch mode footprint

- 17.5.5.5 Region footprint

- 17.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- 17.6.5 COMPETITIVE BENCHMARKING

- 17.6.5.1 List of start-ups/SMEs

- 17.6.5.2 Competitive benchmarking of start-ups/SMEs

- 17.7 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8 BRAND/PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 OTHERS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 AEROVIRONMENT, INC.

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Others

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 ELBIT SYSTEMS LTD.

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches

- 18.1.2.3.2 Others

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 RHEINMETALL AG

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Others

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 ISRAEL AEROSPACE INDUSTRIES

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.3.3 Others

- 18.1.4.4 MnM view

- 18.1.4.4.1 Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 UVISION

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Deals

- 18.1.5.3.2 Others

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 THALES

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Deals

- 18.1.7 NORTHROP GRUMMAN

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product Launches

- 18.1.8 WB GROUP

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Others

- 18.1.9 EDGE GROUP PJSC

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches

- 18.1.9.3.2 Deals

- 18.1.9.3.3 Others

- 18.1.10 ANDURIL INDUSTRIES

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches

- 18.1.10.3.2 Deals

- 18.1.10.3.3 Others

- 18.1.11 AEVEX AEROSPACE

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Deals

- 18.1.12 STM

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Deals

- 18.1.12.3.2 Others

- 18.1.13 KNDS

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Deals

- 18.1.13.3.2 Others

- 18.1.14 PARAMOUNT GROUP

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Deals

- 18.1.15 MBDA

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Deals

- 18.1.15.3.2 Others

- 18.1.16 TELEDYNE FLIR LLC

- 18.1.16.1 Business overview

- 18.1.16.2 Products offered

- 18.1.16.3 Recent developments

- 18.1.16.3.1 Others

- 18.1.17 SOLAR GROUP

- 18.1.17.1 Business overview

- 18.1.17.2 Products offered

- 18.1.17.3 Recent developments

- 18.1.17.3.1 Others

- 18.1.1 AEROVIRONMENT, INC.

- 18.2 OTHER PLAYERS

- 18.2.1 ARQUIMEA

- 18.2.2 ROKETSAN

- 18.2.3 TATA ADVANCED SYSTEMS LIMITED

- 18.2.4 SPEAR

- 18.2.5 TRANSVARO ELEKTRON ALETLERI

- 18.2.6 BAYKAR TECH

- 18.2.7 OVERWATCH GROUP

- 18.2.8 KADET DEFENCE SYSTEMS

- 18.2.9 DEFENDTEX

- 18.2.10 JOHNNETTE GROUP

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 Primary interview participants

- 19.1.2.2 Key data from primary sources

- 19.1.2.3 Breakdown of primary interviews

- 19.1.2.4 Insights from industry experts

- 19.1.1 SECONDARY DATA

- 19.2 FACTOR ANALYSIS

- 19.2.1 SUPPLY-SIDE INDICATORS

- 19.2.2 DEMAND-SIDE INDICATORS

- 19.3 MARKET SIZE ESTIMATION

- 19.3.1 BOTTOM-UP APPROACH

- 19.3.2 TOP-DOWN APPROACH

- 19.3.3 BASE NUMBER CALCULATION

- 19.4 DATA TRIANGULATION

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS