|

시장보고서

상품코드

1523348

접합유리 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2024-2029년)Laminated Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

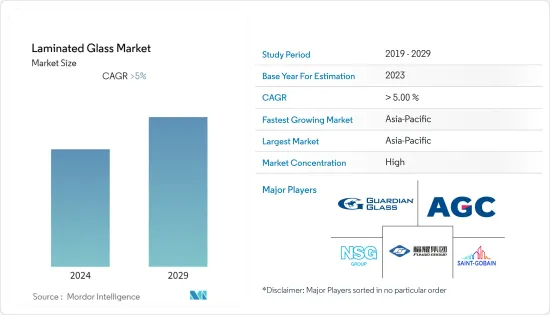

접합유리 시장 규모는 2024년 206억 2,000만 달러로 추정되고, 2029년에는 268억 3,000만 달러에 이를 것으로 예측되며, 예측 기간 동안의 복합 연간 성장률(CAGR)은 5%를 초과할 것으로 예측됩니다.

COVID-19는 접합 유리 시장에 부정적인 영향을 미쳤습니다. 많은 산업과 마찬가지로 합판 유리 시장도 유행의 초기 단계에서 감속을 경험했습니다. 이는 공급망의 혼란, 노동력 부족, 건설 활동의 감소로 인한 것이었습니다. 봉쇄 조치가 완화되고 건설 활동이 재개되면 합판 유리 수요가 회복되었습니다. 유행에 의해 연기 또는 중단된 건설 프로젝트가 재개되어 주택, 상업시설, 인프라 프로젝트에 사용되는 접합 유리를 포함한 유리 제품에 대한 수요가 증가했습니다.

주요 하이라이트

- 건축 분야에서 벽돌을 구조용 유리로 대체하는 합판 유리의 용도가 증가하고 있는 것과 기술의 진보가 합판 유리 시장을 견인하고 있는 주요 요인입니다.

- 합판 유리는 제조 공정이 많기 때문에 다른 일반적인 창유리보다 비싸고 시장 성장을 방해할 가능성이 높습니다.

- 또한 개발 도상국의 급속한 도시화와 자동차 분야의 유리 수요 증가는 시장 관계자들에게 다양한 기회를 제공할 것으로 예상됩니다.

- 중국, 인도, 일본 등은 합판 유리의 중요한 소비국이기 때문에 아시아태평양은 높은 성장률을 보이고 있습니다.

접합 유리 시장 동향

시장을 독점하는 자동차 부문

- 접합 유리는 차량 실내로의 소음 투과를 줄이고 탑승자의 편안함을 향상시킵니다. 소비자는 편안함과 조용한 운전 경험을 선호하기 때문에 자동차 제조업체는 접합 유리를 사용하여 차음성을 높입니다.

- 접합 유리에는 UV 컷 기능을 가지는 중간막을 짜넣을 수 있어 내장재의 퇴색을 억제해, 유해한 자외선으로부터 탑승자를 지킵니다. 이 기능은 햇빛이 강한 지역에 필수적입니다.

- 전기자동차(EV)의 인기 증가는 접합 유리 제조 업체에 기회를 제공합니다. EV 제조업체는 안전, 편안함, 에너지 효율을 위해 맞춤형 유리를 사용하는 등 제품을 차별화하기 위해 고급 기능과 기술을 선호하는 경우가 많습니다.

- 국제에너지기구(IEA)가 발표한 추계에 따르면 2022년 배터리 전기차 판매량은 730만대에 달할 것으로 예측되고 2021년 약 460만대에서 증가합니다. 지속가능한 수송에 대한 소비자의 관심 증가와 직접적인 대기오염 감소를 목적으로 하는 정부의 법규제 등의 요인이 BEV 판매량 증가로 이어졌습니다.

- 또한 IEA가 발표한 추계에 따르면 2022년에는 세계 전기차의 약 84.76%가 판매되어 그 결과 전기차의 국내 생산이 증가했습니다. 이는 같은 해 국제무역에 의한 판매대수 160만대에 대해 약 900만대의 판매에 해당합니다.

- 경제분석국(BEA)이 발표한 최신 추계에 따르면 2023년 미국의 승용차 연간 판매량은 312만대로 2022년 286만대에서 증가했습니다.

- 그 결과, 이 시장은 상기 요인으로부터 예측기간 동안 성장을 기록할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 급속한 인구 증가와 도시화가 진행되고 있으며 건설 및 인프라 정비 수요를 견인하고 있습니다. 합판 유리는 아시아태평양의 상업시설, 주택, 시설 등 건물의 외관, 도이 및 창문, 문, 채광창 등에 널리 사용됩니다.

- 이 지역은 세계에서 가장 경제 성장이 현저한 지역 중 하나이며 건설 프로젝트에 많은 투자가 이루어지고 있습니다. 합판 유리는 그 안전성, 방범성, 심미성으로부터 건축가나 건설업자에게 선호되고 있습니다. 상하이, 베이징, 싱가포르, 뭄바이 등의 도시에서 고층 빌딩, 쇼핑몰, 호텔, 집합 주택의 건설은 접합 유리 수요를 촉진하고 있습니다.

- 또한 중국국가통계국이 발표한 최신 추계에 따르면 2022년 중국 건설산업은 31조 위안 이상의 생산고를 올리고 있습니다.

- 아시아태평양은 세계 최대의 자동차 시장이며 자동차 생산 및 판매에서 선도하고 있습니다. 접합 유리는 안전과 소음 감소를 위해 자동차의 앞 유리에 주로 사용됩니다. 이 지역의 자동차 산업의 성장은 접합 유리 수요에 더욱 기여하고 있습니다.

- 중국 기차공업협회(CAAM)가 발표한 최신 추계에 따르면 2022년 4월 현재 중국의 상용차 생산 대수는 약 21만대, 승용차 생산 대수는 약 99만 6,000대가 되고 있습니다. 이 업계는 같은 달 동안 총 120만 대를 생산했습니다.

- 일본 경제산업성(경산성)이 발표한 추계에 따르면 2022년 일본 자동차산업에 의한 자동차 생산액은 약 19조 2,900억엔(1,300억 달러)으로, 전년의 약 17조 6,500억엔(1,200억 달러)에서 증가했습니다.

- 앞으로 몇 년동안 이 모든 것이 이 지역 시장 성장에 큰 영향을 미칠 것으로 예상됩니다.

접합 유리 산업 개요

접합 유리 시장은 부분적으로 통합됩니다. 이 시장의 주요 기업(순부동)에는 Saint-Gobain, AGC Glass Europe, Guardian Industries Holdings, Nippon Sheet Glass, Fuyao Glass Industry Group이 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 벽돌에서 구조용 유리로 대체 용도 증가

- 기술의 진보

- 억제요인

- 제조 비용의 높이

- 기타 억제요인

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 베이스 시장 규모)

- 유형별

- 폴리비닐부티랄(PVB)

- 센트리 글라스 플러스(SGP)

- 에틸렌비닐아세테이트(EVA)

- 기타(이오노 플라스트, 방화 맞추기 유리)

- 최종 사용자 산업별

- 자동차

- 건축 및 건설

- 일렉트로닉스

- 기타(보안?방위)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국의

- 말레이시아

- 인도세이아의

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 터키

- 러시아

- 북유럽 국가

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 이집트

- 카타르

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- AGC Inc.

- Asahi India Glass Limited

- CARDINAL GLASS INDUSTRIES INC.

- Central Glass Co. Ltd

- Fuyao Group

- GSC GLASS LTD

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd

- Saint-Gobain

- Stevenage Glass Company Ltd

- Taiwan Glass Ind. Corp.

제7장 시장 기회와 앞으로의 동향

BJH 24.08.09The Laminated Glass Market size is estimated at USD 20.62 billion in 2024, and is expected to reach USD 26.83 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

COVID-19 had a detrimental effect on the laminated glass market. Like many industries, the laminated glass market experienced a slowdown in the early stages of the pandemic. This occurred due to disruptions in supply chains, labor shortages, and decreased construction activity. As lockdown measures eased and construction activities resumed, the demand for laminated glass picked up. Construction projects that were delayed or put on hold due to the pandemic restarted, driving demand for glass products, including laminated glass, for use in residential, commercial, and infrastructure projects.

Key Highlights

- The increasing application of laminated glass in replacing bricks with structural glass in the construction sector and the advancement in technology are the key factors that are driving the laminated glass market.

- Laminated glass is more expensive than other regular windows because of the number of steps taken to produce it, which is likely to hamper market growth.

- Also, the rapid urbanization in developing countries and the rising demand for laminated glasses from the automotive sector are expected to provide various opportunities to market players.

- Due to the fact that countries like China, India, and Japan are critical consumers of laminated glass, Asia-Pacific has a high growth rate.

Laminated Glass Market Trends

Automotive Segment to Dominate the Market

- Laminated glass helps reduce noise transmission into the vehicle cabin, enhancing comfort for passengers. As consumers increasingly prioritize comfort and a quieter driving experience, automakers utilize laminated glass to improve acoustic insulation.

- Laminated glass can incorporate interlayers that provide UV protection, reducing the fading of interior materials and protecting occupants from harmful UV radiation. This feature is essential for regions with intense sunlight exposure.

- The increasing popularity of electric vehicles (EVs) offers opportunities for laminated glass manufacturers. EV manufacturers often prioritize advanced features and technologies to differentiate their products, including the use of laminated glass for safety, comfort, and energy efficiency.

- According to the estimate released by the International Energy Agency (IEA), in 2022, sales of battery electric vehicles reached 7.3 million, up from around 4.6 million in 2021. Factors such as increased consumer interest in sustainable transport and governmental legislation that aims to reduce direct air pollution have led to a rise in the sale of BEVs.

- Further, according to the estimate released by the IEA, in 2022, around 84.76% of global electric vehicles were sold, resulting from the domestic production of these vehicles. This represented nearly 9 million sales, compared to 1.6 million units sold from international trade that year.

- According to the latest estimate published by the Bureau of Economic Analysis (BEA), the annual passenger car sales in the United States were 3.12 million units in 2023, which increased from 2.86 million units in 2022.

- Consequently, the market is expected to register growth during the forecast period due to the abovementioned factors.

Asia-Pacific to Dominate the Market

- Asia-Pacific has experienced rapid population growth and urbanization, driving demand for construction and infrastructure development. Laminated glass is widely used in building facades, windows, doors, and skylights in commercial, residential, and institutional buildings across the region.

- It is home to some of the world's fastest-growing economies, leading to significant investments in construction projects. Laminated glass is a preferred choice for architects and builders due to its safety, security, and aesthetic properties. The construction of skyscrapers, shopping malls, hotels, and residential complexes in cities like Shanghai, Beijing, Singapore, and Mumbai fuels the demand for laminated glass.

- Furthermore, according to the latest estimate published by the National Bureau of Statistics of China, in 2022, the construction industry in China generated an output of over CNY 31 trillion.

- Asia-Pacific is the largest automotive market globally, leading in automobile production and sales. Laminated glass is majorly used in automotive windshields for safety and noise reduction. The region's automotive industry's growth further contributes to the demand for laminated glass.

- According to the latest estimate published by the China Association of Automobile Manufacturers (CAAM), China produced approximately 210,000 commercial vehicles and 996,000 passenger cars as of April 2022. The industry produced a total of 1.2 million vehicles during the month.

- According to the estimate released by the Ministry for Economy, Trade, and Industry (Meti), Japan, in 2022, the production value of motor vehicles by the automotive industry in Japan was approximately JPY 19.29 trillion (USD 0.13 trillion), increasing from around JPY 17.65 trillion (USD 0.12 trillion) in the previous year.

- In the coming years, all of this is expected to have a significant impact on the growth of the region's market.

Laminated Glass Industry Overview

The laminated glass market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Saint-Gobain, AGC Glass Europe, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, and Fuyao Glass Industry Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Replacement of Bricks with Structural Glass

- 4.1.2 Advancements in Technology

- 4.2 Restraints

- 4.2.1 High Cost of Manufacturing

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyvinyl Butyral (PVB)

- 5.1.2 Sentryglas Plus (SGP)

- 5.1.3 Ethylene-vinyl Acetate (EVA)

- 5.1.4 Other Types (Ionoplast, Fire-Rated Laminated Glass)

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Electronics

- 5.2.4 Other End-user Industries (Security and Defense)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Asahi India Glass Limited

- 6.4.3 CARDINAL GLASS INDUSTRIES INC.

- 6.4.4 Central Glass Co. Ltd

- 6.4.5 Fuyao Group

- 6.4.6 GSC GLASS LTD

- 6.4.7 Guardian Industries Holdings

- 6.4.8 Nippon Sheet Glass Co. Ltd

- 6.4.9 Saint-Gobain

- 6.4.10 Stevenage Glass Company Ltd

- 6.4.11 Taiwan Glass Ind. Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Urbanization in Developing Countries

- 7.2 Rising Demand from the Automotive Sector