|

시장보고서

상품코드

1689878

포장용 폼 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Packaging Foams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

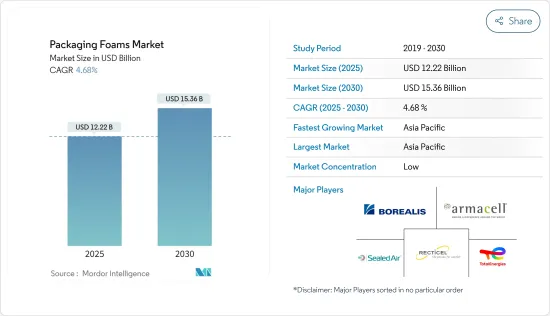

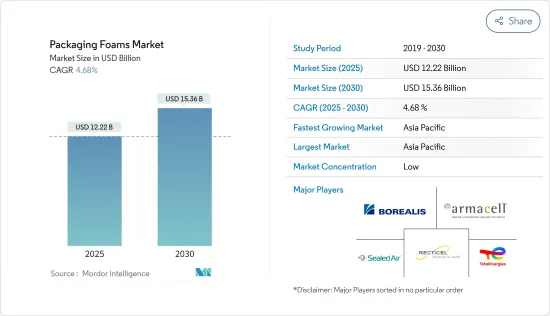

포장용 폼 시장 규모는 2025년에 122억 2,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 4.68%로, 2030년에는 153억 6,000만 달러에 달할 것으로 예측됩니다.

COVID-19는 2020년 세계 경제에 부정적인 영향을 미쳤습니다. 공급망에 지장을 초래하고 포장 부문 등 여러 산업 부문에 영향을 미쳤습니다. 봉쇄와 셧다운으로 인해 국제 공급망, 국제 공급망 및 다양한 분야의 구매 소매 비즈니스의 행동이 크게 바뀌었습니다. 그러나 2021년 하반기에 규제가 해제된 후 소비자들은 온라인 쇼핑과 운송 활동 증가로 인해 식료품 및 기타 식품을 온라인으로 주문하는 경우가 많아지면서 편의성에 대한 수요가 증가하여 업계가 회복세를 보이고 있습니다.

주요 하이라이트

- 단기적으로는 산업 포장 산업 수요 증가가 시장 성장의 주요 요인입니다.

- 그러나 환경 친화적인 대체품으로 성형 펄프를 사용할 수 있다는 점이 예측 기간 중 대상 산업의 성장을 억제할 것으로 예상되는 주요 요인입니다.

- 그럼에도 불구하고 친환경 포장용 폼에 대한 요구가 높아짐에 따라 조만간 세계 시장에서 유리한 성장 기회를 창출할 가능성이 높습니다.

- 아시아태평양은 포장용 폼 세계 시장을 독점할 것으로 예상되며, 중국, 인도 등의 국가에서 시장 용도가 증가함에 따라 예측 기간 중 가장 빠르게 성장하는 시장이 될 것으로 추정 및 예측됩니다.

포장용 폼 시장 동향

산업 포장 분야 수요 증가

- 포장용 폼은 일반적으로 상자의 완충재로 사용되며, 이 포장 솔루션은 다용도하고 사용자 정의가 가능한 것으로 알려져 있습니다.

- 폼은 산업용 제품, 가전제품, 자동차 등 최적의 보호와 내구성이 최우선인 다양한 포장 용도 및 산업에서 사용되고 있습니다.

- 자동차 부품은 취급이 어렵고 보관 및 운송시 각별한 주의가 필요한 부품도 있습니다. 이는 일부 부품, 특히 내장재와 엔진 부품이 복잡하게 얽혀 있기 때문입니다.

- 세계 자동차 산업은 조사 기간 중 큰 성장을 기록했으며, OICA에 따르면 2021년 자동차 생산량은 8,014만 5,988대로 2020년 대비 3%의 성장률을 보일 것으로 예측했습니다. 아시아태평양은 2021년 생산량이 4,673만 2,785대로 세계 자동차 시장에서 가장 높은 점유율을 차지하고 있습니다.

- 인구 조사국에 따르면 미국 소매 E-Commerce 매출은 2,659억 달러로 2022년 2분기 대비 3.0%(+-0.5%) 증가했습니다.

- 유럽의 E-Commerce 산업은 2021년 말 기준 7조 7,180억 유로(7조 9,023억 2,000만 달러)로 평가되며, 작년 대비 13% 증가한 것으로 나타났습니다. 이 지역의 주요 기여도는 북유럽이 전체 E-Commerce의 86%를 차지하며 가장 큰 기여를 했습니다.

- 또한 군용 폼 포장은 상업용 포장보다 더 세심한 주의를 기울여야 합니다. 내용물이 섬세하므로 군용 화물의 상당 부분이 신중한 포장과 취급이 필요합니다. 군용품은 전 세계를 자주 이동하므로 안전한 운송을 보장하기 위해 고품질의 국방용 폼 포장을 사용해야 합니다.

- 이처럼 운송 및 E-Commerce 산업의 성장은 포장 부문의 비약적인 성장으로 이어지고 있으며, 친환경 포장에 대한 인식과 사용 증가로 인해 포장 부문의 성장에 도움을 주고 있습니다. 따라서 이러한 추세는 향후 수년간 포장용 스티로폼 시장에 잠재적으로 긍정적인 영향을 미칠 것으로 예측됩니다.

아시아태평양이 시장을 장악

- 아시아태평양이 세계 포장용 스티로폼 시장을 독점하고 있는 주요 이유는 물류 분야의 포장 수요 증가, 산업 및 자동차 제조, 기타 제조 사업 증가에 기인합니다.

- 중국은 세계, 특히 아시아태평양의 포장용 폼 시장에 크게 기여하는 국가 중 하나입니다. 식품 및 음료, 자동차, 전자제품, 퍼스널케어, 제약 산업의 성장이 시장 성장을 촉진할 것으로 예측됩니다.

- 중국은 세계 최대 식품 산업 중 하나입니다. 중국 국가통계국에 따르면 2021년 중국 식품 산업은 약 6,187억 위안(863억 3,000만 달러)의 총이익을 창출했습니다. 이 중 식품 제조업은 약 1,654억 위안(230억 8,000만 달러)의 이익에 기여했습니다.

- 일본 경제산업성에 따르면 2021년 일본 전자산업 총생산액은 약 10조 9,500억 엔(800억 달러)으로 전년 대비 110% 증가했습니다. 또한 2021년 전자기기 수출 총액은 10조 8,200억 엔(790억 달러)에 달하고 2021년 12월에만 1조 400억 엔(76억 달러)에 달할 것으로 예상되어 이 지역의 포장용 폼에 대한 엄청난 수요가 있을 것으로 예측됩니다.

- 한국의 E-Commerce 시장 규모는 연간 920억 달러가 넘습니다. 건설과 투자의 물결은 GIC, APG, 안젤로 고든, 워버그 핀커스, 블랙스톤과 같은 국제적인 투자자들로부터 큰 관심과 자본을 끌어들이고 있습니다. 한국은 또한 아시아태평양에서 4번째로 큰 제3자 물류(3PL) 시장으로 연 8%에 가까운 성장률로 일본, 호주, 싱가포르보다 더 빠른 속도로 성장하고 있습니다.

- 따라서 아시아태평양의 포장 산업이 빠르게 성장함에 따라 포장용 폼에 대한 수요도 예측 기간 중 빠르게 증가할 것으로 예측됩니다.

포장용 폼 산업 개요

포장용 폼 시장은 그 특성상 부분적으로 세분화되어 있습니다. 주요 기업은 Borealis AG, Sealed AIR, Armacell, TotalEnergies, Recticel NV/SA 등입니다(무순서).

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 촉진요인

- 포장 업계로부터의 수요 증가

- 억제요인

- 그린 대체품으로서의 성형 펄프

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁의 정도

제5장 시장 세분화

- 소재

- 폴리스티렌

- 폴리우레탄

- 폴리올레핀

- 기타 소재

- 구조

- 유연

- 경질

- 용도

- 식품 포장

- 산업 포장

- 운송

- 전기·전자

- 퍼스널케어

- 의약품

- 기타 산업용 포장

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합병사업, 제휴, 협정

- 시장 순위 분석

- 주요 기업의 전략

- 기업 개요

- Armacell

- Atlas Roofing Corporation

- Borealis AG

- Drew Foam

- Foamcraft Inc.

- TotalEnergies

- Huntington Solutions

- Recticel

- Sealed Air

- Williams Foam

- Zotefoams PLC

제7장 시장 기회와 향후 동향

- 친환경 포장용 발포체에 대한 요구의 증가

The Packaging Foams Market size is estimated at USD 12.22 billion in 2025, and is expected to reach USD 15.36 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

COVID-19 had a negative impact on the global economy in 2020. It affected several industrial sectors such as the packaging sector by hindering their supply chain. The lockdown and shutdown have changed the behavior of retail business shuttered, international supply chains, and purchase significantly across various sectors. However, the industry witnessed a recovery, with the growing demand for convenience as consumers are increasingly ordering groceries and other food products online owing to increased online shopping and transportation activities after the lifting of restrictions in the second half of 2021.

Key Highlights

- Over the short term, the rising demand from the industrial packaging industries is a major factor driving the growth of the market studied.

- However, the availability of molded pulp as a green alternative is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing quest for eco-friendly packaging foam is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the global packaging foams market, and it is also estimated to be the fastest-growing market over the forecast period due to the increasing market applications in countries such as China and India.

Packaging Foam Market Trends

Increasing Demand from the Industrial Packaging Sector

- Packaging foam is commonly used as a cushioning material for boxes, and this packaging solution is known for its versatility and ability to be customized.

- Foams are used in a wide variety of packaging applications and industries including industrial goods, consumer electronics, automotive, and other applications where optimum protection and durability are overriding considerations.

- Automotive spares are difficult to handle, and some parts necessitate extra caution during storage and transportation. This is due to the intricate nature of some parts, particularly those in the interior and engine.

- The global automotive industry registered huge growth in the studied period. According to OICA, the total number of vehicles produced in 2021 was 80,145,988 and witnessed a growth rate of 3% compared to 2020. The Asia-Pacific region holds the highest production share in the global automotive market with 46,732,785 units in 2021.

- According to the Census Bureau, United States retail e-commerce sales amounted to USD 265.9 billion, an increase of 3.0 percent (+-0.5%) from the second quarter of 2022.

- The European e-commerce industry was valued at EUR 7718 billion (USD 7,902.32 billion) at the end of 2021, registering an increase of 13 % as compared to the situation last year. The major contribution in the region comes from Northern Europe, which accounts for 86% of the total e-commerce value.

- Moreover, Military foam packaging necessitates a higher level of attention to detail than commercial packaging. Because of the sensitive contents, a huge proportion of military cargo requires careful packing and handling. Military equipment is frequently moved around the world, which necessitates the use of high-quality defense foam packaging to ensure safe shipping.

- Thus, the growth in transportation and e-commerce industries has led to the exponential growth of the packaging sector, also taking support from the rising awareness and use of green packaging. Therefore, these trends are expected to have a potentially positive impact on the packaging foam market in the forecast years.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global packaging foams market primarily due to the growing demand for packaging in logistics, the growing industrial and automotive manufacturing and other manufacturing operations.

- China is one of the major contributors to the packaging foams markets globally, especially in Asia-Pacific. The growing food and beverages, automotive, electronics, personal care, and pharmaceutical industry are expected to boost the growth of the market.

- China has one of the largest food industries in the world. As per the National Bureau of Statistics of China, in 2021, the food industry in China generated a total profit of about CNY 618.7 billion (USD 86.33 billion). The food manufacturing industry contributed approximately CNY 165.4 billion (USD 23.08 billion) to the total profits.

- As per METI (Japan), the total production value of the electronics industry in Japan is around JPY 10.95 trillion (USD 80 billion) in 2021, which is 110% of the production value compared to the last year. Furthermore, the total electronics exports in 2021 amount to JPY 10.82 trillion (USD 79 billion) with JPY 1.04 trillion (USD 7.6 billion) in December 2021 alone, thus providing huge demand for packaging foams in the region.

- The South Korean e-commerce market stands at over USD 92 billion per annum. A wave of building and investment has been drawing significant interest and capital from international investors, including GIC, APG, Angelo Gordon, Warburg Pincus, and Blackstone. South Korea is also the 4th-largest third-party logistics (3PL) market in Asia-Pacific and is growing at an annual rate of nearly 8%, faster than Japan, Australia, and Singapore.

- Hence, owing to the rapidly growing packaging industry in the Asia-Pacific region, the demand for packaging foams is also expected to increase rapidly over the forecast period.

Packaging Foam Industry Overview

The packaging foams market is partially fragmented in nature. The major companies include (not in any particular order) Borealis AG, Sealed AIR, Armacell, TotalEnergies, and Recticel NV/SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Molded Pulp as a Green Alternative

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Polystyrene

- 5.1.2 Polyurethane

- 5.1.3 Polyolefin

- 5.1.4 Other Materials

- 5.2 Structure

- 5.2.1 Flexible

- 5.2.2 Rigid

- 5.3 Application

- 5.3.1 Food Packaging

- 5.3.2 Industrial Packaging

- 5.3.2.1 Transportation

- 5.3.2.2 Electrical and Electronics

- 5.3.2.3 Personal Care

- 5.3.2.4 Pharmaceutical

- 5.3.2.5 Other Industrial Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Armacell

- 6.4.2 Atlas Roofing Corporation

- 6.4.3 Borealis AG

- 6.4.4 Drew Foam

- 6.4.5 Foamcraft Inc.

- 6.4.6 TotalEnergies

- 6.4.7 Huntington Solutions

- 6.4.8 Recticel

- 6.4.9 Sealed Air

- 6.4.10 Williams Foam

- 6.4.11 Zotefoams PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Quest for Eco-friendly Packaging Foam