|

시장보고서

상품코드

1687319

세계의 백금족 금속 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

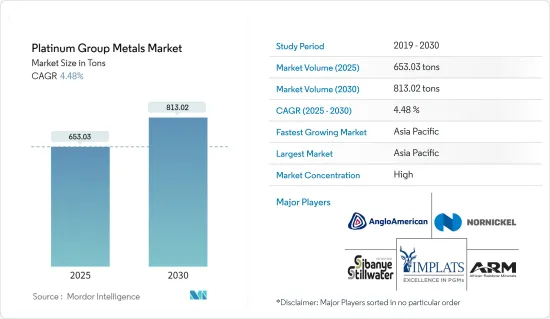

세계의 백금족 금속 시장 규모는 2025년 653.03톤으로 예측되며, 예측 기간 중(2025-2030년) CAGR 4.48%로 확대되어, 2030년에는 813.02톤에 달할 것으로 예측됩니다.

주요 하이라이트

- COVID-19 팬데믹은 2020년 시장에 부정적인 영향을 주었습니다.

- 단기적으로는 자동차 산업에 의한 촉매 컨버터 수요 증가, 일렉트로닉스 산업에 의한 백금, 팔라듐, 루테늄 수요 증가, 아시아태평양 국가에서의 보석품 소비의 확대가 시장 성장을 견인할 것으로 보입니다.

- 그러나, 백금족 금속의 생산과 유지에 걸리는 고비용이 시장 성장의 방해가 될 것으로 예상됩니다.

- 그러나, 그린테크놀로지에서의 백금의 이용, 아프리카 국가에서의 백금 산업에 대한 투자 증가는 예측 기간 중에 시장에 기회를 가져올 것으로 예상됩니다.

- 예측기간 중 아시아태평양이 세계 시장을 독점할 것으로 보입니다.

백금족 금속 시장 동향

자동차 촉매 부문이 시장을 독점

- 백금, 팔라듐, 로듐을 포함한 백금족 원소 또는 백금족 금속(PGM)은 자동차 산업에서 자동차 촉매로 널리 사용되고 있습니다.

- 이러한 금속은 엔진과 머플러 사이의 배기 시스템에 배치되어 엔진이 금속을 가열하면 그 과정에서 오염물질이 중화됩니다.

- 경제적인 자동차 제조업체가 더 비싼 팔라듐과 백금을 교환하려고 하는 경향이 강해지기 때문에 백금은 2022년의 자동차 제조 대수 증가에 의해 이익을 얻었습니다. 백금이 선호되고 가스 자동차에서는 팔라듐이 선호됩니다.

- OICA(Internationale des Constructeurs d'Automobiles)에 따르면 2022년 전 자동차의 세계 판매 대수는 8,162만대로, 2021년은 8,275만대였습니다.

- 세계무역기관(WTO)에 따르면 미국은 2022년 일본을 제치고 제2위 자동차 수출국이 되었습니다. 중국은 수출 상위 10개국 중 수출을 30% 증가시켰습니다.

- 인도 자동차 산업의 투자 증가와 진보가 자동차용 촉매 시장 수요를 끌어올릴 것으로 예상됩니다. 자동차 산업은 인도 제조업 GDP의 49%, GDP 전체의 7.1%를 차지하고 있습니다.

- 상기의 모든 요인이 자동차 촉매 부문을 견인해, 예측 기간중의 백금족 금속 수요를 높일 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 백금족 금속 시장에서 가장 큰 점유율을 차지하고 세계 점유율의 거의 절반을 차지했습니다.

- 전자 산업에서는 백금, 팔라듐, 로듐 및 이리듐이 전극 코팅에 사용됩니다. 팔라듐 금속은 대부분의 마이크로프로세서와 인쇄 회로 기판에 포함되어 있습니다.

- 중국에서는 스마트폰 이용자가 증가하고 있습니다.

- 마찬가지로 인도의 전자기기 시장은 향후 3년간 4,000억 달러에 이를 것으로 예상되고 있습니다.

- 또한 Platinum Guild International(PGI)에 따르면 2022년 일본에서의 백금 매출은 14년 만에 1조엔(100억 달러)을 돌파했습니다.

- 일본은 현재 미국에 이은 세계 제2위의 보석품 시장으로 간주되고 있습니다.

- 따라서 위의 모든 요인은 예측 기간 동안 백금족 금속 시장 수요를 증가시킬 것으로 예상됩니다.

백금족 금속 산업 개요

백금족 금속 시장은 통합된 성질을 가지고 있습니다. 주요 기업(특별한 순서 없음)에는 Anglo American Platinum Limited, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, African Rainbow Minerals Limited 등이 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 자동차 산업으로부터 촉매 컨버터 수요 증대

- 일렉트로닉스 산업에 있어서의 백금, 팔라듐, 루테늄 수요 증가

- 아시아태평양 국가의 보석품 소비 성장

- 억제요인

- 생산과 유지보수에 드는 높은 비용

- 기타 억제요인

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 금속 유형별

- 백금

- 팔라듐

- 로듐

- 이리듐

- 루테늄

- 오스뮴

- 용도별

- 자동차 촉매

- 전기 및 전자

- 연료전지

- 유리, 세라믹, 안료

- 보석 장식

- 의료(치과 및 의약품)

- 화학공업

- 기타 용도(항공기용 터빈, 수처리, 센서, 사진, 스크린, 법의학적 검사)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- African Rainbow Minerals Limited

- ANGLO AMERICAN PLATINUM LIMITED

- GLENCORE

- Implats Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Platinum Group Metals Ltd

- Sibanye-Stillwater

- Vale

제7장 시장 기회와 앞으로의 동향

- 그린테크놀로지에서의 백금의 이용

- 아프리카 국가의 투자 증가

The Platinum Group Metals Market size is estimated at 653.03 tons in 2025, and is expected to reach 813.02 tons by 2030, at a CAGR of 4.48% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and grow steadily during the forecast period.

- Over the short term, the growing demand for catalytic converters from the automotive industry, increasing demand for platinum, palladium, and ruthenium from the electronics industry, and growing jewelry consumption in Asia-Pacific countries are expected to drive market growth.

- However, the high costs involved in production and maintaining platinum group metals are expected to hinder the market's growth.

- Nevertheless, the usage of platinum in green technology and increasing investment in the platinum industry in African countries are likely to create opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the global market during the forecast period. It is also expected to register the highest CAGR during the forecast period due to rising demand for antimony, mainly in autocatalysts and jewelry applications.

Platinum Group Metals Market Trends

Autocatalysts Segment to Dominate the Market

- Platinum group elements or platinum group metals (PGMs), including platinum, palladium, and rhodium, are widely used as autocatalysts in the automotive industry. Autocatalysts, or catalytic converters, are devices integrated into the exhaust systems of vehicles to reduce harmful emissions.

- These metals are placed in the exhaust system between the engine and the muffler, and when the engine heats the metals, the process neutralizes the pollutants.

- Platinum profited from increased car manufacture in 2022 as economical automakers increasingly attempt to swap it for more expensive palladium. Platinum is preferred in diesel catalytic converters, while palladium is preferred in gas-powered automobiles. Nevertheless, both metals may be exchanged, one for the other, in diesel- and gas-powered vehicles, which is common when one of the metals is somewhat expensive.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) (International Organization of Motor Vehicle Manufacturers), global sales of all vehicles in 2022 were 81.62 million, compared to 82.75 million in 2021. According to the OICA, total production statistics for all vehicles was 85.02 million in 2022, compared to 80.21 million in 2021.

- According to the World Trade Organization, the United States overtook Japan as the second-largest automotive exporter in 2022. China increased its exports the most among the top ten exporters by 30%. One notable development in the manufacturing sector is that China increased the value of its automotive product exports by 7% year on year in November 2023.

- Increased investments and advancements in the Indian automobile industry are expected to boost demand for the automotive catalyst market. The automobile industry accounts for 49 percent of India's manufacturing GDP and 7.1 percent of its overall GDP. The Indian auto market was ranked third in the world, surpassing Japan in 2022 and fourth in commercial vehicle manufacturing in 2023.

- All the factors above are expected to drive the autocatalysts segment, enhancing the demand for platinum group metals during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounted for the largest share in the market for platinum group metals, with almost half of the global share. It is expected to be the fastest-growing market.

- In the electronics industry, platinum, palladium, rhodium, and iridium are used to coat electrodes, the tiny components in all the electronic products that help in controlling the flow of electricity. Palladium metal is contained in most microprocessors and printed circuit boards. The industry majorly uses platinum in electronic components of computers, televisions, mobile phones, and others.

- The number of smartphone users in China is increasing. By 2023, the country's smartphone user base had risen to 868.2 million.

- Similarly, the Indian electronics market is expected to reach USD 400 billion over the next three years. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- Additionally, according to Platinum Guild International (PGI), in 2022, the sales of platinum in Japan exceeded the mark of JPY one trillion (USD 10 billion) for the first time in 14 years. The country remains the biggest platinum market per capita.

- Japan is now considered the second largest jewelry market in the world, after only the United States. The country is also the world's second-largest consumer of platinum, with 14.06 tons of the metal used for jewelry creation.

- Thus, all the above factors will likely increase the demand for the platinum group metals market during the forecast period.

Platinum Group Metals Industry Overview

The platinum group metals market is consolidated in nature. The major players (not in any particular order) include Anglo American Platinum Limited, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, and African Rainbow Minerals Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.1.2 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.1.3 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.2 Restraints

- 4.2.1 High Costs Involved in Production and Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics, and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharmaceuticals)

- 5.2.7 Chemical Industry

- 5.2.8 Other Applications (Aircraft Turbines, Water Treatment, Sensors, Photography, Screens, and Forensic straining)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 African Rainbow Minerals Limited

- 6.4.2 ANGLO AMERICAN PLATINUM LIMITED

- 6.4.3 GLENCORE

- 6.4.4 Implats Platinum Limited

- 6.4.5 Johnson Matthey

- 6.4.6 Norilsk Nickel

- 6.4.7 Northam Platinum Holdings Limited

- 6.4.8 Platinum Group Metals Ltd

- 6.4.9 Sibanye-Stillwater

- 6.4.10 Vale

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Platinum in Green Technology

- 7.2 Increasing Investment in the African Countries

샘플 요청 목록