|

시장보고서

상품코드

1910511

퍼스널케어용 물티슈 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Personal Care Wipes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

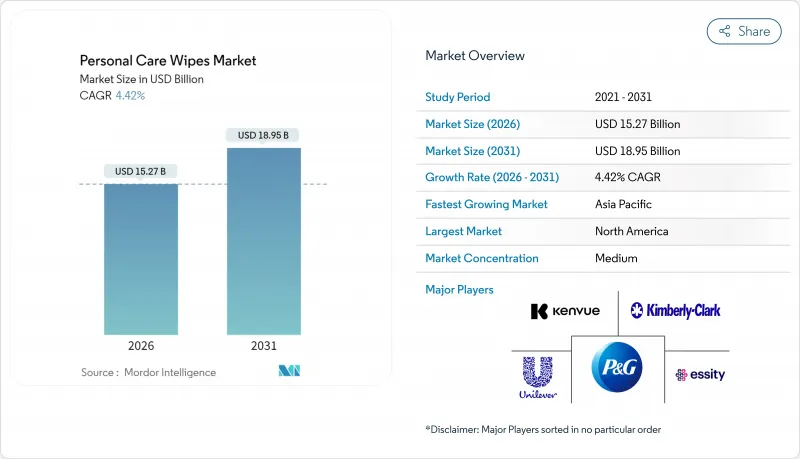

퍼스널케어용 물티슈 시장은 2025년에 146억 2,000만 달러로 평가되었으며, 2026년 152억 7,000만 달러에서 2031년까지 189억 5,000만 달러에 이를 것으로 전망됩니다.

예측 기간(2026-2031년)의 CAGR은 4.42%를 나타낼 것으로 예상됩니다.

시장의 성장은 주로 편리하고 일회용 위생 제품에 대한 소비자의 지속적인 선호에 견인되고 있으며, 이러한 경향은 유행 후 위생 습관에 의해 더욱 강화되고 있습니다. 동시에, 플라스틱 사용량과 화학 방부제의 삭감에 대한 규제 압력 증가가 제조업체에 생분해성 소재의 채용이나 보다 마일드한 처방의 개발을 촉구하고 있습니다. 생산 비용 상승에 대한 대응책으로서 기업은 재료 절약 기술과 절수 공정을 활용하고 있으며, 이들은 지속가능성 목표와도 일치하고 있습니다. 또한, 프리미엄 천연 제품 라인의 도입은 특히 선진국 시장에서 이익률 확대의 기회를 창출하고 있습니다. 아시아태평양의 도시 중산 계급이 시장에 최대 증가량을 가져오고 있는 반면, 북미는 제품 혁신과 옴니채널 소매 전략에서 계속 주도적인 입장에 있으며, 세계 업계에서 벤치마크를 확립하고 있습니다.

세계의 퍼스널케어용 물티슈 시장 동향과 인사이트

높아지는 건강·위생 의식

유행 후의 시대에 위생 의식은 현저하게 높아지고 있습니다. 현재 소비자의 88%가 소독용 물티슈를 사용하고 있으며, 이는 유행 전 64%에서 증가하고 있습니다. 또한 73%가 일상적으로 사용하고 있습니다. 이 행동의 변화는 일상생활에 있어서 위생의 우선도가 높아지고 있는 것을 나타내고 있습니다. 세계보건기구(WHO)는 위생제품이 전염병 대책과 일상적인 위생관리에 중요한 역할을 한다는 것을 강조하고 있으며, 의료, 외식산업, 퍼스널케어 등 주요 분야의 지속적인 수요를 뒷받침하고 있습니다. 미국 질병 예방관리센터(CDC)는 세계 20억 명이 기본 위생 서비스를 이용할 수 없는 현황을 지적하고 접근 가능한 위생 솔루션의 거대한 시장 가능성을 강조하고 있습니다. 이 충족되지 않은 요구는 위생 제품 시장에 큰 성장 기회를 가져왔습니다. 의료 분야에서는 효과적인 감염 예방의 필요성으로 EPA 등록 소독용 물티슈의 채용이 증가하고 있습니다. 일관된 성능을 보장하기 위해 2024년 11월에는 이러한 물티슈에 대한 새로운 표준화된 효능 시험 방법이 도입되어 중요한 용도에 대한 신뢰성과 효능이 강화되었습니다.

