|

시장보고서

상품코드

1927584

외부 단열 및 마감 시스템(EIFS) 시장 : 유형별, 단열재 유형별, 용도별, 지역별 - 예측(-2030년)Exterior Insulation and Finish System Market by Type (Polymer-based and Polymer-modified ), Insulation Type (Expanded Polystyrene, Mineral Wool, and Other Insulation Types), End-use, and Region - Global Forecast To 2030 |

||||||

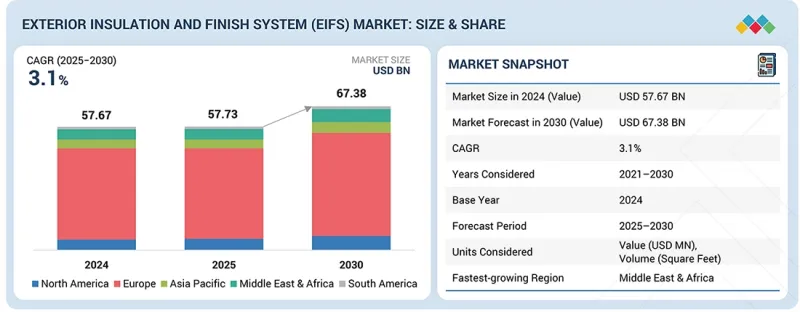

세계의 외부 단열 및 마감 시스템(EIFS) 시장 규모는 2025년에 577억 3,000만 달러, 2030년까지 673억 8,000만 달러에 이를 것으로 예측되고, 2025년-2030년 CAGR 3.1%의 성장이 전망되고 있습니다.

에너지 효율이 높은 건축물에 대한 수요 증가와 대부분의 지역에서 강화되고 있는 건물 에너지 기준의 강화로 인해 시장이 확대될 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 단위 | 금액(100만 달러)/면적(sq. ft.) |

| 부문 | 유형, 단열재 유형, 최종 용도, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

비주거 시장에서의 건설 증가도 시장 성장에 크게 기여하고 있습니다. 또한, EIFS는 에너지 사용의 장기적인 절감과 건축물의 내구성을 제공합니다.

"폴리머 기반 부문이 2025-2030년 가장 높은 CAGR을 보일 것으로 예측됩니다. "

폴리머 기반은 예측 기간 동안 외부 단열 및 마감 시스템(EIFS) 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 폴리머 베이스 유형이 기존 소재에 비해 유연성, 내균열성, 내구성 면에서 우수하기 때문입니다. 내후성이 뛰어나며, 아름다운 마감으로 현대 건축 디자인에 잘 어울립니다. 또한, 신축 및 개보수 공사에 대한 수요 증가도 그 채택을 더욱 증가시키고 있습니다.

"발포 폴리스티렌(EPS) 부문이 2030년에 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. "

외부 단열 및 마감 시스템(EIFS) 시장에서 가장 큰 단열재는 발포 폴리스티렌(EPS)입니다. 이는 가볍고 우수한 단열 성능을 가지고 있으며, 저렴한 비용이기 때문입니다. 시공이 용이하고 모든 EIFS 설계에 적합하기 때문에 시공업체들 사이에서 가장 인기 있는 유형 중 하나입니다.

"비주거 부문이 2025-2030년 동안 가장 높은 CAGR을 보일 것으로 예측됩니다. "

비주거용 최종 용도 부문은 예측 기간 동안 외부 단열 및 마감 시스템(EIFS) 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 상업용 건물, 사무실, 병원, 호텔, 공공시설에 대한 투자 증가에 따른 것입니다. 비주거용 건축물에 EIFS의 사용은 에너지 절약과 다양한 설계에 대응할 수 있는 능력으로 인해 인기가 높아지고 있습니다. 또한, 정부 및 민간 개발업체들도 지속 가능하고 친환경적인 건축 솔루션을 중요시하고 있으며, 이는 수요 증가에 기여하고 있습니다.

"중동 및 아프리카의 외부 단열 및 마감 시스템(EIFS) 시장은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. "

중동 및 아프리카에서는 급속한 도시화, 인구 증가, 대규모 인프라 개발로 인해 외부 단열 및 마감 시스템(EIFS) 시장이 급성장하고 있습니다. 고온의 기후 조건에서는 우수한 단열성이 요구되기 때문에 EIFS에 대한 수요가 증가하고 있습니다.

세계의 외부 단열 및 마감 시스템(EIFS) 시장에 대해 조사 분석했으며, 주요 촉진요인 및 저해요인, 제품 개발 및 혁신, 경쟁 구도 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 지견

- 외부 단열 및 마감 시스템(EIFS) 시장의 매력적인 기회

- 유럽 EIFS : 용도별, 국가별

- EIFS 시장 : 유형별

- EIFS 시장 : 단열재 별

- EIFS 시장 : 최종 용도별

- EIFS 시장 : 국가별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 외부 단열 및 마감 시스템(EIFS) 시장 미충족 요구

- 화이트 스페이스 기회

- 연결된 시장과 부문간 기회

- 연결된 시장

- 부문간 기회

- 도시 인프라?지속가능건축

- Tier 1/2/3 기업의 전략적 움직임

- Tier 1 기업 : 통합과 혁신을 추진하는 세계 리더

- SIKA - EIFS 관련 건설용 화학제품 플랫폼 확대를 향한 인수

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 분석

- 밸류체인 분석

- 생태계 분석

- 무역 분석

- 수입 시나리오(HS코드 680610)

- 수출 시나리오(HS코드 680610)

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 2025년 미국 관세의 영향 : 외부 단열 및 마감 시스템(EIFS) 시장

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 부문에 대한 영향

제6장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 이니셔티브

- 지속가능성에 대한 영향과 규제 정책 대처

- 인증, 라벨, 환경기준

제7장 기술, 특허, 디지털, AI 채택에 의한 전략적 파괴

- 주요 신기술

- 프리패브/패널 EIFS

- 3D 프린팅·커스터마이즈 패널

- 보완 기술

- 인접 기술

- 기술/제품 로드맵

- 단기|퍼포먼스 최적화·디지털 이동 단계(2025년-2027년)

- 중기 : 시스템 통합·기능 혁신 단계(2027년-2030년)

- 장기 : 인텔리전트, 어댑티브, 데이터드리분 EIFS 단계(2030년-2035년 이후)

- 특허 분석

- 접근

- 문서 유형

- 관할 분석

- 주요 출원자

- 향후 용도

- 스마트 센서 통합형 EIFS(디지털 빌딩 포락선)

- 카본 네가티브·순환형 EIFS

- 넷 제로·에너지 생성 EIFS

- 동적인 열·습도 응답기능을 갖춘 자기 적응형 EIFS

- 미적 적응성과 디자인성을 겸비한 커스텀 EIFS

- 외부 단열 및 마감 시스템(EIFS) 시장에 대한 AI/생성형 AI의 영향

- 주요 이용 사례와 시장 장래성

- EIFS 베스트 프랙티스

- 외부 단열 및 마감 시스템(EIFS) 시장 AI도입에 관한 사례 연구

- 상호 접속된 에코시스템과 시장 기업에 대한 영향

- AI 통합형 EIFS 솔루션 채택에 대한 고객 준비 상황

- 성공 사례와 실세계에의 응용

- ROCKWOOL 단열재가 도시 재생을 가능하게 한다

- Dryvit Outsulite 패널이 구면 프레하브크랏딘그를 가능하게 한다

- FenX 미네랄 폼 기술이 광물 폐기물을 지속가능단열 패널로 바꾼다

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 미충족 요구

- 시장 수익성

- 잠재적인 매출

- 비용 역학

- 마진 기회 : 용도별

제9장 EIFS 시장 : 컴포넌트별

- 접착제

- 단열 보드

- 베이스코트

- 강화

- 마무리 코트

제10장 EIFS 시장 : 두께별

- 1-2인치

- 3-6인치

- 6인치 이상

제11장 EIFS 시장 : 단열재별

- 발포 폴리스티렌(EPS)

- 미네랄울(MW)

- 기타 단열재

제12장 EIFS 시장 : 유형별

- 폴리머 기반(PB)

- 폴리머 개질(PM)

제13장 EIFS 시장 : 최종 용도별

- 주택

- 비주택

- 상업 빌딩

- 산업 빌딩

- 기타 비주택 건물

제14장 EIFS 시장 : 지역별

- 유럽

- 영국

- 독일

- 프랑스

- 폴란드

- 이탈리아

- 스페인

- 기타 유럽

- 북미

- 미국

- 캐나다

- 중동 및 아프리카

- GCC 국가

- 사우디아라비아

- 아랍에미리트

- 기타 GCC 국가

- 튀르키예

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제15장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가와 재무 지표

- 재무 지표

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- BASF

- SAINT-GOBAIN

- SIKA AG

- WACKER CHEMIE AG

- OWENS CORNING

- STO SE & CO. KGAA

- RPM INTERNATIONAL INC.

- SFS GROUP AG

- ROCKWOOL A/S

- MASTER WALL INC.

- ADDITIONAL PLAYERS

- KINGSPAN GROUP PLC

- DURABOND PRODUCTS LTD

- DUROCK ALFACING INTERNATIONAL LIMITED

- TERRACO HOLDINGS LTD.

- OMEGA PRODUCTS INTERNATIONAL

- ADEX SYSTEMS

- IVAS GROUP

- FORMA INSULATION

- ATLAS MOLDED PRODUCTS

- VA-Q-TEC THERMAL SOLUTIONS GMBH

- FENX

- CABOT GYPSUM

- EASTERN EXTERIOR WALL SYSTEMS, INC.

- INDINATURE

- CELLOFOAM NORTH AMERICA INC.

제17장 조사 방법

제18장 부록

LSHThe exterior insulation and finish system (EIFS) market size is projected to be USD 57.73 billion in 2025 and USD 67.38 billion by 2030, at a CAGR of 3.1% from 2025 to 2030. The exterior insulation and finish system (EIFS) market will expand owing to the rise in demand for energy-efficient buildings and building energy codes that are stricter in most regions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Square Feet) |

| Segments | Type, Insulation Type, End-use, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The increase in construction in residential and non-residential markets also contributes well to the growth in the market. Also, exterior insulation and finish systems provide long-term savings in energy usage and the durability of buildings.

"Polymer-based segment is projected to exhibit the highest CAGR from 2025 to 2030."

Polymer-based is expected to record the highest CAGR in the exterior insulation and finish system (EIFS) market during the forecast period, because polymer-based types are superior in terms of flexibility, crack resistance, and durability compared to traditional materials. These are more resistant to weather and have improved aesthetic finishes, hence fit in the modern architectural designs. There is also a growing demand for new construction and renovation works that are further increasing its adoption.

"Expanded polystyrene (EPS) segment is projected to capture the largest market share in 2030."

The largest insulation material in the exterior insulation and finish system (EIFS) market is expanded polystyrene (EPS), as it is lightweight, has good thermal insulation capacity, and is low-cost. It is simple to install, and it fits in any kind of exterior insulation and finish system design and is therefore one of the most popular types among contractors.

"Non-residential segment is projected to exhibit the highest CAGR from 2025 to 2030."

The non-residential end-use segment is expected to record the highest CAGR in the exterior insulation and finish system (EIFS) market during the forecast period, owing to an increase in investments in commercial buildings, offices, hospitals, hotels, and institutional infrastructure. The use of exterior insulation and finish systems in non-residential buildings is gaining popularity because of their energy-efficient nature and capability to be designed in a variety of ways. In addition, the governments and private developers are also targeting sustainable and green building solutions, which are also contributing to the demand.

"The Middle East & Africa exterior insulation and finish system (EIFS) market is projected to grow at the highest CAGR during the forecast period."

The Middle East & Africa are experiencing high growth in the exterior insulation and finish system (EIFS) market due to rapid urbanization, population growth, and massive infrastructure development. The hot weather conditions demand good thermal insulation, which makes exterior insulation and finish systems more popular.

By Company Type: Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

By Designation: C-level Executives - 33, Directors - 33%, and Others - 34%

By Region: North America - 20%, Europe - 25%, Asia Pacific - 25%, South America - 10%, and Middle East & Africa - 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: BASF SE (Germany), Saint-Gobain (France), Sika AG (Switzerland), Wacker Chemie AG (Germany), Owens Corning (US), STO SE & Co. KGaA (Germany), RPM International (US), among other companies are covered in the report.

The study includes an in-depth competitive analysis of these key players in the exterior insulation and finish system (EIFS) market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the exterior insulation and finish system (EIFS) market based on type (polymer-based (PB), and polymer-modified (PM)), insulation type (expanded polystyrene (EPS), mineral wool (MW), and other insulation types), end-use (residential, and non-residential), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the exterior insulation and finish system (EIFS) market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as mergers & acquisitions, collaborations, partnerships, product launches, expansions, and research & development, associated with the exterior insulation and finish system (EIFS) market. This report covers a competitive analysis of upcoming startups in the exterior insulation and finish system (EIFS) market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall exterior insulation and finish system (EIFS) market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

Analysis of key drivers (Urbanization and infrastructure-led construction growth), restraints (High dependence on skilled labor and installation quality limits adoption), opportunities (Advanced materials and smart exterior insulation and finish system technologies), and challenges (Limited awareness among end users)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the exterior insulation and finish system (EIFS) market

- Market Development: Comprehensive information about profitable markets-the report analyzes the exterior insulation and finish system (EIFS) market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the exterior insulation and finish system (EIFS) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as BASF SE (Germany), Saint-Gobain (France), Sika AG (Switzerland), Wacker Chemie AG (Germany), Owens Corning (US), STO SE & Co. KGaA (Germany), RPM International (US), and others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

- 3.2 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEMS, BY END USE AND COUNTRY

- 3.3 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY TYPE

- 3.4 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY INSULATION MATERIAL

- 3.5 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY END USE

- 3.6 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Urbanization and infrastructure-led construction growth

- 4.2.1.2 GHGs reduction & sustainability initiatives

- 4.2.1.3 Need to reduce energy consumption and focus on green buildings

- 4.2.1.4 Introduction of rebates and tax credits

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront costs limiting adoption across price-sensitive construction markets

- 4.2.2.2 High dependence on skilled labor and installation quality limits adoption

- 4.2.2.3 Availability of alternative green insulation material

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advanced materials and smart exterior insulation and finish system technologies

- 4.2.4 CHALLENGES

- 4.2.4.1 Limited awareness among end users

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.4.2.1 Construction ↔ energy efficiency

- 4.4.3 URBAN INFRASTRUCTURE ↔ SUSTAINABLE BUILDING

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 4.5.1.1 SAINT-GOBAIN - STRATEGIC ACQUISITIONS TO STRENGTHEN EXTERIOR INSULATION AND FINISH SYSTEM AND FACADE SOLUTIONS

- 4.5.2 SIKA - ACQUISITION TO EXPAND EXTERIOR INSULATION AND FINISH SYSTEM-RELATED CONSTRUCTION CHEMICALS PLATFORM

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC ANALYSIS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECASTS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PRICING ANALYSIS

- 5.4.1.1 Pricing analysis based on region

- 5.4.1 PRICING ANALYSIS

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT SCENARIO (HS CODE 680610)

- 5.5.2 EXPORT SCENARIO (HS CODE 680610)

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.8.1 IMPACT OF 2025 US TARIFF: EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

- 5.8.1.1 Introduction

- 5.8.2 KEY TARIFF RATES

- 5.8.3 PRICE IMPACT ANALYSIS

- 5.8.4 IMPACT ON COUNTRY/REGION

- 5.8.4.1 US

- 5.8.4.2 Asia Pacific

- 5.8.4.3 Europe

- 5.8.5 END-USE SECTOR IMPACT

- 5.8.1 IMPACT OF 2025 US TARIFF: EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

6 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 INDUSTRY STANDARDS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GRAPHENE

- 6.2.1.1 Carbon Impact Reduction

- 6.2.1.2 Eco-Applications

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF GRAPHENE

- 6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 6.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 PREFABRICATED/PANELIZED EXTERIOR INSULATION AND FINISH SYSTEMS

- 7.1.2 3D PRINTING AND CUSTOMIZED PANELS

- 7.1.3 COMPLEMENTARY TECHNOLOGIES

- 7.1.3.1 Advanced polymeric binders and coatings

- 7.1.3.2 Fire-resistant and non-combustible insulation materials

- 7.1.4 ADJACENT TECHNOLOGIES

- 7.1.4.1 Building information modelling (BIM) & digital design tools

- 7.1.4.2 Smart building envelopes & IoT integration

- 7.2 TECHNOLOGY/PRODUCT ROADMAP

- 7.2.1 SHORT-TERM (2025-2027) | PERFORMANCE OPTIMIZATION & DIGITAL TRANSITION PHASE

- 7.2.2 MID-TERM (2027-2030): SYSTEM INTEGRATION & FUNCTIONAL INNOVATION PHASE

- 7.2.3 LONG-TERM (2030-2035+): INTELLIGENT, ADAPTIVE & DATA-DRIVEN EXTERIOR INSULATION AND FINISH SYSTEMS PHASE

- 7.3 PATENT ANALYSIS

- 7.3.1 INTRODUCTION

- 7.3.2 APPROACH

- 7.3.3 DOCUMENT TYPE

- 7.3.4 JURISDICTION ANALYSIS

- 7.3.5 TOP APPLICANTS

- 7.4 FUTURE APPLICATIONS

- 7.4.1 SMART & SENSOR-INTEGRATED EXTERIOR INSULATION AND FINISH SYSTEMS (DIGITAL BUILDING ENVELOPES)

- 7.4.2 CARBON-NEGATIVE & CIRCULAR EXTERIOR INSULATION AND FINISH SYSTEMS

- 7.4.3 NET-ZERO AND ENERGY-GENERATING EXTERIOR INSULATION AND FINISH SYSTEMS

- 7.4.4 SELF-ADAPTIVE EXTERIOR INSULATION AND FINISH SYSTEMS WITH DYNAMIC THERMAL & MOISTURE RESPONSE

- 7.4.5 AESTHETICALLY ADAPTIVE & DESIGN-CUSTOM EXTERIOR INSULATION AND FINISH SYSTEMS

- 7.5 IMPACT OF AI/GEN AI ON EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

- 7.5.1 TOP USE CASES AND MARKET POTENTIAL

- 7.5.2 BEST PRACTICES IN EXTERIOR INSULATION AND FINISH SYSTEMS

- 7.5.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN EXTERIOR INSULATION AND FINISH SYSTEMS MARKET

- 7.5.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.5.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED EXTERIOR INSULATION AND FINISH SYSTEM SOLUTIONS

- 7.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.6.1 ROCKWOOL INSULATION ENABLES URBAN REGENERATION THROUGH RENOVATION

- 7.6.2 DRYVIT OUTSULITE PANELS ENABLE PREFABRICATED CLADDING FOR THE SPHERE

- 7.6.3 FENX'S MINERAL FOAM TECHNOLOGY TRANSFORMS MINERAL WASTE INTO SUSTAINABLE INSULATION PANELS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END USE

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES BY APPLICATION

9 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 ADHESIVE

- 9.3 INSULATION BOARD

- 9.4 BASE COAT

- 9.5 REINFORCEMENT

- 9.6 FINISH COAT

10 EXTERNAL INSULATION AND FINISH SYSTEMS MARKET, BY THICKNESS

- 10.1 INTRODUCTION

- 10.2 1-2 INCHES

- 10.3 3-6 INCHES

- 10.4 MORE THAN 6 INCHES

11 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY INSULATION MATERIAL

- 11.1 INTRODUCTION

- 11.2 EXPANDED POLYSTYRENE (EPS)

- 11.2.1 RISING USE OF EPS/XPS IN FACADE, ROOF, AND WALL APPLICATIONS TO DRIVE DEMAND

- 11.3 MINERAL WOOL (MW)

- 11.3.1 GROWTH OF HIGH-RISE AND URBAN CONSTRUCTION REQUIRING LIGHTWEIGHT FACADE SYSTEMS TO AUGMENT DEMAND

- 11.4 OTHER INSULATION MATERIALS

12 EXTERIOR INSULATION FINISH SYSTEMS MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 POLYMER-BASED (PB)

- 12.3 POLYMER-MODIFIED (PM)

13 EXTERNAL INSULATION AND FINISH SYSTEMS MARKET, BY END USE

- 13.1 INTRODUCTION

- 13.2 RESIDENTIAL

- 13.3 NON-RESIDENTIAL

- 13.3.1 COMMERCIAL BUILDINGS

- 13.3.2 INDUSTRIAL BUILDINGS

- 13.3.3 OTHER NON-RESIDENTIAL BUILDINGS

14 EXTERIOR INSULATION AND FINISH SYSTEMS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 EUROPE

- 14.2.1 UK

- 14.2.1.1 New construction projects to drive demand

- 14.2.2 GERMANY

- 14.2.2.1 Booming construction industry to drive market

- 14.2.3 FRANCE

- 14.2.3.1 Growth in construction industry to propel demand

- 14.2.4 POLAND

- 14.2.4.1 Rising demand for commercial spaces to drive market

- 14.2.5 ITALY

- 14.2.5.1 Need to reduce energy consumption to drive market

- 14.2.6 SPAIN

- 14.2.6.1 Increasing LEED green building initiatives to boost market

- 14.2.7 REST OF EUROPE

- 14.2.1 UK

- 14.3 NORTH AMERICA

- 14.3.1 US

- 14.3.1.1 Sustainability frameworks and government policies to drive market

- 14.3.2 CANADA

- 14.3.2.1 Expanding construction activities to drive market

- 14.3.2.2 Growing residential and non-residential projects to support market growth

- 14.3.1 US

- 14.4 MIDDLE EAST & AFRICA

- 14.4.1 GCC COUNTRIES

- 14.4.2 SAUDI ARABIA

- 14.4.2.1 Expanding construction industry to drive demand for exterior insulation and finish system

- 14.4.3 UAE

- 14.4.3.1 Expansion of real estate sector to drive demand

- 14.4.4 REST OF GCC COUNTRIES

- 14.4.5 TURKEY

- 14.4.5.1 Government initiatives to drive demand for exterior insulation and finish systems

- 14.4.6 SOUTH AFRICA

- 14.4.6.1 Government investment and energy projects drive demand for intumescent coatings

- 14.4.7 REST OF MIDDLE EAST & AFRICA

- 14.5 ASIA PACIFIC

- 14.5.1 CHINA

- 14.5.1.1 Large-scale urban renewal and energy-saving renovation programs to propel market

- 14.5.2 JAPAN

- 14.5.2.1 High vulnerability to natural disasters to drive market

- 14.5.3 INDIA

- 14.5.3.1 Massive infrastructure expansion and rapid urbanization to drive market

- 14.5.4 SOUTH KOREA

- 14.5.4.1 Zero-energy building mandates and stricter building energy standards to drive market

- 14.5.5 AUSTRALIA

- 14.5.5.1 Large public infrastructure pipeline to propel market

- 14.5.6 REST OF ASIA PACIFIC

- 14.5.1 CHINA

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Growing demand for energy-efficient facade systems to boost market

- 14.6.2 ARGENTINA

- 14.6.2.1 Increasing government expenditure on construction projects to propel market

- 14.6.3 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS

- 15.5 BRAND COMPARISON

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Region footprint

- 15.6.5.3 Type footprint

- 15.6.5.4 Insulation material footprint

- 15.6.5.5 Component footprint

- 15.6.5.6 End use footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.7.5.1 Detailed list of key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.8.1 COMPANY VALUATION

- 15.9 FINANCIAL METRICS

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 BASF

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weakness and competitive threats

- 16.1.2 SAINT-GOBAIN

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.3.2 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 SIKA AG

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 WACKER CHEMIE AG

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 OWENS CORNING

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 STO SE & CO. KGAA

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Expansions

- 16.1.6.4 MnM view

- 16.1.7 RPM INTERNATIONAL INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.4 MnM view

- 16.1.8 SFS GROUP AG

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.4 MnM view

- 16.1.9 ROCKWOOL A/S

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Expansions

- 16.1.9.4 MnM view

- 16.1.10 MASTER WALL INC.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.4 MnM view

- 16.1.1 BASF

- 16.2 ADDITIONAL PLAYERS

- 16.2.1 KINGSPAN GROUP PLC

- 16.2.2 DURABOND PRODUCTS LTD

- 16.2.3 DUROCK ALFACING INTERNATIONAL LIMITED

- 16.2.4 TERRACO HOLDINGS LTD.

- 16.2.5 OMEGA PRODUCTS INTERNATIONAL

- 16.2.6 ADEX SYSTEMS

- 16.2.7 IVAS GROUP

- 16.2.8 FORMA INSULATION

- 16.2.9 ATLAS MOLDED PRODUCTS

- 16.2.10 VA-Q-TEC THERMAL SOLUTIONS GMBH

- 16.2.11 FENX

- 16.2.12 CABOT GYPSUM

- 16.2.13 EASTERN EXTERIOR WALL SYSTEMS, INC.

- 16.2.14 INDINATURE

- 16.2.15 CELLOFOAM NORTH AMERICA INC.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.2 SECONDARY DATA

- 17.2.1 KEY DATA FROM SECONDARY SOURCES

- 17.3 PRIMARY DATA

- 17.3.1 KEY DATA FROM PRIMARY SOURCES

- 17.4 MARKET SIZE ESTIMATION

- 17.5 DATA TRIANGULATION

- 17.6 RESEARCH ASSUMPTIONS

- 17.7 RISK ASSESSMENT

- 17.8 GROWTH RATE ASSUMPTIONS

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 AUTHOR DETAILS