|

시장보고서

상품코드

1431572

세계 항공용 GPS 및 GNSS 수신기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)GPS And GNSS Receivers In Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

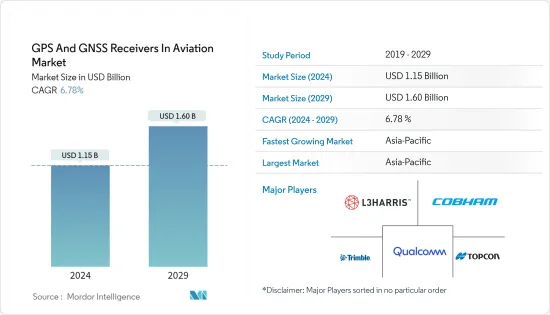

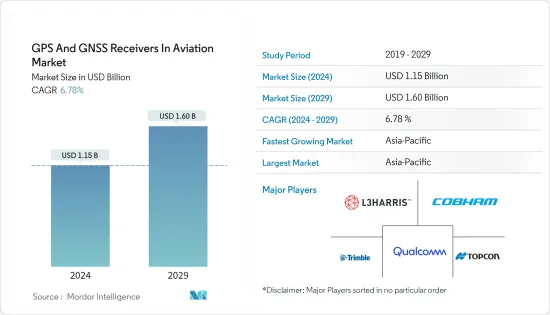

항공용 GPS 및 GNSS 수신기 시장 규모는 2024년에 11억 5,000만 달러로 추정되고, 2029년에는 16억 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년)의 CAGR은 6.78%로 성장할 것으로 예상됩니다.

주요 하이라이트

- 항공용 세계 측위시스템(GPS)과 전지구항법위성시스템(GNSS) 수신기는 COVID-19의 대유행으로 인해 전례없는 과제를 목격했습니다. 저성장, 항공 여객 수 감소, 항공 업무 감소로 민간기와 군용기 수요가 부진했습니다.

- 또한, Boeing 737 MAX형기의 착륙에 의해 와이드 바디기와 좁은 바디기의 수주 성장률이 저하하고 있었습니다. 그럼에도 불구하고 이 침체는 일시적인 것으로, 항공기의 상대방 상표 제품 제조업체(OEM)와 정비, 수리 및 오버홀(MRO) 서비스 제공 업체 모두에서 이러한 장비에 대한 수요가 있기 때문에 시장은 강력한 성장을 보여줄 것으로 예상되었습니다.

- 민간 항공기에서 사용하도록 설계된 대부분의 GPS 장비는 테스트 및 승인된 위치에 적절한 전원과 함께 영구적으로 설치되며 다른 비행 시스템과 통합됩니다. 항공 네비게이션 시스템은 일반적으로 이동 지도 디스플레이를 포함하며, 종종 엔루트 항법을 위한 자동 조종 장치에 연결됩니다. 항공 산업의 성장과 새로운 항공기의 도입과 함께 빠르고 번거로운 항공기 네비게이션에 대한 수요는 예측 기간 동안 항공 시장에서 GPS 및 GNSS 수신기에 대한 수요를 끌어올릴 것입니다.

항공에서 GPS 및 GNSS 수신기 시장 동향

군사 항공 부문은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측

- 군사 항공 부문은 예측 기간 동안 큰 성장을 나타낼 것으로 예상됩니다. 이 성장은 모든 지역 정부의 군사비 증가, 새로운 군용기에 대한 수요 증가, 군사 현대화 프로그램 증가로 인한 것입니다. 위성 네비게이션은 적지대에서 네비게이션 목적의 군사 임무 수행에 매우 중요하며, 야간 임무에서 빛이 없을 때 특히 중요합니다. 군는 자군 부대의 정확한 위치와 적군의 위치를 파악하기 위해 GNSS와 GPS에 크게 의존하고 있습니다.

- 군이 효율적으로 임무를 수행하는 데 도움이 되기 때문에 일부 방어기관도 GPS와 GNSS 기술에 의존하고 있습니다. 미국, 중국, 인도, 영국, 러시아, 프랑스는 현재 각각 세계 최대의 군사 지출국입니다. 2021년 8월, BAE Systems plc는 방해와 스푸핑에 강한 차세대 M-코드 군용 GPS와 호환되는 초소형 MicroGRAM-M 세계 측위 시스템 리시버를 발표했습니다. MicroGRAM-M은 크기에 제한이 있는 기타 마이크로 용도을 위한 세계 최소, 가벼운 무게, 가장 전력 효율적인 GPS 수신기입니다.

- 각국은 군용기의 현대화를 위해 군사 예산을 늘리고 있습니다. 군용기 증가에 따라 GPS 및 GNSS 수신기 수요도 예측 기간 동안 증가할 것입니다.

아시아태평양은 예측기간 동안 현저한 성장을 보임

- 아시아태평양은 예측 기간 동안 가장 높은 성장을 보일 것으로 예상됩니다. 항공 분야에 대한 지출 증가와 특히 중국과 인도의 새로운 항공기에 대한 수요 증가는 이 지역 시장 성장을 뒷받침하고 있습니다. 국제항공운송협회(IATA)에 따르면 중국은 2022년 미국을 제치고 세계 최대 항공시장이 되고 있습니다. 또한 중국은 2036년까지 항공 여객 수가 15억 명에 달할 것으로 예상됩니다.

- 또한 인도 민간항공부는 인도가 2021년 국내 항공시장 3위가 될 것이라고 발표했습니다. 게다가 인도, 중국, 일본에서 차세대 전투기 조달은 시장 성장을 가속할 것으로 보입니다. 민간 및 군용 항공기가 증가함에 따라 네비게이션 장치, 특히 GPS 및 GNSS에 대한 수요도 증가하여 시장 성장으로 이어질 것입니다.

- 예를 들어 2021년 12월 러시아 우주 기관 로스코스모스와 중국 위성항법시스템위원회는 러시아 GLONASS와 중국 BeiDou라는 네비게이션 시스템 개발과 양국 영토에 지상 기반 측정 사이트를 설치하기 위해의 협정에 조인했습니다. 따라서 아시아 국가의 민간기와 군용기 수요가 증가함에 따라 시장 성장이 뒷받침되고 있습니다.

항공의 GPS 및 GNSS 수신기 개요

항공 시장의 GPS 및 GNSS 수신기는 소수의 기업이 시장에서 중요한 점유율을 유지하는 특성상 적당히 통합되어 있습니다. 유명한 시장 기업로는 Cobham Limited, Trimble Inc., Qualcomm Technologies, Inc., L3Harris Technologies, Inc., Topcon Positioning Systems, Inc. 등이 있습니다. 이 시장에 진입하고 있는 이들 대기업은 M&A, R&D 투자, 제휴, 파트너십, 지역사업 확대, 신제품 투입 등 다양한 전략을 채택하고 있습니다.

예를 들어, 2020년 11월, Cobham Aerospace Connectivity는 MQ-1C ER Gray Eagle Extended Range(GE-ER) 무인 항공기 시스템(UAS) 플랫폼에 안티 잼 GPS 시스템을 제공하기 때문에 General Atomics Aeronautical Systems, Inc.(GA-ASI)와 미국 육군으로 선정되었습니다. 또한 L3 Harris는 고급 네비게이션 및 타이밍 페이로드 기술의 개발과 통합을 통해 차세대 GPS III 위성 별자리를 구축하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 용도별

- 민간항공

- 군용기

- 유형별

- 유선 수신기

- 무선 수신기

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Trimble Inc.

- Topcon Positioning Systems, Inc.

- Broadcom, Inc.

- Hexagon AB

- Garmin Ltd.

- Tallysman

- NavtechGPS

- L3 Harris Technologies, Inc.

- Cobham Limited

- Qualcomm Technologies, Inc.

제7장 시장 기회와 앞으로의 동향

JHS 24.03.04The GPS And GNSS Receivers In Aviation Market size is estimated at USD 1.15 billion in 2024, and is expected to reach USD 1.60 billion by 2029, growing at a CAGR of 6.78% during the forecast period (2024-2029).

Key Highlights

- The global positioning system (GPS) and global navigation satellite system (GNSS) receivers in the aviation market witnessed unprecedented challenges due to the COVID-19 pandemic. The demand for commercial and military aircraft slumped due to low economic growth, a decrease in air traffic passengers, and a decline in aviation operations.

- Moreover, there had been a decrease in the growth rate of wide-body aircraft and narrow-body aircraft orders owing to the grounding of the Boeing 737 MAX aircraft. Nevertheless, the slump was temporary, and the market was anticipated to witness robust growth due to the demand for such equipment both from aircraft original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) service providers.

- Most of the GPS equipment designed for use in commercial aircraft is permanently installed in tested and approved locations with appropriate power supplies and is integrated with other flight systems. Air navigation systems usually have a moving map display and are often connected to the autopilot for en-route navigation. With the growth of the aviation industry and the introduction of new aircraft to the fleet, the demand for quick and hassle-free aircraft navigation will boost the demand for GPS and GNSS Receivers in the Aviation market during the forecast period.

GPS And GNSS Receivers In Aviation Market Trends

Military Aviation Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

- The military aviation segment is expected to show significant growth during the forecast period. The growth can be attributed to the increasing military expenditure by governments of all regions, rising demand for new military aircraft, and growing military modernization programs. Satellite navigation is very crucial for carrying out military missions for navigation purposes in enemy territories and is especially important in the absence of light in night missions. The military forces heavily rely on GNSS and GPS in order to obtain an accurate positioning of their own units, as well as the enemy force's positions.

- Several defense bodies also depend on GPS and GNSS technologies as it helps the forces to efficiently conduct their missions. The United States, China, India, the UK, Russia, and France are currently the world's largest military spenders, respectively. In August 2021, BAE Systems plc unveiled its ultra-small MicroGRAM-M global positioning system receiver compatible with next-generation M-Code military GPS that is resistant to jamming and spoofing. MicroGRAM-M is the world's smallest, lightest, and most power-efficient GPS receiver for size-constrained and other micro-applications.

- Countries are increasing their military budgets in order to modernize their military aircraft fleet. With the rise in military aircraft, the demand for GPS and GNSS receivers will also increase during the forecast period.

Asia Pacific Will Showcase Remarkable Growth During the Forecast Period

- Asia-Pacific is projected to show the highest growth during the forecast period. Growing expenditure on the aviation sector and growing demand for new aircraft, especially from China and India, boost the market growth across the region. According to the International Air Transport Association (IATA), China surpassed the United States and became the largest aviation market in the world in 2022. Furthermore, China is expected to reach a total of 1.5 billion aviation passengers by 2036.

- Also, the Indian civil aviation ministry announced that India would become the third-largest domestic aviation market in 2021. Furthermore, the procurement of next-generation fighter jets from India, China, and Japan will propel the growth of the market. As the aircraft fleet commercial and military increases, the demand for navigation devices, particularly GPS and GNSS, will also increase, leading to the growth of the market.

- For instance, in December 2021, Russian space agency Roscosmos and the Chinese Satellite Navigation System Commission signed an agreement for the development of navigation systems, Russia's GLONASS and China's BeiDou, and installing ground-based measuring sites on the territory of both states. Thus, the growing demand for commercial and military aircraft from Asian countries drives the growth of the market.

GPS And GNSS Receivers In Aviation Industry Overview

The GPS and GNSS Receivers in the Aviation Market are moderately consolidated in nature, with few players holding significant shares in the market. Some prominent market players are Cobham Limited, Trimble Inc., Qualcomm Technologies, Inc., L3Harris Technologies, Inc., and Topcon Positioning Systems, Inc. These major players operating in this market have adopted various strategies comprising mergers and acquisitions, investment in R&D, collaborations, partnerships, regional business expansion, and new product launches.

For instance, in November 2020, Cobham Aerospace Connectivity was selected by the General Atomics Aeronautical Systems, Inc. (GA-ASI) and the U.S. Army to provide the anti-jam GPS systems for the MQ-1C ER Gray Eagle Extended Range (GE-ER) Unmanned Aircraft System (UAS) platform. In addition, L3 Harris is building the next-generation GPS III satellite constellation by developing and integrating advanced navigation and timing payload technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-Use

- 5.1.1 Commercial Aviation

- 5.1.2 Military Aviation

- 5.2 Type

- 5.2.1 Wired Receivers

- 5.2.2 Wireless Receivers

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trimble Inc.

- 6.1.2 Topcon Positioning Systems, Inc.

- 6.1.3 Broadcom, Inc.

- 6.1.4 Hexagon AB

- 6.1.5 Garmin Ltd.

- 6.1.6 Tallysman

- 6.1.7 NavtechGPS

- 6.1.8 L3 Harris Technologies, Inc.

- 6.1.9 Cobham Limited

- 6.1.10 Qualcomm Technologies, Inc.