|

시장보고서

상품코드

1850340

수술용 스테이플러 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Surgical Stapler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

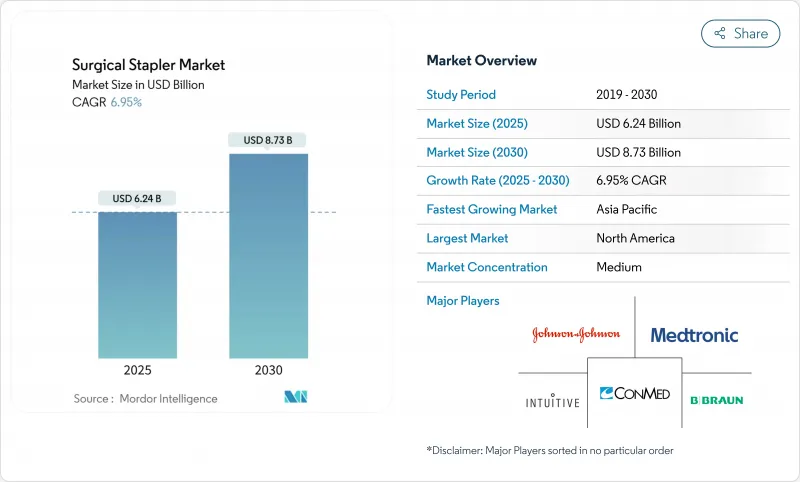

수술용 스테이플러 시장 규모는 2025년에 62억 4,000만 달러로 평가되었고 2030년에 87억 3,000만 달러에 달할 것으로 예측되며, CAGR은 6.95%를 나타낼 전망입니다.

성장의 축이 되는 것은 로봇 수술의 급속한 통합, 리로 더블 카트리지를 장려하는 병원의 지속가능성의 의무화, 보다 높은 급성기의 성형외과 및 비만수술을 뒷받침하는 고령화입니다. 대병원 체인은 OR 시간을 단축하기 위해 동력 스테이플러를 표준화하고 외래수술센터(ASC)는 자본 예산을 절약하기 위해 비용 효율적인 수동 스테이플러를 채택하고 있습니다. 또한 ISO13485에 따른 품질 시스템에 대한 규제가 명확해짐에 따라 장비 업그레이드의 컴플라이언스 불확실성이 저하된 것도 채택의 장점이 되었습니다. 이러한 요인들이 함께, 스테이플러는 가동 가능한 폐쇄 기구가 아니라 데이터 풍부한 수술 기구로 자리매김되어 세계에서 대응 가능한 수술 건수를 확대하는 진화를 이루고 있습니다.

세계의 수술용 스테이플러 시장 동향 및 인사이트

로봇 지원 수술 플랫폼과의 통합

로봇 플랫폼은 이제 손목 관절 운동과 조직 피드백을 밀리초 단위로 해석하는 예측 발사 알고리즘을 위해 설계된 스테이플러와 함께 제공되어, 단일 포트 또는 다중 포트 접근을 통한 정밀한 스테이플 라인을 가능하게 합니다. 8,606대의 다빈치 시스템 설치 기반은 독점적 재장전 장치에 대한 안정적인 수요를 창출하며, 2024년 1분기 18억 9천만 달러의 로봇 매출로 이 수익 모델이 강화되었습니다. 아시아태평양 지역 병원들은 로봇 수술실로 바로 도약하며, 혼합 장비 지원을 통해 벤더 종속성을 줄이는 플랫폼 독립적 스테이플러 설계를 촉진하고 있습니다. 동료 검토를 거친 프로토타입에서 선보인 혁신적인 3액추에이터 원형 스테이플러는 75도 카트리지 굴곡을 가능케 하여 식도 문합술의 과제를 직접 해결합니다. 차세대 시스템 내 프로세서가 10,000배 확장됨에 따라 스테이플러는 개별 조직 두께에 따라 발사 매개변수를 조정하는 실시간 분석 기능을 통합하여 장치 지능을 수술 현장 최전선으로 확장할 것입니다.

최소 침습 수술 선호도 증가

10mm 미만 포트 수술 건수는 2024년 17% 증가해 전 세계 263만 건에 달했습니다. 복잡한 전위장관 및 흉부 수술은 이제 제한된 공간 내에서 조작 가능한 고관절형 스테이플러에 의존하며 개복 전환율을 낮추고 있습니다. 외래 수술 센터는 설치 시간을 단축하는 스테이플러를 선호하며, 전동식 재장전형 제품은 반복적인 핸들 조작 없이 일관된 압착력을 제공함으로써 이를 충족합니다. 2025년 4월 SP SureForm 45의 FDA 승인은 스테이플러가 수술 방식의 변화를 주도하기보다 그 흐름을 따르고 있음을 보여줍니다. 내장된 SmartFire 센서는 최소 침습 수술 방식에 내재된 촉각 피드백의 한계를 해소하여, 외과의가 수동적 감각 대신 디지털 압착력 표시값을 신뢰할 수 있게 합니다.

수술 후 감염 및 누출 사고

사례 보고서에 따르면 수술 후 수년이 지나서도 스테이플 라인 누출로 인한 소장 폐색이 발생하여, 외과의사들이 무분별한 스테이플 사용에 경계심을 갖게 되었습니다. VATS 중 혈관 손상 발생률은 계획되지 않은 개흉술을 유발했으며, 이는 스테이플 경로에 대한 정밀 영상 검사를 권고하는 지침 개정을 촉발했습니다. 정형외과 문헌에 따르면 금속 스테이플은 봉합사에 비해 감염 위험이 더 높으며, 특히 뼈가 치유될 때까지 장치가 남아 있는 경우 더욱 그렇습니다. 소아 충수절제술은 스테이플 잔류 시 연령별 위험성을 보여줍니다. 이러한 사건들로 인해 일부 외과의들은 유착 발생 가능성이 높은 해부학적 부위에 봉합사나 가시 실을 사용하게 되어 단기적으로 시장 규모 성장이 둔화되고 있습니다.

부문 분석

선형 장치는 절단 및 문합이 일상적인 위장관 및 흉부 수술 작업량을 바탕으로 2024년 수술용 스테이플러 시장 규모의 40.74%를 차지했습니다. 긴 카트리지는 단일 통과로 넓은 조직 직경을 커버하여 슬리브 위절제술 및 폐절제술을 효율화하고 수술실 시간과 마취 노출을 단축합니다. 3열 원형 스테이플러는 틈새 시장이지만 대장항문 수술에서 문합 누출률을 6.1%에서 2.1%로 낮춰 프리미엄 가격을 유지하는 표적 임상적 이점을 입증합니다. 커터 조합은 특수 외상 시나리오에 국한되지만, 블레이드 마모로 새 카트리지가 필요해 재장전 판매를 주도합니다.

스테이플러 재충전 카트리지는 연간 8.02% 증가할 것으로 예상되며, 외과의의 작업 흐름을 변경하지 않고도 조달 담당자에게 ESG 목표 달성을 위한 빠른 투자 회수 경로를 제공합니다. 조달 데이터에 따르면, 멸균 가동 시간을 최적화할 경우 2년 수명 주기 동안 재충전 카트리지가 완전 일회용 제품보다 30-40% 저렴합니다. 병원들은 대량 계약 협상을 통해 일회용 기기에서는 불가능한 추가 단위 할인 혜택을 확보합니다. 결과적으로 재충전 카트리지는 이전에 내시경 전용이었던 자본 예산 항목을 점차 차지하며 전략적 조달 의제 내 입지를 확대하고 있습니다.

2024년 복부 수술은 비만, 대장항문, 간담도 수술이 속도와 지혈을 위해 스테이플링에 의존함에 따라 수술용 스테이플러 시장 점유율의 36.91%를 차지했습니다. 표준화된 발사 순서는 수술팀 간 변동성을 줄여 병원이 가치 기반 구매 기준을 준수하도록 돕습니다. 로봇 시스템은 심부 골반 대장 문합술을 위한 360도 관절 운동을 제공함으로써 채택 범위를 확대하고 임상적 수용도를 높입니다.

노령화 인구를 위한 무릎 및 고관절 치환술에 힘입어 정형외과 수요는 연평균 8.76% 성장률을 기록하고 있습니다. 신속한 피부 봉합은 수술당 최대 12분의 수술실 회전 시간을 단축시켜, 고량 관절 치환술 수술실에서 하루에 한 건의 추가 수술이 가능해집니다. 척추 유합술 및 스포츠 의학 분야에서도 제거를 위한 외래 방문을 없애는 흡수성 스테이플러를 채택하며 수술 건수를 증가시키고 있습니다. 심장 및 흉부 수술 분야에서는 엽절제술 시 취약한 폐동맥을 봉합하는 혈관용 재사용 스테이플러가 선호되며, 자궁적출술 같은 산부인과 수술은 정밀한 스테이플 배치로 출혈 감소 효과를 얻습니다.

지역 분석

북미는 2024년 수술용 스테이플러 시장 규모에서 34.57%를 차지하며 최대 점유율을 유지했으며, 2030년까지 연평균 복합 성장률(CAGR) 6.27%로 성장할 전망입니다. 설치된 로봇 장비는 꾸준한 소모품 수요를 창출하는 반면, ESG 프로그램은 폐기물을 줄이는 재충전식 제품 사용을 촉진합니다. 메디케어의 묶음 지불 모델은 재입원률 감소를 보상하므로, 병원들은 재정적 마진을 유지하기 위해 스테이플 라인 누출을 점점 더 모니터링하고 있습니다. 그러나 티타늄 수입에 대한 의존도는 제조사들을 지정학적 관세 위험에 노출시켜, 일부는 코발트-크롬 또는 바이오폴리머 대체재 탐색을 촉진하고 있습니다.

유럽은 품질 기준을 높이고 첨단 소재 연구를 장려하는 EU 의료기기 규정(MDR)의 지원으로 6.63% CAGR로 성장하고 있습니다. 독일과 영국이 지역 로봇 수술 사례의 절반 이상을 차지하며 고관절형 스테이플러 수요를 견인하고 있습니다. 다수 대학병원이 조달 탄소 발자국을 측정함에 따라, 재사용 가능한 핸들이 북미보다 빠르게 확산되고 있습니다. 현지 공급망은 아시아태평양 지역의 금속 가격 변동성으로부터 지역을 보호하여, 유럽 OEM 업체들이 원자재 충격 시 지속성 우위를 점할 수 있게 합니다.

아시아태평양 지역은 2030년까지 8.34%의 최고 CAGR을 기록할 전망입니다. 중국은 연간 12%의 로봇 생산 능력 증가율을 보이며 수입품보다 저렴한 국내 스테이플러 브랜드를 육성하는 동시에 수출 목표를 위해 FDA 승인을 추진 중입니다. 인도의 110억 달러 규모 의료기기 산업은 유리한 세금 감면 혜택으로 두 자릿수 성장을 노리며, 2선 도시 병원을 겨냥한 전동 스테이플러 생산 능력 확장을 지원하고 있습니다. CE 인증을 획득한 아시아태평양 혁신 기업들은 2035년까지 글로벌 출시를 계획하며 전 세계적 경쟁 구도를 강화하고 있습니다. 중동 및 아프리카와 남미는 의료 관광 회랑 및 국가 보건 비전 프로그램 연계 병원 인프라 투자에 힘입어 각각 7.82%, 7.29%의 연평균 복합 성장률(CAGR)을 기록할 전망입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 로봇 지원 수술 플랫폼과 통합

- 최소 침습 수술에 대한 관심 증가

- 전동식 및 재장전 가능 스테이플러의 빠른 채택

- 신속한 피부 봉합 솔루션이 필요한 노인 정형외과 시술 증가

- 세계에서 비만 및 대사 관련 수술 급증

- 재사용 가능한 카트리지 시스템을 선호하는 병원 ESG 의무화

- 시장 성장 억제요인

- 기계적 스테이플에의 의존을 경감하는 차세대 생체 접착 실란트

- 수술 후 감염 및 누출 사고

- 스테이플 원자재 가격을 교란시키는 집중된 티타늄 공급

- 엄격한 규제 안전 요건과 리콜

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 선형 수술용 스테이플러

- 원형 수술용 스테이플러

- 커터 스테이플러

- 스킨 스테이플러

- 스테이플러 재충전 카트리지

- 용도별

- 복부 수술

- 산부인과 수술

- 심장 및 흉부 외과

- 정형외과

- 기타 외과적 용도

- 기구별

- 수동

- 전동

- 사용성별

- 일회용

- 재사용 가능

- 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 전문 클리닉

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 경쟁 벤치마킹

- 시장 점유율 분석

- 기업 프로파일

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- ConMed Corporation

- EziSurg Medical

- Frankenman International Ltd.

- Grena Limited

- Intuitive Surgical Inc.

- Johnson & Johnson Services, Inc.

- Lexington Medical, Inc.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Purple Surgical

- Reach Surgical Inc.

- Smith & Nephew plc

- Solventum Corporation

- Standard Bariatrics

- Stryker Corporation

- Surgnova Healthcare Technologies

- Teleflex Incorporated

- Zimmer Biomet Holdings Inc.

제7장 시장 기회와 장래의 전망

HBR 25.11.19The surgical stapler market size is valued at USD 6.24 billion in 2025 and is forecast to reach USD 8.73 billion by 2030 at a 6.95% CAGR.

Growth pivots on rapid robotic-surgery integration, hospital sustainability mandates encouraging reloadable cartridges, and the aging population that pushes higher-acuity orthopedic and bariatric procedures. Large hospital chains are standardizing powered staplers to trim OR time, while ambulatory surgery centers adopt cost-efficient manual variants to keep capital budgets lean. Adoption also benefits from regulatory clarity on ISO 13485-aligned quality systems, which lowers compliance uncertainty for device upgrades. Together, these factors reposition staplers as data-rich surgical tools rather than commodity closure devices, an evolution that broadens addressable procedure volumes worldwide.

Global Surgical Stapler Market Trends and Insights

Integration with Robotic-Assisted Surgery Platforms

Robotic platforms now ship with staplers engineered for wristed articulation and predictive firing algorithms that interpret tissue feedback in milliseconds, enabling precise staple lines through single-port or multi-port access. The installed base of 8,606 da Vinci systems generates stable pull-through demand for proprietary reloads, a revenue model reinforced by Q1 2024 robotic revenue of USD 1.89 billion. APAC hospitals are leapfrogging straight to robotic theatres, fostering platform-agnostic stapler designs that support mixed fleets and reduce vendor lock-in. Innovative three-actuator circular staplers showcased in peer-reviewed prototypes promise 75-degree cartridge flexion, directly addressing esophageal anastomosis challenges. As processors inside next-generation systems scale 10,000-fold, staplers will incorporate real-time analytics that adjust firing parameters to individual tissue thickness, pushing device intelligence to the surgical field edge.

Rising Preference for Minimally-Invasive Procedures

Surgeries performed through ports under 10 mm rose 17% in 2024, reaching 2.63 million global cases. Complex foregut and thoracic procedures now rely on highly articulated staplers that maneuver within restrictive cavities, trimming conversion-to-open rates. Ambulatory centers seek staplers that cut setup time; powered reloadables satisfy this by delivering consistent compression without repeated handle squeezes. FDA clearance of the SP SureForm 45 in April 2025 underscores how staplers follow procedural migration patterns rather than dictating them. Embedded SmartFire sensors close the tactile-feedback gap inherent to MIS approaches, allowing surgeons to trust digital compression readouts instead of manual feel.

Post-Operative Infection & Leakage Incidents

Case reports cite staple-line leakage leading to small-bowel obstruction years after surgery, fueling surgeon caution toward indiscriminate staple use. Incidence of vascular injuries during VATS has triggered unplanned thoracotomies, sparking guideline revisions that urge advanced imaging of staple paths. Orthopedic literature shows higher infection odds for metal staples compared with sutures, particularly where devices remain until bone healing. Pediatric appendectomies illustrate age-specific risks when staples are retained. These events push some surgeons to suture or use barbed threads in anatomies prone to adhesion, tempering volume growth in the short term.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Powered & Reloadable Staplers

- Surge in Bariatric & Metabolic Surgeries Globally

- Stringent Regulatory Safety Requirements & Recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Linear devices held 40.74% of the surgical stapler market size in 2024, anchored on the back of gastrointestinal and thoracic workloads where transection and anastomosis are routine. Long cartridges streamline sleeve gastrectomy and lung resection by spanning wide tissue diameters in single passes, cutting OR time and anesthetic exposure. Three-row circular staplers, though niche, cut anastomotic leakage from 6.1% to 2.1% in colorectal surgery, illustrating targeted clinical gains that preserve premium pricing. Cutter combinations remain confined to specialty trauma scenarios, yet drive reload sales because blade wear necessitates fresh cartridges.

Stapler reloads, projected to rise 8.02% annually, give procurement officers a quick payback path toward ESG goals without altering surgeon workflow. Procurement data show reloads costing 30-40% less than full disposables over a two-year life cycle once sterilization uptime is optimized. Hospitals negotiating bulk contracts secure further unit discounts, a lever unavailable on single-use devices. Consequently, reloads increasingly command capital-budget line items previously reserved for endoscopes, expanding their footprint inside strategic sourcing agendas.

Abdominal procedures delivered 36.91% of the surgical stapler market share in 2024 as bariatric, colorectal, and hepatobiliary cases rely on stapling for speed and hemostasis. Standardized firing sequences reduce variability across surgical teams, helping hospitals comply with value-based purchasing benchmarks. Robotic systems broaden adoption by offering 360-degree articulation for deep-pelvic colorectal anastomoses, widening clinical acceptance.

Orthopedic demand grows at an 8.76% CAGR on the back of knee and hip replacements for an aging population. Rapid skin closure slices OR turnover time by up to 12 minutes per case, translating to one extra daily slot in high-volume arthroplasty suites. Spine fusions and sports-medicine portals also turn to absorbable staplers that eliminate removal clinic visits, driving incremental volume. Cardiac and thoracic indications lean toward vascular reloads that seal friable pulmonary arteries in lobectomies, while OB/GYN procedures such as hysterectomies benefit from reduced blood loss via precise staple placement.

The Surgical Stapler Market Report is Segmented by Product (Linear Surgical Stapler, Circular Surgical Stapler, and More), Application (Abdominal Surgery, Obstetrics & Gynecological Surgeries, and More), by Mechanism (Manual and Powered), by Usability (Disposable and Reusable), End-User (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest shareholder, with 34.57% of the surgical stapler market size in 2024, and is set to advance at a 6.27% CAGR to 2030. Installed robotic fleets create steady consumable pull-through, while ESG programs promote reloadables that cut waste. Medicare's bundled-payment models reward lower readmissions, so hospitals increasingly monitor staple-line leaks to preserve financial margins. However, reliance on titanium imports exposes manufacturers to geopolitical tariffs, prompting some to explore cobalt-chromium or biopolymer alternatives.

Europe grows at a 6.63% CAGR, supported by EU MDR rules that elevate quality thresholds and encourage advanced material research. Germany and the United Kingdom jointly account for more than half of regional robotic cases, boosting demand for highly articulated staplers. Many university hospitals measure procurement carbon footprints; as a result, reusable handles gain faster traction here than in North America. Local supply chains insulate the region from Asia-Pacific metal volatility, giving European OEMs continuity advantages during raw-material shocks.

Asia-Pacific posts the leading 8.34% CAGR through 2030. China, adding 12% yearly robotic capacity, is cultivating domestic stapler brands that undercut imports while chasing FDA clearance for export ambitions. India's USD 11 billion medical-device sector eyes double-digit growth on favorable tax holidays, backing capacity-expansion for powered staplers geared to tier-2 city hospitals. CE-cleared APAC innovators plan global rollout by 2035, intensifying competitive dynamics worldwide. The Middle East & Africa and South America track 7.82% and 7.29% CAGRs respectively, buoyed by medical-tourism corridors and hospital-infrastructure investments linked to national health-vision programs.

- B. Braun

- Beckton Dickinson

- Conmed

- EziSurg Medical

- Frankenman International Ltd.

- Grena Limited

- Intuitive Surgical

- Johnson & Johnson

- Lexington Medical, Inc.

- Medtronic

- Meril Life Science

- Purple Surgical

- Reach Surgical Inc.

- Smiths Group

- Solventum Corporation

- Standard Bariatrics

- Stryker

- Surgnova Healthcare Technologies

- Teleflex

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration with robotic-assisted surgery platforms

- 4.2.2 Rising preference for minimally-invasive procedures

- 4.2.3 Rapid adoption of powered & reloadable staplers

- 4.2.4 Growing geriatric orthopedic procedures demanding fast skin-closure solutions

- 4.2.5 Surge in bariatric & metabolic surgeries globally

- 4.2.6 Hospital ESG mandates favoring reusable cartridge systems

- 4.3 Market Restraints

- 4.3.1 Next-generation bioadhesive sealants reducing dependence on mechanical stapling

- 4.3.2 Post-operative infection & leakage incidents

- 4.3.3 Concentrated titanium supply disrupting staple raw material pricing

- 4.3.4 Stringent regulatory safety requirements & recalls

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Linear Surgical Stapler

- 5.1.2 Circular Surgical Stapler

- 5.1.3 Cutter Stapler

- 5.1.4 Skin Stapler

- 5.1.5 Stapler Reloads

- 5.2 By Application

- 5.2.1 Abdominal Surgery

- 5.2.2 Obstetrics & Gynecological Surgeries

- 5.2.3 Cardiac & Thoracic Surgeries

- 5.2.4 Orthopedic Surgery

- 5.2.5 Other Surgical Applications

- 5.3 By Mechanism

- 5.3.1 Manual

- 5.3.2 Powered

- 5.4 By Usability

- 5.4.1 Disposable

- 5.4.2 Reusable

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty Clinics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 B. Braun Melsungen AG

- 6.4.2 Becton, Dickinson and Company

- 6.4.3 ConMed Corporation

- 6.4.4 EziSurg Medical

- 6.4.5 Frankenman International Ltd.

- 6.4.6 Grena Limited

- 6.4.7 Intuitive Surgical Inc.

- 6.4.8 Johnson & Johnson Services, Inc.

- 6.4.9 Lexington Medical, Inc.

- 6.4.10 Medtronic plc

- 6.4.11 Meril Life Sciences Pvt. Ltd.

- 6.4.12 Purple Surgical

- 6.4.13 Reach Surgical Inc.

- 6.4.14 Smith & Nephew plc

- 6.4.15 Solventum Corporation

- 6.4.16 Standard Bariatrics

- 6.4.17 Stryker Corporation

- 6.4.18 Surgnova Healthcare Technologies

- 6.4.19 Teleflex Incorporated

- 6.4.20 Zimmer Biomet Holdings Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment