|

시장보고서

상품코드

1852208

해부병리학 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Anatomic Pathology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

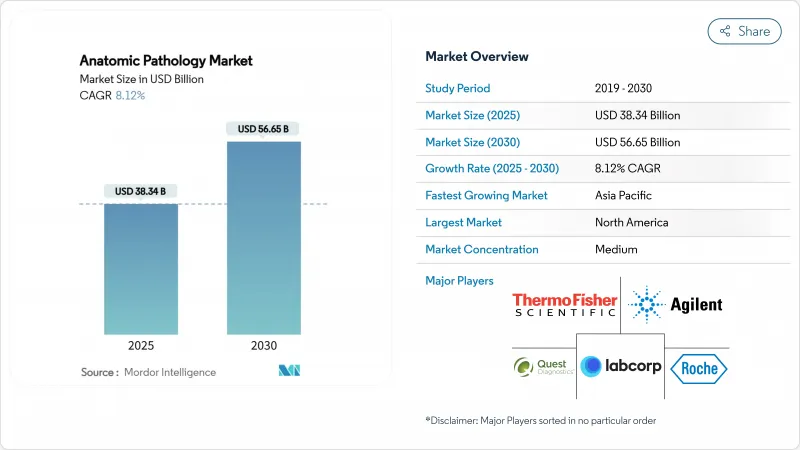

해부병리학 시장 규모는 2025년에 383억 4,000만 달러로 평가되었으며, 2030년에 566억 5,000만 달러에 이를 것으로 예측되며, CAGR은 8.12%를 나타낼 전망입니다.

암 발병률 증가, 지속적인 기술 업그레이드, 정밀의학 활용 확대는 높은 검사량과 꾸준한 자본 지출을 유지합니다. 병원들은 종양학 프로그램을 지원하기 위해 조직 기반 진단을 확대하고, 제약사들은 후기 임상시험에 동반진단(CDT)을 도입하여 새로운 수익원을 창출합니다. 디지털 슬라이드 스캐너, 실험실 자동화, 인공지능은 처리 시간을 단축하고 인력 부족을 부분적으로 상쇄합니다. 규제 기관들은 품질 기준을 강화하면서도 디지털 병리학에 대한 승인을 가속화하여 더 빠른 도입을 장려합니다.

세계의 해부병리학 시장 동향 및 인사이트

암과 만성 질환의 부담 증가

2022년 전 세계 암 환자 수는 2,000만 명에 달했으며, 폐암만 250만 건의 진단을 차지했습니다. 미국 암 학회(ACS)는 2025년 미국 내 신규 암 진단이 200만 건 이상, 사망자가 61만 8,000 명에 이를 것으로 예측하여 검체 처리량이 증가 추세를 유지할 전망입니다. 선진국의 고령화 인구와 신흥 지역의 생활 방식 변화가 병행 성장을 촉진하는 한편, 검진 프로그램은 조기 발견의 경제적 효과를 부각시키고 있습니다. 이러한 추세는 조직학, 세포학 및 분자하위전문분야 전반에 걸쳐 지속적인 수요를 창출하며, 해부병리학 시장을 종양학 치료의 필수적인 기둥으로 공고히 하고 있습니다.

정밀의학 및 맞춤형 의학의 확산

동반진단(컴패니언 진단)은 이제 많은 항암제 출시의 핵심 요소로 자리잡았습니다. 2025년 4월, 로슈는 비소세포폐암 치료를 안내하고 면역조직화학(IHC)과 디지털 알고리즘을 결합한 AI 기반 TROP2 검사에 대해 획기적 의료기기 지정을 획득했습니다. 인간 단백질체 프로젝트는 예측된 인간 단백질의 93% 식별을 확인하여 향후 검사를 위한 바이오마커 풀을 확대했습니다. 순환 DNA 단편체학을 포함한 액체 생검 플랫폼은 HPV 유발 암에 대해 0.32 복제본/μL 미만의 검출 한계를 가진 비침습적 옵션을 추가합니다. 따라서 실험실들은 이 의약품 중심 수익원을 확보하기 위해 다중 염색, 차세대 시퀀싱 및 이미지 분석 소프트웨어에 투자하고 있습니다.

엄격한 규정 및 인증 요구 사항

2024년 7월 발효되는 FDA의 실험실 개발 검사(LDT) 최종 규정은 수십 년간 지속된 집행 재량권을 종료하고, 수천 개의 검사를 설계 관리, 이상 사례 보고, 시판 전 심사 의무가 적용되는 의료기기 경로로 강제 편입시킵니다. 품질 시스템 규정(QSR) 개정은 ISO 13485와 조화를 이루며, 광범위한 문서 업데이트와 감사를 요구합니다. 유럽에서는 전문 학회의 디지털 병리학 지침이 표준화된 검증 및 지속 가능성을 요구하여 국경 간 일관성을 개선하는 동시에 규정 준수 비용을 증가시킵니다. 미국 보험사들은 동시에 네트워크를 축소하고 보상금을 줄여 소규모 실험실에 대한 압박을 가중시키고 있습니다.

부문 분석

소모품 부문은 2024년 매출의 46.54%를 차지했습니다. 모든 조직 블록 분석에 시약, 염색제, 슬라이드가 필요하기 때문입니다. 검사 복잡성 증가로 프리미엄 항체 및 분자 키트 수요가 확대되며 꾸준한 성장세를 유지하고 있습니다. 서비스 부문은 아웃소싱 확대와 전문 분자 검사의 내부 처리 능력 초과로 2030년까지 10.45%의 가장 빠른 연평균 복합 성장률(CAGR)을 기록할 전망입니다. 장비 부문은 실험실 확장과 함께 성장하며, 디지털 스캐너와 자동 염색기는 인력 부족을 완화하고 표준화를 촉진합니다. 퀘스트 진단(Quest Diagnostics)은 디지털 판독이 진단 지연을 방지하고 병리학자 간 협업을 개선하여 효율성을 높인다고 강조합니다.

해부병리학의 소모품 시장 규모는 2030년에 264억 달러로 평가되었고, 총액의 46.6%에 해당할 것으로 예측되고 있습니다. 반면 서비스 부문은 지속적인 두 자릿수 성장으로 예측 기간 종료 시점 해부병리학 시장 규모의 34%를 차지할 것으로 예상됩니다. 이에 따라 소모품 공급업체들은 고객의 자본 부담을 완화하면서 반복 수익을 보장하는 시약 임대 모델을 추진 중입니다.

지역 분석

북미는 높은 암 검진률, 확립된 보험 적용 체계, 조기 디지털 도입으로 2024년 매출의 41.56%를 차지했습니다. 미국 의료 지출은 4조 달러를 초과하며, 병리학은 임상 결정의 3분의 2에 영향을 미쳐 서비스 수요를 공고히 합니다. 미국임상병리학회(ASCP)의 인력 양성 프로그램은 장학금 지원 및 보험급여 옹호에 중점을 두지만, 여전히 두 자릿수 수준의 인력 공백이 존재합니다.

아시아태평양 지역은 2030년까지 9.45%의 가장 빠른 연평균 복합성장률(CAGR)을 기록할 전망입니다. 중국의 의료 지출은 2022년 8조 5,300억 위안에 달했으며, 2030년까지 20조 위안을 넘어설 것으로 예상되어 지방 중심 도시 전역에 걸쳐 실험실 확장을 촉진하고 있습니다. 일본은 일상 병리 업무에 AI 영상 분석을 도입해 수작업 피로를 줄이고 있으며, 인도의 진단 체인들은 예방 검사 수요를 포착하기 위해 4급 도시로 확장 중입니다. 원격 병리학 시범 사업은 원격 병원과 중앙 실험실을 연결해 인프라 중복 없이 접근성을 개선합니다.

유럽병리학회(ESP)의 주도 아래 디지털 슬라이드 표준과 품질 프레임워크가 추진력을 얻으며 유럽에서도 꾸준한 도입이 이루어지고 있습니다. 영국 병리의 3%만이 완전한 인력을 확보한 것으로 보고되어 자동 커버슬리퍼 및 AI 분류 도구에 대한 시급성이 대두되고 있습니다. 중동 및 아프리카 및 남미는 대형 장비 투자에서 뒤처지지만, 모바일 슬라이드 스캐너와 클라우드 포털이 확산되며 해부병리학 시장 참여가 점진적으로 확대되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 암과 만성 질환의 부담 증가

- 정밀의학 및 맞춤형 의학의 확산

- 병리학 기기 및 자동화의 지속적인 기술 발전

- 디지털 병리학 및 인공지능의 통합 확대

- 일상적 조직병리학의 분자 및 공간 오믹스 확대

- 자원 제한 환경의 원격 병리학 네트워크 출현

- 시장 성장 억제요인

- 엄격한 규제와 인증 요건

- 숙련된 병리학자 및 조직기술사 부족

- 첨단 시스템의 높은 자본 및 운영 비용

- 표준화된 데이터 포맷과 상호 운용성 부족

- 규제 상황

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 및 서비스별

- 기기

- 소모품

- 서비스

- 용도별

- 질병 진단

- 암

- 감염성 질환

- 기타

- 창약 및 의약품 개발

- 전임상 독성학

- 동반진단

- 바이오마커 검증

- 기타 용도

- 질병 진단

- 최종 사용자별

- 병원

- 진단 실험실

- 연구실

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- F. Hoffmann-La Roche

- Danaher(Leica Biosystems)

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Sakura Finetek

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- NeoGenomics

- Cardinal Health

- BioGenex

- Bio SB

- 3DHISTECH

- Philips Healthcare

- Ventana Medical Systems

- Indica Labs

- Hologic(Biocare)

- Sysmex

- PerkinElmer

- OptraSCAN

- Hamamatsu Photonics

- Microsoft(GigaPath)

제7장 시장 기회와 장래의 전망

HBR 25.11.27The anatomic pathology market size is valued at USD 38.34 billion in 2025 and is projected to reach USD 56.65 billion by 2030, advancing at an 8.12% CAGR.

Rising cancer incidence, continued technology upgrades, and wider precision medicine use sustain high test volumes and steady capital spending. Hospitals expand tissue-based diagnostics to support oncology programs while pharmaceutical companies embed companion diagnostics into late-stage trials, creating new revenue layers. Digital slide scanners, laboratory automation, and artificial intelligence cut turnaround time and partially offset staff shortages. Regulatory agencies strengthen quality expectations yet also accelerate clearances for digital pathology, encouraging faster adoption.

Global Anatomic Pathology Market Trends and Insights

Rising Burden of Cancer and Chronic Diseases

Global cancer cases reached 20 million in 2022, with lung cancer alone contributing 2.5 million diagnoses. The American Cancer Society forecasts more than 2 million new US diagnoses and 618,000 deaths in 2025, keeping specimen volumes on an upward curve. Aging populations in developed economies and lifestyle shifts in emerging regions add parallel growth, while screening programs highlight the economic payoff of early detection. These trends drive sustained demand across histology, cytology, and molecular sub-specialties, cementing the anatomic pathology market as an indispensable pillar of oncology care.

Growing Adoption of Precision and Personalized Medicine

Companion diagnostics now sit at the core of many oncology drug launches. In April 2025, Roche received breakthrough device designation for its AI-enabled TROP2 test that guides treatment of non-small-cell lung cancer and unites immunohistochemistry with digital algorithms. The Human Proteome Project confirms identification of 93% of predicted human proteins, broadening the biomarker pool for future assays. Liquid biopsy platforms, including circulating DNA fragmentomics, add non-invasive options with detection limits below 0.32 copies/µL for HPV-driven cancers. Laboratories therefore invest in multiplex staining, next-generation sequencing, and image analysis software to secure this medicine-first revenue stream.

Stringent Regulatory and Accreditation Requirements

The FDA final rule on laboratory-developed tests, effective July 2024, ends decades of enforcement discretion and forces thousands of assays into the medical-device pathway with design control, adverse event reporting, and premarket review obligations. Quality System Regulation revisions harmonize with ISO 13485, requiring broad documentation updates and audits. In Europe, digital pathology guidance from professional societies demands standardized validation and sustainability, adding compliance expense while improving cross-border consistency. US payers simultaneously narrow networks and reduce reimbursement, compounding pressure on smaller labs.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Pathology Instruments and Automation

- Increasing Integration of Digital Pathology and Artificial Intelligence

- Shortage of Skilled Pathologists and Histotechnologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables held 46.54% revenue in 2024 because every tissue block requires reagents, stains, and slides. Rising test complexity boosts premium antibody and molecular kit demand, supporting steady incremental growth. Services post the fastest 10.45% CAGR to 2030 as outsourcing gains traction and specialized molecular assays exceed in-house bandwidth. Instruments move in step with lab expansions, with digital scanners and automated stainers mitigating staff gaps and lifting standardization. Quest Diagnostics notes that upfront digital readouts prevent diagnostic delay and improve inter-pathologist collaboration, highlighting efficiency gains.

The anatomic pathology market size for consumables is projected to reach USD 26.4 billion in 2030, equal to 46.6% of total value. In contrast, services are anticipated to account for 34% of the anatomic pathology market size at the end of the forecast horizon due to sustained double-digit growth. Consumable suppliers therefore pursue reagent-lease models, guaranteeing recurring revenue while easing customer capital strain.

The Anatomic Pathology Market Report is Segmented by Product & Services (Instruments, Consumables, and Services), Application (Disease Diagnosis, Drug Discovery & Development, and Other Applications), End User (Hospitals, Diagnostic Laboratories, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.56% revenue in 2024 owing to high cancer screening rates, established reimbursement, and early digital adoption. US healthcare spending surpasses USD 4 trillion, and pathology influences two-thirds of clinical decisions, solidifying service demand. Workforce programs from the American Society for Clinical Pathology focus on scholarship funding and reimbursement advocacy, though vacancies remain in double digits.

Asia-Pacific delivers the fastest 9.45% CAGR through 2030. China's healthcare outlays reached 8.53 trillion yuan in 2022 and may pass 20 trillion yuan by 2030, boosting laboratory build-outs across provincial centers. Japan embeds AI imaging within routine pathology workflows to cut manual fatigue, and India's diagnostic chains expand into tier-4 towns to capture preventive testing demand. Telepathology pilots link remote hospitals to central labs, improving access without duplicating infrastructure.

Europe shows steady uptake as digital slide standards and quality frameworks gain momentum under the European Society of Pathology. Only 3% of UK departments report full staffing, creating urgency for automated coverslippers and AI triage tools. Middle East & Africa and South America lag on large instrument investment, yet mobile slide scanners and cloud portals are spreading, enabling gradual participation in the anatomic pathology market.

- Roche

- Danaher (Leica Biosystems)

- Thermo Fisher Scientific

- Agilent Technologies

- Sakura Finetek

- Quest Diagnostics

- LabCorp

- NeoGenomics

- Cardinal Health

- BioGenex

- Bio SB

- 3DHISTECH

- Koninklijke Philips

- Ventana Medical Systems

- Indica Labs

- Hologic (Biocare)

- Sysmex

- PerkinElmer

- OptraSCAN

- Hamamatsu Photonics

- Microsoft (GigaPath)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Cancer and Chronic Diseases

- 4.2.2 Growing Adoption of Precision and Personalized Medicine

- 4.2.3 Continuous Technological Advancements in Pathology Instruments And Automation

- 4.2.4 Increasing Integration of Digital Pathology and Artificial Intelligence

- 4.2.5 Expansion of Molecular and Spatial Omics in Routine Histopathology

- 4.2.6 Emergence of Telepathology Networks in Resource-Limited Settings

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory and Accreditation Requirements

- 4.3.2 Shortage of Skilled Pathologists and Histotechnologists

- 4.3.3 High Capital and Operating Costs of Advanced Systems

- 4.3.4 Lack of Standardized Data Formats and Interoperability

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product & Services

- 5.1.1 Instruments

- 5.1.2 Consumables

- 5.1.3 Services

- 5.2 By Application

- 5.2.1 Disease Diagnosis

- 5.2.1.1 Cancer

- 5.2.1.2 Infectious Diseases

- 5.2.1.3 Other Conditions

- 5.2.2 Drug Discovery & Development

- 5.2.2.1 Pre-Clinical Toxicology

- 5.2.2.2 Companion Diagnostics

- 5.2.2.3 Biomarker Validation

- 5.2.3 Other Applications

- 5.2.1 Disease Diagnosis

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Laboratories

- 5.3.3 Research Laboratories

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 F. Hoffmann-La Roche

- 6.3.2 Danaher (Leica Biosystems)

- 6.3.3 Thermo Fisher Scientific, Inc.

- 6.3.4 Agilent Technologies, Inc.

- 6.3.5 Sakura Finetek

- 6.3.6 Quest Diagnostics Incorporated

- 6.3.7 Laboratory Corporation of America Holdings

- 6.3.8 NeoGenomics

- 6.3.9 Cardinal Health

- 6.3.10 BioGenex

- 6.3.11 Bio SB

- 6.3.12 3DHISTECH

- 6.3.13 Philips Healthcare

- 6.3.14 Ventana Medical Systems

- 6.3.15 Indica Labs

- 6.3.16 Hologic (Biocare)

- 6.3.17 Sysmex

- 6.3.18 PerkinElmer

- 6.3.19 OptraSCAN

- 6.3.20 Hamamatsu Photonics

- 6.3.21 Microsoft (GigaPath)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment