|

시장보고서

상품코드

1435215

공업염 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Industrial Salts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

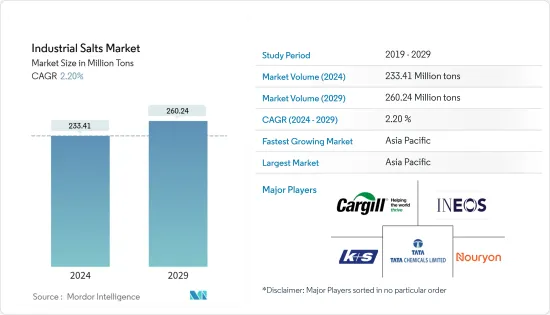

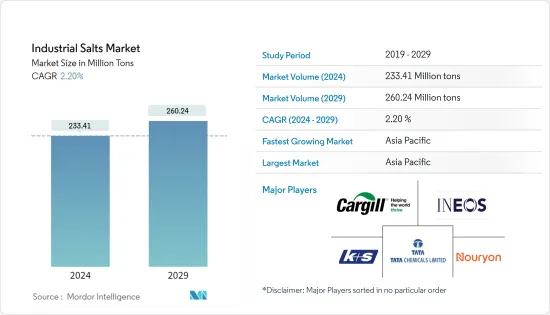

공업염 시장 규모는 2024년 2억 3,341만 톤으로 추정되고, 2029년까지 2억 6,024만 톤에 이를 것으로 예측되며, 예측기간(2024-2029년) 동안 2.20%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예상됩니다.

2020년 시장은 신형 코로나 바이러스 감염(COVID-19)에 의해 악영향을 받았습니다. 공업염은 염소 및 가성소다와 같은 화학 물질의 제조에 사용됩니다. 팬데믹 시나리오로 인해 정부가 부과한 봉쇄 중에 화학 제조 부문이 일시적으로 중단되어 화학 처리에 필요한 원재료 수요가 감소하게 되었습니다. 또한 공업염은 제지 중에도 소비됩니다. 유럽제지산업연맹(CEPA)에 따르면 Cepi 회원국의 종이 및 판지 생산량은 2020년 전년 대비 5% 감소했습니다. 이것은 주로 신형 코로나 바이러스 감염(COVID-19)의 팬데믹에 의한 세계 수요의 영향을 받아 연구 시장 수요에 부정적인 영향을 미쳤습니다. 그러나 개인의 위생과 청결한 환경을 고려하여 생산시 공업염을 원료로 사용하는 비누 및 세제의 사용량이 크게 증가하고 있으며, 이는 공업염 시장 수요를 자극하고 있습니다.

주요 하이라이트

- 단기적으로, 화학 처리 및 수처리 용도를 위한 공업염 수요 증가는 시장 성장을 가속할 것으로 예상됩니다.

- 한편, 환경보호청(EPA)이 부과한 엄격한 규제가 시장 성장을 방해할 것으로 예상됩니다.

- 용도별로는 소다재, 가성소다, 염소의 제조에 있어서의 사용량이 증가하고 있기 때문에 화학 처리 부문이 시장을 독점할 것으로 예상되고 있습니다.

- 아시아태평양은 세계 시장을 독점하고 있으며 중국과 인도와 같은 국가에서 소비가 가장 큽니다.

공업염 시장 동향

화학제품 처리 용도 수요 증가

- 공업염은 전통적인 채굴, 천일 증발, 진공 증발에 의해 암염 또는 천연 염수로 제조됩니다.

- 화학 처리 용도는 공업염의 총 수요의 50% 이상을 차지합니다. 공업염은 대량으로 이용 가능하고 비용 효율적이기 때문에 염소, 소다 재, 가성소다의 제조에 널리 사용됩니다.

- 비용 효율적인 대체품이 없기 때문에 공업염은 이염화 에틸렌과 같은 제품을 생산하는 염소 알칼리 공정에서 적극적으로 사용되고 있으며 공업염 수요가 자극되고 있습니다.

- 미국 화학평의회에 따르면 미국 화학산업의 연간 생산성장률은 2021년 전년 대비 약 12.3% 증가할 수 있습니다. 화학 설비 투자의 총액은 2021년까지 전년 대비 15.7%의 성장률로 335억 달러로 증가할 것으로 전망되고 있으며, 이로써 공업염 시장 수요가 자극될 것으로 예상됩니다.

- 공업염은 폴리비닐 클로라이드, 비누, 세제, 제초제, 살충제와 같은 플라스틱의 제조에 사용됩니다. 또한 이산화티타늄 등 무기화학물질의 제조에도 사용되어 공업염 시장의 성장을 가속합니다.

- 세탁 관리 부서는 세제, 비누 및 기타 세탁 관리 제품을 제조하기 위해 공업염을 소비합니다. 미국의 세탁 관리 시장은 2019년 약 128억 달러로 평가되었으며, 2020년에는 약 131억 달러에 이르렀으며 성장률은 약 2%로 조사 대상 시장 수요를 자극했습니다.

- 따라서 앞서 언급한 요인은 향후 수년간 시장에 큰 영향을 미칠 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 이 지역에서 산업화의 발전으로 예측 기간 동안 공업염 시장을 독점할 것으로 예상됩니다. 중국, 인도, 일본 등 국가에서는 화학가공산업에서 공업염을 사용함으로써 공업염에 대한 수요가 증가하고 있습니다.

- 2019년 일본의 화학산업 규모는 약 2,000억 달러로 전년 대비 약 2.5%의 성장률이며, 이는 공업염 시장 수요를 자극하였습니다.

- 공업염은 폭설이 내리는 지역의 도로를 제설하는 제빙에 널리 사용됩니다. 공업염의 제빙 특성은 얼음의 재형성을 일정 기간 지연시키는 데에도 도움이 됩니다.

- 수처리 플랜트는 물의 연화와 정화 과정에 공업염을 사용합니다. 인도와 중국과 같은 국가에서는 많은 수처리 프로젝트가 건설되고 있으며 예측 기간 동안 공업염의 성장을 가속할 수 있습니다.

- 플라스틱 부문에서는 공업염을 사용하여 PVC(폴리염화비닐)를 제조합니다. PVC는 건설 산업에서 배관, PVC 보드 등 다양한 용도로 널리 사용됩니다. 중국은 2019년 시장 규모가 1조 929억 달러로 건설 업계를 선도해 전년대비 14.71%의 성장률을 기록했습니다.

- 또한 국내 신축 총호수는 2019년 약 1억 2,755만 평방미터, 2020년에는 약 1억 1,374만 평방미터에 이르며 감소율은 약 10.5%가 됐습니다. 이로 인해 PVC 제재의 소비량이 줄어들고 공업염 시장 수요가 자극되었습니다.

- 아시아태평양에서 사업을 전개하는 주요 기업으로는 카길, KS Aktiengesellschaft, Tata Chemicals Ltd 등이 있습니다.

- 따라서 앞서 언급한 요인은 향후 수년간 시장에 큰 영향을 미칠 것으로 예상됩니다.

공업염 산업 개요

공업염 시장은 세분화되어 상위 5개 기업이 시장의 약간의 점유율을 차지하고 있습니다. 시장의 주요 기업으로는 Cargill Incorporated, KS Aktiengesellschaft, Tata Chemicals Ltd, INEOS 및 Nouryon 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 화학처리에 있어서 수요 증가

- 수처리 분야에서 수요 증가

- 억제요인

- 엄격한 정부 규제

- COVID-19의 영향으로 인한 불리한 상황

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 유래별

- 암염

- 천연 염수

- 제조 공정별

- 천일 건조

- 진공 증발

- 기존 채굴

- 용도별

- 화학처리

- 수처리

- 제빙

- 농업

- 식품가공

- 석유 및 가스

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 점유율 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Archean Group

- Cargill Incorporated

- Compass Minerals

- Delmon Group of Companies

- Dominion Salt Limited

- Donald Brown Group

- Exportadora de Sal de CV

- INEOS

- KS Aktiengesellschaft

- MITSUI & CO. LTD

- Morton Salt Inc.

- Nouryon

- Rio Tinto

- Salins IAA

- Tata Chemicals Ltd

제7장 시장 기회 및 앞으로의 동향

AJY 24.03.05The Industrial Salts Market size is estimated at 233.41 Million tons in 2024, and is expected to reach 260.24 Million tons by 2029, growing at a CAGR of 2.20% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Industrial salts are used to produce chemicals like chlorine and caustic soda. Owing to the pandemic scenario, the chemical manufacturing units were on a temporary halt during the government-imposed lockdown, thus leading to a decrease in the demand for raw material needed in chemical processing. Furthermore, industrial salts are also consumed in paper manufacturing. According to the CONFEDERATION OF EUROPEAN PAPER INDUSTRIES (CEPA), the paper and board production by Cepi member countries decreased by 5% in 2020 compared to the previous year, mainly due to global demand impacted by the COVID-19 pandemic, which in turn negatively impacts the demand for the studied market. However, the usage of soaps and detergents that use industrial salts as a raw material during production has significantly increased during this situation, considering the personal hygiene and clean surrounding, which in turn stimulates the demand for the industrial salts market.

Key Highlights

- Over the short term, the increasing demand for industrial salts for chemical processing and water treatment applications is expected to drive the market's growth.

- On the flip side, strict regulations imposed by the environmental protection agency (EPA) are expected to hinder the growth of the market.

- By application, the chemical processing segment is expected to dominate the market, owing to the increasing usage in manufacturing soda ash, caustic soda, and chlorine.

- The Asia-Pacific region dominated the market across the world, with the largest consumption from countries such as China and India.

Industrial Salts Market Trends

Increasing Demand from Chemicals Processing Application

- Industrial salts are manufactured from rock salt or natural brine by conventional mining, solar evaporation, and vacuum evaporation.

- Chemical processing applications account for over 50% of the total industrial salts demand. Industrial salts are widely used for manufacturing chlorine, soda ash, and caustic soda, owing to their availability in large quantities and cost-effectiveness.

- Due to the lack of cost-effective substitutes, industrial salts are actively used in the chloralkali process to manufacture products such as ethylene dichloride, which is stimulating the demand for industrial salts.

- According to the American Chemistry Council, the annual production growth of the chemical industry in the United States is likely to rise by about 12.3% in 2021 compared to the previous year. The total chemical capital expenditure is likely to rise to USD 33.5 billion by 2021, with a growth rate of 15.7% compared to the previous year, which in turn is expected to stimulate the market demand for industrial salts.

- Industrial salts are used in the production of plastics, including polyvinyl chloride, soaps, detergents, herbicides, and pesticides. It is also used in the production of inorganic chemicals like titanium dioxide, enhancing the growth of the industrial salts market.

- The laundry care segment also consumes industrial salts for manufacturing detergents, soaps, and other laundry care products. The US laundry care market was valued at about USD 12.8 billion in 2019 and reached about USD 13.1 billion in 2020, with a growth rate of about 2%, stimulating the demand for the studied market.

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for industrial salts during the forecast period, owing to the growing industrialization in the region. In countries like China, India, and Japan, due to the usage of industrial salts in the chemicals processing industry, the demand for industrial salts has been increasing.

- The Japanese chemical industry was valued at about USD 200 billion in 2019, with a growth rate of about 2.5% compared to the previous year, which in turn stimulates the market demand for industrial salts.

- Industrial salts are widely used for de-icing for clearing roadways in countries with heavy snowfall. De-icing property of industrial salts also helps to delay the reformation of ice for a certain period of time.

- In water treatment plants, industrial salts are used for the water softening and purification process. In countries like India and China, many water treatment projects are being constructed, which is likely to help stimulate the growth of industrial salts over the forecast period.

- The plastic segment uses industrial salts to produce polyvinyl chloride (PVC), which are widely used in the construction industry for different applications, including piping, PVC boards, and others. China was leading the construction industry with market size of USD 1,092.9 billion in 2019, registering a growth rate of 14.71% compared to the previous year.

- Furthermore, the total new construction in Japan accounted for about 127.55 million sq. m in 2019 and reached about 113.74 million sq. m in 2020, with a decline rate of about 10.5%. This led to a decrease in consumption of PVC-made construction materials, in turn stimulating the demand for the industrial salts market.

- Some major companies operating in the Asia-Pacific region include Cargill Incorporated, K+S Aktiengesellschaft, and Tata Chemicals Ltd.

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

Industrial Salts Industry Overview

The industrial salts market is fragmented, with the top five players accounting for a marginal share of the market. Some key players in the market include Cargill Incorporated, K+S Aktiengesellschaft, Tata Chemicals Ltd, INEOS, and Nouryon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand in Chemical Processing

- 4.1.2 Growing Demand from Water Treatment

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Rock Salt

- 5.1.2 Natural Brine

- 5.2 Manufacturing Process

- 5.2.1 Solar Evaporation

- 5.2.2 Vacuum Evaporation

- 5.2.3 Conventional Mining

- 5.3 Application

- 5.3.1 Chemical Processing

- 5.3.2 Water Treatment

- 5.3.3 De-icing

- 5.3.4 Agriculture

- 5.3.5 Food Processing

- 5.3.6 Oil and Gas

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Archean Group

- 6.4.2 Cargill Incorporated

- 6.4.3 Compass Minerals

- 6.4.4 Delmon Group of Companies

- 6.4.5 Dominion Salt Limited

- 6.4.6 Donald Brown Group

- 6.4.7 Exportadora de Sal de CV

- 6.4.8 INEOS

- 6.4.9 K+S Aktiengesellschaft

- 6.4.10 MITSUI & CO. LTD

- 6.4.11 Morton Salt Inc.

- 6.4.12 Nouryon

- 6.4.13 Rio Tinto

- 6.4.14 Salins IAA

- 6.4.15 Tata Chemicals Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements to Produce High Purity Salts

- 7.2 Other Opportunities