|

시장보고서

상품코드

1851856

배터리 에너지 저장 시스템(BESS) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Battery Energy Storage System (BESS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

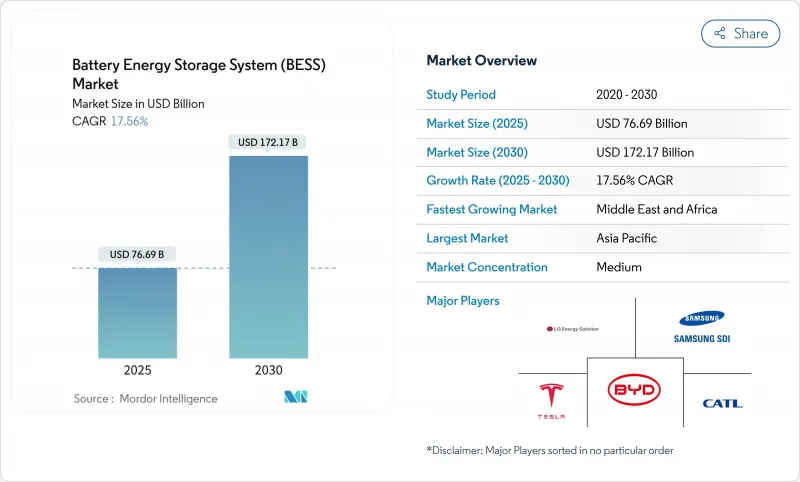

배터리 에너지 저장 시스템(BESS) 시장 규모는 2025년에 766억 9,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 17.56%로, 2030년에는 1,721억 7,000만 달러에 달할 것으로 예상됩니다.

리튬 이온 배터리의 급속한 비용 절감, 지원 조달 의무, 그리드 현대화 지출 증가는 대규모 스토리지를 틈새 신뢰성 도구에서 주류 인프라로 바꾸고 있습니다. 미국의 인플레이션 삭감법이나 EU의 넷·제로 산업법 등의 정책적 추풍이, 몇 기가와트 규모의 프로젝트·파이프라인을 지지하고 있습니다. 한편, 계통형성 인버터 요건은 에너지재정거래 이외의 수익원을 확대하고 있습니다. 동시에 호주와 칠레에서는 태양광발전과 축전지를 결합한 전력구매계약(PPA)의 가격이 동등하게 되어 4시간 배터리가 경쟁력 있는 요금으로 저녁부터 피크까지 안정공급을 제공할 수 있음이 증명되었습니다. 데이터센터의 전력 수요 증가와 정치적 지지를 받은 공급망의 재조달이 이 분야의 기세를 더욱 강화하고 있습니다.

세계의 배터리 에너지 저장 시스템(BESS) 시장 동향 및 인사이트

미국, 중국, EU의 유틸리티 규모 조달 의무화

의무화된 조달은 개발 상황을 재구성하고 있습니다. 캘리포니아에서는 2GW, 중국 전력에서는 16GWh, 한국에서는 540MW/3,240MWh를 대상으로 한 장기 모집이 이루어져 개발업체에게 수익과 자금 조달 가능성을 보여주고 있습니다. 유럽에서는 인터넷 제로산업법이 국내 컨텐츠에 인센티브를 주고 중국의 최근 개혁에서는 엄격한 할당 규칙이 철폐되어 시장의 펀더멘탈스가 경제성을 이끌게 되었습니다. 이러한 프로그램은 대출 비용을 낮추고 그리드 서비스 성능 보증을 충족하는 적격 인티 그레이터에 양을 흘립니다.

그리드 형성 인버터의 채용이 공동 위치의 가치를 풀어줍니다.

계통 추종형에서 계통 형성형 아키텍처로 이행함으로써 계통 운용자가 지금까지 동기 발전에서 조달했던 서비스인 합성 관성과 전압 서포트를 배터리가 제공할 수 있게 됩니다. 4.8GW 그리드 형성의 필요성을 보여주는 트랜스그리드 조사와 30만kW의 플루언스 호주 프로젝트는 상업적 실현 가능성을 강조합니다. 유럽의 사업자 TenneT는 2030년까지 520-1270만 kW의 축전을 전망하고 있어 폭넓은 적용 가능성을 강조하고 있습니다. 관성 제품의 추가 수입과 상호 연결 조건의 강화는 프로젝트의 경제성을 개선하고 태양광 및 축전의 하이브리드 개발에 유리하게 작용합니다.

리튬과 흑연 가공 병목

중국은 세계 흑연의 90%를 가공하고 있으며, 인도네시아의 니켈 수출 금지는 국내 정련을 촉구하고 집중 위험을 초래하고 있습니다. 몇 기가와트의 경매가 급증하고 있는 화살촉, 재료 부족이 셀 생산을 위협하고 있습니다. Group14와 같은 신흥기업이 실리콘을 많이 포함하는 애노드를 시험적으로 생산하고 있지만, 상업생산량은 아직 수년 앞입니다. 재활용 프로그램은 1차 수요를 완화시킬 수 있지만 물류상의 장애물이 높기 때문에 고순도 원료를 필요로 하는 유틸리티 스케일 프로젝트에 대한 직접적인 영향은 제한적입니다.

부문 분석

리튬 이온은 2024년에 88.6% 배터리 에너지 저장 시스템(BESS) 시장 점유율을 유지했습니다. 그러나 LFP의 비용과 열안정성의 우위성은 BYD의 40GWh의 2024년 도입으로 대표되는 CAGR 19%를 견인하고 있습니다. NMC Chemistry는 에너지 밀도가 중요시되는 분야에서 계속 중요하며, 바나듐 흐름과 나트륨 이온 기술은 장시간 사용 및 하이사이클 응용 분야에서 틈새 관심을 끌고 있습니다. 리튬 이온 배터리의 에너지 저장 시스템(BESS) 시장 규모는 미세화에 의해 킬로와트 시간당 비용이 낮아짐에 따라 확대될 것으로 예측됩니다. 화학의 다양화는 공급망의 위험을 줄이고 프로젝트 자금 조달을 자산에 특화된 위험 회피 구조로 개방합니다.

실시 전술은 지역에 따라 다릅니다. 중국의 전력 회사는 초저가의 LFP 랙을 제공하고, 유럽의 전력 회사는 한랭지에 대한 내성을 높이기 위해 나트륨 이온을 테스트하고 미국 계통 운영자는 8 시간 서비스를 위해 아연 브롬 플로우 배터리를 시험적으로 도입하고 있습니다. 이 병렬 경로는 화학 선택이 다목적 패러다임이 아니라 듀티 사이클에 최적화되고 있음을 보여줍니다.

온그리드 시스템은 표준화된 상호 연결과 왕성한 상업 수익 기회에 힘입어 2024년 도입의 78%를 차지했습니다. 그러나 오프 그리드 분야는 농촌 지역의 전기와 산업의 탄력성 요건으로 인해 CAGR 18.5%로 가속화되고 있습니다. 파키스탄의 2030년까지의 수입 예측은 8.75GWh로 취약한 국가 인프라를 우회하는 마이크로그리드에 대한 신흥 시장 수요를 상징하고 있습니다.

그리드 모드와 아일랜드 모드 간의 전환 하이브리드 구성은 수요가에게 수요 충전 감소 및 백업 전력을 제공하는 하위 집합으로 증가하고 있습니다. 이러한 유연한 자산은 가상 발전소 어그리게이션을 통해 도매 시장에 참여합니다. 이 동향은 현재 미국의 독립 시스템 운영자 여러 회사의 탈리프 업데이트로 체계화되고 있습니다.

배터리 에너지 저장 시스템(BESS) 시장 보고서는 배터리 유형(리튬 이온, 인산철 리튬 등), 연결 유형(On-grid, 오프 그리드), 구성 요소(배터리 팩 및 랙, 전력 변환 시스템 등), 에너지 용량 범위(100MWh 미만, 기타), 최종 사용자 응용(유틸리티, 주택, 기타), 지역(북미, 유럽)

지역 분석

아시아태평양은 2024년에 50.4%의 점유율을 유지했으며, 중국의 7,000만kW 설치 기준이 매년 두배로 늘고 있습니다. 인도는 SECI의 1GW/2GWh 경매로 전환점을 맞이해, 일본은 167만 kW의 용량 시장 입찰로, 용량 충전에 있어서 스토리지의 역할을 증명했습니다. 한국은 540MW의 입찰을 진행했고 LG에너지 솔루션은 몇 GWh의 시스템을 유럽과 일본에 수출해 이 지역의 제조력을 강조했습니다.

중동 및 아프리카는 CAGR 19.5%로 가장 빠르게 성장하는 지역입니다. 사우디아라비아의 Sungrow와 7.8GW의 파트너십과 이집트의 200MWh AfDB 대출 프로젝트는 대규모 약속을 보여줍니다. 남아프리카의 1GW 상은 축전이 만성 송전망의 불안정성을 어떻게 다루는지를 강조합니다. 또한 아랍에미리트(UAE)은 19GWh를 5.2GW의 태양광 발전소와 통합하여 사막 기후에서 베이스 로드 재생에너지의 선구자가 되었습니다.

북미와 유럽은 계속 절대량이 많습니다. 미국은 1,000억 달러의 투자를 발표하고 있지만, 2,600 GW 프로젝트에 4년간의 상호 연결 대기가 발생하고 있습니다. 유럽의 넷 제로 산업법은 공급망의 지역화를 목표로 하고 있지만, 발표된 기가팩토리의 절반 이상이 자금 조달의 지연에 직면하고 있습니다. 영국 용량 시장, 이탈리아 함대 의무, 캐나다 생산 크레딧 등 지역 정책의 다양성은 정교한 개발자가 재정 거래를 수행하는 수익 모델의 모자이크를 창출합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 상정과 조사 방법의 범위

- 시장 정의

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 최근 동향과 혁신

- 시장 성장 촉진요인

- 미국, 중국, EU에 있어서 유틸리티 규모의 조달 의무화에 의해 기가와트 규모의 수주가 가속

- 코로케이션의 밸류 스택을 해방하는 그리드 형성 인버터의 요건

- 호주와 칠레에서의 PV 플러스 스토리지 PPA의 가격평가

- 국내 제조의 풀스루를 낳는 EU와 미국의 배터리 공급 체인 행위

- 데이터센터와 AI 부하 증가가 북미의 4시간 스토리지 수요를 견인

- 세컨드 라이프 EV용 배터리의 이용 가능성이 아시아의 설비 투자를 삭감

- 시장 성장 억제요인

- 인도네시아와 아프리카의 리튬과 흑연 가공의 병목

- 소방법 강화(UL-9540A, NFPA-855)에 의한 공장 밸런스 비용 상승

- 미국 ISO의 긴 상호연결 대기행렬이 FTM 프로젝트의 수익을 지연

- 고금리 환경으로 인한 상업용 수익 구조 압박

- 공급망 분석

- 규제와 정책의 전망

- 기술 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 배터리 유형별

- 리튬 이온

- 인산철리튬(LFP)

- 니켈 망간 코발트(NMC)

- 납산

- 기타 (유동 배터리(바나듐, 아연-브로민), 나트륨계(NaS, 나트륨 이온)

- 연결 유형별

- 온그리드(유틸리티 연계)

- 오프 그리드(마이크로그리드, 하이브리드)

- 구성 요소별

- 배터리 팩 및 랙

- 전력 변환 시스템(PCS)

- 에너지 관리 소프트웨어(EMS)

- 플랜트 균형 장비 및 서비스

- 에너지 용량 범위별

- 100MWh 미만

- 101-500 MWh

- 500MWh 이상

- 최종 사용자 용도별

- 주택용

- 상업 및 산업용

- 유틸리티

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 북유럽 국가

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 파트너십, PPA)

- 시장 점유율 분석(주요 기업의 시장 순위/점유율)

- 기업 프로파일

- BYD Company Limited

- Contemporary Amperex Technology Co. Ltd.(CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Fluence Energy Inc.

- ABB Ltd.

- Siemens Energy AG

- GE Vernova

- Hitachi Energy Ltd.

- Mitsubishi Power

- Sungrow Power Supply Co.

- Eaton Corporation plc

- Toshiba Corp.

- EVE Energy Co.

- VARTA AG

- Saft SAS(TotalEnergies)

- CellCube Energy Storage Systems Inc.

- Enphase Energy Inc.

제7장 시장 기회와 향후 전망

KTH 25.11.17The Battery Energy Storage System Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 172.17 billion by 2030, at a CAGR of 17.56% during the forecast period (2025-2030).

Rapid cost declines in lithium-ion cells, supportive procurement mandates, and rising grid-modernization spending are turning large-scale storage from a niche reliability tool into mainstream infrastructure. Policy tailwinds such as the Inflation Reduction Act in the United States and the Net-Zero Industry Act in the European Union have anchored multi-gigawatt project pipelines, while grid-forming inverter requirements are expanding revenue streams beyond energy arbitrage. Simultaneously, price parity for solar-plus-storage power purchase agreements (PPAs) in Australia and Chile proves that four-hour batteries can offer firm, evening-peak supply at competitive rates. Growing data-center electricity demand and politically driven supply-chain reshoring further reinforce the sector's momentum.

Global Battery Energy Storage System (BESS) Market Trends and Insights

Utility-scale procurement mandates in the United States, China, and the European Union

Mandated procurements are reshaping the development landscape. California's long-duration solicitation targets 2 GW, Power China tender seeks 16 GWh, and South Korea awarded 540 MW/3,240 MWh, giving developers visibility on revenue and bankability. In Europe, the Net-Zero Industry Act incentivizes domestic content, while recent Chinese reforms removed rigid allocation rules, letting market fundamentals guide economics. Such programs lower financing costs and channel volume to qualified integrators who meet grid-service performance guarantees.

Grid-forming inverter adoption unlocking co-location value

Moving from grid-following to grid-forming architectures lets batteries deliver synthetic inertia and voltage support, services that grid operators historically procured from synchronous generation. Transgrid's study showing 4.8 GW of grid-forming needs and Fluence's 300 MW Australian project highlight commercial viability. European operator TenneT foresees 5.2-12.7 GW storage by 2030, underscoring broad applicability. Added revenue from inertia products and strengthened interconnection terms improve project economics and favor hybrid solar-storage development.

Lithium and graphite processing bottlenecks

China processes 90% of global graphite, and Indonesia's nickel export bans push domestic refining, introducing concentration risk. Material shortages threaten cell production just as multi-gigawatt auctions surge. Start-ups such as Group14 are piloting silicon-rich anodes, but commercial volumes remain years away. Recycling programs can ease primary demand, yet logistic hurdles limit immediate impact for utility-scale projects that require high-purity inputs.

Other drivers and restraints analyzed in the detailed report include:

- PV-plus-storage PPA price parity in Australia and Chile

- EU and US supply-chain acts catalyzing domestic manufacturing

- Fire-safety code tightening under UL-9540A and NFPA-855

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion maintained 88.6% battery energy storage system market share in 2024. Yet LFP's cost and thermal-stability advantages drive its 19% CAGR, exemplified by BYD's 40 GWh 2024 installations. NMC chemistries remain relevant where energy density matters, while vanadium flow and sodium-ion technologies attract niche interest for long-duration or high-cycle use. Lithium-ion variants' battery energy storage system market size is projected to widen as scaling lowers per-kilowatt-hour costs. Diversification across chemistries reduces supply-chain risk and opens project financing to asset-specific hedging structures.

Implementation tactics vary by region. Chinese players offer ultra-low-priced LFP racks, European utilities test sodium-ion for cold-weather resilience, and U.S. grid operators pilot zinc-bromine flow batteries for eight-hour services. These parallel pathways illustrate how chemistry choice is increasingly optimized for duty cycle rather than a one-size-fits-all paradigm.

On-grid systems captured 78% of 2024 deployments, supported by standardized interconnection and robust merchant revenue opportunities. The off-grid segment, however, is accelerating at 18.5% CAGR owing to rural electrification and industrial resilience requirements. Pakistan's import projection of 8.75 GWh by 2030 typifies emerging-market demand for microgrids that bypass weak national infrastructure.

Hybrid configurations that switch between grid and islanded mode are a rising subset, offering customers demand-charge reduction plus backup power. These flexible assets partake in wholesale markets through virtual-power-plant aggregation, a trend now codified in several U.S. independent system operators' tariff updates.

The Battery Energy Storage System (BESS) Market Report is Segmented Into Battery Type (Lithium-Ion, Lithium Iron Phosphate, and Others), Connection Type (On-Grid and Off-Grid), Components (Battery Pack and Racks, Power Conversion System, and Others), Energy Capacity Range (Below 100 MWh, and Others), End-User Application (Utility, Residential, and Others), and Geography (North America, Europe, Asia-Pacific, and Others).

Geography Analysis

Asia-Pacific retained a 50.4% share in 2024, powered by China's 70 million kW installed base that doubled yearly. India reached an inflection point with SECI's 1 GW/2 GWh auction, and Japan's 1.67 GW capacity-market awards validated storage's role in capacity adequacy. South Korea advanced a 540 MW tender, and LG Energy Solution exported multi-GWh systems to Europe and Japan, underscoring the region's manufacturing clout.

The Middle East and Africa are the fastest-growing regions at 19.5% CAGR. Saudi Arabia's 7.8 GW partnership with Sungrow and Egypt's 200 MWh AfDB-financed project illustrate large-scale commitments. South Africa's 1 GW awards highlight how storage addresses chronic grid instability. Moreover, the United Arab Emirates integrates 19 GWh with a 5.2 GW solar plant, pioneering baseload renewables in desert climates.

North America and Europe continue to post high absolute volumes. The United States hosts USD 100 billion in announced investments but suffers four-year interconnection queues for 2,600 GW of projects. Europe's Net-Zero Industry Act seeks to localize supply chains, yet over half of announced gigafactories face financing delays. Regional policy diversity-capacity markets in the United Kingdom, fleet mandates in Italy, and production credits in Canada-produces a mosaic of revenue models that sophisticated developers arbitrage.

- BYD Company Limited

- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution Ltd.

- Panasonic Holdings Corp.

- Tesla Inc.

- Samsung SDI Co. Ltd.

- Fluence Energy Inc.

- ABB Ltd.

- Siemens Energy AG

- GE Vernova

- Hitachi Energy Ltd.

- Mitsubishi Power

- Sungrow Power Supply Co.

- Eaton Corporation plc

- Toshiba Corp.

- EVE Energy Co.

- VARTA AG

- Saft SAS (TotalEnergies)

- CellCube Energy Storage Systems Inc.

- Enphase Energy Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Methodology Scope

- 1.2 Market Definition

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Innovations

- 4.3 Market Drivers

- 4.3.1 Utility-Scale Procurement Mandates in U.S., China & EU Accelerating Gigawatt-Scale Orders

- 4.3.2 Grid-Forming Inverter Requirements Unlocking Co-Location Value Stacks

- 4.3.3 PV-Plus-Storage PPA Price Parity in Australia & Chile

- 4.3.4 EU & U.S. Battery Supply-Chain Acts Creating Domestic Manufacturing Pull-Through

- 4.3.5 Data-Center & AI Load Growth Driving 4-Hr Storage Demand in North America

- 4.3.6 Second-Life EV Battery Availability Reducing CapEx in Asia

- 4.4 Market Restraints

- 4.4.1 Lithium & Graphite Processing Bottlenecks in Indonesia and Africa

- 4.4.2 Fire-Safety Code Tightening (UL-9540A, NFPA-855) Inflating Balance-of-Plant Costs

- 4.4.3 Long Interconnection Queues in U.S. ISOs Delaying FTM Project Revenues

- 4.4.4 High Interest-Rate Environment Compressing Merchant Revenue Stacks

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory and Policy Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lithium Iron Phosphate (LFP)

- 5.1.3 Nickel-Manganese-Cobalt (NMC)

- 5.1.4 Lead-acid

- 5.1.5 Others [Flow Batteries (Vanadium, Zinc-Br), Sodium-based (NaS, Na-ion)]

- 5.2 By Connection Type

- 5.2.1 On-Grid (Utility Interconnected)

- 5.2.2 Off-Grid (Micro-Grid, Hybrid)

- 5.3 By Component

- 5.3.1 Battery Pack and Racks

- 5.3.2 Power Conversion System (PCS)

- 5.3.3 Energy Management Software (EMS)

- 5.3.4 Balance-of-Plant and Services

- 5.4 By Energy Capacity Range

- 5.4.1 Below 100 MWh

- 5.4.2 101 to 500 MWh

- 5.4.3 Above 500 MWh

- 5.5 By End-user Application

- 5.5.1 Residential

- 5.5.2 Commercial and Industrial

- 5.5.3 Utility

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 BYD Company Limited

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 LG Energy Solution Ltd.

- 6.4.4 Panasonic Holdings Corp.

- 6.4.5 Tesla Inc.

- 6.4.6 Samsung SDI Co. Ltd.

- 6.4.7 Fluence Energy Inc.

- 6.4.8 ABB Ltd.

- 6.4.9 Siemens Energy AG

- 6.4.10 GE Vernova

- 6.4.11 Hitachi Energy Ltd.

- 6.4.12 Mitsubishi Power

- 6.4.13 Sungrow Power Supply Co.

- 6.4.14 Eaton Corporation plc

- 6.4.15 Toshiba Corp.

- 6.4.16 EVE Energy Co.

- 6.4.17 VARTA AG

- 6.4.18 Saft SAS (TotalEnergies)

- 6.4.19 CellCube Energy Storage Systems Inc.

- 6.4.20 Enphase Energy Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment