|

시장보고서

상품코드

1850073

생검 기기 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Biopsy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

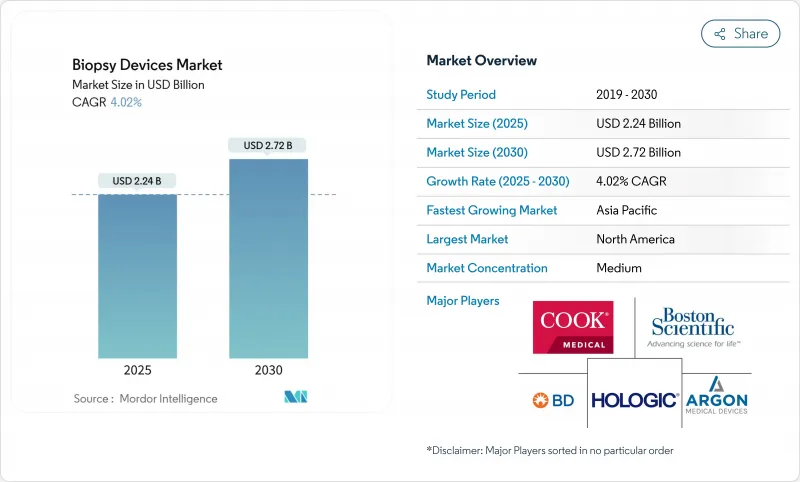

세계의 생검 기기 시장은 2025년 22억 4,000만 달러를 창출하고, 2030년까지 27억 2,000만 달러에 이를 것으로 예측되며, 기간 중 CAGR은 4.02%로 예상됩니다.

병원, 외래센터, 진단 클리닉이 조직 확인에 의존하는 조기암 프로그램을 확대함에 따라 수요는 꾸준히 진행되고 있습니다. 바늘 기반 기술 혁신, 특히 진공 기술과 인공지능 이미지 지침을 결합한 시스템은 절차의 효율성을 추진하고 저침습 워크플로우로의 전환을 지원합니다. 벌크 빌링 저선량 CT를 이용한 호주의 새로운 폐 프로그램과 같은 정부 출자의 스크리닝 이니셔티브는 후속 생검의 건수를 늘리고 접근에 대한 장벽을 줄이고 있습니다. 한편, 생검 기기 시장은 멸균 관련 리콜이나 액체 생검 분석의 보급 가속과 같은 역풍에 직면하고 있지만, 성장 궤도를 감속시키는 요인은 되고 있지 않습니다.

세계 생검 기기 시장 동향과 통찰

저침습 암 진단에 대한 수요 증가

King's College London에서 개발된 나노 니들 패치는 인간 머리카락의 1,000분의 1 얇은 수백만 개의 마이크로니들을 삽입하여 무통 조직 샘플링을 가능하게 하고 조직을 손상시키지 않고 실시간 모니터링을 가능하게 합니다. 공압으로 구동되는 로봇 카테터의 병렬 진보로 구부러진 루멘 내장기의 6방향 샘플링이 가능해져, 수술 시간이 단축되어 환자의 쾌적성이 향상되었습니다. 따라서 합병증을 최소화하고 고품질 검체를 채취할 수 있는 침습성이 낮은 하드웨어가 점점 임상에서 선호되고 있어, 이것이 생검 기기 시장의 세계적인 중요한 기폭제가 되고 있습니다. 또한 의료 시스템 구매자는 회복 시간 단축과 재수술 감소로 인한 다운스트림 비용 저하에 주목하여 채용을 강화하고 있습니다. 이러한 기술이 성숙함에 따라 로봇 작동과 마이크로 샘플링을 통합한 플랫폼에 통합한 공급업체가 경쟁력을 얻고 있습니다.

도달하기 어려운 장기 암 증가

폐암은 여전히 세계 최대의 암 사망 원인이며, 2024년에는 세계 암 사망자의 18.7%를 차지했습니다. 폐, 췌장 및 뇌에 대한 접근에는 해부학적 장애가 있기 때문에 정밀 바늘, 스티어러블 카테터 시스템 및 고급 영상 액세서리에 대한 수요가 증가하고 있습니다. 고소득국은 가장 큰 질병부담을 보고하고 있지만 신흥 시장에서는 동등한 진단능력이 없는 채 이환율이 급증하고 있습니다. 따라서 병원은 샘플링 정밀도를 향상시키고 마취 시간을 단축하는 영상 유도 코어와 진공 어시스트 장치로 업그레이드를 진행하고 있으며, 이는 상환 제도가 엄격해져도 생검 기기 시장을 유지하는 투자 패턴이 되고 있습니다.

장비 리콜 및 멸균 불량 이벤트

Olympus는 폐 생검 시스의 팁이 분리되어 26건의 중상 사고가 발생했기 때문에 1회용 폐 생검 시스를 회수했고, 병원은 재고 격리 및 수술 일정 변경을 강요했습니다. Hologic은 BioZorb 마커 5만 3,492개의 클래스 I 리콜을 실시하여 통증, 감염, 이동의 보고를 받았습니다. Cardinal Health는 또한 멸균 우려에서 생검 관련 치료 키트를 회수했습니다. 이러한 사태는 규제 당국의 감시를 강화하고, 비용이 많이 드는 개선 프로그램을 강요시키고, 임상의의 신뢰를 저하시키고, 생검 기기 시장의 당면 성장을 억제할 수 있습니다.

부문 분석

바늘 기반 장비는 2025년에 7억 9,000만 달러의 수익을 올리고 생검 기기 시장 규모의 35.25%에 해당하며, 2030년까지 CAGR은 8.25%로 예측되고 있습니다. 핵심 모델과 진공 보조 모델은 전자기 추적과 AI 분석을 통합하고 의심스러운 조직을 실시간으로 강조 표시함으로써 경험이 없는 운영자의 학습 곡선을 단축합니다. Elucent Medical의 EnVisio X1은 광 네비게이션과 고주파 유도 심도 제어를 결합하여 FDA의 획기적인 상태를 획득하여 고정밀 타겟팅을 둘러싼 투자 경쟁을 부각하고 있습니다. 이와 병행하여, 일회용 주사 바늘 카트리지는 감염 제어의 의무에 부합하여 외래 수술실에서의 회전을 가속화하고 생검 기기 시장이 낮은 급성기 의료 환경에 침투하는 데 도움이 됩니다.

프로시저 트레이는 표준화된 키트가 설치를 간소화하고 사례당 비용을 낮추기 때문에 꾸준히 이익을 얻고 있습니다. 국부적인 와이어는 유방 케어의 클래식이지만 용해 또는 저에너지 레이더 신호를 보내는 새로운 클립 기반 마커는 환자의 편안함을 향상시키고 회수 단계를 없애서 점차 수요를 다루고 있습니다. 캐뉼라, 옵튜레이터, 진공 튜브 등의 액세서리는 RFID 태그를 사용하여 로트 추적을 자동화하고 리콜 관리를 간소화합니다.

지역 분석

북미는 2024년 매출액의 41.82%를 차지하여 견고한 보험 적용, 기술 지향 임상사, 명확한 상환 경로를 통해 세계 생검 기기 시장에서 이 지역의 중심 지위를 굳혔습니다. AI 지원 OCT, 로봇 기관지경, 극세 연성 바늘로 대표되는 끊임없는 기술 혁신은 장비 장비의 꾸준한 업데이트 사이클을 보장합니다. 그럼에도 불구하고, 병원은 절차의 번들에 대한 지불자의 조사에 직면하고 있으며, 시설은 비용 효율적인 소모품과 불필요한 샘플링을 줄이는 예측 분석으로 유도되고 있습니다.

유럽에서는 각국의 의료제도가 가치 기반 구매와 맞춤형 의료를 중시하고 있기 때문에 완만하지만 안정된 성장을 기록하고 있습니다. 마진 평가에 도움이 되는 마커나 표적 치료의 지침이 되는 분자 분석의 보급이 눈에 띄고, EU의 고품질 조직 채취에 대한 수요에 박차를 가하고 있습니다. 의료기기 규제에 의한 규제의 조정에 의해 승인까지의 기간이 길어지고 있지만, 명확한 임상적 편익의 문서화가 관료적 부담을 경감하고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR) 8.62%로 예측되며 생검 기기 시장에서 가장 빠른 속도입니다. 인도에서는 6,120억 달러를 들여 의료 부문이 정비되어 중국에서는 Tier 2 종양 센터가 확대되고, 동남아시아에서는 민간 병원 붐이 일어나고 있습니다. 각국 정부는 동시에 폐, 장, 자궁경부의 검진 정책을 전개해, 그 결과, 의료기기공급 파이프라인이 충실하고 있습니다. 국내 제조업체도 대두하고 있지만, 미국, 일본, 유럽의 고급 브랜드는 진공 시스템과 영상 유도 시스템에서 기술적 리더십을 유지하고 있습니다.

중동 및 아프리카, 남미에서는 점유율은 작지만, 관민 파트너십에 의한 암 거점 병원이 선택적으로 급증하고 있습니다. 걸프 국가에서는 대규모 전문 병원이 종합적인 종양학 캠퍼스와 협력하여 최고급 생검 시설을 조달하고 있습니다. 브라질과 멕시코에서는 진료 보상 개혁으로 민간 보험 회사가 첨단 생검 기술을 다루게 되어 환자층이 점차 퍼지고 있습니다. 공급망의 과제와 규제 당국의 감시의 어려움으로 인해 당면의 이익은 제한적이지만, 다국적 기업은 현지에서의 조립과 판매 제휴에 의해 장래의 성장을 가능하게 하는 태세를 정돈하고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 저침습 암 진단 수요 증가

- 도달하기 어려운 장기에서 암 발생률 증가

- AI를 활용한 영상 가이드로 퍼스트 패스 수율 향상

- 정부 자금에 의한 스크리닝 프로그램 확대

- 신흥 시장에서 외래수술센터(ASC) 성장

- 시장 성장 억제요인

- 기기 리콜 및 멸균 불량 사건

- 액체 생검 기술과의 경쟁

- 대규모 시장에서의 상환 압력

- 공급망 분석

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 바늘식 생검 기구

- 코어 생검 기기

- 흡인 생검 바늘

- 진공 어시스트 생검 기기

- 수술용 트레이

- 국소성 와이어

- 기타 제품

- 바늘식 생검 기구

- 용도별

- 유방 생검

- 폐 생검

- 대장 생검

- 전립선 생검

- 기타 용도

- 최종 사용자별

- 병원

- 진단 및 영상 진단센터

- 외래수술센터(ASC)

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Becton, Dickinson & Company

- Hologic Inc.

- Danaher Corporation

- Cook Medical

- Boston Scientific Corporation

- Gallini Medical

- TSK Laboratory Europe BV

- Argon Medical Devices

- B. Braun Melsungen AG

- Cardinal Health Inc.

- Medtronic PLC

- Fujifilm Holdings Corporation

- INRAD Inc.

- Olympus Corporation

- Merit Medical Systems Inc.

- IZI Medical Products

- Leica Biosystems

- Devicor Medical Products

제7장 시장 기회와 장래의 전망

JHS 25.11.17The biopsy devices market generated USD 2.24 billion in 2025 and is forecast to reach USD 2.72 billion by 2030, posting a 4.02% CAGR during the period.

Demand is advancing steadily as hospitals, ambulatory centers, and diagnostic clinics expand early-cancer programs that hinge on tissue confirmation. Needle-based innovation, especially systems that mate vacuum technology with AI image guidance, is driving procedural efficiency and supporting a shift toward minimally invasive work-flows. Government-funded screening initiatives, such as Australia's new lung program using bulk-billed low-dose CT, are pushing higher volumes of follow-up biopsies and reducing barriers to access. Meanwhile, the biopsy devices market faces headwinds from sterility-related recalls and the accelerating uptake of liquid-biopsy assays, factors that temper-but do not derail-its growth trajectory.

Global Biopsy Devices Market Trends and Insights

Rising Demand For Minimally Invasive Cancer Diagnostics

Nanoneedle patches developed at King's College London allow painless tissue sampling by inserting millions of micro-needles that are 1,000 times thinner than human hair, enabling real-time monitoring without tissue damage. Parallel advances in pneumatically driven robotic catheters achieve six-direction sampling inside tortuous luminal organs, cutting procedure time and improving patient comfort. Clinics therefore increasingly favor less invasive hardware that minimizes complications and yields high-quality specimens, a key catalyst for the biopsy devices market worldwide. Health-system purchasers also note lower downstream costs from shorter recovery times and fewer repeat procedures, reinforcing adoption. As these technologies mature, suppliers that integrate robotic actuation and micro-sampling into cohesive platforms are gaining a competitive edge.

Growing Incidence Of Hard-To-Reach Organ Cancers

Lung cancer remains the world's top cause of cancer mortality, representing 18.7% of global cancer deaths in 2024. The anatomical obstacles of accessing lungs, pancreas, and brain heighten demand for precision needles, steerable catheter systems, and advanced imaging accessories. High-income nations report the greatest disease burden, yet emerging markets are witnessing rapid incidence growth without equivalent diagnostic capacity. Hospitals are therefore upgrading to image-guided core and vacuum-assisted devices that improve sampling accuracy and shorten anesthesia time-an investment pattern that sustains the biopsy devices market even as reimbursement regimes tighten.

Device Recalls & Sterility-Failure Events

Olympus withdrew single-use lung-biopsy sheaths after detachable tips caused 26 serious injuries, compelling hospitals to quarantine stock and reschedule procedures. Hologic's Class I recall of 53,492 BioZorb markers followed reports of pain, infection, and migration. Cardinal Health likewise pulled biopsy-related procedure kits over sterility concerns. Such events intensify regulatory scrutiny, force costly remediation programs, and can dampen clinician confidence, thereby restraining near-term growth for the biopsy devices market.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Image Guidance Improves First-Pass Yield

- Expansion Of Government-Funded Screening Programs

- Competition From Liquid-Biopsy Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Needle-based instruments generated USD 0.79 billion of revenue in 2025, equal to 35.25% of the biopsy devices market size, and they are forecast to clock an 8.25% CAGR through 2030. Core and vacuum-assisted models integrate electromagnetic tracking and AI analytics that highlight suspicious tissue in real time, cutting the learning curve for less-experienced operators. Elucent Medical's EnVisio X1 earned FDA breakthrough status for combining optical navigation with radiofrequency-guided depth control, underscoring the investment arms race around precision targeting. In parallel, disposable needle cartridges align with infection-control mandates and accelerate turnover in ambulatory theatres, helping the biopsy devices market penetrate lower-acuity settings.

Procedure trays register steady gains because standardized kits streamline set-up and lower costs per case, an advantage prized by outpatient facilities under bundled-payment models. Localization wires remain a breast-care staple, yet newer clip-based markers that dissolve or emit low-energy radar signals are gradually cannibalizing demand by improving patient comfort and eliminating retrieval steps. Supporting accessories such as cannulas, obturators, and vacuum tubing now feature RFID tags that automate lot tracking and simplify recall management, a response to recent sterility failures.

The Biopsy Devices Market Report is Segmented by Product (Needle-Based Biopsy Instruments [Core Biopsy Devices, and More], Procedure Trays, and More), Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, and More), End-User (Hospitals, Diagnostic & Imaging Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 41.82% of 2024 revenue owing to robust insurance coverage, technology-minded clinicians, and well-defined reimbursement pathways, cementing the region's anchor position in the global biopsy devices market. Continuous innovation-illustrated by AI-assisted OCT, robotic bronchoscopy, and ultrathin flexible needles-ensures a steady refresh cycle for capital equipment. Nevertheless, hospitals face payer scrutiny over procedure bundles, nudging facilities toward cost-effective disposables and predictive analytics that prune unnecessary sampling.

Europe records modest but stable gains as national health systems emphasize value-based purchasing and personalized medicine. Uptake of markers that aid in margin assessment and molecular assays that guide targeted therapy is noticeable, spurring EU demand for high-quality tissue retrieval. Regulatory alignment under the Medical Device Regulation has lengthened approval timelines, but clear clinical-benefit documentation offsets the bureaucratic burden.

Asia-Pacific is projected to log an 8.62% CAGR through 2030, by far the fastest cadence for the biopsy devices market. India's USD 612 billion health-sector build-out, China's expansion of tier-2 oncology centers, and Southeast Asia's private hospital boom enlarge the addressable install base. Governments simultaneously roll out lung, bowel, and cervical screening policies that feed procedure pipelines. Domestic manufacturers are emerging, yet premium U.S., Japanese, and European brands maintain technical leadership in vacuum and image-guided systems.

The Middle East, Africa, and South America account for smaller shares but show selective spikes where public-private partnerships fund cancer hubs. In the Gulf, large specialty hospitals procure top-tier biopsy suites tied to comprehensive oncology campuses. In Brazil and Mexico, reimbursement reforms encourage private insurers to cover advanced biopsy techniques, incrementally widening the patient pool. Supply-chain challenges and variable regulatory oversight temper immediate gains, but multinationals are positioning via local assembly and distribution alliances to unlock future growth.

- Beckton Dickinson

- Hologic

- Danaher

- Cook Group

- Boston Scientific

- Gallini Medical

- TSK Laboratory Europe

- Argon Medical Devices

- B. Braun

- Cardinal Health

- Medtronic

- FUJIFILM

- INRAD

- Olympus

- Merit Medical Systems

- IZI Medical Products

- Danaher

- Devicor Medical Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Minimally-Invasive Cancer Diagnostics

- 4.2.2 Growing Incidence Of Hard-To-Reach Organ Cancers

- 4.2.3 AI-Enabled Image Guidance Improves First-Pass Yield

- 4.2.4 Expansion Of Government-Funded Screening Programs

- 4.2.5 Growth Of Ambulatory Surgical Centers In Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Device Recalls & Sterility-Failure Events

- 4.3.2 Competition From Liquid-Biopsy Technologies

- 4.3.3 Reimbursement Pressure In High-Volume Markets

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Needle-based Biopsy Instruments

- 5.1.1.1 Core Biopsy Devices

- 5.1.1.2 Aspiration Biopsy Needles

- 5.1.1.3 Vacuum-Assisted Biopsy Devices

- 5.1.2 Procedure Trays

- 5.1.3 Localization Wires

- 5.1.4 Other Products

- 5.1.1 Needle-based Biopsy Instruments

- 5.2 By Application

- 5.2.1 Breast Biopsy

- 5.2.2 Lung Biopsy

- 5.2.3 Colorectal Biopsy

- 5.2.4 Prostate Biopsy

- 5.2.5 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic & Imaging Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Becton, Dickinson & Company

- 6.3.2 Hologic Inc.

- 6.3.3 Danaher Corporation

- 6.3.4 Cook Medical

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Gallini Medical

- 6.3.7 TSK Laboratory Europe BV

- 6.3.8 Argon Medical Devices

- 6.3.9 B. Braun Melsungen AG

- 6.3.10 Cardinal Health Inc.

- 6.3.11 Medtronic PLC

- 6.3.12 Fujifilm Holdings Corporation

- 6.3.13 INRAD Inc.

- 6.3.14 Olympus Corporation

- 6.3.15 Merit Medical Systems Inc.

- 6.3.16 IZI Medical Products

- 6.3.17 Leica Biosystems

- 6.3.18 Devicor Medical Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment