|

시장보고서

상품코드

1872363

물리적 액세스 제어 시장(2025-2030년) - 하드웨어, 소프트웨어, 인증The Physical Access Control Business 2025 to 2030 - Hardware, Software & Credentials Market Analysis |

||||||

물리적 액세스 제어(PACS)는 독립형 도어 보안에서 클라우드 아키텍처, 모바일 인증 및 AI 를 갖춘 스마트 빌딩 경영의 핵심 소프트웨어 정의 플랫폼으로 진화하고 있습니다. 이는 조직이 시설을 보호하고, 신원을 관리하고, 직장 경험을 최적화하는 방법을 변화시키고, 제조업체에서 시스템 통합사업자에 이르기까지 모든 관계자에게 전략적 기회와 경쟁 위험을 초래합니다.

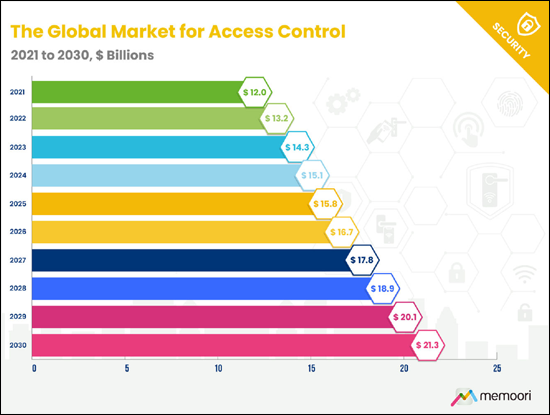

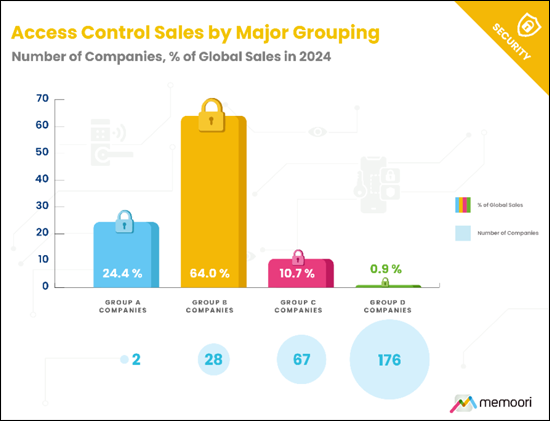

- 세계의 액세스 제어 시장 규모는 2024년에 151억 달러에 달했고, 2030년까지 213억 달러에 이를 것으로 예측되며 CAGR로 5.94%를 나타낼 것으로 전망됩니다. 그룹 A 기업(수익 10억 달러 이상)이 세계 수익의 약 24.4%를 차지하고 있습니다. 그룹 B(수익 1억 달러-10억 달러)에는 28개 기업이 포함되어 있으며 평균 수익은 3억 2,700만 달러로 전 세계 매출의 64%를 차지합니다.

- 아시아태평양이 2030년까지 유럽을 제치고 2위 시장이 될 전망입니다. 개축이 견인하는 성숙 시장과 달리 아시아태평양의 성장은 사무실, 물류, 제조, 정부 시설의 신축에 기인합니다.

- 2023년 9월-2025년 9월 총 79억 달러에 이르는 16 건의 거래가 완료되었습니다. 그 필두가 Honeywell에 의한 Carrier의 액세스 제어 사업의 49억 5,000만 달러로 인수 입니다.

- 소프트웨어 리컬링 수익, 관리 서비스, 클라우드 구독이 기존 하드웨어 이익률을 대체하고 가치 획득은 극적으로 변화하고 있습니다.

- 모바일 인증은 조직이 액세스 권한을 부여, 관리 및 무효화하는 방식에 큰 변화를 가져오고 있습니다. 시장은 자체 앱 기반 인증에서 Apple Wallet 또는 Google Wallet에 직접 통합된 월렛 네이티브 인증으로 전환하고 있습니다. 이를 통해 기기의 잠금을 해제하지 않고 탭하면 입장할 수 있는 경험을 제공하고 기본적으로 생체 인증을 지원합니다.

액세스 제어 플랫폼에 대한 벤처 캐피탈 투자는 2021년 피크 유입에서 급격히 감소했습니다. 2023년 9월-2025년 9월에 12 건의 투자 거래로 3억 2,600만 달러를 넘는 공개 자금이 이 부문에 투입되어 자본은 통합 클라우드 플랫폼 주변에 집중하고 있습니다. Verkada는 45억 달러의 평가를 받고 시리즈 E에서 2억 달러의 자금을 확보했지만 Rhombus Systems는 시리즈 C 라운드에서 4,500만 달러를 조달했습니다. 이는 액세스 제어, 비디오 모니터링 및 환경 센서를 단일 관리 플랫폼에 통합하는 기업에 대한 투자자의 지속적인 신뢰를 보여줍니다.

전략적 제휴는 혁신의 구조적 인에이블러로서 중요성을 늘리고 있으며, 인증 제공업체, 스마트폰 제조업체, 클라우드 플랫폼 벤더의 협력으로 모바일 인증 채택이 가속화되고 멀티벤더 생태계가 정상화되고 있습니다.

이 보고서는 전 세계 물리적 액세스 제어 시장을 조사했으며, 기업 273개 기업의 성과, 제품 포트폴리오 및 전략적 포지셔닝을 분석합니다.

목차

서문

주요 요약

제1장 액세스 제어 사업의 구조와 형태

- 액세스 제어 시장 구조

- 기업 분류 및 시장 점유율

- 액세스 제어 시장 밸류체인

- 판매 및 유통 채널

- 가격 설정, TCO, 라이프 사이클 경제

제2장 액세스 제어 시장

- 액세스 제어 시장의 진화

- 시장 역학, 투자, 도입 동향

- 시장 경영

- 도입 신호 및 예산 전망

- 투자 우선순위

- 구매자의 행동, 조달, 위험

- 시장 규모와 성장 예측

- 시장 규모와 동향 : 지역별

- 북미

- 라틴 아메리카 및 카리브해

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 시장 규모와 동향 : 업계별

- 사무실

- 정부

- 교육

- 제조 및 물류

- 의료

- 소매

- 운송

- 호텔 및 외식 서비스

- 데이터센터

- 엔터테인먼트 및 레저

- 하드웨어

- 전자식, 무선 및 스마트 잠금

- 리더, 스캐너 및 키패드

- 제어 패널 및 서버

- 인증

- 시장 규모 : 자격별

- 인증 유형의 비교 분석

- 마그네틱 스트라이프 카드

- 근접 카드

- 스마트 카드

- 모바일 월렛 인증

- 생체 인식

- 바코드/QR코드

- 소프트웨어

- 소프트웨어 시장 : 배포 방법별

- 전용 액세스 제어 소프트웨어

- 통합 보안 솔루션

- PIAM(물리적 ID 및 액세스 관리)

- 관련 소프트웨어 도메인

제3장 IP, IoT, 상호 운용성

- IP와 IoT의 융합

- 개방형 표준 이니셔티브

- IoT의 성장과 도입 동향

- IP와 IoT의 장점

- IP와 IoT의 도입 과제

- 액세스 제어용 엣지 처리

- API, SDK, 플랫폼 에코시스템의 상승

제4장 클라우드 및 ACaaS

- 액세스 제어의 클라우드 아키텍처

- 클라우드 및 ACaaS의 도입 동향과 예측

- 클라우드 기반 액세스 제어의 장점과 과제

- ACaaS 경쟁 구도와 비즈니스 모델

제5장 액세스 제어에 있어서의 AI 및 머신러닝

- 액세스 제어에 있어서의 AI 혁신과 용도

- AI 도입 동향

- 주요 도입 과제와 장벽

- 데이터의 프라이버시와 윤리적 배려

제6장 모바일 액세스 제어

- 모바일 액세스 제어 기술 및 인증

- 모바일 도입 동향과 시장 역학

- 모바일 액세스 제어경쟁 구도

제7장 생체 인증

- 생체 인증 기술과 모달리티

- 생체 인증의 도입 동향

- 생체 인증 관련 과제

- 규제, 법 및 프라이버시에 관한 고려 사항

- 생체 인증경쟁 구도

제8장 다중 인증 및 멀티 테크놀로지 리더

- 다중 인증

- 멀티 테크놀로지 리더

- 과제와 단점

제9장 시스템 통합과 컨버전스 동향

- 물리 및 논리 보안의 융합

- 영상 액세스 통합

- 빌딩 관리 시스템 통합

제10장 공급망과 제조 동향

- 공급망의 운용 조건

- 공급에 대한 지정학적 영향

- 지역화와 온쇼어의 동향

제11장 상업 건설과 부동산 시장

- 액세스 제어 수요에 대한 CRE와 건설 시장의 영향

- 주목해야 할 부동산의 동향

- 상업 건설 전망

제12장 기술, 인재, 노동자

- 주요 동향과 과제

- 새로운 기회

제13장 사이버 보안 및 데이터 프라이버시

- 통합 시스템의 사이버 보안에 미치는 영향

- 위협 상황과 주목할만한 취약성

- 규제 요인

- 사이버 위험 완화를 위한 모범 사례

제14장 지속가능성

- 투자 촉진요인으로서의 지속가능성

- 액세스 제어 시스템의 지속가능성 강화

- 지속가능성을 실현하는 액세스 제어

- 표준, 인증, 바이어의 기대

제15장 합병과 인수

- 과거의 M&A 시장 역학

- 새로운 M&A 거래

- M&A의 동향과 영향

제16장 전략적 제휴

- 과거의 전략적 제휴와 시장 역학

- 새로운 전략적 제휴(2023년 9월-2025년 9월)

- 전략적 제휴의 동향과 영향

제17장 투자 동향

- 과거의 투자거래와 투자 시장 역학

- 새로운 투자거래

- 투자 동향과 영향

This report is an in-depth study providing a detailed market analysis of access control, with a specific focus on revenues generated by hardware, software & credentials.

Physical access control (PACS) is evolving from standalone door security into a software-defined platform at the center of smart building operations, with cloud architectures, mobile credentials, and artificial intelligence reshaping how organizations secure facilities, manage identities, and optimize workplace experiences, creating both strategic opportunities and competitive risks for everyone from manufacturers to systems integrators.

It is the second instalment of a two-part series covering Physical Security Technology. Part 1, covering Video Surveillance, was published in Q3 2025. Both these reports are included in Memoori's 2025 Premium Subscription Service.

Key Questions Addressed:

- What is the size and structure of the global access control market in 2025? The market reached $15.1 billion in 2024 and will grow to $21.3 billion by 2030 at a 5.94 percent CAGR. Group A companies (those with over $1 billion in revenues), together represent approximately 24.4 percent of global revenues. Group B (those with between $100 million and $1 billion) encompasses 28 companies with average revenues of $327 million, collectively accounting for 64 percent of global revenues.

- Which region offers the strongest growth opportunity through 2030? Asia Pacific will overtake Europe as the second-largest market by 2030. Unlike mature markets driven by retrofits, Asia Pacific growth comes from new construction across offices, logistics, manufacturing, and government facilities.

- How is M&A reshaping and consolidating the industry? 16 transactions totaling $7.9 billion were completed between September 2023 and September 2025, led by Honeywell's $4.95 billion acquisition of Carrier's access control business.

Within its 238 Pages and 13 Charts, This report presents all the key facts and draws conclusions, so you can understand what is shaping the future of the access control industry:

- Our comprehensive analysis of the global access control market is structured around 3 core revenue categories: hardware (electronic locks, readers, control panels, and supporting infrastructure), credentials (cards, mobile, biometrics, and alternative formats), and software (on-premises and cloud-based platforms). Our methodology evaluates 273 active companies worldwide, classifying vendors into four groups based on 2024 revenues and analyzing their financial performance, product portfolios, and strategic positioning.

- Value capture is shifting dramatically as recurring software revenue, managed services, and cloud subscriptions displace traditional hardware margins. This report maps these dynamics across vendor groups and identifies where profits are concentrating as the industry transitions from product sales to platform economics.

- Mobile credentials represent a significant transformation in how organizations provision, manage, and revoke access rights. The market is shifting from proprietary app-based credentials toward wallet-native credentials embedded directly in Apple Wallet and Google Wallet, enabling tap-to-enter experiences without unlocking devices and supporting biometric authentication by default. This report analyzes adoption patterns across vertical markets, quantifies infrastructure investment requirements, and evaluates competing standards.

This report provides valuable information into how physical security companies can develop their business strategy through mergers, acquisitions, and alliances.

Venture capital investment in access control platforms declined sharply from peak inflows in 2021. Between September 2023 and September 2025, 12 investment deals directed well over $326 million in disclosed funding into the sector, with capital concentrating around unified cloud platforms. Verkada secured $200 million in Series E funding at a $4.5 billion valuation, while Rhombus Systems raised a $45 million Series C round, demonstrating continued investor confidence in companies integrating access control, video surveillance, and environmental sensors into single management platforms.

Strategic partnerships have become important as structural enablers of innovation, with alliances between credential providers, smartphone manufacturers, and cloud platform vendors accelerating mobile credential adoption and normalizing multi-vendor ecosystems.

The report documents funding rounds, analyzes which technologies and business models are attracting capital, maps strategic alliances shaping interoperability standards, and identifies which vendor partnerships deliver genuine integration versus marketing announcements, critical intelligence for buyers evaluating platform longevity and ecosystem risk.

Who Should Buy This Report?

The information in this report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful.

Table of Contents

Preface

Executive Summary

1. The Structure & Shape of the Access Control Business

- 1.1. Access Control Market Structure

- 1.2. Company Classifications & Market Share

- 1.3. Access Control Market Value Chain

- 1.4. Sales & Distribution Channels

- 1.5. Pricing, TCO and Lifecycle Economics

2. The Access Control Market

- 2.1. The Evolution of the Access Control Market

- 2.2. Market Dynamics, Investment & Adoption Trends

- 2.2.1. Market Operating Conditions

- 2.2.2. Adoption Signals and Budget Outlook

- 2.2.3. Investment Priorities

- 2.2.4. Buyer Behavior, Procurement and Risk

- 2.3. Market Size & Growth Forecasts

- 2.4. Market Size & Trends by Region

- 2.4.1. North America

- 2.4.2. Latin America & The Caribbean

- 2.4.3. Asia Pacific

- 2.4.4. Europe

- 2.4.5. Middle East & Africa

- 2.5. Market Size & Trends by Vertical

- 2.5.1. Offices

- 2.5.2. Government

- 2.5.3. Education

- 2.5.4. Manufacturing & Logistics

- 2.5.5. Healthcare

- 2.5.6. Retail

- 2.5.7. Transport

- 2.5.8. Hospitality & Food Services

- 2.5.9. Datacenters

- 2.5.10. Entertainment / Leisure

- 2.6. Hardware

- 2.6.1. Electronic, Wireless & Smart Locks

- 2.6.2. Readers, Scanners & Keypads

- 2.6.3. Control Panels and Servers

- 2.7. Credentials

- 2.7.1. Market Size by Credential

- 2.7.2. Comparative Analysis of Credential Types

- 2.7.3. Magnetic Stripe Cards

- 2.7.4. Proximity Cards

- 2.7.5. Smart Cards

- 2.7.6. Mobile-Wallet Credentials

- 2.7.7. Biometrics

- 2.7.8. Barcodes/QR Codes

- 2.8. Software

- 2.8.1. Software Market by Deployment Method

- 2.8.2. Dedicated Access Control Software

- 2.8.3. Unified Security Solutions

- 2.8.4. PIAM (Physical Identity and Access Management)

- 2.8.5. Related Software Domains

3. IP, IoT, and Interoperability

- 3.1. The Convergence of IP and IoT

- 3.2. Open Standards Initiatives

- 3.3. IoT Growth & Adoption Trends

- 3.4. The Benefits of IP & IoT

- 3.5. IP and IoT Adoption Challenges

- 3.6. Edge Processing for Access Control

- 3.7. APIs, SDKs the Rise of Platform Ecosystems

4. The Cloud & ACaaS

- 4.1. Cloud Architectures in Access Control

- 4.2. Cloud & ACaaS Adoption Trends & Forecasts

- 4.3. Benefits & Challenges of Cloud-Based Access Control

- 4.4. ACaaS Competitive Landscape & Business Models

5. AI & Machine Learning in Access Control

- 5.1. AI Innovations & Applications for Access Control

- 5.2. AI Adoption Trends

- 5.3. Key Adoption Challenges & Barriers

- 5.4. Data Privacy & Ethical Considerations

6. Mobile Access Control

- 6.1. Mobile Access Control Technologies & Credentials

- 6.2. Mobile Adoption Trends & Market Dynamics

- 6.3. Mobile Access Control Competitive Landscape

7. Biometrics

- 7.1. Biometrics Technologies & Modalities

- 7.2. Biometric Adoption Trends

- 7.3. Biometrics Related Challenges

- 7.4. Regulatory, Legal & Privacy Considerations

- 7.5. Biometrics Competitive Landscape

8. Multifactor Authentication & Multi Technology Readers

- 8.1. Multifactor Authentication

- 8.2. Multi Technology Readers

- 8.3. Challenges and Drawbacks

9. Systems Integration & Convergence Trends

- 9.1. Physical-Logical Security Convergence

- 9.2. Video-Access Integration

- 9.3. Building Management Systems Integration

10. Supply Chain & Manufacturing Trends

- 10.1. Supply Chain Operating Conditions

- 10.2. Geopolitical Impacts on Supply

- 10.3. Regionalization and onshore trends

11. Commercial Construction & Real Estate Markets

- 11.1. Influence of CRE and Construction Markets on Access Control Demand

- 11.2. Notable Real Estate Trends

- 11.3. Commercial Construction Outlook

12. Skills, Talent & Labor

- 12.1. Key Trends & Challenges

- 12.2. Emerging Opportunities

13. Cybersecurity & Data Privacy

- 13.1. Cybersecurity Implications of Converged Systems

- 13.2. Threat Landscape & Notable Vulnerabilities

- 13.3. Regulatory Drivers

- 13.4. Best Practices for Cyber Risk Mitigation

14. Sustainability

- 14.1. Sustainability as an Investment Driver

- 14.2. Making Access Control Systems More Sustainable

- 14.3. Access Control as a Sustainability Enabler

- 14.4. Standards, Certifications, and Buyer Expectations

15. Mergers & Acquisitions

- 15.1. Historic M&A Market Dynamics

- 15.2. New M&A Deals

- 15.3. M&A Trends and Implications

16. Strategic Alliances

- 16.1. Historic Strategic Alliances and Market Dynamics

- 16.2. New Strategic Alliances (September 2023 to September 2025)

- 16.3. Strategic Alliance Trends and Implications

17. Investment Trends

- 17.1. Historic Investment Deals & Investment Market Dynamics

- 17.2. New Investment Deals

- 17.3. Investment Trends and Implications