|

시장보고서

상품코드

1852172

중환자 치료 진단 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Critical Care Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

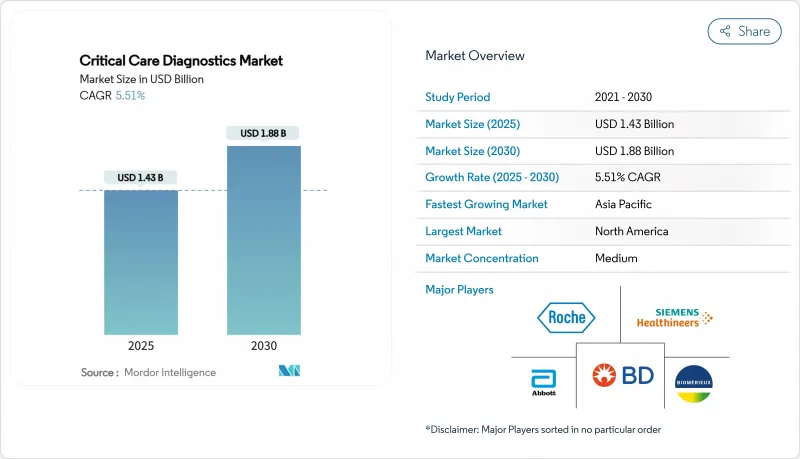

중환자 치료 진단 시장 규모는 2025년에 14억 3,000만 달러, 2030년에는 18억 8,000만 달러에 이르고, CAGR 5.51%로 확대될 것으로 예측됩니다.

집중 치료실(ICU), 응급실, 이동 ICU에서의 신속한 방어에 대한 수요가 증가함에 따라, 침대 측 분석기는 병원 예산의 중심에 위치하게 됩니다. 패혈증, 심혈관 질환 및 급성 호흡기 질환의 증례 수가 증가함에 따라 결과를 몇 시간에서 수십 분으로 단축하는 장비에 대한 구매 의욕이 높아지고 있습니다. 주요 의료 시스템의 디지털화 프로그램은 구조화된 데이터를 전자 기록으로 직접 전송하고 AI 대시보드가 종단적인 바이오마커의 동향을 실용적인 케어 경로로 변환하는 분석 장치를 필요로 합니다. 아시아태평양의 공공 인프라 확장과 초고속 병원체 및 숙주 응답 분석에 특화된 신흥 기업에 대한 사모 펀드 금융으로부터 자본이 계속 유입되어 경쟁의 역학이 재구성되어 기기의 교체 사이클이 활성화되고 있습니다.

세계의 치명적인 치료 진단 시장 동향과 통찰

신속한 진단이 필요한 중증 질환의 부담 증가

패혈증은 매년 170만 명 이상의 미국 성인을 앓고 있으며 진단이 6시간 이상 늦어지면 사망률이 급상승합니다. 2025년 FDA가 MeMed BV 숙주 반응 검사를 허가하면 임상의는 박테리아 감염과 바이러스 감염을 20분 이내에 구별할 수 있습니다. 고령화로 인해 이미 복잡해지고 있는 ICU의 등록에 다질환 합병증이 더해지고 있는 한편, 신흥 시장에서는 외상이나 감염증의 부담이 증가하고 있습니다. 고감도 트로포닌, 젖산, 프로칼시토닌을 추적하는 예측 알고리즘을 통해 증상이 나타나기 6-12시간 전에 생리적 저하를 경고할 수 있어 결과 개선과 자원 이용 저감이 가능해졌습니다.

급성기 의료에서 POC 검사 확대

휴대용 카트리지 분석기는 지금까지 45-90분이 소요된 시료를 셔틀링할 필요가 없습니다. Nova Biomedical의 Stat Profile Prime Plus와 같은 장비는 90 μL 모세관 혈액에서 11 매개 변수 패널을 만들고 혈행 역학이 불안정한 환자의 시료를 절약합니다. 트로포닌 측정법을 중앙 검사실에서 베드사이드 플랫폼으로 이행한 구명 구급 센터에서는 처리량 시간이 30-40% 단축되었다고 보고하고 있습니다. COVID-19 위기시 도입된 휴대용 분자 유닛은 현재 구급차에 장착되어 병원 문이 열리기 전에도 혈전 용해 요법과 항생제 치료를 시작할 수 있습니다.

고도 진단 플랫폼의 높은 자본 비용과 운영 비용

AI 대응 혈액가스 워크스테이션은 1대당 50만 달러 이상의 비용이 듭니다. 소규모 지역 병원에서는 검사 수량의 회수가 보증되지 않기 때문에 주저합니다. 구독 및 결과 기반 가격 모델도 등장하지만, 이사회는 커밋하기 전에 여러 해의 증거를 요구하는 경우가 많습니다.

부문 분석

혈액학 검사는 수혈 결정, 응고 감시 및 감염 모니터링에서의 역할을 반영하여 2024년 치명적 치료 진단 시장 규모의 24.45%를 차지했습니다. 자동 분석기는 현재 60초 이내에 완전 혈구 계수를 제공하고 수혈 관리 소프트웨어에 직접 연결되어 있습니다. 응고 서브 패널은 혈전 형성을 실시간으로 추적하고 외상 소생시 표적 항선 요법의 지침이되는 점탄성 분석으로 확장되었습니다.

루틴 및 특수 화학 검사는 조기 악화 예측을 가능하게 하는 고감도 트로포닌, 프레셉신, 대사 스트레스 마커를 커버하는 패널의 확충에 추진되어 CAGR 7.65%로 성장할 전망입니다. 미생물학 및 분자 병원체 패널은 항생제 스튜어드십의 의무화와 연계하여 진보하고 광역 스펙트럼 약물의 사용을 억제하는 1시간 미만의 감수성 프로파일을 제공합니다. 유동세포계측법은 이식 ICU의 면역억제된 집단에 대한 가치를 유지하며, 면역단백질 분석은 패혈증의 위험 계층화를 정밀화하는 가용성 CD14 변형으로 확대됩니다. 이러한 변화를 종합하면 단일 매개 변수가 아닌 환자의 전반적인 스냅 샷을 제시하는 멀티 플렉스 대시 보드에 대한 임상의의 요구와 일치하며 통합 플랫폼은 조달 결정의 최전선에 위치합니다.

현장진단 기기는 2024년 중환자 치료 진단 시장의 매출액의 52.56%를 차지하며, 침대 측에서 턴어라운드 시간을 단축하는 데 필수적입니다. 카트리지식 혈액가스 분석기, 핸드헬드형 포도당·케톤 측정 장치, 소형 면역 측정 장치는 유지 보수가 최소화되어 고도 급성기 워크플로우에 원활하게 적합하기 때문에 구매 목록의 상위를 차지하고 있습니다.

그러나 CAGR 7.78%로 확대될 것으로 예측되는 AI 대응 의사결정 지원 시스템은 구매자의 기대를 재구축하고 있습니다. 신경망이 장착된 미들웨어 허브는 종단적인 바이오마커 데이터를 지속적으로 분석하여 최대 12시간의 부작용을 예측하고 프로토콜 중심의 개입을 유도합니다. 중앙 실험실 분석기는 여전히 높은 처리량 요구에 부응하지만 분산화가 진행되고 있기 때문에 미래는 계층화된 관리 설정을 지원하는 허브 및 스포크 아키텍처에 있습니다. 하이브리드 클라우드 인프라는 컴퓨팅 수요를 오프로드하여 지역 병원 진입 장벽을 낮추고 사이버 보안 강화는 환자 데이터 침해에 대한 우려 증가를 해결합니다. 이러한 움직임을 종합하면 베드사이드 하드웨어와 클라우드 인텔리전스가 함께 작동하여 임상 결과를 향상시키는 기술 믹스가 예측됩니다.

지역 분석

북미는 2024년 매출의 42.45%를 차지하며 고급 ICU 병상 밀도, 광범위한 지불 시스템, 신속한 장비 인가를 가능하게 하는 FDA의 합리화된 경로에 지원되고 있습니다. 미국의 병원은 가치 기반의 진료 보상에 대응하기 위해 AI 대시보드의 통합을 계속하고 있으며, 캐나다의 주 입찰에서는 분산된 의료 현장에서의 카트리지의 상호 운용성이 중시되고 있습니다. 유럽에서는 근대화 프로그램과 고령화로 인해 심각한 환자 발생률이 증가하고 있기 때문에 왕성한 수요가 계속되고 있습니다. 독일은 점탄성 응고 분석기를 지정하는 외상 네트워크에 자금을 제공하고 프랑스는 항균제 내성을 다루기 위해 미세 유체 분자 플랫폼에 투자하고 있습니다. 영국은 커뮤니티 진단센터에 23억 파운드를 투입하여 분산형 검사로의 전환을 보여줍니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR) 6.54%로 성장할 것으로 전망됩니다. 중국과 인도가 수십억 달러의 예산을 새로운 3차 병원과 이동식 ICU에 투입하기 때문입니다. 현지 합작의 조립 라인은 수입 관세를 줄이고 중견 병원에 대한 접근성을 확대합니다. 일본에서는 AI를 활용한 패혈증 경보가 개량되고, 한국에서는 클라우드 접속에 의한 지역 병원간의 심근 트로포닌 네트워크가 개척됩니다. 동남아시아에서는 휴대용 PCR과 혈액가스 분석장치가 농촌의 진료소에 도입되어 지금까지 검사서비스에서 멀어져 있던 사람들의 건강공평성의 갭을 메웁니다.

중동 및 아프리카에서는 걸프 협력 회의 국가에서 석유 자금을 통한 병원 프로젝트와 북아프리카의 기증자 지원을 통해 외상 센터가 이익을 얻고 있습니다. 남미에서는 브라질이 높은 뇌혈관 사망률을 다루기 위해 CT와 혈액가스 분석기를 갖춘 이동식 뇌졸중 유닛을 배치하여 한 자리 대 중반의 안정적인 이익을 기록하고 있습니다. 이러한 지리적 요인이 함께, 중환자 치료 진단 시장은 예측 기간 중 확대해 나갈 것으로 예측됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 신속 진단을 필요로 하는 심각한 질환의 부담 증가

- 급성기 의료에 있어서의 현장진단 기기 검사의 확대

- 진단과 병원 생태계의 통합

- 집중 치료 인프라에 대한 정부 투자와 민간 투자

- 지속적인 기술 혁신에 의한 검사 속도와 정밀도 향상

- 조기 임상 의사 결정을 중시하는 가치 기반 의료로의 전환

- 시장 성장 억제요인

- 고도 진단 플랫폼의 높은 자본 비용과 운영 비용

- 중환자 치료 검사실에서의 한정된 숙련 노동력

- 신규 검사에 대한 규제와 상환의 불확실성

- 커넥티드 진단 기기의 데이터 보안 및 프라이버시 우려

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 검사 유형별

- 유세포 분석

- 혈액학 검사

- 미생물학·감염증 검사

- 응고 검사

- 면역단백질 검정

- 일반화학과 특수화학

- 기타 검사 유형

- 기술별

- 중앙 연구소 분석기

- 현장진단 기기

- 분자진단(PCR/NGS)

- 면역 측정 플랫폼

- 마이크로플루이딕스 & 랩 온칩

- AI를 활용한 의사결정 지원 시스템

- 최종 사용자별

- 집중치료실(ICU)

- 응급실(ER)

- 수술실(OR)

- 구급차와 이동식 ICU

- 기타 최종 사용자

- 샘플 유형별

- 전혈

- 혈장/혈청

- 현장진단 모세관

- 호흡기 분비물

- 기타 샘플 유형

- 지리

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Abbott

- F. Hoffmann-La Roche

- Siemens Healthineers

- Danaher(Beckman Coulter & Cepheid)

- bioMerieux

- Sysmex Corporation

- Becton, Dickinson & Company

- Thermo Fisher Scientific

- Bayer AG

- Chembio Diagnostics

- Radiometer Medical

- Instrumentation Laboratory(Werfen)

- Nova Biomedical

- QuidelOrtho

- Werfen Group

- PixCell Medical

- Truvian Health

- EKF Diagnostics

- OptiMedical Systems

- Randox Laboratories

제7장 시장 기회와 장래의 전망

SHW 25.11.19The critical care diagnostics market size is USD 1.43 billion in 2025 and is forecast to reach USD 1.88 billion by 2030, expanding at a 5.51% CAGR.

Intensifying demand for rapid triage inside intensive care units (ICUs), emergency departments and mobile ICUs keeps bedside analyzers at the center of hospital budgets. Growing sepsis, cardiovascular and acute respiratory caseloads reinforce purchasing momentum for instruments that cut result-turnaround from hours to single-digit minutes. Major health-system digitalization programs now seek analyzers that transmit structured data directly to electronic records while AI dashboards translate longitudinal biomarker trends into actionable care pathways. Capital continues to pour in from public infrastructure expansions across Asia-Pacific and from private-equity financing of start-ups with narrowly focused, ultra-fast pathogen and host-response assays, reshaping competitive dynamics and catalyzing device replacement cycles.

Global Critical Care Diagnostics Market Trends and Insights

Growing Burden of Critical Illnesses Requiring Rapid Diagnostics

Sepsis affects more than 1.7 million U.S. adults each year, and mortality jumps when diagnosis is delayed beyond six hours. FDA clearance of the MeMed BV host-response test in 2025 enables clinicians to distinguish bacterial from viral infections in under 20 minutes. Aging populations add multimorbidity to already complex ICU rosters, while emerging markets confront rising trauma and infectious-disease burdens. Predictive algorithms that track high-sensitivity troponin, lactate and procalcitonin can now warn of physiologic decline six to twelve hours before overt symptoms, improving outcomes and reducing resource utilization.

Expansion of Point-of-Care Testing in Acute Care Settings

Hand-held cartridge analyzers eliminate specimen shuttling that previously added 45-90 minutes to turnaround. Devices such as Nova Biomedical's Stat Profile Prime Plus produce 11-parameter panels from 90 µL of capillary blood, preserving sample volume for hemodynamically unstable patients. Emergency rooms that migrated troponin assays from central labs to bedside platforms report 30-40% shorter throughput times. Portable molecular units introduced during the COVID-19 crisis now equip ambulances, allowing thrombolysis or antibiotic therapy to begin even before hospital doors open.

High Capital and Operational Costs of Advanced Diagnostic Platforms

AI-ready blood-gas workstations can cost more than USD 500,000 per unit, while service contracts add roughly 10% annually. Smaller community hospitals hesitate when test volumes cannot guarantee payback. Subscription or outcome-based pricing models have emerged, yet boards often demand multi-year evidence before committing.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Diagnostics into Connected Hospital Ecosystems

- Government and Private Investments in Intensive-Care Infrastructure

- Limited Skilled Workforce in Critical Care Laboratories

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hematology tests accounted for 24.45% of the critical care diagnostics market size in 2024, reflecting their role in transfusion decisions, coagulation surveillance and infection monitoring. Automated analyzers now deliver a complete blood count in under 60 seconds and link directly to transfusion-management software. Coagulation sub-panels have expanded with viscoelastic assays that track clot formation in real time, guiding targeted antifibrinolytic therapy during trauma resuscitation.

Routine and special chemistry is set to grow at a 7.65% CAGR, fueled by expanded panels covering high-sensitivity troponins, presepsin and metabolic stress markers that enable early deterioration prediction. Microbiology and molecular pathogen panels advance in tandem with antibiotic stewardship mandates, providing sub-hour susceptibility profiles that curtail broad-spectrum drug use. Flow cytometry retains value for immunosuppressed cohorts in transplant ICUs, while immunoprotein assays broaden with soluble CD14 variants that refine sepsis risk stratification. Collectively, these shifts align with clinician demand for multiplex dashboards that present holistic patient snapshots rather than isolated parameters, positioning integrated platforms at the forefront of procurement decisions.

Point-of-care devices generated 52.56% of 2024 revenue for the critical care diagnostics market and remain essential for collapsing turnaround times at the bedside. Cartridge-based blood-gas analyzers, handheld glucose-ketone meters and compact immunoassay instruments dominate purchase lists because they require minimal maintenance and fit seamlessly into high-acuity workflows.

Yet AI-enabled decision-support systems, projected to expand at a 7.78% CAGR, are reshaping buyer expectations. Middleware hubs equipped with neural networks continuously analyze longitudinal biomarker data to predict adverse events up to 12 hours in advance, triggering protocol-driven interventions. Central-lab analyzers still serve high-throughput needs, but increased decentralization means their future lies in hub-and-spoke architectures that support tiered care settings. Hybrid cloud infrastructures lower entry barriers for community hospitals by offloading computational demands, while cybersecurity enhancements address rising concern over patient-data breaches. Collectively, these developments forecast a technology mix where bedside hardware and cloud intelligence operate in lock-step to bolster clinical outcomes.

The Critical Care Diagnostics Market Report is Segmented by Test Type (Flow Cytometry, Hematology Tests, Microbiology & Infectious Disease Tests, and More), Technology (Central-Lab Analyzers, and More), End User (Intensive Care Units, and More), Sample Type (Whole Blood, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.45% of 2024 revenue, underpinned by advanced ICU bed density, expansive payer systems and streamlined FDA pathways that allow rapid device clearance. U.S. hospitals continue to integrate AI dashboards to comply with value-based reimbursement, while Canadian provincial tenders emphasize cartridge interoperability across dispersed care settings. Europe follows with robust demand driven by modernization programs and an aging demographic that elevates critical-illness incidence. Germany funds trauma networks that specify viscoelastic coagulation analyzers, and France invests in micro-fluidic molecular platforms to tackle antimicrobial resistance. The United Kingdom's GBP 2.3 billion commitment to community diagnostic centers demonstrates a shift toward decentralized testing.

Asia-Pacific will lead growth at a 6.54% CAGR through 2030 as China and India channel multibillion-dollar budgets into new tertiary hospitals and mobile ICU fleets. Local joint-venture assembly lines reduce import duties, expanding accessibility for mid-tier hospitals. Japan refines AI-assisted sepsis alerts, while South Korea pioneers cloud-connected cardiac troponin networks across regional hospitals. In Southeast Asia, portable PCR and blood-gas analyzers equip rural clinics, bridging health-equity gaps for populations historically distant from laboratory services.

The Middle East and Africa benefit from oil-funded hospital projects in Gulf Cooperation Council states and donor-backed trauma centers in North Africa. South America records stable mid-single-digit gains, with Brazil deploying mobile stroke units fit with CT and blood-gas analyzers to address high cerebrovascular mortality. Together these geographic threads position the critical care diagnostics market for synchronized yet region-specific expansion over the forecast period.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher (Beckman Coulter & Cepheid)

- bioMerieux

- Sysmex

- Beckton Dickinson

- Thermo Fisher Scientific

- Bayer

- Chembio Diagnostics

- Radiometer Medical

- Instrumentation Laboratory (Werfen)

- Nova Biomedical

- QuidelOrtho

- Werfen Group

- PixCell Medical

- Truvian Health

- EKF Diagnostics

- OptiMedical Systems

- Randox Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Critical Illnesses Requiring Rapid Diagnostics

- 4.2.2 Expansion of Point-of-Care Testing in Acute Care Settings

- 4.2.3 Integration of Diagnostics Into Connected Hospital Ecosystems

- 4.2.4 Government and Private Investments in Intensive Care Infrastructure

- 4.2.5 Continuous Technological Innovations Enhancing Test Speed and Accuracy

- 4.2.6 Shift Toward Value-Based Care Emphasizing Early Clinical Decision-Making

- 4.3 Market Restraints

- 4.3.1 High Capital And Operational Costs of Advanced Diagnostic Platforms

- 4.3.2 Limited Skilled Workforce in Critical Care Laboratories

- 4.3.3 Regulatory and Reimbursement Uncertainties for Novel Tests

- 4.3.4 Data Security and Privacy Concerns in Connected Diagnostic Devices

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test Type

- 5.1.1 Flow Cytometry

- 5.1.2 Hematology Tests

- 5.1.3 Microbiology & Infectious Disease Tests

- 5.1.4 Coagulation Tests

- 5.1.5 Immunoprotein Assays

- 5.1.6 Routine & Special Chemistry

- 5.1.7 Other Test Types

- 5.2 By Technology

- 5.2.1 Central-Lab Analyzers

- 5.2.2 Point-Of-Care Devices

- 5.2.3 Molecular Diagnostics (PCR/NGS)

- 5.2.4 Immunoassay Platforms

- 5.2.5 Microfluidic & Lab-On-Chip

- 5.2.6 AI-Enabled Decision-Support Systems

- 5.3 By End User

- 5.3.1 Intensive Care Units (ICU)

- 5.3.2 Emergency Rooms (ER)

- 5.3.3 Operating Rooms (OR)

- 5.3.4 Ambulance & Mobile ICUs

- 5.3.5 Other End User

- 5.4 By Sample Type

- 5.4.1 Whole Blood

- 5.4.2 Plasma / Serum

- 5.4.3 Point-Of-Care Capillary

- 5.4.4 Respiratory Secretions

- 5.4.5 Other Sample Types

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott

- 6.3.2 F. Hoffmann-La Roche

- 6.3.3 Siemens Healthineers

- 6.3.4 Danaher (Beckman Coulter & Cepheid)

- 6.3.5 bioMerieux

- 6.3.6 Sysmex Corporation

- 6.3.7 Becton, Dickinson & Company

- 6.3.8 Thermo Fisher Scientific

- 6.3.9 Bayer AG

- 6.3.10 Chembio Diagnostics

- 6.3.11 Radiometer Medical

- 6.3.12 Instrumentation Laboratory (Werfen)

- 6.3.13 Nova Biomedical

- 6.3.14 QuidelOrtho

- 6.3.15 Werfen Group

- 6.3.16 PixCell Medical

- 6.3.17 Truvian Health

- 6.3.18 EKF Diagnostics

- 6.3.19 OptiMedical Systems

- 6.3.20 Randox Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment