|

시장보고서

상품코드

1851082

안티 드론 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Anti-Drone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

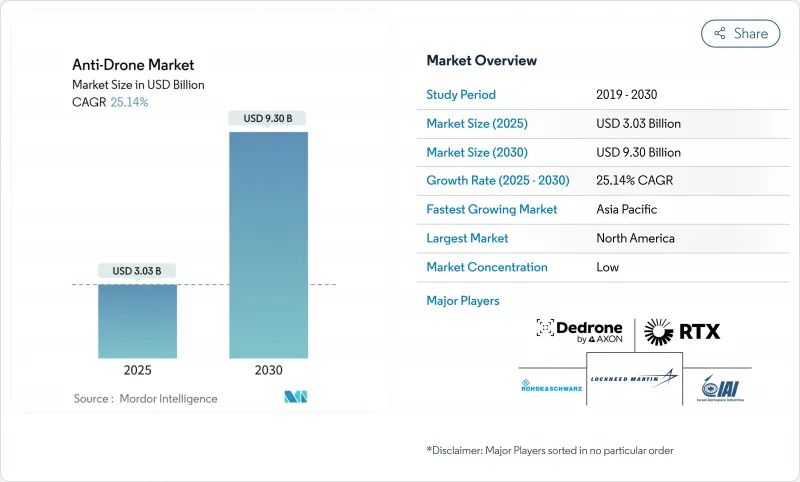

안티 드론 시장 규모는 2025년에 30억 3,000만 달러로 추정되고, 2030년에는 93억 달러에 이를 것으로 예측되며, CAGR 25.14%로 성장할 전망입니다.

급속한 확장은 틈새 경계 보안에서 필수적인 레이어형 방공으로의 변화를 반영하며, 활발한 분쟁 지역에서 무기화 무인 항공기의 확산과 국가 에너지 그리드에 대한 위협 증가가 박차를 가하고 있습니다. 북미는 연방항공 규정이 공항에서 UAS 감지를 의무화하고 있으며, 국방부가 UAS 대책 프로그램에 500억 달러를 돌리면서, 2024년 매출의 41.25%에서 가장 큰 슬라이스를 차지했습니다. 아시아태평양은 2030년까지 연평균 복합 성장률(CAGR) 25.66%로 가장 빠른 성장을 전망하고 있는데, 이는 일미 공동의 마이크로파 프로젝트와 중국의 드론 생산 붐이 지역의 전력 균형을 변화시키기 때문입니다. 현재 수요는 감지 시스템이 55.43%의 점유율로 압도적으로 많지만, 중화 솔루션이 가장 빠르게 성장하고 있으며, 조달 우선순위가 상황 인식에서 강살 효과로 이동하고 있음을 뒷받침하고 있습니다. 플랫폼의 선호도는 이러한 진화를 반영합니다. 지상 고정형 어레이는 여전히 리드하고 있지만, 드론 온 드론에 의한 교전이 현대의 전장에서 일반적으로 됨에 따라, 드론 탑재형 요격 미사일이 급속히 확대되고 있습니다.

세계의 안티 드론 시장 동향 및 인사이트

비대칭 위협을 허용하는 저비용 상용 무인 항공기의 보급

우크라이나에서만 76개 국내 기업에 걸친 계약 하에 연간 250만 유닛을 조달하고 있습니다. 수백만 달러의 장갑을 무효화하는 500달러의 취미용 무인 항공기의 능력은 기존의 비용 교환 비율을 근본적으로 뒤집고 있으며, 기존에는 일반 방공에 의존했던 군들 사이에서 안티 드론 시장 수요를 가속화하고 있습니다. NORAD는 미국 군사 시설에서 1년에 350건의 무단 UAV 이벤트를 기록했습니다. 파이프라인, 저장소 및 운송 허브를 대상으로 한 유사한 사건은 중요한 인프라가 마찬가지로 위험에 처해 있음을 입증합니다. 공급업체는 이러한 확산된 위협 프로파일에 대응하기 위해 고정 센서 및 모바일 이펙터를 결합한 확장 가능한 대 UAS 네트워크를 선호합니다. 신흥 국내 드론 제조업체 공급을 뒷받침하고 온라인으로 저렴한 부품 입수 가용성으로 인해, 확산 압력이 10년 내내 고공행진 할 것이 확실합니다.

엄격한 공역 안보의 의무화

FAA가 뉴저지, 뉴멕시코, 노스다코타, 미시시피에서 실시한 단계적 평가에서는 드론 감지 및 경감 툴을 국가 공역 시스템에 통합하기 위한 46개의 실행 가능한 지령이 내려졌습니다(1). EASA의 업데이트된 원격 ID 및 사이버 보안 규칙을 통해 병행하여 유럽의 규제 강화가 진행되고 있으며, 공항, 헬보고서 및 중요 인프라는 인증된 UAS 제품군의 도입을 강요합니다. 운항 라이선스를 유지하기 위해 운항 회사는 실시간 상황 인식과 대응 능력을 입증해야 하므로 컴플라이언스는 즉시 자본 지출 주기의 방아쇠가 됩니다. 보험사는 30,000명 이상의 관중을 수용하는 장소에서 승인된 기술의 존재와 보상을 연결함으로써 긴급성을 높이고 있습니다. 이러한 얽힌 의무는 대 드론 채용을 재량적 지출에서 규제된 필요성으로 변화시켜 군사 계약 이외의 안티 드론 시장을 확대합니다.

RF 재밍과 키네틱 인디렉션의 모호한 합법성

드론을 능동적으로 무력화하기 위한 법적 권한은 미국에서는 연방 정부의 소수 부서로 제한되며, 경기장과 화학 공장에 UAV의 위협이 있을 경우 주나 지역의 법 집행 기관에 더해집니다. 국제적으로도 유사한 법적 회색 영역은 군사 지역 이외의 RF 재머 및 지향성 에너지 요격 미사일 시장 도입을 제한하고 있습니다. 제안된 국방법은 공공안전기관이 승인된 대 드론 툴에 접근할 수 있도록 하는 것이지만, 그 성립시기는 아직 불투명합니다. 유럽에서는 전자전 방사가 엄격한 주파수 관리 규칙에 직면하여 고출력 장치의 급속한 배치를 억제합니다. 세계 규제 당국이 민간 하늘에서 무력 행사의 비례에 대한 규칙을 조화시킬 때까지 많은 운영자가 감지 전용 솔루션을 전개하여 안티 드론 시장에서 이펙터의 수익 성장을 억제할 것으로 보입니다.

부문 분석

감지 플랫폼은 2024년 매출의 55.43%를 차지했으며, 안티 드론 시장 입구 역할을 명확히 했습니다. 초기 배치는 활주로, 전방 작전 기지, 에너지 허브의 독립형 레이더와 RF 파인더가 중심이었습니다. 이제 소프트웨어 정의 업그레이드를 통해 추가 하드웨어 교환 없이 멀티모달 정확도를 향상시키는 센서 퓨전 오버레이가 가능해졌습니다. AI를 활용한 분류는 운영자의 작업 부담을 더욱 줄여줍니다. 이것은 위협의 양이 증가함에 따라 매우 중요한 이점입니다. 앞으로 조달 예산은 민간 및 군 이해관계자가 실시간으로 액세스할 수 있는 공통 조작 이미지에서 공역을 시각화하는 명령 및 제어 소프트웨어와 감지 노드를 번들하는 경향이 커지고 있습니다.

중화기술은 현재는 소규모이지만 오퍼레이터가 '보기'에서 '멈추기'로 이행함에 따라 CAGR 29.52%로 확대되고 있습니다. 록히드 마틴의 헬리오스 레이저와 같은 지향성 에너지 시스템은 미사일에 비해 1발당 잔돈의 비용으로 해상 요격을 기록하고 있습니다. 고주파 고출력 마이크로파 건은 운동 파편 없이 무인 항공기의 전자 장치를 파괴하는 짧은 버스트 펄스를 제공하여 연속 생산을 시작합니다. 네트워킹된 40mm 스마트 탄에서 초소형 UAV 도그 파이터에 이르기까지, 키네틱 인터셉터는 지휘관에게 교전 범위 전반에 걸친 중층적인 옵션을 제공합니다. 이러한 진보는 인구밀집지 상공으로의 파편 낙하를 금지하는 안전 규칙을 준수해야 하는 최종 사용자들 사이에서 안티 드론 시장의 매력을 크게 넓혀가고 있습니다. 기술 경쟁의 중심은 고가의 교환 사이클을 강요하지 않고 미래의 이펙터를 받아들일 수 있는 개방형 아키텍처의 명령 소프트웨어로, 조기 진입 벤더의 락인을 강화하고 있습니다.

공항, 감옥, 석유화학 시설이 마스트형 레이더, 파노라마 카메라, 전자전용 이미터를 설치했기 때문에 지상고정형 어레이가 2024년 지출액의 42.12%를 차지했습니다. 광범위한 커버 범위와 지속적인 전력 공급은 24시간 시스템에서 정한 경계선을 확보해야 하는 정적 시설에 적합합니다. 입퇴실 관리 및 비상 대응 네트워크와의 통합을 통해 운영자는 규제 당국이 요구하는 대시보드 규정 준수를 유지할 수 있습니다. 컨테이너형 쉼터의 발전으로 고정 시스템은 몇 시간 이내에 이전할 수 있어 반영구적 커버리지를 필요로 하는 원정 기지를 지원합니다.

UAV 탑재형 대 UAS 플랫폼은 26.32%의 연평균 복합 성장률(CAGR)을 기록하고 있는데, 이것은 드론 온 드론에 의한 교전이 지상으로부터의 시선이 차단되는 역동적인 전장에서 뛰어나기 때문입니다. MARSS Interceptor-MR과 같은 자율적 요격 미사일은 5km 이상 떨어진 적대적인 무인 항공기를 추적하고, 폭발물을 사용하지 않고 위협을 제거하며, 연루 위험을 줄입니다. MRAP에 탑재된 지상 이동 시스템은 정지 사이트와 공중 헌터 사이의 갭을 메우고 기동 부대가 운송대를 보호할 수 있도록 합니다. 핸드헬드 재머와 라이플형 디스랩터는 1km 이내에 개별 군인에게 마지막 수단을 제공합니다. 해병대는 무인 위협이 앞바다로 이동함에 따라 갑판 탑재형 레이저와 RF 디스랩터를 채용하여 확대하는 안티 드론 시장에서 어떠한 작전 영역도 제외되지 않는다는 것을 보여줍니다.

지역 분석

북미가 2024년 매출의 41.25%를 차지하며 선두를 유지했습니다. 국방부의 500억 달러 재구성은 다층 대 UAS 아키텍처에 자금을 제공합니다. RTX와 노스롭 그라만과 같은 국내 프라임은 연속 생산 로트를 확보하고 Anduril과 같은 벤처 지원 과제는 해병대로부터 AI 중심의 계약을 획득합니다. 통합은 계속되고 있습니다. : Axon의 Dedrone 인수와 AeroVironment의 BlueHalo 인수는 틈새 기능을 보다 광범위한 명령 및 제어 스택에 통합하는 것을 목표로 합니다. 보험 회사는 경기장과 도시 축제가 보상을 발행하기 전에 승인된 기어를 통합하도록 주장하고, 안티 드론 시장 전체에서 민간인을 끌어들이고 있어 지자체 수요가 가속화되고 있습니다.

아시아태평양은 CAGR 25.66%에서 가장 빠르게 성장하고 있습니다. 도쿄와 워싱턴은 고출력 마이크로파 무기를 공동 개발하고 베이징은 CASIC 하에서 레이저 기반 대 UAS 생산 라인을 확장하고 있습니다. 서울의 해군 드론 경력 구상은 지역 세력이 통합된 무인 위협 엔벨로프를 중심으로 블루워터 플랫폼을 설계하는 방법을 강조하고 있습니다. 호주, 인도, 대만의 국방 근대화 자금은 최근 분쟁에서 관찰된 대량군 전술을 둔화시킬 것으로 기대하며 대 드론에 기록적인 비율을 할당하고 있습니다. 듀얼 유스 산업 프로그램은 정부 보조금을 받아 수출 규제가 강화되는 가운데 국내 공급의 회복력을 확보하고 있습니다. 이러한 군사적 긴급성 및 산업 정책의 융합이 이 지역 전체의 지속적인 안티 드론 시장의 확대를 뒷받침하고 있습니다.

유럽에서는 유럽 방위 기금 하에서 협력 조달을 배경으로 꾸준한 도입이 진행되고 있습니다. 탈레스가 주도하는 EISNET 컨소시엄과 같은 프로젝트는 드론 무리에 대한 하늘과 미사일의 통합 방위를 위한 로드맵을 공유하기 위해 23개 기업을 연결시켰습니다. 영국은 DragonFire 레이저를, 독일은 CICADA 요격 시스템을, 프랑스는 PARADE 시스템을 국가 이벤트 용으로 조달하고 있습니다. EASA의 규제 조화는 국경을 넘는 장애물을 제거하여 공항이 공통 원격 ID 및 사이버 보안 기준선을 도입할 수 있게 합니다. 국내 패자는 수입 질화 갈륨 파워 앰프에 노출되는 기회를 줄이기 위해 주권 공급망을 추진합니다. 이러한 노력을 통해 유럽은 세계 안티 드론 시장에서 기술 혁신가이자 중요한 소비자임을 입증했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 비대칭적 위협을 가능하게 하는 저가의 상용 드론 보급

- 엄격한 공역 보안 의무화(FAA 공항 UAS 감지, EU U 공간)

- 중요 에너지 자산 주변으로의 드론 침입

- AI를 활용한 센서 퓨전이 도시의 RF 클러터의 검출 정밀도 상승

- 우크라이나 분쟁 후의 국방 예산의 재배분은 레이어형 C-UAS로 집중

- 경기장 및 이벤트에 관한 보험 주도의 배상 책임 조항

- 시장 성장 억제요인

- 민간공역에서 RF 재밍 및 키네틱 인터딕션의 모호한 합법성

- 5G가 밀집하는 도시에서의 높은 오경보율

- 모바일 및 전술 플랫폼의 SWaP 제약 조건

- 고에너지 레이저용 GaN 파워 앰프 공급의 병목

- 밸류체인 분석

- 규제 및 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 기술별

- 검출 시스템

- 중화 및 대책 시스템

- 플랫폼 유형별

- 지상 고정

- 지상 이동형(차량 탑재형)

- 핸드헬드

- UAV 기반 대 UAS

- 해군 베이스

- 업계별

- 군 및 방위

- 국토 안보 및 법 집행

- 중요 인프라

- 상업 및 공공시설(스타디움, 테마파크)

- VIP 보호

- 동작 범위별

- 근거리(1 km 미만)

- 중거리(1-5km)

- 장거리(5km 이상)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

제6장 경쟁 구도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Dedrone Holdings, Inc.

- RTX Corporation

- Rohde & Schwarz India Pvt. Ltd.

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Saab AB

- Thales Group

- QinetiQ Group

- Anduril Industries, Inc.

- Leonardo SpA

- Northrop Grumman Corporation

- Rheinmetall AG

- CACI International Inc

- Honeywell International, Inc.

- Meteksan Defence Industry Inc.

- Drone Defence Services Ltd.

- DeTect, Inc

- Chess Technologies Ltd.

- OpenWorks Engineering Ltd.

제7장 시장 기회 및 향후 전망

AJY 25.11.12The anti-drone market size reached USD 3.03 billion in 2025 and is forecasted to climb to USD 9.3 billion by 2030, advancing at a 25.14% CAGR.

Rapid scale-up reflects the shift from niche perimeter security toward indispensable layered air-defense, spurred by weaponized-drone proliferation in active conflict zones and rising threats to national energy grids. North America accounts for the largest slice of 2024 revenue at 41.25% because federal aviation rules mandate airport UAS detection, and the Pentagon redirected USD 50 billion to counter-UAS programs. Asia-Pacific records the fastest growth at a 25.66% CAGR through 2030 as joint Japan-US microwave projects and China's drone-production boom alter regional force balances. Detection systems dominate current demand with a 55.43% share, yet neutralization solutions post the quickest gains, underscoring procurement priorities moving from situational awareness to hard-kill effects. Platform preferences mirror this evolution: ground-fixed arrays still lead, but drone-mounted interceptors are scaling fast as drone-on-drone engagements grow common on modern battlefields.

Global Anti-Drone Market Trends and Insights

Proliferation of Low-Cost Commercial Drones Enabling Asymmetric Threats

Commercial quadcopters converted into loitering munitions now flood battlefields, with Ukraine alone procuring an annual 2.5 million units under contracts spanning 76 domestic firms. The capacity of USD 500 hobby drones to disable multi-million-dollar armor has upended traditional cost-exchange ratios, accelerating anti-drone market demand among armed forces that historically relied on conventional air defense. NORAD logged 350 unauthorized UAV events at US military facilities in one year, a data point that broadened the perceived risk envelope to homeland installations. Similar incidents targeting pipelines, depots, and transport hubs prove that critical infrastructure is equally exposed. Procurement agencies consequently favor scalable counter-UAS networks that marry fixed sensors with mobile effectors to counter this diffuse threat profile. The supply push from emergent domestic drone makers and cheap online component availability ensures that proliferation pressures will remain high through the decade.

Stringent Air-Space Security Mandates

The FAA's phased evaluations in New Jersey, New Mexico, North Dakota, and Mississippi produced 46 actionable directives for integrating drone-detection and mitigation tools into the National Airspace System.[1]Through EASA's updated Remote ID and cybersecurity rules, parallel European regulatory consolidation forces airports, heliports, and critical infrastructure to field certified counter-UAS suites. Compliance triggers immediate capital-expenditure cycles because operators must prove real-time situational awareness and response capability to retain operating licenses. Insurance carriers amplify urgency by linking coverage to the presence of approved technologies at venues that host crowds above 30,000. These intertwined mandates transform counter-drone adoption from discretionary spend into a regulated necessity, broadening the anti-drone market beyond military contracting.

Ambiguous Legality of RF Jamming and Kinetic Interdiction

Statutory authority for active drone neutralization is largely confined to a handful of US federal departments, leaving state and local law enforcement hamstrung when rogue UAVs threaten stadiums or chemical plants. Internationally, similar legal gray zones limit market uptake for RF jammers and directed-energy interceptors outside military domains. The proposed Defense Act seeks to grant vetted public-safety entities access to approved counter-drone tools, yet its passage timeline remains uncertain. In Europe, electronic-warfare emissions face strict spectrum-management rules, curbing the rapid deployment of high-power devices. Until global regulators harmonize rules on proportional use of force in civilian skies, many operators will deploy detection-only solutions, tempering revenue growth for effectors inside the anti-drone market.

Other drivers and restraints analyzed in the detailed report include:

- Drone Incursions Around Critical Energy Assets

- AI-Powered Sensor-Fusion Boosting Detection Accuracy in Urban RF Clutter

- High False-Alarm Rates in 5G-Dense Urban Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Detection platforms generated 55.43% of 2024 revenue, underscoring their role as the entry point into the anti-drone market. Early deployments revolved around stand-alone radar or RF finders at runways, forward operating bases, and energy hubs. Software-defined upgrades now allow sensor-fusion overlays that elevate multi-modal accuracy without additional hardware swaps. AI-driven classification further trims operator workload, a critical benefit as threat volumes escalate. Moving forward, procurement budgets increasingly bundle detection nodes with command-and-control software that visualizes airspace on common operating pictures accessible to civilian and military stakeholders in real time.

Neutralization technologies, while smaller today, are scaling at a 29.52% CAGR as operators move beyond "see" to "stop". Directed-energy systems such as Lockheed Martin's HELIOS laser have recorded at-sea interceptions that cost pennies per shot compared with missiles. Radio-frequency high-power microwave guns are entering serial production, providing short-burst pulses that fry drone electronics without kinetic debris. Kinetic interceptors, from networked 40mm smart rounds to micro-UAV dogfighters, give commanders layered options across engagement ranges. These advances significantly broaden the anti-drone market appeal among end users who must comply with safety rules prohibiting falling shrapnel over populated areas. The technology race centres on open-architecture command software that can accept future effectors without forcing expensive rip-and-replace cycles, reinforcing vendor lock-in for early movers.

Ground-fixed arrays controlled 42.12% of 2024 spending as airports, prisons, and petrochemical sites installed mast-mounted radars, panoramic cameras, and electronic warfare emitters. Their broad coverage and continuous power supply fit static facilities that must secure defined perimeters around the clock. Integration with access-control and emergency-response networks helps operators maintain compliance with the dashboards regulators require. Advances in containerized shelters now let fixed systems relocate within hours, supporting expeditionary bases that need semi-permanent coverage.

UAV-mounted counter-UAS platforms post a striking 26.32% CAGR because drone-on-drone engagements excel in dynamic theatres where ground line-of-sight is obstructed. Autonomous interceptors such as the MARSS Interceptor-MR chase hostile drones beyond 5km and terminate threats without explosives, reducing collateral risk. Ground-mobile systems mounted on MRAPs fill the gap between static sites and airborne hunters, enabling maneuver units to protect convoys. Hand-held jammers and rifle-shaped disruptors give individual soldiers last-ditch options inside 1km bubbles. Naval forces adopt deck-mounted lasers and RF disruptors as unmanned threats migrate offshore, signalling that no domain of operation is exempt from the expanding anti-drone market.

The Anti-Drone Market Report is Segmented by Application (Detection Systems and Neutralization/Counter-Measure Systems), Platform Type (Ground-Fixed, UAV-Based Counter UAS, and More), End-Use Vertical (Military and Defense, Critical Infrastructure, and More), Operating Range (Short-Range, Medium-Range, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains leadership with 41.25% of 2024 revenue. Federal rule-making compels airports to field detection networks, while the Pentagon's USD 50 billion realignment funds multi-tier counter-UAS architectures. Domestic primes such as RTX and Northrop Grumman secure serial production lots, and venture-backed challengers like Anduril win AI-centric contracts from the Marine Corps. Consolidation continues: Axon's Dedrone deal and AeroVironment's BlueHalo buyout aim to fold niche capabilities into broader command-and-control stacks. Municipal demand accelerates as insurance firms insist that stadiums and city festivals integrate approved gear before issuing coverage, deepening civilian uptake across the anti-drone market.

Asia-Pacific is the fastest climber at a 25.66% CAGR. Tokyo and Washington co-develop high-power microwave weapons while Beijing expands laser-based counter-UAS production lines under CASIC. Seoul's naval drone-carrier concepts underscore how regional forces design blue-water platforms around integrated unmanned threat envelopes. Defense modernization funds across Australia, India, and Taiwan allocate record shares to counter-drone, hoping to blunt mass-swarm tactics observed during recent conflicts. Dual-use industrial programs receive government subsidies, ensuring domestic supply resilience as export-control regimes tighten. This convergence of military urgency and industrial policy propels sustained anti-drone market expansion across the region.

Europe delivers steady uptake on the back of coordinated procurement under the European Defence Fund. Projects like the Thales-led EISNET consortium knit 23 companies into a shared roadmap for integrated air-and-missile defense against drone swarms. The UK bankrolls DragonFire lasers, Germany fields CICADA interceptors, and France procures PARADE systems for national events. Regulatory harmonization through EASA removes cross-border hurdles, letting airports deploy common Remote ID and cybersecurity baselines. Domestic champions push sovereign supply chains to reduce exposure to imported gallium nitride power amps. These initiatives cement Europe as a technology innovator and significant consumer within the global anti-drone market.

- Dedrone Holdings, Inc.

- RTX Corporation

- Rohde & Schwarz India Pvt. Ltd.

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Saab AB

- Thales Group

- QinetiQ Group

- Anduril Industries, Inc.

- Leonardo S.p.A

- Northrop Grumman Corporation

- Rheinmetall AG

- CACI International Inc

- Honeywell International, Inc.

- Meteksan Defence Industry Inc.

- Drone Defence Services Ltd.

- DeTect, Inc

- Chess Technologies Ltd.

- OpenWorks Engineering Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of low-cost commercial drones enabling asymmetric threats

- 4.2.2 Stringent air-space security mandates (FAA Airport UAS Detection, EU U-space)

- 4.2.3 Drone incursions around critical energy assets

- 4.2.4 AI-powered sensor-fusion boosting detection accuracy in urban RF clutter

- 4.2.5 Defense budget reallocation post Ukraine conflict toward layered C-UAS

- 4.2.6 Insurance-led liability clauses for stadiums and events

- 4.3 Market Restraints

- 4.3.1 Ambiguous legality of RF jamming and kinetic interdiction in civilian airspace

- 4.3.2 High false-alarm rates in 5G-dense urban zones

- 4.3.3 SWaP constraints for mobile/tactical platforms

- 4.3.4 GaN power-amp supply bottlenecks for high-energy lasers

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Detection Systems

- 5.1.2 Neutralization/Counter-Measure Systems

- 5.2 By Platform Type

- 5.2.1 Ground-Fixed

- 5.2.2 Ground-Mobile (Vehicle-mounted)

- 5.2.3 Hand-Held

- 5.2.4 UAV-based Counter-UAS

- 5.2.5 Naval-based

- 5.3 By End-Use Vertical

- 5.3.1 Military and Defense

- 5.3.2 Homeland Security and Law Enforcement

- 5.3.3 Critical Infrastructure

- 5.3.4 Commercial and Public Venues (Stadiums, Theme Parks)

- 5.3.5 VIP Protection

- 5.4 By Operating Range

- 5.4.1 Short-Range (Less than 1 km)

- 5.4.2 Medium-Range (1-5 km)

- 5.4.3 Long-Range (Greater than 5 km)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Dedrone Holdings, Inc.

- 6.3.2 RTX Corporation

- 6.3.3 Rohde & Schwarz India Pvt. Ltd.

- 6.3.4 Lockheed Martin Corporation

- 6.3.5 Israel Aerospace Industries Ltd.

- 6.3.6 Saab AB

- 6.3.7 Thales Group

- 6.3.8 QinetiQ Group

- 6.3.9 Anduril Industries, Inc.

- 6.3.10 Leonardo S.p.A

- 6.3.11 Northrop Grumman Corporation

- 6.3.12 Rheinmetall AG

- 6.3.13 CACI International Inc

- 6.3.14 Honeywell International, Inc.

- 6.3.15 Meteksan Defence Industry Inc.

- 6.3.16 Drone Defence Services Ltd.

- 6.3.17 DeTect, Inc

- 6.3.18 Chess Technologies Ltd.

- 6.3.19 OpenWorks Engineering Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment