|

시장보고서

상품코드

1693945

위성 부품 및 컴포넌트 시장(2025-2030년) : 시장 점유율 분석, 산업 동향, 성장 예측Satellite Parts and Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

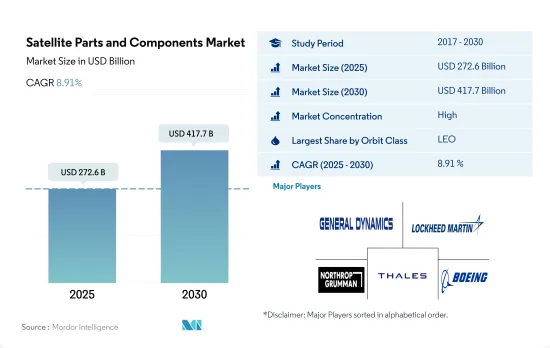

위성 부품 및 컴포넌트 시장 규모는 2025년에 2,726억 달러로 추정되며, 2030년에는 4,177억 달러에 이를 것으로 예측되고, 예측 기간(2025-2030년) 동안 CAGR 8.91%로 성장할 전망입니다.

새로운 위성 제조 기술의 적응이 새로운 비즈니스 기회를 열 것으로 예상

- 세계의 위성 부품 및 컴포넌트 산업은 최근 몇 가지 동향을 경험해 왔습니다.

- 적층제조(3D 프린팅)는 복잡한 부품의 제조와 제조 비용을 절감할 수 있기 때문에 위성 산업에서 인기를 끌고 있으며 부품 및 컴포넌트 제조에 이용되고 있습니다. NASA와 유럽 우주 기관과 같은 주요 우주 기관은 적층제조 기술을 활용하고 있습니다. 이 혁신적인 기술에는 고성능 일렉트로닉스, 첨단 센서, 경량 재료, 추진 시스템 등이 포함됩니다. 또다른 경향으로는 컴포넌트와 서브 시스템의 상용 기성품(COTS) 이용이 증가하고 있다는 점입니다.

- 2017-2022년 5월 사이에 세계적으로 약 4,300기 이상의 위성이 제조되어 발사되었습니다. 회사는 끊임없이 변화하는 시장 수요에 대응하면서 이 부문의 기술 혁신을 추진하고 있습니다.

세계 위성 부품 및 컴포넌트 시장 동향

위성 소형화의 중요성 증가가 위성 질량에 영향을 미칠 것으로 예상

- 최근에는 위성의 소형화가 진행되고 있으며 소형 위성은 종래의 위성의 몇 분의 1의 비용으로 종래의 위성이 할 수 있는 거의 모든 기능을 실현하기 때문에 소형 위성 별자리의 구축, 발사, 운용이 점점 현실화되고 있습니다. 그에 따라, 소형 위성의 신뢰도도 비약적으로 높아지고 있습니다.

- 질량에 따라 크게 분류되는 것은 1,000kg을 넘는 대형 위성입니다. 세계적으로 320기 이상의 위성이 발사되었습니다. 위성은 질량에 따라 분류됩니다.

- 개발 기간이 짧아 전체 임무 비용을 절감할 수 있기 때문에 이 지역에서는 소형 위성으로의 전환 동향이 높아지고 있습니다. 미국의 소형 위성 산업은 특정 용도에 맞춘 소형 위성을 설계 및 제조하기 위한 견고한 프레임워크에 의해 지지되고 있습니다.

다양한 우주 기관의 지출 증가는 위성 산업에 긍정적인 영향을 미칠 것으로 예측됩니다.

- 통신, 네비게이션, 지구 관측 등 다양한 용도로 위성 기술의 이용이 증가하고 있기 때문에 새롭고 혁신적인 위성 컴포넌트에 대한 요구가 높아지고 있습니다. AI와 머신러닝, 적층제조, 첨단 재료의 이용과 같은 기술의 진보가 위성 부품 및 컴포넌트 산업에 있어서의 연구 개발 투자의 필요성을 뒷받침하고 있습니다.

- 2022년 11월, 유럽우주국(ESA)은 지구 관측에서 유럽의 리드를 유지하고 항법 서비스를 확대하여 미국과의 탐사 파트너십을 지속하기 위해 향후 3년간 우주 자금을 25% 증액할 것을 발표했습니다. 유럽우주국(ESA)은 2023-2025년에 걸쳐 약 185억 유로의 예산을 지원하도록 22개국에 요구하고 있습니다.

- 북미에서는 우주 계획을 위한 세계 정부 지출이 2021년에 역대 최고인 약 1,030억에 달했습니다. 이 지역은 세계 최대의 우주 기관인 NASA가 존재하는 우주 혁신과 연구의 진원지입니다. 미국에서는 연방 정부 기관이 매년 정부로부터 자금 지원을 받고 있으며 소속 자회사를 위해 323억 3,000만 달러를 사용하고 있습니다.

위성 부품 및 컴포넌트 산업 개요

위성 부품 및 컴포넌트 시장은 상당히 통합되어 있으며 상위 5개 기업에서 90.12%를 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 위성의 소형화

- 위성 질량

- 우주 개발에의 지출

- 규제 프레임워크

- 세계

- 호주

- 브라질

- 캐나다

- 중국

- 프랑스

- 독일

- 인도

- 이란

- 일본

- 뉴질랜드

- 러시아

- 싱가포르

- 한국

- 아랍에미리트(UAE)

- 영국

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 지역

- 아시아태평양

- 유럽

- 북미

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AAC Clyde Space

- BAE Systems

- General Dynamics

- Innovative Solutions in Space BV

- Jena-Optronik

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- OHB SE

- SENER Group

- Sitael SpA

- Thales

- The Boeing Company

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Satellite Parts and Components Market size is estimated at 272.6 billion USD in 2025, and is expected to reach 417.7 billion USD by 2030, growing at a CAGR of 8.91% during the forecast period (2025-2030).

The adaptation of new satellite manufacturing techniques is expected to open new scope of opportunities

- The global satellite parts and components industry has been experiencing several trends in recent years. With the advancements in technology, small satellites have become more capable and cost-effective, making them an attractive option for various applications. The trend of satellite miniaturization resulted in an increasing demand for small satellite components, such as propulsion systems, power systems, and antennas.

- Additive manufacturing, or 3D printing, has been gaining popularity in the satellite industry due to its ability to produce complex parts and reduce manufacturing costs. This technology is being used to produce satellite components such as antennas, brackets, and engine parts. The major space agencies such as NASA and the European Space Agency have emphasized that. One of the major players in the global space industry, the United States, is a trendsetter in the development of advanced technologies for satellite communications, remote sensing, and space exploration. These innovative technologies include high-performance electronics, advanced sensors, lightweight materials, and propulsion systems. Another trend is the increasing use of pre-existing components and subsystems commercial-off-the-shelf (COTS) in satellite design and development. COTS components can significantly reduce development time and costs while improving reliability and performance.

- Between 2017 and May 2022, around 4300+ satellites were manufactured and launched globally. Overall, these trends are shaping the future of the global satellite parts and components industry as companies work to meet the demands of an ever-changing market while also driving innovation in the field. The global satellite parts and components market is expected to grow by 40% between 2023 and 2029.

Global Satellite Parts and Components Market Trends

The increased importance of satellite miniaturization is expected to affect the satellite mass

- Satellites are getting smaller nowadays, and a small satellite can do almost everything that a conventional satellite can at a fraction of the cost of the conventional satellite, which has made the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, reliance on them has been growing exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch.

- The major classification types according to mass are large satellites that are more than 1,000 kg. During 2017-2022, around 44 large satellites launched were owned by North American organizations. A medium-sized satellite has a mass between 500 and 1000 kg. Globally, organizations operated more than 320 satellites launched. Satellites are classified according to mass. Satellites with a mass of less than 500 kg are considered small satellites, and around 3800+ small satellites were launched globally.

- There is a growing trend toward small satellites in the region because of their shorter development time, which can reduce overall mission costs. They have made it possible to significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by a robust framework for designing and manufacturing small satellites tailored to serve specific application profiles. The demand for satellite parts and components in the North American region is expected to surge during 2023-2029 due to increasing demand in the commercial and military space sector.

The increasing expenditures of different space agencies is expected to positively impact the satellite industry

- The increasing use of satellite technology in various applications, including communication, navigation, and earth observation, has created a need for new and innovative satellite components. Companies are investing in R&D to develop components that meet the specific requirements of these applications. Technological advancements, such as the use of AI and machine learning, additive manufacturing, and advanced materials, are driving the need for R&D investment in the satellite parts and components industry. These advancements are creating new opportunities for the development of innovative components.

- In November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. The European Space Agency (ESA) is asking its 22 nations to back a budget of some EUR 18.5 billion for 2023-2025. Likewise, in September 2022, France announced that it is expecting to increase spending on national and European space programs.

- In North America, global government expenditure for space programs hit a record of approximately 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of NASA, the world's biggest space agency. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space in the world. In the United States, federal agencies receive aid from the government every year, known as funding, USD 32.33 billion for its subsidiaries. The spending on space and research grants is expected to surge in the region, growing the sector's importance in every domain of the global economy.

Satellite Parts and Components Industry Overview

The Satellite Parts and Components Market is fairly consolidated, with the top five companies occupying 90.12%. The major players in this market are General Dynamics, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Region

- 5.1.1 Asia-Pacific

- 5.1.2 Europe

- 5.1.3 North America

- 5.1.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AAC Clyde Space

- 6.4.2 BAE Systems

- 6.4.3 General Dynamics

- 6.4.4 Innovative Solutions in Space BV

- 6.4.5 Jena-Optronik

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 OHB SE

- 6.4.9 SENER Group

- 6.4.10 Sitael S.p.A.

- 6.4.11 Thales

- 6.4.12 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록