|

시장보고서

상품코드

1850202

벤더 중립 아카이브 및 PACS 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Vendor-Neutral Archive And PACS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

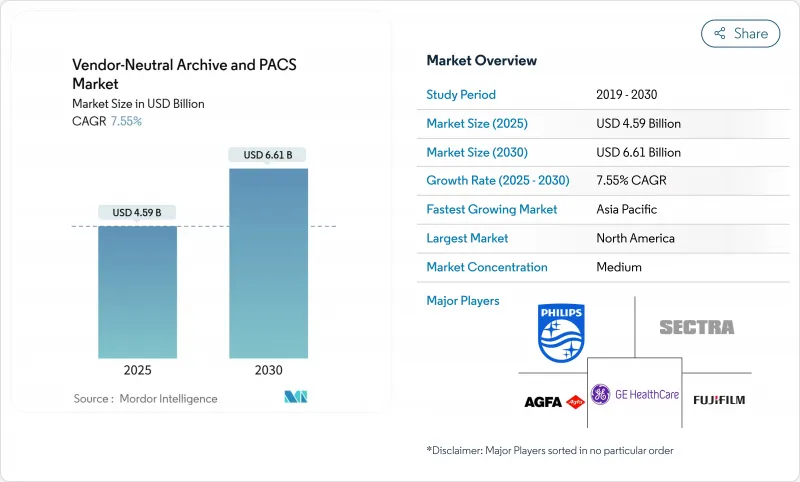

벤더 중립 아카이브 및 PACS 시장 규모는 2025년에 45억 9,000만 달러, 2030년에는 66억 1,000만 달러에 이르고, CAGR 7.55%로 성장할 것으로 예측됩니다.

이 기세는 이미지 처리량 가속화, 프라이버시 규제 강화, 상호 운용가능한 클라우드 지원 이미지 처리 에코시스템으로의 결정적인 변화로 인해 발생합니다. 프로바이더는 방사선과, 순환기과, 병리 진단과, 정형외과에 대응하는 엔터프라이즈 플랫폼을 채택해, 화상 관리와 분석을 일원화하는 것으로, 부문별 사일로화를 해소하려고 하고 있습니다. 경쟁의 격화는 RadNet에 의한 1억 300만 달러를 들인 iCAD의 인수나, GE 헬스케어에 의한 Sutter Health와의 300개소에 걸친 장기적인 화상 처리 파트너십 등의 통합극에 의해 강화되고 있어, 포인트 제품이 아닌 엔드 투 엔드의 엔터프라이즈 화상 처리 스위트에 업계의 전환을 강조합니다. 30%의 비용 절감을 약속하는 클라우드 도입의 지속적인 채택, 제로 트러스트 사이버 보안의 의무화의 대두, 이미지 워크플로우에 통합된 1,000개 이상의 FDA 인증 AI 툴이 벤더 중립 아카이브(VNA) 및 이미지 보관 통신 시스템(PACS) 시장의 향후 성장을 총체적으로 지원하고 있습니다.

세계 벤더 중립 아카이브 및 PACS - 시장 동향 및 통찰력

유니버설 의료 이미지 아카이브 수요 증가

의료 시스템은 방사선과, 순환기과, 병리 진단과, 정형외과의 이미지를 단일 백본에 저장하는 엔터프라이즈 아카이브를 통해 부서별 사일로를 대체하고 있습니다. 이 마이그레이션을 통해 임상의는 워크플로우 내에서 완전한 종단 이미지 이력을 확인할 수 있어 진단의 맹점을 없애고 의료 협력을 향상시킬 수 있습니다. Sectra 및 Hyland와 같은 공급업체는 VNA 제품군을 '픽셀 EMR'로 판매합니다. 가치 기반의 진료 보상은 이 통합에 추가로 보상하는 것으로, 벤더 중립 아카이브(VNA) & 화상 보관 통신 시스템(PACS) 시장을 데이터 주도의 정밀의료의 핵심 칩으로 만듭니다.

데이터 저장 비용 감소(클라우드 및 On-Premise)

클라우드의 경제성을 통해 공급자는 이미지 처리의 TCO를 30% 절감하는 동시에, 지금까지보다 대규모 검사에 대응할 수 있는 탄력적인 용량을 얻을 수 있습니다. 자동화된 라이프사이클 정책을 통해 검색 속도를 저하시키지 않으면서 오래된 검사를 더 저렴한 콜드 티어로 전환하여 지역 병원과 지역 클리닉이 과거에는 학술 센터에 한정된 엔터프라이즈 기능을 도입할 수 있습니다. 신흥 시장은 레거시 하드웨어를 완벽하게 구축하여 벤더 중립 아카이브(VNA) 및 이미지 보존 통신 시스템(PACS) 시장에서 클라우드의 기세를 강화하고 있습니다.

높은 전환 및 통합 비용

레거시 PACS에서 완전히 클라우드 네이티브 VNA로 전환하려면 몇 년 동안 수백만 달러의 프로그램이 필요할 수 있습니다. 조직은 두 시스템을 운영하고 직원을 재교육하며 워크플로를 재설계해야 하며 IT 예산이 늘어납니다. 그러나 대규모 소아병원에서는 5년간 300만 달러, 성인용 네트워크에서는 도입 직후 70만 달러의 비용 절감을 실현한 사례가 있습니다. 초기 비용은 판매 오더를 늦추지만 장기 투자 회수는 벤더 중립 아카이브(VNA) 및 이미지 보존 통신 시스템(PACS) 시장 진입을 지원합니다.

부문 분석

CT는 2024년 벤더 중립 아카이브(VNA) 및 이미지 아카이브 커뮤니케이션 시스템(PACS) 시장의 27.34%를 차지했으며, 뇌졸중 치료, 외상 평가, 종양 병기 분류 등의 다용도 역할을 했습니다. 이 모달리티의 높은 처리 능력은 안정적인 아카이브의 성장으로 이어져 벤더 중립 아카이브(VNA) 및 이미지 보존 통신 시스템(PACS) 시장 전체의 확대를 뒷받침합니다. 핸드헬드 디바이스와 AI 지원 지침의 혜택을 받는 초음파 검사는 CAGR 10.16%를 기록하여 1차 케어와 원격지에서 새로운 기회를 엽니다.

MRI와 PET 데이터는 다중 시퀀싱 재구성이 많고 저장 및 검색 요구가 엄격합니다. 유방 조영술의 작업량은 위험 예측 AI가 FDA의 허가를 받을수록 증가하고, 더 많은 시설이 종단적인 유방 이미지 저장소를 채택하게 됩니다. 혈관 조영술은 인터벤셔널 카디올로지(심장병 치료)의 성장에 연동하여 안정된 작업량을 제공해, 모달리티의 다양성을 두드러지게 하고 있습니다.

2024년 벤더 중립 아카이브(VNA) 및 이미지 저장 통신 시스템(PACS) 시장 규모의 39.45%는 소프트웨어가 차지합니다. 서비스는 마이그레이션, 관리 호스팅 및 24시간 365일 모니터링이 규정 준수 및 가동 시간에 필수적이며 CAGR 9.67%에서 가장 빠르게 상승합니다. 하드웨어 수요는 대기 시간에 민감한 카테 랩이나 OR 환경에서 에지 캐시로 인해 지속되고 있지만 점유율은 점차 줄어들고 있습니다.

배포 컨설턴트는 데이터 추출, 검증 및 다운타임 없이 컷오버를 지휘하기 때문에 비용이 많이 드는 비용을 부과합니다. 매니지드 서비스는 자본 지출보다 예측 가능한 OPEX를 선호하는 자원에 제약이 있는 지역 병원에 호소하고, 벤더 중립 아카이브(VNA) 및 이미지 보존 통신 시스템(PACS) 시장에서 서비스의 발판을 굳히고 있습니다.

지역 분석

북미는 2024년 벤더 중립 아카이브(VNA) & 이미지 보존 통신 시스템(PACS) 시장의 43.78%를 차지하며, 견고한 HIPAA 프레임워크, 대규모 기업 의료 시스템, 여러 병원의 영상 진단을 지원하는 대규모 자본 예산의 혜택을 누리고 있습니다. 공급자는 이미지 처리 효율성과 관련된 품질 지표를 중시하는 지불자 모델의 진화를 예상하여 불변의 아카이브 및 AI 분석을 채택합니다.

아시아태평양은 중국, 인도 및 ASEAN 정부가 디지털 건강 인프라에 자극책을 투입하고 있기 때문에 2030년까지 연평균 복합 성장률(CAGR) 9.34%로 성장할 것으로 예상됩니다. 국가의 의료 정보 교환이 표준 기반 이미지 처리를 요구하고 있으며 레거시 잠금을 피하는 클라우드 네이티브 VNA 배포가 추진되고 있습니다. 민간 병원 체인과 원격 영상 진단 기업은 고령화와 암 검진 확대에 따른 영상 수요의 급증에 대응하기 위해 도입을 더욱 가속시킵니다.

유럽에서는 GDPR(EU 개인정보보호규정) 데이터 거버넌스 룰이나 국경을 넘은 의료 이니셔티브에 힘입어 꾸준한 기세를 기록. 의료 제공업체는 데이터 주권을 선호하고 로컬 클라우드 지역 또는 하이브리드 모델을 선호합니다. 중동, 아프리카, 라틴아메리카에서는 신규 진입 병원이 디지털 퍼스트 이미지 처리 스택을 구축하고 구독 VNA를 활용하여 초기 자본을 절약하고 있습니다. 이러한 지역을 합산하면 공급업체 중립 아카이브(VNA) 및 이미지 보존 통신 시스템(PACS) 시장의 세계 밑단을 넓히는 볼륨이 증가합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유니버설 의료 이미지 아카이브 수요 증가

- 데이터 스토리지 비용 감소(클라우드 및 On-Premise)

- 전자 건강 기록과의 고급 통합

- 증가하는 화상량과 고해상도의 모달리티

- AI/ML 트레이닝 데이터 세트에는 대규모의 종단적 이미지 리포지토리가 필요

- 사이버 보험 컴플라이언스 : 불변하고 제로 트러스트인 VNA의 추진

- 시장 성장 억제요인

- 높은 선불 마이그레이션 및 통합 비용

- 제품 수명주기가 길기 때문에 교체 수요가 둔화

- 독점 메타데이터 매핑으로 공급업체 잠금 위험 증가

- 예측 불가능한 클라우드 출구 요금이 클라우드 VNA의 도입을 저해

- 가치/공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 화상 진단법별

- 혈관 조영 검사

- 유방 조영

- 컴퓨터 단층 촬영(CT)

- 자기 공명 영상법(MRI)

- 초음파

- 핵의학/PET

- 기타 모달리티

- 구성요소별

- 하드웨어

- 소프트웨어

- 서비스(실장, 마이그레이션, 관리)

- 유형별

- 화상 통신 시스템

- 벤더 중립 아카이브(VNA) 소프트웨어

- 배송 방법별

- 현장(부지내)

- 하이브리드

- 클라우드 호스트

- 사용 모델별

- 단일 부문

- 여러 부문(엔터프라이즈 이미징)

- 여러 사이트/의료 시스템

- 최종 사용자별

- 병원(대규모, 중규모, 소규모)

- 진단 이미지 센터

- 외래수술센터(ASC) 및 전문 클리닉

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Agfa-Gevaert Group

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corp.

- Koninklijke Philips NV

- Sectra AB

- Siemens Healthineers AG

- IBM Corp.(Merge PACS)

- Dell Technologies Inc.

- Hyland Software(OnBase/Acuo VNA)

- Mach7 Technologies

- Novarad Corp.

- Lexmark(Vidyo)

- Change Healthcare(Nucleus.io)

- Intelerad Medical Systems

- Carestream Health

- RamSoft Inc.

- BridgeHead Software

- Canon Medical

- Visage Imaging

제7장 시장 기회와 장래의 전망

SHW 25.11.11The Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market size reached USD 4.59 billion in 2025 and is projected to climb to USD 6.61 billion by 2030, advancing at a 7.55% CAGR.

Strong momentum arises from accelerating imaging volumes, stricter privacy regulations, and a decisive shift toward interoperable, cloud-enabled imaging ecosystems. Providers are retiring departmental silos in favor of enterprise platforms that serve radiology, cardiology, pathology, and orthopedics, thereby unifying image management and analytics. Competitive intensity is reinforced by consolidation plays such as RadNet's USD 103 million purchase of iCAD and GE HealthCare's long-term imaging partnership with Sutter Health across 300+ sites, underscoring an industry pivot toward end-to-end enterprise imaging suites rather than point products. Continued adoption of cloud deployments that promise 30% cost savings, the rise of zero-trust cybersecurity mandates, and over 1,000 FDA-cleared AI tools embedded in imaging workflows collectively sustain future growth for the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market.

Global Vendor-Neutral Archive And PACS Market Trends and Insights

Increasing Demand For Universal Medical-Image Archiving

Health systems are replacing departmental silos with enterprise archives that house radiology, cardiology, pathology, and orthopedic images on a single backbone. The migration enables clinicians to review complete longitudinal imaging histories inside their workflow, eliminating diagnostic blind spots and improving care coordination. Vendors such as Sectra and Hyland market their VNA suites as "pixel EMRs" because they align images with clinical data in real time. Value-based reimbursement further rewards this consolidation, making the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market a linchpin for data-driven precision care.

Declining Data-Storage Cost (Cloud & On-Prem)

Cloud economics let providers lower imaging TCO by 30% while gaining elastic capacity for ever-larger studies. Automated lifecycle policies move older exams into cheaper cold tiers without harming retrieval speed, helping community hospitals and rural clinics adopt enterprise capabilities once limited to academic centers. Emerging markets leapfrog legacy hardware altogether, reinforcing cloud momentum within the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market.

High Upfront Migration & Integration Costs

Transitioning from legacy PACS to a fully cloud-native VNA can require multi-year, multi-million-dollar programs. Organizations must run dual systems, retrain staff, and redesign workflows, stretching IT budgets. Yet documented cases show five-year savings of USD 3 million for large children's hospitals and immediate reductions of USD 700,000 in adult networks after go-live. While initial expense slows orders, the long-term payback sustains participation in the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market.

Other drivers and restraints analyzed in the detailed report include:

- High-Level Integration With Electronic Health Records

- AI/ML Training Datasets Require Large Longitudinal Image Repositories

- Long Product Life Cycle Slows Replacement Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CT captured 27.34% of the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market in 2024, driven by its versatile role in stroke triage, trauma evaluation, and oncology staging. The modality's high throughput translates into steady archive growth, reinforcing overall Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market expansion. Ultrasound, benefiting from handheld devices and AI-assisted guidance, posts a 10.16% CAGR that opens new opportunities in primary care and remote settings.

Demand for MRI and PET data-rich in multi-sequence reconstructions-poses stringent storage and retrieval needs best met by scalable VNAs. Mammography workloads also intensify as risk prediction AI gains FDA clearance, pushing more facilities to adopt longitudinal breast-imaging repositories. Angiography contributes stable volumes linked to interventional cardiology growth, rounding out modality diversity.

Software owned 39.45% of the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market size in 2024 thanks to agile, cloud-native codebases that add AI and cybersecurity features via push updates. Services rise quickest at 9.67% CAGR as migrations, managed hosting, and 24/7 monitoring become mandatory for compliance and uptime. Hardware demand persists for edge caches in latency-sensitive cath-lab or OR settings, yet its share gradually tapers.

Implementation consultancies charge premium rates because they orchestrate data extraction, validation, and downtime-free cutovers. Managed services appeal to resource-strained community hospitals that prefer predictable OPEX rather than capital outlays, solidifying the service footprint within the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market.

The Vendor-Neutral Archive and PACS Market Report is Segmented by Imaging Modality (Angiography, Mammography, and More), Component (Hardware, Software and More), Type (PACS and VNA Software), Mode of Delivery (On-Site, Hybrid, and More), Usage Model (Single Department, Multiple Departments, and More), End User (Hospitals, Diagnostic Imaging Centers and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, holding 43.78% of the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market in 2024, benefits from robust HIPAA frameworks, large enterprise health systems, and sizeable capital budgets that support multi-hospital imaging transformations. GE HealthCare's partnership with Sutter Health covering 300+ facilities exemplifies regional scale and sophistication.Providers adopt immutable archives and AI analytics in anticipation of evolving payer models emphasizing quality metrics tied to imaging efficiency.

Asia-Pacific leads growth at 9.34% CAGR through 2030 as governments in China, India, and ASEAN channel stimulus into digital health infrastructure. National health-information exchanges require standards-based imaging, driving cloud-native VNA deployments that sidestep legacy lock-in. Private hospital chains and teleradiology firms further accelerate adoption to meet soaring imaging demand from aging populations and expanded cancer screening.

Europe records steady momentum supported by GDPR data-governance rules and cross-border care initiatives. Providers prioritize data sovereignty, favoring local cloud regions or hybrid models. In the Middle East, Africa, and Latin America, greenfield hospitals build digital-first imaging stacks, leveraging subscription VNAs to conserve upfront capital. Collectively these regions add incremental volume that broadens the global footprint of the Vendor-Neutral Archive (VNA) & Picture Archiving and Communication System (PACS) market.

- Agfa-Gevaert

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corp.

- Koninklijke Philips

- Sectra

- Siemens Healthineers

- IBM Corp. (Merge PACS)

- Dell

- Hyland Software (OnBase / Acuo VNA)

- Mach7 Technologies

- Novarad Corp.

- Lexmark (Vidyo)

- Change Healthcare (Nucleus.io)

- Intelerad Medical Systems

- Carestream Health

- Ram Soft

- BridgeHead Software

- Canon Medical

- Visage Imaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand For Universal Medical-Image Archiving

- 4.2.2 Declining Data-Storage Cost (Cloud & On-Prem)

- 4.2.3 High-Level Integration With Electronic Health Records

- 4.2.4 Rising Imaging Volumes & Higher-Resolution Modalities

- 4.2.5 AI/ML Training Datasets Require Large Longitudinal Image Repositories

- 4.2.6 Cyber-Insurance Compliance Driving Immutable, Zero-Trust VNAs

- 4.3 Market Restraints

- 4.3.1 High Upfront Migration & Integration Costs

- 4.3.2 Long Product Life Cycle Slows Replacement Sales

- 4.3.3 Proprietary Metadata Mapping Raises Vendor-Lock-In Risk

- 4.3.4 Unpredictable Cloud-Egress Fees Inhibit Cloud VNA Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Imaging Modality

- 5.1.1 Angiography

- 5.1.2 Mammography

- 5.1.3 Computed Tomography (CT)

- 5.1.4 Magnetic Resonance Imaging (MRI)

- 5.1.5 Ultrasound

- 5.1.6 Nuclear Medicine/PET

- 5.1.7 Other Modalities

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services (Implementation, Migration, Managed)

- 5.3 By Type

- 5.3.1 PACS

- 5.3.2 Vendor-Neutral Archive (VNA) Software

- 5.4 By Mode of Delivery

- 5.4.1 On-site (Premise)

- 5.4.2 Hybrid

- 5.4.3 Cloud-Hosted

- 5.5 By Usage Model

- 5.5.1 Single Department

- 5.5.2 Multiple Departments (Enterprise Imaging)

- 5.5.3 Multiple Sites / Health-system

- 5.6 By End-User

- 5.6.1 Hospitals (Large, Mid-size, Small)

- 5.6.2 Diagnostic Imaging Centers

- 5.6.3 Ambulatory Surgical Centers & Specialty Clinics

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Agfa-Gevaert Group

- 6.3.2 GE HealthCare Technologies Inc.

- 6.3.3 FUJIFILM Holdings Corp.

- 6.3.4 Koninklijke Philips N.V.

- 6.3.5 Sectra AB

- 6.3.6 Siemens Healthineers AG

- 6.3.7 IBM Corp. (Merge PACS)

- 6.3.8 Dell Technologies Inc.

- 6.3.9 Hyland Software (OnBase / Acuo VNA)

- 6.3.10 Mach7 Technologies

- 6.3.11 Novarad Corp.

- 6.3.12 Lexmark (Vidyo)

- 6.3.13 Change Healthcare (Nucleus.io)

- 6.3.14 Intelerad Medical Systems

- 6.3.15 Carestream Health

- 6.3.16 RamSoft Inc.

- 6.3.17 BridgeHead Software

- 6.3.18 Canon Medical

- 6.3.19 Visage Imaging

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment