|

시장보고서

상품코드

1639503

요소 포름알데히드 수지 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Urea Formaldehyde Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

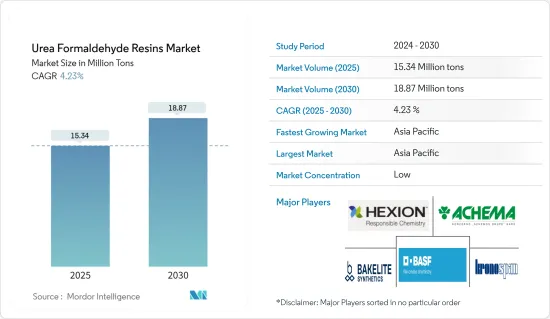

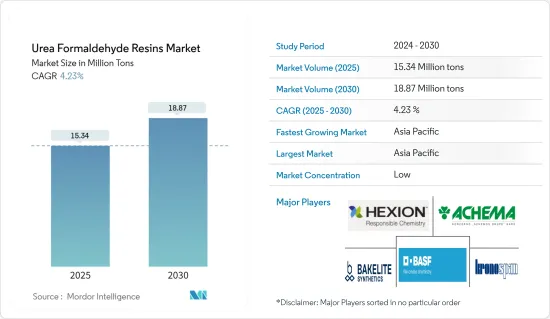

요소 포름알데히드 수지 시장 규모는 2025년에 1,534만 톤으로 추정되며, 예측 기간(2025-2030년) 동안 4.23%의 CAGR로 2030년에는 1,887만 톤에 달할 것으로 예상됩니다.

COVID-19 전염병은 요소 포름알데히드 시장에 부정적인 영향을 미쳤습니다. 전 세계 봉쇄와 엄격한 정부 규제로 인해 대부분의 생산 기지가 폐쇄되어 큰 타격을 입었습니다. 그럼에도 불구하고 시장은 2021년에 회복되고 향후 몇 년 동안 크게 상승할 것으로 예상됩니다.

주요 하이라이트

- 단기적으로는 가구 부문의 파티클보드 수요 증가와 중밀도 섬유판(MDF) 수요 증가가 시장 성장을 견인할 것으로 예상됩니다.

- 그러나 우레아-포름알데히드 수지와 관련된 건강상의 문제가 시장 성장의 걸림돌이 될 것으로 예상됩니다.

- 자동차 및 가전제품의 고품질 수지에 대한 수요는 조사 대상 시장에서 새로운 기회를 창출할 것으로 예상됩니다.

- 아시아태평양이 세계 시장을 독점하고 있으며, 중국과 인도에서 가장 많이 소비하고 있습니다.

요소 포름알데히드 수지 시장 동향

건축 및 건설 부문이 시장을 독점할 것으로 예측

- 파티클보드, 합판, 중밀도 섬유판과 같은 재료에 크게 의존하는 건축 및 건설 부문은 요소 포름알데히드 수지 시장의 성장을 촉진하는 중요한 요인입니다.

- 건설 활동이 증가함에 따라 이러한 건축자재에 대한 수요와 생산도 증가합니다. 보드와 합판에서 요소 포름알데히드의 광범위한 사용은 그 중요성을 강조하고 요소 포름알데히드 시장의 전반적인 성장을 촉진하고 있습니다.

- Oxford Economics는 세계 건설 생산량이 견조한 성장 궤도를 그릴 것으로 예측하고 있으며, 2037년까지 4조 2,000억 달러 이상에서 13조 9,000억 달러 이상으로 증가할 것으로 전망하고 있습니다.

- 아시아태평양과 북미 모두 주택 건설이 급증하고 있습니다. 아시아태평양에서는 인도, 중국, 필리핀, 베트남, 인도네시아 등의 국가들이 선두를 달리고 있습니다. 반면, 북미의 주택 건설은 인구 증가, 이민자 증가, 핵가족화 추세에 힘입어 성장하고 있습니다.

- 한국의 건설산업은 주요 경제 기여자이자 외환 및 수출 수익의 중요한 원천입니다. 국내 건설시장 규모는 민간 주택건설의 견조한 성장에 힘입어 확대되고 있습니다.

- 정부는 또한 2025년까지 서울과 다른 도시에 83만 가구의 주택을 공급하는 대규모 재개발 사업을 시행할 계획입니다. 서울에 32만3,000가구, 경기도와 인천에 29만3,000가구가 새로 건설됩니다. 부산, 대구, 대전 등 대도시도 4년간 22만 가구의 신규 주택 공급 혜택을 받습니다.

- 주택시장 상승에 따라 중국과 인도를 필두로 한 아시아태평양이 세계 주택 건설 러시를 주도할 것으로 보입니다.

- 전 세계 건설 투자의 20%를 차지하는 중국은 2030년까지 약 13조 달러를 건축에 투자할 것으로 예상되며, 이는 니오브 시장의 낙관적인 전망을 뒷받침하고 있습니다.

- 그 중요성을 인식한 인도 정부는 13억 인구의 주택 수요를 충족시키기 위해 주택 건설에 대한 노력을 강화하고 있습니다.

- National Real Estate Development Corporation(NAREDCO)의 보고서에 따르면, 2023년에는 상위 7개 도시에서 총 43만 5,000채의 주택이 완공될 예정이며, 2024년에는 그 수가 크게 증가할 것으로 예상됩니다. 이러한 추세를 더욱 뒷받침하기 위해 노이다에 기반을 둔 저명한 부동산 개발업체인 카운티 그룹(County Group)은 올해 3개의 야심찬 주택 프로젝트에서 400만 평방피트 이상의 주택을 발표할 예정입니다.

- 북미 건설 산업을 지배하는 것은 미국이며, 캐나다와 멕시코도 많은 투자를 하고 있습니다. 미국 인구조사국에 따르면 미국의 신축 주택 수는 2023년 4.46% 증가하여 2022년 139,500가구에서 145,000가구로 증가할 것으로 예상했습니다. 또한, 미국의 연간 건설액은 2023년 1조 9,700억 달러로 2022년 1조 8,400억 달러에서 7% 증가할 것으로 예상됩니다.

- 캐나다에서는 Affordable Housing Initiative(AHI), New Building Canada Plan(NBCP), Made in Canada와 같은 정부 이니셔티브가 건설 부문을 크게 강화할 준비가 되어 있습니다. 이상의 대규모 투자를 발표했으며, 상당수의 저렴한 주택을 포함하여 전국적으로 약 17,000채의 주택 개발을 목표로 하고 있습니다.

- 이러한 움직임에 비추어 볼 때, 건축 및 건설 부문은 예측 기간 동안에도 시장의 주도적인 위치를 유지할 것으로 보입니다.

아시아태평양이 시장을 장악

- 중국과 인도를 필두로 아시아태평양이 세계 시장을 독점하고 있습니다.

- 중국은 세계 최고의 요소 포름알데히드 수지 생산국으로서 매우 중요한 역할을 하고 있습니다. 인구가 증가함에 따라 중국의 농업 부문은 식량 수요 증가에 대응하기 위해 진화하고 있습니다. 이러한 진화는 비료의 성능과 효율성에 달려 있으며, 요소 포름알데히드 수지의 소비를 증가시키고 있습니다.

- 세계 최대 건설 시장인 중국은 전 세계 건설 투자의 20%를 차지하고 있습니다. 예측에 따르면 중국은 2030년까지 약 13조 달러를 건축에 투자할 것으로 예상되며, 이는 견조한 시장 전망을 보여줍니다. 주택 수요의 증가는 고층 빌딩과 호텔의 현저한 증가와 함께 공공 및 민간 주택 건설을 촉진할 것입니다.

- 저비용 주택 프로젝트를 가속화하기 위해 홍콩 주택 당국은 2030년까지 30만 1,000채의 공공주택 공급을 목표로 하는 구상을 발표했습니다.

- 건축 외에도 요소 포름알데히드 수지는 섬유판 제조에서 중요한 역할을 하고 있습니다. 이 섬유판은 자동차 부문에서 대시보드 및 도어 쉘과 같은 부품을 성형하는 데 사용됩니다. 중국자동차공업협회(CAAM)가 발표한 최신 데이터에 따르면 2023년 자동차 생산량은 3,016만 대를 넘어 전년 대비 11.6% 증가할 것이며, 2023년 국내 승용차 판매량은 3,009만 대로 전년 대비 12% 증가할 것으로 예상됩니다.

- 인도자동차제조협회(SIAM)가 발표한 자료에 따르면, 2023년 자동차 생산량은 458만 대, 2022년 생산량은 365만 대로, 2023년 자동차 생산량은 전년 대비 약 25% 증가했습니다.

- 인도의 전자제품 제조 부문은 꾸준히 성장하고 있으며, 정부의 호의적인 조치에 힘입어 성장하고 있습니다. 인도는 2023년 8월, 국내 전자제품 제조를 지원하기 위해 1억 1,400만 달러의 예산으로 M-SIPS(Modified Incentive Special Package Scheme)와 EDF(Electronics Development Fund)를 출범시켰습니다. Special Package Scheme)와 EDF(Electronics Development Fund)를 출범시켰습니다.

- 이러한 역학관계로 인해 아시아태평양은 예측 기간 동안 시장 우위를 유지할 것으로 보입니다.

요소 포름알데히드 수지 산업 개요

세계 요소 포름알데히드 수지 시장은 세분화되어 있습니다. 시장 주요 기업으로는 Achema, BASF SE, Hexion, Kronoplus Limited, Bakelite Synthetics 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 중밀도 섬유판(MDF) 수요 증가

- 가구 부문의 파티클보드 수요 증가

- 기타 촉진요인

- 성장 억제요인

- 요소 포름알데히드 수지에 관한 건강 피해

- 기타 성장 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(시장 규모(수량 기준))

- 용도별

- 파티클보드

- 목재 접착제

- 합판

- 중밀도 섬유판

- 기타

- 최종 이용 산업별

- 자동차

- 전기제품

- 농업

- 건축·건설

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트

- 나이지리아

- 이집트

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- Achema

- ARCL Organics Ltd

- Arclin Inc.

- Ashland

- Asta Chemicals

- Bakelite Synthetics

- BASF SE

- Hexion

- Hexza Corporation Berhad

- Jiangsu Sanmu Group Co. Ltd

- Kronoplus Limited

- Melamin kemicna tovarna d.d. Kocevje

- Metadynea Metafrax Group

- QAFCO

- SABIC

제7장 시장 기회와 향후 동향

- 자동차와 가전제품의 고품질 수지 수요 증가

- 기타 기회

The Urea Formaldehyde Resins Market size is estimated at 15.34 million tons in 2025, and is expected to reach 18.87 million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The COVID-19 epidemic negatively impacted the urea formaldehyde market. Global lockdowns and severe government rules resulted in a catastrophic setback, as most production hubs were shut down. Nonetheless, the market recovered in 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the growing demand for particle boards from the furniture sector and the increasing demand for medium-density fiberboard (MDF) are expected to drive the market's growth.

- However, health hazards regarding urea-formaldehyde resins are expected to hinder the market's growth.

- Nevertheless, the demand for good-quality resins in automobiles and electrical appliances is expected to create new opportunities for the market studied.

- Asia-Pacific dominates the market globally, with the most consumption from China and India.

Urea Formaldehyde Resins Market Trends

Building and Construction Segment Anticipated to Dominate the Market

- The building and construction sector, heavily dependent on materials like particle boards, plywood, and medium-density fiberboard, is a crucial driver of the urea formaldehyde resin market's growth.

- As construction activities ramp up, so does the demand and production of these building materials. The extensive use of urea-formaldehyde in boards and plywood underscores its importance and propels the overall growth of the urea-formaldehyde market.

- Oxford Economics forecasts a robust growth trajectory for global construction output, projecting an increase from over USD 4.2 trillion to a staggering USD 13.9 trillion by 2037, predominantly fueled by the construction powerhouses of China, the United States, and India.

- Both Asia-Pacific and North America are experiencing a surge in residential construction. Countries like India, China, the Philippines, Vietnam, and Indonesia are at the forefront in Asia-Pacific. Meanwhile, North America's residential construction is buoyed by a growing population, rising immigration, and the trend toward nuclear families.

- South Korea's construction industry is a major economic contributor and an essential source of foreign exchange and export earnings. The size of South Korea's local construction market is expanding mainly due to solid growth in private residential construction.

- The government has also planned to execute large-scale redevelopment projects to supply 830,000 housing units in Seoul and other cities by 2025. From the planned construction, Seoul will get 323,000 new houses, and 293,000 will be built near Gyeonggi Province and Incheon. Major cities like Busan, Daegu, and Daejeon will also benefit with 220,000 new houses in 4 years.

- With housing markets rising, the Asia-Pacific region, spearheaded by China and India, is set to lead the global surge in housing construction.

- China, commanding 20% of the world's construction investments, is projected to channel nearly USD 13 trillion into buildings by 2030, underscoring a bullish outlook for the niobium market.

- Recognizing its significance, the Indian government is ramping up housing construction efforts, aiming to cater to the needs of its 1.3 billion citizens.

- Highlighting India's momentum, the National Real Estate Development Corporation (NAREDCO) reports that the top 7 cities collectively completed 4.35 lakh units in 2023, with 2024 poised for a substantial uptick. Further underscoring this trend, County Group, a prominent Noida-based real estate developer, is set to unveil over 4 million sq. ft across three ambitious housing projects this year.

- The United States dominates the construction industry in North America, with Canada and Mexico also making substantial investments. According to the US Census Bureau, the United States saw a 4.46% increase in new housing units in 2023, reaching 1,452 thousand units, up from 1,390.5 thousand in 2022. Additionally, the annual construction value in the country hit USD 1.97 trillion in 2023, marking a 7% rise from USD 1.84 trillion in 2022.

- In Canada, government initiatives like the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada are poised to bolster the construction sector significantly. In August 2022, the Canadian government unveiled a major investment exceeding USD 2 billion for these initiatives, aiming to develop around 17,000 homes nationwide, including a substantial number of affordable units.

- Given these dynamics, the building and construction segment is poised to retain its leading position in the market during the forecast period.

Asia-Pacific to Dominate the Market

- With China and India at the forefront, the Asia-Pacific region dominates the global market.

- China plays a pivotal role as the world's top producer of urea formaldehyde resins. With its growing population, China's agricultural sector is evolving to meet rising food demands. This evolution hinges on fertilizer performance and efficiency, boosting the consumption of urea formaldehyde resins.

- Boasting the world's largest construction market, China accounts for 20% of global construction investments. Projections indicate that by 2030, China is expected to invest nearly USD 13 trillion in buildings, signaling a robust market outlook. The nation's escalating housing demand is set to bolster public and private residential construction, with a notable uptick in tall buildings and hotels.

- To accelerate low-cost housing projects, Hong Kong's housing authorities have unveiled initiatives targeting the delivery of 301,000 public housing units by 2030.

- Beyond construction, urea formaldehyde resin plays a pivotal role in fiberboard production. This fiberboard finds its application in the automotive sector, shaping components like dashboards and door shells. According to the latest data released by the China Association of Automobile Manufacturers (CAAM), car production in the country it exceeded 30.16 million units in the year 2023, registering an 11.6% increase compared to the previous year. A total of 30.09 million units of passenger cars were sold in the country in 2023, registering a 12% increase compared to last year.

- According to the data released by the Society of India Automotive Manufacturing (SIAM), 4.58 million automotive vehicles were manufactured in the FY2023, compared to 3.65 million vehicles produced in 2022. The country saw a rise of around 25% in automotive production in 2023 compared to the previous year.

- India's electronics manufacturing sector is growing steadily and is driven by favorable government policies. These include 100% Foreign Direct Investment (FDI), no industrial license requirements, and a shift to automated production. In August 2023, India launched the Modified Incentive Special Package Scheme (M-SIPS) and the Electronics Development Fund (EDF), with a budget of USD 114 million to support domestic electronics manufacturing.

- Given these dynamics, the Asia-Pacific region is set to uphold its market dominance throughout the forecast period.

Urea Formaldehyde Resins Industry Overview

The global urea formaldehyde resins market is fragmented in nature. The major players in the market (not in a particular order) include Achema, BASF SE, Hexion, Kronoplus Limited, and Bakelite Synthetics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Medium Density Fiberboard (MDF)

- 4.1.2 Rising Demand for Particle Board in the Furniture Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazards Regarding Urea Formaldehyde Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Particle Board

- 5.1.2 Wood Adhesives

- 5.1.3 Plywood

- 5.1.4 Medium Density Fiberboard

- 5.1.5 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical Appliances

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Achema

- 6.4.2 ARCL Organics Ltd

- 6.4.3 Arclin Inc.

- 6.4.4 Ashland

- 6.4.5 Asta Chemicals

- 6.4.6 Bakelite Synthetics

- 6.4.7 BASF SE

- 6.4.8 Hexion

- 6.4.9 Hexza Corporation Berhad

- 6.4.10 Jiangsu Sanmu Group Co. Ltd

- 6.4.11 Kronoplus Limited

- 6.4.12 Melamin kemicna tovarna d.d. Kocevje

- 6.4.13 Metadynea Metafrax Group

- 6.4.14 QAFCO

- 6.4.15 SABIC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Good Quality Resins in Automobile and Electrical Appliances

- 7.2 Other Opportunities