|

시장보고서

상품코드

1445973

내분비 검사 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Global Endocrine Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

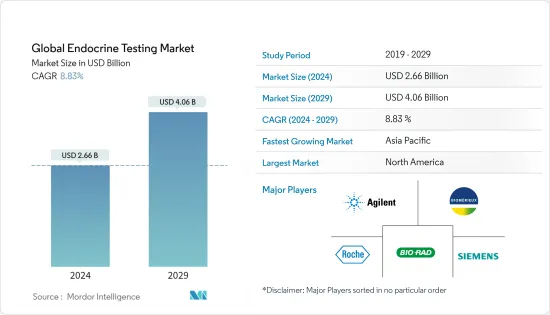

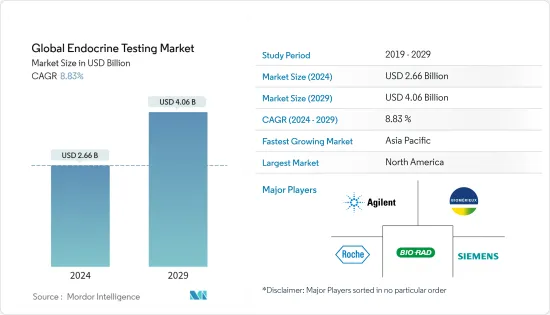

세계 내분비 검사 시장 규모는 2024년 26억 6,000만 달러로 추정됩니다. 2029년까지 40억 6,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) 동안 8.83%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

전 세계적으로 갑상선 질환을 앓고 있는 사람들이 신종 코로나 바이러스 감염에 취약하다는 사실이 여러 연구를 통해 입증되면서 갑상선 호르몬 수치를 확인하고 관리하기 위한 다양한 내분비 검사가 전 세계적으로 큰 수요를 창출하고 있습니다. 2021년 1월에 발표된 '코로나19 환자 1950명의 갑상선 기능 분석 : 후향적 연구'라는 제목의 연구에 따르면, 코로나19가 심할수록 TSH와 TT3 수치가 낮아지고 통계적으로 유의미한 것으로 나타났습니다. TSH 및 TT3 수준의 감소 정도는 질병의 중증도와 양의 상관 관계가있었습니다. 따라서 혈청 TSH 및 TT3 수준의 변화는 COVID-19 증상의 진행 과정의 중요한 징후입니다. 이로 인해 대유행 기간 동안 갑상선 호르몬 검사의 내분비 검사가 증가하여 시장 성장을 가속했을 수 있습니다.

내분비 질환의 유병률 증가와 진단 기술의 발전이 시장 성장을 주도하고 있습니다. 또한 전 세계적으로 노인 인구 증가와 조기 진단 및 치료에 대한 인식이 높아짐에 따라 시장 성장을 가속할 것으로 예상됩니다. 내분비 검사는 내분비선에서 분비되는 호르몬 수치를 측정하여 비만, 당뇨병, 갑상선 질환과 같은 다양한 질병을 진단하는 것을 말합니다. 국제연맹에 따르면 2021년에는 약 5억 3,700만 명의 성인이 당뇨병을 앓고 있으며, 2045년까지 이 숫자는 7억 8,300만 명으로 증가할 것으로 예상하고 있습니다. 전 세계적으로 당뇨병이 증가함에 따라 인슐린 호르몬 검사의 채택이 증가하여 시장 성장을 가속할 것으로 예상됩니다.

세계보건기구(WHO)의 2022년 3월 발표에 따르면, 전 세계 성인 6억 5,000만 명, 청소년 3억 4,000만 명, 어린이 3,900만 명이 비만이며, 그 수는 계속 증가하고 있습니다. WHO는 2025년까지 1억 6,700만 명의 성인과 어린이가 과체중 또는 비만으로 인해 건강의 일부를 잃을 것으로 예측했습니다. 이는 갑상선 기능 내분비 검사의 추가 채택으로 이어져 시장 성장을 가속할 것입니다.

또한, 알코올 섭취는 다양한 내분비 질환과 장애의 가장 큰 위험 요소 중 하나입니다. 전 세계적으로 선진국의 고소득 국가들이 가장 많은 알코올을 섭취하고 있습니다. 이 많은 양의 알코올 섭취도 질병 부담의 주요 요인 중 하나입니다. 내분비 검사 도구에 대한 수요로 인해 시장 관계자들은 제품 개발 및 신제품 출시에 주력하고 있습니다. 예를 들어, 2021년 11월 스위스의 의료 기술 회사인 블룸다이애그노스틱스는 갑상선 기능 저하증을 식별하는 데 도움이 되는 블룸 갑상선 검사를 도입했습니다. 이 검사를 통해 성인은 일회용 키트를 사용하여 갑상선 자극 호르몬(TSH)을 검사하여 갑상선 기능 장애를 확인할 수 있습니다.

전 세계 많은 국가에서 당뇨병, 갑상선 질환의 유병률이 증가하고 있으며, 이는 시장 성장을 더욱 촉진할 것으로 예상됩니다. 그러나 높은 검사 기술 개발 비용과 후진국 및 신흥국에서의 인식 부족은 예측 기간 동안 시장 성장을 저해할 것으로 예상됩니다.

내분비 검사 시장 동향

갑상선자극호르몬 검사(TSH), 수익성 있는 성장 기대

갑상선 질환의 유병률 증가, 갑상선 관리 노력, 담배와 알코올 소비 증가, 주요 기업들의 혁신적인 제품 출시를 위한 기술 발전 등이 이 부문의 성장을 견인하는 요인으로 꼽힙니다.갑상선자극호르몬(TSH)은 뇌하수체에서 생성되며, 갑상선을 자극하여 티록신과 트리요오드티로닌을 생성하여 신진대사를 돕습니다. TSH 검사는 갑상선 수치를 측정하는 데 사용됩니다. 갑상선 질환의 부담은 전 세계적으로 증가하고 있습니다. 예를 들어, 2021년 6월 'Frontiers in Endocrinology'에 게재된 'The Burden of Hormonal Disorders: A Worldwide Overview With a Particular Look in Italy'(호르몬 장애의 부담: 이탈리아를 중심으로 한 전 세계 개요) : 이탈리아를 중심으로 한 전 세계 개요(The Burden of Hormonal Disorders: Worldwide Overview With a Particular Look in Italy)'라는 제목의 연구에 따르면, 가장 대표적인 갑상선 질환인 갑상선 결절은 다음과 같은 것으로 밝혀졌습니다. 전 세계 일반 인구의 19-68%에 해당하며, 여성과 노년층에서 더 많이 발생합니다. 따라서 갑상선 질환의 높은 유병률은 이 부문의 성장을 가속할 것으로 예상됩니다.

또한, 2022년 5월 Thyrocare Technologies Limited는 인도 나그푸르(Nagpur)에 최초의 지역 처리 실험실(RPL)을 설립하여 빠르고 정확한 갑상선 기능 검사를 저렴한 가격으로 제공하게 되었습니다. 인도와 같이 인구 밀도가 높은 국가에서의 이러한 노력은 이 부문의 성장을 더욱 촉진할 것입니다.

TSH 측정은 최근 갑상선 기능 검사에서 그 중요성이 증가하고 있는데, 이는 주로 비용 효율적인 질병 선별을 용이하게 하는 검사 기술의 개발로 인한 것입니다. TSH는 또한 생화학적 치료 목표를 제공하고 잠재적 갑상선 기능 저하증 또는 갑상선 기능 항진증에 대한 새로운 정의를 도입했습니다. 또한, 제품 기술의 발전과 의료 서비스의 경제성 증가가 시장 성장을 가속하고 있습니다. 현재 액체 크로마토그래피와 함께 질량 분석법이 정확한 결과를 얻기 위해 사용되고 있으며, 이는 예측 기간 동안 시장 성장을 가속할 것입니다.

북미가 큰 점유율을 차지할 것으로 예상

북미는 잘 구축된 의료 인프라, 높은 비만 유병률, 진단 기술 발전, 신제품 출시 등의 요인으로 인해 큰 점유율을 차지할 것으로 예상됩니다. 신체 활동 감소와 갑상선 질환의 유병률 증가는 시장 성장을 가속할 것으로 예상됩니다.

미국암협회에 따르면 2022년 미국에서 약 43,800명(남성 11,860명, 여성 31,940명)의 갑상선암 환자가 새로 발생하고 약 2,230명(남성 1,070명, 여성 1,160명)이 사망할 것으로 예상되고 있습니다. 따라서 미국의 높은 갑상선암 발병률과 사망률은 갑상선 치료 증가로 이어져 이 지역의 내분비 검사 시장의 성장을 가속할 것으로 보입니다.

북미는 선천성 갑상선 기능 저하증 신생아에 대한 강제 선별검사, 갑상선 호르몬 기능에 대한 혁신적인 연구 활동, 갑상선암을 발견하는 비용 효율적인 방법, 갑상선 질환에 대한 유망한 연구 등 몇 가지 노력으로 인해 향후 몇 년동안 큰 성장을 이룰 수 있습니다. 수 있습니다. 이 질병은 더 나은 예후로 이어질 가능성이 높으며, 갑상선 질환에 대한 새로운 예방 치료법도 개발할 수 있습니다.

또한 2021년 8월, Inito는 미국 시장에 가정용 불임 검사를 도입했습니다. Inito 장치는 스마트폰 앱과 함께 사용된 전제조건용 검사로 프로게스테론, 황체형성호르몬, 에스트로겐의 실제 수치를 측정하는 가정용 검사입니다. 이 정보는 사용자에게 임신 과정에 대한 의사결정을 돕기 위해 사용자에게 제공됩니다. 따라서 미국 시장에 이러한 신제품 출시는 이 지역 시장 성장을 가속할 것으로 예상됩니다.

따라서 위의 요인으로 인해 조사 대상 시장은 예측 기간 동안 이 지역에서 성장할 것으로 예상됩니다.

내분비 검사 산업 개요

세계 내분비 검사 시장은 적당한 경쟁이 있으며, 이 시장에는 여러 국내 및 국제 기업이 있습니다. 시장 참여자들은 신제품 출시, 제품 혁신 및 지리적 확장에 초점을 맞추었습니다. 시장에서 활동하는 주요 시장 기업으로는 Bio-Rad Laboratories Inc., Agilent Technologies Inc., bioMerieux SA, F. Hoffmann-La Roche Ltd, Siemens AG 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 테스트

- 갑상선 검사

- 인슐린 검사

- 인간 융모 성선 자극 호르몬 검사

- 프로락틴 검사

- 황체 형성 호르몬 검사

- 프로게스테론 검사

- 기타 테스트

- 기술별

- 면역측정법

- 텐덤 질량 분석

- 센서 기술

- 기타 기술

- 최종사용자별

- 병원

- 임상 실험실

- 기타 최종사용자

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- AB Sciex

- Abbott Laboratories

- Agilent Technologies Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- DiaSorin SpA

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Ortho Clinical Diagnostics

- Quest Diagnostics

- Siemens Healthineers AG

- Thermo Fisher Scientific

제7장 시장 기회와 향후 동향

LSH 24.03.19The Global Endocrine Testing Market size is estimated at USD 2.66 billion in 2024, and is expected to reach USD 4.06 billion by 2029, growing at a CAGR of 8.83% during the forecast period (2024-2029).

During the pandemic, many research studies have demonstrated that people with thyroid disorders are more prone to the COVID 19 infection, creating a significant demand for various endocrine tests globally to check and manage thyroid hormone levels. As per the January 2021 research study titled 'Thyroid Function Analysis in 50 Patients with COVID-19: A Retrospective Study', the more severe the COVID-19, the lower the TSH and TT3 levels were, with statistical significance. The degree of the decreases in TSH and TT3 levels was positively correlated with the severity of the disease. Hence, the changes in serum TSH and TT3 levels are the important manifestations of the courses of COVID-19. This might have increased the endocrine testing during the pandemic for the testing of thyroid hormone, driving the market growth.

The growing prevalence of endocrine disorders and advancements in diagnostic technologies are primarily driving the market growth. Furthermore, the growing older population, coupled with rising awareness about early diagnosis and treatment worldwide, is anticipated to boost the market growth. Endocrine testing refers to the measuring of levels of hormones secreted by the endocrine glands and the diagnosis of various disorders such as obesity, diabetes, and thyroid disease. According to the International Federation, in 2021, approximately 537 million adults were living with diabetes, and by 2045, this number will rise to 783 million. The rising diabetes across the globe will lead to increase adoption of insulin hormone testing, thereby expected to drive the market growth.

According to the World Health Organization (WHO) in March 2022, 650 million adults, 340 million teenagers, and 39 million children are obese around the world and the number is still rising. By 2025, the WHO predicts that 167 million adults and children will lose some of their health due to being overweight or obese. This will lead to further adoption of endocrine testing for thyroid function, driving the market growth.

In addition, alcohol consumption is one of the largest risk factors for various endocrine diseases and disabilities. Globally, high-income countries of the developed region have the highest alcohol consumption. This high consumption of alcohol is also serving as one of the major factors for the burden of the disease. Due to the demand for endocrine testing tools, market players are also focusing on product development and novel launches. For instance, in November 2021, Bloom Diagnostics, a Swiss medical technology company has introduced the Bloom Thyroid Test to assist identify hypothyroidism. With this test, adults can test for thyroid-stimulating hormone (TSH) using the single-use kit to identify thyroid dysfunction.

The growing prevalence of diabetes, thyroid disorders in many of the countries around the world are anticipated to further fuel the market growth. However, the high cost for the development of testing technologies and lack of awareness in underdeveloped and developing countries is expected to impede market growth over the forecast period.

Endocrine Testing Market Trends

Thyroid Stimulating Hormone Testing (TSH) Anticipated to have Lucrative Growth

The factors driving the segment growth include the rise in the prevalence of thyroid conditions, initiatives for thyrocare, the rise in consumption of tobacco and alcohol, and technological advancements by the key players for the launch of innovative products, among others.

Thyroid-stimulating hormone (TSH) is produced by the pituitary gland and stimulates the thyroid gland to produce thyroxine and triiodothyronine, which helps in metabolism. TSH testing is used to measure thyroid levels. The burden of thyroid disorders is increasing across the globe. For instance, according to the study published in 'Frontiers in Endocrinology', titled ' The Burden of Hormonal Disorders: A Worldwide Overview With a Particular Look in Italy' in June 2021, The thyroid nodule, the most typical thyroid condition was found to be 19-68% of the general population globally, with women and the elderly having a higher frequency. Such a high prevalence of thyroid conditions is therefore expected to drive this segment growth.

In addition, in May 2022, Thyrocare Technologies Limited has launched its first Regional Processing Lab (RPL) in Nagpur, India to provide thyroid function test with speed and accuracy at affordable prices. Such initiatives in highly populated countries such as India will further drive the growth of this segment.

TSH measurement has recently gained importance in thyroid function testing mainly due to the technological developments in these tests facilitating cost-effective disease screening. TSH also introduced new definitions of subclinical hypothyroidism or hyperthyroidism, along with delivering biochemical treatment targets. Furthermore, advancements in product technologies, coupled with the growing affordability for healthcare, are fueling the market growth. Mass spectroscopy is now used along with liquid chromatography for accurate results, which will fuel the market growth over the forecast period.

North America is Anticipated to have Significant Share

North America is anticipated to have a significant share, owing to the factors such as well-established healthcare infrastructure, high prevalence of obesity, advancements in diagnostic technologies, and new product launches. The less physical activity and growing prevalence of thyroid disorders are anticipated to fuel the market growth.

According to the American Cancer Society in 2022, about 43,800 new cases of thyroid cancer (11,860 in men and 31,940 in women) and about 2,230 deaths from thyroid cancer (1,070 men and 1,160 women) will be reported in the United States. The high prevalence and deaths of thyroid cancer in the United States will therefore lead to increased thyroid care, thereby driving the market growth for endocrine testing in this region.

North America is likely to witness major growth in the coming years, owing to several initiatives, such as compulsory screening of newborns for congenital hypothyroidism, revolutionary research work on thyroid hormone function, cost-effective methods to detect thyroid cancer, promising research on Graves' disease, which is likely to further lead to improved prognosis, and new preventive treatments of thyroid diseases.

Moreover, in August 2021, Inito has introduced the home fertility test to the American market. The Inito device, used in conjunction with a smartphone app, is a home test that determines the actual levels of progesterone, luteinizing hormone, and oestrogen. This information is provided to users to help them make decisions regarding the conception process. Such launch of new products to the market in the United States is therefore expected to drive the market growth in this region.

Hence, owing to the above-mentioned factors, the market studied is expected to grow over the forecast period in the region.

Endocrine Testing Industry Overview

The global endocrine testing market is moderately competitive, and there are several local and international companies in this market. Market players are focusing on new product launches, product innovations, and geographical expansions. The key market players operating in the market include Bio-Rad Laboratories Inc., Agilent Technologies Inc., bioMerieux SA, F. Hoffmann-La Roche Ltd, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Endocrine Disorders and Increasing Geriatric Population

- 4.2.2 Advancements in Product Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Endocrine Testing Devices

- 4.3.2 Lack of Awareness in Underdeveloped and Developing Countries

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Test

- 5.1.1 Thyroid Test

- 5.1.2 Insulin Test

- 5.1.3 Human Chorionic Gonadotropin Test

- 5.1.4 Prolactin Test

- 5.1.5 Luteinizing Hormone Test

- 5.1.6 Progesterone Test

- 5.1.7 Other Tests

- 5.2 By Technology

- 5.2.1 Immunoassay

- 5.2.2 Tandem Mass Spectroscopy

- 5.2.3 Sensor Technology

- 5.2.4 Other Technologies

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clincal Laboratories

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AB Sciex

- 6.1.2 Abbott Laboratories

- 6.1.3 Agilent Technologies Inc.

- 6.1.4 bioMerieux SA

- 6.1.5 Bio-Rad Laboratories Inc.

- 6.1.6 Danaher Corporation

- 6.1.7 DiaSorin SpA

- 6.1.8 F. Hoffmann-La Roche Ltd

- 6.1.9 Hologic Inc.

- 6.1.10 Ortho Clinical Diagnostics

- 6.1.11 Quest Diagnostics

- 6.1.12 Siemens Healthineers AG

- 6.1.13 Thermo Fisher Scientific