|

시장보고서

상품코드

1641888

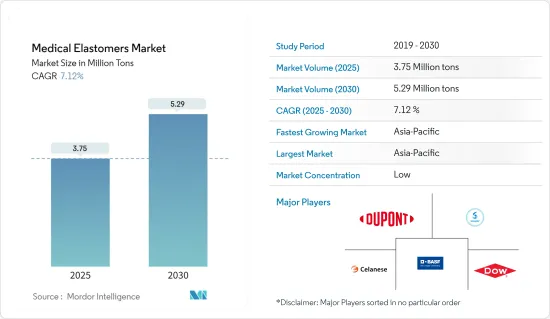

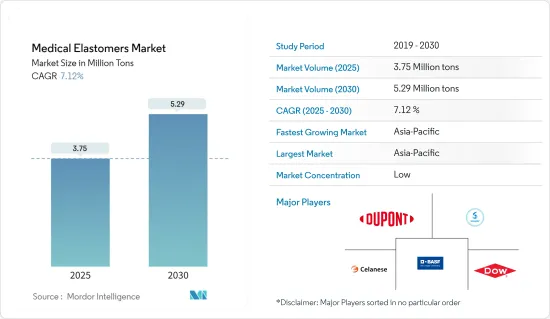

의료용 엘라스토머 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Medical Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

의료용 엘라스토머 시장 규모는 2025년에 375만 톤으로 추정되며, 예측기간(2025-2030년)의 CAGR은 7.12%로, 2030년에는 529만 톤에 달할 것으로 예측됩니다.

시장은 2020년 COVID-19에 의해 큰 타격을 받았습니다. 전국적인 봉쇄와 엄격한 사회적 거리의 의무화로 인해 시장의 다양한 부문에서 공급망이 중단되었습니다. 그러나 의료에 대한 투자 증가로 시장은 안정적으로 성장할 것으로 예상됩니다.

주요 하이라이트

- 안전한 무할로겐폴리머에 대한 수요와 웨어러블 의료기기 및 외부에서 상호 통신 가능한 의료기기로의 의료산업전환이 시장을 견인하고 있습니다.

- 일회용 기기의 사용 감소와 실리콘 가격 상승이 시장의 성장을 둔화시키는 요인이 되고 있습니다. 의료용 엘라스토머 산업은 환경 보호 의식이 증가함에 따라 지속 가능하고 환경 친화적 인 프로젝트로 전환하고 있습니다.

- 바이오 열가소성 엘라스토머의 개발은 주요 시장 기회입니다.

아시아태평양이 세계 시장을 석권하고 있으며, 중국, 인도 등에서 소비가 가장 많습니다.

의료용 엘라스토머 시장 동향

열가소성 엘라스토머(TPE) 부문이 급성장

- 의료용 엘라스토머 시장에서는 열가소성 엘라스토머(TPE) 부문이 가장 큰 점유율을 차지합니다.

- 의료 산업에서는 스티렌계 블록 공중합체(SBC)가 주로 의료용 튜브 및 필름 용도에 사용됩니다. 또한 수술용 드레이프, 바늘 실드, 치과용 댐, 점적실, 운동용 밴드, 주사기 플런저 팁, 호흡기용 기기, 정형외과용 부품, 의료용 패치 등의 의료용 가방, 상처 케어, 기기, 포장, 진단용 제품의 제조에도 사용되고 있습니다.

- 열가소성 폴리우레탄(TPU)은 긴 사슬의 선형 폴리머로, 폴리우레탄을 녹여 부품을 형성한 다음 부품을 응고시킬 수 있습니다. TPU의 고성능 특성, 화학제품 및 오일에 대한 내성, 기계적 특성의 향상, 내구성의 향상으로 의료 용도에서의 사용은 꾸준히 증가하고 있습니다.

- 폴리 염화 비닐(PVC)은 선형 열가소성 중합체이며 대부분 비정질입니다. 가소화 폴리염화비닐(PVC-P) 또는 연질 PVC는 가소화함으로써 유연성, 강도, 투명성, 꼬임저항성, 내스크래치성, 가스 투과성, 생체 적합성, 일반적인 용제나 접착제로의 접착의 용이함, 감마선 멸균, 에틸렌옥사이드 멸균, 전자선 멸균시의 안정성 등, 다양한

- 의료 산업에서 TPV는 O 링, 소프트 터치 그립, 연동 펌프 튜브, 주사기 팁, 병 드롭퍼, 스톱 씰, 개스킷, 밸브, 다이어프램 및 다양한 의료기기용 튜브의 제조에 사용됩니다. 또한 의료 산업에서는 주사기 플런저의 개스킷으로도 사용됩니다.

이러한 요인으로 세계 의료 산업에서 열가소성 엘라스토머 수요는 시장에 큰 영향을 미칠 가능성이 높습니다.

아시아태평양이 시장을 독점

- 아시아태평양에서는 중국과 인도가 시장을 독점할 것으로 예상되는 2대 경제 대국입니다.

- 중국은 지난 5년간 공립병원 투입액을 380억 달러로 두 배 넘게 늘렸습니다. 2030년까지 의료산업의 가치를 현재의 2배 이상의 2조 3,000억 달러로 끌어올리는 것을 목표로 하고 있습니다.

- 또한 중국 정부는 국내 의료기기 혁신을 지원,장려하는 시책을 시작하여 시장 조사 기회를 제공합니다. '메이드 인 차이나 2025' 이니셔티브는 산업 효율성, 제품 품질, 브랜드 명성을 높이고 국내 의료기기 제조업체 발전에 박차를 가하고 경쟁을 강화하고 있습니다.

- 중국은 세계 2위의 의료 시장입니다. 그러나 이 나라는 선진국에서 기술적으로 고급 임플란트를 수입하고 있습니다. 의료기기의 주요 소비자는 공립병원입니다. 2021년 의료 분야 공적 지출은 1조 9,200억 위안이었습니다.

- 인도에서는 2021년 말 연방 보건부 장관이 국내 의료 시설을 개선하기 위한 인도 정부의 다양한 계획을 발표했습니다. 정부는 향후 6년간 의료 부문에 64,180억 루피를 투자할 계획입니다. 정부는 1차, 2차, 3차 의료시스템과 신종 및 신종 질병의 발견과 치료를 위한 기관의 능력을 개발함으로써 기존의 '국민건강미션'을 강화할 계획입니다.

- COVID-19의 발생으로 인한 다양한 의료 분야 수요 증가는 예측 기간 동안 의료용 엘라스토머 시장을 견인할 것으로 추정됩니다.

의료용 엘라스토머 산업 개요

세계의 의료용 엘라스토머 시장은 소수의 대기업이 우위를 차지하고 많은 지역 기업이 존재하는 단편적인 성질을 가지고 있습니다. 시장의 주요 기업으로는 BASF SE, Celanese Corporation, DOW, Solvay, DuPont 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 안전한 무할로겐 폴리머에 대한 수요 증가

- 기타 촉진요인

- 억제요인

- 일회용 사용 기기의 감소

- 실리콘 가격 상승

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유형

- 열가소성 엘라스토머

- 스티렌계 블록 공중합체(SBC)

- 열가소성 폴리우레탄(TPU)

- 가소화 폴리염화비닐(PVC)

- 열가소성 발카니젯(TPV)

- 기타 열가소성 엘라스토머

- 열경화성 엘라스토머

- 실리콘

- 액상 실리콘 고무(LSR)

- 높은 일관성 고무(HCR)

- 기타 실리콘

- 천연 고무(라텍스)

- 부틸 고무

- 기타 열경화성 엘라스토머

- 열가소성 엘라스토머

- 용도

- 의료용 튜브

- 카테터

- 주사기

- 부직포·필름

- 장갑

- 의료용 가방

- 임플란트

- 기타

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동?아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Arkema Group

- AVANTOR Inc.

- Avient

- BASF SE

- Biomerics

- Celanese Corporation

- Covestro AG

- DOW

- DSM

- DuPont de Nemours inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- Foster Corporation

- Hexpol AB

- Kraton Corporation

- Kuraray Co.Ltd.

- Momentive

- Romar

- RTP Company

- Solvay

- Sumitomo Rubber Industries Ltd.

- Tekni-Plex

- Teknor Apex

- The Rubber Group

제7장 시장 기회와 앞으로의 동향

- 바이오 베이스 열가소성 엘라스토머의 채용

The Medical Elastomers Market size is estimated at 3.75 million tons in 2025, and is expected to reach 5.29 million tons by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. The nationwide lockdowns and stringent social distancing mandates led to supply chain disruptions across different segments of the market. However, the market is expected to grow steadily owing to increasing investments in healthcare.

Key Highlights

- The demand for safe, halogen-free polymers and the shift in the medical industry toward wearable health devices and medical tools that can talk to each other from the outside are the main things driving the market.

- Decreasing usage of single-use devices and the increasing prices of silicone are the factors that may slow down the market's growth. The medical elastomer industry is moving toward sustainable and green projects as environmental awareness grows.

- The development of bio-based thermoplastic elastomers is the key market opportunity.

Asia-Pacific dominated the market across the globe, with the largest consumption in countries such as China, India, etc.

Medical Elastomers Market Trends

Thermoplastic Elastomers (TPE) Segment to Register Fastest Growth

- Among the types, the thermoplastic elastomers (TPE) segment is the largest market shareholder in the medical elastomers market.

- In the medical industry, Styrenic Block Copolymers (SBCs) are mainly used in medical tubing and film applications. They are also used in the manufacturing of medical bags, wound care, equipment, packaging, and diagnostic products, including surgical drapery, needle shields, dental dams, drip chambers, exercise bands, syringe plunger tips, respiratory equipment, orthopedic parts, medical patches, and others.

- Thermoplastic polyurethanes (TPU) are long-chain linear polymers, which allow the polyurethane to be melted to form parts, and then the parts are solidified. The usage of TPU in medical applications is consistently increasing, owing to its high-performance characteristics, resistance to chemicals and oils, improved mechanical properties, and enhanced durability.

- Polyvinyl chloride (PVC) is a linear, thermoplastic, mostly amorphous polymer. Plasticized Polyvinyl Chloride (PVC-P) or flexible PVC is used for medical applications as it offers various properties when plasticized, including flexibility, strength, transparency, kink resistance, scratch resistance, gas permeability, biocompatibility, ease of bonding with common solvents or adhesives, and stability during gamma, ethylene oxide, or E-beam sterilization, among others.

- In the medical industry, TPVs are used in the manufacturing of O-rings, soft touch grips, peristaltic pump tubes, syringe tips, bottle droppers, stop seals and gaskets, valves, diaphragms, and tubing for various medical devices. They are also used in the medical industry as a gasket on syringe plungers.

Due to the aforementioned factors, the demand for thermoplastic elastomers in the global medical industry is likely to affect the market.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China and India are two major economies that are expected to dominate the market.

- China has doubled the amount, it had been pouring into public hospitals in the last five years, to USD 38 billion. It aims to raise the healthcare industry's value to USD 2.3 trillion by 2030, more than twice its size now.

- Furthermore, the Chinese government has started policies to support and encourage domestic medical device innovation providing opportunities for the market studied. The 'Made in China 2025' initiative improves industry efficiency, product quality, and brand reputation, which will spur the development of domestic medical device manufactures and will increase competitiveness.

- China is the second-largest healthcare market in the world. However, the country imports technologically high-end implants from advanced economies. The public hospitals in the country are leading consumers of medical devices in the country. In 2021, the public expenditure done on healthcare was 1.92 trillion yuan.

- In India, in late 2021, the Union Health Minister announced various plans of the Indian government to improve healthcare facilities in the country. The government plans to invest INR 64,180 crore in healthcare sector over the next six years in the country. The government plans to strengthen the existing 'National Health Mission' by developing capacities of primary, secondary, and tertiary healthcare systems and institutions for detection and cure of new and emerging diseases.

- The increasing demand from various medical applications due to the COVID-19 outbreak is estimated to drive the market for medical elastomers during the forecast period.

Medical Elastomers Industry Overview

The global medical elastomer market is fragmented in nature with the dominance of a few large players and the existence of many local players. Some of the major players in the market include (not in any particular order) BASF SE, Celanese Corporation, DOW, Solvay, and DuPont, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Demand for Safe and Halogen-free Polymers

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Decreasing Usage of Single-Use Devices

- 4.2.2 Increases Prices of SIlicone

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thermoplastic Elastomer

- 5.1.1.1 Styrenic Block Copolymers (SBC)

- 5.1.1.2 Thermoplastic Polyurethane (TPU)

- 5.1.1.3 Plasticized Polyvinyl Chloride (PVC)

- 5.1.1.4 Thermoplastic Vulcanizate (TPV)

- 5.1.1.5 Other Thermoplastic Elastomers

- 5.1.2 Thermoset Elastomer

- 5.1.2.1 Silicones

- 5.1.2.1.1 Liquid silicone rubber (LSR)

- 5.1.2.1.2 High consistency rubber (HCR)

- 5.1.2.1.3 Other Silicones

- 5.1.2.2 Natural Rubber (Latex)

- 5.1.2.3 Butyl Rubber

- 5.1.2.4 Other Thermoset Elastomers

- 5.1.1 Thermoplastic Elastomer

- 5.2 Application

- 5.2.1 Medical Tubes

- 5.2.2 Catheters

- 5.2.3 Syringes

- 5.2.4 Non-wovens and Films

- 5.2.5 Gloves

- 5.2.6 Medical Bags

- 5.2.7 Implants

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 AVANTOR Inc.

- 6.4.3 Avient

- 6.4.4 BASF SE

- 6.4.5 Biomerics

- 6.4.6 Celanese Corporation

- 6.4.7 Covestro AG

- 6.4.8 DOW

- 6.4.9 DSM

- 6.4.10 DuPont de Nemours inc.

- 6.4.11 Eastman Chemical Company

- 6.4.12 ExxonMobil Corporation

- 6.4.13 Foster Corporation

- 6.4.14 Hexpol AB

- 6.4.15 Kraton Corporation

- 6.4.16 Kuraray Co.Ltd.

- 6.4.17 Momentive

- 6.4.18 Romar

- 6.4.19 RTP Company

- 6.4.20 Solvay

- 6.4.21 Sumitomo Rubber Industries Ltd.

- 6.4.22 Tekni-Plex

- 6.4.23 Teknor Apex

- 6.4.24 The Rubber Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Introduction of Bio-based Thermoplastic Elastomer in Market