|

시장보고서

상품코드

1430554

동물용 창상 치료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Global Animal Wound Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

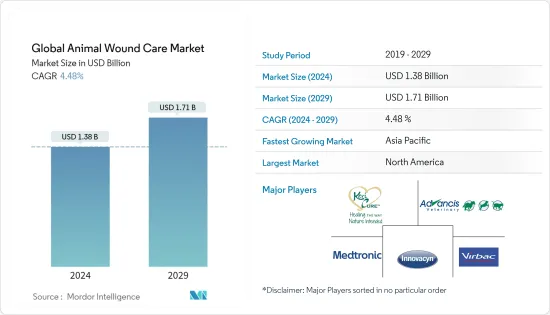

세계의 동물용 창상 치료 시장 규모는 2024년에 13억 8,000만 달러로 추정되며, 2029년에는 17억 1,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) CAGR은 4.48%로 성장할 것으로 예측됩니다.

COVID-19의 발생은 동물용 창상 치료 시장에 큰 영향을 미쳤습니다. 예를 들어 전 세계 반려동물의 코로나바이러스 확산을 이해하기 위해 여러 연구가 수행되고 있습니다. 예를 들어 2021년에 발표된 논문 '멕시코의 반려동물의 숙주 특성, 소유 행동 및 SARS-CoV-2 감염 위험 요인'에 따르면 멕시코의 조사 대상 반려동물 중 31.8%의 개와 27.3%의 고양이가 IgG ELISA 양성 반응을 보였다고 합니다. 같은 정보원에 따르면 COVID-19에 따르면 집에 있는 COVID 양성 반려동물 주인과 매장에서 구입한 반려동물사료는 동물의 건강에 영향을 미치지 않았다고 합니다. 또한 동물용 창상 치료 시장은 조사 대상 시장공급망 혼란으로 인해 성장세가 둔화되는 것을 관찰했습니다.

동물용 창상 치료 시장의 성장을 가져온 주요 요인은 정부 및 동물 복지 협회의 구상 증가, 동물 사육 및 동물 헬스케어 지출 증가입니다. 세계동물보건기구(OIE)는 동물 의료를 포함한 모든 동물 복지 기준이 과학적 근거에 기반한 것임을 보장하기 위해 노력하고 있습니다. 또한 다른 요인들도 고려해야 한다는 것을 인지하고 있습니다. 국제축산동물복지연합(ICFAW)은 전 세계 비정부 동물복지단체의 이익을 대변하기 위해 설립되었습니다.

또한 수의학 상처 치유 협회는 2022년 5월 파리에서 회의를 개최하였습니다. 회의 주제는 'Wound and Surgical Site Infections In The Modern Veterinary Clinic: Prevention And Treatment(현대 동물병원의 상처 및 수술 부위 감염: 예방과 치료)'였습니다, 이 주제는 모든 수의사들이 매일 직면하는 문제와 의문을 다루었습니다. 수술 부위 감염(SSI)은 수의사, 보호자 및 동물이 직면하는 주요 문제 중 하나입니다. 따라서 반려동물과 동물의 수술 부위 감염에 대한 신속한 치료의 중요성과 필요성을 고려하여 이번 컨퍼런스에서는 SSI를 우선적으로 다루었습니다. 따라서 전 세계 정부 구상 증가와 동물 복지에 대한 관심이 높아지면서 조사 대상 시장의 성장에 도움이 되고 있습니다.

따라서 위의 요인들로 인해 동물용 창상 치료 시장은 예측 기간 중 크게 성장할 것으로 예상됩니다. 그러나 개와 고양이의 상처 치료 제품에 대한 비교 연구가 충분하지 않고 동물 헬스케어에 드는 비용이 높다는 점이 시장 성장을 저해하고 있습니다.

동물용 상시술료제 시장 동향

반려동물 상시술료제 시장, 예측기간 중 양호한 성장세 전망

COVID-19의 발생과 함께 반려동물 입양이 크게 증가한 것으로 관찰되었으며, 이는 조사 대상 시장에 큰 영향을 미칠 것으로 보입니다. 예를 들어 2021년 5월에 발표된 "Did the COVID-19 Pandemic Spark a Public Interest in Pet Adoption?"에 따르면 COVID-19 이후 전 세계에서 반려동물 입양에 대한 관심이 높아지고 있으며, 그 중 개가 가장 높은 관심을 받고 있습니다. 가장 높은 관심을 받고 있으며, 시장 성장에 큰 영향을 미칠 것으로 예상됩니다.

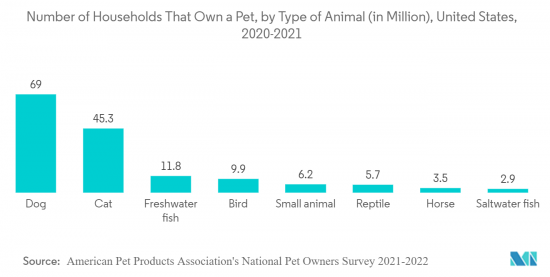

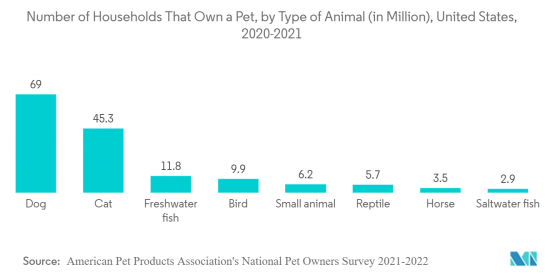

또한 반려동물의 수는 전 세계에서 증가하고 있으며, 2021-2022년 미국 반려동물 사육자 조사에 따르면 미국 가구의 70%가 반려동물을 키우고 있는 것으로 나타났습니다. 최근 연구에 따르면 반려동물을 키우면 혈압이 낮아지고, 스트레스가 감소하며, 심장병 위험이 낮아지고, 총 의료비 지출이 낮아지는 것으로 나타났습니다. 요약하면 반려동물을 키우면 삶의 질이 향상된다는 것입니다. 따라서 반려동물 주인은 일반적으로 동물에게 영향을 미치는 상처와 문제를 적절히 처리하려고 노력합니다. 이는 시장에 긍정적인 영향을 미치고 예측 기간 중 시장 성장을 가속할 것입니다. 또한 유럽 반려동물 식품산업협회(FEDIAF)의 2020년 연례보고서에 따르면 유럽에서 기르는 주요 반려동물은 개와 고양이입니다. 또한 유럽에서는 약 8,500만 가구가 최소 1마리 이상의 반려동물을 키우고 있으며, 이는 동물용 상시술료제 시장을 촉진할 가능성이 높습니다. 또한 반려동물의 상처 치유 과정의 진전을 지적하는 많은 연구 기사도 있습니다. 예를 들어 2022년 8월에 발표된 '국소 주사된 자가 다혈소판 혈장은 고양이의 피부 상처 치유를 개선한다'라는 제목의 논문에 따르면 실험용 고양이의 개방성 상처를 치료하기 위해 다혈소판 혈장(PRP)을 국소적으로 사용했을 때, PRP를 투여한 그룹이 더 빨리 회복되었습니다는 유망한 연구 결과가 발표되었습니다. 회복이 빨랐다는 유망한 결과를 얻었습니다. 따라서 반려동물 상처 치료 분야의 이러한 연구 구상은 시장 성장을 가속할 것입니다.

기업은 반려동물을 위한 신제품을 개발하고 있으며, 이는 이 분야 시장 조사를 가속화할 것으로 예상됩니다. 예를 들어 2021년 3월 힐러스 펫케어(Healers PetCare)는 반려동물의 건강을 위한 조합 키트를 출시했습니다. 이 키트에는 반려동물의 건강과 웰빙을 위한 스킨 앤 코트 건강 츄, 핫스팟 릴리프 크림, 컨디셔닝 티트리 오일 샴푸가 포함되어 있습니다. 이처럼 앞서 언급한 요인들은 조사 대상 시장에 긍정적인 영향을 미칠 것으로 예상됩니다.

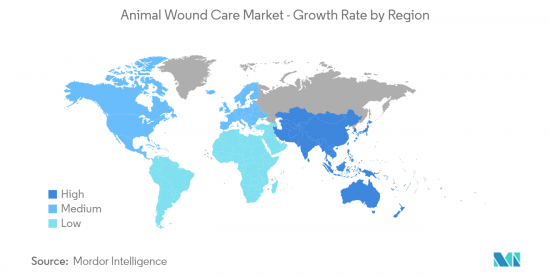

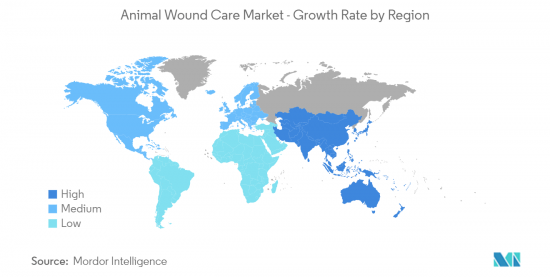

예측 기간 중 북미가 시장을 독점할 것으로 예상

북미는 정부 및 동물 복지 협회의 구상 증가, 동물 사육 및 동물 헬스케어 지출 증가 등의 요인으로 인해 예측 기간 중 전체 시장을 지배할 것으로 예상됩니다. 미국 반려동물용품협회(APPA)가 실시한 2021-2022년 전국 반려동물 소유자 조사에 따르면 북미 반려동물 산업 지출 총액은 1,236억 달러로 2020년의 1,036억 달러에서 19% 증가했습니다.

또 북미 반려동물건강보험협회(NAPHIA)의 'State of the Industry Report 2022 Highlights'에 따르면 미국내 반려동물 보험의 총 보험료는 약 26억 달러로 2021년 말 기준 미국에서 보험에 가입된 반려동물의 총 수는 390만 마리로 2020년 대비 28% 증가했습니다. 반려견의 평균 상해 및 질병 보험료는 연간 583달러, 월 49달러였습니다. 보험에 가입한 반려동물은 캘리포니아, 뉴욕, 플로리다에서 가장 많습니다. 보험에 가입한 반려동물은 개가 82%로 가장 많았고, 고양이는 18%였습니다. 캐나다에서는 77.5%가 개, 22.5%가 고양이였습니다.

또한 멕시코 농업농촌개발부는 사실상 전국적으로 심각한 동물 질병에 대한 수의사 교육을 시작했습니다. 이 단체는 2021년까지 멕시코에서 2,000명 이상의 수의사를 훈련시켰습니다. 이 교육은 자폐증을 포함한 다양한 질병과 그 치료법을 다루고 있습니다. 이러한 교육 프로그램의 결과로 조사 대상 지역의 동물용 창상 치료 시장은 예측 기간 중 강력하게 성장할 것으로 예상됩니다.

북미에서는 미국이 가장 큰 시장 점유율을 차지하고 있습니다. 미국동물보건협회는 수의사의 상처 치료를 담당하는 단체입니다. 이 단체는 동물 헬스케어에 필요한 향후 제품을 파악하고 있습니다. 이 협회가 국내에서 시행하는 다양한 홍보 프로그램을 통해 수의사 전문가와 일반인이 동물의 효과적인 상처 치료 관리에 대해 이해할 수 있도록 돕고 있습니다. 또한 미국 반려동물용품협회(American Pet Products Association Inc.)에 따르면 2020년 미국에서 반려동물에 지출된 비용은 약 990억 달러로 추정되며, 2019년 957억 달러에서 증가했습니다. 캐나다와 멕시코에서도 비슷한 높은 지출이 관찰되었으며, 이는 반려동물 치료에 대한 치료 수요와 보호자의 인식이 높다는 것을 보여줍니다. 이러한 요인들이 상처 치료 시장의 성장에 기여하고 있습니다. 따라서 앞서 언급 한 요인은 시장 성장을 가속화할 것으로 예상됩니다.

동물용 상시술료제 산업 개요

동물용 상시술료제 시장에는 여러 대기업이 진출해 경쟁이 치열합니다. 시장 점유율 측면에서 현재 소수의 대기업이 시장을 독점하고 있습니다. 국민들의 동물 보호에 대한 인식이 높아짐에 따라 향후 몇년안에 다른 소규모 기업이 시장에 진입할 것으로 예상됩니다. 시장의 주요 기업으로는 Advancis Veterinary Ltd, Virbac, Medtronic PLC 등이 있습니다.

기타 혜택 :

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 정부 및 동물 복지 협회에 의한 구상의 증가

- 동물 사육과 동물 헬스케어 지출의 증가

- 시장 억제요인

- 개와 고양이에서 창상 치유 제품의 잘 디자인된 비교 연구의 결여

- 동물 헬스케어에 관련된 고비용

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 강도

제5장 시장 세분화

- 제품별

- 수술용

- 첨단 의료

- 전통적

- 기타 제품

- 동물 유형별

- 반려

- 가축

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Innovacyn, Inc.

- Advancis Veterinary Ltd

- KeriCure Inc.

- Medtronic PLC

- MILLIKEN & COMPANY

- Neogen Corporation

- Vernacare

- Elanco Animal Health

- Virbac

- Sentrx Animal Care, Inc.

- Primavet Inc.

제7장 시장 기회와 향후 동향

KSA 24.03.14The Global Animal Wound Care Market size is estimated at USD 1.38 billion in 2024, and is expected to reach USD 1.71 billion by 2029, growing at a CAGR of 4.48% during the forecast period (2024-2029).

Due to the outbreak of COVID-19, there was a significant impact on the animal wound care market. For instance, several studies have been conducted to understand the spread of coronavirus across pets worldwide. For instance, as per the article published in 2021 titled, 'Host traits, ownership behavior and risk factors of SARS-CoV-2 infection in domestic pets in Mexico,' IgG ELISA positive results were found in 31.8% of dogs and 27.3% of cats in Mexico's surveyed pets. As per the same source, the COVID-positive pet owner residing in the home or pet food purchased from a store had no impact on the health of the animal according to COVID-19. Moreover, the animal wound care market observed a setback in growth due to the disruption of the supply chain in the market studied.

The major factors attributing to the growth of the animal wound care market are the increasing initiatives by the governments and animal welfare associations and increased animal adoption and animal healthcare expenditure. The World Organization for Animal Health (OIE) is committed to ensuring that all animal welfare standards, including veterinary healthcare, are science-based. It also recognizes that other factors must also be considered. The International Coalition for Farm Animal Welfare (ICFAW) was formed to represent the interests of non-governmental animal welfare organizations globally.

Moreover, the veterinary wound healing association conducted its conference in Paris on May 2022. The theme of the conference was 'Wound and Surgical Site Infections In The Modern Veterinary Clinic: Prevention And Treatment' and this theme addressed issues and queries that all veterinarians deal with daily. Surgical site infections (SSI) is one of the main issue faced by veterinarian, owner, and the animal. Therefore, the conference has given priority to the SSI considering the significance and necessity of a prompt cure for surgical site infections in pets and animals. Hence, the increasing government initiatives and rising animal welfare worldwide are helping in the growth of the market studied, as these initiatives are making people consider their pet's health as important.

Hence as per the factors mentioned above, the animal wound care market is expected to grow significantly over the forecast period. However, the lack of well-designed comparative studies of wound healing products in cats and dogs and the high costs associated with veterinary healthcare restrain the market growth.

Animal Wound Care Market Trends

Companion Animal Wound Care Market is Expected to Observe Good Growth Over the Forecast Period

With the outbreak of COVID-19, a significant increase in the adoption of pets was observed, which is likely to influence the market studied significantly. For instance, as per the article published in May 2021 under the title 'Did the COVID-19 Pandemic Spark a Public Interest in Pet Adoption?', Following the COVID-19 epidemic, the study noticed a global interest in pet adoption worldwide, with dogs garnering the most interest which is expected to have a significant impact on the market growth.

Moreover, the number of pets is increasing globally. The National Pet Owners Survey during 2021-2022 found that 70% of US households have a companion animal. Owning a pet is associated with lower blood pressure, less stress, a lower risk of heart disease, and cheaper total health care expenses, according to recent studies. In summary, having pets around improves the quality of life. Hence, pet owners generally ensure that the wounds and problems affecting their animals are properly addressed. That has a favorable effect on the market and thereby promotes market growth over the forecast period. Moreover, according to the annual report of the European Pet Food Industry Association (FEDIAF) for 2020, dogs and cats are the major pets adopted in Europe. Moreover, approximately 85 million European households own at least one pet animal which is likely to boost the animal wound care market. Moreover, many of the research articles point out the advancements in the wound healing process in companion animals. For instance, as per the article published in August 2022 under the title 'Locally Injected Autologous Platelet-Rich Plasma Improves Cutaneous Wound Healing in Cats', the topical use of Platelet-rich plasma (PRP) in the treatment of open wounds in laboratory cats, and results from the research found to be promising, they indicate that the PRP group saw more rapid recovery. Hence such research initiatives in the field of pet wound care boost the market growth.

Companies are developing new products for companion animals, which are expected to accelerate the market studied in this segment. For instance, in March 2021, Healers PetCare introduced a combination kit offering for pet health. This kit includes Skin and Coat Health Chews, Hot Spot Relief cream, and Conditioning Tea Tree Oil Shampoo for pet health and wellness. Thus, the aforementioned factors are expected to positively impact the market studied.

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the overall market throughout the forecast period owing to the factors such as increasing initiatives by the governments and animal welfare associations and an increase in animal adoption and animal healthcare expenditure. According to the 2021-2022 National Pet Owners Survey, conducted by the American Pet Products Association (APPA), total pet industry expenditures in the United totaled USD 123.6 billion, up 19% from USD 103.6 billion in 2020.

Furthermore, the North American Pet Health Insurance Association's (NAPHIA) State of the Industry Report 2022 Highlights stated that the total premium volume for pet insurance in the United States was nearly USD 2.6 billion. The total number of pets insured in the United States at year-end 2021 was 3.9 million, a 28% increase since 2020. The average accident and illness premium for dogs was USD 583 a year or USD 49 a month. The largest share of insured pets lives in California, New York, and Florida. The largest number of pets insured were dogs at 82 % versus cats at 18 %. In Canada, 77.5% of insured pets were dogs versus 22.5% of cats.

Additionally, Mexico's Ministry of Agriculture and Rural Development has begun training veterinarians throughout the nation virtually for severe animal diseases. This organization has trained more than 2,000 veterinarians in Mexico so far in 2021. With this training, various illnesses, including autism, and their therapies have been covered. The market for animal wound healing in the studied region is anticipated to increase strongly over the forecast period as a result of such training programs.

In North America, the United States holds the largest market share. The United States Animal Health Association is an organization that takes care of wound care in veterinary. This organization keeps track of the upcoming products that are required for animal healthcare. Various promotion programs are being carried out by this association in the country, which enables veterinary professionals and the general population to understand effective wound care management for animals. Furthermore, as per the American Pet Products Association Inc., in 2020, it was estimated that around USD 99 billion was spent on pets in the United States, up from USD 95.7 billion in 2019. A similar high expenditure can be observed both in Canada and Mexico, which shows the demand for treatment and awareness among the owners regarding the treatment of their pets. Such factors help in the growth of the wound care market. Thus, the aforementioned factors are expected to accelerate market growth.

Animal Wound Care Industry Overview

The animal wound care market is moderately competitive with several major players. In terms of market share, few of the major players currently dominate the market. With the rising awareness levels of animal care among the population, few other smaller players are expected to enter the market in the coming years. Some of the major players in the market are Advancis Veterinary Ltd, Virbac, and Medtronic PLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Initiatives by the Governments and Animal Welfare Associations

- 4.2.2 Increase in Animal Adoption and Animal Healthcare Expenditure

- 4.3 Market Restraints

- 4.3.1 Lack of Well-designed Comparative Studies of Wound Healing Products in Cats and Dogs

- 4.3.2 High Costs Associated with Veterinary Healthcare

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Products

- 5.1.1 Surgical

- 5.1.2 Advanced

- 5.1.3 Traditional

- 5.1.4 Other Products

- 5.2 By Animal Type

- 5.2.1 Companion

- 5.2.2 Livestock

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Innovacyn, Inc.

- 6.1.2 Advancis Veterinary Ltd

- 6.1.3 KeriCure Inc.

- 6.1.4 Medtronic PLC

- 6.1.5 MILLIKEN & COMPANY

- 6.1.6 Neogen Corporation

- 6.1.7 Vernacare

- 6.1.8 Elanco Animal Health

- 6.1.9 Virbac

- 6.1.10 Sentrx Animal Care, Inc.

- 6.1.11 Primavet Inc.