|

시장보고서

상품코드

1850197

여성용 피임약 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Female Contraceptives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

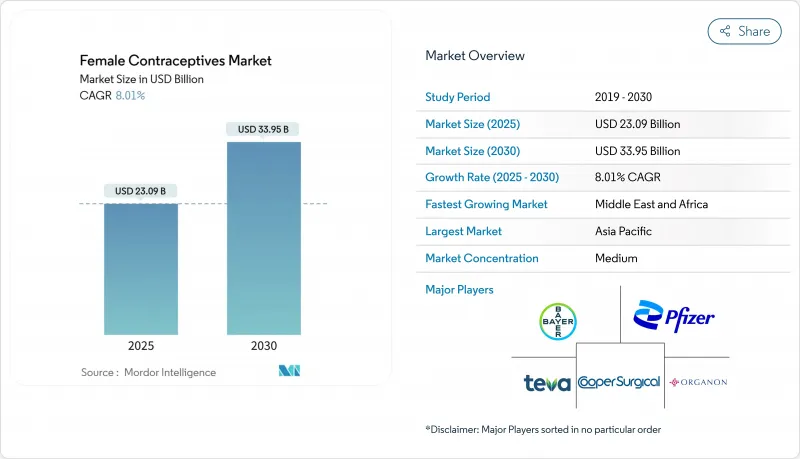

여성용 피임약 시장의 2025년 시장 규모는 230억 9,000만 달러, 2030년에는 339억 5,000만 달러에 이르고, CAGR은 8.01%를 나타낼 전망입니다.

비호르몬성 피임법에 대한 수요 가속, 디지털 건강의 급속한 보급, 지원적인 정책 조치가 확대에 향하고 있습니다. 2025년 2월에 FDA가 승인한 MIUDELLA는 40년 만의 새로운 구리제 자궁내 시스템으로 호르몬을 사용하지 않는 선택의 상업적 기세를 입증하고 있습니다. 동시에 소비자 직결형 텔레헬스 플랫폼이 이용 범위를 넓히고 있는 한편, 특정 호르몬 제제에 대한 법적인 조사가 사용자를 보다 안전한 프로파일로 유도하고 있습니다. 저비강 임플란트와 생분해성 기구의 연구개발이 강화되어 특히 신흥경제 국가에서 새로운 대응가능 인구가 확대되고 있습니다. 이러한 힘이 결합되어 여성용 피임약 시장에는 탄력적인 성장 경로가 형성됩니다.

세계 여성용 피임약 시장 동향과 통찰

선진적이고 혁신적인 피임약에 대한 선호도 증가

호르몬이없는 피임에 대한 운이 가속화되었습니다. MIUDELLA는 2025년 2월에 FDA의 인가를 취득해 출혈과 통증을 억제하면서 99%의 유효성을 유지하는 저동제 IUD를 발표했습니다. 임상 파이프라인도 이 동향을 뒷받침하고 있어, 배리어 작용과 국소 약물전달를 조합한 오바프렌의 제3상 임상시험은 2025년에 종료할 예정입니다. 연구개발에서는 삽입을 용이하게 하고 유해 사건을 억제하기 위한 폴리머 코팅이나 합금의 개량이 목표로 되어 있습니다. 이 가치 제안은 효과적이면서 내분비적으로 중립적인 선택을 요구하는 여성의 공감을 불러 일으키며, 기존의 호르몬 제형에서 수요가 이동하고 있습니다. 따라서 기구 제조업체는 구리와 고분자를 기반으로 하는 플랫폼에 큰 자본 예산을 나누어 여성용 피임구 시장의 이 분야에서 지속적인 확대를 시사하고 있습니다.

계몽과 접근을 위한 정부와 시장 선수의 이니셔티브

관민연합은 피임약의 자금 부족을 해소하고 있습니다. 2024년 유엔 총회에서 기증자들은 2030년까지 15억 달러로 예측되는 세계 피임 자금 부족에 대해 3억 5,000만 달러를 기부할 것을 약속했습니다. 게이츠 재단은 2030년까지 매년 2억 8,000만 달러를 혁신적인 기술과 커뮤니티 프로그램에 기여하고 있습니다. 우간다에서는 젊은 성인 생식 건강(성 및 생식 건강) 캠페인을 통합하여 25-49세 여성의 피임률이 예상치 못하게 향상되었습니다. 이러한 약속은 특히 자원이 부족한 지역에서 여성용 피임약 시장 전체의 장기 성장을 지원합니다.

피임법 보급을 위한 종교적, 사회적, 윤리적 문제

일부 지역에서는 문화적 규범이 피임의 확산을 제한합니다. 가족계획정책 아틀라스(Family Planning Policy Atlas) 암메트 니즈 2023(MENA 2023)에 따르면 중동과 북아프리카에서는 15-49세 여성의 15%가 사회적 제약으로 인해 여전히 피임 요구를 충족시키지 못하고 있다고 합니다. 2025년 에티오피아 조사에서 농촌 여성이 LARC를 사용하는 비율은 도시 지역 여성에 비해 53%나 낮은 것으로 나타났습니다. 미국에서 프로젝트 2025에서 제안된 정책 전환은 4,800만 명의 사용자에 대한 무료 긴급 피임을 억제할 수 있습니다. 이러한 역풍은 여성용 피임약 시장의 궤도를 유지하기 위해 문화적 뉘앙스가있는 아웃리치가 필요합니다.

부문 분석

2024년 여성용 피임약 시장 점유율의 68.4%는 기기가 차지했고 99%의 유효성과 낮은 유지보수를 실현하는 자궁내 시스템이 그 중심입니다. MIUDELLA는 구리 부담을 줄이면서도 효과를 유지하는 혁신에 대한 의지를 보여줍니다. 이 분야는 출혈을 억제하는 고분자 코팅에 대한 지속적인 투자로 처음으로 피임기구를 사용하는 사람들에게 널리 받아 들여지고 있습니다. 피임약은 규모는 작고, 제제 제조업체가 복용 방법을 세련시키고 방출 프로파일을 확장하고 있기 때문에 2030년까지 연평균 복합 성장률(CAGR) 8.1%로 성장할 것으로 예상됩니다. 최초의 OTC 프로게스틴 정제는 소매점의 판로를 확대하고, 경구제는 여성용 피임약 시장 규모를 보다 급속히 확대시킵니다.

고급 질 링과 오바프렌과 같은 비 호르몬 후보는 새로운 하위 부문을 개척하려고합니다. 약물 개발자는 투여 갭을 단축하고 복약 준수를 향상시키기 위해 서방형 매트릭스를 활용합니다. 이러한 기술 혁신이 결합되어 약리학적 제어를 유지하면서 장치와의 편의성 격차를 줄일 것으로 기대됩니다. 따라서 여성용 피임약 시장에서 각 회사가 두 가지 스타일에 걸쳐 있기 때문에 경쟁의 치열성이 증가하고 있습니다.

에스트로겐 프로게스테론 제형은 2024년에 51.2%의 판매를 차지합니다. 그 긴 임상력과 예측 가능한 출혈 패턴은 의사의 선호를 강화하고 있습니다. 그러나 프로게스테론만의 선택은 CAGR 8.8%로 확대되고 있어 에스트로겐금기의 여성에 대한 안전성과 서방형 주사제의 대두가 그 원동력이 되고 있습니다. 사야나 프레스의 유통 파트너십은 저소득층 시장에 3억 2,000만 회분을 공급하는 것을 목표로 하고 있습니다. 이 계획은 충분한 서비스를 받지 않은 지역의 여성용 피임약 시장 규모를 확대할 수 있습니다.

부작용이 없는 피임에 대한 수요에 힘입어 비호르몬 경로에 대한 연구가 계속되고 있습니다. 초기 구리 합금 피임기구와 정자 장벽은 눈에 보이는 진보를 보여줍니다. 이러한 대안은 여성용 피임약 시장에서 다양한 제품을 제공하는 반면 제조업체에게 배상 책임을 헤지할 여지를 제공합니다.

지역 분석

2024년 여성용 피임약 시장은 아시아태평양이 31.60%의 점유율로 선도했습니다. 정부의 가족 계획 캠페인, 출생률 감소, 여성의 디지털 건강 생태계의 상승이 주도권을 지원합니다. 중국과 인도는 규모를 확대하고 일본과 한국은 만혼층에 대한 LARCs의 보급을 확대합니다. 텔레헬스의 보급은 급속히 확대되고 있으며, 여성의 디지털 헬스 분야는 2034년까지 연평균 복합 성장률(CAGR) 20.54%로 확대될 것으로 예측됩니다.

북미는 성숙한 보험 보장과 규제 유연성 덕분에 두 번째로 높은 순위를 차지했습니다. 약사의 처방 권한은 액세스 포인트를 늘리고 지역 사용자에게 혜택을 줍니다. 미국에서는 1,900만명의 미국 여성들에게 지속되고 있지만, 원격의료와 OTC의 선택에 의해 여성용 피임약 시장의 격차는 서서히 축소되고 있습니다. 유럽에서는 강력한 상환이 이루어지고 있지만, 선호되는 방법은 다양합니다. 북유럽 시장은 LARC를 선호하는 경향이 있지만 남유럽은 경구 우위를 유지하고 있습니다.

중동 및 아프리카는 2030년까지 연평균 복합 성장률(CAGR) 9.30%로 가장 급성장하고 있습니다. 알제리와 튀니지는 지지적인 법적 틀을 보여줍니다. Merck for Mothers는 모바일 정보 서비스를 통해 아프리카 여성 830만 명에게 도달했습니다. 아랍에미리트(UAE)는 2022-2030년간 피임구 분야가 두배로 늘어나고 있으며 상업적 유망성을 보여주고 있습니다. 보수적인 지역에서는 사회적 규범이 아직 보급을 억제하고 있지만, 도시화와 교육이 진행됨에 따라 진보적인 태도가 태어나 여성용 피임구 시장의 확대가 기대되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 호르몬 프리 구리 IUD 등의 선진적이고 혁신적인 피임법에 대한 선호도 증가

- 여성용 피임약의 인지도 향상과 액세스 향상을 향한 정부와 시장 관계자의 대처

- 원격 처방과 원격 의료 증가 경향

- 저렴한 가격 임플란트에 대한 시장 진출기업 투자

- HPV 관련 암 리스크의 인식이 배리어법의 도입을 가속

- 일반의약품(OTC) 일일 경구 피임약에 대한 규제 청신호

- 시장 성장 억제요인

- IUD 등 다양한 피임제품의 채택에 관한 종교적, 사회적, 윤리적 문제

- 제조물 책임 소송과 호르몬 보충 요법/임플란트 등의 부작용 위험

- 규제상의 과제와 보험 적용 범위의 제한

- 주요 호르몬 원료공급 체인 취약성

- 가치/공급망 분석

- 규제와 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 카테고리별

- 피임약

- 경구 피임약

- 복합 알약

- 프로게스틴 전용 알약

- 피임 주사

- 국소 피임약

- 살정자제

- 피임기구

- 여성용 콘돔

- 다이어프램과 자궁 경부 캡

- 질 링

- 피임 스폰지

- 피하 임플란트

- 자궁내 피임 기구(IUD)

- 구리 부가 자궁내 피임 기구

- 호르몬 성 자궁 내 피임기구

- 피임약

- 호르몬 유형별

- 에스트로겐만

- 프로게스테론만

- 복합(EP)

- 작용 지속시간별

- 단기작용법

- 장기 작용형 가역적 피임약(LARC)

- 연령층별

- 15-19세

- 20-29세

- 30-39세

- 40년 이상

- 유통 채널별

- 병원 약국

- 소매 약국

- 온라인 및 DTC 플랫폼

- 커뮤니티/불임치료클리닉

- 최종 사용자 환경별

- 가정 사용

- 임상 사용

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Bayer AG

- Organon & Co.

- Pfizer Inc.

- CooperSurgical Inc.

- Teva Pharmaceutical Industries Ltd.

- Agile Therapeutics Inc.

- Viatris

- Lupin Pharmaceuticals Ltd.

- Mayer Laboratories Inc.

- Amneal Pharmaceuticals LLC

- Reckitt Benckiser Group plc

- Johnson & Johnson(ETHICON)

- Chemring Group plc(AngelCare)

- Mona Lisa NV

- Pregna International Ltd.

- Glenmark Pharmaceuticals

- DKT International

- Gedeon Richter Polska Sp. z oo

- HLL Lifecare Ltd.

- Cupid Ltd.

제7장 시장 기회와 장래의 전망

SHW 25.11.17The female contraceptive market is valued at USD 23.09 billion in 2025 and is forecast to reach USD 33.95 billion by 2030, posting an 8.01% CAGR.

Accelerated demand for non-hormonal methods, rapid digital health uptake, and supportive policy measures are steering expansion. The February 2025 FDA approval of MIUDELLA, the first new copper intrauterine system in four decades, validates commercial momentum for hormone-free options. Simultaneously, direct-to-consumer telehealth platforms are widening access, while legal scrutiny of certain hormonal products is nudging users toward safer profiles. Intensifying R&D in low-cost implants and biodegradable devices is opening new addressable populations, particularly in emerging economies. Together, these forces have created a resilient growth path for the female contraceptive market.

Global Female Contraceptives Market Trends and Insights

Growing Preference for Advanced and Innovative Contraceptives

Momentum for hormone-free contraception is accelerating. MIUDELLA received FDA clearance in February 2025, introducing a lower-copper IUD that maintains 99% efficacy while reducing bleeding and pain. Clinical pipelines support the trend, with Ovaprene's Phase 3 trial read-out expected in 2025, combining barrier action and local drug delivery. R&D is targeting polymer coatings and alloy modifications to ease insertion and limit adverse events. The value proposition resonates with women seeking effective yet endocrine-neutral options, shifting demand away from legacy hormonal products. Device makers are therefore allocating larger capital budgets to copper and polymer-based platforms, signalling sustained expansion for this segment of the female contraceptive market.

Government and Market-Player Initiatives for Awareness and Access

Public-private coalitions are narrowing the contraceptive funding deficit. During the 2024 UN General Assembly, donors pledged USD 350 million toward the global contraceptive financing gap, projected at USD 1.5 billion by 2030. The Gates Foundation is contributing USD 280 million annually for innovative technologies and community programs through 2030. Early results are evident in Uganda, where integrated youth reproductive-health campaigns unexpectedly boosted uptake among women aged 25-49 years. Such commitments underpin long-term growth across the female contraceptive market, particularly in resource-limited regions.

Religious, Social and Ethical Issues for Contraceptive Adoption

Cultural norms restrict uptake in several regions. The Family Planning Policy Atlas MENA 2023 indicates that 15% of women aged 15-49 in the Middle East and North Africa still have unmet contraceptive needs due to social constraints. A 2025 Ethiopian study found rural women 53% less likely to use LARCs than urban peers. In the United States, proposed policy shifts under Project 2025 could curtail free emergency contraception for 48 million users. Such headwinds demand culturally nuanced outreach to sustain the female contraceptive market trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Trend of Tele-Prescribing and Telehealth

- Investment by Market Players in Low-Cost Implants

- Product Liability Litigation and Side-Effect Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Devices held 68.4% of female contraceptive market share in 2024, anchored by intrauterine systems that deliver 99% efficacy alongside low maintenance. MIUDELLA showcases the appetite for innovations that cut copper load yet preserve effectiveness. The segment benefits from sustained investments in polymer coatings that reduce bleeding, broadening acceptance among first-time users. Contraceptive drugs, while smaller, are rising at an 8.1% CAGR through 2030 as formulators refine dosing and extend release profiles. The first OTC progestin pill has expanded retail reach, positioning oral agents for faster gains inside the female contraceptive market size.

Advanced vaginal rings and non-hormonal candidates like Ovaprene are poised to open new sub-segments. Drug developers are leveraging sustained-release matrices to shorten dosing gaps and improve adherence. Together, these innovations are expected to close the convenience gap with devices while retaining pharmacological control. Competitive intensity is therefore increasing as firms straddle both modalities within the female contraceptive market.

Combined estrogen-progesterone products accounted for 51.2% revenue in 2024. Their long clinical history and predictable bleeding patterns reinforce physician preference. However, progesterone-only options are expanding at an 8.8% CAGR, driven by safety for women with estrogen contraindications and emerging prolonged-release injectables. Sayana Press distribution partnerships aim to supply 320 million doses to low-income markets. That plan could lift the female contraceptive market size in underserved areas.

Research into non-hormonal pathways continues, propelled by demand for side-effect-free contraception. Early copper-alloy devices and spermicidal barriers represent tangible progress. These alternatives give manufacturers scope to hedge against liability exposure while diversifying offerings in the female contraceptive market.

The Female Contraceptives Market Report is Segmented by Product Category (Contraceptive Drugs and Contraceptive Devices), Hormone Type (Estrogen-Only, Progestrone-Only, and More), Duration of Action (Short-Acting Methods and LARC), Age Group (15-19 Years and More), Distribution Channel (Hospital Pharmacies and More), End-User (Home and Clinical Use), and Geography. The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the female contraceptive market with 31.60% share in 2024. Government-backed family-planning campaigns, falling fertility rates, and the rise of women's digital health ecosystems underpin leadership. China and India supply scale, while Japan and South Korea broaden uptake of LARCs among late-marrying populations. Telehealth penetration is growing quickly, with the women's digital health sector forecast to expand at 20.54% CAGR to 2034.

North America ranks second aided by mature insurance coverage and regulatory flexibility. Pharmacist prescribing authority has multiplied access points, benefiting rural users. Contraceptive deserts persist for 19 million US women, but telehealth and OTC options are gradually shrinking gaps in the female contraceptive market. Europe exhibits strong reimbursement yet heterogeneity in preferred methods. Northern markets tend toward LARCs while Southern Europe maintains oral dominance.

The Middle East and Africa region is the fastest-growing with a 9.30% CAGR to 2030. Algeria and Tunisia showcase supportive legal frameworks. Merck for Mothers has reached 8.3 million African women through mobile information services. The UAE exemplifies commercial promise as its contraceptive device segment is set to double between 2022 and 2030. Social norms still restrain adoption in conservative areas, yet rising urbanization and education catalyze progressive attitudes that favour female contraceptive market expansion.

- Bayer

- Organon

- Pfizer

- The Cooper Companies

- Teva Pharmaceutical Industries

- Agile Therapeutics Inc.

- Viatris

- Lupin Pharmaceuticals Ltd.

- Mayer Laboratories

- Amneal Pharmaceuticals

- Reckitt Benckiser Group

- Johnson & Johnson

- Chemring Group plc (AngelCare)

- Mona Lisa

- Pregna International Ltd.

- Glenmark Pharmaceuticals

- DKT International

- Gedeon Richter Polska Sp. z o.o.

- HLL Lifecare Ltd.

- Cupid Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Preference for Advanced and Innovative Contraceptives Such as Hormone-Free Copper IUDs

- 4.2.2 Government and Market Players Initiatives To Increase Awaarenss and Access of Feamle Contraceptives

- 4.2.3 Increasing Trend of Tele-Prescribing and Tele-health

- 4.2.4 Investment by Market Players in Low-Cost Implants

- 4.2.5 HPV-Linked Cancer Risk Awareness Accelerating Barrier-Method Adoption

- 4.2.6 Regulatory Green-Light for Over-The-Counter (OTC) Daily Oral Contraceptive Pills

- 4.3 Market Restraints

- 4.3.1 Religious, Social and Ethical Issues for Adoption of Various Contraceptives Such as IUDs etc.

- 4.3.2 Product Liability Litigation and Risks od Side Effects such as Hormonal Pills/ Implants

- 4.3.3 Regulatory Challenges Coupled with Limited Insurance Coverage

- 4.3.4 Supply-Chain Fragility for Key Hormonal APIs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Category

- 5.1.1 Contraceptive Drugs

- 5.1.1.1 Oral Contraceptives

- 5.1.1.1.1 Combined Pills

- 5.1.1.1.2 Progestin-Only Pills

- 5.1.1.2 Contraceptive Injections

- 5.1.1.3 Topical Contraceptives

- 5.1.1.4 Spermicides

- 5.1.2 Contraceptive Devices

- 5.1.2.1 Female Condoms

- 5.1.2.2 Diaphragms & Cervical Caps

- 5.1.2.3 Vaginal Rings

- 5.1.2.4 Contraceptive Sponges

- 5.1.2.5 Sub-Dermal Implants

- 5.1.2.6 Intra-Uterine Devices (IUD)

- 5.1.2.6.1 Copper IUDs

- 5.1.2.6.2 Hormonal IUDs

- 5.1.1 Contraceptive Drugs

- 5.2 By Hormone Type

- 5.2.1 Estrogen-Only

- 5.2.2 Progesterone-Only

- 5.2.3 Combined (E+P)

- 5.3 By Duration of Action

- 5.3.1 Short-Acting Methods

- 5.3.2 Long-Acting Reversible Contraceptives (LARC)

- 5.4 By Age Group

- 5.4.1 15-19 Years

- 5.4.2 20-29 Years

- 5.4.3 30-39 Years

- 5.4.4 40+ Years

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online and DTC Platforms

- 5.5.4 Community / Fertility Clinics

- 5.6 By End-User Setting

- 5.6.1 Home Use

- 5.6.2 Clinical Use

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Organon & Co.

- 6.4.3 Pfizer Inc.

- 6.4.4 CooperSurgical Inc.

- 6.4.5 Teva Pharmaceutical Industries Ltd.

- 6.4.6 Agile Therapeutics Inc.

- 6.4.7 Viatris

- 6.4.8 Lupin Pharmaceuticals Ltd.

- 6.4.9 Mayer Laboratories Inc.

- 6.4.10 Amneal Pharmaceuticals LLC

- 6.4.11 Reckitt Benckiser Group plc

- 6.4.12 Johnson & Johnson (ETHICON)

- 6.4.13 Chemring Group plc (AngelCare)

- 6.4.14 Mona Lisa NV

- 6.4.15 Pregna International Ltd.

- 6.4.16 Glenmark Pharmaceuticals

- 6.4.17 DKT International

- 6.4.18 Gedeon Richter Polska Sp. z o.o.

- 6.4.19 HLL Lifecare Ltd.

- 6.4.20 Cupid Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment