|

시장보고서

상품코드

1927588

수술용 로봇 시장 : 제공 제품별, 용도별, 최종사용자별, 지역별 - 예측(-2030년)Surgical Robots Market By Product (Instruments & Accessories, Robotic Systems (Laparoscopy, Orthopedic), Services), Application (Urological Surgery, Orthopedic Surgery), End User (Hospitals, Clinics, Ambulatory Surgery Centers) - Global Forecast to 2030 |

||||||

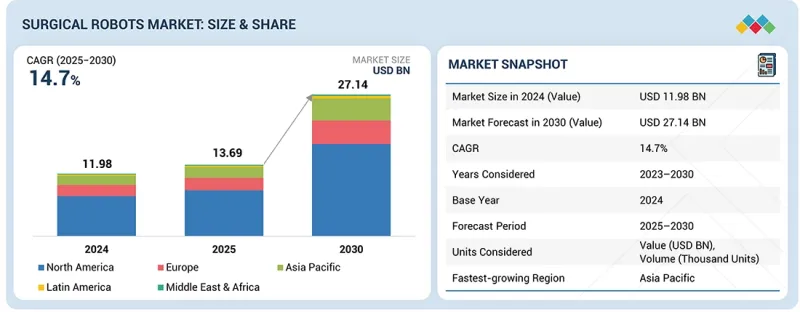

세계의 수술용 로봇 시장 규모는 예측 기간 중에 CAGR 14.7%로 성장하여 2025년 136억 9,000만 달러에서 2030년에는 271억 4,000만 달러에 이를 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공 제품별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

수술용 로봇 시장은 의료진이 수술의 정확도 향상, 환자 결과 개선, 최소 침습 수술 지원을 목적으로 로봇 지원 시스템 도입을 확대함에 따라 괄목할 만한 성장세를 보이고 있습니다. 회복 기간 단축, 합병증 감소, 입원 기간 단축에 대한 수요 증가로 인해 병원에서는 여러 전문 분야에 걸쳐 로봇 기술에 대한 투자를 촉진하고 있습니다. 영상 기술의 향상, AI 기반 안내, 보다 컴팩트한 로봇 플랫폼 등 지속적인 기술 발전으로 로봇 수술의 임상 적용 범위가 확대되고 있습니다. 동시에 외과의사 교육 프로그램 확대, 지원적 상환 제도, 환자 인식 개선도 도입에 박차를 가하고 있습니다. 이러한 요인들이 복합적으로 작용하여 로봇 보조 수술의 세계 보급 범위를 넓혀가고 있습니다.

수술용 로봇 시장에서 기구 및 액세서리 부문이 가장 큰 비중을 차지하는 이유는 이들 부품이 모든 로봇 수술에 필수적이기 때문에 안정적이고 지속적인 수요가 발생하기 때문입니다. 로봇 시스템 자체는 초기 투자형 설비투자이지만, 스테이플러, 가위, 집게, 에너지 장치 등의 기구 및 기타 소모품은 일정 횟수 사용 후 교체가 필요하기 때문에 지속적인 이용과 수익이 보장됩니다. 또한, 시각 도구, 포트, 트로카 등의 액세서리도 시스템 기능에 필수적이며, 자주 보충해야 합니다. 로봇 수술 건수 증가와 병원의 로봇 프로그램 확대에 따라 기구 및 액세서리 소비가 비례적으로 증가하여 이 부문이 전체 시장 수익에 가장 큰 기여를 하고 있습니다.

병원-병원이 수술용 로봇 시장을 주도하고 있는 배경에는 수술 수행의 주요 거점이라는 점과 함께 로봇 기술 도입에 필요한 시설, 자금, 훈련된 인력을 보유하고 있다는 점을 들 수 있습니다. 이들 기관은 수술 정확도 향상, 환자 결과 개선, 임상 워크플로우 효율화를 목적으로 로봇 기술에 투자하고 있습니다. 저침습 수술에 대한 유리한 수가 정책도 로봇 시스템 도입을 더욱 부추기고 있습니다. 또한, 대부분의 외과의사들은 병원 환경에서 로봇 수술에 대한 교육을 받기 때문에 로봇 수술의 활용도가 높아지고 있습니다. 환자들이 고도의 최소침습적 치료에 대한 기대가 높아지는 가운데, 병원 및 클리닉은 여전히 시장에서 가장 크고 영향력 있는 최종 사용자로 남아있습니다.

