|

시장보고서

상품코드

1851160

잔디 보호 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Turf Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

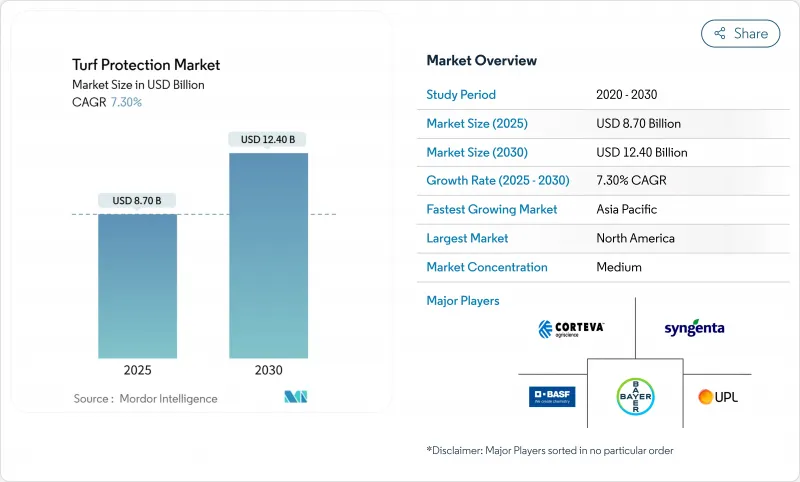

잔디 보호 시장 규모는 2025년에 87억 달러, 2030년에는 124억 달러에 이를 것으로 예상되며, 이 기간의 CAGR은 7.3%를 나타낼 전망입니다.

이 시장 확대는 골프 코스, 프로 스포츠 장소, 고급 주거 지역 등 탄력성이 있으며, 외형에도 아름다운 플레이와 레저를위한 서페이스가 필요한 장소에 대한 투자가 가속되고 있음을 반영합니다. 기후 변화의 격화, 선수의 안전기준의 엄격화, 종합적 해충관리 프로그램으로의 이동은 첨단 살균제, 생물자극제, 정밀 살포 기술에 대한 수요를 끌어올리고 있습니다. 규제 당국이 합성 화학물질을 조사하고 소유자가 환경 실적를 줄이는 것을 목표로 하고 있기 때문에 생물학적 제품은 두 자릿수 성장을 기록하고 있습니다. 경쟁면에서는 신젠타가 가장 높은 점유율을 차지하고 이어 바이엘 크롭 사이언스가 계속되지만, 단편화가 진행되고 있기 때문에 바이오스티뮬란트나 정밀 센서·패키지 등의 틈새 분야에서는 각 지역의 전문가가 침투를 도모하고 있습니다. 북미는 성숙한 스포츠 인프라와 잔디 관리를 위한 가정 지출의 높이에 의해 주도권을 유지하고 있지만, 아시아태평양은 도시화와 대규모 시설의 건설이 수요 증가에 박차를 가하고 있기 때문에 가장 빠른 성장을 기록하고 있습니다.

세계의 잔디 보호 시장 동향과 인사이트

골프장과 프로 스포츠 시설 건설 증가

특히 인도, 중국, 걸프 국가에서는 유행 이후 새로운 시설에 대한 설비 투자가 급증하고, 내구성과 자연적인 플레이 어빌리티를 밸런싱한 하이브리드 잔디 시스템에 대한 안정적인 풀스루 수요가 탄생했습니다. 프로 리그는 표면 품질 평가 기준을 공식적으로 정하고, 회장의 소유자는 더 엄격한 안전 테스트를 통과한 살균제, 식물 성장 조절제, 스트레스 완화제를 지정하게 되었습니다. 일단 건설되면 각 장소는 시즌 동안 병해 방제를 필요로하므로 공급업체는 경상 수익을 보장 할 수 있습니다. 시장 개척자는 종자, 영양제, 디지털 모니터링을 번들로 한 통합 패키지에도 주목하여 잔디 보호 시장에서의 크로스셀링 기회를 넓히고 있습니다.

잔디의 질병 발생률 증가

겨울이 온난해지고 습도가 장기화됨으로써 달러 스폿이나 브라운 패치의 발생이 격화되고 있기 때문에 슈퍼 인텐던트는 캘린더 스케줄이 아니라 실시간 병원균의 압력에 대응하는 다이나믹 로테이션 프로그램의 채용을 촉구하고 있습니다. 조사에 의하면, 톨페스크의 농장에서는 고질소의 시비를 실시했을 경우, 중간 정도의 시비를 실시한 경우에 비해, 브라운 패치의 발생률이 40% 높아지는 것을 나타내고 있어, 균형 잡힌 영양 전략의 필요성이 부각되고 있습니다. 첨단 진단 키트와 AI 모델을 통해 97%의 정확도로 달러 스팟을 검출할 수 있어 조기 개입과 살균제 살포량을 최적화할 수 있습니다. 이러한 추세로 잔디 보호 산업은 유익한 토양 생물을 보전하기 위한 예측 분석 및 부위 특이적 치료로 향하고 있습니다.

인공 잔디 솔루션의 급속한 보급

인공 잔디 필드는 일상적인 잔디 깎기와 농약의 사용을 필요로 하지 않기 때문에 노동력과 물의 제약으로 고민하는 교육위원회와 지자체를 매료시킵니다. 미국에서는 현재 연간 1,200-1,500개의 설치가 진행 중입니다. 그럼에도 불구하고 PFAS 오염의 발견과 유럽에서 연간 1만 6,000톤의 마이크로플라스틱 유출량 추정은 전환을 정체시키고 자연 대체물에 생명을 불어넣을 수 있는 정책을 재검토했습니다. 잔디 보호 공급업체는 하이브리드 기술과 자연 시스템의 건강과 지속가능성의 이점을 강조하는 커뮤니케이션 캠페인을 지원합니다.

부문 분석

살균제는 달러 스팟, 브라운 패치, 피슘의 지속적인 위협을 반영하여 2024년 잔디 보호 시장 매출의 38.1%를 차지하며 가장 큰 비율을 차지했습니다. SDHI, QoI 및 DMI를 혼합한 정교한 회전 계획은 토너먼트 등급의 서피스를 유지하려는 과정에 필수적입니다. 그러나 CAGR 11.5%를 기록한 바이오스티뮬란트는 스트레스 내성과 뿌리의 건강 증진이 입증된 지속 가능한 입력에 시장의 축족을 부각하고 있습니다. 제초제는 관리자가 1등급 블루그라스나 히로바 잡초에 임하기 위해 수요의 약 31.4%를 차지하고 있으며, 식물 성장 조절제는 잔디깎기기계의 연료와 인건비를 삭감하는 것으로 견인역이 되고 있습니다.

식물성장조정제의 잔디 보호 시장 규모는 노동력 제약과 지속가능성 목표가 높아짐에 따라 확대되는 경향이 있습니다. 철 기반 대체제와 미생물 칵테일은 현재 기존의 살균제를 보충하고 낮은 환경 위험에서 동등한 돌 스폿 억제 효과를 보여줍니다. 생물학적 제제와 합성제는 흡수성과 지속성을 높이는 공동 제제를 만들어내고 관리자의 선택을 넓히고 있습니다.

2024년의 전체 수요의 42.5%를 차지한 것은 정세이며, 이는 주택과 상업시설에서의 매력적인 외관을 요구하는 견조한 지출에 지지되었습니다. 제품 구성은 광범위한 잡초 방제, 서방형 영양제, 균일한 외관을 제공하는 착색제에 중점을 둡니다. 대조적으로, 스포츠 필드는 프랜차이즈와 대학이 선수의 안전성과 표면 일관성을 선호하기 때문에 CAGR 9.8%로 성장 테이블의 선두를 달리고 있습니다. 표준화된 현장 테스트를 추진하는 NFL은 이미 고성능 살균제 프로그램과 하이브리드 오버 시딩 블렌드의 구매 사양을 개발했습니다.

골프장에 특화된 잔디 보호 시장 규모는 28.6%로 여전히 크지만, 많은 성숙한 코스가 설비확장에서 개수모드로 이행함에 따라 스포츠경기장과 비교하면 성장이 둔화됩니다. 소드농장은 틈새이지만 병해충을 집중적으로 방제할 필요가 있는 무병의 롤을 공급하는 역할을 통해 영향력을 발휘하고 있습니다.

지역 분석

북미는 1만 5,000개가 넘는 골프 코스와 세계 최대의 전문 경기장 포트폴리오를 지원하며 2024년 세계 매출의 35.0%를 유지했습니다. 미국은 이 지역 수요의 약 90%를 차지하며, IoT 토양 프로브와 AI 분산 스케줄링 툴의 조기 도입으로 혜택을 누리고 있습니다. 캐나다는 생육기간이 짧기 때문에 병해의 발생이 여름의 피크에 집중되어 프리미엄 살균제 프로그램이 장려되고 있습니다. 멕시코는 리조트의 회랑이 있기 때문에 해안을 따라 토양에서 자라는 내염성 잔디 품종과 비옥도 프로그램에 투자가 집중됩니다.

아시아태평양의 CAGR은 8.7%로 세계에서 가장 빠른 것으로 예측됩니다. 중국의 연구 기관은 스트레스에 강한 잔디에 대한 생식원 컬렉션을 확대하고 있지만, 코스 운영자는 여전히 많은 고급 품종을 수입하고 있습니다. 인도의 도시 골프와 크리켓 인프라는 몬순의 변동을 견디는 살균제와 성장 조절제 패키지에 대한 왕성한 수요를 지원합니다. 일본의 성숙한 골프 장면은 정부의 지속가능성 목표를 달성하기 위해 정밀 관개와 생물학적 투입으로 축족을 옮깁니다. 호주 코스 관리자는 엄격한 수량 제한에 직면하고 있으며, 플레이의 질을 보호하기 위해 습윤제와 가뭄에 강한 배합제에 대한 의존도를 높이고 있습니다.

유럽은 여전히 기술과 규제 주도의 무대입니다. 유럽위원회는 지속가능한 농약의 사용과 마이크로플라스틱의 금지를 추진하고 있으며, 생물학적 프로그램과 생분해성 캐리어에 인센티브를 부여하고 있습니다. 독일과 영국은 살균제의 타이밍을 미세 조정하는 커넥티드 센서 네트워크의 보급에 앞장서고 있습니다. 프랑스의 그라운드 승무원은 국가의 농약 감소 목표를 준수하기 위해 바이오 스티뮬란트 종자 처리를 신속하게 채택하고 정책이 조달 선택에 어떻게 영향을 미치는지를 보여줍니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 골프장과 프로 스포츠 회장의 건설 증가

- 잔디 병해 증가

- 심미적인 잔디에 대한 주택 수요 증가

- 생물학적 살균제와 생리활성제로의 변화

- 센서에 의한 정밀 잔디 관리의 채용

- 기후 변화에 의한 열 스트레스 완화 솔루션

- 시장 성장 억제요인

- 인공 잔디 솔루션의 급속한 침투

- 신규화학물질이 높은 연구개발비용

- 기존 살균제에 대한 규제 압력

- 인조잔디로부터의 마이크로 플라스틱 및 나노 플라스틱 오염에 관한 우려

- 기술 전망

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 유형별

- 살균제

- 제초제

- 살충제

- 식물 생장 조절제

- 생장 촉진제 및 바이오비료

- 용도별

- 조경

- 골프장

- 운동장

- 잔디 농장

- 최종 사용자별

- 주택 고객

- 상업용 조경업자

- 스포츠 시설 오너

- 지자체 및 학교

- 작용 기전별

- 화학

- 생물학

- 통합 솔루션

- 제형별

- 과립제

- 액체 농축액

- 수용성 분말

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Syngenta AG

- Bayer Cropscience AG

- BASF SE

- UPL Limited

- Nufarm Limited

- AMVAC Chemical Corporation

- Sumitomo Group

- Bioceres LLC(Morrone Bio Innovations)

- ICL Group

- FMC Corporation

- Corteva Agriscience

- SePRO Corporation

- Gowan Company, LLC

- Koch Agronomic Services, LLC

- LebanonTurf(Lebanon Seaboard Corporation)

제7장 시장 기회와 향후 전망

KTH 25.11.20The turf protection market size stands at USD 8.7 billion in 2025 and is forecast to reach USD 12.4 billion by 2030, translating into a 7.3% CAGR over the period.

This expansion reflects accelerating investment in golf courses, professional sports venues, and high-end residential landscapes that demand resilient, visually appealing playing and leisure surfaces. Rising climate volatility, tighter player-safety standards, and the shift toward integrated pest-management programs are lifting demand for advanced fungicides, biostimulants, and precision application technologies. Biological products are registering double-digit growth as regulators scrutinize synthetic chemistries and owners look to reduce environmental footprints. On the competitive front, the top five suppliers account for the majority share in global revenue, with Syngenta accounting for the highest share, followed by Bayer CropScience yet fragmentation still enables regional specialists to penetrate niches such as biostimulants and precision-sensor packages. North America sustains leadership due to mature sports infrastructure and high household spending on lawn care, while Asia-Pacific logs the fastest gains as urbanization and mega-facility construction spur incremental demand.

Global Turf Protection Market Trends and Insights

Rising Construction of Golf Courses and Professional Sports Venues

Capital allocations for new facilities surged after the pandemic, particularly across India, China, and Gulf states, creating steady pull-through demand for hybrid turf systems that balance durability with natural playability. Professional leagues have formalized surface-quality metrics, prompting venue owners to specify fungicides, plant growth regulators, and stress-mitigation products that pass stricter safety tests. Once built, each venue requires season-long disease control, anchoring recurring revenue for suppliers. Developers also lean on integrated packages that bundle seed, nutrition, and digital monitoring, opening cross-selling opportunities in the turf protection market.

Increasing Incidence of Turfgrass Disease

Milder winters and prolonged humidity are intensifying outbreaks of dollar spot and brown patch, prompting superintendents to adopt dynamic rotation programs that respond to real-time pathogen pressure instead of calendar schedules. Research shows tall fescue plots receiving high nitrogen suffer 40% higher brown patch severity than moderately fertilized turf, underscoring the need for balanced nutrition strategies. Advanced diagnostic kits and AI models now detect dollar spot with 97% accuracy, enabling earlier interventions and optimized fungicide loads. The trend is pushing the turf protection industry toward predictive analytics and site-specific treatments that preserve beneficial soil organisms.

Rapid Penetration of Artificial Turf Solutions

Synthetic fields eliminate routine mowing and pesticide spending, enticing school boards and municipalities wrestling with labor and water constraints. Installations in the United States now run between 1,200 and 1,500 per year. Nonetheless, PFAS contamination findings and microplastic-shed estimates of 16,000 tons annually in Europe have triggered policy reviews that could stall conversions and breathe life into natural alternatives. Turf protection vendors are responding with hybrid technology and communication campaigns highlighting the health and sustainability benefits of natural systems.

Other drivers and restraints analyzed in the detailed report include:

- Growing Residential Demand for Aesthetic Lawns

- Shift Toward Biological Fungicides and Biostimulants

- Regulatory Pressure on Conventional Fungicides

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fungicides generated the largest slice of turf protection market revenue with a 38.1% share in 2024, reflecting the continual threat of dollar spot, brown patch, and Pythium. Sophisticated rotation plans mixing SDHI, QoI, and DMI chemistry remain indispensable for courses aiming to maintain tournament-grade surfaces. However, biostimulants, posting an 11.5% CAGR, highlight the market's pivot toward sustainable inputs backed by proven stress tolerance and root health gains. Herbicides corner roughly 31.4% of demand as managers tackle annual bluegrass and broadleaf weeds, while plant growth regulators find traction by trimming mower fuel and labor costs.

The turf protection market size for plant growth regulators is poised to expand alongside heightened labor constraints and sustainability targets. Iron-based alternatives and microbial cocktails now supplement conventional fungicides, demonstrating equivalent dollar spot suppression with lower environmental risk. Biologicals and synthetics are spawning co-formulations that enhance uptake and persistence, broadening choice for superintendents.

Landscaping maintained 42.5% of overall demand in 2024, supported by steady residential and commercial spending on curb appeal. Product mixes focus on broad-spectrum weed control, slow-release nutrition, and colorants that deliver a uniform appearance. In contrast, sports fields are heading the growth table at 9.8% CAGR as franchises and universities prioritize athlete safety and surface consistency. The NFL's push for standardized field testing is already shaping purchasing specifications toward high-performance fungicide programs and hybrid overseeding blends.

The turf protection market size dedicated to golf courses remains sizable at 28.6%, but growth plateaus relative to sports arenas as many mature courses transition from capital expansion to renovation mode. Sod farms, while niche, exert influence through their role in supplying disease-free rolls that demand intensive pest shielding.

The Turf Protection Market Report is Segmented by Product Type (Fungicides, Herbicides, and More), Application (Landscaping, Golf Courses, Sports Fields, and More), End-User (Residential Customers, and More), Mode of Action (Chemical, Biological, and Integrated Solution), Formulation (Granular, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Report Offers Forecasts in Terms of Value (USD).

Geography Analysis

North America retained 35.0% of global revenue in 2024, anchored by more than 15,000 golf courses and one of the world's largest portfolios of professional stadiums. The United States represents roughly 90% of regional demand and benefits from the early adoption of IoT soil probes and AI spray scheduling tools. Canada's shorter growing window concentrates disease outbreaks into intense summer peaks, encouraging premium fungicide programs. Mexico's resort corridors channel investment into salt-tolerant turf cultivars and fertility programs that thrive in coastal soils.

Asia-Pacific is projected to clock an 8.7% CAGR, the fastest worldwide. China's research institutes are expanding germplasm collections for stress-resistant turf, but course operators still import many premium cultivars. India's urban golf and cricket infrastructure underpins robust demand for fungicide and growth-regulator packages capable of withstanding monsoon swings. Japan's mature golf scene is pivoting toward precision irrigation and biological inputs to meet government sustainability targets. Australian course managers face stringent water quotas, increasing reliance on wetting agents and drought-resilient blends to safeguard playing quality.

Europe remains a technology- and regulation-driven arena. The European Commission's push for sustainable pesticide use and microplastic bans incentivizes biological programs and biodegradable carriers. Germany and the United Kingdom spearhead the uptake of connected-sensor networks that fine-tune fungicide timing. France's grounds crews are early adopters of biostimulant seed treatments to comply with national pesticide-reduction objectives, showcasing how policy influences procurement choices.

- Syngenta AG

- Bayer Cropscience AG

- BASF SE

- UPL Limited

- Nufarm Limited

- AMVAC Chemical Corporation

- Sumitomo Group

- Bioceres LLC (Morrone Bio Innovations)

- ICL Group

- FMC Corporation

- Corteva Agriscience

- SePRO Corporation

- Gowan Company, L.L.C.

- Koch Agronomic Services, LLC

- LebanonTurf (Lebanon Seaboard Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising construction of golf courses and professional sports venues

- 4.2.2 Increasing incidence of turfgrass diseases

- 4.2.3 Growing residential demand for aesthetic lawns

- 4.2.4 Shift toward biological fungicides and biostimulants

- 4.2.5 Adoption of sensor-based precision turf management

- 4.2.6 Climate-change-induced heat-stress mitigation solutions

- 4.3 Market Restraints

- 4.3.1 Rapid penetration of artificial turf solutions

- 4.3.2 High Research and Development cost for novel chemistries

- 4.3.3 Regulatory pressure on conventional fungicides

- 4.3.4 Micro- and nanoplastic pollution concerns from turf inputs

- 4.4 Technological Outlook

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Fungicides

- 5.1.2 Herbicides

- 5.1.3 Insecticides

- 5.1.4 Plant Growth Regulators

- 5.1.5 Biostimulants and Bio-fertilizers

- 5.2 By Application

- 5.2.1 Landscaping

- 5.2.2 Golf Courses

- 5.2.3 Sports Fields

- 5.2.4 Sod Farms

- 5.3 By End-user

- 5.3.1 Residential Customers

- 5.3.2 Commercial Landscape Contractors

- 5.3.3 Sports Facility Owners

- 5.3.4 Municipalities and Schools

- 5.4 By Mode of Action

- 5.4.1 Chemical

- 5.4.2 Biological

- 5.4.3 Integrated Solutions

- 5.5 By Formulation

- 5.5.1 Granular

- 5.5.2 Liquid Concentrate

- 5.5.3 Wettable Powder

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of the North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Syngenta AG

- 6.4.2 Bayer Cropscience AG

- 6.4.3 BASF SE

- 6.4.4 UPL Limited

- 6.4.5 Nufarm Limited

- 6.4.6 AMVAC Chemical Corporation

- 6.4.7 Sumitomo Group

- 6.4.8 Bioceres LLC (Morrone Bio Innovations)

- 6.4.9 ICL Group

- 6.4.10 FMC Corporation

- 6.4.11 Corteva Agriscience

- 6.4.12 SePRO Corporation

- 6.4.13 Gowan Company, L.L.C.

- 6.4.14 Koch Agronomic Services, LLC

- 6.4.15 LebanonTurf (Lebanon Seaboard Corporation)