|

시장보고서

상품코드

1910715

폴리에테르아민 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Polyetheramine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

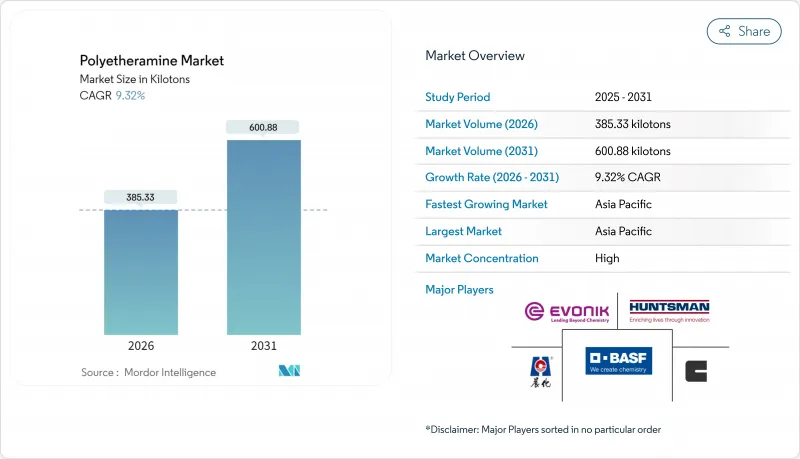

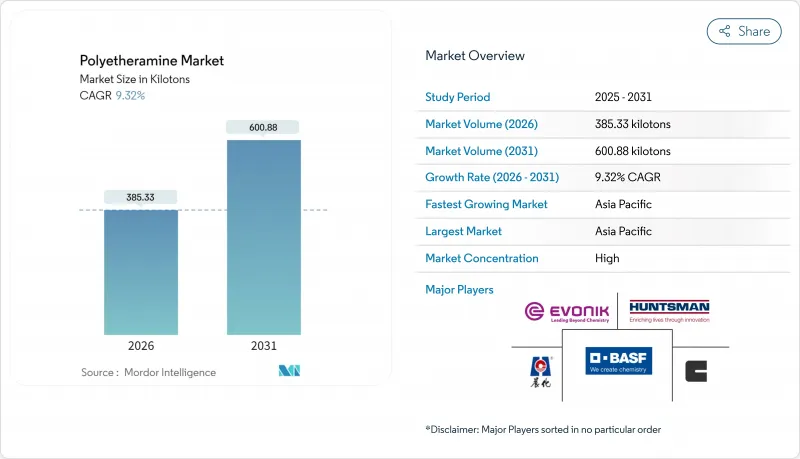

폴리에테르아민 시장의 규모는 2026년에는 385.33킬로톤으로 추정되고 있습니다.

이는 2025년 352.47킬로톤에서 성장한 수치이며, 2031년에는 600.88킬로톤에 달할 것으로 예측되고 있습니다. 2026년부터 2031년까지는 CAGR 9.32%로 성장할 전망입니다.

이러한 성장의 기세는 풍력 터빈 블레이드 생산, 복합소재 제조, 고성능 코팅 수요 증가에 기인하고 있으며, 다운스트림 산업이 보다 가볍고 내구성이 높은 재료를 추구하고 있기 때문입니다. 디아민 등급이 주류를 차지하고 있는 이유는 균형 잡힌 반응성이 대규모 블레이드 경화나 구조용 복합소재에 적합하기 때문입니다. 해상 풍력 발전 확대, 자동차 경량화, 인프라 내장 프로젝트가 특수 아민 수요를 계속 견인하는 반면, 3D 프린팅 제조업체는 복잡한 형상에 대응하기 위해 폴리에테르아민 경화 에폭시를 도입하고 있습니다. 원료 가격 변동과 아민 배출 규제 강화가 단기적인 이익률을 억제하는 반면, 바이오 제품, 아시아태평양에서의 생산 능력 증강, 수직 통합 전략을 통해 주요 공급업체는 지속적인 수익 성장의 기반을 구축하고 있습니다.

세계의 폴리에테르아민 시장의 동향 및 전망

접착제 및 실란트 산업에 대한 투자 증가

건설업자와 자동차 제조업체가 가볍고 내식성이 우수한 접착 솔루션을 요구하는 가운데, 선진적인 건설용 및 전동 모빌리티용 접착제에 대한 자본 배분이 증가하고 있습니다. 폴리에테르아민 개질 시스템은 저VOC 특성과 극한 온도 하에서 높은 박리 강도를 실현하므로 프리미엄 가격이 설정됩니다. BASF의 Baxxodur 제품군(북미에서는 유니버 솔루션을 통해 판매)은 통합 물류가 시장 침투를 강화하는 좋은 예입니다. 또한 지속가능성에 대한 요구도 에보닉사의 바이오 폴리에테르아민 'Ancamide 2853/2865'등의 제품 출시를 뒷받침하고 있어 ISO 14001 인증 공장에서 폴리에테르아민의 도입을 촉진하고 있습니다.

복합재 제조 분야 수요 증가

항공우주인증과 자동차연비 규제의 강화에 의해 수지 제조업체는 가사시간을 연장하면서 피로 저항성을 높이는 경화제로의 전환을 요구받고 있습니다. 세계의 풍력 발전 용량이 이미 743GW를 넘는 가운데, 100미터를 넘는 블레이드에는 저온 환경하에서의 대형 부품 가공 시에 구조적 무결성을 유지하는 폴리에테르아민 경화 에폭시 수지가 필수적입니다. 광섬유 내장 감지 시스템의 보급은 광학적으로 투명하고 수축률이 낮은 경화제에 대한 수요를 더욱 높입니다. 헝리(Hengli) 및 셩홍(Shenghong)과 같은 중국의 석유화학 대기업은 원료 확보와 리드타임 단축을 위해 다운스트림 공정으로의 통합을 추진하고 있어 경쟁은 격화하는 한편 공급의 탄력성도 확대하고 있습니다.

아민 배출에 대한 환경 우려

미국 환경보호청(EPA)의 NESHAP 규제범위 확대로 플랜트는 스크러버의 개보수 또는 폐쇄계 시스템의 도입을 강요받고 있어 중규모 생산자의 설비투자액이 증가하고 있습니다. 배출규제는 아민계 탄소회수용제에 대한 사회적 평가에도 영향을 주고, 간접적으로 폴리에테르아민의 평판에도 파급되고 있습니다. 공급업체는 저휘발 바이오 등급의 판촉과 기기 OEM과의 연계에 의한 저배출 가공 프로토콜의 공동 개발로 대응하고 있습니다.

부문 분석

디아민 등급은 2025년 출하량의 49.05%를 차지하였고 반응성과 유연성 간의 균형이 요구되는 풍력 블레이드나 구조용 복합재 용도를 지원하고 있으며, 2031년까지 연평균 복합 성장률(CAGR) 9.88%로 추이할 전망입니다. 헌츠만사의 제파민 D 시리즈는 분자량 230-2,000의 범위를 커버해, 20년의 내용연수를 설계 목표로 하는 블레이드용으로 가교 밀도를 조정할 수 있습니다.

모노아민과 트리아민은 생산량은 적지만, 틈새 요구에 대응하고 있습니다. 모노아민은 코팅에서 표면 습윤성을 향상시키고, 트리아민은 고Tg 항공우주 패널을 위해 가교 밀도를 증가시킵니다. 중국의 제조업체인 Zibo Dexin Lianbang Chemical은 연간 30,000톤 규모로 확대되어 비용에 중점을 둔 구매자를 위한 원료 선택을 확대하고 있습니다. 에보닉사의 Ancamine 2880으로 대표되는 바이오 디아민의 연구 개발은 옥외용 키트의 자외선 안정성을 유지하면서 지속 가능한 원료로의 이행을 실증하고 있습니다.

폴리에테르아민 시장 보고서는 유형별(모노아민, 디아민, 트리아민), 용도별(폴리우레아, 연료 첨가제, 복합재료, 에폭시 도료, 접착제 및 실란트, 기타), 최종 사용자 산업별(자동차, 건축 및 건설, 풍력에너지, 전자 및 전기, 기타 최종 사용자 산업), 지역별(아시아태평양, 북미, 유럽 남미)로 구분됩니다.

지역별 분석

2025년 아시아태평양은 폴리에테르아민 시장에서 53.42%의 점유율을 차지했습니다. 중국, 인도, 동남아시아의 블레이드 및 복합재 부품 생산량 증가가 그 배경에 있습니다. 생산능력의 증강으로는 BASF의 난징 특수 아민 공장 및 차오징 공장의 연간 1만 8,800톤 확장을 들 수 있으며, 이로써 지역 공급이 강화되고 납기 단축이 도모되고 있습니다.

북미는 항공우주 주요 제조업체와 선진적인 3D 프린팅 서비스 사업자를 핵심으로 하는 혁신 거점으로 계속되고 있습니다. EPA NESHAP 규정 준수는 확고한 환경 인증을 갖춘 공급업체에게 이익을 제공하고 사용자에게 저VOC 디아민 화학제품을 채택하도록 촉구합니다. BASF의 Baxxodur 제품이 유니버 솔루션즈를 통해 독점 판매됨으로써 기술 서비스망이 강화되어 자동차 및 건설 분야의 1차 OEM 제조업체에서 신속한 사양 책정 사이클을 지원하고 있습니다.

유럽의 에너지 전환 정책은 재생 가능 블레이드와 순환형 경제에 대응하는 코팅 수요를 유지하고 있습니다. TPI 컴포지츠의 튀르키예 거점은 유럽의 풍력 발전소용 생산 능력을 확충하고, REACH 규제는 복잡한 문서 관리가 가능한 기존 공급자를 우대하고 있습니다. 남미나 중동의 신흥 지역에서는 재생에너지 설비와 공업용 코팅 수요가 확대 중이지만, 주로 아시아태평양 거점으로부터의 수입에 의존하고 있어 현지에서의 혼합 시설 도입이 검토되고 있습니다.

기타 혜택

- 시장 예측(ME) 엑셀 시트

- 3개월 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 촉진요인

- 접착제 및 실란트 산업에 대한 투자 증가

- 복합재 제조 분야 수요 증가

- 풍력 터빈 블레이드 생산 확대

- 고성능 폴리우레아 보호 도료 수요 급증

- 3D 프린팅용 에폭시 수지 시스템으로의 도입

- 억제요인

- 원료 프로필렌옥사이드 가격의 변동성

- 아민 배출에 관한 환경 문제

- 식품접촉용 접착제 등급의 허가 지연

- 밸류체인 분석

- Porter's Five Forces

- 공급자의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모 및 성장 예측

- 유형별

- 모노아민

- 디아민

- 트리아민

- 용도별

- 폴리우레아

- 연료 첨가제

- 복합재료

- 에폭시 수지 코팅

- 접착제 및 실란트

- 기타

- 최종 사용자 산업별

- 자동차

- 건설 및 건축

- 풍력에너지

- 전자 및 전기

- 기타 최종 사용자 산업

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%) 및 순위 분석

- 기업 프로파일

- BASF

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Material Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

제7장 시장 기회 및 미래 전망

CSM 26.01.28Polyetheramine market size in 2026 is estimated at 385.33 kilotons, growing from 2025 value of 352.47 kilotons with 2031 projections showing 600.88 kilotons, growing at 9.32% CAGR over 2026-2031.

Momentum stems from escalating demand in wind-turbine blade production, composites manufacturing, and high-performance coatings as downstream industries target lighter, more durable materials. Diamine grades dominate because their balanced reactivity suits large-scale blade curing and structural composites. Offshore wind expansion, automotive lightweighting, and infrastructure resilience projects continue to pull specialty amine volumes, while 3D-printing formulators adopt polyetheramine-cured epoxies for complex geometries. Feedstock price swings and tightening amine-emission regulations temper short-term margins, yet bio-based variants, capacity builds in Asia-Pacific, and vertical integration strategies position leading suppliers for sustained earnings growth.

Global Polyetheramine Market Trends and Insights

Increasing Investments in Adhesives and Sealants Industry

Capital allocation into advanced construction and e-mobility adhesives is rising as builders and automakers seek lighter, corrosion-resistant bonding options. Polyetheramine-modified systems command a premium because they deliver low-VOC profiles and high peel strength under extreme temperatures. BASF's Baxxodur portfolio, distributed in North America via Univar Solutions, illustrates how integrated logistics strengthen market penetration. Sustainability mandates also spur launches such as Evonik's bio-content Ancamide 2853/2865, reinforcing polyetheramine uptake in ISO 14001-certified plants.

Growing Demand from Composites Manufacturing

Aerospace certification and automotive fuel-efficiency rules push resin suppliers toward curing agents that lengthen pot life yet boost fatigue resistance. With global wind capacity already above 743 GW, blades exceeding 100 meters require polyetheramine-cured epoxies that maintain structural integrity during low-temperature, large-part processing. Embedded fiber-optic sensing systems further raise the need for optically clear, low-shrinkage hardeners. Chinese petrochemical majors such as Hengli and Shenghong are integrating downstream to secure feedstocks and compress lead times, which intensifies competitive pricing but also broadens supply resilience.

Environmental Concerns over Amine Emissions

Expanded EPA NESHAP scopes compel plants to retrofit scrubbers or adopt closed-loop systems, raising capex for mid-scale producers. Emission caps also influence public perception of amine-based carbon-capture solvents, indirectly affecting polyetheramine reputations. Suppliers counter by marketing low-odor, bio-content grades and partnering with equipment OEMs to co-develop lower-emission processing protocols.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Wind-Turbine Blade Production

- Surge in High-Performance Polyurea Protective Coatings

- Slow Approval for Food-Contact Adhesive Grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diamine grades accounted for 49.05% of 2025 shipments, underpinning wind-blade and structural composite uses that demand balanced reactivity and flexibility, and is on track for a 9.88% CAGR to 2031. Huntsman's JEFFAMINE D-series ranges from molecular weight 230 to 2,000, letting processors tune crosslink density for blades designed to last 20 years.

Monoamine and triamine volumes trail but address niche needs: monoamines improve surface wetting in coatings, while triamines hike crosslink density for high-Tg aerospace panels. Chinese producer Zibo Dexin Lianbang Chemical scaled to 30,000 tons per year, widening raw material choice for cost-sensitive buyers. Bio-based diamine research and development from Evonik's Ancamine 2880 evidences a shift to sustainable feedstocks while retaining UV stability for outdoor kits.

The Polyetheramine Report is Segmented by Type (Monoamine, Diamine, and Triamine), Application (Polyurea, Fuel Additives, Composites, Epoxy Coatings, Adhesives and Sealants, and Others), End-User Industry (Automotive, Building and Construction, Wind Energy, Electronics and Electrical, and Other End-User Industries), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific commanded 53.42% of the polyetheramine market share in 2025 as China, India, and Southeast Asia intensified blade and composite part output. Capacity additions include BASF's Nanjing specialty amine plant and a Caojing expansion to 18,800 tons per year, consolidating regional supply and shortening delivery times.

North America remains an innovation nucleus anchored by aerospace primes and advanced 3D-printing service bureaus. EPA NESHAP compliance rewards suppliers with robust environmental credentials and motivates users to adopt low-VOC diamine chemistries. BASF's exclusive Baxxodur distribution via Univar Solutions strengthens technical-service reach, supporting rapid specification cycles among tier-one auto and construction OEMs.

Europe's energy-transition agenda sustains demand for recyclable blades and circular-economy coatings. TPI Composites' Turkish site adds capacity serving European wind parks, and the REACH regulation favors established suppliers able to navigate documentation complexity. Emerging regions in South America and the Middle East ramp up renewable capacity and industrial coatings needs, depending chiefly on imports from APAC hubs, though local blending facilities are under evaluation.

- BASF

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- Qingdao IRO Surfactant Co., Ltd.

- Shandong Longhua New Materials Co., Ltd.

- Wuxi Akeli Technology Co., Ltd.

- Yangzhou Chenhua New Material Co., Ltd.

- Yantai Dasteck Chemicals Co., Ltd.

- Zibo Zhengda Polyurethane Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing investments in adhesives and sealants industry

- 4.2.2 Growing demand from composites manufacturing

- 4.2.3 Expansion of wind-turbine blade production

- 4.2.4 Surge in high-performance polyurea protective coatings

- 4.2.5 Adoption in 3-D-printing-grade epoxy systems

- 4.3 Market Restraints

- 4.3.1 Volatile propylene-oxide feedstock prices

- 4.3.2 Environmental concerns over amine emissions

- 4.3.3 Slow approval for food-contact adhesive grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Monoamine

- 5.1.2 Diamine

- 5.1.3 Triamine

- 5.2 By Application

- 5.2.1 Polyurea

- 5.2.2 Fuel Additives

- 5.2.3 Composites

- 5.2.4 Epoxy Coatings

- 5.2.5 Adhesives and Sealants

- 5.2.6 Others

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Building and Construction

- 5.3.3 Wind energy

- 5.3.4 Electronics and Electrical

- 5.3.5 Other End-User Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Clariant

- 6.4.3 Evonik Industries AG

- 6.4.4 Huntsman International LLC

- 6.4.5 Qingdao IRO Surfactant Co., Ltd.

- 6.4.6 Shandong Longhua New Materials Co., Ltd.

- 6.4.7 Wuxi Akeli Technology Co., Ltd.

- 6.4.8 Yangzhou Chenhua New Material Co., Ltd.

- 6.4.9 Yantai Dasteck Chemicals Co., Ltd.

- 6.4.10 Zibo Zhengda Polyurethane Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment