|

시장보고서

상품코드

1440408

가상 케어 : 세계 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2024-2029년)Global Virtual Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

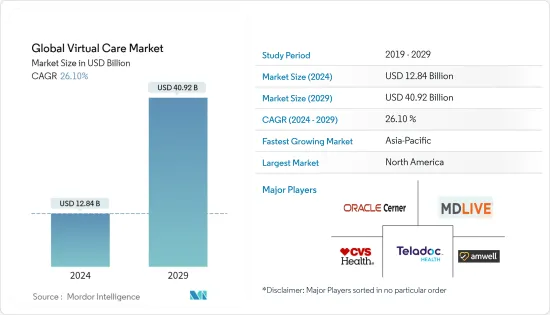

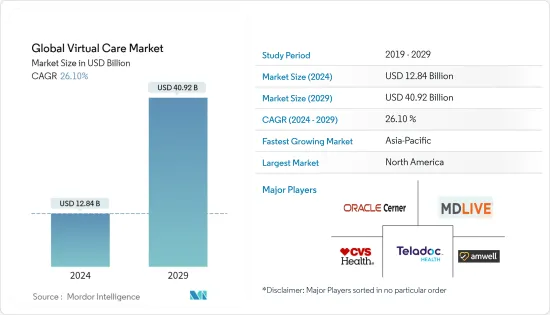

세계의 가상 케어 시장 규모는 2024년에 128억 4,000만 달러로 추정되고, 2029년까지 409억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 26.10%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다.

신형 코로나바이러스 감염증(COVID-19)의 팬데믹은 가상 케어 시장에 긍정적인 영향을 미쳤습니다. 팬데믹에 의해, 모든 연령대의 사람들 사이에 가상 케어 지원의 도입을 증가 시켰습니다. 처음 가상 케어의 개념은 청소년과 같은 특정 연령층으로 제한되었습니다. 그러나 COVID-19의 출현은 나이에 관계없이 모든 환자들 사이에서 '가상 케어'라는 용어가 매우 눈에 띄게 되었습니다. 예를 들어 2020년 6월 캐나다 의사협회(CMA)가 실시한 조사에 따르면 COVID-19 위기 중에 캐나다인의 47%가 전화, 이메일, 메시지, 비디오 등의 '가상 케어'를 이용했습니다. 91%가 방문에 매우 만족한다고 응답했습니다. 이 정보통은 팬데믹 중에 조언을 필요로 한 개인의 34%가 전화로 의사에게 연락했다고 말했습니다. 그러나 직접 의사의 진찰을 받은 것은 불과 10%, 워크인 클리닉에 간 것은 6%, 구급 외래에 간 것은 5%였습니다. 또한 Canada Health Infoway에 따르면 팬데믹이 선언되기 전에 캐나다의 기본 관리 방문의 약 4%가 원격(전화, 동영상, 텍스트 또는 앱)에서 이루어졌습니다. 따라서 이러한 사례는 팬데믹 단계에서 가상 케어 솔루션에 대한 수요가 증가했음을 보여줍니다.

또한 가상 케어가 의사와 환자 모두에게 제공하는 상호 이점은 시장 성장을 가속하는 주요 요인 중 하나입니다. 가상 케어를 통해 환자는 집에서 진찰을 받을 수 있습니다. 또한 의사는 물리적인 진단을 하지 않고도 더 많은 환자에게 가상으로 대응할 수 있으므로 환자와 의사 사이의 홈을 채우는 데 도움이 됩니다. 또한 가상 케어는 교통비나 대기 시간이 걸리지 않기 때문에 물리적 진료보다 훨씬 저렴합니다. 가상 케어의 도입이 증가함에 따라 많은 주요 기업과 소규모 기업들이 가상 케어와 관련된 서비스를 시작하게 되었습니다. 예를 들어, LifeMD는 2021년 11월에 가상 케어 플랫폼을 출시하여 세계 환자들이 합리적인 가격으로 연중 무휴로 건강 관리를 받을 수 있도록 했습니다. 마찬가지로 2022년 4월 성장 주식회사 제너럴 애틀랜틱이 주도하는 3억 달러의 시리즈 D 투자로 가상 케어와 디지털 의료의 선구자인 Biofourmis는 유니콘의 지위를 획득했습니다. Biofourmis는 이 자금 조달을 통해 가상 케어 제공을 확대할 예정입니다. 여기에는 증가하는 급성 질환 환자에게 개별화된 예측형 재택 케어를 제공하고 가상 전문 케어 서비스인 Biofourmis Care를 복잡한 만성 질환이 있는 환자로 확대하는 것이 포함됩니다. 동시에 Biofourmis는 임상시험에 자금을 제공하고 고가치 의약품과 협력하여 효율성을 높이고 디지털 건강 및 가상 퍼스트 케어 생태계에서 기업과의 전략적 관계를 구축하는 디지털 의약품 개발을 가속화할 예정입니다. 이러한 혁신은 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

따라서 위의 요인으로 조사 대상 시장은 분석 기간 동안 크게 성장할 것으로 예상됩니다. 그러나 병원 통합 문제 및 프라이버시 침해로 이어지는 데이터 침해 가능성으로 인해 시장 성장이 방해될 수 있습니다.

가상 케어 시장 동향

재택 건강 관리 부문은 예측 기간 동안 크게 성장할 것으로 예상됩니다.

재택 건강 관리 부서는 예측 기간 동안 크게 성장할 것으로 예상됩니다. COVID-19의 출현으로 환자는 점차 가상 케어 개념을 채택하고 있습니다. 이 개념은 미국과 같은 선진국에서는 이미 존재하지만 많은 신흥 국가에서는 여전히 새로운 것입니다. 신형 코로나바이러스 감염(COVID-19)의 발생으로 가상 케어는 모든 연령대에서 가장 쉽고 가장 많이 사용되는 상담 방법 중 하나로 부상했습니다.

병원의 침대 부족과 진료 대기 시간이 많아 물리적 케어에서 가상 케어로의 동향 전환에 크게 기여하고 있습니다. 예를 들어, 영국의 국민 보건 서비스는 2021년 12월에 환자를 위한 기술적 대응 가상 병동을 수립하는 지침을 발표했습니다. 가상 병동을 사용하면 일반적으로 입원하는 환자가 급성기 치료, 원격 모니터링 및 치료를 받을 수 있습니다. 그들은 케어 홈을 포함한 편안한 집에서의 생활이 필요합니다. 이 조직은 또한 기술을 통해 적절한 시기에 적절한 정보를 적절한 사람이 이용할 수 있게 함으로써 조직이 최전선에서 일하는 사람들의 스트레스를 줄이고 환자의 결과를 향상시키는 데 도움이 될 가능성이 있다고 말했습니다. 가상 병동은 집에서 안전하고 적절하게 치료하고 모니터링 할 수 있는 다양한 질병에 적합합니다. 많은 커뮤니티에서는 호흡기 질환, 심부전, 허약 관련 질환의 급성 악화와 같은 다양한 환자를 위한 가상 병동을 만들거나 만들고 있습니다. 또한 가상 방문에서는 감염 위험이 없지만 물리적 방문에서는 위험이 상대적으로 높습니다. 그러므로 이러한 사례는 가정 보건 부문이 예측 기간 동안 상당한 성장을 이룰 것으로 예상됨을 보여줍니다.

예측기간 중 북미가 가상 케어 시장을 독점할 것으로 예상됩니다.

가상 케어 모델 채용 증가, 기업 지리적 범위 확대, 가상 헬스 케어 스타트업 기업 수 급증, 주요 소규모 기업의 서비스 출시 증가 등 요인으로 북미 지역이 시장을 독점할 것으로 예측됩니다. 예를 들어, 2022년 2월, 임상의는 캐나다 최초의 아동용 가상 케어 서비스 KixCare를 시작했습니다. 따라서 이러한 개발은 이 지역 시장 성장을 가속할 것으로 예상됩니다.

게다가 주요 서비스의 시작, 가상 케어를 위한 정부의 이니셔티브, 미국 시장 관계자와 제조업체의 높은 집중도 등도 이 나라의 가상 케어 시장 성장을 가속하는 요인의 일부입니다. 예를 들어, 2022년 2월 미국 보건 복지부(HHS)가 발행한 보고서에 따르면 HHS는 지역 의료 센터를 통한 가상 의료에 대한 접근성과 질을 향상시키기 위해 약 5,500만 달러를 교부했습니다. 이 펀드는 보건 센터가 최신 혁신과 기술을 도입하여 충분한 서비스를 받지 못한 지역사회의 1차 진료 시설을 확장하는 데 도움이 됩니다. 마찬가지로 CVS Health는 2022년 5월에 단일 디지털 플랫폼에서 액세스할 수 있는 새로운 가상 케어 솔루션인 CVS Health Virtual Primary Care를 도입했습니다. 보다 조정된 소비자 중심의 건강 관리 경험을 위해 이 솔루션은 CVS Health 서비스, 임상 전문 지식 및 데이터를 통합합니다. 따라서 이러한 요인은 예측 기간 동안 미국 시장 성장을 가속할 것으로 예상됩니다. 따라서 앞서 언급한 요인으로 인해 조사 대상 시장은 북미에서의 성장이 예상됩니다.

가상 케어 산업 개요

가상 케어 시장은 세계적으로 그리고 지역적으로 사업을 전개하는 다수의 기업이 존재하기 때문에 본질적으로 세분화됩니다. 경쟁 구도에는 Teladoc Health, Inc., American Well Corporation, United Healthcare Services, Inc., CVS Health, MDLIVE, Medocity, Inc., Amazon.com, Inc., VirtualHealth, General Electric Company 및 Cerner Corporation 등 시장 점유율을 보유하고 잘 알려진 몇몇 국제 및 현지 기업에 대한 분석이 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건 및 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 가상 케어를 채용하는 환자 수 증가 및 가상 케어에 대한 정부의 대처

- 가상 케어의 장점 및 시장 관계자에 의한 신서비스 개시

- 시장 성장 억제요인

- 의사의 지원 부족 및 프라이버시에 대한 우려에 의한 병원 통합의 문제

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화(금액별 시장 규모)

- 배송 방법별

- 비디오

- 오디오

- 메시징

- 컴포넌트별

- 솔루션

- 서비스

- 최종 사용자별

- 재택 헬스케어

- 병원

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Teladoc Health, Inc.

- American Well Corporation

- United HealthCare Services, Inc.

- CVS Health

- MDLIVE

- Medocity, Inc.

- Amazon.com, Inc.

- VirtualHealth

- General Electric Company

- Oracle Corporation(Cerner)

제7장 시장 기회 및 미래 동향

AJY 24.03.15The Global Virtual Care Market size is estimated at USD 12.84 billion in 2024, and is expected to reach USD 40.92 billion by 2029, growing at a CAGR of 26.10% during the forecast period (2024-2029).

The COVID-19 pandemic had a positive impact on the virtual care market. The pandemic has increased the adoption of virtual care assistance among people of all age groups. Initially, the concept of virtual care was restricted to certain age groups, such as youngsters. However, with the advent of COVID-19, the term "virtual care" gained significant prominence among all patients, irrespective of their age. For instance, as per the survey conducted by the Canadian Medical Association (CMA) in June 2020, during the COVID-19 crisis, 47% of Canadians used "virtual care" such as phone calls, emails, messages, or videos during the outbreak. Ninety-one percent indicated they were incredibly satisfied with their visit. The same source further stated that 34% of individuals who required advice during the pandemic contacted their doctor by phone. However, only 10% saw a doctor in person, 6% went to a walk-in clinic, and 5% went to an emergency department. Furthermore, according to Canada Health Infoway, about 4% of primary care visits in Canada were done remotely (by phone, video, text, or app) before the pandemic was declared. Therefore, such instances indicate the demand for virtual care solutions bolstered during the pandemic phase.

Furthermore, the mutual advantages offered by virtual care for both doctors and patients are one of the major factors driving the market's growth. Through virtual care, patients can undergo consultation from home. It also helps to bridge the gap between patient and doctor, as doctors can reach out to more patients virtually rather than through physical consultation. In addition, virtual care is much more inexpensive than physical consultation as no traveling costs or waiting time are involved. The rising adoption of virtual care has encouraged many key and small players to launch services related to virtual care. For instance, in November 2021, LifeMD launched its virtual care platform to enable affordable and accessible healthcare 24/7 to patients globally. Likewise, in April 2022, with a USD 300 million Series D investment led by growth equity company General Atlantic, Biofourmis, a pioneer in virtual care and digital medicine, achieved unicorn status. Biofourmis intends to expand its virtual care offerings with this financing. This involves providing individualized and predictive in-home care to an increasing number of acutely ill patients and expanding Biofourmis Care, its virtual specialist care service, to patients with complicated chronic diseases. Parallelly, Biofourmis intends to fund clinical trials to accelerate the development of digital medicines that collaborate with high-value medications to boost efficacy and build strategic relationships with firms in digital health and virtual-first care ecosystems. Such innovations are anticipated to drive the market over the forecast period.

Therefore, owing to the above-mentioned factors, the studied market is anticipated to witness considerable growth over the analysis period. However, hospital integration issues and the chances of data breaches leading to compromised privacy are likely to impede the market's growth.

Virtual Care Market Trends

Home Healthcare Segment is Expected to Witness Significant Growth Over the Forecast Period

The home healthcare segment is anticipated to witness significant growth over the forecast period. With the advent of COVID-19, patients are gradually adopting the virtual care concept. Although the concept already exists in developed countries such as the United States, it is still new in many developing countries. With the onset of COVID-19, virtual care has emerged as one of the easiest and most utilized modes of consultation among all age groups.

The lack of beds and high consultation waiting time in hospitals have majorly contributed to the shift of the physical to virtual care trend. For instance, the National Health Service in the United Kingdom published a guideline on establishing technology-enabled virtual wards for patients in December 2021. Virtual wards enable patients who would normally be admitted to the hospital to receive the acute care, remote monitoring, and therapy they require in the comfort of their own homes, including care homes. The organization further stated that by making the appropriate information available to the right people at the right time, technology might help organizations lessen the stress on frontline workers and enhance patient outcomes. Virtual wards are appropriate for a variety of illnesses that can be handled and monitored safely and successfully at home. Many communities have created or are working to create virtual wards for a variety of patients, including those with respiratory issues, heart failure, or acute exacerbations of a frailty-related ailment. In addition, there is no risk of getting any infections during virtual visits, while in physical visits, the risk is comparatively high. Therefore, such instances indicate that the home healthcare segment is expected to witness significant growth over the forecast period.

North America is Expected to Dominate the Virtual Care Market Over the Forecast Period

North America is expected to dominate the market owing to factors such as increasing adoption of virtual care models, expanding the geographical reach of the companies, a surge in the number of virtual healthcare start-ups, and growing service launches by key and small players operating in this region. For instance, in February 2022, Clinicians launched the first virtual care service, KixCare, for kids in Canada. Therefore, such developments are anticipated to propel the market's growth in this region.

Moreover, key service launches, government initiatives toward virtual care, and a high concentration of market players or manufacturers' presence in the United States are some of the other factors driving the growth of the virtual care market in the country. For instance, as per the report published by the US Department of Health & Human Services (HHS) in February 2022, HHS awarded around USD 55 million to increase virtual health care access and quality through community health care centers. The funding will help the health centers adopt the latest innovations and technologies to expand facilities for primary care for underserved communities. Likewise, in May 2022, CVS Health introduced CVS Health Virtual Primary Care, a new virtual care solution accessible via a single digital platform. For a more coordinated and consumer-centric health care experience, the solution integrates CVS Health's services, clinical expertise, and data. Hence, such factors are anticipated to propel the market growth in the United States over the forecast period. Therefore, owing to the aforementioned factors, the growth of the studied market is anticipated in the North American region.

Virtual Care Industry Overview

The virtual care market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold the market shares and are well known, including Teladoc Health, Inc., American Well Corporation, United HealthCare Services, Inc., CVS Health, MDLIVE, Medocity, Inc., Amazon.com, Inc., VirtualHealth, General Electric Company, and Cerner Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Patients Adopting Virtual Care and Government Initiatives Towards Virtual Care Access

- 4.2.2 Advantages Of Virtual Care and New Service Launches by Market Players

- 4.3 Market Restraints

- 4.3.1 Lack of Physician Support and Hospital Integration Issues Due to Privacy Concerns

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers and Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD Million)

- 5.1 By Mode of Delivery

- 5.1.1 Video

- 5.1.2 Audio

- 5.1.3 Messaging

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By End Users

- 5.3.1 Home Healthcare

- 5.3.2 Hospitals

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Teladoc Health, Inc.

- 6.1.2 American Well Corporation

- 6.1.3 United HealthCare Services, Inc.

- 6.1.4 CVS Health

- 6.1.5 MDLIVE

- 6.1.6 Medocity, Inc.

- 6.1.7 Amazon.com, Inc.

- 6.1.8 VirtualHealth

- 6.1.9 General Electric Company

- 6.1.10 Oracle Corporation (Cerner)