|

시장보고서

상품코드

1852046

인공 고관절 치환술 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Hip Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

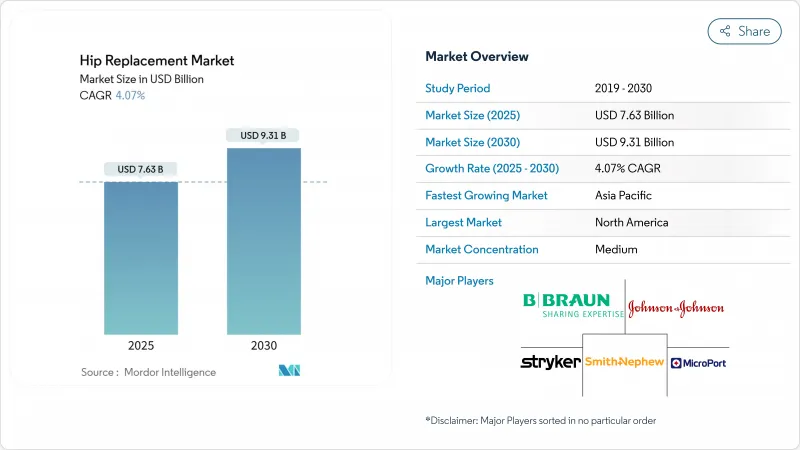

인공 고관절 치환술 시장 규모는 2025년에 76억 3,000만 달러로 추정되고, CAGR 4.07%로 확대될 전망이며, 2030년에는 93억 1,000만 달러에 달할 것으로 예측되고 있습니다.

수요는 인구동태의 고령화, 골관절염의 급증, 입원 치료를 대체하는 외래에서의 인공 관절 치환술 프로토콜의 수용 확대에 따라 확대됩니다. 수술 절차의 성장은 외과의사에게 재현성 있는 컴포넌트의 정렬을 제공하는 로봇 지원 시스템의 신속한 채용에 의해 강화되고, 3D 인쇄 다공성 임플란트는 뼈 성장을 최적화함으로써 장치의 수명을 연장합니다. 북미가 매출을 이끌고 있지만 아시아태평양이 가장 빠른 속도로 성장하고 있는 이유는 중국과 인도가 임플란트 비용을 낮추고 환자 접근을 확대하는 수량 기준 입찰을 도입했기 때문입니다. 경쟁 포지셔닝의 중심은 차별화된 기술이며, 선두 공급업체는 로봇공학, AI플래닝, 표면가공 임플란트를 통합하여 상환 압력이 강해지는 가운데 프리미엄 가격을 실현하고 있습니다.

세계의 인공 고관절 치환술 시장 동향 및 인사이트

골관절염의 유병률 증가

골관절염은 세계에서 6억 650만 명이 앓고 있으며, 인구의 고령화 및 비만률의 상승에 따라 이 숫자는 계속 상승하고 있습니다. 고관절 질환의 진행은 특히 치열하고, 종래의 베어링은 20년 생존율 94.1%를 실현하는 선진적인 옥시늄제 표면에 비해 재치환 리스크가 35% 높습니다. 지역적 부담은 동아시아와 남아시아에서 가장 무겁지만 비만도와 같은 수정 가능한 위험은 관련 장애의 5분의 1을 차지합니다. 유전체 연구에서 900개 이상의 유전자좌가 질병과 연관되어 있으며, 관련된 유전자의 10%가 기존 치료법과 매핑됩니다. 따라서 노화 및 신진 대사 이상의 수렴은 수술 수요를 수술 능력보다 선행합니다.

노년 인구 및 비만 인구 증가

2030년까지 미국에서만 최초 인공 고관절 치환술의 건수가 현재보다 171% 증가한 635,000건이 될 것으로 예측되며, 세계 전체에서는 2060년까지 123만 건을 넘을 가능성이 있습니다. BMI가 24kg/m2를 넘는 환자에서는 로봇 시스템이 이러한 과제를 해결하고 관골구의 정밀도를 향상시킵니다. 고소득국가가 가장 증례가 급증하고 있지만, 신흥 시장에서는 특히 개개에 맞는 임플란트를 필요로 하는 보다 복잡한 고관절의 해부학적 구조를 가진 여성에게 시기적절한 치료를 제한하는 능력 격차와 싸우고 있습니다.

높은 임플란트 비용 및 수술 비용 부담

인공 고관절 전치환술에 대한 메디케어 보상은 2013-2021년 사례 수가 44.17% 증가했음에도 불구하고, 44.04% 감소하여 의료 제공업체의 이폭을 압박하고 있습니다. 미국 고관절 및 무릎관절 외과학회는 2025년에 예정된 추가 삭감에 반대하도록 의회에 청원하고 있습니다. 북동부의 평균 지불액은 1,731달러이지만, 가장 가파른 하락률에 휩싸이고 있습니다. 티타늄과 같은 공급망에 대한 투입은 현재 정형외과 제조 비용의 20%를 차지하고 있으며, 지정학적 긴장이 변동을 크게 하고 있습니다. 이러한 요인은 비용에 민감한 지역에서의 사용을 억제하고 의료 접근의 불공평을 확대할 위험이 있습니다.

부문 분석

인공 고관절 치환술의 합계는 2024년 매출의 63.21%를 차지했으며, 연령층을 불문하고 임상의 주력 제품으로서의 지위를 재확인했습니다. 이 제품의 인공 고관절 치환술 시장 규모는 2025년에 48억 4,000만 달러에 달하고, 탈구 위험을 줄이는 듀얼 모빌리티 컵 등 설계의 개량에 따라 성장을 계속하고 있습니다. 고관절 표면 치환술은 현재 틈새 시장이지만 장기적인 임플란트의 적합성을 추구하는 활동적인 환자들 사이에서 뼈 온존 철학이 뒷받침됨에 따라 CAGR 6.84%에서 진전하고 있습니다.

로봇에 의한 재치환 수술의 기세는 재치환 수술 건수 증가를 뒷받침하고 있습니다. Stryker사의 Mako 4는 관골구의 제거와 재이식의 워크플로우를 간소화하는 알고리즘 가이던스를 도입하고 있습니다. 심각한 변형에 대한 FDA 승인의 리버스 힙 구조와 같은 인접한 혁신 기술은 보험 상환이 높은 개별화된 솔루션에 대한 파이프라인의 기울기를 보여줍니다.

시멘트리스 구조는 2024년에 57.23%의 수익을 얻었지만, 외과의사가 젊고 활동적인 집단에 생물학적 고정을 선호하기 때문에 관련 인공 고관절 치환술 시장 점유율은 더욱 상승할 것으로 예측됩니다. 다공성이 높은 티타늄과 탄탈은 조기 골 침윤을 억제하고 대퇴골 경부 골절의 비유합률은 2%인 반면 표준 스크류에서는 현저히 높습니다. 골다공증의 뼈에는 시멘트 줄기가 필수적인 것에 변함이 없지만, 복잡한 해부학적 구조에는 양자의 원리를 융합시킨 하이브리드 기술이 유효합니다.

토폴로지에 최적화된 격자는 임플란트의 강성을 감소시키고 하중을 균일하게 분산시켜 응력 차폐를 억제하며 기능 수명을 연장합니다. 전방 접근 수술에 최적화된 Smith Nephew의 CATALYSTEM 줄기는 OR 시간을 단축하는 설계의 대표적인 예입니다.

지역 분석

북미는 2024년 매출의 37.58%를 차지했으며, 로봇 공학, AI 계획, 고급 베어링 표면의 조기 도입으로 기술적 리더십을 유지하고 있습니다. 이 지역의 인공 고관절 시장 규모는 2025년에 28억 7,000만 달러로 추정되며, 임상적 근거가 있는 업그레이드에 대한 유리한 상환에 지원되고 있습니다. 유럽의 성숙한 지불자 환경은 꾸준한 성장을 유지하고 있지만 비용 억제 요청은 프리미엄 장비의 보급 속도를 억제하고 있습니다.

아시아태평양이 확대 엔진으로 상승하고 2030년까지 CAGR 5.98%로 성장할 전망입니다. 중국과 인도가 임플란트의 가격을 반액으로 하는 조달 프로그램을 실시해, 수술의 도입을 자극하고 있기 때문입니다. 중국의 증례 수는 2011년 168,040례에서 2019년 577,153례로 급증하여 국산 임플란트가 수술의 4분의 1 가까이를 차지하게 되었습니다. 인도는 의료 관광의 유입과 병원 투자에 힘입어 선택적 인공관절 치환술의 연간 성장률은 두 자리를 예상하고 있습니다.

남미와 중동 및 아프리카는 잠재적 가능성을 지니고 있습니다. 생산 능력의 확대는 정형외과 의사의 양성과 장비 비용을 인상하는 수입 관세의 완화에 달려 있습니다. 탄화수소 수입으로 윤택한 걸프 협력 이사회 제국은 미국과 유럽의 시스템 수입을 늘리는 한편 전문적인 공동연구기관에 자금을 공급하고 있으며, 장기적으로는 현지 생산의 무대가 갖추어지게 됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 골관절염 증가

- 노년 인구 및 비만 인구 증가

- 로봇 지원 인공 고관절 치환술의 채용

- 뼈의 신생을 가능하게 하는 3D 프린팅 다공질 임플란트

- 외래 및 ASC 기반 절차로 이동

- 접근성을 확대하는 중국-인도 가격 거래량 입찰

- 시장 성장 억제요인

- 높은 임플란트 비용 및 수술 비용 부담

- 기기 리콜 및 메탈 온 메탈 소송

- 성숙 시장에서의 상환 압축

- 티타늄 및 코발트 공급망 압박

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 제품별

- 총 인공 고관절 치환술

- 표면 치환형 인공 고관절 치환술

- 고관절 재치환술

- 기타 제품

- 고정 유형별

- 시멘트

- 시멘트리스

- 하이브리드

- 재료별(베어링 및 커플)

- 메탈온 폴리에틸렌

- 세라믹 온 폴리에틸렌

- 세라믹 온 세라믹

- 메탈 온 메탈

- 최종 사용자별

- 병원

- 정형외과 센터

- 외래 외과 센터

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Zimmer Biomet

- Stryker Corporation

- Johnson & Johnson(DePuy Synthes)

- Smith & Nephew plc

- B. Braun SE

- MicroPort Scientific Corporation

- Enovis(DJO Global)

- Exactech Inc.

- Corin Group

- Wright Medical Group NV

- Integra LifeSciences

- Globus Medical

- Conformis

- Medacta Group

- LimaCorporate

- Bioimpianti

- Arthrex

- Mathys Ltd Bettlach

- United Orthopedic

- JRI Orthopaedics

제7장 시장 기회 및 향후 전망

AJY 25.11.26The hip arthroplasty market size reached USD 7.63 billion in 2025 and is forecast to expand at a 4.07% CAGR, lifting value to USD 9.31 billion by 2030.

Demand scales with demographic aging, surging osteoarthritis prevalence, and widening acceptance of outpatient joint-replacement protocols that displace inpatient care. Procedure growth is reinforced by rapid adoption of robotic-assisted systems that give surgeons reproducible component alignment, while 3-D-printed porous implants extend device longevity by optimizing bone ingrowth. North America leads revenue, but Asia-Pacific posts the quickest pace because China and India deploy volume-based tenders that lower implant costs and expand patient access. Competitive positioning centers on differentiated technology; leading suppliers integrate robotics, AI planning, and surface-engineered implants to secure premium price realization even as reimbursement pressure intensifies.

Global Hip Replacement Market Trends and Insights

Growing Prevalence of Osteoarthritis

Osteoarthritis affects 606.5 million people worldwide, a figure that continues to climb as populations age and obesity rates rise. Hip disease progression is particularly aggressive, and traditional bearings show a 35% higher revision risk than advanced OXINIUM surfaces that deliver 94.1% twenty-year survivorship. Regional burden is heaviest in East and South Asia, yet modifiable risks such as body-mass-index contribute one-fifth of related disability. Genomic studies link more than 900 loci to disease, and 10% of implicated genes map to existing therapies, hinting at pharmacologic options that could postpone surgery. The convergence of aging and metabolic disorders thus keeps procedure demand ahead of surgical capacity.

Rising Geriatric & Obese Population

By 2030, surgeons in the United States alone anticipate 635,000 primary hip replacements-up 171% from today-while global volumes may top 1.23 million by 2060. Higher body-mass-index complicates manual component positioning; robotic systems correct these challenges and boost acetabular accuracy in patients with BMI > 24 kg/m2. High-income nations carry the steepest caseload growth, but emerging markets battle capacity gaps that restrict timely care, particularly for women who present with more complex hip anatomy requiring personalized implants.

High Implant & Procedure Cost Burden

Medicare reimbursement for total hip arthroplasty slid 44.04% between 2013 and 2021 even as volumes rose 44.17%, squeezing provider margins. The American Association of Hip and Knee Surgeons has petitioned Congress to counter another scheduled cut for 2025. Regional spreads are stark: the Northeast commands USD 1,731 average payment yet suffered the steepest percentage decline. Supply chain inputs such as titanium now represent up to 20% of orthopedic manufacturing cost bases, and geopolitical tension magnifies volatility. These factors risk curtailing uptake in cost-sensitive zones and widening inequity in care access.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Robotic-Assisted Hip Arthroplasty

- Shift Toward Outpatient & ASC-Based Procedures

- Device Recalls & Metal-On-Metal Litigation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Total hip replacement accounted for 63.21% of 2024 revenue, reaffirming its status as the clinical workhorse across age cohorts. The hip arthroplasty market size for this product reached USD 4.84 billion in 2025 and continues to grow in tandem with incremental design refinements, such as dual-mobility cups that mitigate dislocation risk. Hip resurfacing, although presently niche, is advancing at 6.84% CAGR as bone-preserving philosophy gains traction among active patients seeking long-term implant compatibility.

Momentum in robotic revision surgery underscores rising revision volumes: Stryker's Mako 4 introduces algorithmic guidance that simplifies acetabular explant and re-implant workflows. Adjacent innovations, like FDA-authorized reverse-hip constructs for severe deformity, illustrate the pipeline's tilt toward personalized solutions commanding premium reimbursement.

Cementless constructs captured 57.23% revenue in 2024, and associated hip arthroplasty market share is forecast to climb further as surgeons favor biologic fixation for younger, active cohorts. Highly porous titanium and tantalum buttress early bone infiltration, yielding 2% nonunion in femoral neck fractures compared to markedly higher rates with standard screws. Cemented stems remain indispensable for osteoporotic bone, and hybrid techniques blend both principles for complex anatomy.

Additive manufacturing accelerates cementless innovation: topology-optimized lattices reduce implant stiffness and distribute load uniformly, curbing stress shielding and extending functional lifespan. Smith+Nephew's CATALYSTEM stem, optimized for anterior approach surgery, typifies designs that shorten OR time-a critical metric in high-throughput ASC settings.

The Hip Replacement Market Report is Segmented by Product (Total Hip Replacement, Hip Resurfacing, Hip Revision, and More), Fixation Type (Cemented, and More), Material (Metal-On-Polyethylene, Ceramic-On-Polyethylene, and More), End User (Hospitals, Orthopedic Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 37.58% of 2024 revenue and retains technology leadership through early adoption of robotics, AI planning, and advanced bearing surfaces. The hip arthroplasty market size for the region is estimated at USD 2.87 billion in 2025, underpinned by favorable reimbursement for clinically evidenced upgrades. Europe's mature payer environment sustains steady growth, though cost-containment imperatives temper premium device penetration speed.

Asia-Pacific emerges as the expansion engine, registering 5.98% CAGR through 2030 as China and India execute procurement programs that halve implant prices and stimulate surgical uptake. China's case volume jumped from 168,040 in 2011 to 577,153 in 2019, while domestic implants captured nearly one-quarter of procedures. India, buoyed by medical-tourism inflows and hospital investment, anticipates double-digit annual growth in elective joint replacement.

South America and the Middle East & Africa present latent potential: Brazil projects 39,270 lower-limb arthroplasties by 2050, yet current penetration is 8.01 per 100,000-far below global averages. Capacity expansion hinges on training orthopedic surgeons and easing import tariffs that elevate device cost. Gulf Cooperation Council states, flush with hydrocarbon revenue, increasingly import U.S. and European systems while funding specialty joint institutes, setting the stage for localized manufacturing over the long term.

- Zimmer Biomet

- Stryker

- Johnson & Johnson

- Smiths Group

- B. Braun

- MicroPort

- Enovis

- Exactech

- Corin Group

- Wright Medical Group

- Integra LifeSciences

- Globus Medical

- Conformis

- Medacta Group

- LimaCorporate

- Bioimpianti

- Arthrex

- Mathys Ltd Bettlach

- United Orthopedic

- JRI Orthopaedics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Osteoarthritis

- 4.2.2 Rising Geriatric & Obese Population

- 4.2.3 Adoption of Robotic-Assisted Hip Arthroplasty

- 4.2.4 3-D Printed Porous Implants Enabling Bone In-Growth

- 4.2.5 Shift Toward Outpatient & ASC-Based Procedures

- 4.2.6 China-India Price-Volume Tenders Expanding Access

- 4.3 Market Restraints

- 4.3.1 High Implant & Procedure Cost Burden

- 4.3.2 Device Recalls & Metal-On-Metal Litigation

- 4.3.3 Reimbursement Compression in Mature Markets

- 4.3.4 Supply-Chain Tightness for Titanium & Cobalt

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Total Hip Replacement

- 5.1.2 Hip Resurfacing

- 5.1.3 Hip Revision

- 5.1.4 Other Products

- 5.2 By Fixation Type

- 5.2.1 Cemented

- 5.2.2 Cementless

- 5.2.3 Hybrid

- 5.3 By Material (Bearing Couple)

- 5.3.1 Metal-on-Polyethylene

- 5.3.2 Ceramic-on-Polyethylene

- 5.3.3 Ceramic-on-Ceramic

- 5.3.4 Metal-on-Metal

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Orthopedic Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Zimmer Biomet

- 6.3.2 Stryker Corporation

- 6.3.3 Johnson & Johnson (DePuy Synthes)

- 6.3.4 Smith & Nephew plc

- 6.3.5 B. Braun SE

- 6.3.6 MicroPort Scientific Corporation

- 6.3.7 Enovis (DJO Global)

- 6.3.8 Exactech Inc.

- 6.3.9 Corin Group

- 6.3.10 Wright Medical Group N.V.

- 6.3.11 Integra LifeSciences

- 6.3.12 Globus Medical

- 6.3.13 Conformis

- 6.3.14 Medacta Group

- 6.3.15 LimaCorporate

- 6.3.16 Bioimpianti

- 6.3.17 Arthrex

- 6.3.18 Mathys Ltd Bettlach

- 6.3.19 United Orthopedic

- 6.3.20 JRI Orthopaedics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment