|

시장보고서

상품코드

1493834

스마트 빌딩용 스타트업 전망(2024년) : 스타트업 상황의 개요, 누가 주목받고 있는가?The Smart Building Startup Landscape 2024 - Overview of the Startup Landscape. Who is Gaining Traction? |

||||||

스마트 빌딩용 스타트업 상황을 평가하기 위한 최신판(2024년)·결정판의 리소스입니다.

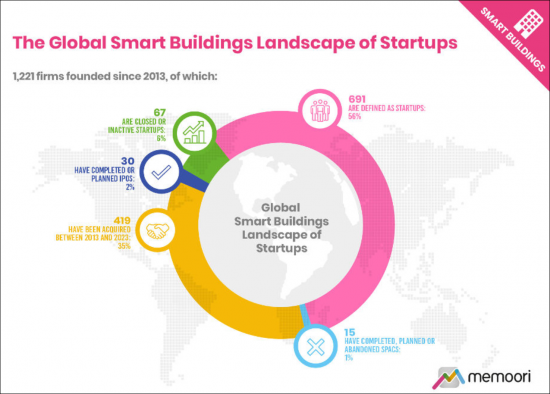

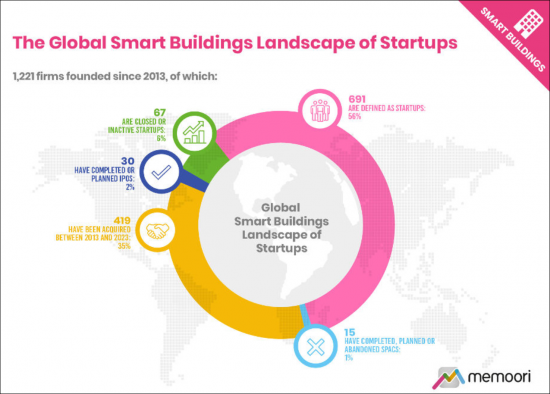

세계의 스마트 상업 빌딩 시장에서 2013년 이후에 설립된 관리·운영 단계에 있는 1,221사 중 691사가 활동중이며, 스타트업의 정의에 적합합니다. 주요 부문(합계 16종)에서 작년도에 관심을 모은 스타트업 기업 100사를 선정하고, 상세 분석했습니다.

스타트업의 정의는 '설립으로부터 10년 이내의 비공개 회사로, 상업·산업 건물 시장에 초점을 맞추고, 대기업의 자회사 및 인수가 아니라 벤처캐피털 및 사모펀드로부터의 자금조달이 많은 회사'입니다.

이 보고서에는 견인력을 얻고 있는 스타트업을 모두 리스트업한 스프레드시트와 이 보고서에 게재된 고해상도 도표를 포함한 프레젠테이션 파일이 추가 요금 없이 포함되어 있습니다. 이 리포트는 Memoori의 최신판(2024년도) Premium Subscription Service에도 포함되어 있습니다.

이 보고서의 조사 내용

- 스마트 빌딩 분야의 주요 16부문에서 과거 2년간 주목받은 스타트업 100사를 다루고 있습니다. 60%는 신규 참여 기업이며, Memoori의 과거 리포트에서는 견인력을 얻고 있는 기업으로 리스트업되었던 적이 아직 없습니다.

- 이 100사는 스마트 빌딩 분야에서 2013년 이후에 설립된 스타트업의 약 14.5%를 차지하고 있습니다.

- 운영·활동 정지중인 스타트업 및 폐쇄된 스타트업(전체 스타트업의 약 6%)을 검토하고 있습니다. 또한 과거 1년간 인원 삭감에 의해 견인력을 잃은 주요 스타트업을 식별하고 있습니다.

이 보고서의 정보는 스마트 빌딩 시장의 엄밀한 분석에 기반하고 있으며, 과거의 다음 조사에 기반하고 있습니다. : 인공지능, 거주 분석, 직장 체험 앱, 사물인터넷, 비디오 감시, 입퇴실 관리.

이 보고서는 2부 구성으로, 모든 이해관계자와 투자자가 성장 분야에서 스타트업의 영향력과 범위를 평가하는데 도움이 될 것으로 생각됩니다. 또한 기타 하이테크 산업에 비해 상업 건물의 운영·정비 단계에서 시장의 혼란이 지연된 이유에 대해서도 분석하고 있습니다.

이 보고서는 121페이지와 42매의 프레젠테이션 슬라이드로 구성되어 있으며, 주요 팩트를 모두 선별하고, 결론을 도출하고 있으므로 2024년 스타트업 상황 및 이 기업이 프롭테크(proptech)의 미래를 어떻게 형성하고 있는지 이해할 수 있습니다.

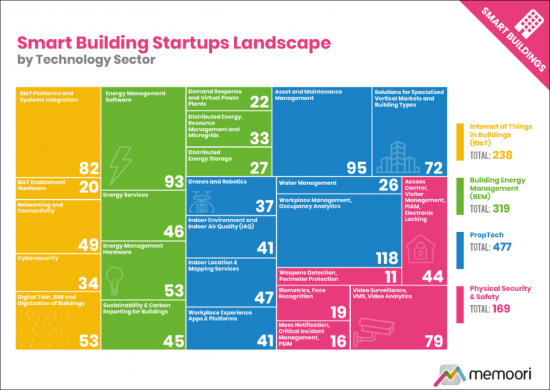

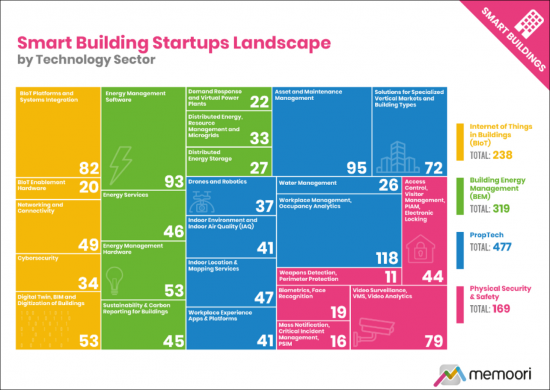

IoT(사물인터넷)는 스마트 빌딩 분야에 침투하고 있으며, 조사 대상 스타트업의 다수에게 주요 기술 촉진요인이 되고 있습니다. BIoT 카테고리는 238사와 전체의 19%를 차지했으나, 스타트업은 4개 부문 모두에서 건물의 운영 실적 개선 및 사용자 체험의 향상을 실현하기 위해 IoT 기술을 전문적인 사용 사례로 사용하고 있으며, 주목할 만한 동향이 되고 있습니다.

목차

서문

조사 범위·방법

주요 요약

제1장 세계의 스마트 빌딩용 스타트업 기업의 상황

- 스마트 빌딩용 스타트업 기업 : 2015년 이후에 370억 달러 투자 -- 시장의 디스럽션(혼란)은 어디에 있는가?

- 스마트 빌딩용 스타트업 : 기술 분야별

- 스타트업의 분포 상황 : 지역별

제2장 스마트 빌딩용 스타트업 견인력의 증대

- BIoT(건물내 사물인터넷)

- IoT 플랫폼 구축

- 디지털 트윈 솔루션

- 빌딩 에너지 관리

- 에너지 관리 소프트웨어

- 지속가능성과 카본 매니지먼트

- 에너지 서비스

- 에너지 관리 하드웨어

- 에너지 저장

- 프롭테크

- 자산관리·정비

- 직장 관리 및 직장 체험

- 실내 매핑 및 위치기반서비스

- 드론 및 로봇

- 실내공기질(IAQ)

- 접객(Hoapitality) 업계

- 물리적 보안

- 액세스 제어·방문자 관리

- 비디오 분석·컴퓨터 비전

- 무기 탐지·경계 방어

제3장 스타트업 폐쇄

- 가동 정지중인 스타트업과 폐쇄

- 대형 스타트업에 대한 관심 저하

제4장 스마트 빌딩용 스타트업의 미래 전망

부록

KSA 24.06.27This Report is a New 2024 Definitive Resource for Evaluating the Smart Building Startup Landscape.

