|

시장보고서

상품코드

1911338

자동차 엔진 오일 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Automotive Engine Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

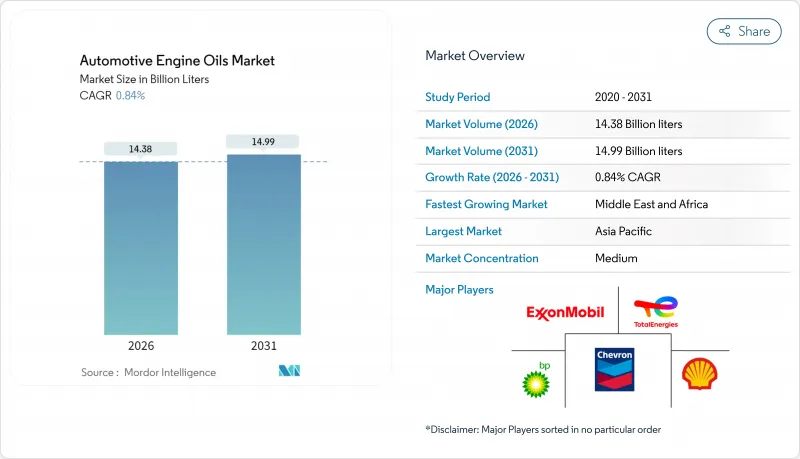

세계의 자동차 엔진 오일 시장은 2025년 142억 6,000만 달러에서 2026년에는 143억 8,000만 달러로 성장할 것으로 보입니다. 2026-2031년에 걸쳐 CAGR 0.84%로 성장을 지속하여 2031년까지 149억 9,000만 달러에 이를 전망입니다.

더 엄격한 배출 기준의 지속적인 시행, OEM의 저점도 합성 오일 등급으로의 급속한 전환, 신흥 경제국에서의 급증하는 차량 보유량이 이 신중한 확장을 뒷받침하고 있습니다. 디지털 리테일링, 전자 정비 플랫폼, 장수명 오일 규격 역시 수익 구조를 재정의하기 시작했으며, 비용 민감 지역에서 광유(mineral oil)의 우위가 지속되는 가운데 부가가치 제형 개발을 촉진하고 있습니다. 한편, 위조 위험, 원유 가격 변동성, 폐유 규제 강화는 단기 마진 전망을 억제하여 공급망 추적성 및 순환 경제 투자를 촉진하고 있습니다.

세계의 자동차 엔진 오일 시장 동향 및 인사이트

2025년 3월 도입된 API SQ 및 ILSAC GF-7 규격은 입증된 연비 향상을 의무화하여 수요를 0W-20 및 5W-30 합성 오일 등급으로 전환시키고 있습니다. 유럽 ACEA 2024 개정안도 이러한 요구사항을 반영하여, OEM 업체들은 유로 7 및 CAFE 기준을 충족하기 위해 저점도 오일을 공장 충전하고 있습니다. 소비자들은 OEM 지침을 따르며, 스티커 가격이 여전히 높음에도 불구하고 광유 제품에서 합성 제품으로의 대량 전환을 강화하고 있습니다.

디지털 퀵루브와 전자상거래 채널을 통한 보급 확대

2024년까지 성숙 시장에서 온라인 플랫폼이 소비자 오일 판매량의 약 5분의 1을 차지했으며, 모바일 퀵루브 앱은 원격 진단을 통해 서비스 주기를 최적화했습니다. 푸흐스(FUCHS)의 동남아시아 진출은 IoT 센서와 차량 군용 자동 재주문 시스템을 결합하여 유통업체의 마찰을 줄이고 합성 오일의 가치 제안을 부각시키는 디지털화의 사례를 보여줍니다.

개발도상국의 위조/저품질 윤활유

여러 신흥국에서 위조 제품이 전체 물량의 최대 15%를 차지합니다. 쉘은 블록체인 추적 및 QR 코드를 활용해 제품 진위를 확인했으나, 이러한 시스템은 비용 증가와 유통업체 교육이 필요합니다. 고가인 프리미엄 합성 오일이 가장 큰 위험에 노출되어 있습니다.

부문 분석

승용차 엔진 오일은 OEM 공장 충전 및 퀵루브 네트워크 수요에 힘입어 2025년 자동차 엔진 오일 시장 점유율의 61.85%를 차지했습니다. 오토바이 엔진 오일 부문은 아시아태평양 지역의 이륜차 급증 속에 2031년까지 연평균 0.94% 성장률로 가장 빠른 속도를 기록했습니다. 일본 및 인도 OEM 업체들이 고회전 열순환을 견디고 오일 교환 주기를 연장하는 합성 혼합유를 지정함에 따라 MCO 프리미엄화가 진행 중입니다. 다중 카테고리 포트폴리오를 관리하는 제조업체들은 조달 규모와 유통 채널 영향력을 확보합니다.

2차 시장인 중장비 엔진 오일은 장거리 운송 차량에 공급되며 안정적이지만 전기화 불확실성에 직면해 있습니다. 그럼에도 텔레매틱스 기반 교환 주기 계획 및 배기가스 후처리 장치는 특히 충전 인프라가 미비한 지역에서 윤활유의 가치 제안을 유지합니다.

세계의 자동차 엔진 오일 보고서는 제품 유형(승용차 엔진 오일, 중장비 엔진 오일, 이륜차 엔진 오일), 기유(미네랄 오일, 합성 오일, 반합성 오일, 바이오 기반 오일), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)별로 분할되어 있습니다. 시장 예측은 수량(리터) 단위로 제공됩니다.

지역별 분석

아시아태평양은 2025년 판매량의 43.36%를 차지해 중국에서 2,610만대의 자동차 생산과 인도의 이륜차 기반 확대가 주도했습니다. 동남아시아 국가가 추가적인 성장을 가져오고 주요 도시에서 도시 EV 보급률이 35% 이상의 가운데 중국의 ICE(내연기관) 성장 둔화를 상쇄하고 있습니다.

중동 및 아프리카은 2031년까지 연평균 복합 성장률(CAGR) 2.17%에서 가장 빠르게 성장합니다. 사우디아라비아의 '비전 2030' 인프라 프로젝트, 아랍에미리트의 물류 확장, 나이지리아의 초기 조립 생산이 승용차 및 상용차 군 전체에 걸쳐 윤활유 수요를 공동으로 자극합니다. 광범위한 GCC(걸프협력회의) 규격 조화는 국경을 넘는 제품 유통을 용이하게 하지만, 위조품 단속 및 사용유 관리 체계는 여전히 뒤처져 있습니다.

북미와 유럽은 프리미엄 제품 구성에 힘입어 저점도 합성 오일를 채택함으로써 특히 높은 수익성을 실현하고 있습니다. 오일 교환 간격 연장, EV용 전자 유체, 디지털 서비스 모델은 신흥 시장에도 파급될 가능성이 있는 변화를 예측했습니다. 폐유 회수나 PFAS 함량에 관한 규제의 역풍에 의해 보다 환경 친화적인 화학 조성으로의 연구 개발의 전환이 강요되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 배출 및 연비 규제의 강화로 인한 저점도 합성 오일 수요 증가

- 디지털 퀵루브 및 전자상거래 채널에 의한 판매망 확대

- 신흥 시장에서의 이륜차 및 승용차 수요 급증

- OEM 전용 장수명 사양으로 인한 오일 가치 상승

- PAO(폴리알파 올레핀) 및 GTL(가스 투 리퀴드)공급 확대에 의한 합성 비용 저하

- 시장 성장 억제요인

- 변동성 높은 원유 및 기반 오일 가격이 마진을 압박

- 개발도상국 시장의 위조/저품질 윤활유

- 강화된 사용유 처리 및 재활용 규정

- 밸류체인과 유통채널 분석

- Porter's Five Forces

- 신규 참가업체 위협

- 공급기업 협상력

- 구매자 협상력

- 대체품 위협

- 업계 간 경쟁

- 규제 프레임워크

- 자동차 업계 동향

제5장 시장 규모와 성장 예측

- 제품 유형별

- 승용차 엔진 오일(PCMO)

- 0W-XX

- 5W-XX

- 10W-XX

- 15W-XX

- 모노그레이드

- 기타 등급

- 중장비 엔진 오일(HDMO)

- 0W-XX

- 5W-XX

- 10W-XX

- 15W-XX

- 모노그레이드

- 기타 등급

- 이륜차 엔진 오일(MCO)

- 0W-XX

- 5W-XX

- 10W-XX

- 15W-XX

- 모노그레이드

- 기타 등급

- 승용차 엔진 오일(PCMO)

- 기초유 유형별

- 미네랄

- 합성

- 반합성

- 바이오 기반

- 지역별

- 아시아태평양

- 중국

- 인도

- 파키스탄

- 방글라데시

- 일본

- 한국

- 대만

- 호주

- 말레이시아

- 인도네시아

- 태국

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 이란

- 남아프리카

- 이집트

- 나이지리아

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- BP plc

- Chevron Corporation

- China Petroleum Corporation

- CNPC

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Gazpromneft-Lubricants Ltd.

- Gulf Oil International Ltd

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- LUKOIL

- Motul

- Repsol

- Saudi Arabian Oil Co.

- Shell plc

- SK ZIC

- TotalEnergies

- Veedol Corporation Limited

제7장 시장 기회와 장래의 전망

제8장 CEO를 위한 주요 전략적 과제

HBR 26.01.29The Global Automotive Engine Oils Market is expected to grow from USD 14.26 billion in 2025 to USD 14.38 billion in 2026 and is forecast to reach USD 14.99 billion by 2031 at 0.84% CAGR over 2026-2031.

Continued enforcement of more stringent emission limits, rapid OEM migration to low-viscosity synthetic grades, and the surging vehicle parc in emerging economies collectively underpin this guarded expansion. Digital retailing, e-maintenance platforms, and long-drain oil specifications have also begun to redefine the revenue mix, encouraging value-added formulations even as mineral-oil dominance persists in cost-sensitive pockets. Meanwhile, counterfeit risks, crude-price volatility, and tightening waste-oil regulations temper near-term margin prospects, prompting greater supply-chain traceability and circular-economy investments.

Global Automotive Engine Oils Market Trends and Insights

Stricter Emission and Fuel-Economy Norms Spurring Low-Viscosity Synthetics

API SQ and ILSAC GF-7 were introduced in March 2025, mandating proven fuel-economy gains that tilt demand toward 0W-20 and 5W-30 synthetic grades. European ACEA 2024 revisions echo these requirements, with OEMs factory-filling lower-viscosity oils to hit Euro 7 and CAFE thresholds. Consumer uptake follows OEM guidance, reinforcing a volume migration from mineral to synthetic products even where sticker prices remain higher.

Digital Quick-Lube and E-Commerce Channels Expanding Reach

By 2024, online platforms handled nearly one-fifth of consumer oil sales in mature markets, while mobile quick-lube apps optimized service cycles through remote diagnostics. FUCHS's Southeast Asia roll-out combines IoT sensors with automated re-ordering for fleets, illustrating how digitalization lowers distributor friction and highlights synthetic oil value propositions.

Counterfeit/Low-Quality Lubricants in Developing Markets

Fake products account for as much as 15% of volume in several emerging countries. Shell deployed blockchain tracking and QR codes to authenticate packs, yet these systems add cost and require retailer education. Premium synthetics face the greatest exposure given their higher ticket value.

Other drivers and restraints analyzed in the detailed report include:

- Emerging-Market Two-Wheeler and Passenger-Car Boom

- OEM Proprietary Long-Drain Specifications Raising Oil Value

- Stricter Used-Oil Disposal and Recycling Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger Car Motor Oil delivered 61.85% of the automotive engine oils market share in 2025 as OEM factory fills and quick-lube networks anchored demand. Motorcycle Engine Oil posted the swiftest pace, advancing at a 0.94% CAGR through 2031 amid Asia-Pacific's two-wheeler surge. MCO premiumization is underway, with Japanese and Indian OEMs specifying synthetic blends that tolerate high-RPM heat cycles and extend drains. Manufacturers that manage multi-category portfolios gain procurement scale and channel leverage.

Second-tier Heavy Duty Motor Oil supplies long-haul fleets and remains stable but faces electrification uncertainty. Still, telematics-enabled drain planning and emissions-after-treatment devices sustain lubricant value propositions, particularly in regions where charging infrastructure remains nascent.

The Global Automotive Engine Oils Report is Segmented by Product Type (Passenger Car Motor Oil, Heavy Duty Motor Oil, and Motorcycle Engine Oil), Base Stock (Mineral, Synthetic, Semi-Synthetic, and Bio-Based), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Litres).

Geography Analysis

Asia-Pacific captured 43.36% of 2025 volume, led by China's 26.1-million-unit vehicle output and India's expanding two-wheeler base. Southeast Asian nations add incremental gains, offsetting moderating Chinese ICE growth as urban EV adoption climbs beyond 35% in top cities.

The Middle East and Africa will grow the fastest at a 2.17% CAGR to 2031. Saudi Vision 2030 infrastructure projects, UAE logistics expansion, and Nigeria's nascent assembly output collectively stimulate lubricant demand across passenger and commercial fleets. Wider GCC specification harmonization eases cross-border product flows, but counterfeit policing and used-oil stewardship lag behind.

North America and Europe are buoyed by a premium mix, and the adoption of low-viscosity synthetics renders them disproportionately profitable. Extended drains, EV e-fluids, and digital service models preview shifts likely to percolate into emerging markets. Regulatory headwinds around waste-oil collection and PFAS content compel research and development redeployments toward more benign chemistries.

- BP p.l.c.

- Chevron Corporation

- China Petroleum Corporation

- CNPC

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Gazpromneft - Lubricants Ltd.

- Gulf Oil International Ltd

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Ltd.

- LUKOIL

- Motul

- Repsol

- Saudi Arabian Oil Co.

- Shell plc

- SK ZIC

- TotalEnergies

- Veedol Corporation Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter emission and fuel-economy norms spurring low-viscosity synthetics

- 4.2.2 Digital quick-lube and e-commerce channels expanding reach

- 4.2.3 Emerging-market two-wheeler and passenger-car boom

- 4.2.4 OEM proprietary long-drain specifications raising oil value

- 4.2.5 PAO (Polyalphaolefin) and GTL (Gas-to-Liquids) supply expansion lowering synthetic cost

- 4.3 Market Restraints

- 4.3.1 Volatile crude and base-oil prices compressing margins

- 4.3.2 Counterfeit/low-quality lubricants in developing markets

- 4.3.3 Stricter used-oil disposal and recycling regulations

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Regulatory Framework

- 4.7 Automotive Industry Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Passenger Car Motor Oil (PCMO)

- 5.1.1.1 0W-XX

- 5.1.1.2 5W-XX

- 5.1.1.3 10W-XX

- 5.1.1.4 15W-XX

- 5.1.1.5 Monogrades

- 5.1.1.6 Other Grades

- 5.1.2 Heavy Duty Motor Oil (HDMO)

- 5.1.2.1 0W-XX

- 5.1.2.2 5W-XX

- 5.1.2.3 10W-XX

- 5.1.2.4 15W-XX

- 5.1.2.5 Monogrades

- 5.1.2.6 Other Grades

- 5.1.3 Motorcycle Engine Oil (MCO)

- 5.1.3.1 0W-XX

- 5.1.3.2 5W-XX

- 5.1.3.3 10W-XX

- 5.1.3.4 15W-XX

- 5.1.3.5 Monogrades

- 5.1.3.6 Other Grades

- 5.1.1 Passenger Car Motor Oil (PCMO)

- 5.2 By Base Stock

- 5.2.1 Mineral

- 5.2.2 Synthetic

- 5.2.3 Semi-Synthetic

- 5.2.4 Bio-Based

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Pakistan

- 5.3.1.4 Bangladesh

- 5.3.1.5 Japan

- 5.3.1.6 South Korea

- 5.3.1.7 Taiwan

- 5.3.1.8 Australia

- 5.3.1.9 Malaysia

- 5.3.1.10 Indonesia

- 5.3.1.11 Thailand

- 5.3.1.12 Vietnam

- 5.3.1.13 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Russia

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Iran

- 5.3.5.5 South Africa

- 5.3.5.6 Egypt

- 5.3.5.7 Nigeria

- 5.3.5.8 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Production Capacity, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BP p.l.c.

- 6.4.2 Chevron Corporation

- 6.4.3 China Petroleum Corporation

- 6.4.4 CNPC

- 6.4.5 ENEOS Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Gazpromneft - Lubricants Ltd.

- 6.4.9 Gulf Oil International Ltd

- 6.4.10 Idemitsu Kosan Co., Ltd.

- 6.4.11 Indian Oil Corporation Ltd.

- 6.4.12 LUKOIL

- 6.4.13 Motul

- 6.4.14 Repsol

- 6.4.15 Saudi Arabian Oil Co.

- 6.4.16 Shell plc

- 6.4.17 SK ZIC

- 6.4.18 TotalEnergies

- 6.4.19 Veedol Corporation Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment