|

시장보고서

상품코드

1850404

공항 보안 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Airport Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

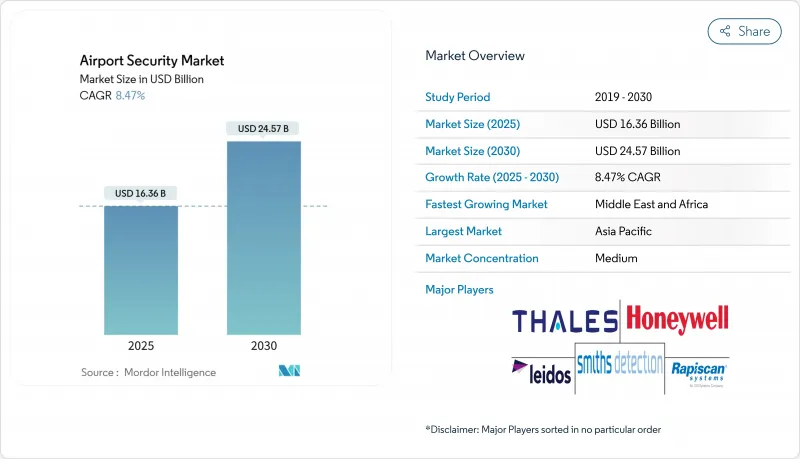

공항 보안 시장 규모는 2025년에 163억 6,000만 달러로 추정되고, 2030년에는 245억 7,000만 달러에 이를 것으로 예상되며, CAGR 8.47%로 전망됩니다.

강력한 성장은 꾸준한 여객 회복, 터미널 업그레이드를 위한 대규모 자본 지출, 인공지능 대응 스크리닝 및 경계 솔루션의 급속한 채용으로 인한 것입니다. 공항은 생체인증 등록 프로그램을 가속시키고 있으며, 여객의 신원을 탑승 데이터나 수하물 상황에 링크시켜 여정을 합리화하고 있습니다. 동시에 통합된 명령 및 제어 플랫폼은 체크 포인트, 에어 사이드 움직임 및 사이버 경고의 통합 뷰를 운영자에게 제공하여 사고 대응 속도를 향상시킵니다. 또한 지정학적 위험이 증가함에 따라 고해상도 레이더, 무인 항공기 차단 도구, 항공사, 정부 및 공항 시스템 간 데이터 흐름을 보호하는 탄력적인 클라우드 아키텍처에 대한 수요가 증가하고 있습니다.

세계의 공항 보안 시장 동향 및 인사이트

여객 수 증가는 스크리닝 자동화 촉진

항공 여객 수는 회복 추세에 있으며, 2024년 세계 여객 수는 전년 대비 10% 증가한 95억 명에 달할 전망입니다. 따라서 검문소는 지속적인 처리량 압력에 직면하고 있습니다. TSA 사전 점검 및 EU 스마트 보안과 같은 프로그램은 현재의 감지율에 필적하거나 이를 초과하면서 더 많은 여객을 지우는 이미지 처리 시스템이 필요합니다. TSA는 현재 바쁜 여행일에 300만 명 이상의 여행자를 검사하고 있으며 주요 허브 공항에서 컴퓨터 단층 촬영 레인과 자동 트레이 반환 시스템을 도입하도록 촉구하고 있습니다. 마이애미 국제공항의 바이오메트릭스 탑승 도입은 얼굴 인증을 통해 개인 인증을 2초로 단축하고 보안을 저하시키지 않고 행렬을 완화할 수 있음을 보여줍니다. 이러한 성과는 은행 출발 피크 시에도 여객을 계속 이동시키는 셀프 서비스 키오스크 및 AI 분석의 비즈니스 케이스를 강화하는 것입니다.

