|

시장보고서

상품코드

1429210

화학적 종자 처리 : 시장 점유율 분석, 산업 동향, 통계 및 성장 예측(2024-2029년)Global Chemical Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

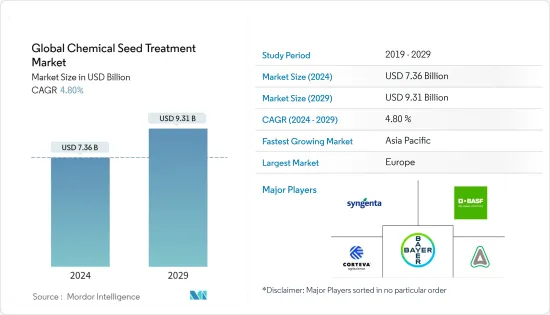

세계의 화학적 종자 처리 시장 규모는 2024년에 73억 6,000만 달러로 추정 및 예측되고, 2029년에는 93억 1,000만 달러에 이를 전망이며, 예측기간(2024-2029년)의 CAGR은 4.80%로 성장할 것으로 예측됩니다.

COVID-19 팬데믹이 종자 처리 시장에 미치는 영향은 주로 운송 장벽으로 인해 매우 적습니다. 봉쇄와 혼란의 영향은 모든 유형의 농업 활동에 대해 정부에 의해 면제되기 때문에 코로나 발생에 의한 그러한 영향은 없습니다. 사실 농약회사는 농가의 공황 구매 행동으로 작년에 비해 2자리 수익을 올렸습니다. 씨앗 처리에 대한 농민의 의식 증가는 정부의 지원으로 이어지고 있습니다. 종자 처리로 적절하게 처리된 종자를 보관하고 종자의 부패를 방지하기 위해 개발 도상국 정부는 국가와 마을 수준에서 여러 종자 은행을 관리합니다. 종자 처리의 사용을 둘러싼 정부의 규제와 캠페인의 장려가 시장을 견인하고 있습니다. 세계의 종자 처리 시장은 살충제, 살균제 및 기타 화학 약품으로 구성되며, 그 중 화학 약제가 가장 지배적인 용도 부문을 형성합니다.

화학적 종자 처리 시장 동향

고품질 씨앗의 비용 증가가 시장을 견인

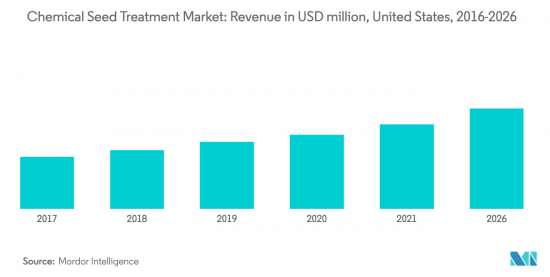

하이브리드 및 유전자 변형 종자와 관련된 높은 비용은 세계적으로 종자 처리 시장의 성장을 가속하는 주요 요인입니다. 씨앗 처리는 훈증과 농약의 잎 표면 살포와 관련된 규제 문제 증가로 인해 농부가 양질의 씨앗에 대한 투자를 보호하는 수단으로 점차 고려되고 있습니다. 원하는 농학적 특성을 지닌 고품질 종자에 대한 수요가 증가함에 따라 종자 비용이 상승할 것으로 예상됩니다. 기업과 농부 모두 고품질의 종자를 저장하기 위해 종자 처리 솔루션에 지출할 준비가 되어 있습니다. 2019년 미국 농무부의 추계에 따르면, 옥수수 종자는 1995년 이후 약 300%의 비용이 들고 있지만, 수율은 35%만 증가했습니다. 프레이머는 여러 번 화학제품을 투여할 필요가 없는 종자를 선택하여 운영 비용을 줄이려고 합니다. 이러한 인공 종자의 초기 보호는 종자 처리 제품을 사용하여 보장됩니다.

아시아태평양에서의 사용 증가

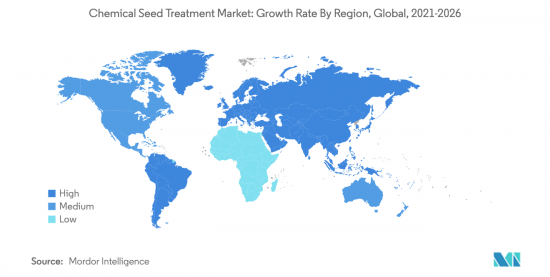

지역적으로 아시아태평양은 종자 처리의 최고 소비자이며 시장 점유율은 약 60.0%입니다. 아시아에서 생산되는 주요 작물에는 쌀, 사탕무, 과일 및 채소, 곡물, 곡류가 포함됩니다. 한국, 중국, 일본 및 최근에는 베트남과 같은 아시아 국가들은 단기 및 다년생 작물 모두에 종자 보호 및 강화 제품을 더 많이 적용하고 있습니다. 신젠타, BASF, 바이엘 등 다양한 대형 종자처리 기업들이 이러한 지역에서 사업을 전개하고 있으며, 자사 제품에 대한 인지도를 높이고 종자 처리 제품을 사용하는 이점을 소개하기 위해 정기적으로 농장시험과 연수회를 개최하고 있습니다. 농업 관행 증가와 고품질 농산물의 요구는 이 지역에서 종자 처리 시장의 성장을 가속할 것으로 예상되는 요인입니다.

화학적 종자 처리 산업 개요

화학적 종자 처리 시장은 통합되어 있습니다. 시장의 주요 기업은 시장의 대부분을 차지하고 다양하고 증가하는 제품 포트폴리오를 가지고 있습니다. 시장 점유율의 우위성이라는 점에서 Syngenta International AG의 점유율은 24.0%로 Bayer CropScience AG, Corteva Agriscience, BASF SE, Syngenta가 이어지고 있습니다. 이 시장에서 이러한 대기업은 사업 확대 및 투자, 합병 및 인수, 제휴, 합작 사업, 계약 등을 통해 존재감을 높이는 데 주력하고 있습니다. 이 회사들은 북미, 아시아태평양, 유럽에서 강한 존재감을 보여줍니다. 또한 이 지역 전체에 강력한 유통망과 함께 제조시설을 가지고 있습니다. 이 시장의 주요 기업은 사업 확대 및 제품 혁신, M&A, 제휴, 합작 사업, 계약 등을 통해 존재감을 높이는 데 주력하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 대체품의 위협

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 용도

- 살충제

- 살균제

- 기타 화학제품

- 작물

- 옥수수

- 콩

- 밀

- 쌀

- 카놀라

- 면화

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 스페인

- 영국

- 프랑스

- 독일

- 러시아

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 태국

- 베트남

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- DowDuPont Inc.

- ADAMA Agricultural Solutions Ltd

- Advanced Biological Systems

- BioWorks Inc.

- Germains Seed Technology

- Incotec Group BV

- Nufarm Limited

- Plant Health Care

- Precision Laboratories

- Valent Biosciences Corporation

- Verdesian Life Sciences

제7장 시장 기회 및 앞으로의 동향

제8장 시장에 대한 COVID-19의 영향 평가

AJY 24.02.28The Global Chemical Seed Treatment Market size is estimated at USD 7.36 billion in 2024, and is expected to reach USD 9.31 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

The impact of the COVID-19 pandemic on the seed treatment market has been minimal, mainly due to transportation barriers. The impact of lockdowns or disruptions has been exempted by the government for all types of agricultural activities, hence there has been no such effect of corona outbreak. Indeed, the agrochemical companies have made double-digit profits as compared to last year, due to panic buying behavior from farmers. Growing awareness among farmers over the use of seed treatment has resulted in support from the government. Multiple seed banks are being managed by the governments of developing countries, at the national, as well as village levels, in order to store seeds that are properly treated by seed treatment chemicals, hence preventing the rotting of seeds. Encouraging government regulations and campaigns over the use of seed treatment is driving the market. The global market for seed treatment comprises chemical agents, including insecticides, fungicides, and other chemicals, of which chemical agents form the most dominant application segment.

Chemical Seed Treatment Market Trends

Increase in Cost of High-Quality Seeds driving the Market

High costs associated with hybrids and genetically modified seeds is a major factor driving the growth of the seed treatment market, globally. Seed treatment is gradually being considered by farmers as a mode to protect investments made on good quality seeds, due to an increase in regulatory issues relating to fumigation, as well as the foliar application of pesticides. Cost of seeds is expected to increase, owing to a increase in the demand for high-quality seeds, with desirable agronomic traits. Both companies and farmers are ready to spend on seed treatment solutions, in order to save high-quality seeds. According to USDA estimates of 2019, corn seeds cost about 300% since 1995, while the yield grew by only 35%. Framers are trying to cut down operating costs by selecting seeds that do not require multiple doses of chemicals. The initial protection of these engineered seeds is ensured by using seed treatments products.

Increasing Usage in the Asia Pacific region

Geographically, Asia Pacific is the top consumer of seed treatment with a market share of around 60.0%. Major crops produced in Asia include rice, sugar beet, fruits & vegetables, cereals, and grains. Asian countries, such as Korea, China, Japan, and recently Vietnam, are applying more of seed protection/enhancement products for both short-term and perennial crops. Various leading seed treatment companies like Syngenta, BASF, and Bayer are operating in these regions and they regularly organize field trials and training sessions to increase the awareness regarding their products, as well as to present the benefits of using seed treatment products. The increasing agricultural practices and requirement of high-quality agricultural produce are factors that are projected to drive the seed treatment market growth in this region.

Chemical Seed Treatment Industry Overview

The market for chemical seed treatment is consolidated. Top players in the market occupy a major portion of the market, having a diverse and increasing product portfolio. In terms of market share dominance, Syngenta International AG with 24.0% share is followed by Bayer CropScience AG, Corteva Agriscience, BASF SE, and Syngenta. These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions. The major players in this market are focusing on increasing their presence through expansions & product innovations, mergers & acquisitions, partnerships, joint ventures, and agreements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Insecticide

- 5.1.2 Fungicide

- 5.1.3 Other Chemicals

- 5.2 Crop

- 5.2.1 Corn/Maize

- 5.2.2 Soybean

- 5.2.3 Wheat

- 5.2.4 Rice

- 5.2.5 Canola

- 5.2.6 Cotton

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Syngenta International AG

- 6.3.2 Bayer CropScience AG

- 6.3.3 BASF SE

- 6.3.4 DowDuPont Inc.

- 6.3.5 ADAMA Agricultural Solutions Ltd

- 6.3.6 Advanced Biological Systems

- 6.3.7 BioWorks Inc.

- 6.3.8 Germains Seed Technology

- 6.3.9 Incotec Group BV

- 6.3.10 Nufarm Limited

- 6.3.11 Plant Health Care

- 6.3.12 Precision Laboratories

- 6.3.13 Valent Biosciences Corporation

- 6.3.14 Verdesian Life Sciences