|

시장보고서

상품코드

1690814

HIPPS(고 무결성 압력 보호 시스템) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)HIPPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

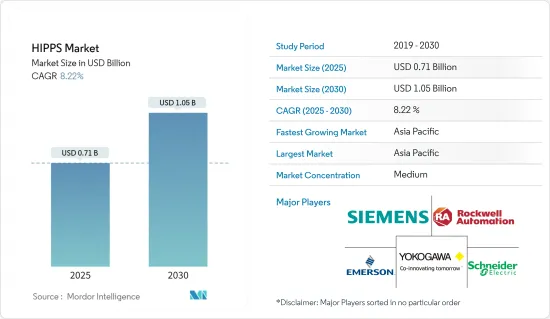

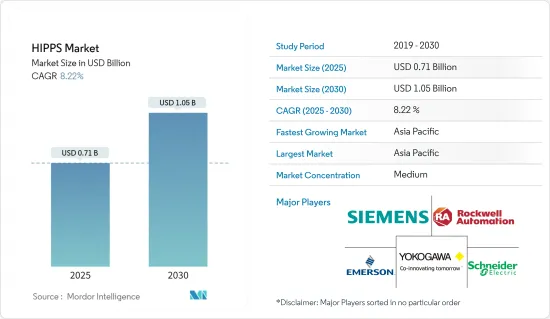

HIPPS(고 무결성 압력 보호 시스템) 시장 규모는 2025년에 7억 1,000만 달러로 추정되고, 2030년에는 10억 5,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 8.22%를 나타낼 전망입니다.

석유 및 가스는 고 무결성 압력 보호 시스템(HIPPS) 시장의 중요한 타겟 부문 중 하나입니다. 최근 코로나19가 확산되면서 업계는 시장 성장에 영향을 미치는 하향 추세를 보이고 있습니다. 수요 측면에서 석유와 가스는 코로나19 확산의 영향으로 어려움을 겪고 있습니다. 이로 인해 생산업체들은 자본 지출과 시추 프로그램을 급격히 삭감했습니다. 팬데믹은 여러 프로젝트의 진행에 영향을 미쳐 파이프라인이 중단되거나 지연되는 결과를 초래했습니다.

주요 하이라이트

- 새로운 가스 생산원을 가스 플랜트 시설에 연결할 때 가스 생산 시설이나 파이프라인을 보호하기 위해 기계적 안전 장치가 필요한 경우가 많습니다. 기존 파이프라인에 연결된 새로운 생산원은 잠재적인 과압으로부터 파이프라인을 보호해야 하므로 플레어 시스템을 통해 탄화수소가 대기 중으로 방출되거나 바람직하지 않은 연소로 인해 탄화수소가 연소될 수 있습니다. 공장에서의 사고 증가로 인해 산업 공장의 안전과 보안을 지키기 위한 정부 규제 기준이 높아지면서 시장이 성장하고 있습니다.

- 작업장 안전을 강화하기 위해 산업 전반의 배출 수준에 대한 각국 정부의 엄격한 규제는 다양한 HIPPS 용도에 대한 수요를 강화했습니다. 신흥 시장의 급속한 발전, 지속 가능성 정책, 신기술의 부상, 소비자 선호도 변화로 인해 최종 사용자 산업 환경은 빠르게 진화하고 있습니다.

- 2020년 7월, 인도 네이벨리 화력발전소의 보일러 폭발 사고로 최소 6명이 사망하고 17명이 중상을 입었습니다. 이는 같은 발전소에서 두 달 만에 발생한 두 번째 보일러 폭발 사고였습니다. 타밀 나두(인도)의 발전소 폭발은 과열과 고압이 원인인 것으로 추정되고 있습니다.

- 연구 대상 시장에서 활동하는 업체들은 HIPPS 응용과 관련된 첨단 기술 개발에 주력하고 있습니다. 예를 들어, 2019년 12월, 고압 장비 회사(Graco의 자회사)는 액체 및 가스 배관 시스템을 과압 손상 및 고장으로부터 보호하도록 설계된 새로운 소프트 시트 릴리프 밸브를 출시했습니다. 새로운 릴리프 밸브는 9/16' O.D. 튜브용 1,500-25,000psi의 압력 범위에서 사용할 수 있으며, 다른 크기에 맞는 어댑터도 함께 제공됩니다. 새로 개발된 밸브는 공장에서 지정된 압력으로 설정되어 있으며 그에 따라 태그가 부착되어 있습니다. 이 밸브는 316 스테인리스 스틸 바디와 탈착식 시트 글랜드, 표준용 17-4PH 스템 및 씰 링이 특징입니다.

고 무결성 압력 보호 시스템(HIPPS) 시장 동향

예측 기간 동안 주요 점유율을 차지하는 석유 및 가스 부문

- 고 무결성 압력 보호 시스템(HIPPS)은 석유 및 가스 생산, 정제 및 파이프 라인 시스템을 과압으로부터 보호하도록 설계된 안전 계측 시스템입니다. .

- 이 시장에서 활동하는 진출기업은 혁신적인 제품과 솔루션을 개발하는 데 주력하고 있으며, 이는 향후 몇 년 동안 HIPPS 시장의 성장을 강화할 수 있습니다. 최근에는 아랍에미리트의 주요 고객사에 HIPPS를 공급하기도 했습니다. ATV HIPPS는 석유 및 가스 산업을 위한 해저 및 탑사이드 중요 서비스 밸브 분야의 주요 업체인 ATV 그룹과 ATV SpA의 계열사입니다. 이 회사는 유정 장비 및 제어 전문 기업인 Hydropneumatic을 인수했습니다. 이를 통해 강화된 HIPPS 솔루션 기술 포트폴리오를 활용할 수 있습니다.

- OCT SW 개발은 화재 안전을 위해 사용되는 해수 서비스 밸브에 대한 해양 석유 및 가스 사업자의 시장 피드백에 의해 추진되었습니다. 새로운 솔루션은 바닷물에 노출될 경우 주변 금속의 부식 취약성을 높일 수 있는 흑연 부품을 보장합니다.

- 과도한 유정 압력은 다운스트림 직원, 생산 및 생산 자산, 환경에 심각한 결과를 초래할 수 있습니다.

- 과거 인도의 엔지니어링 대기업인 라센 & 투브로는 아삼주의 디록 가스전 개발 프로젝트에 인도에서 자체 개발한 HIPPS를 공급한 바 있습니다. 라센 앤 투브로의 자회사인 L&T 밸브는 힌두스탄 석유 탐사 회사, 오일 인디아, IOCL 컨소시엄이 추진하는 디록 프로젝트에 자체 개발한 HIPPS를 공급했습니다.

- HIPPS의 수요는 지속 가능한 개발 정책에 따라 달라지며, 이는 산업 적용 요건에서 더 벗어날 수 있습니다. 지속 가능한 개발 시나리오에서 결정적인 정책 개입은 향후 몇 년 내에 전 세계 석유 수요의 정점을 초래할 수 있습니다.

예측 기간 동안 상당한 속도로 성장할 것으로 예상되는 아시아태평양 지역

- 아시아태평양 HIPPS 시장은 중국, 일본 인도가이 지역의 주요 국가 중 일부인 석유 및 가스 정제 능력 개발에 중점을두고 화학 산업에서 주목할만한 성장으로 인해 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다.

- IEA에 따르면 향후 5년간 가스 수요는 아시아 태평양 지역이 주도할 것으로 예상되며, 2024년까지 전체 소비 증가분의 거의 60%를 차지할 것으로 전망됩니다.

- 아시아태평양 지역은 석유 및 가스, 화학, 발전 사업에서 HIPPS를 설치할 수 있는 엄청난 잠재력을 가지고 있습니다. 중국과 인도와 같은 국가에서 석유화학에 대한 수요가 급증하면서 석유, 가스, 화학제품의 생산이 증가하고 있습니다.

- 예를 들어, 인도 화학비료부에 따르면 주요 화학제품의 경우 2018-2019년 연간 생산량이 전년 대비 4.70% 증가했으며, 8년간 연평균 성장률은 3.02%에 달했습니다.

고 무결성 압력 보호 시스템(HIPPS) 산업 개요

HIPPS 시장의 경쟁은 중간 정도로 상당한 수의 세계적 및 지역적 진출기업으로 구성되어 있습니다.

- 2020년 7월 : MOGAS Industries, Inc.는 수리 및 코팅 서비스를 제공하기 위해 미국에 본사를 둔 고강도 서비스 밸브 제조업체인 왓슨 밸브의 자산을 인수했습니다. 왓슨 밸브는 주로 광산업에 3,400개 이상의 밸브를 전 세계에 설치했으며, 화학 및 석유 및 가스 산업을 아우르고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 공장에서의 사고 증가로 인해 산업 공장의 안전 및 보안을 방어하기위한 정부 규제 기준 증가

- 시장의 과제

- 구현 비용 및 필수 기술 부족

- 시장 기회

- 산업의 규제 상황(SIL, IEC 61511, IEC 61508 등)

제6장 시장 세분화

- 유형

- 컴포넌트

- 서비스

- 최종 사용자 산업

- 석유 및 가스

- 화학

- 전력

- 금속 및 광업

- 식음료

- 기타 공정 산업

- 지역

- 북미

- 유럽

- 아시아태평양

- 기타

제7장 경쟁 구도

- 기업 프로파일

- Rockwell Automation

- Emerson Electric Co.

- Severn Glocon Group

- Schneider Electric

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Schlumberger NV

- Mogas Industries Inc.

- Mokveld Valves BV

- SELLA CONTROLS Ltd

- ATV Hipps

- HIMA Paul Hildebrandt GmbH

- PetrolValves SpA

- L& T Valves Limited(Larsen & Toubro Limited)

- BEL Valves(British Engines Limited)

제8장 벤더 포지셔닝 분석

제9장 투자 분석

제10장 시장 기회와 앞으로의 동향

HBR 25.05.09The HIPPS Market size is estimated at USD 0.71 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 8.22% during the forecast period (2025-2030).

Oil and gas are one of the significant target segments for the high integrity pressure protection system (HIPPS) market. With the recent outbreak, the industry has observed a downward trend, affecting market growth. From the demand perspective, oil and gas have been challenged by the effects of the COVID-19 outbreak. Owing to this, producers have rapidly slashed capital spending and drilling programs. The pandemic has impacted the progress of several projects, resulting in pipelines getting stalled or delayed.

Key Highlights

- The connection of new gas production sources to a gas plant facility has often required mechanical relief devices to protect gas production facilities or pipelines. New production sources connected to existing pipelines require the pipeline to be protected against potential overpressure, resulting in the release of hydrocarbons to the atmosphere or undesirable burning of these hydrocarbons via a flare system. Rising government regulatory standards to defend safety and security at industrial plants due to increasing accidents at plants drives the growth of the market.

- Strict government regulations in the regions on emission levels across industries to increase workstation safety have bolstered the demand for various HIPPS applications. Due to rapid developments in the emerging markets, sustainability policies, the rise of new technologies, and changing consumer preferences, the end-user industry landscape has been rapidly evolving.

- In July 2020, in a boiler blast at Neyveli Thermal Power Station (India), at least six people died, and as many as 17 others suffered serious injuries. This was the second boiler explosion in two months at the same plant. It is suspected that overheating and high pressure led to the power plant explosion in Tamil Nadu (India).

- Players operating in the market studied have been focusing on cutting-edge technology developments pertaining to HIPPS applications. For instance, in December 2019, High-Pressure Equipment Company (a subsidiary of Graco Inc.) introduced a new soft seat relief valve designed to protect liquid and gas tubing systems from overpressure damage and failure. The new relief valves are available in pressure ranges from 1,500 to 25,000 psi for 9/16' O.D. tubing, with adapters available for other sizes. The company's newly developed valves are factory set to the designated pressure and tagged accordingly. They feature 316 stainless steel bodies and removable seat glands, with a 17-4PH stem and seal ring for standard applications.

High Integrity Pressure Protection System Market Trends

Oil and Gas Segment Holds for a Major Share Throughout the Forecast period

- A high integrity pressure protection system is a safety instrumented system designed to protect oil and gas production, refining, and pipeline systems against over-pressurization. HIPPS leverages an oil and gas company's expertise in system design and integration.

- Players operating in the market are focusing on developing innovative products and solutions, which may bolster the growth of the HIPPS market in the coming years. In the recent past, ATV HIPPS delivered HIPPS to a major customer in the United Arab Emirates. ATV HIPPS is part of ATV Group and ATV SpA, a major player in Subsea and Topside critical service valves for the oil and gas industry. The company acquired Hydropneumatic, which is specialized in wellhead equipment and controls. This may leverage its enhanced technical portfolio of HIPPS solutions.

- The OCT SW development was driven by market feedback from offshore oil and gas operators concerning seawater service valves used for fire safety. The new solution ensures graphite parts, which can increase neighboring metals' susceptibility to corrosion when exposed to seawater.

- Excessive wellhead pressure can cause serious consequences to downstream personnel, production and production assets, and the environment. It is, therefore, mandatory to have IEC 61511 compliant protection systems. Companies implement various strategies, but the most common are 1oo2 or 2oo3 architectures for compliance to SIL 2 or SIL 3.

- In the past, the Indian engineering major, Larsen & Toubro, supplied the country's indigenously developed HIPPS to Dirok Gas Field Development Project in Assam. L&T Valves, a part of Larsen & Toubro, supplied indigenously developed HIPPS to Dirok, which is promoted by a consortium of Hindustan Oil Exploration Company, Oil India, and IOCL.

- HIPPS's demand further depends on sustainable development policies, which may deviate the industry application requirement further. In the sustainable development scenario, determined policy interventions may lead to a peak in the global oil demand within the next few years. The demand is estimated to fall by more than 50% in advanced economies and by 10% in developing economies between 2018 and 2040.

Asia Pacific Segment Expected to Grow at a Significant Rate Over the Forecast Period

- The Asia Pacific HIPPS market is anticipated to witness the highest growth rate during the forecast period due to the region's focus on developing oil and gas refining capacity and notable growth in the chemicals industry, with China, Japan India being some of the principal countries in this region. For instance, according to IEA, Asia continued to be the key destination for LNG, accounting for 70% of the total LNG imports by 2020.

- According to IEA, gas demand in the coming five years is set to be driven by Asia Pacific, and it is anticipated to account for almost 60% of the total consumption increase by 2024. In 2019, the requirement for gas in China surged sharply due to the expansion of the petroleum industry, improvement in living standards, and the development of gas infrastructure.

- Asia Pacific presents a tremendous potential for the installation of HIPPS in the oil and gas, chemicals, and power generation businesses. The burgeoning demand for petrochemicals in countries, such as China and India, is augmenting the production of oil, gas, and chemicals.

- For instance, according to the Ministry of Chemicals and Fertilizers, India, the annual growth of production during 2018-2019 was 4.70% over the preceding year, with a CAGR of 3.02% over a period of eight years, in case of major chemicals. The annual growth of basic major petrochemicals was 3.82% over preceding year, with a CAGR of 3.54% during the same period.

High Integrity Pressure Protection System Industry Overview

The high integrity pressure protection system (HIPPS) market is moderately competitive and consists of a significant number of global and regional players. These players account for a considerable share in the market and focus on expanding their customer base. These vendors focus on the research and development activities, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

- July 2020 - MOGAS Industries, Inc. acquired the assets of Watson Valve, a US-based manufacturer of severe service valves, in order to have repairs and coating services. Watson Valve has a global install base of more than 3,400 valves, majorly in the mining industry, and encompasses the chemical and oil & gas industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants, Owing to Increasing Accidents at Plants

- 5.2 Market Challenges

- 5.2.1 Implementation Cost and Lack of Required Skillsets

- 5.3 Market Opportunities

- 5.4 Regulatory Landscape of the Industry (SIL, IEC 61511, IEC 61508, etc.)

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Components

- 6.1.2 Services

- 6.2 End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Power

- 6.2.4 Metal and Mining

- 6.2.5 Food and Beverages

- 6.2.6 Other Process Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 Emerson Electric Co.

- 7.1.3 Severn Glocon Group

- 7.1.4 Schneider Electric

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 ABB Ltd

- 7.1.7 Siemens AG

- 7.1.8 Schlumberger NV

- 7.1.9 Mogas Industries Inc.

- 7.1.10 Mokveld Valves BV

- 7.1.11 SELLA CONTROLS Ltd

- 7.1.12 ATV Hipps

- 7.1.13 HIMA Paul Hildebrandt GmbH

- 7.1.14 PetrolValves SpA

- 7.1.15 L&T Valves Limited (Larsen & Toubro Limited)

- 7.1.16 BEL Valves (British Engines Limited)