|

시장보고서

상품코드

1928852

단백질 및 단백질 결정 시장 : 제품 유형별, 용도별, 최종사용자별, 지역별 - 예측(-2030년)Proteins & Protein Crystals Market by Product Type, Structural, Specialty, Application, End User - Global Forecast to 2030 |

||||||

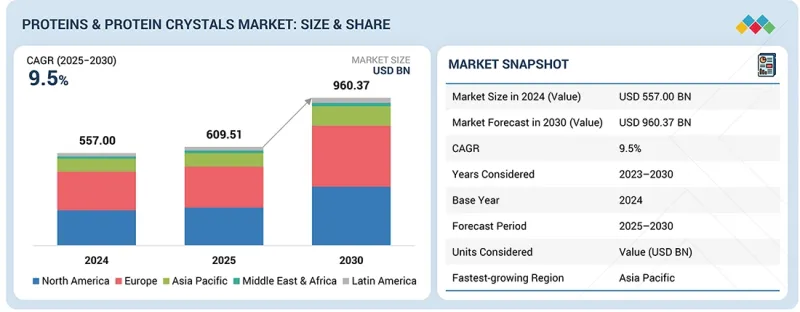

세계의 단백질 및 단백질 결정 시장 규모는 2025년 6,095억 1,000만 달러에서 2030년까지 9,603억 7,000만 달러에 이를 것으로 예측됩니다.

2025년부터 2030년까지 연평균 성장률(CAGR)은 9.5%로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제품 유형별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

단백질 및 단백질 결정체 시장은 주로 바이오 의약품에 대한 수요 증가, 구조 생물학 및 신약 개발 분야의 연구 개발 증가, 진단, 치료 및 산업 응용 분야에서 단백질의 사용 확대에 의해 주도되고 있습니다. 효소 단백질은 치료제, 산업용 바이오 촉매, 하이스루풋 스크리닝 등 다양한 용도로 시장을 선도하고 있습니다. 한편, 재조합 단백질과 단클론 단백질은 특이성과 확장성으로 인해 의약품 개발 및 개인 맞춤형 의료 분야 수요를 주도하고 있습니다.

또한, 구조 분석을 위한 단백질 결정화 키트, 시약, 자동 결정화 플랫폼의 채택 확대도 시장을 견인하고 있습니다. 연구자들과 제약회사들은 단백질 구조 규명, 신약 개발 과정의 가속화, 효소 기반 산업 공정의 효율화를 위해 이 제품들에 대한 의존도를 높이고 있습니다.

제품 유형별로는 구조 단백질 부문이 단백질 및 단백질 결정체 시장에서 가장 높은 CAGR을 차지할 것으로 예측됩니다. 단백질 및 단백질 결정체 시장에서 구조 단백질 부문의 성장은 연구, 의료 및 산업 응용 분야에 걸친 여러 요인에 의해 주도되고 있습니다. 액틴, 튜브린과 같은 연구용 단백질은 구조생물학, 하이스루풋 결정학, 신약개발에서 높은 수요가 있으며, 정밀한 단백질 구조 결정과 합리적인 신약개발을 가능하게 합니다. 막단백질은 생물학적 제제 및 정밀의료 개발에서 중요한 치료 표적으로서 점점 더 많이 요구되고 있습니다. 콜라겐, 엘라스틴, 라미닌, 프로테오글리칸과 같은 결합조직 및 세포외 기질 단백질은 생체재료, 조직공학, 재생의료, 화장품 및 헬스케어 제품 수요를 주도하고 있습니다.

치료용 단백질, 단클론 항체, 백신, 진단용 효소에 대한 수요 증가로 인해 의료용 단백질 및 단백질 결정체 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 만성질환, 암, 대사성 질환의 유병률 증가는 단백질 기반 생물학적 제제의 개발 및 활용을 촉진하는 한편, 구조생물학 및 단백질 결정학의 발전은 신약개발과 표적치료제를 가속화하고 있습니다. 바이오 의약품 연구개발, 임상연구, 고처리량 단백질 분석에 대한 투자 증가는 의료 분야에서 단백질 결정 및 관련 제품의 채택을 촉진하고 있으며, 이 분야는 산업, 식품, 연구용에 비해 가장 빠르게 성장하고 있습니다. 치료용 및 구조용 단백질이 바이오 의약품 개발에 점점 더 많이 활용되고 있는 가운데, 유전성 질환 및 만성 질환의 발생률 증가로 단백질 기반 치료법의 필요성이 높아지고 있습니다. 단백질 결정학의 발전으로 정밀한 구조 기반 신약 개발이 가능해져 바이오 의약품의 혁신을 촉진하고 있습니다. 임상 적용 범위의 확대와 연구개발비용 증가도 이 시장의 성장에 기여하고 있습니다.

아시아태평양은 의료, 연구 및 기타 응용 분야의 견고한 성장으로 인해 단백질 및 단백질 결정체 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 의료 분야에서는 바이오의약품 연구개발 증가, 만성질환의 유병률 증가, 개인 맞춤형 의료의 도입이 치료용 단백질, 단일클론항체, 단백질 기반 진단약에 대한 수요를 견인하고 있습니다. 연구 및 학술 분야에서는 생명과학 인프라의 확충, CRO(의약품 개발 위탁기관) 증가, 구조생물학 이니셔티브, 단백질 결정화 키트 및 시약의 사용이 촉진되고 있습니다. 다른 용도도 시장 성장에 기여하고 있으며, 농업 및 동물 의료 분야에서는 사료 첨가제, 백신, 질병 관리에 단백질과 효소가 사용되고 있습니다. 화장품 분야에서는 콜라겐, 엘라스틴 등의 구조 단백질이 노화 방지 및 스킨케어 제품에 활용되고 있습니다. 바이오에너지 분야에서는 효소가 바이오매스 전환과 바이오연료 생산을 촉진하고 있습니다. 의료, 연구, 농업, 동물 위생, 화장품, 바이오에너지 분야 수요의 총합이 아시아태평양 시장의 급속한 성장을 주도하고 있습니다.

이 시장의 주요 기업으로는 Danaher(미국), Thermo Fischer Scientific inc. Flavours and Fragrances(미국),Biocon(인도),RayBiotech(미국),Merck KGaA(미국),Sanofi(프랑스),Agilent(미국),Takeda Pharmaceutical Company(일본), International Flavours and Fragrances(미국), Biocon(인도), RayBiotech(미국), Merck KGaAKGaA(독일), Amgen(미국), Eli lilly(미국), Roche(스위스), Novo Nordisk(덴마크), Pfizer(미국) 등이 있습니다.

조사 범위

단백질 및 단백질 결정 시장은 제품 유형, 용도, 최종 사용자 및 지역별로 세분화됩니다. 시장 성장에 영향을 미치는 주요 요인으로는 촉진요인, 제약 요인, 기회, 이해관계자의 과제 등이 있습니다. 이 보고서는 단백질 및 단백질 결정 시장에서 경쟁하는 주요 기업들에 대해서도 검토하고 있습니다. 트렌드, 성장 기회, 시장 기여도를 검증하기 위한 미시적 수준의 분석이 가능합니다. 또한, 5개 주요 지역의 다양한 시장 부문에 걸쳐 잠재적인 수익 성장 기회를 강조하고 있습니다.

본 보고서 구매의 주요 이점

이 보고서는 단백질 및 단백질 결정 시장에 새로 진입하는 기업에게 시장에 대한 종합적인 정보를 제공하기 때문에 매우 유용합니다. 이 정보는 다양한 투자 기회를 이해하는 데 필수적인 정보입니다. 이 보고서는 시장의 주요 기업과 중소기업 모두에게 인사이트를 제공하고, 투자 결정 시 리스크 분석에 대한 확고한 기반을 구축하는 데 도움이 될 것입니다. 최종 사용자 및 지역별로 정확한 시장 세분화를 통해 특정 시장 부문에 초점을 맞춘 인사이트를 제공합니다. 또한, 철저한 분석을 통해 전략적 의사결정을 지원하는 주요 동향, 과제, 촉진요인, 성장 기회를 강조하고 있습니다.

이 보고서는 다음 사항에 대한 인사이트를 제공합니다.

- 주요 촉진요인(치료용 단백질에 대한 수요 증가, 단백질 결정화 및 구조생물학의 발전, 식품 가공 및 산업 생명공학 분야에서의 응용 확대), 제약요인(높은 생산 및 정제 비용, 단백질 기반 제품의 안정성 및 보존성 제한), 기회요인(단백질 결정학의 AI 및 자동화의 부상, 하이브리드 및 3D 프린팅의 통합, 산학협력) AI 및 자동화의 부상, 하이브리드 기술과 3D 프린팅 기술의 통합, 산학협력), 과제(단백질 결정화에서의 재현성 문제, 대체 분석기술과의 경쟁)

- 제품 개발/혁신 : 단백질 및 단백질 결정체 시장의 신기술, 연구 개발, 최근 제품 출시 및 승인 현황.

- 시장 성장 : 수익성 높은 시장에 대한 상세한 분석 보고서를 통해 다양한 지역의 단백질 및 단백질 결정 시장을 분석합니다.

- 시장 다각화 : 단백질 및 단백질 결정 시장의 신제품, 미개척 지역, 최신 동향, 투자에 대한 심층 분석

- 경쟁사 평가: 주요 기업(Danaher(미국), Thermo Fisher Scientific Inc.(미국), FF. Hoffmann-La F. Hoffmann-La Roche AG(스위스), Roche Ltd(독일), Amgen(미국), Merck KGaAKGaA(독일) 등) 시장 점유율, 서비스 제공 내용, 주요 전략에 대한 상세한 평가.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 프리미엄 인사이트

제4장 시장 개요

- 시장 역학

- 미충족 요구

- 연결된 시장과 분야간 기회

- Tier1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세가 단백질 및 단백질 결정 시장에 미치는 영향

제6장 기술, 특허, 디지털, AI 도입 별 전략적 파괴

- 주요 신기술

- 보완적 기술

- 특허 분석

- AI/생성형 AI가 단백질 및 단백질 결정 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

- 규제 상황

- 업계표준

- 인증, 라벨, 환경기준

- 고객 상황과 구매 행동

- 주요 이해관계자와 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터 미충족 요구

제7장 단백질 및 단백질 결정 시장(제품 유형별)

- 효소 단백질

- 치료용 단백질

- 구조 단백질

- 특수 단백질

제8장 단백질 및 단백질 결정 시장(용도별)

- 건강 관리

- 조직공학

- 농업과 동물 영양

- 산업 처리

- 바이오에너지와 환경

- 화장품 및 식이보충제

- 기타

제9장 단백질 및 단백질 결정 시장(최종사용자별)

- 제약 업계

- 바이오테크놀러지 산업

- 연구, 학술, 그리고 크로스

- 식품 및 음료 업계

- 기타

제10장 단백질·단백질 결정 시장(지역별)

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- GCC 국가

- 기타

제11장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2021년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 시장 진출기업

- DANAHER CORPORATION

- RAYBIOTECH, INC.

- MERCK & CO., INC.

- AMGEN INC.

- ELI LILLY AND COMPANY

- F. HOFFMANN-LA ROCHE LTD.

- NOVO NORDISK A/S

- PFIZER INC.

- THERMO FISHER SCIENTIFIC INC.

- SANOFI

- AGILENT TECHNOLOGIES, INC.

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- INTERNATIONAL FLAVOURS & FRAGRANCES INC.(IFF)

- BIOCON

- 기타 기업

- AMANO ENZYME INC.

- ULTREZE ENZYMES

- NEOGEN

- BIOLAXI ENZYMES PVT. LTD.

- GENSCRIPT

- BIOSEUTICA

- KERRY GROUP PLC

- ASSOCIATED BRITISH FOODS PLC

- K-GENIX GROUP

- NAGASE & CO., LTD.

- GRIFOLS, S.A

- BASF

- BIO-CAT

- AMCO PROTEINS

- PROTALIX BIOTHERAPEUTICS

제13장 조사 방법

제14장 부록

LSHThe global protein and protein crystals market is projected to reach USD 960.37 billion by 2030 from USD 609.51 billion in 2025, at a CAGR of 9.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The protein and protein crystals market is primarily driven by the growing demand for biopharmaceuticals, increasing R&D in structural biology and drug discovery, and the rising use of proteins in diagnostics, therapeutics, and industrial applications. Enzymatic proteins lead the market due to their wide use in therapeutics, industrial biocatalysis, and high-throughput screening, while recombinant and monoclonal proteins drive demand in drug development and personalized medicine because of their specificity and scalability.

Additionally, the growing adoption of protein crystallization kits, reagents, and automated crystallization platforms for structural studies further fuels the market, as researchers and pharmaceutical companies increasingly rely on these products to determine protein structures, accelerate drug design, and enhance enzyme-based industrial processes.

By product type, the structural proteins segment is expected to register the highest CAGR during the forecast period.

By product type, the structural proteins segment is expected to account for the highest CAGR in the protein and protein crystals market. The growth of the structural proteins segment in the protein and protein crystals market is driven by multiple factors across research, healthcare, and industrial applications. Research proteins such as actin and tubulin are in high demand for structural biology, high-throughput crystallography, and drug discovery, enabling precise protein structure determination and rational drug design. Membrane proteins are increasingly sought after as critical therapeutic targets in the development of biologics and precision medicine. Connective tissue and extracellular matrix proteins, including collagen, elastin, laminins, and proteoglycans, are fueling demand in biomaterials, tissue engineering, and regenerative medicine, as well as in cosmetic and healthcare products.

By application, the healthcare segment accounted for the highest CAGR of the market in 2024.

The healthcare application segment is expected to register the highest CAGR in the proteins and protein crystals market due to the increasing demand for therapeutic proteins, monoclonal antibodies, vaccines, and diagnostic enzymes. Growing prevalence of chronic diseases, cancer, and metabolic disorders is driving the development and use of protein-based biologics, while advances in structural biology and protein crystallography are accelerating drug discovery and targeted therapy. Rising investments in biopharmaceutical R&D, clinical research, and high-throughput protein analysis are fueling the adoption of protein crystals and related products in healthcare, making this segment the fastest-growing compared with industrial, food, and research applications. as therapeutic and structural proteins are increasingly being used in biologics development. The rising incidence of hereditary and chronic diseases is driving the need for protein-based treatments. Precise structure-based drug design is made possible by developments in protein crystallography, which drives biopharmaceutical innovation. Expanding clinical applications and higher R&D expenditures also contribute to this market's growth.

Asia Pacific is expected to register the highest growth rate in the market during the forecast period.

The Asia-Pacific region is expected to register the highest CAGR in the protein and protein crystals market due to strong growth across healthcare, research, and other applications. In healthcare, increasing biopharmaceutical R&D, rising prevalence of chronic diseases, and adoption of personalized medicine are driving demand for therapeutic proteins, monoclonal antibodies, and protein-based diagnostics. In research and academia, expanding life sciences infrastructure, CROs, and structural biology initiatives boost the use of protein crystallization kits and reagents. Other applications are contributing to market growth, in agriculture and animal health, proteins and enzymes are used for feed additives, vaccines, and disease management; in cosmetics, structural proteins like collagen and elastin are applied in anti-aging and skincare products; and in bioenergy, enzymes facilitate biomass conversion and biofuel production. The combined demand across healthcare, research, agriculture, animal health, cosmetics, and bioenergy is fueling rapid market growth in Asia-Pacific.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

The prominent players in this market are Danaher (US), Thermo Fischer Scientific inc. (US), Sanofi (France), Agilent (US), Takeda Pharmaceutical Company (Japan), International Flavours and Fragrances (US), Biocon (India), RayBiotech (US), Merck KGaA (Germany), Amgen (US), Eli lilly (US), Roche (Switzerland), Novo Nordisk (Denmark), and Pfizer (US), among others.

Research Coverage

The protein and protein crystals market is segmented by product type, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the Protein and Pprotein Ccrystals market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the protein and protein crystals market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report provides insights into both key and smaller players in the market, which can help create a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following points:

- Key drivers (Rising demand for therapeutic proteins, Advancements in protein crystallization and structural biology, increasing applications in food processing and industrial biotechnology), restraints (High production and purification costs, Limited stability and storage of protein-based products), opportunities (Emergence of AI and automation in protein crystallography, Integration of hybrid and 3D printing technologies, Collaborations between academia and industry), and challenges (reproducibility issues in protein crystallization, Competition from alternative analytical techniques)

- Product Development/Innovation: Emerging technologies in space, R&D, recent product launches & approvals in the protein and protein crystals market.

- Market Growth: In-depth insights into remunerative markets report analyze the protein and protein crystals market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the protein and protein crystals market

- Competitive Assessment: Detailed assessment of market share, service offerings, leading strategies of major players such as Danaher (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La F. Hoffmann-La Roche AG (Switzerland), Roche Ltd (Germany), Amgen (US) and Merck KGaA (Germany), among others..

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS & KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PROTEINS & PROTEIN CRYSTALS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 PROTEINS & PROTEIN CRYSTALS MARKET OVERVIEW

- 3.2 VALUE CHAIN ANALYSIS OF PROTEINS & PROTEIN CRYSTALS MARKET

- 3.3 NORTH AMERICA: PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION AND END USER, 2025

- 3.4 GEOGRAPHIC SNAPSHOT OF PROTEINS & PROTEIN CRYSTALS MARKET

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing emphasis on structure-based drug discovery and development

- 4.2.1.2 Rising demand for protein-based drug development

- 4.2.1.3 Increasing demand for therapeutic proteins

- 4.2.1.4 Technological advancements in crystallization methods

- 4.2.2 RESTRAINTS

- 4.2.2.1 High technical complexity and low success rates in protein crystallization

- 4.2.2.2 Exposure to ionizing radiation and contrast-related concerns among vulnerable populations

- 4.2.2.3 Need for high costs, technical expertise, and advanced infrastructure for commercialization

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of AI-enabled innovations

- 4.2.3.2 Collaboration between academia and industry

- 4.2.3.3 High investment and funding in structural biology, biopharmaceuticals, and advanced drug development

- 4.2.4 CHALLENGES

- 4.2.4.1 Reproducibility issues in protein crystallization

- 4.2.4.2 Scalability concerns in recombinant protein production

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF BUYERS

- 5.1.2 BARGAINING POWER OF SUPPLIERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 GDP TRENDS & FORECAST

- 5.2.2 TRENDS IN GLOBAL ENVIRONMENTAL INDUSTRY

- 5.2.3 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.3.3 END USERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 MANUFACTURING

- 5.4.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF PROTEINS & PROTEIN CRYSTALS, BY PRODUCT, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF PROTEINS & PROTEIN CRYSTALS, BY REGION, 2022-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA FOR HS CODE 3507, 2021-2024

- 5.7.2 EXPORT DATA FOR HS CODE 3507, 2021-2024

- 5.7.3 TRADE ANALYSIS FOR HS CODE 293719

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.10 INVESTMENT & FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 COMPUTATIONAL DESIGN OF HIGH-AFFINITY MINIBINDER PROTEINS FOR THERAPEUTIC TARGETS

- 5.12 IMPACT OF 2025 US TARIFF ON PROTEINS & PROTEIN CRYSTALS MARKET

- 5.12.1 KEY TARIFF RATES

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 North America

- 5.12.4.1.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.4.1 North America

- 5.12.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CRYO-CRYSTALLIZATION

- 6.1.2 X-RAY FREE-ELECTRON LASERS (XFELS)

- 6.1.3 COMPUTATIONAL PROTEIN DESIGN TOOLS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MICROFLUIDICS AND LAB-ON-A-CHIP (LOC) TECHNOLOGIES

- 6.2.2 NUCLEAR MAGNETIC RESONANCE (NMR) SPECTROSCOPY

- 6.3 PATENT ANALYSIS

- 6.4 IMPACT OF AI/GEN AI ON PROTEINS & PROTEIN CRYSTALS MARKET

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES IN PROTEINS & PROTEIN CRYSTALS MARKET

- 6.4.3 CASE STUDIES

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENT'S READINESS TO ADOPT GEN AI IN PROTEINS & PROTEIN CRYSTALS MARKET

- 6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6 REGULATORY LANDSCAPE

- 6.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7 INDUSTRY STANDARDS

- 6.8 CERTIFICATIONS, LABELLING, AND ECO-STANDARDS

- 6.8.1 CERTIFICATIONS & GOOD MANUFACTURING/QUALITY STANDARDS

- 6.8.2 LABELLING & TRACEABILITY

- 6.8.3 ECO-STANDARDS/ENVIRONMENTAL/SUSTAINABILITY CERTIFICATION

- 6.9 CUSTOMER LANDSCAPE & BUYER BEHAVIOUR

- 6.9.1 DECISION-MAKING PROCESS

- 6.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.10.2 KEY BUYING CRITERIA

- 6.11 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 6.12 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

7 PROTEINS & PROTEIN CRYSTALS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 ENZYMATIC PROTEINS

- 7.2.1 INDUSTRIAL ENZYMES

- 7.2.1.1 Focus on green manufacturing and sustainable solutions to aid adoption

- 7.2.2 FOOD ENZYMES

- 7.2.2.1 Expansion of food-based technologies to propel market growth

- 7.2.1 INDUSTRIAL ENZYMES

- 7.3 THERAPEUTIC PROTEINS

- 7.3.1 MONOCLONAL ANTIBODIES

- 7.3.1.1 Advancing disease targeting and treatment through monoclonal antibody technologies to spur adoption

- 7.3.2 INSULIN

- 7.3.2.1 Strengthening investment scenario for insulin development to fuel market growth

- 7.3.3 HORMONES

- 7.3.3.1 Introduction of new drugs and therapies for hormonal diseases to propel segment growth

- 7.3.4 COAGULATION FACTORS

- 7.3.4.1 Enhanced hemostasis therapies through advanced coagulation protein technologies to augment market growth

- 7.3.1 MONOCLONAL ANTIBODIES

- 7.4 STRUCTURAL PROTEINS

- 7.4.1 RESEARCH PROTEINS

- 7.4.1.1 Research proteins to empower drug discovery and molecular research with AI integration

- 7.4.2 STRUCTURAL PROTEINS

- 7.4.2.1 Advancements in structural protein through collagen and connective tissue insights to fuel market growth

- 7.4.1 RESEARCH PROTEINS

- 7.5 SPECIALTY PROTEINS

- 7.5.1 INDUSTRIAL PROTEINS

- 7.5.1.1 Industrial proteins to optimize industrial processes through advanced protein technologies

- 7.5.2 NUTRITIONAL PROTEINS

- 7.5.2.1 Nutritional proteins to enable evidence-based, disease-specific nutrition for complementing pharmaceutical therapies

- 7.5.3 ANALYTICAL PROTEINS

- 7.5.3.1 Analytical proteins to support quality control and scientific discovery

- 7.5.4 COSMECEUTICAL PROTEINS

- 7.5.4.1 Focus on innovative personal care products to support segment growth

- 7.5.5 FUNTIONAL FOOD PROTEINS

- 7.5.5.1 Functional foods & beverages with advanced proteins to improve digestibility of nutritional profile

- 7.5.1 INDUSTRIAL PROTEINS

8 PROTEINS & PROTEIN CRYSTALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE

- 8.2.1 ADVANCEMENTS IN PROTEIN ENGINEERING, STRUCTURAL BIOLOGY, AND HIGH-THROUGHPUT CRYSTALLIZATION TO SPUR MARKET

- 8.3 TISSUE ENGINEERING

- 8.3.1 DEVELOPMENT OF ADVANCED REGENERATIVE MEDICINE THROUGH PROTEIN-BASED TISSUE ENGINEERING TO AID MARKET GROWTH

- 8.4 AGRICULTURE & ANIMAL NUTRITION

- 8.4.1 FOCUS ON BETTER AGRICULTURAL PRODUCTIVITY AND ANIMAL HEALTH THROUGH PROTEIN-BASED SOLUTIONS TO DRIVE MARKET

- 8.5 INDUSTRIAL PROCESSING

- 8.5.1 GROWING DEMAND FOR HIGH-PERFORMANCE AND ECO-FRIENDLY PRODUCTS TO DRIVE MARKET GROWTH

- 8.6 BIOENERGY & ENVIRONMENTAL

- 8.6.1 GROWING DEMAND FOR SUSTAINABLE ENERGY AND ECO-FRIENDLY SOLUTIONS TO BOOST MARKET GROWTH

- 8.7 COMECEUTICALS & NUTRACEUTICALS

- 8.7.1 ADVANCEMENTS IN PROTEIN-BASED NUTRACEUTICALS TO ENHANCE DIGESTIBILITY AND NUTRIENT DELIVERY

- 8.8 OTHER APPLICATIONS

9 PROTEINS & PROTEIN CRYSTALS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 PHARMA INDUSTRY

- 9.2.1 DRUG DEVELOPMENT

- 9.2.1.1 Increased internal biologics discovery and process-development activity to augment market growth

- 9.2.2 FORMULATION/MANUFACTURING

- 9.2.2.1 Advancing protein therapeutics through optimized formulation and manufacturing to propel segment growth

- 9.2.3 STORAGE/INVENTORY MANAGEMENT

- 9.2.3.1 Optimal storage/inventory management to optimize supply, reduce waste, and prevent stockouts

- 9.2.1 DRUG DEVELOPMENT

- 9.3 BIOTECHNOLOGY INDUSTRY

- 9.3.1 DRUG DEVELOPMENT

- 9.3.1.1 Growth of precision/personalized medicines and advanced therapeutics to aid segment growth

- 9.3.2 FORMULATION/MANUFACTURING

- 9.3.2.1 Expansion of manufacturing facilities in biotechnology industry leading to support market growth

- 9.3.3 STORAGE/INVENTORY MANAGEMENT

- 9.3.3.1 Optimizing storage and inventory management for proteins and protein crystals to enhance safety, quality, and accessibility

- 9.3.1 DRUG DEVELOPMENT

- 9.4 RESEARCH, ACADEMIA, AND CROS

- 9.4.1 DRUG DEVELOPMENT & DISCOVERY

- 9.4.1.1 Focus on accelerating advancements protein & protein crystal applications to fuel segment growth

- 9.4.2 LIFE SCIENCE RESEARCH

- 9.4.2.1 Expanding scope of research for formulating targeted treatment strategies to boost Market

- 9.4.1 DRUG DEVELOPMENT & DISCOVERY

- 9.5 FOOD & BEVERAGE INDUSTRY

- 9.5.1 INCREASING DEMAND FOR HIGH PROTEIN DIETS, NUTRITIONAL SUPPLEMENTS, AND FUNCTIONAL FOODS TO AID MARKET GROWTH

- 9.6 OTHER END USERS

10 PROTEINS & PROTEIN CRYSTALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 US to dominate North American proteins & protein crystals market during study period

- 10.2.2 CANADA

- 10.2.2.1 Innovations in protein AI to drive advanced protein design and structure prediction

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Favorable healthcare policies and regulatory landscape to drive market

- 10.3.2 UK

- 10.3.2.1 Favorable regulatory scenario for protein & protein crystal development to support market growth

- 10.3.3 FRANCE

- 10.3.3.1 Increased healthcare funding by government bodies to aid market growth

- 10.3.4 ITALY

- 10.3.4.1 Increased availability of reimbursement coverage for proteins and protein crystals to augment market growth

- 10.3.5 SPAIN

- 10.3.5.1 Ongoing research linking crystallography to disease mechanisms and infrastructure development to aid market growth

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Emphasis on modernization and expansion of healthcare infrastructure to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Rise in research applications using proteins & protein crystals to propel market growth

- 10.4.3 INDIA

- 10.4.3.1 Investments and funding activities in Indian biotechnology and biopharma industry to augment market growth

- 10.4.4 AUSTRALIA

- 10.4.4.1 Rising investments in healthcare infrastructure to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Strong academic & research infrastructure and favorable national funding programs to aid market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 LATIN AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Growing adoption of proteins in research centers and workshops to propel market growth

- 10.5.2 MEXICO

- 10.5.2.1 Increasing investments and funding for development and manufacturing of protein-based APIs to drive market

- 10.5.3 REST OF LATIN AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Government initiatives for better digital health and improved telemedicine to drive market

- 10.6.2 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PROTEINS & PROTEIN CRYSTALS MARKET

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION & FINANCIAL METRICS

- 11.5.1 FINANCIAL METRICS

- 11.5.2 COMPANY VALUATION

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DANAHER CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 RAYBIOTECH, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MERCK & CO., INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 AMGEN INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 ELI LILLY AND COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product approvals

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 F. HOFFMANN-LA ROCHE LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & approvals

- 12.1.6.4 Recent developments

- 12.1.6.4.1 Deals

- 12.1.7 NOVO NORDISK A/S

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 PFIZER INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product approvals

- 12.1.8.3.2 Deals

- 12.1.9 THERMO FISHER SCIENTIFIC INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 SANOFI

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 AGILENT TECHNOLOGIES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.12 TAKEDA PHARMACEUTICAL COMPANY LIMITED

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product approvals

- 12.1.13 INTERNATIONAL FLAVOURS & FRAGRANCES INC. (IFF)

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches & approvals

- 12.1.13.3.2 Deals

- 12.1.13.3.3 Expansions

- 12.1.14 BIOCON

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product approvals

- 12.1.14.3.2 Deals

- 12.1.1 DANAHER CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 AMANO ENZYME INC.

- 12.2.2 ULTREZE ENZYMES

- 12.2.3 NEOGEN

- 12.2.4 BIOLAXI ENZYMES PVT. LTD.

- 12.2.5 GENSCRIPT

- 12.2.6 BIOSEUTICA

- 12.2.7 KERRY GROUP PLC

- 12.2.8 ASSOCIATED BRITISH FOODS PLC

- 12.2.9 K-GENIX GROUP

- 12.2.10 NAGASE & CO., LTD.

- 12.2.11 GRIFOLS, S.A

- 12.2.12 BASF

- 12.2.13 BIO-CAT

- 12.2.14 AMCO PROTEINS

- 12.2.15 PROTALIX BIOTHERAPEUTICS

13 RESEARCH METHODOLOGY

- 13.1 RESEARCH DATA

- 13.1.1 SECONDARY RESEARCH

- 13.1.1.1 Key secondary sources

- 13.1.1.2 Objectives of secondary research

- 13.1.1.3 Key data from secondary sources

- 13.1.2 PRIMARY RESEARCH

- 13.1.2.1 Key primary sources

- 13.1.2.2 Key objectives of primary research

- 13.1.2.3 Key industry insights

- 13.1.1 SECONDARY RESEARCH

- 13.2 MARKET SIZE ESTIMATION APPROACH

- 13.2.1 COMPANY REVENUE ESTIMATION APPROACH

- 13.2.2 CUSTOMER-BASED MARKET ESTIMATION

- 13.2.3 TOP-DOWN APPROACH

- 13.3 MARKET FORECASTING APPROACH

- 13.4 DATA TRIANGULATION

- 13.5 MARKET SHARE ASSESSMENT

- 13.6 STUDY ASSUMPTIONS

- 13.7 RESEARCH LIMITATIONS

- 13.8 RISK ANALYSIS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS