|

시장보고서

상품코드

1437954

이동식 크레인 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Mobile Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

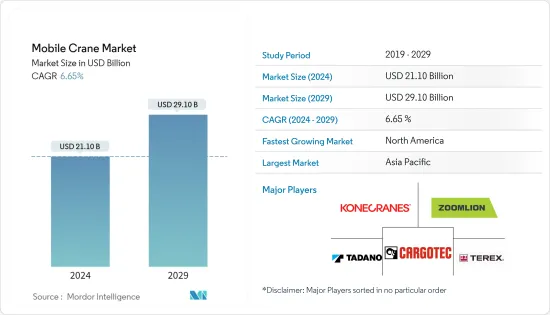

이동식 크레인(Mobile Crane) 시장 규모는 2024년에 211억 달러로 추정되며, 2029년까지 291억 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 6.65%의 CAGR로 추이하며 성장할 전망입니다.

COVID-19 팬데믹은 이동식 크레인 시장에도 적지 않은 영향을 미쳤습니다. 처음에는 크레인의 주요 사업장인 전 세계의 많은 건설 및 인프라 현장이 각국 정부의 봉쇄령으로 인해 폐쇄되었습니다. 그러나 일부 지역에서는 채굴 활동이 필수적이라고 선언되어 봉쇄령 속에서도 운영되면서 모바일 크레인의 비즈니스 기회는 여전히 살아났습니다.

중기적으로는 인프라 개발 프로젝트의 증가와 건설사의 높은 수준의 투자가 예측 기간 동안 이동식 크레인에 대한 수요를 주도합니다. 친환경 기능을 갖춘 첨단 기계의 개발과 차량 관리, GPS 추적 등과 같은 첨단 기술의 채택이 더욱 증가함에 따라 시장 성장이 촉진될 것으로 보입니다.

또한 건설 및 중장비 회사가 임대 또는 리스 서비스를 선호하고 중고 장비를 사용하는 경향이 증가함에 따라 새로운 장비를 생산하는 OEM이 방해받을 수 있습니다.

아시아 태평양 지역은 주로 중국과 인도의 인프라 개발 성장에 힘입어 중기적으로 전 세계 건설 지출의 대부분을 차지할 것으로 보입니다. 아시아 지역의 중소형 프로젝트의 유연성 증가는 예측 기간 동안 시장 수요에 더욱 기여할 것입니다. 북미와 유럽 전역의 정부 자금 지원 증가와 주요 제조업체의 적극적인 입지는 시장 성장을 더욱 강화할 것입니다.

이동식 크레인 시장 동향

시장 수요를 촉진하기 위해 전 세계적으로 건설 및 리노베이션 활동이 증가

건설 및 광업 산업은 매우 역동적이며 전체 경제, 예산, 세계 경제 시나리오 등 많은 요인이 시장 성장에 영향을 미칩니다. 대규모 인프라 프로젝트 전망과 노동력 관계 변화로 인해 건설기계 수요는 예측기간 동안 성장할 것으로 예상됩니다.

게다가 일부 국가에서는 건설 부문 전체에서 많은 양의 해외 직접 투자(FDI)가 이루어지고 있습니다. 예를 들어, 2020년에는 호주 건설 부문에 대한 해외 직접 투자는 약 22억 호주 달러였습니다.

세계의 정부와 이 분야에서 활동하는 기업의 인프라 지출은 지난 몇 년간 현저한 증가를 보이고 있으며, 이로 인해 건설 분야의 기계 및 장비에 대한 수요가 증가하고 있습니다. 또한 인도네시아 국가 중기 개발 계획(4,600억 달러), 베트남 사회 경제 개발 계획(615억 달러), 필리핀 개발 계획 'Build, Build' 등 관민 인프라에 대한 투자도 이루어지고 있습니다. '빌딩'(718억 달러)은 이 지역의 건설기계 수요 증가가 예상됩니다.

다른 여러 국가에서 정부의 이니셔티브도 건설 기계 시장 성장 촉진 요인이 되었습니다. 이로 인해 향후 수년간 건설 산업 성장이 촉진될 것입니다. 예를 들어,

- 2020년 3월 영국 정부는 2020년부터 2025년까지 총 6,400억 유로(8,250억 달러)를 지출할 계획을 발표했습니다. 이 지출 중 약 109억 유로는 신축 주택의 건설에 충당되어 2025년까지 100만채의 새로운 주택을 건설합니다.

- 2021년 7월 캐나다는 캐나다 인프라 프로젝트에 330억 달러 이상, 국가 인프라 개발을 위해 향후 12년간 1,800억 달러 이상을 투자할 것이라고 발표했습니다. 2020년에는 미국 97개 도시가 256억 달러 상당의 304건의 인프라 프로젝트를 발표했습니다. 2021년 7월, 연방 정부는 도로와 다리, 수도 인프라 등을 대상으로 한 5,500억 달러 상당의 프로젝트를 발표했습니다.

북미가 시장에서 큰 점유율을 차지할 것으로 예상

북미 전역의 건설 부문은 견고한 경제 펀더멘털, 정부의 인프라 구축에 대한 집중, 통화 정책의 긴축에 힘입어 견조한 성장세를 보일 것으로 예상되며, 이로 인해 국내 시장뿐만 아니라 외부 시장으로부터 자본 유입이 활발해질 것으로 전망됩니다.

지난 몇 년동안 유행의 영향으로 건설 활동이 중단되고 수요가 감소했지만 진행중인 프로젝트와 정부의 유리한 정책 발표를 통해 예측 기간 동안 기세가 증가할 것으로 예상됩니다. 예를 들어,

- 2021년 11월 미국 의회는 1조 달러 규모의 인프라 지출 법안을 통과했습니다. 인프라법은 도로, 교량, 간선도로 개조, 도시교통시스템 및 여객철도망의 현대화를 위해 향후 8년간 미국에서 5억 5,000만 달러의 새로운 연방지출을 제안하고 있습니다.

- 새로운 인프라 지출법안은 당초 제안액인 2조 3,000억 달러에 미치지 못하는 것, 동 출판사는 미국의 다양한 인프라 부문에 1조 달러가 지출되어 향후 4-8분기에 걸쳐 국내 건설 업계 성장을 계속 지원할 것으로 예상했습니다.

미국 항구에서 화물과 해상 무역 수요가 증가함에 따라 제조업체와 항구 소유자는 상품 운송을 촉진하기 위해 항구 조달 및 이동식 크레인 보관에 현금을 투자하고 있다고 생각합니다. 됩니다. 예를 들어 :

- SeaPortManatee는 터미널 운영 회사인 Logistec USA Inc.와 함께 이동식 항만 크레인 2대를 추가하라는 요청을 받았으며 4월 22일에 도착했습니다. 두 크레인 모두 항구에서 125m 톤의 수하물을 들어 올릴 수 있으며, 200m 톤의 수하물을 함께 들어올릴 수 있습니다. 또한, 이러한 이동식 크레인은 SeaPort Manatee의 하역 능력을 향상시킬 수 있습니다.

- 2022년 4월, 기존 및 전기화 차량 추진 솔루션의 선도적 설계 및 제조업체인 Allison Transmission은 검증된 앨리슨의 4000 시리즈TM를 평가하고 통합하기 위해 벨 장비 그룹 서비스(BELL)와 건설적인 제휴를 맺었습니다. 테라트란은 굴절식 덤프트럭, 이동식 크레인, 와이드바디 광산 덤프트럭과 같은 애플리케이션을 위해 제작된 다목적 차량입니다.

캐나다와 멕시코 시장에서도 이 나라가 산불로 피해를 입은 인프라의 재건을 추진하고 있기 때문에 주택 부문 수요가 예상됩니다. 석유 가격 상승과 북극의 빙상 융해로 새로운 무역 경로가 열리고 새로운 탐사 활동으로 이어질 것으로 예상되며, 예측 기간 동안 해상 및 해상 크레인 수요가 증가할 것으로 예상됩니다.

이동식 크레인 산업 개요

이동식 크레인 시장에서 사업을 전개하는 주요 기업으로는 Liebherr, Cargotec, Tadano, Manitowoc, Palfinger 등이 있습니다. 이러한 기업들은 건설, 광업, 산업 분야의 주요 기업으로부터 신뢰할 수 있는 크레인에 대한 큰 수요를 잘 활용하고 있습니다. Tier 2 및 Tier 3 공급망과 중소규모 용도에 대한 공급과 관련하여 조사 대상 시장은 상당히 통합되어 있으며 지역 기업이 존재합니다.

저명한 기업은 혁신과 탁월한 성과를 통합하기 위해 R&D 지출을 획기적으로 증가시켜 왔습니다. 고성능, 고효율 및 안전하게 취급할 수 있는 장비에 대한 수요로 인해 조사 대상 시장은 예측 기간 동안 경쟁력이 높고 효과적으로 역동적일 것으로 예상됩니다.

- 2021년 5월, 고객 서비스 향상과 회사의 세계 확장의 일환으로 Zoomlion은 이탈리아 Mantova에 생산 시설을 개설했습니다. 이 확장으로 인해 회사는 유럽의 발판과 전반적인 세계의 존재감을 더욱 향상시킬 것으로 기대되고 있습니다.

- 2021년 4월, Liebherr은 컴팩트한 원만 택시 크레인, MK 73-3.1 이동식 건설용 크레인을 발표했습니다. 이 최신 기계는 소형, 소형, 유연하고 빠르고 민첩하게 작동하는 이동식 건설 크레인에 대한 시장 수요를 충족하도록 설계되었습니다.

- 2021년 2월 미국에 본사를 둔 Manitex international의 자회사인 Manitex Valla of Italy는 배터리 구동으로 원격 제어되는 완전히 새로운 전기 이동식 크레인 V 110 R을 출시했습니다. 이 기계는 좁은 곳이나 붐비는 지역에서 작업하기에 적합하지만, 동시에 가장 중요하고 까다로운 운영 환경에서도 최대한의 조작성과 유연성을 보장합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장의 추진력

- 시장 억제

- 산업의 매력도-Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체 제품의 위협

- 기업 간 경쟁 정도

제5장 시장 세분화(시장 규모, 금액)

- 머신 유형별

- 이동식 크레인

- 고정 크레인

- 해상 및 항만 크레인

- 용도 유형별

- 건설

- 채굴과 드릴링

- 해양 및 해양

- 산업용도

- 기타 용도 유형

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 미국

- 프랑스

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아 태평양

- 기타 세계 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Konecranes PLC

- Cargotec

- Manitowoc

- Terex Corporation

- Tadano Limited

- Kobelco Cranes Co. Limited

- Palfinger AG

- Liebherr-International AG

- Zoomlion Heavy Industry Science and Technology Co. Limited

- Favelle Favco Group

- Sumitomo Heavy Industries Construction Cranes Co. Ltd

제7장 시장 기회 및 향후 동향

LYJThe Mobile Crane Market size is estimated at USD 21.10 billion in 2024, and is expected to reach USD 29.10 billion by 2029, growing at a CAGR of 6.65% during the forecast period (2024-2029).

The COVID-19 pandemic had a mild impact on the mobile cranes market. Initially, many construction and infrastructure sites across the world, which are major business sites for cranes, were shut down due to the lockdown orders of governments. However, in some regions, as mining activities were declared essential and running through the lockdown, the business opportunity for mobile cranes still survived.

Over medium-term, rising infrastructural development projects and high-level investments by construction companies drive demand for mobile cranes during the forecast period. The development of advanced machinery with eco-friendly features and further growing adoption of advanced technologies like fleet management, GPS tracking, and others are likely to augment the market's growth.

Additionally, the increasing preference of construction and heavy equipment companies to use rental or lease services and inclination towards used equipment for their operations is bound to hinder the new equipment-producing OEMs.

The Asia Pacific is likely to hold a majority share of the global construction spending by the mid-term, primarily driven by the growth in infrastructure development in China and India. The increased flexibility in small-sized and medium-sized projects in the Asia region to further contribute to demand in the market over forecast period. Growing government funding and the active presence of key manufacturers across North America and Europe to further enhance the growth of the market.

Mobile Crane Market Trends

Increase in Construction and Renovation Activities Globally to Drive Demand in the Market

The construction and mining industry is highly dynamic, and numerous factors, such as the overall economy, budgets, and global economic scenario, are influencing the market's growth. With the prospects of large infrastructure projects and shifting labor dynamics, the demand for construction equipment is expected to witness growth during the forecast period.

Moreover, several countries are witnessing significant foreign direct investment (FDI) across the construction sector. For instance, In 2020, there was approximately AUD 2.2 billion in foreign direct investment into the construction sector in Australia.

Infrastructure spending by governments worldwide and players operating in this sector are witnessing a notable rise over the past few years, thereby pushing the demand for machinery and equipment in the construction sector. In addition, the investments in infrastructure, both public and private, such as the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan 'Build, Build, and Build' (USD 71.8 billion), are expected to increase the demand for construction machinery demand in these regions.

Government initiatives in several other countries are also driving factors in the construction machinery market. This, in turn, will help the construction industry grow in the upcoming years. For instance,

- In March 2020, the United Kingdom government announced its plan to spend a total of EUR 640 billion (USD 825 billion) between 2020 and 2025. Around EUR 10.9 billion of this spending will be allocated for the construction of new homes, with the aim of building one million new homes by 2025.

- In July 2021, Canada announced over USD 33 billion investment into Canada's infrastructure projects and over USD 180 billion in the next 12 years for the development of the country's infrastructure. In 2020, 97 cities across the United States announced 304 infrastructure projects valued at USD 25.6 billion. In July 2021, USD 550 billion worth of projects were announced by the federal government for roads and bridges, water infrastructure, and others.

North America Expected to Occupy Significant Share in the Market

The construction sector across North America is expected to experience solid growth, backed by strong economic fundamentals, the government's focus on creating infrastructure, and the tightening of monetary policy, which is expected to result in strong capital inflows from the external markets as well as domestic markets.

Though construction activities halted and demand declined over past years due to the pandemic, it is expected that it will gain traction over the forecast period in the wake of ongoing projects and announcements of favorable policies by the government. For instance,

- In November 2021, the US Congress passed a USD 1 trillion infrastructure spending bill. The infrastructure legislation proposes USD 550 million in new federal expenditure over the next eight years in the United States for the upgrade of roads, bridges, and highways and to modernize the city transit systems and passenger rail networks.

- While the new infrastructure spending bill falls short of the original USD 2.3 trillion proposals, the publisher expects 1 trillion spending on various United States infrastructure sectors to keep supporting the growth of the construction industry over the next four to eight quarters in the country.

With the increase in demand for cargo and maritime trade at the United States ports, manufacturers and port owners are seeing investing cash in procuring ports and harboring mobile cranes to felicitate the goods transportation. For instance:

- SeaPortManatee, along with terminal operator Logistec USA Inc. has demanded the addition of two mobile harbor cranes which has been arrived on 22 April. Both of the cranes are capable of lifting 125 metric tons of goods load at the port and together can be able to lift 200 metric tons load. Furthermore, these mobile cranes shall be able to increase cargo handling capabilities at SeaPort Manatee.

- In April 2022, Allison Transmission, a leading designer and manufacturer of conventional and electrified vehicle propulsion solutions, came under a constructive alliance with Bell Equipment Group Services (BELL) to evaluate and integrate Allison's proven 4000 SeriesTM. The TerraTran is a multi-purpose vehicle built for applications such as articulated dump trucks, mobile cranes, and wide-body mining dump trucks.

The Canadian and Mexico markets are also likely to experience demand from the residential sector as the country is rebuilding its infrastructure damaged by wildfires. The rise in prices of oil and the melting of ice caps in the Arctic is expected to open new trade routes and lead to new exploration activities, which are expected to increase the demand for marine and offshore cranes during the forecast period.

Mobile Crane Industry Overview

Major players operating in the mobile crane market are Liebherr, Cargotec, Tadano, Manitowoc, and Palfinger, among others. These players have successfully capitalized on the significant demand for reliable cranes from key players in the construction, mining, and industrial sectors. In terms of tier-2 and tier-3 supply chains and supplying to small- and medium-sized applications, the market studied is fairly consolidated, with the presence of regional players.

The prominent players have exponentially increased their R&D expenditure to integrate innovation with excellence in performance. The demand for high-performance, highly efficient, and safe-handling equipment, is expected to make the market studied more competitive and effectively dynamic during the forecast period.

- In May 2021, In an effort to better serve the customers and as part of the global expansion of the company, Zoomlion inaugurated a production facility in Mantova, Italy. With this expansion, the company expects to further improve its foothold in Europe and global presence as a whole.

- In April 2021, Liebherr introduced a compact one-man taxi crane, MK 73-3.1 mobile construction crane. This latest machine is designed to fulfill the market demands for a small, compact, and flexible mobile construction crane that is fast and agile in operation.

- In February 2021, Manitex Valla of Italy, a subsidiary of the US-based Manitex international, launched the all-new V 110 R Electric Mobile Crane, which is battery-operated and remote-controlled. The machine is suitable to work in tight places and congested areas but securing in the meantime maximum maneuverability and flexibility in the most critical and demanding operating environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.2 Market Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Machine Type

- 5.1.1 Mobile Crane

- 5.1.2 Fixed Crane

- 5.1.3 Marine and Port Cranes

- 5.2 By Application Type

- 5.2.1 Construction

- 5.2.2 Mining and Excavation

- 5.2.3 Marine and Offshore

- 5.2.4 Industrial Applications

- 5.2.5 Other Application Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United States

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Konecranes PLC

- 6.2.2 Cargotec

- 6.2.3 Manitowoc

- 6.2.4 Terex Corporation

- 6.2.5 Tadano Limited

- 6.2.6 Kobelco Cranes Co. Limited

- 6.2.7 Palfinger AG

- 6.2.8 Liebherr-International AG

- 6.2.9 Zoomlion Heavy Industry Science and Technology Co. Limited

- 6.2.10 Favelle Favco Group

- 6.2.11 Sumitomo Heavy Industries Construction Cranes Co. Ltd