|

시장보고서

상품코드

1436002

프렌치 도어 냉장고 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2024-2029년)French Door Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

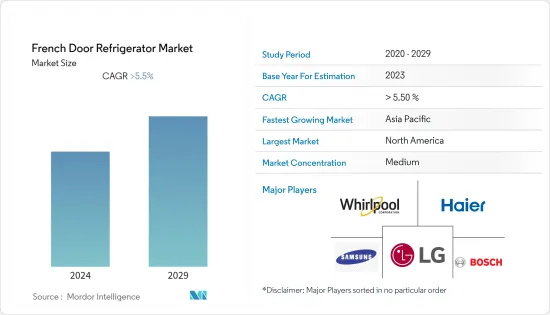

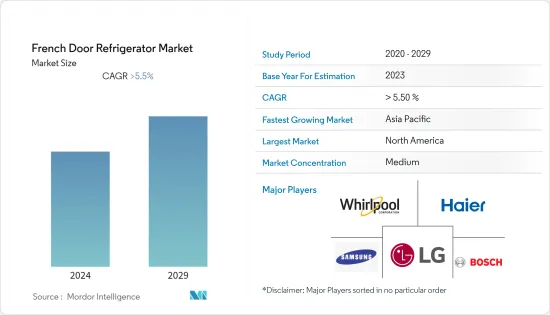

프렌치 도어 냉장고 시장 규모는 2024년 210억 5,000만 달러로 추정되고, 2029년까지 275억 5,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 5.53%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다.

지난 2년간 전 세계 제조업체의 냉장고 부문 판매량과 수익이 지속적으로 증가해 프렌치 도어 냉장고 부문 매출도 증가하고 있습니다. 아시아, 유럽, 북미는 냉장고 가전의 세계 소매량 점유율의 절반 이상을 차지하는 지역으로 존재하며, 세계 제조업체들은 시장의 매출과 수익을 높이기 위해 이러한 지역에서 공급망을 강화하고 있습니다. 아시아에서는 평균 가구 인원이 커지므로 프렌치 도어 냉장고는 더 넓은 치수를 갖추고 있어 대량의 식료품을 보관할 수 있습니다.

다양한 크기의 프렌치 도어 냉장고를 사용할 수 있으며 고급 냉동 기술과 매력적인 디자인으로 이러한 냉장고는 세계에서 인기를 끌고 있습니다. 신흥 경제 국가에서도 제조업체는 IoT(사물 인터넷) 기술과 통합된 비용 효율적인 제품으로 고객을 대상으로 하고 있으며, 프렌치 도어 냉장고에 대한 수요가 높아지고 있습니다. 신형 코로나바이러스 감염 이후 펜트업 수요 증가와 가계 수입 증가로 주요 가전제품에 대한 지출이 지속적으로 증가하고 있으며 프렌치 도어 냉장고 판매시장이 호조를 보이고 있습니다.

신형 코로나 바이러스 감염 후 소비자 행동의 변화로 인해 소매업체와 도매업체는 프렌치 도어 냉장고 판매를 늘리기 위해 온라인 전자상거래 플랫폼과 협력하고 있으며 삼성, 파나소닉, 하이센스, LG 등 제조업체는 냉장고 제품을 직접 판매를 통해 제공합니다. 웹사이트 채널을 통해 소비자는 특정 시점에서 프렌치 도어 냉장고의 큰 부문 중에서 선택할 수 있습니다. 또한 전 세계 냉장고 시장의 온라인 수익 점유율이 22% 이상 상승하고 있기 때문에 향후 프렌치 도어 냉장고의 매출이 증가할 것으로 예상됩니다.

프렌치 도어 냉장고 시장 동향

아시아에서 매출 증가

중국 및 인도와 같은 아시아 국가에서 프렌치 도어 냉장고 수요와 인기는 사용자의 부엌용 전기 및 가전제품에 대한 지출이 증가함에 따라 계속 증가하고 있습니다. 아시아는 세계 냉장고 시장에서 가장 큰 수익 점유율을 자랑하며 연간 약 9%의 성장률로 700억 달러를 넘는 시장 수익을 자랑합니다. 아시아 신흥 시장에서의 가계수입 증가와 생활수준 향상으로 소비자는 고급냉장고 제품을 선호하게 되어 프렌치 도어 냉장고 판매 성장 기회가 탄생하고 있습니다. 인도 시장에서는 LG, Samsung, Whirlpool, Godrej의 냉장고 제조업체가 냉장고 시장의 80% 이상을 차지하고 있으며, 제조업체 간의 과점 상태가 계속되고 있습니다. 게다가 또 다른 아시아 주요 국가인 중국에서는 냉장고의 생산과 판매가 크고, 하이얼, 미디어, 하이센스, 호마 기업이 독점하고 있습니다. 아시아 시장에서 이 회사 지배력의 이러한 기존 지역적 변형은 전 세계 프렌치 도어 냉장고 제조업체에게 이 지역에서 공급망을 확장할 수 있는 기회를 제공합니다.

온라인 판매 증가

냉장고의 온라인 판매는 지속적으로 증가하고 있으며, 그 결과 온라인 채널에서만 프렌치 도어 냉장고를 주문하는 사람이 증가하고 있습니다. 세계 시장에서는 냉장고의 온라인 수익 점유율이 지속적으로 증가하고 있으며 지난해 매출 수익의 22% 이상에 달했습니다. 온라인 판매 중에서도 전자상거래 및 기업 직접 판매 사이트에서는 냉장고와 프렌치 도어 냉장고의 검색 수가 지속적으로 증가하고 있으며, 제조업체나 소매 및 도매업체의 판매 기회도 증가하고 있습니다. 프렌치 도어 냉장고에는 스마트한 기능이 탑재되어 있어 기존 냉장고를 구입하는 대신, 이들 제품에 대한 소비자들의 매력이 높아지고 있습니다. 온라인 판매 채널은 다양한 프렌치 도어 냉장고를 제공하며, EMI 옵션, 쿠폰 코드 할인, 인터넷 뱅킹, 대금 상환 등의 유연한 지불 옵션이 제공됨에 따라 사용자는 다양한 쇼룸에서 시간을 소비하는 것보다 이러한 판매 채널을 선호하게 되었습니다. 온라인 판매를 지지하는 이러한 동향의 변화는 세계의 제조업자에게 새로운 기회를 창출하고 있습니다.

프렌치 도어 냉장고 산업 개요

프렌치 도어 냉장고 제품을 시장에 투입하는 냉장고 제조업체의 수가 증가하고 있으며, 프렌치 도어 냉장고 시장은 부분적으로 세분화되고 있습니다. 기술의 진보와 제품의 혁신에 따라 중규모부터 중소기업은 새로운 계약을 획득하고 새로운 시장을 개척함으로써 시장에서의 존재감을 높이고 있습니다. 프렌치 도어 냉장고의 기존 제조업체로는 Haier, Whirlpool Corporation, Electrolux, Bosch 및 LG 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건 및 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 주요 가전제품에 대한 지출 증가

- 시장 성장 억제요인

- 가정용 전기 제품의 가격 상승

- 지정학적 문제의 고조에 의한 공급망의 혼란

- 시장 기회

- 냉장고에 스마트 기능을 추가하여 고객에게 매력 상승

- 업계의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

- 프렌치 도어 냉장고 시장의 기술 혁신

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 도어 유형별

- 3 문

- 4 문

- 쿼드 도어

- 용량별

- 슈퍼 30-31 입방 피트

- 초대형 25-29 입방 피트

- 대형 20-24입방 피트

- 19 입방 피트 미만

- 최종 사용자 유형별

- 주택

- 상업

- 유통 채널별

- 전문점 및 특선점

- 멀티 브랜드 스토어

- 온라인

- 기타 유통 채널

- 지역별

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

- 세계 기타 지역

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Haier

- Whirlpool Corporation

- Electrolux

- Midea

- Samsung

- Bosch

- LG

- Miele

- Panasonic

- Arcelik AS

- Sharp*

제7장 시장의 향후 동향

제8장 면책사항 및 출판사에 대해서

AJY 24.03.08The French Door Refrigerator Market size is estimated at USD 21.05 billion in 2024, and is expected to reach USD 27.55 billion by 2029, growing at a CAGR of 5.53% during the forecast period (2024-2029).

Over the last two years sales volume and revenue of refrigerator segments of global manufacturers have observed a continuous increase resulting in rising sales of the French Door refrigerator segment as well. Asia, Europe, and North America exist as the regions occupying more than half of the share in the global retail volume of refrigerator appliances leading to global manufacturers strengthening their supply chains in these regions to raise market sales and revenue. With the existing larger average household size in Asia, a French door refrigerator provides with wider dimension that allows users to store large amounts of food items.

The availability of French door refrigerators in varying dimensions, advanced freezing technology, and attractive designs have led to these refrigerators gaining popularity across the globe. In developed as well as developing economies, manufacturers are targeting their customers with cost-effective products integrated with the IoT (Internet of Things) technology raising the demand for French door refrigerators. Post covid, expenditure on major household appliances observed a continuous increase with rising pent-up demand and increasing household income signalling a positive market for sales of the French door refrigerator.

Post Covid with a change in consumer behaviour, retailers and wholesalers are collaborating with online E-commerce platforms to increase the sales of their French door refrigerators and manufacturers such as Samsung, Panasonic, Hisense, LG, and others are offering their refrigerator products through direct websites channels resulting in consumers choosing among a large segment of french door refrigerator at a given point of time. In addition, rising online revenue share of the global refrigerator market by more than 22% is expected to drive the sales of French door refrigerators over the coming period.

French Door Refrigerator Market Trends

Rising Sales In Asia

The demand and popularity of French door refrigerators in Asian countries such as China and India are observing a continuous increase with a rise in expenditure on kitchen electrical and household appliances by the users. Asia exists with the largest revenue share in the global refrigerator market and market revenue of more than USD 70 Billion with a growth rate of around 9% per year. Rising household income and an increase in the standard of living in emerging markets of Asia are resulting in consumers making their preference towards high-end refrigerator products creating growth opportunities for the sale of French door refrigerators. In the Indian market refrigerator manufacturers LG, Samsung, Whirlpool, and Godrej occupy more than 80% of the refrigerator market creating a form of oligopoly among the manufacturers. In addition, another major Asian country, China with significant production and sales of refrigerators is dominated by firms of Haier, Media, HiSense, and Homa. These existing regional variations of the firm's domination in the Asian market are providing opportunities for global French door refrigerator manufacturers to increase their supply chain in the region.

Increasing Online Sale

Online sales of refrigerators are observing a continuous increase resulting in a rising number of people ordering French door refrigerators through online channels only. In the global market online revenue share of refrigerators is observing a continuous increase rising to more than 22% of the sales revenue last year. Among online sales E-Commerce and direct company websites are observing a continuous increase in searches for refrigerators and French door refrigerators as well leading to increasing sales opportunities for the manufacturer and retailers/wholesalers. The French door refrigerators are equipped with smart features resulting in a rising consumer attraction towards these products instead of buying traditional refrigerators. The availability of a large variety of French door refrigerators in online sales channels and flexible payment options of EMI options, coupon code discounts, Net banking, and pay-on-delivery are leading to users finding these sales channels more preferable than spending their time in different showrooms. These changing trends in favor of online sales are creating emerging opportunities for global manufacturers.

French Door Refrigerator Industry Overview

The French door refrigerator market is partially fragmented with an increasing number of refrigerator manufacturers launching their French door refrigerator products in the market. With technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Some of the existing manufacturers of French door refrigerators are Haier, Whirlpool Corporation, Electrolux, Bosch and LG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase of Expenditure on Major Household Appliances

- 4.3 Market Restraints

- 4.3.1 Rising Prices of Consumer Electronic Appliance

- 4.3.2 Supply Chain Disruption With Rising Geopolitical Issues

- 4.4 Market Opportunities

- 4.4.1 Enabling the Refrigerators With Smart Features will Increase Customer Attraction

- 4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in French Door Refrigerator Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Door Type

- 5.1.1 French 3-Door

- 5.1.2 French 4-Door

- 5.1.3 Quad Door

- 5.2 Capacity

- 5.2.1 Super 30-31 Cubic Feet

- 5.2.2 Ultra-large 25-29 Cubic Feet

- 5.2.3 Large 20-24 Cubic Feet

- 5.2.4 Under 19 Cubic Feet

- 5.3 End User Type

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 Distribution Channel

- 5.4.1 Specialty Stores/Exclusive Stores

- 5.4.2 Multi-Branded Stores

- 5.4.3 Online

- 5.4.4 Other Distribution Channels

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 South America

- 5.5.5 Middle East and Africa

- 5.5.6 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Haier

- 6.2.2 Whirlpool Corporation

- 6.2.3 Electrolux

- 6.2.4 Midea

- 6.2.5 Samsung

- 6.2.6 Bosch

- 6.2.7 LG

- 6.2.8 Miele

- 6.2.9 Panasonic

- 6.2.10 Arcelik AS

- 6.2.11 Sharp*