조화로운 국제 규제 강화

2025년까지 모든 1차 체크포인트에 CT 스캐너를 설치해야 하는 유럽의 요구사항은 이제 전 세계의 조달 사이클에 영향을 미치고 있습니다. ICAO 부속서 17 및 ECAC 테스트 프로토콜과 일관되게 함으로써 장비 공급업체는 여러 지역에서의 수용을 위한 단일 경로를 제공하여 중복을 줄이면서 기본 성능 기준을 높일 수 있습니다. TSA의 2025년 예산 118억 달러는 국내 검문소의 근대화를 추진하는 워싱턴의 움직임을 반영하여 고급 스크리닝을 위한 추가 예산을 계상했습니다. 규제의 명확화가 공항 입찰을 형성하고 공급업체에게 금지 품목 검출을 위한 AI 알고리즘을 사전 인증하고, 독립적인 검사 기관에서 오경보율이 낮은 것을 증명하는 인센티브를 부여하고 있습니다.

긴 인증 및 운영 자격 확인 주기

새로운 스캐너와 소프트웨어가 프로덕션 레인에 도입되기 전에는 다단계 실험실 테스트, 현장 테스트 및 규제 당국의 승인이 필요합니다. ECAC의 공통 평가 프로세스는 제출부터 승인까지 18개월을 넘어서 벤더의 자금 소비를 늘리고 레거시 시스템의 수명을 연장하고 있습니다. TSA의 항공화물 스크리닝 기술 목록은 유사한 심사를 적용하며 장비를 적격, 승인 또는 그랜드 파자드 카테고리로 분류합니다. 이러한 엄격한 심사로 성능의 일관성이 확보되는 반면, AI 네이티브 플랫폼의 보급은 지연되고, 공항 보안 시장에 신규 진입하는 벤더의 단기적인 수익의 성장은 완만해집니다.

부문 분석

스크리닝 스캐닝 시스템은 2024년 매출의 36.19%를 차지했으며, CT의 배치 의무화와 트레이의 반환 레인의 통합이 그 기둥이 됩니다. 아시아태평양의 허브 공항은 트래픽 증가에 대응하기 위해 새로운 터미널에 듀얼 뷰 X선과 바디 스캐너를 채용하고 있습니다. 입퇴실 관리 및 바이오메트릭스의 공항 보안 시장 규모는 급속히 확대되었으며, 이는 마찰이 없는 여객 처리 이니셔티브와 연관된 11.62%의 연평균 복합 성장률(CAGR)에 의해 지원됩니다.

TSA의 전국적인 얼굴 인증 확대와 같은 프로그램은 공항이 물리적 탑승권을 생체인식 토큰으로 대체하여 서류 확인 및 위생 우려를 줄이는 방법을 보여줍니다. 경계 침입 감지 시스템은 무인 항공기 침입으로 레이더, 전기 광학 및 RF 재밍 자산을 네트워크화하고 계층화된 방위를 수행하기 위해 운영자를 뒷받침하기 때문에 가시성이 높아지고 있습니다. 명령 및 제어 소프트웨어는 이러한 피드를 통합하고 보안 관리자에게 통합 대시보드 및 감사 추적을 제공합니다.

체크포인트 앞에서 AI 기반 비디오 분석은 폐기물과 기밀문 부근의 서성거림을 자동으로 추적하여 모니터링을 강화합니다. 사이버 보안 제품군은 엣지 스캐너에서 클라우드 서버로의 데이터 흐름을 암호화하여 여행자의 개인 정보 및 위협 이미지 라이브러리를 보호합니다. 규제 당국이 정보 유출 보고 창구를 강화하는 동안 사이버와 물리적 경보를 통합하는 통합 SOC 솔루션은 이제 조달 우선순위가 되고 있습니다. 이러한 요구의 수렴으로 공항 보안 시장은 단일 하드웨어 업데이트가 아닌 소프트웨어 정의 기능을 중심으로 혁신주기를 유지합니다.

5,000만 명 이상의 여객을 취급하는 시설은 2024년 공항 보안 시장 점유율의 42.58%를 차지했으며, 자본 투자 프로그램은 다층 생태계와 디지털 ID 전개에 자금을 공급하고 있습니다. 두바이, 애틀랜타, 베이징과 같은 대규모 허브 공항은 콩코스 전반에 걸쳐 체크포인트 레이아웃을 표준화하여 운영자의 훈련을 단순화하는 동일한 CT 레인의 대량 조달을 용이하게 합니다. 그러나 여객 수 1,500만 명에서 3,000만 명의 공항에서는 CAGR 11.68%로 가장 빨리 기존의 실적에 통합할 수 있는 규모를 축소하면서도 장래성이 있는 플랫폼에 대한 수요가 높아지고 있습니다. 이러한 중견공항은 국내의 2차 게이트웨이 역할을 하는 경우가 많으며 클라우드 호스팅형 액세스 제어를 도입함으로써 현지에 데이터센터를 건설하지 않고 사이버 내성을 유지하고 있습니다.

여행자 수가 500만 명 이하인 소규모 지방 공항은 예산이 제한되어 있음에도 불구하고 유사한 새로운 기준을 준수해야 합니다. 이 공항은 공공 기관의 보조금 및 중앙 집중화된 서비스 계약을 통해 공인 스캐너를 조달하고 SOC를 지원합니다. 항공 협회의 정책 경고는 자금 부족 경계 울타리가 네트워크 수준의 항공 보안에 미치는 위험을 스포트라이트합니다. 그 결과, 중앙정부는 지역 시설이 보안과 지속가능성 향상을 위해 780만 유로(892만 달러)를 받은 아일랜드의 예를 따르고, 적격한 자금을 할당하고 있습니다.

지역 분석

아시아태평양은 적극적인 용량 증설 및 디지털 퍼스트 여객 체험 의무화에 힘입어 2024년 세계 매출의 33.67%를 차지했습니다. 지역 정부는 2025-2035년 2,400억 달러를 투자할 의향으로, 1,360억 달러가 업그레이드에, 1,040억 달러가 신규 공항에 할당되어 여객 수송 능력을 12억 4,000만 석 증가시킵니다. 중국, 인도, 인도네시아는 각각 다년간의 활주로와 터미널 건설을 발표하고, 설계 단계에서 CT 체크포인트와 생체인증 게이트를 통합하여 디자인에 따른 보안을 도입했습니다.

중동 및 아프리카 부문의 CAGR은 가장 빠른 12.18% 걸프 국가의 항공사는 편수를 늘리고 호스트 국가는 관광 다양화 계획과 관련된 메가 터미널 프로젝트에 자금을 제공합니다. 2040년까지 통합 모니터링 및 무인 항공기 차단과 같은 안전 보장과 관련된 업그레이드에 최대 1,510억 달러가 투입될 수 있습니다. 사우디아라비아의 '비전 2030'의 목표인 3억 명의 승객은 스크리닝 자동화와 사이버 물리 모니터링에 대한 지속적인 수요를 강화하고 있습니다.

북미에서는 TSA가 HD-Advanced Imaging Technology를 시험적으로 도입하고 있으며, 검사 중에 여행자는 얇은 옷을 입은 채로 검사를 받을 수 있으므로 기내 반입품의 검사 시간이 단축됩니다. 연방 정부의 보조금도 기존 X선 장비를 CT 시스템으로 대체하는 지역 시설을 지원합니다. 유럽에서는 CT 도입의 의무화 및 출입국 바이오메트릭스 데이터베이스에 의한 기기 정책의 정합화를 도모해, 공항에서의 본인 확인과 리스크 평가의 일원화를 장려하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 승객 수 증가 및 비접촉 검사

- 국제 안보 규제의 조화

- AI 분석을 통한 통합 명령 및 제어

- 사이버 피지컬 컨버전스 및 클라우드 마이그레이션

- 생체 인증 원 ID 및 원활한 여행의 대처

- 드론과 UAS의 위협으로 경계선 수요 증가

- 시장 성장 억제요인

- 긴 인증 및 자격 취득 사이클

- 숙련된 항공 보안 기술자의 부족

- 레거시 인프라의 통합 부채

- 교통 회복 불균형에 의한 설비 투자의 압축

- 밸류체인 분석

- 규제 또는 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력 및 소비자

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 보안 시스템별

- 스크리닝 및 스캔 시스템

- 감시 시스템

- 액세스 제어 및 생체 인증

- 지문 인식

- 얼굴 인식

- 홍채 및 망막 인식

- 경계 침입 검지 시스템

- 화재 및 생명 안전 시스템

- 사이버 보안 및 네트워크 보호

- 커맨드, 컨트롤 및 통합 플랫폼

- 공항 규모별

- 500만 미만

- 500만-1500만

- 1500만-3,000만

- 3,000만-5,000만

- 5,000만 이상

- 기술별

- 하드웨어

- 소프트웨어

- 서비스

- 용도별

- 터미널

- 에어사이드

- 랜드사이드

- 경계 및 제한 구역

- 화물 및 물류 시설

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 중동 및 아프리카

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 카타르

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 싱가포르

- 기타 아시아태평양

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Smiths Detection Group Ltd.(Smiths Group plc)

- Rapiscan Systems, Inc.(OSI Systems, Inc.)

- Leidos, Inc.

- Thales Group

- Honeywell International, Inc.

- Siemens AG

- KEENINFINITY(Robert Bosch GmbH)

- Teledyne FLIR LLC(Teledyne Technologies Incorporated)

- Collins Aerospace(RTX Corporation)

- SITA

- NEC Corporation

- IDEMIA

- Nuctech Technology Co., Ltd.

- Garrett Electronics Inc.

- ICTS Europe SA

- Rohde & Schwarz USA, Inc.

- Hart Security Limited

- Senstar Corp

제7장 시장 기회 및 향후 전망

AJY 25.11.19The airport security market size stands at USD 16.36 billion in 2025 and is forecasted to reach USD 24.57 billion by 2030, supported by an 8.47% CAGR.

Strong growth stems from steady passenger recovery, sizeable capital outlays for terminal upgrades, and rapid adoption of AI-enabled screening and perimeter solutions. Airports are accelerating biometric enrolment programs, linking passenger identity to boarding data and baggage status to streamline journeys. At the same time, integrated command-and-control platforms give operators unified views of checkpoints, airside movements, and cyber alerts, improving incident response speed. Investments also track heightened geopolitical risk, driving demand for high-resolution radar, drone interdiction tools, and resilient cloud architectures that safeguard data flows across airline, government, and airport systems.

Global Airport Security Market Trends and Insights

Rising Passenger Traffic Driving Screening Automation

Air travel is rebounding, with global volumes touching 9.5 billion in 2024, a 10% year-on-year lift. Screening checkpoints, therefore, face sustained throughput pressure. Programs such as TSA PreCheck and EU Smart Security require imaging systems that clear more passengers while matching or exceeding current detection rates. TSA now screens over 3 million travelers on busy travel days, prompting roll-outs of computed-tomography lanes and automated tray return systems at major hubs. Miami International Airport's biometric boarding deployment demonstrates how facial recognition can cut individual verification to two seconds, easing queues without lowering security. These outcomes reinforce the business case for self-service kiosks and AI analytics that keep passengers moving even during peak bank departures.

Harmonised International Regulatory Upgrades

The European requirement that all primary checkpoints install CT scanners by 2025 is now influencing procurement cycles worldwide. Alignment with ICAO Annex 17 and ECAC testing protocols offers equipment vendors a single pathway to multi-region acceptance, reducing duplication yet raising baseline performance criteria. TSA's USD 11.8 billion FY 2025 budget earmarks additional funds for advanced screening, reflecting Washington's comparable push to modernize domestic checkpoints. Regulatory clarity shapes airport tenders, incentivising suppliers to pre-certify AI algorithms for prohibited-item detection and to demonstrate low false-alarm rates in independent laboratories.

Lengthy Certification and Operational Qualification Cycles

Before new scanners or software enter live lanes, they face multi-step lab tests, field pilots, and regulatory sign-off. ECAC's Common Evaluation Process can exceed 18 months from submission to approval, prolonging vendor cash-burn and extending legacy system life. TSA's Air Cargo Screening Technology List applies similar vetting, segmenting equipment into Qualified, Approved, or Grandfathered categories. Such rigor ensures performance consistency but delays widespread installation of AI-native platforms, moderating short-term revenue growth for newer entrants in the airport security market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Integrated Command-and-Control and AI Video Analytics

- Cyber-Physical Convergence and Cloud Migration

- Scarcity of Skilled Aviation Security Technologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Screening and scanning systems delivered 36.19% of 2024 revenue, anchored by mandatory CT deployments and consolidated tray return lanes. Asia-Pacific hubs adopt dual-view X-ray and body scanners at new terminals to keep pace with rising traffic. The airport security market size for access control and biometrics is set to climb swiftly, and this is supported by an 11.62% CAGR tied to frictionless passenger processing initiatives.

Programs like TSA's nationwide facial-verification expansion illustrate how airports substitute physical boarding passes for biometric tokens, trimming document checks and hygiene concerns. Perimeter Intrusion Detection Systems are gaining visibility as drone incursions push operators to network radar, electro-optical, and RF jamming assets into layered defences. Command-and-control software unifies these feeds, granting security managers a consolidated dashboard and audit trail.

Beyond the checkpoint, AI-based video analytics augment surveillance by auto-tracking abandoned items or loitering near sensitive doors. Cybersecurity suites encrypt data flows from edge scanners to cloud servers, shielding traveller PII and threat-image libraries. With regulators tightening breach-reporting windows, integrated SOC solutions that merge cyber and physical alerts are now a procurement priority. All these converging needs keep the airport security market on an innovation cycle centred on software-defined capabilities rather than standalone hardware refreshes.

Facilities handling more than 50 million passengers commanded 42.58% of the airport security market share in 2024 as their capex programs funded multi-layered ecosystems and digital ID rollouts. Large hubs like Dubai, Atlanta, and Beijing standardise checkpoint layouts across concourses, facilitating bulk procurement of identical CT lanes that simplify operator training. However, airports in the 15-30 million passenger bracket post the quickest 11.68% CAGR, driving demand for scaled-down but future-proof platforms that slot into existing footprints. These mid-tier stations often act as national secondary gateways, deploying cloud-hosted access control to maintain cyber resilience without building local data centres.

Smaller regional airports with budgets below 5 million travellers face restricted budgets, yet must comply with the same emerging standards. Public-sector grants and centralised service contracts help them procure certified scanners and managed SOC support. Policy alerts from aviation associations spotlight the risk that under-funded perimeter fences pose to network-level aviation security. Consequently, central governments allocate targeted funds, mirroring the Irish example, where regional facilities received EUR 7.8 million (USD 8.92 million) for security and sustainability works.

The Airport Security Market Report is Segmented by Security System (Screening and Scanning Systems, Surveillance Systems, Access Control and Biometrics, and More), Airport Size (Less Than 5 Million, 5 To 15 Million, and More), Technology (Hardware, Software, and Services), Application (Terminal, Airside, Landside, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 33.67% of global revenue in 2024, buoyed by aggressive capacity additions and digital-first passenger experience mandates. Regional governments intend to invest USD 240 billion from 2025 to 2035, with USD 136 billion allocated to upgrades and USD 104 billion earmarked for new airports, boosting passenger capacity by 1.24 billion seats. China, India, and Indonesia each announced multiyear runway and terminal builds that embed CT checkpoints and biometric gates at the blueprint stage, embedding security by design.

The Middle East and Africa segment posts the fastest 12.18% CAGR. Gulf carriers are raising fleet counts, and host states fund mega-terminal projects linked to tourism diversification plans. Up to USD 151 billion may flow into security-relevant upgrades by 2040, including integrated surveillance and drone interdiction suites. Saudi Arabia's Vision 2030 target of 300 million passengers reinforces sustained demand for screening automation and cyber-physical monitoring.

North America remains a technology bellwether as TSA pilots HD-Advanced Imaging Technology that lets travellers keep light jackets on during scans, cutting carry-on divest time. Federal grants also back regional facilities replacing legacy X-ray units with CT systems. Europe aligns equipment policies through mandatory CT adoption and entry-exit biometric databases, encouraging airports to centralise identity verification and risk assessment.

- Smiths Detection Group Ltd. (Smiths Group plc)

- Rapiscan Systems, Inc. (OSI Systems, Inc.)

- Leidos, Inc.

- Thales Group

- Honeywell International, Inc.

- Siemens AG

- KEENINFINITY (Robert Bosch GmbH)

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Collins Aerospace (RTX Corporation)

- SITA

- NEC Corporation

- IDEMIA

- Nuctech Technology Co., Ltd.

- Garrett Electronics Inc.

- ICTS Europe S.A.

- Rohde & Schwarz USA, Inc.

- Hart Security Limited

- Senstar Corp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising passenger traffic and touchless screening

- 4.2.2 Harmonised international security regulations

- 4.2.3 Integrated command-and-control with AI analytics

- 4.2.4 Cyber-physical convergence and cloud migration

- 4.2.5 Biometric One-ID and seamless travel initiatives

- 4.2.6 Drone and UAS threats lifting perimeter demand

- 4.3 Market Restraints

- 4.3.1 Lengthy certification and qualification cycles

- 4.3.2 Scarcity of skilled aviation security technologists

- 4.3.3 Integration debt from legacy infrastructure

- 4.3.4 Capex compression amid uneven traffic recovery

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Security System

- 5.1.1 Screening and Scanning Systems

- 5.1.2 Surveillance Systems

- 5.1.3 Access Control and Biometrics

- 5.1.3.1 Fingerprint Recognition

- 5.1.3.2 Facial Recognition

- 5.1.3.3 Iris and Retina Recognition

- 5.1.4 Perimeter Intrusion Detection Systems

- 5.1.5 Fire and Life-Safety Systems

- 5.1.6 Cybersecurity and Network Protection

- 5.1.7 Command, Control and Integration Platforms

- 5.2 By Airport Size

- 5.2.1 Less than 5 Million

- 5.2.2 5 to 15 Million

- 5.2.3 15 to 30 Million

- 5.2.4 30 to 50 Million

- 5.2.5 More than 50 Million

- 5.3 By Technology

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Application

- 5.4.1 Terminal

- 5.4.2 Airside

- 5.4.3 Landside

- 5.4.4 Perimeter and Restricted Areas

- 5.4.5 Cargo and Logistics Facilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Qatar

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 Singapore

- 5.5.5.6 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Smiths Detection Group Ltd. (Smiths Group plc)

- 6.4.2 Rapiscan Systems, Inc. (OSI Systems, Inc.)

- 6.4.3 Leidos, Inc.

- 6.4.4 Thales Group

- 6.4.5 Honeywell International, Inc.

- 6.4.6 Siemens AG

- 6.4.7 KEENINFINITY (Robert Bosch GmbH)

- 6.4.8 Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- 6.4.9 Collins Aerospace (RTX Corporation)

- 6.4.10 SITA

- 6.4.11 NEC Corporation

- 6.4.12 IDEMIA

- 6.4.13 Nuctech Technology Co., Ltd.

- 6.4.14 Garrett Electronics Inc.

- 6.4.15 ICTS Europe S.A.

- 6.4.16 Rohde & Schwarz USA, Inc.

- 6.4.17 Hart Security Limited

- 6.4.18 Senstar Corp

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment