|

시장보고서

상품코드

1850120

유체 관리 시스템 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Fluid Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

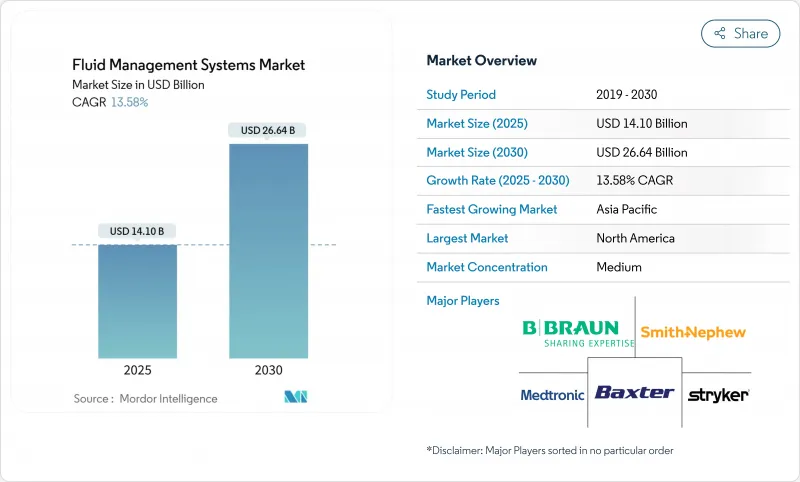

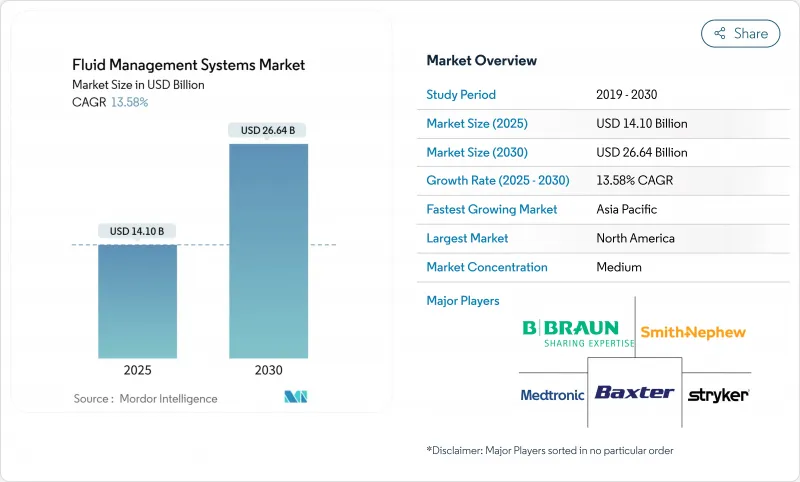

유체 관리 시스템 시장 규모는 2025년에 141억 달러, 예측기간(2025-2030년) CAGR은 13.58%를 나타낼 전망이며, 2030년에는 266억 4,000만 달러에 달할 것으로 예측됩니다.

급성장은 낮은 침습 수술량 증가, 만성 신장병의 유병률 증가, AI 대응 폐루프 한외여과 플랫폼의 채택 가속에 기인합니다. 병원은 여전히 주요 구매자이지만 휴대용 투석기로 가정 치료가 가능하기 때문에 가정 의료 채택이 급속히 확대되고 있습니다. 선도적인 벤더들이 하드웨어, 소프트웨어 및 분석을 번들로 엔드 투 엔드 솔루션을 제공함으로써 경쟁이 치열해지고 있지만, 외과의사의 인력 부족과 의료용 폴리머 공급 제약이 당면의 이익을 억제할 가능성이 있습니다.

세계 유체 관리 시스템 시장 동향과 통찰

낮은 침습 수술 증가

낮은 침습 수술은 현재 정형외과 및 일반 수술의 서비스 라인을 많이 차지하고 있으며, 선명한 시야와 안정적인 강압을 유지할 수있는 관류, 흡입 및 배기 기술에 대한 수요가 높아지고 있습니다. 외래수술센터(ASC)는 워크플로우와 문서화를 간소화하는 통합 유체 관리 플랫폼을 확보하기 위해 의료 기술 공급업체와의 구매 계약을 표준화합니다. AI를 탑재한 기기는 플로우 파라미터를 더욱 최적화하여 출혈량의 편차를 억제하고 있습니다. 이러한 변화가 함께 병원과 외래 시설 모두에서 하이스펙 시스템의 설치 베이스가 확대되고 있습니다.

만성 신장병 및 ESRD 유병률 증가

만성 신장병은 세계 8억 5,000만 명 이상의 환자를 앓고 있으며, 투석 도입량을 증가시키고 바늘이 없는 커넥터와 양방향 데이터 피드를 갖춘 새로운 다이얼라이저 막이 필요합니다. 미국에서는 2025년에 혈액투석여과가 도입되어 독소 클리어런스가 개선될 것으로 기대되고 있습니다. 이러한 진보는 클리닉과 재택 투석에 특화된 체액 관리 플랫폼에 대한 지속적인 수요를 지원합니다.

내시경 훈련을 받은 외과의 부족

2028년까지 외과 전문의가 18% 감소할 것으로 예상되며 많은 지역에서 수술 지연이 발생하고 있습니다. 지방의 병원에서는 인재의 확보가 어렵고, 고도의 내시경 유체 시스템의 도입이 제한되어 이용률이 저하하고 있습니다. 농촌는 외과의 부족의 영향을 불균형에 받고 있어, 고급 유체 관리 기술에의 액세스가 제한되어 의료 제공에 지리적 격차가 생기고 있습니다. 최신 유체 관리 시스템은 복잡하기 때문에 전문적인 교육이 필요하지만 교육은 모든 의료 환경에서 쉽게 받을 수 없으며 기술의 발전에도 불구하고 도입률이 제한될 수 있습니다.

부문 분석

다이얼라이저는 2024년 매출의 26.78%를 차지했으며, 보다 광범위한 유체 관리 시스템 시장에서 신장 대체 요법이 필수적임을 반영합니다. 프레제니우스 메디컬 케어는 2024년 매출액에 215억 유로를 기록하여 다이얼라이저 제품의 견고함을 확인했습니다. 유체폐기물관리시스템은 폐기 엄격화로 2030년까지 연평균 복합 성장률(CAGR)이 14.41%로 성장할 전망입니다. 흡입기, 흡입 장치, 주입 워머는 공급자가 낮은 침습 수술실에 최신 안전 기준을 충족하는 온도 제어, 배연 대응 키트를 장비함에 따라 안정적인 신장을 기록합니다.

AI 센서, 클라우드 대시보드 및 모듈형 허브로 구성된 긴 꼬리의 "기타 제품" 버킷은 예측 알고리즘이 측정 가능한 비용 절감을 실현하면 소프트웨어 중심 공급업체로 점유율을 이동할 수 있습니다. 다이얼라이저 소모품은 높은 경상 수익을 누리고 있는 반면, 자본 집약적인 콘솔의 교환 사이클은 길고, 각 서브 시장에서의 전략적 중요성이 부각되고 있습니다.

카테터는 2024년 매출의 33.67%를 차지했으며 혈관 접근, 관개, 배수장치 등 모든 장면에서의 사용을 반영합니다. LSI 소재, 항균 코팅, 내변색성 형태는 프리미엄 SKU를 차별화하고 병원 감염 제어 목표를 지원합니다. 밸브는 CAGR17.04%로 향후 성장을 견인해 스마트팜프와 원활하게 조합되는 자동 셧오프 및 역류 방지 설계에 대한 수요 증가를 반영하고 있습니다. 튜브 세트와 혈액 라인은 대량 생산의 정평품이지만, 압력 센서와 RFID 추적을 번들한 통합 키트에의 가치 이행이 진행중입니다.

수지 가격 상승으로 마진이 불안정해지고 OEM은 폴리머의 이중 조달이나 패키지의 재설계에 의한 플라스틱의 경량화에 임하고 있습니다. EU 법규제가 재활용 가능성의 한계를 높이고 있기 때문에 조기에 배합을 조정한 공급업체는 다년간공급계약을 체결하여 유체 관리 시스템 시장에서의 점유율을 굳힐 수 있을 것으로 보입니다.

지역 분석

북미는 2024년 매출의 41.56%를 차지해 견고한 상환과 AI 모니터의 조기 도입이 기여했습니다. 보스턴 사이언티픽의 2025년 1분기 매출액 46억 6,300만 달러는 이 지역의 정확한 관류 제어에 의존하는 하이엔드 심혈관 솔루션에 대한 의욕을 뒷받침합니다. FDA 규칙의 정합화는 다시설 전개의 합리화를 기대하지만, 다가오는 외과 수술의 노동력 부족이 성장을 억제할 가능성이 있습니다.

아시아태평양은 확대의 원동력으로 CAGR 14.98%로 성장하고 있습니다. 중국은 3차 병원을 확대하고 인도는 공적 자금을 투석 클리닉에 투입하고 있습니다. 규제의 다양성으로 인해 시장 진입 경로의 맞춤화가 필요하지만, 규제 당국이 틀을 현대화함에 따라 의료기기의 승인이 전반적으로 가속화되고 있습니다.

유럽에서는 성숙과 지속가능성의 양립이 요구되고 있습니다. 시판 후 조사 및 재활용 가능한 포장에 관한 EU 지령은 부품 설계를 재구축하고 요람에서 묘지까지의 컴플라이언스를 검증할 수 있는 제조업체를 우대하고 있습니다. 한편 독일과 프랑스에서는 지방분권정책에 따라 이동식 유체기기에 의존하는 외래환자 치료 건수가 증가하고 있습니다.

중동 및 아프리카와 남미는 절대적인 규모이지만 인프라 프로젝트가 비감염성 질병 부담 증가와 맞물려 두 자릿수 성장률을 기록하고 있습니다. 환율 변동과 수입 관세는 여전히 역풍이며 공급업체는 현지 조립 및 전략적 유통업체 제휴를 추진하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 저침습 수술 건수 증가

- 만성신장병과 말기신부전의 이환율 증가

- AI 대응 폐쇄루프 한외 여과 제어의 도입

- 통합형 유체 폐기물 및 일회용 흡입 시스템

- 휴대용 재택 투석액 플랫폼으로의 이행

- OR유체폐기물 컴플라이언스에 관한 규제 추진

- 시장 성장 억제요인

- 내시경 검사 훈련을 받은 외과의 부족

- 통합 플랫폼의 고자본 비용

- 일회용 플라스틱 법안으로 소비 가능한 비용 증가

- 의료 등급의 폴리머와 수지의 불안정한 공급

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 혈액투석기

- 인서프레이터

- 흡입·관개 시스템

- 유체 가열 장치

- 유체-폐기물 관리

- 기타 제품

- 일회용품과 액세서리

- 카테터

- 블러드 라인

- 트랜스듀서

- 밸브

- 튜브 세트

- 기타 일회용품

- 용도별

- 관절경 검사

- 복강경 검사

- 신경학

- 심장병학

- 비뇨기과

- 치과

- 소화기내과

- 기타 용도

- 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 투석 센터

- 전문 클리닉

- 재택 케어 환경

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson & Co.

- Cardinal Health Inc.

- Hologic Inc.

- Johnson & Johnson

- Medtronic plc

- Smiths Medical (ICU Medical)

- Smith & Nephew plc

- Stryker Corp.

- Fresenius Medical Care AG & Co. KGaA

- Olympus Corp.

- Zimmer Biomet Holdings Inc.

- Arthrex Inc.

- AngioDynamics Inc.

- Ecolab(Skytron)

- Teleflex Inc.

- Nipro Corp.

- Asahi Kasei Corp.

- ConMed Corp.

- Karl Storz SE & Co. KG

- Boston Scientific Corp.

제7장 시장 기회와 장래의 전망

SHW 25.11.17The Fluid Management Systems Market size is estimated at USD 14.10 billion in 2025, and is expected to reach USD 26.64 billion by 2030, at a CAGR of 13.58% during the forecast period (2025-2030).

Rapid growth stems from rising minimally invasive surgery volumes, the increasing prevalence of chronic kidney disease, and accelerating adoption of AI-enabled closed-loop ultrafiltration platforms. Hospitals remain the primary purchasers, but home-care adoption is growing fast as portable dialysis devices enable in-home therapies. Competitive dynamics are intensifying as leading vendors bundle hardware, software, and analytics to deliver end-to-end solutions, yet shortages of surgeon talent and supply constraints on medical-grade polymers could temper near-term gains.

Global Fluid Management Systems Market Trends and Insights

Rise in Minimally-Invasive Surgery Volumes

Minimally invasive procedures now dominate many orthopedic and general surgery service lines, increasing demand for irrigation, suction, and insufflation technologies that can maintain clear visibility and stable cavity pressure. Ambulatory surgery centers are standardizing purchasing agreements with med-tech vendors to secure integrated fluid management platforms that streamline workflow and documentation. AI-enhanced devices are further optimizing flow parameters and reducing blood-loss variability. Together, these shifts are enlarging the installed base of high-specification systems in both hospitals and outpatient facilities.

Growing Prevalence of Chronic Kidney Disease & ESRD

Chronic kidney disease affects more than 850 million people worldwide, pushing dialysis procedure volumes higher and requiring new dialyzer membranes with needle-free connectors and bi-directional data feeds. Hemodiafiltration rollouts in the United States during 2025 promise better toxin clearance, while closed-loop feedback controls have lowered intradialytic hypotension events in 23 of 28 clinical trials. These advancements underpin sustained unit demand for dialysis-specific fluid management platforms across clinics and home settings.

Shortage of Endoscopy-Trained Surgeons

An 18% decline in surgical specialists projected by 2028 is delaying procedure backlogs in many regions. Rural hospitals find it hardest to recruit talent, limiting deployment of advanced endoscopic fluid systems and depressing utilization rates. Rural areas are disproportionately affected by surgeon shortages, limiting access to advanced fluid management technologies and creating geographic disparities in care delivery. The complexity of modern fluid management systems requires specialized training that may not be readily available in all healthcare settings, potentially limiting adoption rates despite technological advancement.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Closed-Loop Ultrafiltration Control Adoption

- Integrated Fluid-Waste & Disposable Insufflation Systems

- High Capital Cost of Integrated Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dialyzers generated 26.78% of 2024 revenue, reflecting the indispensable nature of renal replacement therapy within the broader fluid management systems market. Fresenius Medical Care posted EUR 21.5 billion in 2024 revenue, confirming the resilience of its dialyzer line. Fluid-waste management systems are set to rise at a 14.41% CAGR to 2030, propelled by stricter disposal mandates. Insufflators, suction units, and fluid warmers register steady gains as providers equip minimally invasive theaters with temperature-controlled, smoke-evacuation-ready kits that meet modern safety codes.

The long-tail "other products" bucket comprising AI sensors, cloud dashboards, and modular hubs could shift share toward software-centric vendors if predictive algorithms deliver measurable cost savings. Segment margins vary widely: dialyzer consumables enjoy high recurring revenue, whereas capital-intensive consoles face lengthier replacement cycles, underscoring distinct strategic imperatives within each sub-market.

Catheters accounted for 33.67% of 2024 revenues in this category, reflecting universal application in vascular access, irrigation, and drainage across settings. LSI materials, antimicrobial coatings, and kink-resistant geometries differentiate premium SKUs and support hospitals' infection-control targets. Valves headline future growth with a 17.04% CAGR, mirroring rising demand for automated shut-off and anti-reflux designs that pair seamlessly with smart pumps. Tubing sets and bloodlines represent high-volume staples, but value migration is underway toward integrated kits that bundle pressure sensors and RFID tracking.

Resin price spikes create margin volatility, prompting OEMs to dual-source polymers and redesign packaging to cut plastic weight. As EU legislation ratchets up recyclability thresholds, suppliers that calibrate formulations early could lock in multi-year supply contracts and solidify share positions within the fluid management systems market.

The Fluid Management Systems Market Report Segments the Industry Into by Product (Dialyzers, Insufflators, and More), Disposables and Accessories (Catheters, Bloodlines, and More), Application (Arthroscopy, Laparoscopy, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 41.56% of 2024 revenues, lifted by robust reimbursement and early adoption of AI monitors. Boston Scientific's USD 4.663 billion Q1 2025 sales underline the region's appetite for high-end cardiovascular solutions that rely on precise perfusion control. FDA rule harmonization is expected to streamline multi-site rollouts, though looming surgical workforce shortages could temper growth.

Asia-Pacific is the engine of expansion, advancing at a 14.98% CAGR. China is scaling tertiary hospitals, while India channels public funding into dialysis clinics. Regulatory diversity requires tailored market-access pathways, yet overall device approvals are accelerating as agencies modernize frameworks.

Europe balances maturity with sustainability imperatives. EU directives on post-market surveillance and recyclable packaging are reshaping component design, favoring manufacturers that can verify cradle-to-grave compliance. Meanwhile, decentralization policies in Germany and France bolster outpatient procedure volumes that depend on mobile fluid equipment.

Middle East & Africa and South America trail in absolute size but offer double-digit growth pockets where infrastructure projects align with rising non-communicable disease burdens. Currency fluctuations and import tariffs remain headwinds, pushing suppliers toward local assembly and strategic distributor alliances to penetrate these segments of the fluid management systems market.

- B. Braun

- Baxter

- Beckton Dickinson

- Cardinal Health

- Hologic

- Johnson & Johnson

- Medtronic

- Smiths Group

- Smiths Group

- Stryker

- Fresenius

- Olympus Corp.

- Zimmer Biomet

- Arthrex

- AngioDynamics

- Ecolab (Skytron)

- Teleflex

- Nipro Corp.

- Asahi Kasei Corp.

- ConMed Corp.

- Karl Storz

- Boston Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Minimally-Invasive Surgery Volumes

- 4.2.2 Growing Prevalence of Chronic Kidney Disease & ESRD

- 4.2.3 AI-Enabled Closed-Loop Ultrafiltration Control Adoption

- 4.2.4 Integrated Fluid-Waste & Disposable Insufflation Systems

- 4.2.5 Shift Toward Portable Home-Dialysis Fluid Platforms

- 4.2.6 Regulatory Push on OR Fluid-Waste Compliance

- 4.3 Market Restraints

- 4.3.1 Shortage of Endoscopy-Trained Surgeons

- 4.3.2 High Capital Cost of Integrated Platforms

- 4.3.3 Single-Use-Plastic Legislation Inflating Consumable Costs

- 4.3.4 Volatile Supply of Medical-Grade Polymers & Resins

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Dialyzers

- 5.1.2 Insufflators

- 5.1.3 Suction & Irrigation Systems

- 5.1.4 Fluid-Warming Devices

- 5.1.5 Fluid-Waste Management

- 5.1.6 Other Products

- 5.2 By Disposables & Accessories

- 5.2.1 Catheters

- 5.2.2 Bloodlines

- 5.2.3 Transducers

- 5.2.4 Valves

- 5.2.5 Tubing Sets

- 5.2.6 Other Disposables

- 5.3 By Application

- 5.3.1 Arthroscopy

- 5.3.2 Laparoscopy

- 5.3.3 Neurology

- 5.3.4 Cardiology

- 5.3.5 Urology

- 5.3.6 Dental

- 5.3.7 Gastroenterology

- 5.3.8 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Dialysis Centers

- 5.4.4 Specialty Clinics

- 5.4.5 Home-Care Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 B. Braun Melsungen AG

- 6.3.2 Baxter International Inc.

- 6.3.3 Becton, Dickinson & Co.

- 6.3.4 Cardinal Health Inc.

- 6.3.5 Hologic Inc.

- 6.3.6 Johnson & Johnson

- 6.3.7 Medtronic plc

- 6.3.8 Smiths Medical (ICU Medical)

- 6.3.9 Smith & Nephew plc

- 6.3.10 Stryker Corp.

- 6.3.11 Fresenius Medical Care AG & Co. KGaA

- 6.3.12 Olympus Corp.

- 6.3.13 Zimmer Biomet Holdings Inc.

- 6.3.14 Arthrex Inc.

- 6.3.15 AngioDynamics Inc.

- 6.3.16 Ecolab (Skytron)

- 6.3.17 Teleflex Inc.

- 6.3.18 Nipro Corp.

- 6.3.19 Asahi Kasei Corp.

- 6.3.20 ConMed Corp.

- 6.3.21 Karl Storz SE & Co. KG

- 6.3.22 Boston Scientific Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment