|

시장보고서

상품코드

1430591

폴리에틸렌 나프탈레이트 : 시장 점유율 분석, 산업 동향, 성장 예측(2024-2029년)Polyethylene Naphthalate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

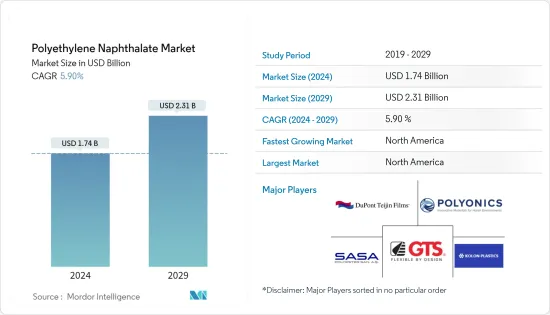

폴리에틸렌 나프탈레이트 시장 규모는 2024년에 17억 4,000만 달러로 추정되고, 2029년에는 23억 1,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR은 5.90%로 성장할 전망입니다.

COVID-19의 발생으로 세계 봉쇄, 제조 활동 및 공급망의 혼란, 생산 정지가 발생하여 2020년 시장은 부정적인 영향을 받았습니다. 그러나 2021년에는 상황이 회복되기 시작하여 시장의 성장 궤도가 회복되었습니다.

주요 하이라이트

- 시장을 견인하는 주요 요인은 포장 용도에서 수요 증가 및 전자 산업에서 수요 증가입니다.

- 반면, 높은 제조 비용이 시장 성장의 저해 요인이 되고 있습니다.

- 태양전지 보호에 있어서의 폴리에틸렌 나프탈레이트의 용도 확대는 시장 성장을 위한 다양한 유리한 기회를 제공할 것으로 예상됩니다.

- 폴리에틸렌 나프탈레이트의 용도별로는 내구성이 높고 화학약품이나 용제에 강하기 때문에 포장 분야가 시장을 독점할 것으로 예상됩니다.

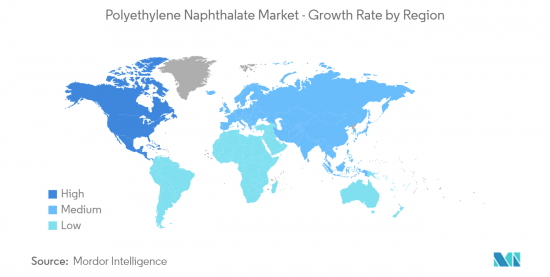

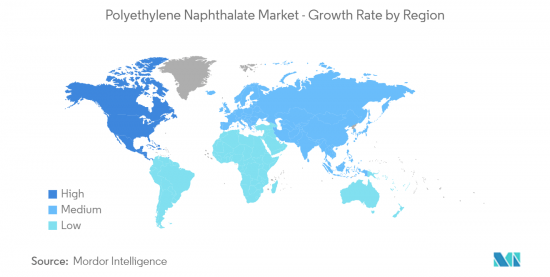

- 북미는 미국, 캐나다, 멕시코 등 국가에서 가장 많이 소비되고 있으며 전 세계에서 시장을 독점하고 있습니다.

폴리에틸렌 나프탈레이트 시장 동향

포장 분야에서 수요 증가

- 폴리에틸렌 나프탈레이트는 2,6 디카르복실산 및 에틸렌 글리콜로부터 얻은 폴리에스테르입니다. 화학약품과 용제에 대한 높은 내성, 높은 기계적 강도, 우수한 신틸레이션 특성 등의 우수한 특성을 가지고 있습니다.

- 포장 용도에서 폴리에틸렌 나프탈레이트 수요가 증가하고 있는 이유는 높은 강성률(영률)이 재료의 우수한 내수축성과 우수한 배리어 기능의 원인이 되고 있기 때문입니다.

- 또한, 폴리에틸렌 나프탈레이트는 산소나 수증기에 대한 투과성이 낮기 때문에 용기 내의 산화 작용을 억제하고 식품 보존 목적에 최적이기 때문에 식품 포장 용도에 사용되고 있습니다.

- 또한, 폴리에틸렌 나프탈레이트는 포장에 필요한 층의 수를 줄일 수 있기 때문에 포장을 단순화할 수 있어 전체 포장 비용을 절감할 수 있습니다.

- 인도 포장산업협회(PIAI)에 따르면 인도의 포장산업은 예측기간 동안 22%의 성장률이 예상됩니다. 또한 인도의 포장 시장은 2025년까지 2,048억 1,000만 달러에 이를 것으로 예상됩니다.

- 연포장은 남미, 아프리카, 아시아태평양의 저소득 국가에서 식품 포장 용도로 사용됩니다. 신흥국에서는 연포장의 인기와 수요가 높아지고 있으며, 지속적인 경기 확대와 식음료 산업의 가속이 수요를 지지하고 있습니다.

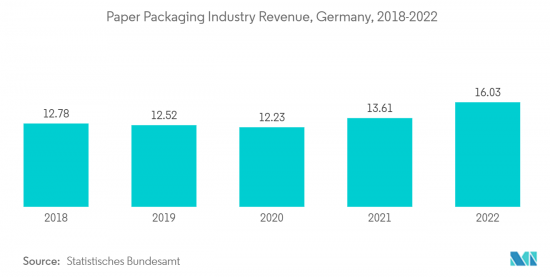

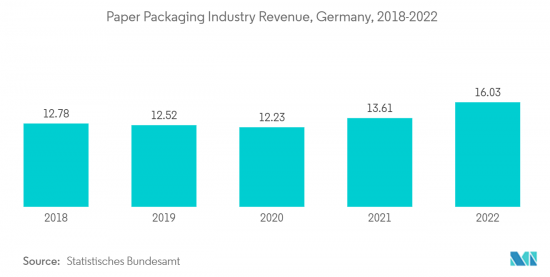

- 독일에서는 다양한 최종 사용자 산업을 위한 비화석 기반 포장 수요가 증가하고 있기 때문에 종이 포장 산업은 2022년에 크게 성장했습니다.

- 폴리에틸렌 나프탈레이트에는 위와 같은 요인이 있기 때문에 시장은 예측 기간 동안 급성장할 것으로 예상됩니다.

시장을 독점하는 북미

- 예측 기간 동안 북미는 폴리에틸렌 나프탈레이트 시장을 독점할 것으로 예상됩니다. 미국과 캐나다와 같은 국가에서는 포장 및 전자 장비와 같은 주요 최종 사용자 산업 수요가 증가하고 있기 때문에 폴리에틸렌 나프탈레이트 수요가 증가하고 있습니다.

- 폴리에틸렌 나프탈레이트는 높은 기계적 및 열적 특성으로 인해 전자 부품의 제조에 필름과 펠릿의 형태로 널리 사용되고 있기 때문에 이 지역에서는 폴리에틸렌 나프탈레이트 수요가 증가하고 있습니다.

- 게다가 전기 자동차의 보급 동향과 고성능, 강성의 고무 타이어의 제조에 있어서의 폴리에틸렌 나프탈레이트의 사용 증가 또한 이 지역 시장을 밀어올릴 가능성이 높습니다.

- 게다가 비산방지로 가벼운 맥주나 주스 병 제조에 있어서의 폴리에틸렌 나프탈레이트 수요 증가가 이 지역에서의 폴리에틸렌 시장의 성장을 더욱 뒷받침할 것으로 보입니다.

- 미국 식품의약국(FDA)은 폴리에틸렌 나프탈레이트와 같은 재활용 가능한 플라스틱 제품을 식품 포장에 사용하도록 승인하고 있으며, 예측 기간 동안 이 지역 시장을 자극할 가능성이 높습니다.

- IEA에 따르면 미국에서는 2030년까지 승용차와 소형 트럭의 신차 판매 대수의 50%를 전기 자동차(EV)로 하는 것을 연방 정부가 목표로 하고 있습니다. 또한 국제 클린 운송 평의회에 따르면 2020년캘리포니아 주 정부는 2035년까지 캘리포니아에서 판매되는 모든 신차 및 승용차 트럭을 BEV 및 PHEV 등을 포함한 제로 방출 차량으로 만들 것을 의무화할 대통령령을 발표했습니다.

- 북미에서 사업을 전개하고 있는 주요 기업에는 폴리오닉스, 듀폰 제인 필름 등이 있습니다.

- 앞서 언급한 요인과 정부의 지원은 예측기간 동안 폴리에틸렌 나프탈레이트 수요 증가에 기여하고 있습니다.

폴리에틸렌 나프탈레이트 산업 개요

폴리에틸렌 나프탈레이트 시장은 고도로 통합되어 있으며 주요 기업이 큰 점유율을 차지하고 있습니다. 시장의 주요 기업으로는 Dupont Teijin Films, SASA Polyester Sanayi AS, KOLON PLASTIC INC., GTS Flexible Ltd., Polyonics 등이 있습니다(순부동).

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 포장 용도에서 수요 증가

- 일렉트로닉스 산업에서 수요 증가

- 기타 촉진요인

- 억제요인

- 높은 제조 비용

- 기타 억제요인

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 베이스 시장 규모)

- 용도별

- 음료 보틀링

- 포장

- 일렉트로닉스

- 고무 타이어

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 점유율(%)** 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Dupont Teijin Films

- EPC Group

- GTS Flexible Ltd.

- KOLON PLASTIC INC.

- Polyonics

- PPI Adhesive Products(CE) sro

- SASA Polyester Sanayi AS

제7장 시장 기회 및 앞으로의 동향

- 태양전지 보호 용도의 확대

- 기타 기회

The Polyethylene Naphthalate Market size is estimated at USD 1.74 billion in 2024, and is expected to reach USD 2.31 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the world, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- Major factors driving the market studied are rising demand in packaging applications and increasing demand in the electronics industry.

- On the flip side, high manufacturing costs are the major restraint that hinders the growth of the market.

- The growing application of polyethylene naphthalate in solar cell protection is expected to offer various lucrative opportunities for the growth of the market.

- By application, the packaging segment is expected to dominate the polyethylene naphthalate market owing to its high durability and resistance to chemicals & solvents.

- North America region dominated the market across the globe with the largest consumption from countries such as United States, Canada and Mexico.

Polyethylene Naphthalate Market Trends

Increasing Demand from Packaging Segment

- Polyethylene naphthalate is a polyester that is derived from 2,6 dicarboxylic acid and ethylene glycol. It has superior properties like high resistance to chemicals & solvents, high mechanical strength, and excellent scintillation properties.

- The demand for polyethylene naphthalate in packaging applications is increasing owing to its high stiffness modulus (Young's modulus) which is responsible for better-shrinking resistance of the material and superior barrier capabilities.

- Additionally, polyethylene naphthalate is used for food packaging applications as it is less permeable to oxygen and water vapor, thus reducing the oxidation effects in containers, making it ideal for food preservation purposes.

- Furthermore, polyethylene naphthalate reduces the number of layers required for packaging, which enables simplification in packaging and also reduces overall packaging costs.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025.

- Flexible packaging is used in food packaging applications in low-income countries in South America, Africa, and Asia-Pacific. The popularity and demand for flexible packaging are rising in emerging economies, and the demand is supported by continued economic expansion and an acceleration in the food and beverage industry.

- In Germany, the paper packaging industry grew significantly in 2022 because of increasing demand for non fossil based packaging for different end user industries.

- Owing to all the above-mentioned factors for polyethylene naphthalate, its market is expected to grow rapidly over the forecast period.

North America Region to Dominate the Market

- North America region is expected to dominate the market for polyethylene naphthalate during the forecast period. In countries like the United States and Canada owing to the growing demand from major end-user industries like packaging and electronics, the demand for polyethylene naphthalate has been increasing in the region.

- Polyethylene naphthalate is widely used in films and pellet forms to manufacture electronic parts owing to its high mechanical and thermal properties, due to which the demand for polyethylene naphthalate is increasing in the region.

- Additionally, with the increasing trend of electric vehicles and the growing use of polyethylene naphthalate in making high-performance and rigid rubber tires is likely to boost its market in the region.

- Furthermore, the rising demand for polyethylene naphthalate in making shatterproof and lightweight beer and juice bottles is likely to further support the polyethylene market growth in the region.

- The United States Food and Drug Administration (FDA) has approved the use of recyclable plastic products like polyethylene naphthalate in food packaging which is likely to stimulate its market in the region during the forecast period.

- According to the IEA, in the United States, the federal aim is for electric vehicles (EVs) to make up 50% of new passenger cars and light trucks sold by 2030. Moreover, as per the International Council on Clean Transportation, in 2020, the California Government has announced an executive order which directs the state to require that, by 2035, all new cars and passenger trucks sold in California be zero-emission vehicles, which includes BEV and PHEV, and others.

- Some of the major companies operating in North America region are - Polyonics and Dupont Teijin Films.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for polyethylene naphthalate during the forecast period.

Polyethylene Naphthalate Industry Overview

The polyethylene naphthalate market is highly consolidated with top players accounting for a major share of the market. Major companies in the market include Dupont Teijin Films, SASA Polyester Sanayi A.S., KOLON PLASTIC INC., GTS Flexible Ltd., and Polyonics among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand in Packaging Applications

- 4.1.2 Increasing Demand in Electronics Industry

- 4.1.3 Other Driver

- 4.2 Restraints

- 4.2.1 High Manufacturing Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Beverage Bottling

- 5.1.2 Packaging

- 5.1.3 Electronics

- 5.1.4 Rubber Tires

- 5.1.5 Others

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dupont Teijin Films

- 6.4.2 EPC Group

- 6.4.3 GTS Flexible Ltd.

- 6.4.4 KOLON PLASTIC INC.

- 6.4.5 Polyonics

- 6.4.6 PPI Adhesive Products (C.E.) s.r.o.

- 6.4.7 SASA Polyester Sanayi A.S.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Solar Cell Protection

- 7.2 Other Opportunities