|

시장보고서

상품코드

1435999

희귀질환 유전자 검사 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2024-2029년)Rare Disease Genetic Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

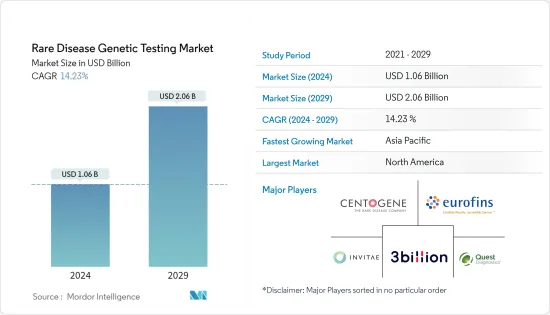

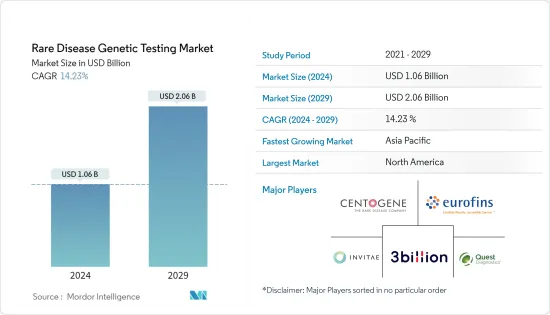

희귀질환 유전자 검사 시장 규모는 2024년에 10억 6,000만 달러로 추정되고, 2029년까지 20억 6,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 14.23%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다.

신형 코로나 바이러스 감염증(COVID-19)의 팬데믹은 희귀질환 유전자 검사 시장에 영향을 미쳤습니다. COVID-19 감염의 증례 수가 증가함에 따라 세계의 건강 관리 서비스는 자원을 COVID-19의 치료로 옮겨 희귀질환 환자에게 영향을 미쳤습니다. 예를 들어, 2022년 3월에 저널 오브 퍼블릭 헬스에 게재된 기사에서는 5,000-8,000개의 희귀질환이 존재하고, 그 대부분이 유전적 근거가 있다고 보고하고 있습니다. 기사는 또한 이러한 희귀질환이 세계 약 4억 명에 영향을 미치고 있다고 보고했습니다. 희귀 및 유전성 질환에 대한 진행 중인 연구 프로젝트 및 임상시험의 대부분은 환자와 조사 직원 간의 COVID-19증 감염을 피하기 위해 중단되었습니다. 이와 같이 팬데믹은 건강 관리 서비스 부족 및 예약 취소를 초래하여 희귀질환 환자의 진단이 불충분해졌습니다. 그러나 COVID-19 감염의 감염자 수가 감소함에 따라 시장은 팬데믹 이전 수준으로 회복되기 시작했으며 예측 기간 동안 동일한 상태가 지속될 것으로 예상됩니다.

시장 성장을 이끌어내는 요인은 희귀질환의 환자 등록 확대, 유전자 검사 기술의 개발, 희귀질환에 대한 정부의 이니셔티브 강화입니다.

사용 가능한 희귀질환 레지스트리 수 증가가 시장 성장을 가속하고 있습니다. 희귀질환 환자 등록의 목적은 환자 중심의 희귀질환 조사를 보다 적절히 추진 및 지원하는 것이며, 이는 치료법의 개발 및 희귀질환의 과학적 이해의 기반을 향상시킵니다. 예를 들어 Journal Frontiers in Endocrinology에 2022년 3월에 게재된 기사에서 환자 등록은 자연사와 돌연변이 질환의 경과에 대한 지식을 향상시키고, 예방 케어 프로그램, 진단 전략 및 오판 약물과 같은 치료로 인한 건강상의 이점, 안전성, 효능, 장기 보존성을 평가함으로써 희귀질환 조사의 여러 목적을 달성할 수 있다고 보고합니다. 따라서 환자 등록은 희귀질환 내에서 사용하는 연구 파트너로서 환자를 중심으로 질병의 자연사 문서화를 지원하는 효과적이고 편리하며 비용 효율적인 도구입니다. 환자 등록 수 증가도 조사 대상 시장의 성장을 가속하고 있습니다.

2022년 2월 Bionano Genomics는 전 세계 3억 5,000만 명의 희귀질환을 앓고 살고 있는 사람들을 대상으로 희귀 미진단 유전병(RUGD)이라는 전략적 노력을 시작했습니다. Bionano의 RIGD 이니셔티브는 일련의 제품 제공, 교육 의식 지원, 이 분야에서의 조사 보조금 개발을 위한 노력, RIGD 환자의 케어와 관리를 개선하는 공통의 사명을 가진 전문가 협회의 지원이 포함되어 있습니다. Bionano의 RIGD 이니셔티브의 일환으로, 회사는 ACMG Foundation for Genetic and Genomic Medicine(ACMGF)과 그 유전학 및 유전체학에서 차세대 휄로우십 및 레지던시 트레이닝 어워드 프로그램에 3년간의 재정적 지원을 제공할 것을 약속했습니다. 따라서 이러한 노력은 조사 대상 시장의 성장을 가속하고 있습니다.

새로운 유전자 검사 기술과 희귀질환 검사에 대한 정부의 이니셔티브가 증가함에 따라 연구 시장의 성장이 더욱 추진되고 있습니다. 예를 들어, 2022년 6월 미국 FDA는 희소 신경퇴행성 질환에 대한 프로그램을 발표했습니다. 이것은 효과적이고 안전한 의료 제품의 진보를 진화시키고 혁신적인 치료법에 환자의 접근을 가능하게 함으로써 희귀질환으로 고통받는 사람들의 수명을 연장하고 개선하기 위한 5년 전략입니다.

마찬가지로, 2021년 1월에는 5년 동안 350만 명의 희귀질환 환자의 신속한 진단, 인식, 케어, 치료에 대한 액세스에 중점을 둔 영국 희귀질환 프레임워크가 시작되었습니다. 따라서 NGS 기반 유전자 검사와 같은 신기술의 도입, 진단 및 정부의 이니셔티브에 대한 수요 증가는 희귀질환 유전자 검사 시장의 성장에 기여하고 있습니다.

그러므로 희귀질환의 환자 등록 확대와 정부의 이니셔티브 증가 및 새로운 유전자 검사 기술의 개발로 조사 대상 시장은 예측 기간 동안 크게 성장할 것으로 예상됩니다. 그러나 희귀질환, 유전자 검사 및 데이터 관리와 관련된 기술적 문제에 대한 인식이 부족하여 시장 성장이 둔화될 수 있습니다.

희귀질환 유전자 검사 시장 동향

전체 엑솜 시퀀싱(WES)는 예측 기간 동안 상당한 성장을 이룰 것으로 예상됩니다.

전체 엑솜 시퀀싱 부문은 유전체학 분야 및 다음 분야에서의 연구개발 증가와 개인 맞춤형 의료 수요 증가에 더하여, 임상 진단에 있어서의 WES의 응용 증가와 희귀질환의 진단에 대한 수요 증가에 의해 예측 기간 중에 대폭적인 성장을 달성할 것으로 예상됩니다.

전체 엑솜 시퀀싱 유전자 검사 도구의 보급이 이 분야의 성장을 가속하고 있습니다. 이 기술은 모든 게놈의 1-2%를 구성하고 질병을 일으키는 모든 돌연변이의 80%를 포함하는 엑손만을 대상으로 합니다. 이러한 지속적인 기술 개발은 정확하고 신속한 결과를 얻을 것으로 기대됩니다. 예를 들어, 2021년 11월 BMJ 저널에 게재된 기사에서는 WES가 드문 소아 유전성 질환의 정기 진단을 위해 선택된 환자에게 이용 가능하다고 보고했습니다. 이 기사는 또한 차세대 시퀀싱이 훨씬 저렴한 비용으로 단기간에 수백 또는 수천 개의 유전자를 시퀀싱할 수 있다고 보고했습니다.

주요 기업의 전략적 활동은 예측 기간 동안 이 부문을 추가로 추진할 것으로 추정됩니다. 예를 들어, 2022년 10월에 BGI Australia의 연구소는 호주에서 임상 WES를 실시하기 위한 NATA 인증을 받았습니다. 이 인증을 통해 BGI 호주는 희귀 유전성 질환과 소아 질환을 일으키는 엑솜의 변화를 감지하기 위한 서비스를 임상 실험실, 병원 및 기타 파트너에게 제공할 수 있습니다.

북미는 예측기간 중 상당한 성장이 예상됩니다.

북미에서는 희귀질환의 높은 유병률, 수많은 질환등록, 초희귀질환의 상당수의 연구개발 시설의 존재 및 진단에 대한 대규모 투자에 의해 예측기간 중에 큰 성장이 예상됩니다. 예를 들어, 2021년에 유전적 희귀질환 정보센터(GARD)는 알려진 희귀질환증례가 약 7,000건이며, 이는 약 10명 중 1명에 해당하며, 2020-2021년에는 미국에서 3,000만명이 희소 질병을 앓았다고 보고했습니다. 따라서 희귀질환의 이환율이 높아 진보된 희귀질환 검사장치에 대한 수요가 증가하고 있어 이 지역 시장 성장이 추진되고 있습니다.

미국에서 이러한 질병의 높은 유병률을 극복하기 위해 진행중인 약물 검사의 임상시험에 재정적 지원과 자금을 제공하는 정부의 이니셔티브도 시장 성장을 지원합니다. 예를 들어, 2020년 10월 미국 FDA는 희귀의약품법을 시행했으며, 향후 4년간 6건의 임상시험 조사에 산업계와 학계에 1,600만 달러 이상의 자금을 부여했습니다. 따라서 증가하는 정부 자금이 신약 연구에 대한 조사를 지원하고 이 지역 시장 성장을 가속하고 있습니다.

주요 시장 기업 간의 전략적 파트너십, 신제품 출시, 합병 및 인수도 이 지역 시장 성장을 가속하고 있습니다. 예를 들어, 2021년 11월, Genomenon은 Alexis와 AstraZeneca Rare Disaster와 협력하여 희귀질환의 치료 및 진단을 보다 쉽게 이용할 수 있도록 했습니다. 제휴의 목표는 희귀질환의 진단에 필요한 데이터를 유전자 검사 기관에 제공할 수 있도록 하는 것입니다.

북미의 유병률 상승과 승인 증가 외에도 건강 관리 인프라 지원, 정부 이니셔티브 및 기술 진보가 시장을 이끌 것으로 예상됩니다. 예를 들어, Centogene은 2021년 4월에 다케다 약품공업 주식회사와 제휴해, Centogene의 유전병 검사 기능에 대한 액세스를 통해 환자를 진단했습니다. 따라서 이러한 기술 개발은 이 지역 시장 성장을 가속하고 있습니다.

희귀질환의 높은 유병률, 수많은 질환등록, 초희귀질환을 위한 상당수의 연구개발 시설의 존재, 질병의 진단에 대한 대규모 투자로 이 지역은 세계적으로 보아도 예측기간 동안 대폭 성장을 이룰 것으로 예상됩니다.

희귀질환 유전자 검사 업계 개요

희귀질환 유전자 검사 시장은 많은 기업들이 존재하기 때문에 경쟁이 격렬하고 세분화되고 있습니다. 이 회사들은 Quest Diagnostics Incorporated, Eurofins Scientific Inc., SAmbry Genetics Corporations, PerkinElmer Genetics Inc., Baylor Miraca Genetics Laboratories LLC, Beijing Genomics Institute Ltd 등 전 세계 및 지역에 존재합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건 및 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 희귀질환 환자 등록 확대

- 유전자 검사 기술의 개발

- 희귀질환에 대한 정부의 대처 강화

- 시장 성장 억제요인

- 희귀질환에 대한 인식의 부족

- 유전자 검사 및 데이터 관리와 관련된 기술적 과제

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 기술별

- 차세대 시퀀싱

- 모든 엑솜 시퀀싱(WES)

- 전체 게놈 시퀀싱(WGS)

- 어레이 기술

- PCR 기반 검사

- 물고기

- 기타 기술

- 차세대 시퀀싱

- 질병별

- 신경학적 장애

- 면역 질환

- 혈액 질환

- 내분비 대사 질환

- 암

- 근골격계 질환

- 기타 병

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Quest Diagnostics Incorporated

- Centogene NV

- Invitae Corporation

- 3billion Inc.

- ARUP Laboratories

- Eurofins Scientific Inc.

- Strand Life Sciences Private Limited

- Ambry Genetics Corporations

- PerkinElmer Genetics Inc.

- Macrogen Inc.

- Baylor Miraca Genetics Laboratories, LLC

- Color Health Inc.

- Beijing Genomics Institute Ltd

제7장 시장 기회 및 미래 동향

AJY 24.03.08The Rare Disease Genetic Testing Market size is estimated at USD 1.06 billion in 2024, and is expected to reach USD 2.06 billion by 2029, growing at a CAGR of 14.23% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the rare disease genetic testing market. The rising number of COVID-19 cases resulted in global healthcare services shifting their resources toward COVID-19 care, which impacted patients with rare diseases. For instance, an article published in the Journal of Public Health, in March 2022, reported that there are between 5,000 and 8,000 rare diseases, most of them with a genetic basis. The article also reported that these rare diseases affect approximately 400 million people worldwide. Many ongoing research projects and clinical trials for rare and genetic diseases were stalled to avoid the transmission of COVID-19 among the patients and research staff. Thus, the pandemic led to a lack of healthcare services and cancellation of appointments, resulting in the underdiagnosis of rare disease patients. However, with the declining cases of COVID-19, the market started to recover at the pre-pandemic levels and is expected to continue the same over the forecast period.

The factors driving the growth of the market are expansion of the patient registry for rare diseases, developing genetic testing technologies, and increasing government initiatives for rare diseases.

The increasing number of available registries for rare diseases is driving the growth of the market. The purpose of rare disease patient registries is to better promote and support patient-focused rare disease research, which improves the foundation for therapy development and scientific understanding of a rare disease. For instance, an article published in March 2022 in the Journal Frontiers in Endocrinology reported that patient registries can fulfil multiple purposes for rare disease research, by improving the knowledge about natural history and variant disease courses and evaluating the safety, effectiveness, and long-term health benefits of preventive care programs, diagnostic strategies, and therapies, such as orphan drugs. Thus, patient registries are effective, convenient, and cost-efficient tools to support documentation of the natural history of a disease, centering patients as research partners for use within rare diseases. The rising number of patient registries is also driving the growth of the studied market.

In February 2022, Bionano Genomics launched a strategic initiative called Rare Undiagnosed Genetic Disease (RUGD) for the 350 million people globally living with rare diseases. Bionano's RUGD initiative includes its suite of product offerings, supporting educational awareness, working toward the development of research grants in this area, and supporting professional societies with a shared mission of improving RUGD patient care and management. As part of Bionano's RUGD initiative, the company has committed to providing three years of financial support for the ACMG Foundation for Genetic and Genomic Medicine (ACMGF) and its Next Generation Fellowship & Residency Training Awards Program in genetics and genomics. Thus, such initiatives are driving the growth of the studied market.

The new genetic testing technologies and the increasing government initiatives for rare disease testing are further propelling the growth of the studied market. For instance, in June 2022, the US FDA revealed its program for rare neurodegenerative diseases, a five-year strategy for extending and refining the lives of people suffering from rare diseases, by evolving the progress of effective and safe medical products and enabling patient access to innovative treatments.

Similarly, in January 2021, the UK Rare Disease Framework was launched, which focused on faster diagnosis, awareness, care, and access to treatment for 3.5 million rare disease patients over five years. Hence, the launch of new technologies, such as NGS-based genetic testing, and the increased demand for diagnosis and government initiatives are contributing to the growth of the rare disease genetic testing market.

Thus, due to the expanding patient registry for rare diseases and increasing government initiatives for the same, as well as the development of new genetic testing technologies, the studied market is expected to witness significant growth over the forecast period. However, a lack of awareness regarding rare diseases and technical challenges associated with genetic tests and data management may slow down the growth of the market.

Rare Disease Genetic Testing Market Trends

Whole Exome Sequencing (WES) is Expected to Witness a Significant Growth During the Forecast Period

The whole-exome sequencing segment is expected to witness significant growth over the forecast period due to the increasing applications of WES in clinical diagnosis and the growing demand for the diagnosis of rare diseases, along with the increasing R&D in the field of genomics and next-generation sequencing and increasing demand for personalized medicine.

The high adoption of the whole-exome sequencing genetic testing tool is driving the growth of the segment. This technique targets only exons, which make 1-2% of the whole genome and contains 80% of all disease-causing mutations. Such continuous technological developments are expected to provide accurate and rapid results. For instance, an article published by the BMJ Journal, in November 2021, reported that WES is available for selected patients for the routine diagnosis of rare childhood genetic diseases. The article also reported that next-generation sequencing allows hundreds or thousands of genes to be sequenced in a short period at a much lower cost.

The strategic activities of key players are estimated to further drive the segment over the forecast period. For instance, in October 2022, BGI Australia's lab achieved accreditation from the NATA to perform clinical WES in Australia. This accreditation will facilitate BGI Australia to provide services to clinical laboratories, hospitals, and other partners to detect changes in the exome that contributes to rare genetic and pediatric diseases.

North America Expected to Witness a Significant Growth During the Forecast Period

North America is expected to witness significant growth over the forecast period due to the high prevalence of rare diseases, a large number of disease registries, the presence of a substantial number of R&D facilities for ultra-rare diseases, and extensive investments in the diagnosis of disease. For instance, in 2021, the Genetic Rare Diseases Information Center (GARD) reported that there were about 7,000 known rare disease cases, which accounted for about 1 in 10 people, and 30 million people in the United States had a rare disease during 2020-2021. Thus, the high prevalence of rare diseases is increasing the demand for advanced rare disease testing devices, thereby propelling the growth of the market in the region.

The government initiatives to provide financial support and funding for the ongoing clinical trials for drug testing to overcome the high prevalence of these diseases in the United States are also supporting the market's growth. For instance, in October 2020, the US FDA carried out the Orphan Drug Act and awarded over USD 16 million for six clinical trial research studies to industry and academia for the next four years. Thus, the increasing government funding is supporting research for new drug trials and driving the growth of the market in the region.

The strategic partnerships among key market players, new product launches, and mergers and acquisitions have also propelled the market's growth in the region. For instance, in November 2021, Genomenon collaborated with Alexion and AstraZeneca Rare Disease to make the treatment and diagnosis of rare diseases more readily available. The goal of the collaboration is to empower the genetic testing laboratories with the data they need for the diagnosis of rare diseases.

Along with rising prevalence and increased approvals, the supportive healthcare infrastructure, government initiatives, and technological advancements in North America are expected to drive the market. For instance, in April 2021, Centogene entered a partnership with Takeda Pharmaceutical Company Limited to diagnose patients through access to Centogene's genetic disease testing capabilities. Thus, such technological developments are fueling the growth of the market in the region.

Due to the high prevalence of rare diseases, a large number of disease registries, the presence of a substantial number of R&D facilities for ultra-rare diseases, and extensive investments in the diagnosis of diseases, the region is expected to witness significant growth over the forecast period.

Rare Disease Genetic Testing Industry Overview

The rare disease genetic testing market is highly competitive and fragmented due to the presence of many players. These players are present globally and regionally, which include Quest Diagnostics Incorporated, Eurofins Scientific Inc., SAmbry Genetics Corporations, PerkinElmer Genetics Inc., Baylor Miraca Genetics Laboratories LLC, and Beijing Genomics Institute Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Patient Registry for Rare Disease

- 4.2.2 Development in Genetic Testing Technologies

- 4.2.3 Increased Government Initiatives for Rare Diseases

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness Regarding Rare Diseases

- 4.3.2 Technical Challenges Associated with Genetic Tests and Data Management

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Technology

- 5.1.1 Next-generation Sequencing

- 5.1.1.1 Whole Exome Sequencing (WES)

- 5.1.1.2 Whole Genome Sequencing (WGS)

- 5.1.2 Array Technology

- 5.1.3 PCR-based Testing

- 5.1.4 FISH

- 5.1.5 Other Technologies

- 5.1.1 Next-generation Sequencing

- 5.2 By Disease

- 5.2.1 Neurological Disorders

- 5.2.2 Immunological Disorders

- 5.2.3 Hematology Diseases

- 5.2.4 Endocrine and Metabolism Diseases

- 5.2.5 Cancer

- 5.2.6 Musculoskeletal Disorders

- 5.2.7 Other Diseases

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Quest Diagnostics Incorporated

- 6.1.2 Centogene NV

- 6.1.3 Invitae Corporation

- 6.1.4 3billion Inc.

- 6.1.5 ARUP Laboratories

- 6.1.6 Eurofins Scientific Inc.

- 6.1.7 Strand Life Sciences Private Limited

- 6.1.8 Ambry Genetics Corporations

- 6.1.9 PerkinElmer Genetics Inc.

- 6.1.10 Macrogen Inc.

- 6.1.11 Baylor Miraca Genetics Laboratories, LLC

- 6.1.12 Color Health Inc.

- 6.1.13 Beijing Genomics Institute Ltd