Of the 1,221 companies founded since 2013 in the management and operations phase of the global smart commercial buildings space, 691 are active and fit our definition of a startup. This report selects 100 startups for further analysis that have gained traction in the last year across 16 major segments.

Our definition of a Startup is "a private company formed for no more than 10 years, that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is often financed by venture capital or private equity funding."

The report INCLUDES at no extra cost, a spreadsheet listing all the startups gaining traction, and a presentation file with high-resolution charts from the report. This report is also included in our 2024 Premium Subscription Service.

What does this Startup Report tell You?

- It highlights 100 startups that have gained traction in the last two years across 16 major segments in the smart buildings space. 60% of these firms are new entrants, in the sense that they have not been listed before as gaining traction in our previous reports.

- These 100 companies account for around 14.5% of the startups founded since 2013 in the smart buildings space.

- It reviews non-operational or inactive startups and closures, which account for around 6% of the startup landscape. We also identify the major startups that have lost traction through headcount reduction in the last year.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into artificial intelligence, occupancy analytics, workplace experience apps, the Internet of Things, video surveillance, and access control.

This report, the second in a 2-part series, will help all stakeholders and investors to assess the impact and range of startups in growth sectors. It also provides some analysis on why market disruption has been slower in the operation and maintenance phases of commercial buildings compared to other tech industries.

Within its 121 Pages and 42 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand what the StartUp Landscape looks like in 2024 and how these Companies are Shaping the Future of PropTech.

The Internet of Things pervades the smart buildings space and is the major technology driver for many of the startups identified. While the BIoT category accounted for 238 or 19% of the total number of companies, it should be noted that startups are using IoT technology in specialized use cases across all four segments to deliver improved operational performance of buildings and enhanced user experiences.

This report provides valuable information for all stakeholders and investors to assess the impact and range of companies in all growth sectors of the smart buildings space.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startup companies will find it particularly useful. Want to know more?

Table of Contents

Preface

Research Scope and Methodology

Executive Summary

1. The Global Smart Buildings Landscape of Startups

- 1.1. With $37Bn Invested in Smart Building Startups Since 2015, Where is the Market Disruption?

- 1.2. Smart Buildings Startups by Technology Sector

- 1.3. Regional Distribution of Startups

2. Smart Building Startups Gaining Traction

- 2.1. Internet of Things in Buildings (BIoT)

- 2.1.1. Building IoT Platforms

- 2.1.2. Digital Twin Solutions

- 2.2. Building Energy Management

- 2.2.1. Energy Management Software

- 2.2.2. Sustainability and Carbon Management

- 2.2.3. Energy Services

- 2.2.4. Energy Management Hardware

- 2.2.5. Energy Storage

- 2.3. PropTech

- 2.3.1. Asset Management and Maintenance

- 2.3.2. Workplace Management and Workplace Experience

- 2.3.3. Indoor Mapping and Location Services

- 2.3.4. Drones and Robotics

- 2.3.5. Indoor Air Quality (IAQ)

- 2.3.6. Hospitality Sector

- 2.4. Physical Security

- 2.4.1. Access Control and Visitor Management

- 2.4.2. Video Analytics and Computer Vision

- 2.4.3. Weapons Detection and Perimeter Protection

3. Startup Closures

- 3.1. Non-Operational Startups and Closures

- 3.2. Major Startups Losing Traction

4. The Future Outlook for Smart Building Startups

Appendix

- A1 Smart Building Startups Gaining Traction