|

시장보고서

상품코드

1910523

물류 자동화 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Logistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

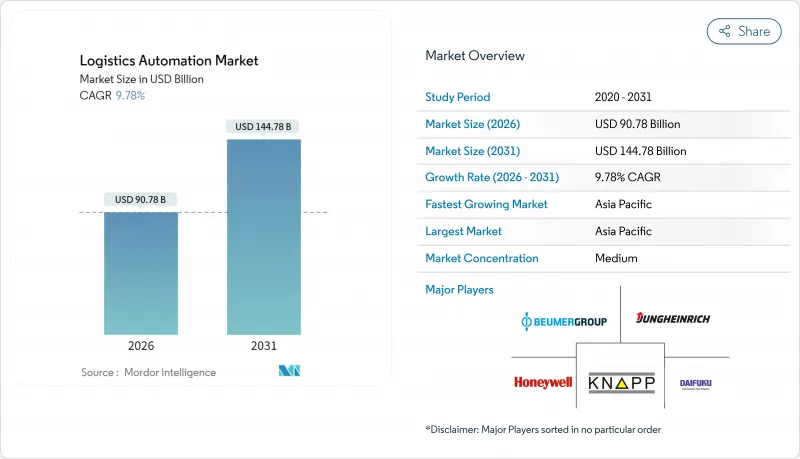

2026년 물류 자동화 시장 규모는 907억 8,000만 달러로 추정되며, 2025년 826억 9,000만 달러에서 성장이 예상됩니다.

2031년까지의 예측으로는 1,447억 8,000만 달러에 달하고, 2026년부터 2031년에 걸쳐 CAGR 9.78%를 나타낼 전망입니다.

전자상거래의 소포 취급량 증가, 심각한 노동력 부족, 기업의 넷 제로 목표의 확대에 의해 자동화는 전술적인 선택으로부터 현대공급 체인 설계에 있어서 필수적인 기둥으로 변모하고 있습니다. 소매 기업은 현재 자동화된 주문 처리 능력을 임금 인플레이션 대책으로 자리 매김하고 있습니다. 또한 창고 내 5G와 프라이빗 LTE 네트워크의 융합으로 기존에 불가능했던 로봇과 야드 차량 간의 실시간 연계가 가능해졌습니다. 환경 목표도 자본 지출의 우선 순위에 영향을 미치고 있으며, 그린 본드에 의한 자금 조달은 피킹·보관·수송에 있어서 에너지 절약 시스템에 대한 투자와 연결되는 경향이 강해지고 있습니다. 이러한 배경을 바탕으로 현재는 반자동화 도입이 주류이지만 AI 비전 기술과 기능 안전 칩의 인증 장벽이 해소되어 실행 위험의 인식이 저하됨에 따라 완전 자동화 프로젝트가 급속히 확대되고 있습니다. 지역별로는 아시아태평양이 새로운 전개를 보이고 있으며, 정부 보조금, 신규 시설 증가, 민간 5G 파일럿 사업의 급증이 함께, 이 지역은 최대이고 가장 빠른 성장 시장 거점이 되고 있습니다.

세계의 물류 자동화 시장 동향과 인사이트

급증하는 전자상거래 소포량이 인프라 현대화를 추진

Fullfilment 사업자는 현재 일년 내내 바쁜 기간의 주문 처리 속도에 직면하고 있으며, 배치 픽킹에서 지속적인 '상품에서 사람'으로의 흐름으로의 전환을 강요하고 있습니다. 이렇게 하면 인력을 늘리지 않고 사이클 시간을 단축할 수 있습니다. 클로거 등 소매업체는 오카도와의 자동화 제휴를 강화하고, 수작업으로는 유지 불가능한 당일 식료품 배달 서비스 수준을 보증하고 있습니다. 병렬로 진행된 적정 규모화 기술로 UPS는 안정적인 처리 목표를 유지하면서 포장 폐기물을 30% 삭감할 수 있었습니다. 고밀도의 도시형 마이크로플루필먼트 허브가 급증하고 있어, 인도만으로도 2027년까지 3,500만 평방 피트를 넘는 규모에 이를 것으로 예측되고 있습니다. 이를 통해 비용 제약이 있는 도시형 창고에서 입방 피트 단위의 수익화를 가능하게 하는 고효율 자동화에 대한 수요가 더욱 높아지고 있습니다. 자동화된 카톤 봉합, 라벨 부착, 라스트마일 수교 등 공정에의 속도 요구가 확대되어, 로보틱스가 E커머스 워크플로우 전체에 통합되고 있습니다. 이러한 요인이 결합되어 물류 자동화 시장의 단기 성장 엔진을 지원합니다.

노동력 부족 심각화가 자동화 투자주기 가속화

인구동태의 역풍에 의해 특히 북미와 유럽에 있어서 노동력의 확보가 전략적 병목이 되고 있습니다. 인도의 PMI는 2024년 3월에 16년 만의 높은 수준을 기록했지만, NIDO그룹 등의 통합업체는 숙련 노동자가 부족한 지방도시를 위한 무인화물 이동 플랫폼을 전개하고 있습니다. 협동형 자율이동 로봇(AMR)이 이 희박함을 완화하고 있습니다. Fleet Feet사에 의하면, 반복적인 반송 업무를 이동 로봇이 담당하는 것으로 생산성이 2-3배 향상해, 인간의 직원은 예외 처리 업무에 전념할 수 있게 되었다고 합니다. 로봇 서비스 계약이 증가하고 있는 배경에는 기업이 장기적인 인건비 부담 없이 계절적인 처리 능력을 확보하고자 하는 요구가 있습니다. 제조업 확대가 노동력 증가를 상회하는 아시아태평양에서는 이러한 모델이 도입 경제성을 재정의하고 있습니다. 노동력 공급 제약과 유연한 자금 조달 옵션의 조합은 물류 자동화 시장을 추진하고 있습니다.

고액의 초기 투자가 중소기업 도입을 막는다.

구조 개조와 신규 설비를 결합한 종합적인 창고 프로젝트는 500만 달러를 초과할 수 있으며, 많은 중소기업들이 진입을 망설이고 있습니다. 오토스토어가 추진하는 '피킹당 과금' 구독 프로그램은 그리드 설치 비용을 최대 40% 절감하지만 건설비와 시스템 통합 비용은 면제되지 않습니다. 통화 변동에 직면한 신흥 시장에서는 저렴한 자금 조달이 가장 어려워 위험 인식을 높이고 있습니다. 그 결과, 렌탈이나 서비스 기반의 모델을 채용하는 벤더의 점유율이 확대되고, 대형 인티그레이터는 틈새 로봇 기업을 인수하고 대출자가 대출 심사하기 쉬운 턴키 패키지를 구축하고 있습니다. 진전이 있는 것, 설비투자(CAPEX)는 여전히 물류 자동화 시장에서 가장 완고한 단기적인 브레이크 요인입니다.

부문 분석

물류 자동화 시장에서 2025년의 수익구성비에서 창고업무는 59.55%를 차지했습니다. 이는 상품 반송식 피킹 스테이션, 자동 창고, 로봇 분류 시스템이 기업에 가져오는 즉각적인 투자 회수율(ROI)을 뒷받침합니다. 이러한 입증된 기술은 관리된 환경에서 진가를 발휘하며, 소매업체는 직원을 증원하지 않고 판매주에서 출하까지의 사이클을 단축할 수 있습니다. 운송 자동화는 현시점에서는 규모가 작은 것, 자율주행 트럭이나 야드 트랙터가 시험 운용으로부터 수익화 단계로 이행함에 따라, 특히 신뢰성이 높은 화물 운송 회랑에 있어서, 2031년까지 연평균 복합 성장률(CAGR) 11.05%를 나타낼 것으로 전망되고 있습니다.

창고 분야의 리더십은 지속적인 혁신으로 유지됩니다. 오토스토어사가 2025년에 도입한 「CarouselAI」는 기존 시설에서도 콘크리트 메자닌 공사 없이 확장 가능한 개조 대응형의 로봇 피스 피킹을 실현합니다. 그러나 기능 경계는 모호해지고 있습니다. CJ 로지스틱스 등 시설에서의 프라이빗 5G 도입은 실내 로봇과 자율주행 야드 차량을 통합하여 도크 도어의 혼잡을 경감하는 통일 데이터 기반을 구축하고 있습니다. 예측 기간 동안 통합 오케스트레이션 플랫폼이 지출을 크로스 펑셔널 솔루션으로 이동시킬 수 있지만 창고는 물류 자동화 시장의 볼륨 앵커로서의 지위를 유지할 것으로 예측됩니다.

지역별 분석

아시아태평양은 2025년 수익의 31.30%를 차지했으며, 2031년까지 연평균 복합 성장률(CAGR) 11.56%를 나타낼 것으로 예측되고 있으며, 물류 자동화 시장에서 최대이고 가장 빠른 성장의 거점이라는 이중 특성을 가진 지역으로 자리매김하고 있습니다. 중국은 11년 연속 세계 최대의 산업용 로봇 구매국이며 2023년에는 43만대를 생산함과 동시에 국내 도입 촉진을 위해 설비 비용의 약 17.5%를 보조했습니다. 인도 시장도 상보적인 기세를 보이고 있습니다. 국가물류정책에 의한 물류비용의 GDP 대비 10% 삭감 목표와 도시문에서의 마이크로플루필먼트 수요의 급증을 배경으로 2027년까지 2억 9,000만 평방피트에서 4억 평방피트로 확대될 전망입니다.

북미는 여전히 기간 시장이며, 복잡한 레거시 IT 시스템과 엄격한 사이버 보안 규제가 프로젝트 사이클을 연장하는 한편, 높은 인건비가 자동화 투자 회수율을 강화하고 있습니다. 미국 외국 무역 지역의 확대는 분산형 재고 전략을 지원하고 최종 판매까지의 관세 부담에서 자동화 허브를 해방함과 동시에 월경 EC의 경쟁력을 높이고 있습니다. 유럽은 비슷한 경향을 보이고 있지만 탄소 감축에 대한 규제 우대 조치가 추가되어 에너지 효율적인 자동 창고 시스템(AS/RS) 및 AI 경로 계획 도구로의 자본 유입을 촉진하고 있습니다.

라틴아메리카, 중동 및 아프리카는 도입 초기 단계에 있습니다. 자본 부족과 통합업체의 생태계가 제한되어 있기 때문에 표면적 성장은 둔화되고 있지만, 인구동태의 동향과 급속한 전자상거래의 보급으로 잠재적인 수요가 크게 존재하는 것으로 나타났습니다. 자금 조달 메커니즘이 진화하고 현지 공급업체의 발자국이 확대됨에 따라, 이 지역은 세계의 물류 자동화 시장에 대한 다음 파동이 될 수 있는 기여자가 될 잠재력을 가지고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 급증하는 전자상거래 소포 취급량

- 노동력 부족의 심각화와 임금 상승 압력

- 기업의 넷 제로 물류에의 대처

- 관세면제형 마이크로플루필먼트 구역에 관한 법령

- 창고 내의 5G와 프라이빗 LTE의 융합

- 오픈소스 로보틱스 OS(ROS-2)의 성숙화

- 시장 성장 억제요인

- 높은 초기 투자비용

- 기존 IT 시스템과의 통합 복잡성

- 기능 안전인증이 끝난 AI 칩의 부족

- OT 네트워크용 사이버 보험의 보험료 상승

- 공급망 분석

- 규제 상황

- 기술 전망

- 거시경제 요인이 시장에 미치는 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기능별

- 창고 자동화

- 구성 요소별

- 하드웨어

- 이동형 로봇(AGV, AMR)

- 자동화 저장 및 검색 시스템(AS/RS)

- 자동 분류 시스템

- 탈팔레타이징 및 팔레타이징 시스템

- 컨베이어 시스템

- 자동 식별 및 데이터 수집(AIDC)

- 주문 피킹

- 소프트웨어

- 서비스

- 하드웨어

- 구성 요소별

- 운송 자동화

- 구성 요소별

- 하드웨어

- 소프트웨어

- 서비스

- 구성 요소별

- 창고 자동화

- 자동화 수준별

- 완전 자동화 시스템

- 반자동화 시스템

- 최종 사용자 업계별

- 전자상거래 및 택배

- 식품 및 음료

- 식료품 소매

- 의류 및 패션

- 제조

- 기타 최종 사용자 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Dematic Corp.(KION Group AG)

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery, Ltd.

- KNAPP AG

- TGW Logistics Group GmbH

- Kardex Holding AG

- Mecalux, SA

- BEUMER Group GmbH & Co. KG

- SSI SCHAFER AG

- Vanderlande Industries BV

- WITRON Logistik Informatik GmbH

- Interroll Holding AG

- GreyOrange Pte Ltd.

- Locus Robotics Corp.

- Geek Technology Co., Ltd.

- Ocado Group plc(Ocado Intelligent Automation)

- AutoStore Holdings Ltd.

- Exotec SAS

- Fetch Robotics Inc.(Zebra Technologies)

- Korber Supply Chain GmbH

- Cimcorp Oy

- Manhattan Associates Inc.

제7장 시장 기회와 향후 전망

KTH 26.01.22Logistics automation market size in 2026 is estimated at USD 90.78 billion, growing from 2025 value of USD 82.69 billion with 2031 projections showing USD 144.78 billion, growing at 9.78% CAGR over 2026-2031.

Rising e-commerce parcel volumes, acute labor shortages, and expanding corporate net-zero commitments are transforming automation from a tactical option into an essential pillar of modern supply chain design. Retailers now treat automated order-fulfillment capacity as a hedge against wage inflation, while the convergence of 5G and private LTE networks inside warehouses enables real-time orchestration between robots and yard vehicles that was previously impossible. Environmental targets are also influencing capital-spending priorities, with green-bond financing increasingly tied to energy-efficient systems for picking, storage, and transport. Against this backdrop, semi-automated deployments currently dominate, but fully automated projects are scaling quickly as AI vision and functional-safety chips clear certification hurdles, thereby lowering perceived execution risk. Geographically, Asia-Pacific is rewriting the playbook: government subsidies, greenfield facility growth, and a surge in private 5G pilots are combining to make the region both the largest and fastest-growing market node.

Global Logistics Automation Market Trends and Insights

Rapid E-Commerce Parcel Volumes Drive Infrastructure Modernization

Fulfillment operators now face holiday-level order velocity all year, forcing a shift from batch-picking to continuous, goods-to-person flows that shrink cycle times without expanding headcount. Retailers such as Kroger deepened automation partnerships with Ocado to guarantee same-day grocery delivery service levels that manual processes cannot sustain.Parallel advances in right-sizing technology enable UPS to cut packaging waste by 30% while maintaining steady throughput targets. Dense urban micro-fulfillment hubs are proliferating, and India alone is projected to reach more than 35 million ft2 of such space by 2027, intensifying demand for high-cube automation capable of monetizing every cubic foot in cost-constrained city warehouses. The velocity mandate now extends to automated carton closing, labeling, and last-mile hand-off, embedding robotics across the full e-commerce workflow. Together, these forces anchor the near-term growth engine for the logistics automation market.

Rising Labor Shortages Accelerate Automation Investment Cycles

Demographic headwinds have turned labor availability into a strategic bottleneck, especially in North America and Europe. The Indian PMI reached a 16-year high in March 2024, yet integrators such as NIDO Group are rolling out unmanned goods-movement platforms for Tier 2 and Tier 3 cities, where skilled labor is scarce. Collaborative AMRs are easing the pinch: Fleet Feet reported productivity gains of 2-3X when mobile robots assumed repetitive transport chores, freeing human associates for exception handling tasks. Robotics-as-a-service contracts are rising because businesses want seasonal capacity without long-term payroll commitments. In the Asia-Pacific region, where manufacturing expansion outpaces workforce growth, these models are redefining adoption economics. The combination of constrained labor supply and flexible financing options is propelling the logistics automation market forward.

High Upfront Capital Requirements Constrain SME Adoption

Comprehensive warehouse projects can exceed USD 5 million when structural retrofits are combined with new equipment, keeping many small enterprises on the sidelines. Pay-per-pick subscription programs, championed by AutoStore, lower grid installation costs by up to 40% but do not eliminate construction and systems integration expenses. Access to affordable financing is toughest in emerging markets that also face currency volatility, elevating perceived risk. As a result, vendors with rental or service-based models are gaining share, and larger integrators are acquiring niche robotics firms to assemble turnkey packages that are easier for lenders to underwrite. Despite progress, CAPEX remains the most stubborn near-term brake on the logistics automation market.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero Commitments Reshape Facility Design Priorities

- Customs-Free Micro-Fulfillment Zones Enable Distributed Inventory Models

- Integration Complexity with Legacy IT Systems Delays Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Warehouse operations captured 59.55% of the 2025 revenue within the logistics automation market share, underscoring the immediate ROI companies achieve from goods-to-person pick stations, automated storage, and robotic sortation. These proven technologies thrive in controlled environments, letting retailers compress order-to-ship cycles without adding workers. Transportation automation is currently smaller but is slated for an 11.05% CAGR to 2031 as autonomous trucks and yard tractors transition from pilots to revenue service, especially along reliable freight corridors.

Continued innovation sustains warehouse leadership: AutoStore's 2025 launch of CarouselAI delivers retrofit-friendly robotic piece-picking, enabling existing sites to scale without concrete mezzanine work. Yet the functional boundary is blurring. Private 5G deployments at sites like CJ Logistics integrate indoor robots and autonomous yard vehicles, creating a unified data fabric that reduces dock-door congestion. Over the forecast horizon, integrated orchestration platforms could shift spending toward cross-functional solutions, but warehouses will remain the volume anchor of the logistics automation market.

The Logistic Automation Market Report is Segmented by Function (Warehouse Automation and Transportation Automation), Automation Level (Fully Automated Systems and Semi-Automated Systems), End-User Industry (E-Commerce and Parcel, Grocery Retail, Manufacturing, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 31.30% of 2025 revenue and is projected to grow at a 11.56% CAGR to 2031, earning the region a dual distinction as both the largest and fastest-growing node of the logistics automation market. China has been the world's top industrial-robot buyer for 11 consecutive years, producing 430,000 units in 2023 while subsidizing roughly 17.5% of equipment costs to accelerate domestic uptake. India brings complementary momentum; Grade A warehouse inventory is on track to increase from 290 million to 400 million ft2 by 2027, driven by the National Logistics Policy's push to reduce logistics costs to 10% of GDP and by surging urban micro-fulfillment demand.

North America remains a cornerstone market, thanks to high labor costs that strengthen the payback math for automation, even as complex legacy IT systems and strict cybersecurity rules lengthen project cycles. The expansion of U.S. Foreign Trade Zones supports distributed inventory strategies, freeing automated hubs from duty liabilities until final sale and sharpening cross-border e-commerce competitiveness. Europe mirrors many of these patterns, with an added regulatory premium on carbon reduction, which is funneling capital toward energy-efficient AS/RS and AI route-planning tools.

Latin America, the Middle East, and Africa are in earlier stages of adoption. Capital scarcity and limited integrator ecosystems slow headline growth, yet demographic trends and rapid e-commerce penetration outline substantial latent demand. As financing mechanisms evolve and local vendor footprints expand, these regions are positioned to become the next wave of contributors to the global logistics automation market.

- Dematic Corp. (KION Group AG)

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery, Ltd.

- KNAPP AG

- TGW Logistics Group GmbH

- Kardex Holding AG

- Mecalux, S.A.

- BEUMER Group GmbH & Co. KG

- SSI SCHAFER AG

- Vanderlande Industries B.V.

- WITRON Logistik + Informatik GmbH

- Interroll Holding AG

- GreyOrange Pte Ltd.

- Locus Robotics Corp.

- Geek+ Technology Co., Ltd.

- Ocado Group plc (Ocado Intelligent Automation)

- AutoStore Holdings Ltd.

- Exotec SAS

- Fetch Robotics Inc. (Zebra Technologies)

- Korber Supply Chain GmbH

- Cimcorp Oy

- Manhattan Associates Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce parcel volumes

- 4.2.2 Rising labor shortages and wage inflation

- 4.2.3 Corporate net-zero logistics commitments

- 4.2.4 Customs-free micro-fulfilment zoning laws

- 4.2.5 Convergence of 5G and private-LTE inside warehouses

- 4.2.6 Open-source robotics operating systems (ROS-2) maturation

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX

- 4.3.2 Integration complexity with brown-field IT

- 4.3.3 Scarcity of functional-safety certified AI chips

- 4.3.4 Rising cyber-insurance premiums for OT networks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Function

- 5.1.1 Warehouse Automation

- 5.1.1.1 By Component

- 5.1.1.1.1 Hardware

- 5.1.1.1.1.1 Mobile Robots (AGV, AMR)

- 5.1.1.1.1.2 Automated Storage And Retrieval Systems (AS/RS)

- 5.1.1.1.1.3 Automated Sorting Systems

- 5.1.1.1.1.4 De-Palletizing/Palletizing Systems

- 5.1.1.1.1.5 Conveyor Systems

- 5.1.1.1.1.6 Automatic Identification and Data Collection (AIDC)

- 5.1.1.1.1.7 Order Picking

- 5.1.1.1.2 Software

- 5.1.1.1.3 Services

- 5.1.1.1.1 Hardware

- 5.1.1.1 By Component

- 5.1.2 Transportation Automation

- 5.1.2.1 By Component

- 5.1.2.1.1 Hardware

- 5.1.2.1.2 Software

- 5.1.2.1.3 Services

- 5.1.2.1 By Component

- 5.1.1 Warehouse Automation

- 5.2 By Automation Level

- 5.2.1 Fully-automated Systems

- 5.2.2 Semi-automated Systems

- 5.3 By End-user Industry

- 5.3.1 E-commerce and Parcel

- 5.3.2 Food and Beverage

- 5.3.3 Grocery Retail

- 5.3.4 Apparel and Fashion

- 5.3.5 Manufacturing

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dematic Corp. (KION Group AG)

- 6.4.2 Daifuku Co., Ltd.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Jungheinrich AG

- 6.4.5 Murata Machinery, Ltd.

- 6.4.6 KNAPP AG

- 6.4.7 TGW Logistics Group GmbH

- 6.4.8 Kardex Holding AG

- 6.4.9 Mecalux, S.A.

- 6.4.10 BEUMER Group GmbH & Co. KG

- 6.4.11 SSI SCHAFER AG

- 6.4.12 Vanderlande Industries B.V.

- 6.4.13 WITRON Logistik + Informatik GmbH

- 6.4.14 Interroll Holding AG

- 6.4.15 GreyOrange Pte Ltd.

- 6.4.16 Locus Robotics Corp.

- 6.4.17 Geek+ Technology Co., Ltd.

- 6.4.18 Ocado Group plc (Ocado Intelligent Automation)

- 6.4.19 AutoStore Holdings Ltd.

- 6.4.20 Exotec SAS

- 6.4.21 Fetch Robotics Inc. (Zebra Technologies)

- 6.4.22 Korber Supply Chain GmbH

- 6.4.23 Cimcorp Oy

- 6.4.24 Manhattan Associates Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment