|

시장보고서

상품코드

1439787

세계 혈관색전술 시장 : 세계 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Global Vascular Embolization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

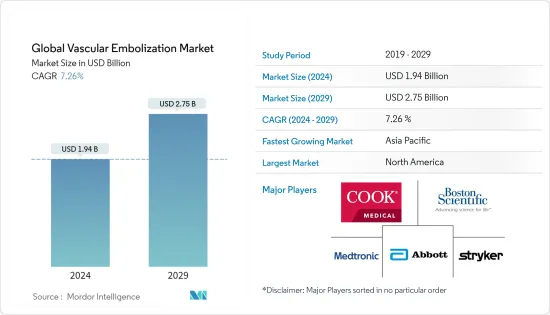

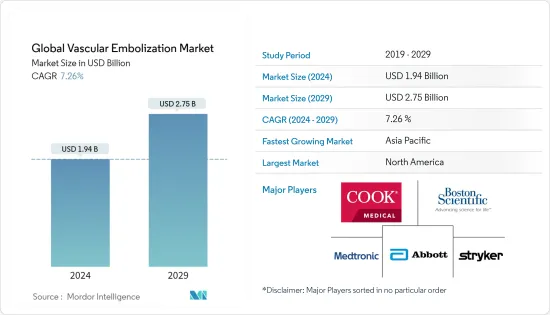

세계 혈관색전술 시장 규모는 2024년 19억 4,000만 달러로 추정되고, 2029년까지 27억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 동안 복합 연간 성장률(CAGR) 7.26%로 성장할 전망입니다.

신형 코로나바이러스 감염(COVID-19)의 유행은 세계적으로 시행된 사회적 거리 조치로 신형 코로나바이러스 이외의 적응증에 대한 병원 및 헬스케어 서비스가 크게 감소했기 때문에 혈관색전술 시장에 영향을 주었습니다. 그러나, 많은 조사 연구는 혈관 색전술이 세심한 주의와 예방책을 강구하여 실시하면 COVID-19 감염의 유행성 하에서도 안전하다는 것이 증명되었습니다. 2020년에 발표된 “COVID-19증 환자에서 행해진 기관지동맥 색전술: 내성과 결과”라는 제목의 조사 연구에 따르면, 그 결과는 기관지동맥 색전술(BAE)을 동반한 COVID-19 환자의 심각한 객혈(SH) 관리가 효과적임을 입증했습니다. 실현 가능하고 효율적이며 안전 가이드라인의 경우 인터벤셔널 방사선과(IR) 직원을 보호하는 것이 가장 중요합니다. 따라서 앞서 언급한 요인들로 인해 조사 대상 시장은 COVID-19 감염의 유행에 영향을 받을 것으로 예상됩니다.

혈관 질환의 유병률 증가, 색전 제품 및 색전술의 기술 진보, 연구 개발 활동 증가, 저침습 수술에 대한 수요 증가가 세계 혈관 색전술 시장의 주요 촉진요인이 되고 있습니다. 세계보건기구의 2020년 최신 정보에 따르면, 허혈성 심장병은 세계 연간 총 사망자 수의 16%의 원인이 되고 있습니다. 게다가 세계보건기구에 따르면 세계적으로 매년 추정 1,790만 명이 심혈관질환으로 사망하고 있습니다. 이것은 세계 사망자 수의 35%에 해당합니다. 또한 이러한 심혈관 질환으로 인한 사망의 85%는 심장 발작과 뇌졸중 때문입니다. 게다가, 2020년 7월에 Cureus Journal of Medical Science에 게재된 논문에 따르면, 허혈성 심장 질환(IHD)은 세계 주요 사망 원인이 되었습니다. 허혈성 심장 질환은 세계 약 1억 2,600만 명(10만 명당 1,655명)이 이환되어 있으며, 이는 세계 인구의 약 1.72%에 해당합니다. 허혈성 심장 질환의 세계 유병률은 관상 동맥성 심장 질환, 류마티스 성 심장 질환, 뇌 혈관 질환 및 기타 심장 질환을 포함한 심혈관 질환으로 인해 2030년까지 100,000 명당 1,845 명 초과할 것으로 예상됩니다. 세계 주요 사인 중 하나입니다.

게다가 기존의 수술에 비해 낮은 침습 수술은 수술 통증, 손상, 흉터, 입원 기간 단축, 정밀도 향상, 회복 시간 단축 등 몇 가지 장점이 있으며, 낮은 침습 풍선 혈관 성형술을 선택하는 환자가 증가하고 있습니다. 수술. 미국 심장병학회가 보고한 데이터에 따르면, 2020년에는 미국에서 연간 약 120만 건의 혈관성형술이 진행되었습니다. 또한, 전문 클리닉에 비해 병원에 접근하기 쉽고 저렴하기 때문에 많은 환자 수가 모일 것으로 예상됩니다.

또한 주요 기업 중 일부는 기존 제품과 경쟁하기 위해 새로운 제품과 기술을 개발하고 출시했으며, 다른 기업은 시장에서 동향이 있는 다른 기업을 인수합니다. 제휴하고 있습니다. 예를 들어, 2020년 2월 Merit Medical Systems Inc.의 EmboCube 및 Torpedo 장치는 혈류를 차단하는 혈관 색전술의 적응으로 FDA에 승인되어 말초 혈관계의 출혈과 출혈을 제어하는 데 도움이되었습니다. 따라서 앞서 언급한 요인들로 인해 조사 대상 부문은 예측 기간 동안 성장할 것으로 예상됩니다. 그러나 절차와 관련된 고가의 비용, 엄격한 규정 및 이러한 절차와 관련된 복잡성은 조사 대상 시장의 성장을 방해할 것으로 예상됩니다.

혈관 색전술 시장 동향

비코일링 장치 부문은 예측 기간 동안 혈관 색전 시장에서 주요 시장 점유율을 유지할 것으로 예상

만성 질환 부담 증가와 대상이 되는 환자층의 확대 등의 요인이 이 부문의 성장을 가속할 것으로 예상되고 있습니다. 세계보건기구의 2020년 보고서에 따르면 지난 20년간 만성질환 증가로 사망률이 상승하고 있으며 세계 심장병이 주요 사인이 되고 있습니다. 2000년 이후 심장병으로 인한 사망자 수는 약 200만 명 증가했으며 2019년에는 약 900만 명에 달했습니다. 미국에서는 현재 심장병이 전체 사망자의 16%를 차지하고 있습니다. 이것은 혈관 색전에 대한 잠재적인 시장 수요를 보여줍니다. 다양한 유형의 만성질환 부담이 증가함에 따라 조사 대상 시장은 향후 성장할 것으로 예상됩니다.

또한 시장 관계자는 시장에서 신제품 출시에 주력하고 있습니다. 예를 들어(2021년) 3월, 셰이프 메모리 메디컬은 IMPEDE-FX 색전 플러그와 관련하여 일본의 의약품 의료기기 종합 기구로부터 승인을 취득했습니다. 억제 색전 플러그는 말초 혈관계의 혈류를 방해하거나 혈류 속도를 감소시키는 것으로 나타났습니다. 따라서, 이러한 요인들에 의해 비-코일링 디바이스 부문은 예측 기간 동안 유리한 성장을 경험할 것으로 예상됩니다.

북미는 조사 대상 시장에서 큰 점유율을 차지하고 있으며 예측 기간 동안에도 비슷한 점유율을 획득할 것으로 예상됩니다.

북미는 암 및 혈관 관련 질환의 유병률 증가와 이 지역의 R&D 활동 증가로 세계 혈관 색전술 시장에서 주요 시장 점유율을 유지할 것으로 예상됩니다. 미국암협회의 추계에 따르면, 2020년에는 미국의 15세부터 39세까지의 청소년 및 젊은 성인(AYA) 사이에서 약 89,500명이 암으로 진단되어 약 9,270명이 암으로 사망했습니다 했습니다. 색전술은 다양한 임상 시나리오를 가진 환자에서 가장 받아 들여지는 암 치료법 중 하나입니다. 이것은 종양 내에 허혈을 일으키고 종양 괴사를 일으키기 위해 수행됩니다. 이 효과는 색전 물질에 화학요법제를 첨가함으로써 더욱 향상될 수 있습니다. 따라서 암 부담 증가로 이 지역의 색전술이 성장하고 있습니다. 뇌동맥류는 미국 국민에게 영향을 미치는 또 다른 주요 질병입니다. 뇌동맥류 재단에 의한 2019년 통계에 따르면 미국에서는 추정 650만명이 미파열 뇌동맥류를 앓고 있으며 연간 파열률은 10만명당 약 8-10명입니다. 뇌동맥류 환자의 경우, 코일 색전술은 낭을 닫고 출혈의 위험을 줄이는 물질로 동맥류를 채우는 것으로 동맥류를 치료하는 가장 흔한 저 침습 치료 중 하나입니다. 따라서 국내 질병 부담 증가로 혈관 색전술 수요가 높아질 것으로 예상됩니다.

게다가 북미는 다른 지역에 비해 기술과 연구개발 활동이 진행되고 있어 시장에 긍정적인 영향을 줄 것으로 기대되고 있습니다. 예를 들어(2021년) 3월, Instylla Inc.는 다혈관 종양 치료를 위한 매우 중요한 엠블레이스 하이드로겔 색전 시스템(HES)의 세계 무작위 임상시험에 첫 환자 등록을 보고했습니다. 했습니다.

따라서 앞서 언급한 요인들로 인해 조사대상시장은 예측기간 동안 북미에서 크게 성장할 것으로 예상됩니다.

혈관 색전술 산업 개요

혈관 색전 시장은 경쟁이 심하고 여러 주요 기업으로 구성되어 있습니다. 현재 시장을 독점하고 있는 기업은 Medtronic PLC, Cook Medical, Stryker Corporation, Boston Scientific Corporation, Abbott Laboratories, Johnson and Johnson(CERENOVUS), Merit Medical Systems Inc., Penumbra Inc., Terumo Corporation 및 Shape Memory 등이 있습니다. Medical Inc. 주요 기업은 확장, 신제품 출시, 인수 등 다양한 전략을 사용하여 이 시장의 거점을 확장했습니다. 예를 들어, 존슨 엔드 존슨은 2020년 10월에 유럽에서 완고한 혈전을 제거하고 급성 허혈성 뇌졸중 환자의 혈행 재건을 허용하는 NIMBUS를 출시했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 혈관질환의 유병률 증가

- 색전술의 제품과 처치에 있어서의 기술의 진보

- 연구개발 활동 증가

- 시장 성장 억제요인

- 색전술에 따른 고액의 비용

- 엄격한 규제 기준

- 색전술에 따른 합병증

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 색전술에 의한

- 코일링 장치

- 비코일링장치

- 용도별

- 말초 혈관 질환

- 종양학

- 신경내과

- 비뇨기과

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Medtronic PLC

- Cook Medical

- Stryker Corporation

- Boston Scientific Corporation

- Abbott Laboratories

- Johnson and Johnson(CERENOVUS)

- Merit Medical Systems Inc.

- Penumbra Inc

- Terumo Corp

- Shape Memory Medical Inc.

- B. Braun Melsungen AG

- WL Gore &Associates Inc.

제7장 시장 기회와 미래 동향

BJH 24.03.11The Global Vascular Embolization Market size is estimated at USD 1.94 billion in 2024, and is expected to reach USD 2.75 billion by 2029, growing at a CAGR of 7.26% during the forecast period (2024-2029).

The outbreak of COVID-19 impacted the vascular embolization market, as hospitals and healthcare services for non-COVID indications were significantly reduced due to social distancing measures enforced globally. However, many research studies have proven that vascular embolization techniques are safe during the COVID-19 pandemic if performed with utmost care and precautions. According to a research study titled "Bronchial Artery Embolization Performed in COVID-19 Patients: Tolerance and Outcomes", published in 2020, the results demonstrated that management of severe hemoptysis (SH) in COVID-19 patients with bronchial artery embolization (BAE) was feasible and efficient, and concerning the safety guidelines, it is of utmost importance to protect the interventional radiology (IR) staff. Thus, owing to the aforementioned factors, the studied market is expected to be impacted during the COVID-19 pandemic.

The increasing prevalence of vascular diseases, technological advancements in embolization products and procedures, increasing research and development activities, and growing demand for minimally invasive procedures are the key driving factors in the global vascular embolization market. According to the 2020 updates of the World Health Organization, ischemic heart disease is responsible for 16% of the world's total deaths annually. Additionally, according to the World Health Organization, an estimated 17.9 million people die due to cardiovascular diseases worldwide, each year. This represents 35% of global deaths. Additionally, 85% of these cardiovascular disease deaths are due to heart attack and stroke. In addition, according to the article published in Cureus Journal of Medical Science in July 2020, ischemic heart disease (IHD) is a leading cause of death worldwide. Ischemic heart disease affects around 126 million individuals (1,655 per 100,000) globally, which is approximately 1.72% of the world's population. The global prevalence of ischemic heart disease is expected to exceed 1,845 per 100,000 by the year 2030.owing to cardiovascular diseases that include coronary heart disease, rheumatic heart disease, cerebrovascular disease, and other heart conditions. It is one of the leading causes of death worldwide.

Moreover, compared to conventional surgeries, the several advantages of minimally invasive surgeries, such as reduced surgical pain, injury, scarring, hospital stay, higher accuracy, and speedy recovery time, are encouraging an increasing number of patients to opt for minimally invasive balloon angioplasty surgeries. As per the data reported by the American College of Cardiology, in 2020, approximately 1.2 million angioplasties were performed in a year in the United States. Moreover, the high accessibility and affordability of hospitals, as compared to the specialty clinics, are expected to attract a large patient population.

Also, a few of the key players are developing and launching novel products and technologies to compete with the existing products, while others are acquiring and partnering with the other companies trending in the market. For instance, in February 2020, EmboCube and Torpedo devices of Merit Medical Systems Inc. were FDA indicated for the embolization of blood vessels to occlude blood flow, thus aiding in the control of bleeding and hemorrhaging in the peripheral vasculature. Thus, owing to the aforementioned factors, the studied segment is expected to grow over the forecast period. However, the high cost associated with the procedures, stringent regulations, and complications associated with these procedures are expected to hinder the growth of the market studied.

Vascular Embolization Market Trends

The Non-coiling Devices Segment is Expected to Hold a Major Market Share in the Vascular Embolization Market over the Forecast Period

Factors such as the growing burden of chronic diseases and the expanding target patient pool are expected to propel the segment's growth. According to the World Health Organization report 2020, the mortality rate has been growing due to the number of chronic diseases increasing over the past 20 years, with heart disease being the leading cause of death worldwide. Since 2000, the number of deaths from heart disease has increased by nearly 2 million, to nearly 9 million in 2019. In the United States, heart disease now accounts for 16% of all deaths. This indicates a potential market demand for vascular embolization. Owing to the increasing burden of various types of chronic disorders, the market studied is expected to grow in the future.

Additionally, market players are focusing on the launch of new products in the market. For instance, in March 2021, Shape Memory Medical received approval from Japan's Pharmaceutical and Medical Devices Agency for IMPEDE-FX Embolization Plug. Impede embolization plugs are indicated to obstruct or reduce the rate of blood flow in the peripheral vasculature. Thus, owing to these factors, the non-coiling devices segment is expected to experience lucrative growth during the forecast period.

North America Holds a Significant Share in the Studied Market and Expected to do Same during the Forecast Period

North America is expected to hold a major market share in the global vascular embolization market due to the increasing prevalence of cancer and vascular-related diseases and increasing research and development activities in this region. According to the American Cancer Society estimates, in 2020, there were approximately 89,500 cancer cases diagnosed and about 9,270 cancer deaths among adolescents and young adults (AYAs) aged between 15 and 39 years in the United States. Embolization is one of the most accepted modalities of cancer treatment in patients with a variety of clinical scenarios. It is done to produce ischemia within the tumor, resulting in tumor necrosis. This effect may be further potentiated by the addition of a chemotherapeutic agent to the embolic material. Hence, the rising burden of cancer is giving growth to the embolization procedures in this region. Brain aneurysm is another major disorder that has affected the American population. As per 2019 Statistics by the Brain Aneurysm Foundation, an estimated 6.5 million people in the United States have an unruptured brain aneurysm, with an annual rate of rupture of approximately 8-10 per 100,000 people. In a patient with a brain aneurysm, coil embolization is one of the most common minimally-invasive procedures to treat an aneurysm by filling it with material that closes the sac and reduces the risk of bleeding. Hence, the increasing burden of diseases in the country is expected to drive the demand for vascular embolization.

Moreover, the North American region is ahead in technology and R&D activities in comparison to other regions, which is expected to positively impact the market. For instance, in March 2021, Instylla Inc. reported the enrollment of the first patients in the pivotal Embrace Hydrogel Embolic System (HES) global randomized clinical trial for the treatment of hypervascular tumors.

Thus, owing to the aforementioned factors, the studied market is expected to witness significant growth in North America over the forecast period.

Vascular Embolization Industry Overview

The vascular embolization market is highly competitive and consists of several major players. Some of the companies that are currently dominating the market are Medtronic PLC, Cook Medical, Stryker Corporation, Boston Scientific Corporation, Abbott Laboratories, Johnson and Johnson (CERENOVUS), Merit Medical Systems Inc., Penumbra Inc., Terumo Corporation, and Shape Memory Medical Inc. The major players have used various strategies such as expansions, new product launches, and acquisitions to increase their footprints in this market. For instance, in October 2020, Johnson and Johnson launched NIMBUS to remove tough clots and enable revascularization for patients with acute ischaemic stroke in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Vascular Diseases

- 4.2.2 Technological Advancements in Embolization Products and Procedures

- 4.2.3 Increasing Research and Development Activities

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Embolization Procedures

- 4.3.2 Stringent Regulatory Norms

- 4.3.3 Complications Associated with Embolization Procedures

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Embolization Technique

- 5.1.1 Coiling Devices

- 5.1.2 Non-coiling Devices

- 5.2 By Application

- 5.2.1 Peripheral Vascular Disease

- 5.2.2 Oncology

- 5.2.3 Neurology

- 5.2.4 Urology

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic PLC

- 6.1.2 Cook Medical

- 6.1.3 Stryker Corporation

- 6.1.4 Boston Scientific Corporation

- 6.1.5 Abbott Laboratories

- 6.1.6 Johnson and Johnson (CERENOVUS)

- 6.1.7 Merit Medical Systems Inc.

- 6.1.8 Penumbra Inc

- 6.1.9 Terumo Corp

- 6.1.10 Shape Memory Medical Inc.

- 6.1.11 B. Braun Melsungen AG

- 6.1.12 W. L. Gore & Associates Inc.