|

시장보고서

상품코드

1924864

무인운반차(AGV) 시장 : 유형별, 내비게이션 기술별 - 예측(-2032년)Automated Guided Vehicle Market by Type, Navigation Technology - Global Forecast to 2032 |

||||||

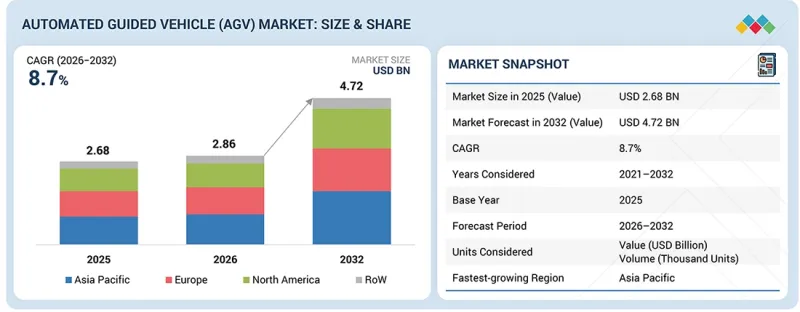

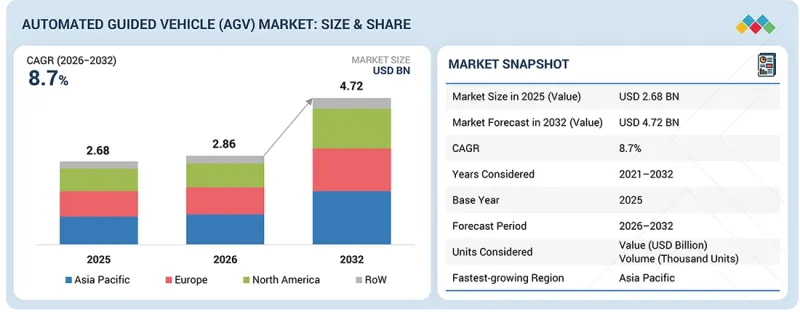

세계의 무인운반차(AGV) 시장 규모는 2026년 28억 6,000만 달러에서 2032년까지 47억 2,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 8.7%의 성장을 기록할 전망입니다.

이러한 성장은 조직이 내부 자재 흐름 개선, 수작업 감소, 일관된 업무 성과 유지에 집중하면서 공장, 창고 및 유통 시설에서 AGV의 채택이 증가하고 있기 때문입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021년-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2032년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 내비게이션 기술, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

기업들은 신뢰성과 안전성이 매우 중요한 구조화된 환경에서 반복적인 운송 작업, 라인 공급, 견인, 팔레트 이동을 지원하기 위해 AGV의 도입을 확대하고 있습니다. 안정적인 네비게이션, 효율적인 교통 관리, 연속 운행 시 안정적인 성능을 제공하는 AGV 시스템에 대한 수요가 증가하고 있습니다. 공장 현대화, 물류 인프라 확장, 자동화 업그레이드에 대한 지속적인 투자가 시장 성장을 더욱 촉진하고 있습니다. 조직이 효율성, 비용 관리 및 확장 가능한 자동화 전략을 우선시하는 가운데, AGV는 세계 시장에서 장기적인 자재관리 및 운영 최적화 계획의 필수적인 요소로 자리 잡고 있습니다.

"경부하 AGV가 무인운반차(AGV) 시장에서 큰 비중을 차지할 것으로 예상"

경부하 AGV 부문은 예측 기간 동안 무인운반차(AGV) 시장에서 큰 비중을 차지할 것으로 예측됩니다. 이는 빈번하고 짧은 거리의 재료 이동이 필요한 응용 분야에서 강력한 채택을 뒷받침하고 있습니다. 경하중 AGV는 공장, 창고, 유통 시설에서 토트 핸들링, 소형 팔레트 운송, 키팅, 라인 사이드 보충 등의 업무에 널리 활용되고 있습니다. 낮은 취득 비용, 콤팩트한 형태, 쉬운 배치로 인해 공간 제약이 있고 적당한 적재량이 필요한 시설에 적합합니다. 기업들은 반복적인 내부 운송의 자동화, 작업장 안전성 향상, 수작업 의존도 감소를 위해 경부하 AGV를 채택하고 있습니다. 이러한 시스템은 효율적인 트래픽 흐름과 연속적인 운영을 지원하여 조직이 일관된 처리량과 운영 관리를 유지하도록 돕습니다. 중소규모 시설 및 개조 프로젝트에서 자동화가 확대됨에 따라 경하중 AGV에 대한 수요가 지속적으로 증가하고 있으며, AGV 시장 전체에서 AGV의 중요성이 더욱 커지고 있습니다.

"레이저 유도는 무인 운반차(AGV) 시장에서 상당한 CAGR로 성장할 것입니다. "

레이저 유도 부문은 예측 기간 동안 무인운반차(AGV) 시장에서 상당한 CAGR로 성장할 것으로 예측됩니다. 이는 구조화된 산업 환경에서 높은 항법 정확도와 안정적인 성능에 대한 수요 증가에 따른 것입니다. 레이저 유도식 AGV는 정밀한 위치 결정, 반복 가능한 경로 설정, 장시간 가동 주기의 일관된 운영이 요구되는 시설에서 널리 채택되고 있습니다. 이 시스템은 레이아웃의 안정성과 예측 가능한 자재 흐름이 중요한 공장, 창고, 유통 센터에 적합합니다. 기업들은 처리량 향상, 내비게이션 오류 감소, 공유 교통 구역의 안전성 향상을 위해 레이저 유도 기술을 채택하고 있습니다. 레이저 유도식 AGV는 잦은 경로 조정이 필요 없고, 신속한 작동과 안정적인 운영이 가능하기 때문에 대규모 배치에서 매력적입니다. 정확성, 신뢰성, 제어된 워크플로우가 우선시되는 환경에서 조직이 자동화를 확대함에 따라 레이저 유도 AGV에 대한 수요는 지속적으로 증가하여 이 부문의 강력한 성장을 뒷받침할 것입니다.

"아시아태평양이 무인운반차(AGV) 시장에서 가장 빠르게 성장하는 지역으로 부상하고 있습니다. "

아시아태평양은 예측 기간 동안 무인운반차(AGV) 시장에서 가장 높은 성장률을 보일 것으로 예측됩니다. 이는 제조 능력의 급속한 확대, 대규모 창고 개발, 생산 및 물류 시설의 자동화 보급 확대에 힘입은 바 큽니다. 이 지역의 기업들은 내부 자재 흐름 개선, 수작업 감소, 대량 처리 업무의 일관된 처리 능력 유지를 위해 AGV를 도입하고 있습니다. 공장 자동화, 유통 인프라, 시설 내 운송 수요의 강력한 성장으로 인해 구조화되고 반복 가능한 AGV 기반 자재관리 시스템에 대한 수요가 증가하고 있습니다.

세계의 무인운반차(AGV) 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 제품 개발 및 혁신, 경쟁 구도 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 지견

- 무인운반차(AGV) 시장 기업에 있어서 매력적인 기회

- 무인운반차(AGV) 시장 : 유형별

- 무인운반차(AGV) 시장 : 내비게이션 기술별

- 무인운반차(AGV) 시장 : 업계별

- 무인운반차(AGV) 시장 : 적재량별

- 북미 무인운반차(AGV) 시장 : 업계별, 국가별

- 무인운반차(AGV) 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 연결된 시장과 부문간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 전망

- GDP 동향과 예측

- 세계의 E-Commerce와 소매 업계 동향

- 자동차 업계 동향

- 밸류체인 분석

- 생태계 분석

- 가격 결정 분석

- 무인운반차(AGV) 가격대 : 주요 기업별(2025년)

- 무인운반차(AGV) 평균 판매 가격 동향 : 유형별(2021년-2025년)

- 견인차 평균 판매 가격 동향 : 지역별(2021년-2025년)

- 투자 및 자금조달 시나리오

- 무역 분석

- 수입 시나리오(842,710)

- 수출 시나리오(842,710)

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 주요 컨퍼런스 및 이벤트(2026년)

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 무인운반차(AGV) 시장

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 업계에 대한 영향

제6장 기술 진보, AI에 의한 영향, 특허, 혁신

- 주요 기술

- AI

- 머신러닝

- 인접 기술

- 산업용 IoT

- 차세대 무선 기술

- 보완 기술

- 협동 로봇

- 디지털 트윈 테크놀러지

- 기술/제품 로드맵

- 특허 분석

- 무인운반차(AGV) 시장에 대한 AI의 영향

- 주요 이용 사례와 시장 장래성

- 무인운반차(AGV) 시장 OEM 베스트 프랙티스

- 무인운반차(AGV) 시장 AI도입에 관한 사례 연구

- 상호 접속된/인접하는 에코시스템과 시장 기업에 대한 영향

- AI 통합 무인운반차(AGV) 채택에 대한 고객 준비 상황

제7장 규제 상황

- 규제 상황과 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 규제

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 그 평가 기준

- 구매 프로세스 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 업계 미충족 요구

제9장 무인운반차(AGV) 기술과 잠재적인 용도

- 무인운반차(AGV)로 사용되는 표준 기술

- LiDAR 센서

- 카메라 비전

- 무인운반차(AGV) 잠재적인 용도

- 공항

- 건설, 인프라 개발 프로젝트

제10장 무인운반차(AGV) 배터리 유형과 충전 방법

- 무인운반차(AGV)로 사용되는 배터리 유형

- 납축전지

- 리튬 이온 배터리

- 니켈계 배터리

- 순 납 배터리

- 배터리 충전 대체 수단

- 자동 충전과 기회 충전

- 배터리 교환

- 플러그인 충전

제11장 무인운반차(AGV)에 제공되는 컴포넌트와 서비스

- 하드웨어

- 소프트웨어 및 서비스

제12장 무인운반차(AGV) 최근 동향

- IoT 접속성

- 협동 AGV 채택

- 확장성와 모듈 설계

- 첨단 내비게이션 기술

- 에너지 효율과 지속가능성

- AI와 머신러닝 통합

- 실시간 데이터 처리용 엣지 컴퓨팅

제13장 무인운반차(AGV) 용도

- Pick & Place

- 포장·팔레타이징

- 조립·보관

제14장 무인운반차(AGV) 시장 : 유형별

- 견인차

- 유닛 로드 캐리어

- 팰릿 트럭

- 조립 라인 차량

- 지게차

- 기타 유형

제15장 무인운반차(AGV) 시장 : 적재량별

- 경부하 AGV

- 안부하 AGV

- 중부하 AGV

제16장 무인운반차(AGV) 시장 : 내비게이션 기술별

- 레이저 유도

- 자기유도

- 전자 유도

- 광테이프 유도

- 시각 유도

- 기타 내비게이션 기술

제17장 무인운반차(AGV) 시장 : 산업별

- 자동차

- 화학제품

- 항공

- 반도체 및 전자

- E-Commerce·소매

- 식품 및 음료

- 의약품

- 의료기기

- 금속·중기

- 물류/3PL

- 펄프 및 종이

- 기타 산업

제18장 무인운반차(AGV) 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 호주

- 한국

- 인도

- 말레이시아

- 인도네시아

- 싱가포르

- 태국

- 기타 아시아태평양

- 기타 지역

- 중동

- 남미

- 아프리카

제19장 경쟁 구도

- 주요 기업 경쟁 전략/강점(2021년-2025년)

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2025년)

- 기업 평가와 재무 지표(2025년)

- 브랜드/제품 비교

- DAIFUKU CO., LTD.(일본)

- JBT(미국)

- KION GROUP AG(독일)

- KUKA SE & CO. KGAA(독일)

- TOYOTA INDUSTRIES CORPORATION(일본)

- 기업 평가 매트릭스 : 주요 기업(2025년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2025년)

- 경쟁 시나리오

제20장 기업 개요

- 주요 기업

- DAIFUKU CO., LTD.

- JBT

- KION GROUP AG

- TOYOTA INDUSTRIES CORPORATION

- KUKA SE & CO. KGAA

- SCOTT

- SSI SCHAEFER

- HYSTER-YALE, INC.

- JUNGHEINRICH AG

- MEIDENSHA CORPORATION

- MITSUBISHI LOGISNEXT CO., LTD.

- OCEANEERING INTERNATIONAL, INC.

- 기타 기업

- NEURA MOBILE ROBOTS GMBH

- AMERICA IN MOTION, INC.

- ASSECO CEIT, A.S.

- SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- JIANGXI DANBAHE ROBOT CO., LTD.

- E80 GROUP S.P.A.

- GLOBAL AGV

- GRENZEBACH GROUP

- IDC CORPORATION

- NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.

- SAFELOG GMBH

- SIMPLEX ROBOTICS PVT. LTD.

- SYSTEM LOGISTICS S.P.A.

- BALYO

제21장 조사 방법

제22장 부록

LSH 26.02.19The global Automated Guided Vehicle (AGV) market is projected to grow from USD 2.86 billion in 2026 to USD 4.72 billion by 2032, registering a CAGR of 8.7 % during the forecast period. Growth is driven by increasing adoption of AGVs across factories, warehouses, and distribution facilities as organizations focus on improving internal material flow, reducing manual handling, and maintaining consistent operational output.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Navigation Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

Companies are expanding AGV deployments to support repetitive transport tasks, line feeding, towing, and pallet movement in structured environments where reliability and safety are critical. Demand is increasing for AGV systems that offer stable navigation, efficient traffic management, and dependable performance under continuous operation. Ongoing investment in factory modernization, logistics infrastructure expansion, and automation upgrades is further supporting market growth. As organizations prioritize efficiency, cost control, and scalable automation strategies, AGVs are becoming an integral component of long term material handling and operational optimization plans across global markets.

"Light-Duty AGVs to Hold a Significant Share in the Automated Guided Vehicle Market"

The light-duty AGV segment is expected to hold a significant share of the Automated Guided Vehicle market during the forecast period, supported by strong adoption in applications requiring frequent and short distance material movement. Light-duty AGVs are widely deployed for tasks such as tote handling, small pallet transport, kitting, and line side replenishment across factories, warehouses, and distribution facilities. Their lower acquisition cost, compact form factor, and ease of deployment make them suitable for facilities with space constraints and moderate payload requirements. Companies are adopting light-duty AGVs to automate repetitive internal transport, improve workplace safety, and reduce reliance on manual labor. These systems support efficient traffic flow and continuous operation, helping organizations maintain consistent throughput and operational control. As automation expands across small and mid scale facilities and retrofit projects, demand for light-duty AGVs continues to grow, reinforcing their importance within the overall AGV market.

"Laser Guidance to Grow at a Significant CAGR in the Automated Guided Vehicle Market"

The laser guidance segment is expected to grow at a significant CAGR in the Automated Guided Vehicle market during the forecast period, supported by rising demand for high navigation accuracy and stable performance in structured industrial environments. Laser guided AGVs are widely adopted in facilities that require precise positioning, repeatable routing, and consistent operation over long duty cycles. These systems are well suited for factories, warehouses, and distribution centres where layout stability and predictable material flow are critical. Companies are adopting laser guidance to support higher throughput, reduce navigation errors, and improve safety in shared traffic areas. Laser guided AGVs also enable faster commissioning and reliable operation without frequent path adjustments, making them attractive for large scale deployments. As organizations expand automation in environments that prioritize accuracy, reliability, and controlled workflows, demand for laser guided AGVs continues to increase, supporting strong growth for this segment.

"Asia Pacific Emerges as the Fastest Growing Region in the Automated Guided Vehicle Market"

The Asia Pacific region is expected to witness the highest growth in the Automated Guided Vehicle market during the forecast period, supported by rapid expansion of manufacturing capacity, large scale warehouse development, and rising adoption of automation across production and logistics facilities. Companies across the region are deploying AGVs to improve internal material flow, reduce manual handling, and maintain consistent throughput in high volume operations. Strong growth in factory automation, distribution infrastructure, and intra facility transport requirements is increasing demand for structured and repeatable AGV based material handling systems. Government support for industrial modernization, smart manufacturing initiatives, and automation focused investment programs is further strengthening market momentum. Asia Pacific also benefits from a strong production base, cost competitive manufacturing, and a growing ecosystem of AGV suppliers and system integrators, which accelerates deployment across both new facilities and retrofit projects. With continued investment in automation, safety improvement, and operational efficiency, Asia Pacific is expected to remain the fastest growing region in the global AGV market throughout the forecast period.

Breakdown of primaries

A variety of executives from key organizations operating in the Automated Guided Vehicle (AGV) market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 40%, C-level - 45%, and Others - 15%

- By Region: Asia Pacific - 41%, North America - 26%, Europe - 28%, and RoW - 5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenues: tier 3: revenue lesser than USD 100 million; tier 2: revenue between USD 100 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: Major companies operating in the Automated Guided Vehicle market include Daifuku Co., Ltd. (Japan), JBT (US), KION GROUP AG (Germany), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), Jungheinrich AG (Germany), Scott (New Zealand), SSI SCHAEFER (Germany), Hyster-Yale Inc. (US), NEURA Mobile Robots GmbH (Germany), MEIDENSHA CORPORATION (Japan), MITSUBISHI LOGISNEXT CO., LTD (Japan), Oceaneering International, Inc. (US), AMERICA IN MOTION, INC. (US), Asseco CEIT, a.s. (Slovakia), Suzhou Casun Intelligent Robot Co., Ltd. (China), Jiangxi Danbao Robot Co., Ltd. (China), E80 Group S.p.A. (Italy), Global AGV (Denmark), Grenzebach Group (Germany), IDC Corporation (US), Nanchang Industrial Control Robot Co., Ltd. (China), SAFELOG GmbH (Germany), Simplex Robotics Pvt. Ltd. (India), System Logistics S.p.A. (Italy), and Balyo (France).

These companies compete through expansion of AGV portfolios, improvements in vehicle reliability and navigation performance, and alignment with structured material handling requirements across factories, warehouses, and distribution facilities. Strategic focus areas include scalable vehicle platforms, standardized safety compliance, flexible deployment models, and long term service support. Continued investment in automation programs, facility modernization, and internal logistics optimization is expected to sustain competition and drive steady innovation across the global AGV market.

The study provides a detailed competitive analysis of these key players in the Automated Guided Vehicle (AGV) market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the Automated Guided Vehicle (AGV) market presents a detailed analysis based on payload capacity, type, navigation technology, industry, and region. By payload capacity, the market is segmented into light-duty AGVs below 500 kg, medium-duty AGVs ranging from 500 to 1,500 kg, and heavy-duty AGVs above 1,500 kg to address varying material handling requirements. By type, the market includes tow vehicles, unit load carriers, pallet trucks, assembly line vehicles, forklift trucks, and other types such as automated guided carts and hybrid AGVs. By navigation technology, the market is segmented into laser guidance, magnetic guidance, inductive guidance, optical tape guidance, vision guidance, and other navigation technologies including inertial, beacon, and dead reckoning guidance. By industry, the market covers automotive, chemicals, aviation, semiconductor and electronics, e-commerce and retail, food and beverages, pharmaceuticals, medical devices, metals and heavy machinery, logistics/3PL, pulp and paper, and other industries such as printing and textile. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World. This segmentation supports detailed assessment of growth opportunities, adoption patterns, and technology developments shaping the global Automated Guided Vehicle (AGV) Market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the Automated Guided Vehicle (AGV) market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising demand for automation solutions in diverse industries, rising emphasis on improving workplace safety, transition from mass production toward flexible, customized manufacturing, rising demand for advanced material handling technologies, and accelerating growth of the e-commerce industry), restraints (High installation, maintenance, and switching costs, growing preference for mobile robots limits AGV demand, and infrastructure limitations in developing markets restrain AGV adoption), opportunities (Rising integration of Industry 4.0 technologies accelerates warehousing modernization, growing investment in AGVs by small and medium-sized enterprises, rapid industrialization in emerging markets creates strong demand for automation, rapid growth of the intralogistics sector in Southeast Asia, ongoing innovation expands the functional capabilities of AGVs), and challenges (Lower labour expenses in emerging markets pose a challenge to AGV adoption, operational downtime driven by technical issues) influencing the growth of the Automated Guided Vehicle (AGV) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the Automated Guided Vehicle (AGV) market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Automated Guided Vehicle (AGV) market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the Automated Guided Vehicle (AGV) market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Daifuku Co., Ltd. (Japan), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), KION GROUP AG (Germany), JBT (US) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AUTOMATED GUIDED VEHICLE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET

- 3.2 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

- 3.3 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

- 3.4 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- 3.5 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

- 3.6 AUTOMATED GUIDED VEHICLE MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 3.7 AUTOMATED GUIDED VEHICLE MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for automation across diverse industries

- 4.2.1.2 Growing emphasis on improving workplace safety

- 4.2.1.3 Transition from mass production toward flexible, customized manufacturing

- 4.2.1.4 Surging demand for advanced material handling technologies

- 4.2.1.5 Booming e-commerce industry

- 4.2.2 RESTRAINTS

- 4.2.2.1 High installation, maintenance, and switching costs

- 4.2.2.2 Growing preference for mobile robots over AGVs

- 4.2.2.3 Infrastructure limitations in developing markets

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Transformation of warehousing through adoption of Industry 4.0 technologies

- 4.2.3.2 Growing investment in AGVs by small and medium-sized enterprises

- 4.2.3.3 Rapid industrialization and e-commerce expansion in emerging markets

- 4.2.3.4 Ongoing innovations to improve AGV performance

- 4.2.4 CHALLENGES

- 4.2.4.1 Lower labor expenses in emerging markets

- 4.2.4.2 Operational downtime due to technical issues

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL E-COMMERCE & RETAIL INDUSTRY

- 5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025

- 5.5.2 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021-2025

- 5.5.3 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021-2025

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (842710)

- 5.7.2 EXPORT SCENARIO (842710)

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TOYOTA ADOPTS MASTERMOVER'S AGV300 TO ENHANCE PRODUCTIVITY AND REDUCE WASTE

- 5.10.2 SCOTT PROVIDES AGV AND PALLETISING SYSTEM TO ENHANCE PRODUCT AND WORKER SAFETY AND MINIMIZE DOWNTIME

- 5.10.3 E80 GROUP IMPLEMENTS LGVS AT METSA TISSUE'S WAREHOUSES TO IMPROVE OPERATIONAL PERFORMANCE

- 5.11 IMPACT OF 2025 US TARIFF - AUTOMATED GUIDED VEHICLE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 ARTIFICIAL INTELLIGENCE

- 6.1.2 MACHINE LEARNING

- 6.2 ADJACENT TECHNOLOGIES

- 6.2.1 INDUSTRIAL INTERNET OF THINGS

- 6.2.2 NEXT-GENERATION WIRELESS TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.3.1 COLLABORATIVE ROBOTS

- 6.3.2 DIGITAL TWIN TECHNOLOGY

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON AUTOMATED GUIDED VEHICLE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN AUTOMATED GUIDED VEHICLE MARKET

- 6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLE MARKET

- 6.6.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED AUTOMATED GUIDED VEHICLES

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 REGULATIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS INDUSTRIES

9 TECHNOLOGIES AND POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 9.1 INTRODUCTION

- 9.2 STANDARD TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES

- 9.2.1 LIDAR SENSORS

- 9.2.2 CAMERA VISION

- 9.3 POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 9.3.1 AIRPORTS

- 9.3.2 CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT PROJECTS

10 BATTERY TYPES AND CHARGING ALTERNATIVES FOR AUTOMATED GUIDED VEHICLES

- 10.1 INTRODUCTION

- 10.2 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES

- 10.2.1 LEAD-ACID BATTERIES

- 10.2.2 LITHIUM-ION BATTERIES

- 10.2.3 NICKEL-BASED BATTERIES

- 10.2.4 PURE LEAD BATTERIES

- 10.3 BATTERY CHARGING ALTERNATIVES

- 10.3.1 AUTOMATIC AND OPPORTUNITY CHARGING

- 10.3.1.1 Wireless charging

- 10.3.2 BATTERY SWAP

- 10.3.2.1 Manual battery swap

- 10.3.2.2 Automatic battery swap

- 10.3.3 PLUG-IN CHARGING

- 10.3.3.1 Manual plug-in charging

- 10.3.3.2 Automatic plug-in charging

- 10.3.1 AUTOMATIC AND OPPORTUNITY CHARGING

11 COMPONENTS AND SERVICES OFFERED FOR AUTOMATED GUIDED VEHICLES

- 11.1 INTRODUCTION

- 11.2 HARDWARE

- 11.3 SOFTWARE AND SERVICES

12 RECENT TRENDS IN AUTOMATED GUIDED VEHICLES

- 12.1 INTRODUCTION

- 12.2 INTERNET OF THINGS CONNECTIVITY

- 12.3 ADOPTION OF COLLABORATIVE AGVS

- 12.4 SCALABILITY AND MODULAR DESIGN

- 12.5 ADVANCED NAVIGATION TECHNOLOGIES

- 12.6 ENERGY EFFICIENCY AND SUSTAINABILITY

- 12.7 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 12.8 EDGE COMPUTING FOR REAL-TIME DATA PROCESSING

13 APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 13.1 INTRODUCTION

- 13.2 PICK-AND-PLACE

- 13.3 PACKAGING AND PALLETIZING

- 13.4 ASSEMBLY AND STORAGE

14 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

- 14.1 INTRODUCTION

- 14.2 TOW VEHICLES

- 14.2.1 POTENTIAL TO AUTOMATE MATERIAL MOVEMENT AND IMPROVE OPERATIONAL EFFICIENCY TO BOOST DEMAND

- 14.3 UNIT LOAD CARRIERS

- 14.3.1 FOCUS ON MINIMIZING PRODUCT DAMAGE WHILE TRANSPORTING TO EXTERNAL LOGISTICS DEPARTMENT TO DRIVE DEMAND

- 14.4 PALLET TRUCKS

- 14.4.1 ABILITY TO HANDLE PALLETS, SKELETON CONTAINERS, RACKS, TUBS, BOXES, AND ROLLS TO ACCELERATE ADOPTION

- 14.5 ASSEMBLY LINE VEHICLES

- 14.5.1 COST ADVANTAGES OVER CHAIN-BASED CONVEYANCE SYSTEMS TO SUPPORT DEPLOYMENT

- 14.6 FORKLIFT TRUCKS

- 14.6.1 PROFICIENCY IN HANDLING DIFFERENT PALLET SIZES AND LOAD FORMATS TO INCREASE DEMAND

- 14.7 OTHER TYPES

15 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

- 15.1 INTRODUCTION

- 15.2 LIGHT-DUTY AGVS

- 15.2.1 ABILITY TO EFFICIENTLY MANAGE SMALL LOADS AND REDUCE WORKFORCE FATIGUE TO ENHANCE ADOPTION

- 15.3 MEDIUM-DUTY AGVS

- 15.3.1 POTENTIAL TO REDUCE WORKPLACE CONGESTION AND EFFECTIVELY MANAGE INVENTORY TO FACILITATE DEPLOYMENT

- 15.4 HEAVY-DUTY AGVS

- 15.4.1 ABILITY TO HANDLE VERY HEAVY LOADS TO DRIVE SEGMENT GROWTH

16 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

- 16.1 INTRODUCTION

- 16.2 LASER GUIDANCE

- 16.2.1 ENHANCED ACCURACY AND FLEXIBILITY TO CONTRIBUTE TO MARKET EXPANSION

- 16.3 MAGNETIC GUIDANCE

- 16.3.1 SIMPLE INSTALLATION, ROBUST PERFORMANCE, AND MINIMAL MAINTENANCE TO ACCELERATE ADOPTION

- 16.4 INDUCTIVE GUIDANCE

- 16.4.1 ABILITY TO PERFORM EFFECTIVELY IN DUSTY AND HIGH-TRAFFIC INDUSTRIAL ENVIRONMENTS TO PROMOTE IMPLEMENTATION

- 16.5 OPTICAL TAPE GUIDANCE

- 16.5.1 EASE OF DEPLOYMENT AND HIGH FLEXIBILITY TO SUPPORT MARKET GROWTH

- 16.6 VISION GUIDANCE

- 16.6.1 HIGH RELIABILITY AND EASY MANEUVERABILITY IN COMPLEX SPACES TO BOOST ADOPTION

- 16.7 OTHER NAVIGATION TECHNOLOGIES

17 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- 17.1 INTRODUCTION

- 17.2 AUTOMOTIVE

- 17.2.1 INCREASING DEMAND FOR AFTER-SALES SPARE PARTS TO SUPPORT MARKET GROWTH

- 17.3 CHEMICALS

- 17.3.1 SIGNIFICANT FOCUS ON ENHANCING SAFETY, EFFICIENCY, AND COMPETITIVENESS TO ACCELERATE MARKET GROWTH

- 17.4 AVIATION

- 17.4.1 RISING DEMAND FOR STREAMLINED AIRCRAFT PRODUCTION TO FUEL MARKET GROWTH

- 17.5 SEMICONDUCTOR & ELECTRONICS

- 17.5.1 EMPHASIS ON REVOLUTIONIZING CLEANROOM OPERATIONS TO DRIVE MARKET

- 17.6 E-COMMERCE & RETAIL

- 17.6.1 NECESSITY TO ENHANCE ORDER ACCURACY AND PROMPT DELIVERY TO FUEL ADOPTION

- 17.7 FOOD & BEVERAGES

- 17.7.1 SURGING DEMAND FOR FRESH, SAFE, AND READILY ACCESSIBLE FOOD PRODUCTS TO STIMULATE MARKET GROWTH

- 17.8 PHARMACEUTICALS

- 17.8.1 STRINGENT REGULATORY AND CLEANLINESS REQUIREMENTS TO SPIKE DEMAND

- 17.9 MEDICAL DEVICES

- 17.9.1 NEED TO FOLLOW INFECTION CONTROL PRACTICES AND IMPROVE WORKPLACE SAFETY TO PROPEL MARKET

- 17.10 METALS & HEAVY MACHINERY

- 17.10.1 SIGNIFICANT FOCUS ON IMPROVING SAFETY AND OPTIMIZING WORKFLOW TO SPUR DEMAND

- 17.11 LOGISTICS/3PL

- 17.11.1 EMPHASIS ON REDUCING WAREHOUSE SPACE AND LABOR COSTS TO ELEVATE ADOPTION

- 17.12 PULP & PAPER

- 17.12.1 NEED TO ADHERE TO SAFETY STANDARDS AND ENSURE HIGHER THROUGHPUT TO SPIKE DEPLOYMENT

- 17.13 OTHER INDUSTRIES

18 AUTOMATED GUIDED VEHICLE MARKET, BY REGION

- 18.1 INTRODUCTION

- 18.2 NORTH AMERICA

- 18.2.1 US

- 18.2.1.1 Established automotive and warehousing base to accelerate market growth

- 18.2.2 CANADA

- 18.2.2.1 Continued adoption of automation across key industries to support market growth

- 18.2.3 MEXICO

- 18.2.3.1 Strong manufacturing base to contribute to market growth

- 18.2.1 US

- 18.3 EUROPE

- 18.3.1 GERMANY

- 18.3.1.1 Strong focus on launching innovative and advanced AGVs to expedite market growth

- 18.3.2 UK

- 18.3.2.1 Thriving automotive sector to fuel market growth

- 18.3.3 FRANCE

- 18.3.3.1 Expansion of e-commerce sector to drive market

- 18.3.4 ITALY

- 18.3.4.1 Rising demand for smart logistics and automation solutions to foster market growth

- 18.3.5 SPAIN

- 18.3.5.1 Integration of AI, IoT, blockchain, 5G technologies in logistics to boost demand

- 18.3.6 NETHERLANDS

- 18.3.6.1 Advanced supply chain networks and modern warehousing infrastructure to spike demand

- 18.3.7 REST OF EUROPE

- 18.3.1 GERMANY

- 18.4 ASIA PACIFIC

- 18.4.1 CHINA

- 18.4.1.1 Increasing investments in transportation, warehousing, and logistics ecosystem to drive market

- 18.4.2 JAPAN

- 18.4.2.1 Rising labor costs and diversified industrial base to facilitate adoption

- 18.4.3 AUSTRALIA

- 18.4.3.1 Sustained automation across manufacturing, logistics, and mining operations to stimulate demand

- 18.4.4 SOUTH KOREA

- 18.4.4.1 Presence of global AGV players to propel market

- 18.4.5 INDIA

- 18.4.5.1 Emphasis on building smart factories to create growth opportunities

- 18.4.6 MALAYSIA

- 18.4.6.1 Thriving manufacturing and logistics sectors to promote AGV adoption

- 18.4.7 INDONESIA

- 18.4.7.1 Focus on expanding domestic manufacturing capacity to spur demand

- 18.4.8 SINGAPORE

- 18.4.8.1 Rising adoption of digital technologies across industries to fuel market growth

- 18.4.9 THAILAND

- 18.4.9.1 Ongoing infrastructure development projects to create lucrative opportunities

- 18.4.10 REST OF ASIA PACIFIC

- 18.4.1 CHINA

- 18.5 ROW

- 18.5.1 MIDDLE EAST

- 18.5.1.1 GCC

- 18.5.1.1.1 Saudi Arabia

- 18.5.1.1.1.1 Increasing emphasis on economic diversification under Vision 2030 to accelerate adoption

- 18.5.1.1.2 UAE

- 18.5.1.1.2.1 Rising demand for transportation, warehousing, and logistics services to drive market

- 18.5.1.1.3 Rest of GCC

- 18.5.1.1.1 Saudi Arabia

- 18.5.1.2 Rest of Middle East

- 18.5.1.1 GCC

- 18.5.2 SOUTH AMERICA

- 18.5.2.1 Government initiatives to automate food & beverages industry to spur demand

- 18.5.3 AFRICA

- 18.5.3.1 Growing imports of consumer goods to foster market growth

- 18.5.1 MIDDLE EAST

19 COMPETITIVE LANDSCAPE

- 19.1 INTRODUCTION

- 19.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 19.3 REVENUE ANALYSIS, 2020-2024

- 19.4 MARKET SHARE ANALYSIS, 2025

- 19.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 19.6 BRAND/PRODUCT COMPARISON

- 19.6.1 DAIFUKU CO., LTD. (JAPAN)

- 19.6.2 JBT (US)

- 19.6.3 KION GROUP AG (GERMANY)

- 19.6.4 KUKA SE & CO. KGAA (GERMANY)

- 19.6.5 TOYOTA INDUSTRIES CORPORATION (JAPAN)

- 19.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 19.7.1 STARS

- 19.7.2 EMERGING LEADERS

- 19.7.3 PERVASIVE PLAYERS

- 19.7.4 PARTICIPANTS

- 19.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 19.7.5.1 Company footprint

- 19.7.5.2 Region footprint

- 19.7.5.3 Navigation technology footprint

- 19.7.5.4 Type footprint

- 19.7.5.5 Industry footprint

- 19.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 19.8.1 PROGRESSIVE COMPANIES

- 19.8.2 RESPONSIVE COMPANIES

- 19.8.3 DYNAMIC COMPANIES

- 19.8.4 STARTING BLOCKS

- 19.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 19.8.5.1 Detailed list of key startups/SMEs

- 19.8.5.2 Competitive benchmarking of key startups/SMEs

- 19.9 COMPETITIVE SCENARIO

- 19.9.1 PRODUCT LAUNCHES

- 19.9.2 DEALS

- 19.9.3 EXPANSIONS

- 19.9.4 OTHER DEVELOPMENTS

20 COMPANY PROFILES

- 20.1 KEY PLAYERS

- 20.1.1 DAIFUKU CO., LTD.

- 20.1.1.1 Business overview

- 20.1.1.2 Products/Solutions/Services offered

- 20.1.1.3 Recent developments

- 20.1.1.3.1 Deals

- 20.1.1.3.2 Expansions

- 20.1.1.4 MnM view

- 20.1.1.4.1 Key strengths

- 20.1.1.4.2 Strategic choices

- 20.1.1.4.3 Weaknesses and competitive threats

- 20.1.2 JBT

- 20.1.2.1 Business overview

- 20.1.2.2 Products/Solutions/Services offered

- 20.1.2.3 Recent developments

- 20.1.2.3.1 Product launches

- 20.1.2.4 MnM view

- 20.1.2.4.1 Key strengths

- 20.1.2.4.2 Strategic choices

- 20.1.2.4.3 Weaknesses and competitive threats

- 20.1.3 KION GROUP AG

- 20.1.3.1 Business overview

- 20.1.3.2 Products/Solutions/Services offered

- 20.1.3.3 Recent developments

- 20.1.3.3.1 Product launches

- 20.1.3.3.2 Expansions

- 20.1.3.4 MnM view

- 20.1.3.4.1 Key strengths

- 20.1.3.4.2 Strategic choices

- 20.1.3.4.3 Weaknesses and competitive threats

- 20.1.4 TOYOTA INDUSTRIES CORPORATION

- 20.1.4.1 Business overview

- 20.1.4.2 Products/Solutions/Services offered

- 20.1.4.3 Recent developments

- 20.1.4.3.1 Product launches

- 20.1.4.3.2 Deals

- 20.1.4.4 MnM view

- 20.1.4.4.1 Key strengths

- 20.1.4.4.2 Strategic choices

- 20.1.4.4.3 Weaknesses and competitive threats

- 20.1.5 KUKA SE & CO. KGAA

- 20.1.5.1 Business overview

- 20.1.5.2 Products/Solutions/Services offered

- 20.1.5.3 Recent developments

- 20.1.5.3.1 Product launches

- 20.1.5.3.2 Deals

- 20.1.5.4 MnM view

- 20.1.5.4.1 Key strengths

- 20.1.5.4.2 Strategic choices

- 20.1.5.4.3 Weaknesses and competitive threats

- 20.1.6 SCOTT

- 20.1.6.1 Business overview

- 20.1.6.2 Products/Solutions/Services offered

- 20.1.6.3 Recent developments

- 20.1.6.3.1 Product launches

- 20.1.7 SSI SCHAEFER

- 20.1.7.1 Business overview

- 20.1.7.2 Products/Solutions/Services offered

- 20.1.7.3 Recent developments

- 20.1.7.3.1 Deals

- 20.1.7.3.2 Other developments

- 20.1.8 HYSTER-YALE, INC.

- 20.1.8.1 Business overview

- 20.1.8.2 Products/Solutions/Services offered

- 20.1.8.3 Recent developments

- 20.1.8.3.1 Developments

- 20.1.9 JUNGHEINRICH AG

- 20.1.9.1 Business overview

- 20.1.9.2 Products/Solutions/Services offered

- 20.1.9.3 Recent developments

- 20.1.9.3.1 Product launches

- 20.1.9.3.2 Deals

- 20.1.9.3.3 Expansions

- 20.1.10 MEIDENSHA CORPORATION

- 20.1.10.1 Business overview

- 20.1.10.2 Products/Solutions/Services offered

- 20.1.10.3 Recent developments

- 20.1.10.3.1 Product launches

- 20.1.11 MITSUBISHI LOGISNEXT CO., LTD.

- 20.1.11.1 Business overview

- 20.1.11.2 Products/Solutions/Services offered

- 20.1.11.3 Recent developments

- 20.1.11.3.1 Deals

- 20.1.12 OCEANEERING INTERNATIONAL, INC.

- 20.1.12.1 Business overview

- 20.1.12.2 Products/Solutions/Services offered

- 20.1.12.3 Recent developments

- 20.1.12.3.1 Expansions

- 20.1.12.3.2 Other developments

- 20.1.1 DAIFUKU CO., LTD.

- 20.2 OTHER PLAYERS

- 20.2.1 NEURA MOBILE ROBOTS GMBH

- 20.2.2 AMERICA IN MOTION, INC.

- 20.2.3 ASSECO CEIT, A.S.

- 20.2.4 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- 20.2.5 JIANGXI DANBAHE ROBOT CO., LTD.

- 20.2.6 E80 GROUP S.P.A.

- 20.2.7 GLOBAL AGV

- 20.2.8 GRENZEBACH GROUP

- 20.2.9 IDC CORPORATION

- 20.2.10 NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.

- 20.2.11 SAFELOG GMBH

- 20.2.12 SIMPLEX ROBOTICS PVT. LTD.

- 20.2.13 SYSTEM LOGISTICS S.P.A.

- 20.2.14 BALYO

21 RESEARCH METHODOLOGY

- 21.1 RESEARCH DATA

- 21.1.1 SECONDARY AND PRIMARY RESEARCH

- 21.1.2 SECONDARY DATA

- 21.1.2.1 List of major secondary sources

- 21.1.2.2 Key data from secondary sources

- 21.1.3 PRIMARY DATA

- 21.1.3.1 Primary interviews with experts

- 21.1.3.2 Key data from primary sources

- 21.1.3.3 Key industry insights

- 21.1.3.4 Breakdown of primaries

- 21.2 MARKET SIZE ESTIMATION

- 21.2.1 BOTTOM-UP APPROACH

- 21.2.2 TOP-DOWN APPROACH

- 21.2.3 MARKET SIZE CALCULATION FOR BASE YEAR

- 21.3 MARKET FORECAST APPROACH

- 21.3.1 SUPPLY SIDE

- 21.3.2 DEMAND SIDE

- 21.4 DATA TRIANGULATION

- 21.5 RESEARCH ASSUMPTIONS

- 21.6 RESEARCH LIMITATIONS

- 21.7 RISK ASSESSMENT

22 APPENDIX

- 22.1 DISCUSSION GUIDE

- 22.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 22.3 CUSTOMIZATION OPTIONS

- 22.4 RELATED REPORTS

- 22.5 AUTHOR DETAILS