|

시장보고서

상품코드

1566486

상업 빌딩용 HVAC 최적화용 에너지 관리 소프트웨어 시장 : 시장 규모, 경쟁 구도(2024-2029년)Energy Management Software for HVAC Optimization in Commercial Buildings - Market Sizing & Competitive Landscape 2024-2029 |

||||||

샘플 뷰

세계의 상업 빌딩용 HVAC 최적화용 에너지 관리 소프트웨어 시장 규모는 2023년의 베이스라인 금액인 36억 5,000만 달러에서 2029년까지 58억 3,000만 달러에 달할 것으로 예측되며, CAGR로 8.1%의 성장이 전망됩니다.

데이터센터는 바닥 면적에 대해 시장의 매출 비율이 크며, 2024년에 HVAC 최적화 소프트웨어 전체 매출의 11.4%(4억 4,900만 달러)를 차지합니다. HVAC에 의한 냉각은 데이터센터의 총 에너지 사용의 최대 40%를 차지할 가능성이 있으며, 효율적인 HVAC 관리가 매우 중요해집니다. 데이터센터의 AI 구동형 HVAC 솔루션은 서버 부하 레벨, 외부 기후 조건, 내부 온도 등의 실시간 데이터에 기반하여 냉각 출력을 동적으로 조정할 수 있습니다.

상업 빌딩용 HVAC 최적화용 에너지 관리 소프트웨어 시장은 기술의 진보, 규제 압력, 에너지 효율의 필요성에 대한 의식의 향상에 의해 향후 5년간 크게 성장할 전망입니다.

세계의 상업 빌딩용 HVAC 최적화용 에너지 관리 소프트웨어 시장에 대해 조사분석했으며, 시장 규모, 동향과 촉진요인, 과제와 장벽, 경쟁 구도 등의 정보를 제공하고 있습니다. 또한 AI를 활용한 에너지 관리 기술이 HVAC 시스템의 운영 방법을 어떻게 변혁하고, 운영 효율과 지속가능성을 향상시키는지 상세히 검토하고 있습니다.

샘플 뷰

다루어진 에너지 관리 소프트웨어 기업의 예

|

|

목차

서문

조사 범위

조사 방법

정의

제1장 서론

제2장 코어 기술

- 센서, 커넥티드 디바이스, IoT

- 애널리틱스, AI, 기계학습

- 엣지/클라우드 컴퓨팅

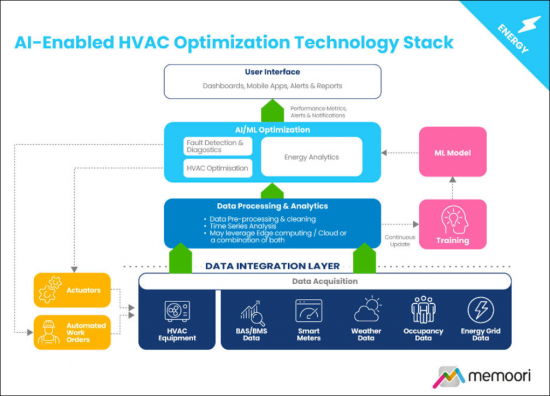

- AI를 활용한 HVAC 최적화 기술 스택

제3장 상업 빌딩에서 에너지 관리의 현황

- 상업 빌딩에서 에너지 소비의 개요

- 상업 빌딩에서의 에너지 사용 패턴

- 상업 빌딩으로부터의 이산화탄소 배출

- 기술 채택률

- HVAC 에너지 관리 솔루션 성숙도 모델

제4장 주요 사용 사례와 용도

- 에너지 성능의 향상

- 이산화탄소 배출의 삭감

- 예지보전과 고장 탐지

- 점유율에 기반한 HVAC 제어

- 계절 및 기후에 부응한 최적화

- 실내공기질(IAQ)과 HVAC의 최적화

제5장 수직 시장의 용도와 기회

- 수직 시장의 개요

- 오피스

- 소매

- 접객(Hoapitality)·푸드서비스

- 창고

- 데이터센터

제6장 시장의 동향과 촉진요인

- 세계의 에너지 상황

- 재생에너지, 에너지 전환

- 건물로부터 그리드로의 통합

- 규제와 정책의 상황

- 경제 요인과 부동산의 동향

- 직장 역학의 변화

- 도시화와 스마트 시티 구상

- 지속가능성, ESG, 그린 파이낸싱

- 인증과 산업 표준

제7장 과제와 장벽

- 재정상 장벽

- 레거시 시스템과의 통합

- 스킬과 노동력 장벽

- 데이터 프라이버시와 보안

- 개보수와 노후화 건물

제8장 세계 시장 예측(2024-2029년)

- 세계 시장 예측

- 시장 내역 : 업계별

제9장 지역 시장 내역과 분석

- 시장 내역 : 지역별

- 지역 특유 시장 촉진요인과 장벽

제10장 AI를 활용한 HVAC 소프트웨어의 경쟁 상황

- 기업의 지역 분포

- 기업의 분포 : 규모별

- 기업의 분포 : 연수별

제11장 주요 기업의 전략적 포지셔닝

- 빌딩 자동화 기업

- HVAC 전문가

- 혁신적인 스타트업과 신규 기업

제12장 투자 동향과 M&A

- 합병과 인수

- 파트너십과 제휴

- 투자의 개요

- 지역적 투자 동향

- 주목해야 할 투자 거래

This report is a new 2024 study that provides a detailed market forecast to 2029, broken down by region and vertical market.

In today's complex commercial real estate landscape, energy management has become a critical focus for property and facilities managers. Optimizing energy use is not just about lowering costs, it has become a key factor in achieving sustainability and resource efficiency.

This new research takes an in-depth look at how artificial intelligence-driven energy management technologies will transform the way HVAC systems operate, enhancing both operational efficiency and sustainability. The report includes, at no extra cost, a spreadsheet containing the data from the report and high-resolution presentation charts showing the key findings. It is the first in a 2-part series of reports, with the second report on building-to-grid interaction software being published later this year.

Both these reports are included in Memoori's 2024 Premium Subscription Service, which also gives access to our chatbot AIM, where you can query all our research using the power of Large Language Models (LLMs).

SAMPLE VIEW

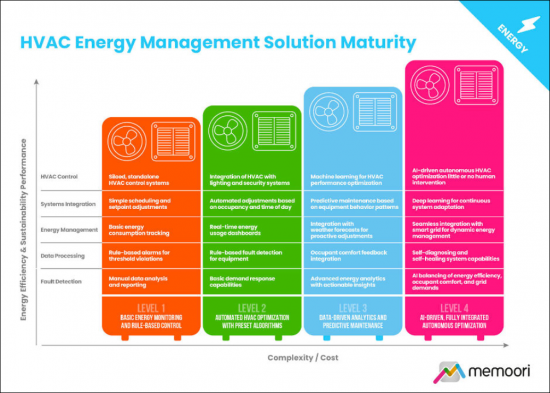

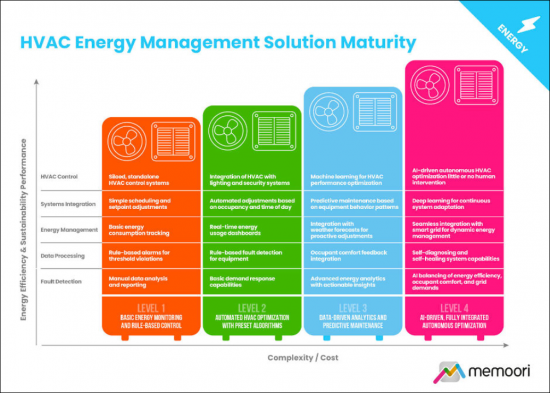

HVAC Energy Management Solution Maturity Model

To better understand the landscape of HVAC energy management solutions and their relative maturity, Memoori has developed a model categorizing these solutions into four distinct tiers.

- Tier 1 represents basic energy monitoring and rule-based control, with limited automation and integration.

- Tier 2 introduces semi-automated control and basic data-driven analytics, allowing for more comprehensive energy management.

- Tier 3 transitions to data-driven optimization incorporating machine learning and predictive analytics, enabling dynamic optimization based on real-time and predictive data.

- Tier 4 represents the pinnacle of HVAC energy management, with predominantly autonomous and AI-driven systems capable of optimizing performance without human intervention.

Based on an assessment of available data on technology adoption, the report develops a theoretical model of the global distribution across the HVAC Energy Management Solution Maturity tiers.

Scope

This report focuses specifically on next-generation software solutions that leverage AI and IoT technologies to track, analyze, automate, and optimize HVAC energy consumption and performance. Software solutions included in the scope of the research for this report include:

- Software solutions directly supporting HVAC automation and optimization.

- Energy performance optimization and carbon emissions reduction solutions.

- Automated HVAC fault detection & diagnostics solutions.

- Data integration and interoperability solutions integral to HVAC optimization.

- AI-enabled occupancy-based HVAC control solutions.

Technology out of the scope of this report includes, broader energy management systems incorporating non-HVAC elements, energy data visualization and reporting tools, sustainability or ESG solutions, grid interaction software, and any hardware revenues related to energy management.

WITHIN ITS 227 PAGES AND 19 CHARTS, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY HOW ENERGY MANAGEMENT TECHNOLOGY IS IMPACTING HVAC SYSTEMS AND WHY;

- The market for Energy Management Software for HVAC Optimization in Commercial Buildings is projected to grow from a baseline value of $3.65 billion in 2023 to $5.83 billion by 2029, representing a compound annual growth rate (CAGR) of 8.1%. Our projection accounts for regional disparities in adoption rates, macroeconomic influences, and technology-driven shifts to deliver a comprehensive and realistic market outlook.

- Data centers account for an outsized proportion of market revenues relative to their floorspace, representing 11.4% of overall HVAC optimization software revenues ($449 million) in 2024. HVAC cooling can account for up to 40% of a data center's total energy use, making efficient HVAC management crucial. AI-driven HVAC solutions in data centers can dynamically adjust cooling outputs based on real-time data such as server load levels, external weather conditions, and internal temperatures.

- The market for Energy Management Software for HVAC Optimization in Commercial Buildings is poised for significant growth over the next five years, driven by technological advancements, regulatory pressures, and increasing awareness of the need for energy efficiency.

This report provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their energy management software business. The final part of the report provides a thorough competitive landscape analysis, profiling key players, market leaders, and emerging startups. This includes an overview of strategic partnerships, mergers, and acquisitions in the sector.

SAMPLE VIEW

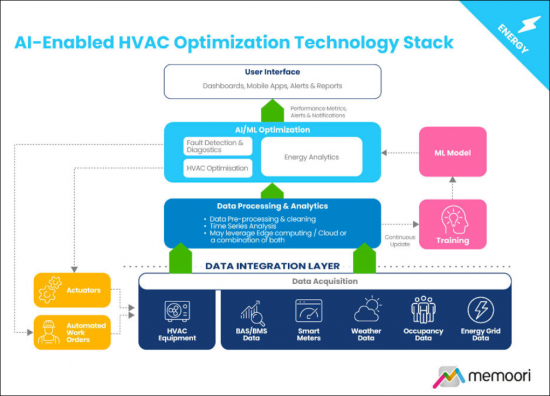

The infographic above visualizes the flows of data that occur between different technologies to enable the AI HVAC Optimization Technology Stack. By integrating AI, IoT, and data analytics, this system can dynamically enhance HVAC performance, reflecting the core concepts discussed in this report.

WHO SHOULD BUY THIS ENERGY MANAGEMENT REPORT?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in Commercial Buildings (and their Advisors) around the world. The report aims to help stakeholders make informed decisions that will drive the future of HVAC optimization and energy management.Energy Management Software Companies Mentioned INCLUDE (but NOT limited to):

|

|

Table of Contents

Preface

Research Scope

Methodology

Definitions

1. Introduction

- 1.1. The Evolution of Building Energy Management Systems (BEMS)

- 1.2. Factors Influencing Energy Consumption in HVAC

2. Core Technologies

- 2.1. Sensors, Connected Devices, and IoT

- 2.2. Analytics, AI & Machine Learning

- 2.3. Edge and Cloud Computing

- 2.4. The AI-Enabled HVAC Optimization Technology Stack

3. The Current State of Energy Management in Commercial Buildings

- 3.1. Overview of Energy Consumption in Commercial Buildings

- 3.2. Energy Use Patterns in Commercial Buildings

- 3.3. Carbon Emissions from Commercial Building

- 3.4. Technology Adoption Rates

- 3.5. HVAC Energy Management Solution Maturity Model

4. Key Use Cases and Applications

- 4.1. Energy Performance Improvements

- 4.2. Carbon Emissions Reduction

- 4.3. Predictive Maintenance and Fault Detection

- 4.4. Occupancy-Based HVAC Control

- 4.5. Seasonal and Weather-Driven Optimization

- 4.6. Indoor Air Quality (IAQ) and HVAC Optimization

5. Vertical Market Applications & Opportunities

- 5.1. Vertical Market Overview

- 5.2. Offices

- 5.3. Retail

- 5.4. Hospitality & Food Services

- 5.5. Warehouses

- 5.6. Data Centers

6. Market Trends & Drivers

- 6.1. Global Energy Landscape

- 6.2. Renewables and the Energy Transition

- 6.3. Building-to-Grid Integration

- 6.4. Regulatory and Policy Landscape

- 6.5. Economic Factors and Real Estate Trends

- 6.6. Changing Workplace Dynamics

- 6.7. Urbanization and Smart City Initiatives

- 6.8. Sustainability, ESG, and Green Financing

- 6.9. Certifications and Industry Standards

7. Challenges and Barriers

- 7.1. Financial Barriers

- 7.2. Integration with Legacy Systems

- 7.3. Skills and Workforce Barriers

- 7.4. Data Privacy and Security

- 7.5. Retrofit and Ageing Building Stocks

8. Global Market Forecasts 2024 to 2029

- 8.1. Global Market Forecasts

- 8.2. Market Breakdown by Vertical

9. Regional Market Breakdown & Analysis

- 9.1. Regional Market Breakdown

- 9.2. Region Specific Market Drivers & Barriers

10. The Competitive Landscape in AI-Enabled HVAC Software

- 10.1. Regional Distribution of Companies

- 10.2. Distribution of Companies by Size

- 10.3. Distribution of Companies by Age

11. The Strategic Positioning of Key Players

- 11.1. Building Automation Firms

- 11.2. HVAC Specialists

- 11.3. Innovative Startups and Emerging Players

12. Investment Trends and M&A

- 12.1. Mergers and Acquisitions

- 12.2. Partnerships & Alliances

- 12.3. Investments Summary

- 12.4. Geographic Investment Trends

- 12.5. Notable Investment Deals