미국은 첨단 의료 기술 도입에 대한 강한 집중, 로봇 보조 수술 프로그램의 급속한 확대, 병원 인프라에 대한 지속적인 투자로 인해 북미 수술용 로봇 시장에서 가장 높은 CAGR로 성장할 것으로 예측됩니다. 중국에는 숙련된 외과의사의 풍부한 인력 기반, 광범위한 임상 연구 활동, 최소 침습 수술에 대한 높은 환자 수요 등의 이점이 있어 로봇 플랫폼의 도입을 가속화하고 있습니다. 유리한 상환 정책, 주요 로봇 수술 제조업체의 강력한 존재감, 지속적인 제품 혁신이 추가 성장을 뒷받침하고 있습니다. 또한, 미국 의료 시스템이 환자 결과 개선, 입원 기간 단축, 수술 정확도 향상에 중점을 두고 있다는 점도 다른 지역 국가들에 비해 수술용 로봇 도입이 가속화되고 있습니다.

수술용 로봇 시장의 주요 기업으로는 Intuitive Surgical(미국), Stryker(미국), Medtronic(아일랜드), Smith+Nephew(영국), Zimmer Biomet(미국), Asensus Surgical(미국), Siemens Healthineers(독일), CMR Surgical(영국), Johnson &Johnson(미국), Renishaw Plc(영국)입니다.

조사 범위:

이 보고서는 수술용 로봇 시장을 분석하여 제공 제품, 용도, 최종 사용자, 지역 등 다양한 부문을 기반으로 시장 규모와 미래 성장 잠재력을 추정하는 것을 목표로 합니다. 또한, 주요 기업의 경쟁 분석과 함께 기업 프로파일, 서비스 제공 내용, 최근 동향, 주요 시장 전략에 대해서도 기술하고 있습니다.

본 보고서 구매 이유

이 보고서는 전체 수술용 로봇 시장의 수익 수치에 대한 가장 정확한 추정치를 제공하여 시장 리더와 신규 시장 진출기업에게 도움이 될 것입니다. 이해관계자들이 경쟁 구도를 이해하고, 사업 포지셔닝을 최적화하고 적절한 시장 진출 전략을 수립하는 데 도움이 되는 귀중한 인사이트를 얻을 수 있도록 돕습니다. 또한 주요 시장 성장 촉진요인, 억제요인, 과제, 기회에 대한 정보를 제공하고 시장 동향을 파악하는 데 도움이 될 것입니다.

이 보고서는 다음 사항에 대한 인사이트를 제공합니다.

- 주요 촉진요인(로봇 보조 수술의 장점, 기술 발전, 상환 상황 개선, 수술용 로봇 도입 확대, 의료용 로봇 연구에 대한 자금 증가), 억제요인(로봇 시스템의 높은 비용), 기회요인(외래수술센터(ASC)에서의 수술용 로봇 보급 확대, 신흥 시장에서의 성장 기회), 과제(수술 실수) 분석. 수술 실수) 분석.

- 시장 침투: 이 보고서에는 세계 수술용 로봇 시장의 주요 업체들이 제공하는 제품에 대한 자세한 정보가 포함되어 있습니다. 제공 형태, 용도, 최종 사용자, 지역별로 다양한 부문을 다루고 있습니다.

- 제품 강화 및 혁신 : 세계 수술용 로봇 시장의 신제품 출시 현황 및 예측 동향에 대한 종합적인 상세 정보.

- 시장 개발: 제품, 용도, 최종 사용자, 지역별로 수익성 높은 성장 시장에 대한 상세한 인사이트와 분석을 제공합니다.

- 시장 다각화 : 세계 수술용 로봇 시장의 신제품 출시, 시장 확대, 현재 진행 상황, 투자에 대한 종합적인 정보를 제공합니다.

- 경쟁사 평가: 세계 수술용 로봇 시장에서 주요 경쟁사 시장 점유율, 성장 계획, 제품 제공 내용, 생산 능력에 대한 상세한 평가.

목차

제1장 서론

제2장 주요 요약

제3장 시장 개요

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 연결된 시장과 분야간 기회

- Tier1/2/3 기업의 전략적 움직임

제4장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 데이터 분석

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세가 수술 로봇 시장에 미치는 영향

제5장 기술 진보, AI 별 영향, 특허, 혁신, 향후 응용

- 주요 신기술

- 기술/제품 로드맵

- 특허 분석

- 수술용 로봇 향후 응용

- AI/생성형 AI가 수술용 로봇 시장에 미치는 영향

제6장 규제 상황

- 지역 규제와 컴플라이언스

- 인증, 라벨, 환경기준

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 평가 기준

- 채택 장벽과 내부 과제

- 최종 이용 산업 미충족 요구

- 시장 수익성

제8장 수술용 로봇 시장(제공 제품별)

- 의료기기 및 부속품

- 로봇 시스템

- 서비스

제9장 수술용 로봇 시장(용도별)

- 일반외과

- 부인과 수술

- 정형외과

- 비뇨기과수술

- 뇌신경 외과

- 현미수술

- 이비과 수술

- 기타

제10장 수술용 로봇 시장(최종사용자별)

- 병원 및 클리닉

- 외래수술센터(ASC)

제11장 수술용 로봇 시장(지역별)

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- GCC 국가

- 기타

제12장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 개요

- 주요 시장 진출기업

- INTUITIVE SURGICAL OPERATIONS, INC.

- STRYKER

- ZIMMER BIOMET

- MEDTRONIC

- SMITH+NEPHEW

- ASENSUS SURGICAL US, INC.

- SIEMENS HEALTHINEERS AG

- RENISHAW PLC

- GLOBUS MEDICAL

- JOHNSON & JOHNSON

- CMR SURGICAL LTD.

- THINK SURGICAL, INC.

- CORIN GROUP

- MICROSURE

- AVATERAMEDICAL GMBH

- MEDICAL MICROINSTRUMENTS, INC.

- MEDICAROID CORPORATION

- BRAINLAB SE

- ECENTIAL ROBOTICS

- SS INNOVATIONS INTERNATIONAL, INC.

- 기타 기업

- MONTERIS

- MOMENTIS INNOVATIVE SURGERY

- TINAVI MEDICAL TECHNOLOGIES CO., LTD.

- DISTALMOTION SA

- NOVUS SAGLIK URUNLERI AR-GE DANISMANLIK(NOVUS ARGE)

제14장 조사 방법

제15장 부록

LSHThe global surgical robots market is projected to reach USD 27.14 billion by 2030 from USD 13.69 billion in 2025, at a CAGR of 14.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The surgical robots market is experiencing strong growth as healthcare providers increasingly adopt robotic-assisted systems to enhance surgical precision, improve patient outcomes, and support minimally invasive procedures. The rising demand for faster recovery, reduced complications, and shorter hospital stays is driving hospitals to invest in robotics across multiple specialties. Continuous technological advancements, such as improved imaging, AI-driven guidance, and more compact robotic platforms, are expanding the clinical applications of robotic surgery. At the same time, the growth of surgeon training programs, supportive reimbursement structures, and increased patient awareness are accelerating adoption. Together, these factors are pushing the market forward and broadening the global footprint of robotic-assisted surgery.

"By offering, the instruments & accessories segment held the largest market share in 2024."

The instruments & accessories segment accounts for the largest share of the surgical robots market because these components are required for every robotic procedure, creating steady and recurring demand. While robotic systems are a one-time capital investment, instruments such as staplers, scissors, graspers, energy devices, and other consumables must be replaced after a limited number of uses, ensuring continuous utilization and revenue. Accessories, such as vision tools, ports, and trocars, are also essential for system functionality and require frequent replenishment. As robotic procedure volumes continue to rise and hospitals expand their robotic programs, the consumption of instruments and accessories grows proportionally, making this segment the most significant contributor to overall market revenue.

"By end user, the hospitals & clinics segment accounted for the largest market share in 2024."

Hospitals & clinics dominate the surgical robots market because they are the primary locations where surgeries are performed and have the necessary facilities, financial resources, and trained personnel to adopt robotic technologies. These institutions invest in robotics to improve surgical precision, enhance patient outcomes, and streamline clinical workflows. Favorable reimbursement policies for minimally invasive procedures further support their adoption of robotic systems. Additionally, most surgeons undergo robotic training within hospital environments, which increases utilization. With growing patient expectations for advanced, minimally invasive care, hospitals & clinics continue to be the largest and most influential end users in the market.

"The US is expected to grow at the highest CAGR during the forecast period."

The US is expected to grow at the highest CAGR within the North American surgical robots market due to its strong focus on adopting advanced medical technologies, rapid expansion of robotic-assisted surgical programs, and continuous investments in hospital infrastructure. The country benefits from a large base of trained surgeons, extensive clinical research activity, and high patient demand for minimally invasive procedures, all of which accelerate the uptake of robotic platforms. Favorable reimbursement policies, a strong presence of leading robotic surgery manufacturers, and ongoing product innovations further support growth. Additionally, the US healthcare system's emphasis on improving patient outcomes, reducing hospital stays, and enhancing surgical precision continues to drive faster adoption of surgical robots compared to other countries in the region.

A breakdown of the primary participants (supply side) for the surgical robots market referred to in this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (40%), and Tier 3 (25%)

- By Designation: C-level Executives (45%), Director-level Executives (35%), and Others (20%)

- By Region: North America (27%), Europe (25%), Asia Pacific (30%), Latin America (8%), and the Middle East & Africa (10%)

Prominent players in the surgical robots market are Intuitive Surgical (US), Stryker (US), Medtronic (Ireland), Smith+Nephew (UK), Zimmer Biomet (US), Asensus Surgical (US), Siemens Healthineers (Germany), CMR Surgical (UK), Johnson & Johnson (US), and Renishaw Plc (UK).

Research Coverage:

The report analyzes the surgical robots market and aims at estimating the market size and future growth potential of this market based on various segments such as offering, application, end user, and region. The report also includes a competitive analysis of the key players in this market along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall surgical robots market. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (advantages of robot-assisted surgery, technological advancements, improving reimbursement scenario, increasing adoption of surgical robots, and increasing funding for medical robot research), restraints (high cost of robotic systems), opportunities (increasing penetration of surgical robots in ASCs and growth opportunities in emerging markets), and challenges (surgical errors).

- Market Penetration: It includes extensive information on products offered by the major players in the global surgical robots market. The report includes various segments by offering, application, end user, and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global surgical robots market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by offering, application, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global surgical robots market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products, and capacities of the major competitors in the global surgical robots market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS & DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET GROWTH

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 MARKET OVERVIEW

- 3.1 INTRODUCTION

- 3.1.1 DRIVERS

- 3.1.1.1 Advantages of robot-assisted minimally invasive surgeries

- 3.1.1.2 Technological advancements in surgical robots

- 3.1.1.3 Improving reimbursement scenario for surgical robots

- 3.1.1.4 Increasing adoption of surgical robots in modern surgeries

- 3.1.1.5 Increasing funding for medical robot research

- 3.1.2 RESTRAINTS

- 3.1.2.1 High cost of robotic systems

- 3.1.3 OPPORTUNITIES

- 3.1.3.1 Increasing penetration of surgical robots in outpatient settings

- 3.1.3.2 High growth opportunities in emerging economies

- 3.1.4 CHALLENGES

- 3.1.4.1 Rising number of surgical errors in global healthcare systems

- 3.1.1 DRIVERS

- 3.2 UNMET NEEDS & WHITE SPACES

- 3.2.1 UNMET NEEDS IN SURGICAL ROBOTS MARKET

- 3.2.2 WHITE SPACE OPPORTUNITIES

- 3.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 3.3.1 INTERCONNECTED MARKETS

- 3.3.2 CROSS-SECTOR OPPORTUNITIES

- 3.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

4 INDUSTRY TRENDS

- 4.1 PORTER'S FIVE FORCES ANALYSIS

- 4.1.1 THREAT OF NEW ENTRANTS

- 4.1.2 THREAT OF SUBSTITUTES

- 4.1.3 BARGAINING POWER OF SUPPLIERS

- 4.1.4 BARGAINING POWER OF BUYERS

- 4.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 4.2 MACROECONOMIC OUTLOOK

- 4.2.1 INTRODUCTION

- 4.2.2 GDP TRENDS AND FORECAST

- 4.2.3 TRENDS IN GLOBAL MINIMALLY INVASIVE SURGICAL INSTRUMENTS INDUSTRY

- 4.2.4 TRENDS IN GLOBAL MEDICAL ROBOTS INDUSTRY

- 4.3 SUPPLY CHAIN ANALYSIS

- 4.4 VALUE CHAIN ANALYSIS

- 4.5 ECOSYSTEM ANALYSIS

- 4.6 PRICING ANALYSIS

- 4.6.1 AVERAGE SELLING PRICE OF SURGICAL ROBOTIC APPLICATIONS, BY KEY PLAYER, 2024

- 4.6.2 AVERAGE SELLING PRICE TREND OF SURGICAL ROBOTS, BY REGION, 2022-2024

- 4.7 TRADE DATA ANALYSIS

- 4.7.1 IMPORT DATA FOR HS CODE 901890

- 4.7.2 EXPORT DATA FOR HS CODE 901890

- 4.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 4.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 4.10 INVESTMENT AND FUNDING SCENARIO

- 4.11 CASE STUDY ANALYSIS

- 4.11.1 REVOLUTIONISING FUTURE OF SURGERY WITH HIGH-PRECISION ROBOTS

- 4.11.2 HUNJAN HOSPITAL DEPLOYS ORTHOPEDIC SURGICAL ROBOT FOR KNEE REPLACEMENT SURGERY

- 4.11.3 BIONAUT LABS CREATES REMOTE-CONTROLLED MICRO-ROBOTS TO TARGET BRAIN DISEASES

- 4.12 IMPACT OF 2025 US TARIFF ON SURGICAL ROBOTS MARKET

- 4.12.1 KEY TARIFF RATES

- 4.12.2 PRICE IMPACT ANALYSIS

- 4.12.3 IMPACT ON COUNTRY/REGION

- 4.12.3.1 North America

- 4.12.3.1.1 US

- 4.12.3.2 Europe

- 4.12.3.3 Asia Pacific

- 4.12.3.1 North America

- 4.12.4 IMPACT ON END-USE INDUSTRIES

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 KEY EMERGING TECHNOLOGIES

- 5.1.1 ROBOTIC ARMS AND INSTRUMENTS

- 5.1.2 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

- 5.1.3 TELEPRESENCE

- 5.1.4 5G TECHNOLOGY

- 5.1.5 COMPLEMENTARY TECHNOLOGIES

- 5.1.5.1 Augmented reality (AR) and virtual reality (VR)

- 5.1.5.2 3D printing

- 5.2 TECHNOLOGY/PRODUCT ROADMAP

- 5.2.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 5.2.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 5.2.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 5.3 PATENT ANALYSIS

- 5.4 FUTURE APPLICATIONS OF SURGICAL ROBOTS

- 5.5 IMPACT OF AI/GEN AI ON SURGICAL ROBOTS MARKET

- 5.5.1 TOP USE CASES AND MARKET POTENTIAL

- 5.5.2 BEST PRACTICES IN SURGICAL ROBOTS PROCESSING

- 5.5.3 CASE STUDIES OF AI IMPLEMENTATION

- 5.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI

6 REGULATORY LANDSCAPE

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 REGULATORY FRAMEWORK

- 6.1.2.1 North America

- 6.1.2.1.1 US

- 6.1.2.2 Europe

- 6.1.2.3 Asia Pacific

- 6.1.2.3.1 Japan

- 6.1.2.3.2 China

- 6.1.2.3.3 India

- 6.1.2.1 North America

- 6.1.3 INDUSTRY STANDARDS

- 6.2 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 KEY STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 KEY BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM END-USE INDUSTRIES

- 7.5 MARKET PROFITABILITY

- 7.5.1 REVENUE POTENTIAL

- 7.5.2 COST DYNAMICS

- 7.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

8 SURGICAL ROBOTS MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 INSTRUMENTS & ACCESSORIES

- 8.2.1 NEED FOR RECURRENT PURCHASE OF INSTRUMENTS & ACCESSORIES TO DRIVE MARKET GROWTH

- 8.3 ROBOTIC SYSTEMS

- 8.3.1 LAPAROSCOPIC ROBOTIC SYSTEMS

- 8.3.1.1 Growing popularity of laparoscopic robotic surgeries to drive market

- 8.3.2 ORTHOPEDIC ROBOTIC SYSTEMS

- 8.3.2.1 Rising number of market players offering orthopedic robots to support market growth

- 8.3.3 NEUROSURGICAL ROBOTIC SYSTEMS

- 8.3.3.1 Better reproducibility, higher accuracy, and greater precision in long, narrow surgical corridors to support market growth

- 8.3.4 OTHER ROBOTIC SYSTEMS

- 8.3.1 LAPAROSCOPIC ROBOTIC SYSTEMS

- 8.4 SERVICES

- 8.4.1 ONGOING NEED FOR SERVICE CONTRACTS FOR FUNDAMENTAL OPERATIONS TO PROPEL MARKET GROWTH

9 SURGICAL ROBOTS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 GENERAL SURGERY

- 9.2.1 GROWING PREFERENCE FOR ROBOT-ASSISTED GENERAL SURGICAL PROCEDURES TO DRIVE MARKET

- 9.3 GYNECOLOGICAL SURGERY

- 9.3.1 RISING NUMBER OF HYSTERECTOMIES TO INCREASE DEMAND FOR SURGICAL ROBOTS

- 9.4 ORTHOPEDIC SURGERY

- 9.4.1 GROWING PREFERENCE FOR KNEE RECONSTRUCTION PROCEDURES TO SUPPORT MARKET GROWTH

- 9.5 UROLOGICAL SURGERY

- 9.5.1 RISING PREVALENCE OF UROLOGICAL DISEASES TO FUEL DEMAND FOR SURGICAL ROBOTS

- 9.6 NEUROSURGERY

- 9.6.1 INCREASING USE OF ROBOTIC TECHNOLOGIES IN NEUROSURGICAL PROCEDURES TO DRIVE MARKET

- 9.7 MICROSURGERY

- 9.7.1 RISING INTERSECTION OF MINIMALLY INVASIVE SURGERY AND SURGICAL ROBOTS TO SUPPORT MARKET GROWTH

- 9.8 OTOLOGICAL SURGERY

- 9.8.1 RISING PREVALENCE OF EAR-RELATED DISORDERS TO SPUR MARKET GROWTH

- 9.9 OTHER APPLICATIONS

10 SURGICAL ROBOTS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS & CLINICS

- 10.2.1 INCREASING ROBOTIC-ASSISTED SURGERIES TO PROPEL MARKET GROWTH

- 10.3 AMBULATORY SURGERY CENTERS

- 10.3.1 GROWING PATIENT PREFERENCE FOR COST-EFFECTIVE TREATMENTS TO DRIVE MARKET GROWTH

11 SURGICAL ROBOTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 US to dominate North American surgical robots market during study period

- 11.2.2 CANADA

- 11.2.2.1 Increased adoption of surgical robots for gynecological surgeries and cancerous tumor removal to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Favorable healthcare initiatives and large pool of stroke patients to spur market growth

- 11.3.2 UK

- 11.3.2.1 Rising investments in surgical robots to propel market growth

- 11.3.3 FRANCE

- 11.3.3.1 Favorable investments and high demand for surgical robotic systems to boost market growth

- 11.3.4 SPAIN

- 11.3.4.1 Increasing number of robotic-assisted surgical procedures and initiatives to fuel growth

- 11.3.5 ITALY

- 11.3.5.1 Increasing number of robotic surgical procedures to propel market growth

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 JAPAN

- 11.4.1.1 Favorable government initiatives to support adoption of surgical robots

- 11.4.2 CHINA

- 11.4.2.1 Favorable government initiatives to boost market growth

- 11.4.3 INDIA

- 11.4.3.1 Rapid developments in healthcare infrastructure to support market growth

- 11.4.4 AUSTRALIA

- 11.4.4.1 Increasing implementation and development of s urgical robotic training programs to fuel market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing installation of surgical robots and growing government investments to ensure steady market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 JAPAN

- 11.5 LATIN AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Rising incidence of target diseases and growing healthcare expenditure to drive market

- 11.5.2 MEXICO

- 11.5.2.1 Growing emphasis on surgical robotics in healthcare to support market growth

- 11.5.3 REST OF LATIN AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 Robust healthcare industry and favorable government strategies to drive market

- 11.6.2 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL ROBOTS MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Offering footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 DYNAMIC COMPANIES

- 12.6.3 STARTING BLOCKS

- 12.6.4 RESPONSIVE COMPANIES

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT/SERVICE LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 INTUITIVE SURGICAL OPERATIONS, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product approvals

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 STRYKER

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 ZIMMER BIOMET

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 MEDTRONIC

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product approvals

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 SMITH+NEPHEW

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product & service launches and enhancements

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 ASENSUS SURGICAL US, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product approvals

- 13.1.6.3.2 Deals

- 13.1.7 SIEMENS HEALTHINEERS AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 RENISHAW PLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product approvals

- 13.1.9 GLOBUS MEDICAL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product approvals

- 13.1.10 JOHNSON & JOHNSON

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product approvals

- 13.1.11 CMR SURGICAL LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product approvals

- 13.1.11.3.2 Deals

- 13.1.11.3.3 Expansions

- 13.1.11.3.4 Other developments

- 13.1.12 THINK SURGICAL, INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product approvals

- 13.1.12.3.2 Deals

- 13.1.13 CORIN GROUP

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches & approvals

- 13.1.14 MICROSURE

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Other developments

- 13.1.15 AVATERAMEDICAL GMBH

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.16 MEDICAL MICROINSTRUMENTS, INC.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Services/Solutions offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product approvals

- 13.1.16.3.2 Deals

- 13.1.16.3.3 Other developments

- 13.1.17 MEDICAROID CORPORATION

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Services/Solutions offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product approvals

- 13.1.17.3.2 Deals

- 13.1.18 BRAINLAB SE

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Services/Solutions offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product approvals

- 13.1.18.3.2 Deals

- 13.1.19 ECENTIAL ROBOTICS

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Services/Solutions offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Product approvals

- 13.1.19.3.2 Deals

- 13.1.20 SS INNOVATIONS INTERNATIONAL, INC.

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Services/Solutions offered

- 13.1.20.3 Products/Services/Solutions in pipeline

- 13.1.20.4 Recent developments

- 13.1.20.4.1 Product launches and approvals

- 13.1.20.5 MnM view

- 13.1.20.5.1 Right to win

- 13.1.20.5.2 Strategic choices

- 13.1.20.5.3 Weaknesses & competitive threats

- 13.1.1 INTUITIVE SURGICAL OPERATIONS, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 MONTERIS

- 13.2.2 MOMENTIS INNOVATIVE SURGERY

- 13.2.3 TINAVI MEDICAL TECHNOLOGIES CO., LTD.

- 13.2.4 DISTALMOTION SA

- 13.2.5 NOVUS SAGLIK URUNLERI AR-GE DANISMANLIK (NOVUS ARGE)

14 RESEARCH METHODOLOGY

- 14.1 RESEARCH DATA

- 14.1.1 SECONDARY DATA

- 14.1.1.1 Key sources of secondary data

- 14.1.1.2 Key data from secondary sources

- 14.1.2 PRIMARY DATA

- 14.1.2.1 Key objectives of primary research

- 14.1.2.2 Key data from primary sources

- 14.1.2.3 Key industry insights

- 14.1.1 SECONDARY DATA

- 14.2 MARKET SIZE ESTIMATION

- 14.2.1 BOTTOM-UP APPROACH

- 14.2.2 TOP-DOWN APPROACH

- 14.2.3 BASE NUMBER ESTIMATION

- 14.2.3.1 Supply-side analysis (revenue share analysis)

- 14.2.3.2 Company presentations and primary interviews

- 14.3 MARKET FORECAST APPROACH

- 14.4 DATA TRIANGULATION

- 14.5 STUDY ASSUMPTIONS

- 14.5.1 MARKET SHARE ASSUMPTIONS

- 14.5.2 RESEARCH ASSUMPTIONS

- 14.6 FACTOR ANALYSIS

- 14.7 RISK ANALYSIS

- 14.8 RESEARCH LIMITATIONS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS