|

시장보고서

상품코드

1432968

세계 항공기용 브레이크 시장 : 점유율 분석, 산업 동향,성장 및 예측(2024-2029년)Aircraft Brakes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

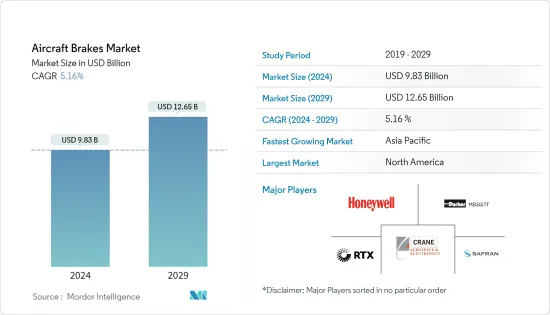

항공기용 브레이크 시장 규모는 2024년에 98억 3,000만 달러로 추정되고 2029년에는 126억 5,000만 달러에 이르며, 예측기간(2024-2029년)의 복합 연간 성장률(CAGR) 5.16%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 항공 부문은 COVID-19 팬데믹에 의해 비교할 수 없는 과제에 직면. 유행에 의해 야기된 공급망의 혼란과 노동력 부족은 유행 기간 동안 시장 성장을 방해했습니다. 또한 에어버스와 보잉과 같은 주요 항공기 OEM은 직원 안전에 대한 우려와 정부 규제로 생산을 중단하고 시장 성장을 방해했습니다. 2021년 이후 신형 항공기 수요 증가와 선진 항공기 브레이크 지출 증가로 시장은 강력한 회복을 보였습니다.

- 민간 및 군사 분야에서 차세대 항공기 조달은 항공기 브레이크 시장 개척의 주된 이유 중 하나입니다. 항공기의 경량화가 중시되고 항공기의 전동화가 진행되는 가운데(전동 브레이크와 같은) 새로운 경량 브레이크가 개발되고 있습니다.

- 항공기 브레이크 시스템은 항공기가 안전하고 신속하게 착륙할 수 있도록 하는 모든 항공기에 필수적인 구성 요소입니다. 새로운 민간 항공기와 군용 항공기 수요 증가와 고급 브레이크 시스템 개발에 대한 지출 증가가 항공기 브레이크 수요를 뒷받침하고 있습니다. 항공기 브레이크 시스템의 기술적 진보와 첨단 브레이크 디스크 소개는 시장 성장을 가속하고 있습니다.

항공기용 브레이크 시장 동향

예측 기간 동안 상용 부문이 가장 높은 성장을 보일 것으로 예측

- 예측 기간 동안 항공기 브레이크 시장에서는 상용 부문이 큰 성장을 보일 것으로 예측됩니다. 이 성장은 전 세계적으로 증가하는 여객 운송에 대응하기 위해 항공기 수주 및 배달 증가로 인한 것입니다. 현재, 탄소 브레이크는 항공 업계에서 매우 인기가 있으며, 스틸 브레이크에 비해 가볍고 평균 수리 간격(MTBR)이 길기 때문에 좁은 바디, 와이드 바디, 지역 제트의 대부분이 채택하고 있습니다.

- 사프란 랜딩 시스템즈의 탄소 브레이크는 에어 버스 A320ceo/neo, A350 패밀리, 보잉 B737NG/MAX, B787 드림 라이너에 채용되고 있습니다. 브레이크 시스템의 주요 이점은 효율성과 내구성 향상입니다. 사프란에 따르면, B737에 장착된 탄소 브레이크는 오버홀과 오버홀 사이에 2,200회의 착륙이 가능합니다. 또한 A320neo 패밀리에서는 2,500회, A350에서는 2,000회의 착륙이 가능합니다.

- 그러나 최근 민간항공부문은 경량화와 연료비 절감을 주 목적으로 보다 전기적인 아키텍처로 전환하고 있습니다. 이 시프트는 가볍고 성능이 향상되고 유지보수가 용이한 새로운 전기 브레이크 기술의 채택을 뒷받침합니다. 항공사는 연료비와 정비비 절감에 도움이 되는 전기 브레이크를 채택하는 경향이 있습니다. 민간 항공기 기술의 동향은 예측 기간 동안이 부문의 성장을 지원하는 주요 요인이 될 것으로 보입니다.

예측기간 동안 아시아태평양이 가장 높은 성장을 이

- 예측 기간 동안 항공기 브레이크 시장에서 가장 높은 성장을 보이는 것은 아시아태평양입니다. 이 성장은 항공 교통량 증가, 새로운 공항 개발, 민간기 및 군용기 조달에 드는 지출 증가로 인한 것입니다. 국제항공운송협회(IATA)에 따르면 중국은 2020년 중반에 좌석수로 세계 최대의 항공시장이 되고 인도는 2024년까지 영국을 제치고 세계 3위 항공시장이 됩니다. 또한 항공기의 OEM인 에어버스는 아시아태평양에서는 2040년까지 17,600대 이상의 항공기가 새로 필요할 것으로 예측했습니다.

- 조달과 수주 외에도 이 지역은 인도용 선진 중형 전투기(AMCA) 프로그램, 한국과 인도네시아용 KF-X, 중국용 COMAC C919 등 신형기 개발에도 종사하고 있습니다. 이러한 첨단 항공기 개발에는 성능을 향상시키는 새로운 브레이크가 필요합니다. 현재 진행중인 항공기 조달은 제조 능력이 향상됨에 따라 예측 기간 동안이 지역의 성장을 밀어 올릴 것입니다. 예를 들어, 2022년 8월, RUAG 호주는 아시아태평양(APAC) 지역에서 F-35 통합 타격 전투기의 바퀴와 브레이크 프로그램을 위한 유지보수, 수리, 오버홀(MRO) 인증 서비스 센터가 되기 위해 Honeywell Inc.?인터내셔널 잉크와 계약을 체결했습니다.

항공기용 브레이크 산업 개요

항공기 브레이크 시장은 소수의 기업이 시장에서 큰 점유율을 차지하고 있으며 그 특성상 통합되어 있습니다. 시장의 유명한 선수는 RTX Corporation, Safran, Crane Aerospace & Electronics, Meggitt PLC, Honeywell International Inc.입니다. 이들은 군사, 상업 및 일반 항공 분야의 항공기 대부분에 브레이크 및 브레이크 시스템을 공급하는 기업입니다.

높은 브랜드 가치와 항공기 OEM 간의 장기 계약으로 인해 이러한 유력 기업은 시장을 독점하고 있으며 신규 진출기업이 이러한 상황을 활용하기가 어렵습니다. 현재 초기 단계에 있는 전기 브레이크 기술에 대한 각 회사의 투자는 가까운 미래에 탄소 브레이크에서 전기 브레이크로의 전환기에 각 회사가 유력한 지위를 유지하는 데 도움이 될 것으로 예상됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트,지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 유형

- 전동 브레이크

- 탄소제 브레이크

- 스틸제 브레이크

- 최종 사용자

- 상용

- 군용

- 일반항공

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 카타르

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 점유율 분석

- 기업 프로파일

- Safran

- Meggitt PLC

- Honeywell International Inc.

- RTX Corporation

- Crane Aerospace & Electronics

- Beringer Aero

- Advent Aircraft Systems Inc.

- Tactair

- RAPCO, Inc.

- Matco Aircraft Landing Systems

- The Carlyle Johnson Machine Company, LLC

제7장 시장 기회와 앞으로의 동향

BJH 24.03.04The Aircraft Brakes Market size is estimated at USD 9.83 billion in 2024, and is expected to reach USD 12.65 billion by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

Key Highlights

- The aviation sector faced unmatched challenges due to the COVID-19 pandemic. Supply chain disruptions brought by the pandemic and labor shortages hindered the market growth during the pandemic. Also, key aircraft OEMs such as Airbus and Boeing halted production due to employee safety concerns and government regulations that hamper the market growth. The market showcased a strong recovery from 2021 due to increased demand for new aircraft and rising spending on advanced aircraft brakes.

- The procurement of newer generation aircraft in the commercial and military sectors is one of the major reasons for the development of the aircraft brakes market. With increasing emphasis on the reduction of the weight of aircraft and with the concept of more electric aircraft, new lightweight brakes are being developed (like electric brakes).

- Aircraft brake systems are essential components of all aircraft that allow the aircraft to land safely and quickly. Growing demand for new commercial and military aircraft and rising spending on the development of advanced braking systems propel the demand for aircraft brakes. Technological advancements in the aircraft braking system and the introduction of advanced brake discs drive the growth of the market.

Aircraft Brakes Market Trends

The Commercial Segment is Projected to Show Highest Growth During the Forecast Period

- The commercial segment is anticipated to show significant growth in the aircraft brakes market during the forecast period. The growth is attributed to the increase in aircraft orders and deliveries to cater to the growing passenger traffic around the world. Currently, carbon brakes are very much popular in the aviation industry, with most narrow-body, wide-body, and regional jets using them due to their lightweight, as compared to steel brakes, and more mean time between repairs (MTBR).

- Safran Landing Systems' carbon brakes feature on the Airbus A320ceo/neo and A350 family, Boeing B737NG/MAX, and the B787 Dreamliner. Increased efficiency and durability are the major benefits of braking systems. According to Safran, carbon brakes equipped with B737 can conduct 2,200 landings between overhauls. It also offers 2,500 landings on A320neo family aircraft and 2,000 landings for those on the A350.

- However, in recent years, the commercial aviation sector has been moving toward more electric architecture, with the main aim of reducing weight and lowering fuel costs. This shift is supporting the adoption of the new electric brake technology that comes with low weight and improved performance, as well as ease of maintenance. The airlines tend to use electric brakes, as they help in cutting down fuel and maintenance costs. The trend in commercial aircraft technology will be a major factor in supporting the growth of this segment during the forecast period.

Asia-Pacific to Experience the Highest Growth During the Forecast Period

- The Asia-Pacific will showcase the highest growth in the aircraft brakes market during the forecast period. The growth is due to increasing air traffic, the development of new airports, and rising expenditure on the procurement of commercial and military aircraft. According to the International Air Transport Association (IATA), China would become the largest aviation market in terms of seating capacity in mid-2020, and India will surpass the UK and become the third-largest aviation market in the world by 2024. Furthermore, Airbus, an aircraft OEM, forecasts that the Asia-Pacific region will need over 17,600 new aircraft by 2040.

- In addition to the procurements and orders, the region is involved in the development of new aircraft, like the Advanced Medium Combat Aircraft (AMCA) program for India, KF-X for Korea and Indonesia, and the COMAC C919 for China. The development of such advanced aircraft will require newer types of brakes, which will improve performance. The ongoing procurements of aircraft, along with the increasing manufacturing capabilities, will boost the growth of the region during the forecast period. For instance, in August 2022, RUAG Australia signed an agreement with Honeywell International Inc. to become a maintenance, repair, and overhaul (MRO) Authorised Service Centre for the F-35 Joint Strike Fighter Wheels and Brakes program in the Asia-Pacific (APAC) region.

Aircraft Brakes Industry Overview

The aircraft brakes market is consolidated in nature, with a presence of few players holding significant shares in the market. The prominent players in the market are RTX Corporation, Safran, Crane Aerospace & Electronics, Meggitt PLC, and Honeywell International Inc. These are firms that supply brakes and braking systems to most of the aircraft in the military, commercial, and general aviation sectors.

With high brand values and long-term contracts with aircraft OEMs, these prominent players dominate the market, making it difficult for new players to capitalize on this landscape. The investments by the companies in electric brake technology, which is currently in its initial stage, are also expected to help them maintain prominent positions, during the transition from carbon brakes to electric brakes, in the near future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Electric Brakes

- 5.1.2 Carbon Brakes

- 5.1.3 Steel Brakes

- 5.2 End-User

- 5.2.1 Commercial

- 5.2.2 Military

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Qatar

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles

- 6.2.1 Safran

- 6.2.2 Meggitt PLC

- 6.2.3 Honeywell International Inc.

- 6.2.4 RTX Corporation

- 6.2.5 Crane Aerospace & Electronics

- 6.2.6 Beringer Aero

- 6.2.7 Advent Aircraft Systems Inc.

- 6.2.8 Tactair

- 6.2.9 RAPCO, Inc.

- 6.2.10 Matco Aircraft Landing Systems

- 6.2.11 The Carlyle Johnson Machine Company, LLC