자연 유래, 유기, 깨끗한 위생 제품에 대한 수요 증가

성분의 안전성과 환경 지속가능성에 대한 의식의 높아짐에 따라 천연·유기 배합 제품에 대한 소비자의 기호는 계속 확대되고 있습니다. 이 동향은 특히 아기 케어 시장에서 두드러지며 피부 민감성에 대한 우려가 구매 결정에 크게 영향을 미칩니다. 예를 들어 99% 천연 성분과 식물 유래 소재로 배합된 밀리 문의 센시브 물티슈는 PARENTS 2025 베스트 포 베이비 어워드를 수상하여 깨끗하고 안전한 배합이 시장에서 평가되고 있음을 보여줍니다. 마찬가지로 허기즈는 100% 천연 유래의 식물성 섬유만을 사용한 "내츄럴 0% 플라스틱 베이비 물티슈"를 발표하여 영국 피부재단보다 민감한 피부에의 적성을 인정받았습니다. 워터 물티슈도 99.9%가 물로 최소한의 성분만을 포함하는 제품으로 이 동향을 파악해, 다액의 투자를 모으고 있습니다. 3i 그룹은 워터 물티슈 유럽, 라틴아메리카, 아시아의 사업 확대를 지원하기 위해 약 1억 4,500만 유로를 투자하기로 결정했습니다. 이는 이러한 제품에 대한 수요 증가에 대한 확신을 반영합니다. 베이비 케어 분야를 넘어 소비자들이 보다 안전하고 지속 가능한 제품 선택을 우선시함에 따라 이 천연 성분 배합으로의 전환은 성인의 퍼스널케어나 가정용 세제 시장에서도 기세를 늘리고 있습니다.

환경 문제와 폐기물 관리 문제

지자체에서는 일회용 물티슈의 부적절한 폐기로 인한 폐기물 처리 비용 증가와 인프라 부하의 악화에 점점 고민하고 있으며, 이러한 제품에 대한 환경 보호파의 반대가 높아지고 있습니다. 이것을 받아 영국에서는 플라스틱 함유 물티슈의 사용 금지를 실시. 이는 소비자의 편의보다 환경 지속가능성을 선호하는 유럽 전반의 노력을 반영한 중요한 규제 조치입니다. 이 규제 강화로 제조업체는 컴플라이언스 요구 사항을 충족하는 지속 가능한 대체품 개발을 서두르는 압력을 받고 있습니다. 그러나 소비자 행동의 변화는 여전히 심각한 도전입니다. 물티슈 싱크로 인한 심각한 하수관 폐색 문제(업계에 연간 수억 파운드의 손실을 초래)에 대한 인식은 널리 퍼졌지만, Water UK의 'Bin the Wipe' 캠페인에서 알 수 있듯이 이러한 영향을 줄이기 위해서는 여전히 효과적인 소비자 교육이 필요합니다.

부문 분석

2025년 베이비 물티슈는 51.92%라는 압도적인 시장 점유율을 차지했습니다. 이는 세계 출생률의 안정, 선진국의 프리미엄 제품 동향, 서양 위생 기준을 받아들이는 신흥 시장의 중산 계급 증가에 의해 뒷받침됩니다. 헤기즈는 유아의 피부 건강에 관한 25년 이상의 조사를 활용하여 안전과 효능에 업계 벤치마크를 확립하고 있습니다. 저자극성 처방과 식물 유래 소재에 대한 대처는 소비자의 신뢰를 구축할 뿐만 아니라 경쟁사가 추종해야 할 기준을 제시하고 있습니다. 이 부문에는 브랜드 충성도와 반복 구매에 지원되는 예측 가능한 수익원이 있습니다. 또한 화장품 분류에 대한 명확한 규정이 안정적인 컴플라이언스 환경을 제공하고 제품 개발에 장기 투자를 촉진하고 있습니다.

화장용 물티슈는 가장 성장이 현저한 분야이며 2031년까지 연평균 복합 성장률(CAGR) 4.66%로 확대될 것으로 예측됩니다. 이 성장은 간소화된 미용 습관에 대한 지향, 여행 시의 편의성, 다단계 스킨케어를 보급한 소셜 미디어의 동향에 의해 견인되고 있습니다. 화장품용 물티슈는 프리미엄 제품으로 자리매김하고 있으며, 범용품에 비해 높은 이익률을 실현하고 있습니다. 이 프리미엄 지위는 첨단 섬유 기술과 유효 성분의 배합에 대한 투자를 촉진하여 메이크업 떨어뜨림 효율과 피부에 효과가 모두 향상되었습니다. 미셀 워터 기술이나 저자극성 계면활성제 등의 혁신에 의해 강한 마찰을 필요로 하지 않고 효과적인 세정이 가능하게 되었습니다. 이것은 특히 미용 루틴에서 편리함과 피부 건강을 모두 중시하는 민감한 피부 분들에게 지지되고 있습니다.

지역별 분석

2025년 시점에서 북미는 확립된 위생 습관, 프리미엄 제품에 대한 선호, 그리고 견고한 소매 인프라에 힘입어 시장 점유율의 37.10%라는 압도적인 비율을 차지했습니다. 이 인프라는 신제품 출시를 지원할 뿐만 아니라 다양한 인구통계 부문에서 브랜드 구축 노력에도 기여하고 있습니다. 또한 FDA(미국식품의약국) 및 EPA(미국환경보호청)의 규제 프레임워크로 명확한 규제환경이 갖추어져 있다는 점도 강점입니다. 이러한 틀은 예측 가능한 컴플라이언스 요건을 정하고 있으며, 제조업체는 자신감을 갖고 투자를 혁신과 시장 확대 전략에 쏟을 수 있습니다. 게다가 자연유래·지속가능한 제품에 대해 프리미엄 가격을 지불하는 소비자의 자세는 이익률 향상에 기여할 뿐만 아니라, 고급 처방개발의 조사를 촉진하고 있습니다. 이러한 처방은 성능 측면에서 기대를 저하시키지 않으면 서 진화하는 안전 및 환경 기준에 적응하도록 설계되었습니다.

아시아태평양은 2031년까지 5.55%라는 견조한 CAGR을 기록해 다른 지역을 능가할 전망입니다. 이 성장은 급속한 도시화, 가처분 소득 증가, 서양 위생 습관으로의 문화적 전환으로 인한 것입니다. 이러한 요인은 다양한 경제·인구구조에 걸쳐 미개척의 거대한 시장 기회를 밝히고 있습니다. 지역에 근거한 제조 기업의 존재는 공급망의 발전을 촉진하고 비용 경쟁력을 확보합니다. 또한 현지 환경에 맞는 맞춤형 솔루션을 제공하고 규제 요건을 준수할 수 있습니다. 중국에서 급성장하는 중산계급과 인도의 젊은층 인구가 판매 수량의 성장을 견인하는 한편, 일본과 한국은 프리미엄 부문의 최전선에 위치하고 있습니다. 전문적인 처방과 최첨단 포장을 선호하는 이 지역의 소비자들은 프리미엄 가격을 지불할 의지가 있으며 이로 인해 이익률이 향상되고 브랜드 차별화 전략이 강화됩니다.

유럽은 성숙 시장과 엄격한 환경 규제의 분기점에 서 있습니다. 이러한 규제는 퍼스널케어 분야에서 지속 가능한 제품과 플라스틱 프리 대체품으로의 전환을 가속화하고 있습니다. 그 좋은 예가 영국에서 널리지지되는 플라스틱 함유 제품 금지 조치이며 유럽의 환경 관리에 대한 노력을 부각하고 있습니다. 이 이니셔티브는 세계 제조 기준의 방향성을 보여줄 뿐만 아니라 유럽을 이 분야의 리더로 자리매김하고 있습니다. 코디 그룹과 같은 기업은 이 유럽의 전문 지식을 활용합니다. 지속가능성에 중점을 두고 엄격한 환경 기준을 준수하면서 베이비 케어, 퍼스널케어, 홈 케어, 심지어 의료 용도에 이르기까지 맞춤형 솔루션을 제공합니다. 또한 EU의 통일된 규제 상황은 제품 개발과 시장 진입을 간소화하면서 동시에 환경 규제와 소비자 기대 모두에 따라 지속 가능한 기술에 대한 투자를 촉진하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 지원(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 높아지는 건강과 위생에의 의식

- 자연 유래·유기·깨끗한 위생 제품에 대한 수요 증가

- 지속 가능하고 생분해성 물티슈의 인기 증가

- 기능성과 향기에 초점을 맞춘 제품 혁신

- 도시화가 신속한 해결책에 대한 수요를 견인

- 전자상거래의 접근성 확대

- 시장 성장 억제요인

- 환경 문제와 폐기물 관리 과제

- 규제 및 안전 기준에의 적합에 관한 과제

- 원재료 및 폐기물 처리에 관한 규제의 강화가 시장 성장을 저해

- 부직포나 화학약품의 가격 변동이 이익률에 영향

- 소비자 행동 분석

- 규제 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 제품 유형별

- 아기 물티슈

- 화장품용 물티슈

- 촉촉한 화장실 물티슈

- 다용도 물티슈

- 인티메이트 물티슈

- 원재료별

- 일반 제품

- 천연 및 유기농 제품

- 유통 채널별

- 슈퍼마켓 및 하이퍼마켓

- 편의점 및 식료품점

- 온라인 소매점

- 기타 유통 채널

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 네덜란드

- 이탈리아

- 스웨덴

- 노르웨이

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 베트남

- 인도네시아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- The Procter & Gamble Company

- Kimberly-Clark Corporation

- Kenvue Inc.

- Essity Hygiene and Health AB

- Unilever PLC

- Ecolab Inc.

- Edgewell Personal Care Company

- Unicharm Corporation

- Hengan International Group Company Limited

- Robanda International Inc.

- Albaad Massuot Yitzhak Ltd.

- WaterWipes Unlimited Company

- The Honest Company, Inc.

- 3M Company

- GAMA Healthcare Ltd

- Ontex Group NV

- Pigeon Corporation

- Reckitt Benckiser Group plc

- Bodyography Inc.

- AM HYGIENE

제7장 시장 기회와 향후 전망

KTH 26.01.22The personal care wipes market was valued at USD 14.62 billion in 2025 and estimated to grow from USD 15.27 billion in 2026 to reach USD 18.95 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

The market's growth is primarily driven by the persistent consumer preference for convenient, single-use hygiene products, a behavior reinforced by post-pandemic hygiene practices. At the same time, increasing regulatory pressure on reducing plastic usage and chemical preservatives is encouraging manufacturers to adopt biodegradable materials and develop milder formulations. To address rising production costs, companies are leveraging material-saving technologies and water-efficient processes, which also align with sustainability goals. Additionally, the introduction of premium natural product lines is creating opportunities for margin expansion, particularly in developed markets. While the urban middle class in the Asia-Pacific region contributes the largest incremental volume to the market, North America continues to lead in product innovation and omnichannel retail strategies, setting a benchmark for the global industry.

Global Personal Care Wipes Market Trends and Insights

Heightened health and hygiene awareness

The post-pandemic era has seen a significant rise in hygiene awareness, with 88% of consumers now using disinfectant wipes, compared to 64% before the pandemic, and 73% incorporating them into their daily routines. This behavioral shift highlights the growing prioritization of hygiene in everyday life. The World Health Organization underscores the critical role of hygiene products in both outbreak response and routine sanitation, which has fueled sustained demand across key sectors such as healthcare, foodservice, and personal care. The Centers for Disease Control and Prevention further emphasizes the vast market potential for accessible hygiene solutions, noting that 2 billion people globally still lack basic hygiene services. This unmet need presents a significant growth opportunity for the hygiene products market. In healthcare, the adoption of EPA-registered disinfectant wipes has increased, driven by the need for effective infection prevention. To ensure consistent performance, new standardized efficacy testing methods for these wipes were introduced in November 2024, reinforcing their reliability and effectiveness in critical applications.

Rising demand for natural, organic, and clean hygiene products

Consumer preference for natural and organic formulations continues to grow, driven by increasing awareness of ingredient safety and environmental sustainability. This trend is particularly evident in the baby care market, where concerns about skin sensitivity significantly influence purchasing decisions. For example, Millie Moon's Sensitive Wipes, formulated with 99% natural ingredients and plant-based materials, received the PARENTS 2025 Best for Baby Awards, highlighting the market's recognition of clean and safe formulations. Similarly, Huggies introduced Natural 0% Plastic Baby Wipes, made entirely from 100% naturally derived plant-based fibers, which have been approved by the British Skin Foundation for their suitability for sensitive skin. WaterWipes has also capitalized on this trend with its products containing 99.9% water and minimal ingredients, attracting substantial investment. The 3i Group committed approximately EUR 145 million to support WaterWipes' expansion across Europe, Latin America, and Asia, reflecting confidence in the growing demand for such products. Beyond baby care, this shift towards natural formulations is gaining traction in the adult personal care and household cleaning markets, as consumers increasingly prioritize safer and more sustainable product options.

Environmental concerns and waste management issues

Municipalities are increasingly struggling with rising waste management costs and infrastructure strain caused by the improper disposal of single-use wipes, fueling growing environmental opposition to these products. In response, the UK has implemented a ban on plastic-containing wipes, a significant regulatory step that mirrors broader European efforts to prioritize environmental sustainability over consumer convenience. This regulatory push is pressuring manufacturers to expedite the development of sustainable alternatives to meet compliance requirements. However, consumer behavior remains a critical challenge. Despite widespread awareness of the severe sewer blockages caused by flushing wipes-an issue that costs the industry hundreds of millions annually-Water UK's 'Bin the Wipe' campaign highlights the ongoing need for effective consumer education to mitigate these impacts.

Other drivers and restraints analyzed in the detailed report include:

- Growing popularity for sustainable and biodegradable wipes

- Product innovation in terms of functionality and fragrance

- Regulatory and safety compliance challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, baby wipes command a leading 51.92% market share, buoyed by steady global birth rates, a trend towards premium products in developed nations, and a rising middle class in emerging markets embracing Western hygiene norms. Huggies, leveraging over 25 years of research in infant skin health, has set industry benchmarks for safety and efficacy. Their commitment to hypoallergenic formulations and plant-based materials has not only built consumer trust but also set a standard that rivals strive to meet. The segment enjoys predictable revenue streams, bolstered by brand loyalty and repeat purchases. Furthermore, clear regulations on cosmetic classifications offer a stable compliance landscape, encouraging long-term investments in product development.

Cosmetic wipes are the fastest-growing segment, projected to expand at a 4.66% CAGR through 2031. This growth is fueled by trends favoring simplified beauty routines, the convenience of travel, and the influence of social media, which has popularized multi-step skincare regimens. Positioned as premium products, cosmetic wipes command higher margins compared to their commodity counterparts. This premium status has drawn investments into advanced fiber technologies and the incorporation of active ingredients, boosting both makeup removal efficiency and skin benefits. Innovations like micellar water technology and gentle surfactants allow for effective cleansing without the need for harsh rubbing. This appeals particularly to consumers with sensitive skin, who value both convenience and skin health in their beauty routines.

The Personal Care Wipes Market Report is Segmented by Product Type (Baby Wipes, Cosmetic Wipes, and More); by Ingredient (Conventional and Natural/Organic); by Distribution Channel (Supermarkets/Hypermarkets, and More); and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a commanding 37.10% share of the market, bolstered by its established hygiene practices, a penchant for premium products, and a robust retail infrastructure. This infrastructure not only supports the launch of new products but also aids in brand-building efforts across varied demographic segments. Furthermore, the region enjoys the benefits of regulatory clarity, courtesy of the FDA and EPA frameworks. These frameworks delineate predictable compliance requirements, empowering manufacturers to channel investments confidently into innovation and strategies for market expansion. Additionally, consumers' readiness to pay a premium for natural and sustainable products not only boosts profit margins but also fuels research into advanced formulations. These formulations are designed to adapt to evolving safety and environmental standards without compromising on performance expectations.

Asia-Pacific is set to outpace all others, charting a robust 5.55% CAGR through 2031. This growth is driven by swift urbanization, increasing disposable incomes, and a cultural shift towards Western hygiene practices. These factors unveil vast, untapped market opportunities across a spectrum of economic and demographic landscapes. The presence of regional manufacturing companies bolsters supply chain development, ensuring cost competitiveness. This presence also allows for tailored solutions that cater to local preferences and adhere to regulatory mandates. While China's burgeoning middle class and India's youthful demographic fuel volume growth, Japan and South Korea are at the forefront of the premium segment. Their consumers, with a penchant for specialized formulations and cutting-edge packaging, are willing to pay a premium, thereby enhancing margins and bolstering brand differentiation strategies.

Europe stands at the crossroads of a mature market and stringent environmental regulations. These regulations are hastening the shift towards sustainable products and plastic-free alternatives in the personal care sector. A case in point is the UK's widely supported ban on plastic-containing products, underscoring Europe's commitment to environmental stewardship. This commitment not only sets the tone for global manufacturing standards but also positions Europe as a leader in the arena. Companies like Codi Group are capitalizing on this European expertise. With a keen focus on sustainability, they're crafting tailored solutions spanning baby care, personal hygiene, home care, and even medical applications, all while adhering to rigorous environmental benchmarks. Moreover, the EU's unified regulatory landscape streamlines product development and market entry, simultaneously fostering investments in sustainable technologies that align with both environmental mandates and consumer expectations.

- The Procter & Gamble Company

- Kimberly-Clark Corporation

- Kenvue Inc.

- Essity Hygiene and Health AB

- Unilever PLC

- Ecolab Inc.

- Edgewell Personal Care Company

- Unicharm Corporation

- Hengan International Group Company Limited

- Robanda International Inc.

- Albaad Massuot Yitzhak Ltd.

- WaterWipes Unlimited Company

- The Honest Company, Inc.

- 3M Company

- GAMA Healthcare Ltd

- Ontex Group NV

- Pigeon Corporation

- Reckitt Benckiser Group plc

- Bodyography Inc.

- A. M. HYGIENE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened health and hygiene awareness

- 4.2.2 Rising demand for natural, organic, and clean hygiene products

- 4.2.3 Growing popularity for sustainable and biodegradable wipes

- 4.2.4 Product innovation in terms of functionality and fragrance

- 4.2.5 Urbanization driving demand for quick solutions.

- 4.2.6 Growth in e-commerce accessibility

- 4.3 Market Restraints

- 4.3.1 Environmental concerns and waste management issues

- 4.3.2 Regulatory and safety compliance challenges

- 4.3.3 Stricter regulations on ingredients and disposal hinder market growth.

- 4.3.4 Fluctuating prices of non-woven fabrics and chemicals affect margins

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Baby Wipes

- 5.1.2 Cosmetic Wipes

- 5.1.3 Moist Toilet Wipes

- 5.1.4 General Purpose Wipes

- 5.1.5 Intimate Wipes

- 5.2 By Ingredient

- 5.2.1 Conventional

- 5.2.2 Natural/Organic

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribtution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Netherlands

- 5.4.2.6 Italy

- 5.4.2.7 Sweden

- 5.4.2.8 Norway

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Vietnam

- 5.4.3.7 Indonesia

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 The Procter & Gamble Company

- 6.4.2 Kimberly-Clark Corporation

- 6.4.3 Kenvue Inc.

- 6.4.4 Essity Hygiene and Health AB

- 6.4.5 Unilever PLC

- 6.4.6 Ecolab Inc.

- 6.4.7 Edgewell Personal Care Company

- 6.4.8 Unicharm Corporation

- 6.4.9 Hengan International Group Company Limited

- 6.4.10 Robanda International Inc.

- 6.4.11 Albaad Massuot Yitzhak Ltd.

- 6.4.12 WaterWipes Unlimited Company

- 6.4.13 The Honest Company, Inc.

- 6.4.14 3M Company

- 6.4.15 GAMA Healthcare Ltd

- 6.4.16 Ontex Group NV

- 6.4.17 Pigeon Corporation

- 6.4.18 Reckitt Benckiser Group plc

- 6.4.19 Bodyography Inc.

- 6.4.20 A. M. HYGIENE