|

시장보고서

상품코드

1850063

주사형 약물전달 기기 : 시장 점유율 분석, 산업 동향 & 통계, 성장 예측(2025-2030년)Injectable Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

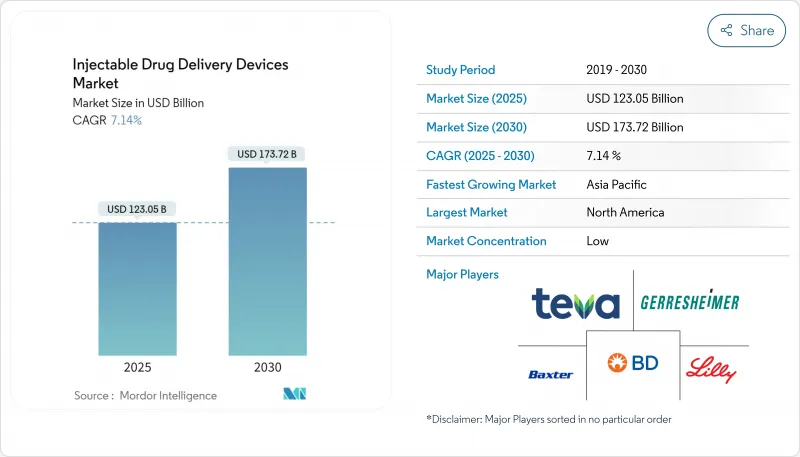

주사형 약물전달 기기 시장의 2025년 시장 규모는 7,489억 9,000만 달러로 평가되었고, CAGR은 8.21%를 나타낼 것으로 예측되며, 2030년에 1조 1,110억 5,000만 달러로 성장할 전망입니다.

견실한 성장은 세 가지 구조적 변화에서 비롯됩니다. 비경구 투여 형식을 요구하는 대규모 생물학적 제제 파이프라인, 병원 중심 치료에서 가정 내 자가 투여로의 뚜렷한 전환, 그리고 치료 순응도와 데이터 수집을 강화하는 기기의 급속한 디지털화입니다. 제약사들은 이제 올바른 플랫폼이 매출 정점 도달 시간을 단축하고 지불자 마찰을 줄이기 때문에, 약물 개발 초기 단계부터 투여 계획 수립을 포함시키고 있습니다. 지불자들이 실제 임상 결과를 기준으로 환급을 연계함에 따라 연결형 주사기에 대한 투자도 증가하고 있습니다. 경쟁 측면에서는 특허 보호를 받는 스마트 웨어러블, 폴리머 프리필드 제형, 기기 중심 서비스 번들이 진입 장벽을 높이는 동시에 제약사와 전문 기기 제조사 간의 협력을 확대하고 있습니다.

세계의 주사형 약물전달 기기 시장 동향 및 인사이트

디지털 복약 지원 도구에 힘입은 자가 투여의 인기 상승

스마트 연결 주사기는 현재 투여량 추적, 알림 제공, 의료진과의 데이터 동기화를 통해 복약 순응도를 최대 32% 향상시키고 진료 방문을 41% 감소시킵니다. 가정 내 사용은 만성 질환 관리에서 입원률을 최대 30%까지 낮춰 지불처의 관심을 끌고 있습니다. Enable Injections와 같은 초기 진입 기업들은 편리한 핸즈프리 웨어러블 기기가 약물 안정성을 저해하지 않으면서도 지속성을 개선함을 입증했습니다. 기술 비용이 하락하면서 프리미엄 바이오의약품을 넘어 확산되고 있습니다. 그 결과 주사제 투여 장치 시장은 점진적으로 규모를 확대하는 동시에 수익 구조를 부가가치 소프트웨어 및 데이터 서비스 쪽으로 전환하고 있습니다.

비경구 투여가 필요한 고분자 생물학적 제제 파이프라인 확대

2024년 매출 상위 10개 의약품 중 7개가 주사 투여 생물학적 제제였으며, 2029년까지는 10개 중 9개가 주사 제제로 전환될 전망으로 총 파이프라인 가치는 1,680억 달러에 달할 것으로 예상됩니다. 점성 단일클론 항체 및 항체-약물 접합체는 대용량 또는 체내 착용형 장치가 필요하여 소재 및 구동 메커니즘 혁신을 촉진하고 있습니다. 이제 투여 방식 선택이 처방 목록 접근성에 영향을 미치므로, 제약사는 초기 단계부터 기기 전문가와 협력하여 턴키 플랫폼을 공동 개발함으로써 경쟁사의 전환 비용을 높이고 제품 수명 주기를 연장하고 있습니다.

감염 및 기타 합병증의 위험

미국 의료 종사자들은 여전히 연간 38만 5,000건의 날카로운 의료 기기 관련 부상을 보고합니다. 웨어러블 주사기는 피부 반응으로 인한 5-8%의 합병증 발생률을 보여 규제 당국이 시판 후 감시를 요구하게 되었습니다. 의료기기 기업들은 현재 이러한 위험을 완화하기 위해 항균 코팅 및 바늘 없는 프로토타입 개발 등 안전성 혁신에 연간 12억 달러를 투자하고 있습니다.

부문 분석

2024년 주사형 약물전달 기기 시장에서 프리필드 형식이 35.90%를 차지할 전망입니다. 이는 다양한 치료 분야에서 활용성과 바이알-주사기 시스템 대비 60% 오류 감소 효과에 기인합니다. 유리는 파손 저항성과 실리콘 오일 상호작용 최소화 특성으로 종양학 및 자가면역 생물학적 제제 분야에서 가치를 인정받는 사이클릭 올레핀 폴리머에 점유율을 점차 내주고 있습니다. 바이오시밀러가 환자 접근성을 확대함에 따라 단위 수요가 증가하고 있습니다. 폴리머로의 전환은 충전-마무리 공정 중 파손률 감소로 제조 규모 확대를 용이하게 합니다. 2024년 기준 규모는 작지만 웨어러블 주사기는 연평균 11.77% 성장률을 기록 중입니다. 이 체내 장착형 시스템은 고점도 제형과 최대 20mL 용량을 처리해 기존 정맥주사로만 가능했던 약물의 피하 투여를 가능케 합니다. 연결 모듈은 시간 기록이 포함된 복약 준수 데이터를 저장해 성과 기반 지불 계약을 가능하게 합니다.

경쟁의 핵심은 인간공학적 설계로 옮겨갔다. 기업들은 직관적인 누름 방식, 청각적 클릭음, 투약 완료를 확인하는 촉각 피드백을 선보입니다. 스마트 변종은 투약 기록을 저장하고 전자건강기록과 연동해 데이터 자산을 창출함으로써 보험사 협상력을 강화합니다. 단일 약물 라이선스에 연동된 맞춤형 웨어러블은 생태계 통제를 강화해 사용자를 원본 브랜드에 묶어두고 수명 주기 수익을 연장합니다. 이러한 역학은 대체 투여 경로가 등장함에도 주사제 투여 장치 시장이 지속적으로 확장되도록 합니다.

당뇨병 치료 분야는 2024년 매출의 31.23%를 차지하며, 주사형 인슐린과 GLP-1 수용체 작용제가 혈당 조절의 핵심으로 자리매김하고 있습니다. 신흥 하이드로겔 저장체는 주사 빈도를 분기별로 줄여 순응도를 높이고 글로벌 보급을 확대할 수 있습니다. 세마글루타이드 처방 증가로 비만 적응증도 물량을 추가로 끌어올립니다. 종양학 분야는 11.47%의 연평균 복합 성장률(CAGR)을 기록하며, 단클론 항체 및 항체-약물 접합체(ADC)의 확대되는 파이프라인으로부터 혜택을 받습니다. 피하 투여용 제형 개량은 진료 대기 시간을 단축하고 환자의 삶의 질을 개선하여, 이 부문에서 주사제 투여 장치 시장 규모의 성장 궤도를 강화합니다.

류마티스 관절염과 같은 자가면역 질환도 주사 생물학적 제제가 병원에서 가정으로 전환되면서 그 뒤를 바짝 따릅니다. 주사형 레나카파비르(lenacapavir)와 같은 장기 작용 항바이러스제는 매일 복용하는 알약을 연 2회 주사로 대체함으로써 HIV 예방 방식을 혁신할 전망입니다. 심장학 분야의 부상은 2-4주마다 투여하는 지질 저하제 PCSK9 억제제에 기반하며, 이는 스타틴 불내성 환자에게 대안을 제공합니다. 이러한 폭넓은 적용 범위는 개별 치료 영역이 변동하더라도 꾸준한 기기 활용을 뒷받침합니다.

지역 분석

북미는 2024년 글로벌 매출의 42.63%를 차지하며, 이는 강력한 보험급여, 활발한 기기 연구개발, 그리고 대부분 첨단 약물전달 기기가 필요한 50종의 신약에 대한 FDA 승인으로 뒷받침됩니다. 최근 CMS 지급 규정은 적격 기기에 대해 2.9%의 요율 인상을 추가하여 채택률을 더욱 높였습니다. 노보 노르디스크가 GLP-1 생산 능력 확보를 위해 3개 충전·완제품 공장을 인수한 사례에서 투자 모멘텀이 확인됩니다. 이러한 움직임은 주사형 약물전달 기기 시장에서 지속되는 리더십을 입증합니다.

유럽은 매출 기준 2위를 차지하며, 재사용 가능한 주사기와 저탄소 소재로의 전환을 가속화하는 지속가능성 의무화로 차별화됩니다. EU 의료기기 규정 시행은 품질 보증을 강화하지만 출시 일정을 연장시킵니다. 유럽의약품청(EMA)은 2025년 2월부터 중앙 플랫폼을 통한 공급 부족 보고를 의무화하여 공급망 투명성을 높일 예정입니다. 영국과 독일은 강력한 당뇨병 기술 도입에 힘입어 성장을 주도하고 있습니다.

아시아태평양 지역은 2030년까지 연평균 9.30% 성장률로 가장 빠르게 성장하는 지역입니다. 도시화와 고령화로 당뇨병 및 심혈관 질환 유병률이 급증하고 있습니다. 중국과 인도는 정책 인센티브를 국내 생물학적 제제 및 주사기 제조로 유도하며 경쟁 중심축을 동쪽으로 이동시키고 있습니다. 일본은 정밀 공학을 활용해 프리미엄 웨어러블 기기를 공급합니다. 지역별 민간 보험 확대는 고가 연결 기기에 대한 환자 접근성을 넓혀 주사형 약물전달 기기 시장의 성장 동력을 강화합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 디지털 복약 관리 지원으로 증가하는 자가 투여 인기

- 비경구 투여가 필요한 고분자 생물학적 제제 파이프라인 확대

- 병원 치료에서 가정 치료로의 전환으로 인한 웨어러블 주사기 수요 증가

- 만성 질환의 높은 부담

- 첨단 기술 주사 장치 개발

- 확대되는 글로벌 백신 접종 계획

- 시장 성장 억제요인

- 사용 시 감염 및 기타 합병증 위험

- 엄격한 규제 요건

- 대체 약물 전달 방법의 가용성

- 의료용 사이클릭 올레핀 폴리머 및 붕규산 유리 가격 변동성 및 주기적 공급 부족

- 가치/공급망 분석

- 규제와 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기기 유형별

- 기존 약물전달 기기

- 주사기 및 바늘

- 바이알 및 앰플

- 첨단 약물전달 기기

- 프리필드 주사기

- 유리 배럴

- 폴리머 배럴

- 펜 주사기

- 자동 주사기

- 일회용 자동 주사기

- 재사용 가능 자동 주사기

- 바늘이 없는 주사기

- 웨어러블 주사기

- 기타

- 기존 약물전달 기기

- 치료 용도별

- 당뇨병

- 종양학

- 자가면역질환

- 심혈관 질환

- 감염증(간염, HIV 등)

- 통증 관리

- 기타(호르몬 장애, 희귀질환 등)

- 사용성별

- 일회용 주사기

- 재사용 가능 주사기

- 투여 경로별

- 피하

- 근육내

- 정맥내

- 기타(피내, 유리체내 등)

- 최종 사용자별

- 병원과 ASC

- 재택 케어 설정

- 전문 클리닉

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Becton, Dickinson and Company(BD)

- West Pharmaceutical Services Inc.

- Terumo Corporation

- Gerresheimer AG

- Baxter International Inc.

- SHL Medical AG

- Ypsomed AG

- Owen Mumford Ltd

- Haselmeier GmbH(Sonceboz)

- Halozyme Therpeutics

- AptarGroup Inc.

- Novo Nordisk A/S

- Sanofi SA

- Eli Lilly and Company

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services Inc.(Janssen)

- Novartis AG

- Schott AG

제7장 시장 기회와 장래의 전망

HBR 25.11.14The injectable drug delivery devices market is valued at USD 748.99 billion in 2025 and is forecast to expand to USD 1,111.05 billion in 2030, reflecting an 8.21% CAGR.

Robust growth comes from three structural shifts: a larger biologics pipeline demanding parenteral formats, a clear move from hospital-based care to self-administration at home, and rapid digitalisation of devices that strengthen adherence and data capture. Pharmaceutical firms now embed delivery planning early in drug development because the correct platform shortens time-to-peak sales and reduces payer friction. Investment in connected injectors is also rising as payers link reimbursement to real-world outcomes. On the competitive front, patent-protected smart wearables, polymer prefilled formats, and device-centric service bundles are creating new barriers to entry while widening collaboration between drug sponsors and specialist device makers.

Global Injectable Drug Delivery Devices Market Trends and Insights

Rising popularity of self-administration supported by digital adherence aids

Smart connected injectors now track dosing, push reminders, and sync data with care teams, lifting adherence by up to 32% and cutting clinic visits by 41%. Home use reduces hospitalisation in chronic disease management by as much as 30%, which appeals to payers. Early movers such as Enable Injections have shown that convenient hands-free wearables improve persistence without sacrificing drug stability. Technology costs are falling, broadening uptake beyond premium biologics. As a result, the injectable drug delivery devices market gains incremental volume while shifting revenue mixes toward value-added software and data services.

Expansion of large-molecule biologics pipeline requiring parenteral delivery

Seven of the ten top-selling medicines in 2024 were biologics delivered by injection, and forecasts see nine of ten by 2029 with a combined pipeline value of USD 168 billion. Viscous monoclonal antibodies and antibody-drug conjugates need larger-volume or on-body devices, fuelling innovation in materials and drive mechanisms. Because delivery choice now influences formulary access, drug sponsors are partnering early with device specialists to co-develop turnkey platforms, thereby increasing switching costs for competitors and extending product life cycles.

Risk of infections and other complications for usage

Healthcare workers still report 385,000 sharps injuries per year in the United States. Wearable injectors show complication rates of 5-8% owing to skin reactions, prompting regulators to demand post-market surveillance. Device firms now dedicate USD 1.2 billion annually to safety innovation, with antimicrobial coatings and needle-free prototypes aimed at mitigating these risks.

Other drivers and restraints analyzed in the detailed report include:

- Shift of care from hospital to home driving demand for wearable injectors

- High burden of chronic diseases

- Stringent regulatory requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Prefilled formats account for 35.90% of the injectable drug delivery devices market in 2024, driven by versatility across therapy classes and a 60% error-reduction advantage over vial-and-syringe systems. Glass is gradually ceding share to cyclic olefin polymers that resist breakage and minimise silicone-oil interactions, traits valued in oncology and autoimmune biologics. Unit demand flexes upward as biosimilars widen patient access. The shift to polymers also eases manufacturing scale-up due to lower break rates during fill-finish operations. Wearable injectors, though smaller in 2024, are scaling at an 11.77% CAGR. These on-body systems handle high-viscosity formulations and volumes up to 20 mL, allowing subcutaneous dosing of drugs once limited to intravenous infusion. Connectivity modules record time-stamped adherence data, opening pay-for-performance contracts.

The competitive battleground turns on human-factors engineering. Companies showcase intuitive presses, audible clicks, or tactile feedback that confirm dose completion. Smart variants log dosing events and integrate with electronic health records, creating data assets that fortify payer negotiations. Tailored wearables tied to single-drug licences tighten ecosystem control, keeping users inside the original brand and extending life-cycle revenue. Collectively, these dynamics keep the injectable drug delivery devices market expanding even as alternative routes arise.

Diabetes commands 31.23% of 2024 revenue as injectable insulin and GLP-1 receptor agonists remain core to glycaemic control. Emerging hydrogel depots could reduce injection frequency to quarterly, boosting adherence and broadening global uptake. Obesity indications further lift volume as semaglutide prescriptions climb. Oncology, registering an 11.47% CAGR, benefits from a swelling pipeline of monoclonal antibodies and antibody-drug conjugates. Subcutaneous reformulations shorten clinic dwell times and improve patient quality of life, reinforcing the growth arc of the injectable drug delivery devices market size in this segment.

Autoimmune conditions such as rheumatoid arthritis follow closely, as injectable biologics shift from hospital to home. Long-acting antivirals like injectable lenacapavir are poised to transform HIV prevention by condensing daily pills into twice-yearly shots. Cardiology's resurgence pivots on lipid-lowering PCSK9 inhibitors administered every two to four weeks, offering alternatives for statin-intolerant patients. This breadth supports steady device utilisation even as individual therapy areas fluctuate.

The Injectable Drug Delivery Devices Market Report is Segmented by Devices Type (Conventional Drug Delivery Devices and Advanced Drug Delivery Devices), Therapeutic Application (Diabetes, Oncology and More), Usability (Disposbales and Re-Usable Injectors), Route of Administration (Subcutaneous, Intravenous, and More), End User (Home Care Setting and More) and Geography. The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 42.63% of global revenue in 2024, supported by robust reimbursement, strong device R&D, and the FDA's approval of 50 novel drugs that mostly require advanced delivery. Recent CMS payment rules add a 2.9% rate increase for eligible devices, further lifting uptake. Investment momentum is visible in Novo Nordisk's acquisition of three fill-finish plants to secure GLP-1 capacity. These moves confirm sustained leadership in the injectable drug delivery devices market.

Europe sits second by revenue, distinguished by sustainability mandates that accelerate shift toward reusable injectors and low-carbon materials. Implementation of the EU Medical Device Regulation strengthens quality assurance but lengthens launch timelines. The European Medicines Agency will make shortage reporting on its central platform mandatory from February 2025, heightening supply-chain transparency. The United Kingdom and Germany spearhead growth, aided by strong diabetes technology adoption.

Asia-Pacific is the fastest-growing region at 9.30% CAGR through 2030. Prevalence of diabetes and cardiovascular disease escalates with urbanisation and ageing. China and India channel policy incentives into domestic biologics and injector manufacture, shifting the competitive centre of gravity eastward. Japan capitalises on precision engineering to supply premium wearables. Regional private insurance expansion widens patient access to higher-priced connected devices, reinforcing momentum in the injectable drug delivery devices market.

- Beckton Dickinson

- West Pharmaceutical Services

- Terumo

- Gerresheimer

- Baxter

- SHL Medical AG

- Ypsomed

- Owen Mumford

- Haselmeier GmbH (Sonceboz)

- Halozyme Therpeutics

- AptarGroup Inc.

- Novo Nordisk

- Sanofi

- Eli Lilly and Company

- Pfizer

- Teva Pharmaceutical Industries

- Roche

- Johnson & Johnson Services Inc. (Janssen)

- Novartis

- SCHOTT

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Self-Administration Supported by Digital Adherence Aids

- 4.2.2 Expansion of Large-Molecule Biologics Pipeline Requiring Parenteral Delivery

- 4.2.3 Shift of Care from Hospital to Home Driving Demand for Wearable Injectors

- 4.2.4 High Burden of Chronic Diseases

- 4.2.5 Devlopment of Advaced Technology Injectable Devices

- 4.2.6 Escalating Global vaccination Initiatives

- 4.3 Market Restraints

- 4.3.1 Risk of Infections and Other Complications for Usage

- 4.3.2 Stringent Regulatory Requirements

- 4.3.3 Availability of Alternative Drug Delivery Methods

- 4.3.4 Price Volatility and Periodic Shortages of Medical-Grade Cyclic-olefin Polymers and Borosilicate Glass

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Conventional Drug Delivery Devices

- 5.1.1.1 Syringes and Needles

- 5.1.1.2 Vials and Ampoules

- 5.1.2 Advanced Drug Delivery Devices

- 5.1.2.1 Prefilled Syringes

- 5.1.2.1.1 Glass Barrel

- 5.1.2.1.2 Polymer Barrel

- 5.1.2.2 Pen Injectors

- 5.1.2.3 Auto-Injectors

- 5.1.2.3.1 Disposable Auto-Injectors

- 5.1.2.3.2 Re-usable Auto-Injectors

- 5.1.2.4 Needle-Free Injectors

- 5.1.2.5 Wearable Injectors

- 5.1.2.6 Other Advanced Types

- 5.1.1 Conventional Drug Delivery Devices

- 5.2 By Therapeutic Application

- 5.2.1 Diabetes

- 5.2.2 Oncology

- 5.2.3 Auto-Immune Disorders

- 5.2.4 Cardiovascular Diseases

- 5.2.5 Infectious Diseases (Hepatitis, HIV, etc.)

- 5.2.6 Pain Management

- 5.2.7 Others (Hormonal disorders, Rare and Orphan Diseases and others)

- 5.3 By Usability

- 5.3.1 Disposable Injectors

- 5.3.2 Re-usable Injectors

- 5.4 By Route of Administration

- 5.4.1 Sub-cutaneous

- 5.4.2 Intramuscular

- 5.4.3 Intravenous

- 5.4.4 Others (Intradermal, Intravitreal, etc.)

- 5.5 By End User

- 5.5.1 Hospitals and ASCs

- 5.5.2 Home-Care Settings

- 5.5.3 Specialty Clinics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Becton, Dickinson and Company (BD)

- 6.4.2 West Pharmaceutical Services Inc.

- 6.4.3 Terumo Corporation

- 6.4.4 Gerresheimer AG

- 6.4.5 Baxter International Inc.

- 6.4.6 SHL Medical AG

- 6.4.7 Ypsomed AG

- 6.4.8 Owen Mumford Ltd

- 6.4.9 Haselmeier GmbH (Sonceboz)

- 6.4.10 Halozyme Therpeutics

- 6.4.11 AptarGroup Inc.

- 6.4.12 Novo Nordisk A/S

- 6.4.13 Sanofi SA

- 6.4.14 Eli Lilly and Company

- 6.4.15 Pfizer Inc.

- 6.4.16 Teva Pharmaceutical Industries Ltd

- 6.4.17 F. Hoffmann-La Roche Ltd

- 6.4.18 Johnson & Johnson Services Inc. (Janssen)

- 6.4.19 Novartis AG

- 6.4.20 Schott AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment